A new national survey finding that teen drivers lack basic knowledge about auto financing and total vehicle ownership costs sparked Junior Achievement USA and American Honda Finance Corp. to create a new website.

The national survey orchestrated by Junior Achievement included 500 drivers who were age 16 or 17. Officials determined new drivers would benefit from basic education about the auto financing process and the costs of vehicle ownership.

For example, when asked what type of information is typically requested on a vehicle financing application, 45 percent of respondents did not know that proof of income was required by finance companies.

The new website is designed to help young drivers navigate the financial aspects of owning and maintaining a vehicle enables. It’s also geared to test their knowledge of auto finance and vehicle ownership costs through an interactive quiz.

The site also provides helpful information and terminology related to auto financing options, auto insurance coverage, routine maintenance and budgeting.

“The goal is to help young drivers make better-informed decisions,” officials said about the site now available at www.financialtestdrive.org.

Honda Finance also has sponsored Junior Achievement to support the JA Personal Finance program, an interactive and experiential blended-learning curriculum, which shows teens how to use credit responsibly, budget and save. The program is targeted to high school students and is facilitated by volunteers in communities across the nation whose personal and professional experiences enhance student learning.

JA Personal Finance is accessible through Junior Achievement's online learning management system and available to local high school students through local Junior Achievement offices across the country.

Consumer Portfolio Services chairman and chief executive officer Brad Bradley explained why the company’s noticeable rise in delinquencies stems from adjustments in collection practices that federal regulators forced the company to make.

To recap, back in May of last year, CPS reached a $5.5 million settlement with the Federal Trade Commission to squash charges that the subprime auto finance company used “illegal tactics” to service and collect consumers’ loans, including collecting money consumers did not owe, harassing consumers and third parties, and disclosing debts to friends, family and employers.

During the company’s quarterly conference call earlier this week, Bradley indicated that it took CPS about six months to modify its collections practices, acknowledging that some personnel in this department have been with the company for some so “trying to get them to learn and do it another way is a long process.”

As a result, CPS reported that its third quarter delinquencies greater than 30 days (including repossession inventory) jumped from 6.66 percent to 8.81 percent. The year-over-year movement triggered a series of questions from investment analysts who wanted to know how that metric was going to impact CPS’ defaults and recovery rates, which also softened year-over-year from 44.6 percent to 40.0 percent.

To quell concern, Bradley spelled out exactly how the collection process unfolds at CPS nowadays.

“Back in the day, you could call a customer up and say, ‘Hey, you are 30 days down or one payment down or two payments down. You need to pay me today or we are going to repossess your car,’” Bradley said. “The regulatory folks didn’t like us saying that to them. You don’t get to say that until they are about 90 days down, three payments. And shockingly when you say, then it works.”

Bradley indicated federal regulators described previous practices when a borrower was behind on payments as “threatening.” CPS has been forced to ease back on the demands for immediate payment but collectors still remain firm when the account hits 90 days past due.

“We may not particularly agree with the term threatening, but at least then you push (delinquent customers) to say, ‘Hey, ‘You need to pay us today or you’re in serious risk of losing your car.’ Then a lot of people pay,” Bradley said. “To the extent you say, ‘Hey, it’s really important you pay, and let’s work something out,’ shockingly they still pay, just takes an extra two months. That’s really fundamentally the exact difference of what we are doing.

“A lot of the way collections is driven in many companies including ours, is you want the collector to collect the payment today. You want them to get the customer to send something today,” he continued. “In the new world, that isn’t really the way to do it. So it’s taking us a dramatic amount of time to convince our collectors not to try and get them pay today.

“The customer says, ‘Hey, I can probably pay you next week.’ That wasn’t good enough in the old dynamic,” Bradley went on to say. “Eventually they do because at the end of the road, you got to tell him, you are in danger of losing your car and that’s when they pay.”

But analysts still wondered if CPS’ portfolio would deteriorate with delinquencies on the rise and recovery rates softening because of company officials conceding that rising off-lease volume is impacting what they can get back in the repossession lanes on the wholesale market. Bradley is confident funds eventually will flow into the company as payments; they might be just delayed.

“In the regulatory environment, you don’t push anymore,” Bradley said. “You give them the time not to string you along, but take some more time.

“There’s two aspects,” he continued. “One is the manner in which you have to address the customers, and two is the dynamic of how the collection arms work. The collection arms used to work to get the money in today, period. And now that’s not true.

“It’s a simple explanation at some level. It is a lot tougher to make it all work,” Bradley added.

Q3 financial report

CPS reported that its Q3 earnings came in at $8.8 million, or $0.28 per diluted share. Those figures are higher than a year ago when net income came in at $7.8 million, or $0.24 per diluted share. The improvement represented a 16.7-percent increase in diluted earnings per share.

The company generated a 22-percent rise in Q3 revenue, watching it climb from $77.1 million to $94.0 million. Meanwhile, CPS noted total operating expenses for the third quarter increased $15.1 million or 23.9 percent to $78.3 million

During the third quarter, CPS purchased $287.5 million of new contracts, an increase of 2.9 percent, compared to $279.3 million during the third quarter of last year. The company's managed receivables totaled $1.941 billion as of Sept. 30, an increase from $1.822 billion as of June 30 and $1.519 billion as of the end of last year’s third quarter.

“We are pleased with our operating results for the third quarter of 2015,” Bradley said. “Our managed portfolio is now in excess of $1.9 billion and we achieved our 16th consecutive quarter of increasing quarterly earnings.”

In another effort to implement cost-saving and innovative technology-based initiatives to foster business and meet the demands of its expanding customer base, Westlake Financial Services is now available on RouteOne’s eContracting platform.

This development arrives not long after Westlake announced it was expanding its servicing team at the WFS Production Center in Dallas.

Westlake Financial Services group president Ian Anderson explained why the company made this move with RouteOne.

“For Westlake, RouteOne eContracting is all about providing faster funding to our dealers,” Anderson said. “We’ve always been about auto-decisioning, and we see this as a step toward auto-originations.”

Anderson emphasized that Westlake’s strategic advantage includes offering a comprehensive, fast and secure originations process. This process is supported by pairing dealerships with knowledgeable credit analysts to assist them in buying deals, verifying stipulations and funding.

“RouteOne is a great partner to Westlake and to our dealers,” Westlake senior vice president of sales Mark Vazquez said. “Launching eContracting will add efficiencies in our originations process by getting decisions faster, reducing contract errors, and in the end, providing better service through faster funding.”

Using RouteOne’s eContracting platform, dealers can receive electronic validation and distribution, ability to audit throughout the entire contracting life-cycle, and a user-friendly signing process that can be done using signature pads, tablets or nearly any touch-screen device.

“We are pleased to expand our finance source availability to our dealer customers,” RouteOne chief executive officer Mike Jurecki said.

“Both RouteOne and Westlake are passionate about technology and bringing efficiencies to the entire vehicle purchasing process,” Jurecki continued. “eContracting accomplishes this in many ways including seamless sharing of data and comprehensive validation prior to the customer signature, all which lead to faster funding and improved customer satisfaction index.”

Dealerships interested in financing their customers through Westlake financing can go to www.westlakefinancial.com or can learn more information by calling (888) 893-7937. Dealers and finance sources interested in eContracting can contact RouteOne at (866) 768-8301.

This week, credit report and compliance solutions provider Credit Bureau Connection (CBC) rolled out dealer access to income and employment data instantly, at point-of-sale through The Work Number, an Equifax service.

CBC highlighted that having fast access to income and employment data can enable dealers to close more sales by eliminating the risk of losing the deal because a customer was sent away from the showroom to collect proof of documentation and never seen again.

Additionally, with the potential of almost 25 percent of borrowers purposely or inadvertently inflating their stated income on auto loan applications by 15 percent or more, CBC insisted the risk of fraud increases dramatically for both dealers and finance companies.

The Work Number can provide dealers with the ability to verify their consumers' reported income and employment. Verifying this information can help the dealer clear common finance company stipulations generated during the financing process and validate data reported on loan applications to ensure accuracy.

The Work Number is a proprietary database owned by Equifax that has grown to include employer-direct payroll records from more than 4,800 employers nationwide.

“The odds of a buyer returning to complete a vehicle purchase decrease substantially if they are forced to leave the dealership,” CBC president and chief executive officer Mike Green said.

“Having the ability to satisfy this requirement of obtaining necessary income and employment proof, while the buyer is in the buying mode, is vital to a dealership’s closing ratio,” Green continued.

Green added that the ability to quickly verify income and employment information at the point-of-sale, versus sending away ready-to-buy prospects to retrieve paystubs or W2's, is advantageous from a strategic standpoint. This scenario can help ease the challenges of finance company “stips” and other potential roadblocks to financing.

“Our mission is to serve the dealer and lender communities alike through access to the highest quality database of income and employment data available in the marketplace,” Equifax senior vice president Michael Kuentz said.

“By partnering with CBC, our auto dealer customers are empowered to close more loans and create a better experience for auto buyers — while effectively protecting themselves from the negative impact of misstated income,” Kuentz continued.

Green added, “Moving forward with Equifax to offer instant income and employment verifications to the automotive industry takes CBC to yet another level of superior products and services as we all understand the value of retaining the customer at the dealership to finalize the deal.”

Recent data and analysis from the American Bankers Association, Cox Automotive and KeyBanc Capital Markets all point toward healthy ongoing performance and a positive outlook for the auto finance market.

According to results from the American Bankers Association’s Consumer Credit Delinquency Bulletin, direct auto loan delinquencies in the second quarter ticked up just 1 basis point year-over-year from 0.71 percent to 0.72 percent. Meanwhile, indirect auto loan delinquencies fell from 1.58 percent to 1.45 percent. To recap, ABA classifies an indirect auto loan as a contract arranged through a third party such as a dealer while a direct auto loan is one arranged directly through a bank.

“The steady forward march of the economy has continued to strengthen consumers’ financial positions,” ABA chief economist James Chessen said. “Consumers continue to impress with their ability to manage debt prudently and keep spending under control.

“The drop in gas prices from last year has provided a big boost to disposable income and has freed up money that makes debt obligations a bit easier to handle,” Chessen continued.

With consumers having more resources to maintain their commitments, finance companies aren’t backing off in the origination department.

According to the August dealer survey from KeyBanc, 83 percent of respondents indicated banks and finance companies remained “aggressive” in August, and 17 percent reported lending was becoming more aggressive.

KeyBanc also mentioned 67 percent of dealers surveyed in August said that subprime financing availability remains intact as the remaining 33 percent reported an increase.

Furthermore, Cox Automotive chief economist Tom Webb discussed employment trends, first going over data that might cause alarm.

Webb acknowledged nonfarm payrolls grew by a “disappointing” 142,000 in September. That reading, plus downward revisions to July and August numbers, pushed the three-month moving average to 167,000 – well below what is considered the self-sustaining 200,000 level.

“Other employment indicators such as the labor force participation rate (down) and earnings (flat) were also disappointing. And, with a loss in September, the number of people employed full time fell below its pre-recession peak reached way back in November 2007,” Webb said.

“With respect to the retail used vehicle market, and more specifically credit availability, one can take comfort in the low of initial jobless claims and the high number of job openings per job seeker,” he continued. “This might not spell robust economic growth, but it does give job holders the confidence to borrow and lenders the confidence to lend.”

In a follow-up conversation with SubPrime Auto Finance News, Webb reinforced why initial jobless claims and job openings are the two metrics finance companies should watch closely.

Webb indicated the initial jobless claims “in shorthand you could say are the probability of a person losing their job, which is a key determinant in a loan default.”

And comparing the of number job openings relative to the amount of job seekers, Webb added, “you would assume even those who have lost a job have a better opportunity to quickly find another one; again a situation which could preclude a default.”

As the ABA reported Q2 auto delinquencies came in at manageable levels, the organization’s bulletin also highlighted the composite ratio — which tracks delinquencies in eight closed-end installment loan categories — fell 17 basis points to 1.36 percent of all accounts, continuing a three-year trend of remaining well below the 15-year average of 2.27 percent.

“A strong job market and rising incomes will go a long way toward keeping delinquencies at these historically low levels,” Chessen said. “With global events creating more uncertainty about the pace of the U.S. economy, it’s even more important for consumers to maintain their disciplined approach to managing debt.”

Webb closed his overall economic assessment by focusing back on auto financing

“The borrowers are paying back those loans,” Webb said. “I don’t believe the retail financing environment can get any better that it’s been because it’s terrific.

“Generally you would expect some deterioration in loan performance before you have any change in originations, and we haven’t seen that at all,” he continued. “The loans are performing extremely well. Until that changes or until the overall financial market changes, it’s good money. People are in an environment where they’re searching for yield. Auto loans provide that yield and actually at very low risk.”

This week as a part of the American Financial Services Association’s 99th annual meeting in Boston, the organization honored three members with its highest accolade, the Distinguished Service Award (DSA).

Receiving the honors were Stevan Schmelzer, Jim Sheeran and Glen Twede.

Schmelzer serves as the president and chief executive officer of Personal Finance Co. Schmelzer first became involved with AFSA 15 years ago and serves on the executive committee and board of directors. He chaired the AFSAPAC in 2013 and the AFSA Independents Section in 2015.

Schmelzer has been an instructor at AFSA’s EDGE education program for consumer finance professionals and has served on the program’s Board of Governors since 2002. From 2008 to 2010, he was president of the Kentucky Consumer Finance Association, where he remains on the board. He also serves on the Tennessee Consumer Finance Association board.

Schmelzer spent nine years with several finance companies before finding a home with Personal Finance in 1986 as a branch manager. Schmelzer earned many promotions throughout the years before he was named chief operating officer in 2007. He added the title of president in 2008, and was promoted to his current position in 2010.

Sheeran is the general counsel with Tidewater Finance Co. Sheeran joined AFSA’s Law Committee in 2005, and served as chair from 2012-2014. During his tenure, he authored the committee’s bylaws, served as parliamentarian and chaired the litigation and emerging issues subcommittees. He chaired the working group that developed AFSA’s Civil Investigative Demand Response Procedures and currently chairs the Ancillary Products Working Group and is developing AFSA’s Cybersecurity Response Procedures. He also serves as the liaison between the Law Committee and the Operations & Regulatory Compliance Committee.

Sheeran joined Tidewater Finance as general counsel in 1999. During the past 16 years, the company has developed new financial service products and grown from a regional to a nationwide financial services company. He received an undergraduate degree with honors in history from George Mason University, followed by a law degree from the College of William and Mary.

Twede serves as the vice president, sales and marketing with GOLDPoint Systems. Twede has been an active member of AFSA since 2004 and has served as chairman of the AFSA Business Partner Board for the past two years. GOLDPoint Systems is a Seven-Star Business Partner and has sponsored the Champions Club session at the AFSA Independents Conference for the last several years.

Twede graduated Magna Cum Laude from Utah State University in 1993 with a degree in business administration and economics. After graduation, he went to work as an accountant for DHI Computing Service, the parent company of GOLDPoint Systems. He eventually worked up to become the chief financial officer of the company. In 2004, he moved to GOLDPoint Systems to develop new business in his current position.

Wells Fargo spokesperson Natalie Brown told SubPrime Auto Finance News late this summer that the company doesn’t “grow for growth’s sake.” So it’s likely the company made a concerted effort with its due diligence as it opened its 57th regional business center (RBC) this week.

Wells Fargo Dealer Services chose to make its expansion in Texas, adding the RBC as the fifth location in the Lone Star State and the second one in the Houston market. The facility — located at 12603 Southwest Freeway, Suite 315, in Stafford — will serve approximately 100 existing dealerships in the region.

“Our new RBC reflects Wells Fargo’s continued commitment to providing localized service to the dealership community through a team of in-market auto finance experts who understand the market because we live and work in the communities we serve,” said Mark Beedlow, greater Texas market manager for Wells Fargo Dealer Services.

“Through this new RBC and four others in the state, we will continue to offer solutions that meet the dealers’ needs, so they can provide vehicle financing for their customers across the credit spectrum,” Beedlow said.

Steven Kannenberg was appointed to lead the new RBC that will initially house 11 Wells Fargo Dealer Services team members. Kannenberg has more than 15 years of industry experience.

Wells Fargo Dealer Services now operates 57 RBCs nationwide staffed with teams of in-market auto finance experts who provide financial solutions for the dealer community, including indirect auto financing, real estate and floor plan financing with access to commercial banking services designed to help dealers operate more efficiently.

“Our story is one of consistency and discipline, and we are pleased with how we’re performing and growing,” Brown said. “We are committed to responsibly providing consumers access to a broad credit spectrum of financing through our network of dealers in all economic cycles.

“We are located in the communities with our dealers and customers,” Brown continued. “Being in the same market helps us understand the local economy, industry, employment and pay scales and this information helps us make responsible lending decisions. It also helps us remain a leader in serving the transportation needs for millions of customers.”

A pair of experts from the Global Financial Literacy Excellence Center at the George Washington University School of Business shared their analysis about millennials’ personal finances and highlighted 10 key findings.

Coming from the report titled, Gen Y Personal Finances: A Crisis of Confidence and Capability, Carlo de Bassa Scheresberg and Annamaria Lusardi emphasized that millennials are arriving at critical points of financial decision making in their adult lives. Lusardi is a professor and academic director while de Bassa Scheresberg is a senior research associate at the university’s center.

“Despite emerging into the workplace in the unstable economic environment of recent years, Gen Y continues to be energetic and highly optimistic,” de Bassa Scheresberg and Lusardi wrote. “But their impact is linked to their financial behavior.

“Indeed, Gen Yers’ personal finances are more relevant to the state of the economy than those of any preceding generation,” they continued. “Against that backdrop, it is becoming increasingly apparent that the financial position of Gen Yers is more fragile than expected.”

With that point as an introduction, here are the 10 most important findings about Generation Y that de Bassa Scheresberg and Lusardi uncovered:

1. Looking only at assets, such as savings or investments, provides a limited view of Gen Yers’ financial profile.

2. Debt is widespread among Gen Yers; most carry short- or long-term debt or both.

3. Members of Generation Y feel overindebted.

4. Student loans are a major source of debt for college-educated millennials, and most of them are concerned about their ability to pay off student loans.

5. Gen Yers use expensive methods of borrowing, such as credit cards, payday loans, pawnshops and other alternative financial services (AFS).

6. There is an educational divide in the use of AFS. While 28 percent of Millennials with a college degree used AFS in the five years prior to the survey, 50 percent of respondents with a high school education or less have relied on AFS.

7. While many millennials have retirement accounts, many have already borrowed on those accounts.

8. Millennials give themselves high marks in their ability to make day-to-day and long-term financial decisions, but there are clear signs of overconfidence.

9. Professional financial advice is used sparingly. Many millennials lack trust in financial professionals and think that professional financial advice is too expensive for them.

10. Even though millennials make many decisions related to investments and debt, most of them lack financial literacy and are not aware of their lack of financial knowledge.

The entire report generated by de Bassa Scheresberg and Lusardi can be downloaded here.

The National Automobile Dealers Association chose an appropriate time to conduct its Washington Conference with all of the vehicle financing activity that percolated out of the nation’s capital last week.

More than 500 franchised dealers and dealer association executives from across the country traveled to Capitol Hill for NADA’s event to attend briefings and meet with members of Congress to discuss key policy issues, which include protecting consumer choice in auto financing and supporting legislation that boost consumer recall completion rates.

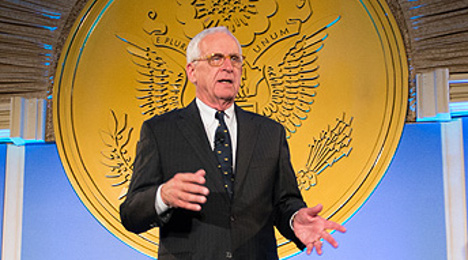

In remarks to conference attendees, NADA chairman Bill Fox stressed the importance of correcting misconceptions in the nation’s capital about the retail-auto industry.

“There’s a disturbing pattern of regulators wrapping ‘red tape’ around our industry and yet, they don’t fully understand it,” said Fox, a franchised dealer in the upstate New York cities of Auburn and Phoenix. “That’s why we need to keep working hard to get H.R. 1737 passed in the House, and explain that dealer-assisted financing is really a consumer issue.”

In July, the House Financial Services Committee passed NADA-backed H.R. 1737 by a bipartisan vote of 47-10 to rescind what the association called the Consumer Financial Protection Bureau’s “flawed” auto finance guidance that would limit or eliminate a customer’s ability to receive discounted auto loans at dealerships. This bill also calls for more transparency from the agency and a public notice and comment period when future auto lending guidance is issued.

NADA’s zeal to get the measure passed gained more steam as the CFPB made a pair of enforcement actions while dealers were in Washington, D.C. First, the CFPB ordered Fifth Third Bank to cap dealer markup at either 1.25 percent or 1 percent, depending on the length of the installment contract. Then, the bureau handed a penalty topping $44 million against Westlake Financial Services for infractions association with debt-collection practices.

Furthermore, the subject of auto financing was one of primary topics lawmakers asked CFPB Richard Cordray to address during his semiannual appearance in front of the House Financial Services Committee.

That same group of legislators also managed to push ahead a measure that likely will get cheers from NADA.

Bipartisan legislation sponsored by Rep. Steve Stivers, a Republican from Ohio, and Rep. Tim Walz, a Democrat from Minnesota, that would create the position of an independent inspector general (IG) at the CFPB passed out of committee.

“The CFPB has been given broad authority and must be accountable to the American people,” Stivers said. “More than 30 other federal departments and agencies have an independent inspector general. This bill would bring the CFPB in line with these agencies and provide the necessary oversight and transparency.”

The CFPB receives its operating funds from the Federal Reserve. Currently, the lawmakers indicated the bureau has very little Congressional oversight and does not have an independent inspector general solely dedicated to the agency. Instead, the CFPB shares an inspector general with the Federal Reserve, which is appointed by the Fed Chairman.

The bill sponsored by Stivers and Walz would amend the Inspector General Act of 1978 to establish an independent inspector general for the CFPB.

“The CFPB is an important agency that works to ensure that you, the consumer, are protected from things like predatory payday lenders, shoddy mortgage bankers and defective products. Their work is important, but that doesn’t mean that they don’t need oversight,” Walz said.

“I believe the appointment of an independent inspector general will only increase their ability to fulfill their important mission and I am pleased this legislation passed out of committee,” he went on to say.

Having passed the committee, H.R. 957, the Bureau of Consumer Financial Protection-Inspector General Reform Act of 2015, will soon head to the House floor.

Meanwhile, a week ago, dealers and state dealer groups made more than 300 congressional visits on Capitol Hill to increase bipartisan support for H.R. 1737. The bill currently has 147 cosponsors (86 Republicans and 61 Democrats). A full House vote is expected this fall.

Furthermore, concerning proposed bills on recalls, Wes Lutz, chairman of NADA’s Government Relations Committee, urged dealers to ask their members of Congress not to cosponsor H.R. 2198 and H.R. 1181, saying the legislation “misses the mark by requiring recalled vehicles be grounded instead of actually fixed.”

Lutz pointed out there are 46 million vehicles on the road today under open recall, but many of the defects have nothing to do with vehicle safety

“Imagine what would happen if dealers could only offer a fraction for customer trade-ins, or couldn’t accept them at all. This could be the reality if the Blumenthal amendment is passed,” said Lutz, a dealer in Jackson, Mich. “Dealers support a 100 percent recall completion rate. Congress should focus on legislation that helps increase recall completion rates.”

Credit Acceptance recently completed a $75 million revolving secured warehouse facility with an institutional investor.

Under this facility, the company explained it will contribute loans to a wholly owned special purpose entity (SPE) and the SPE may borrow up to the lesser of 80 percent of the net book value of the contributed loans or $75.0 million during the facility's revolving period.

Officials indicated the facility will cease to revolve on Sept. 30, 2018.

“If the facility is not renewed prior to this date, and we and the SPE are in compliance with the terms and conditions of the agreement, any amounts outstanding will be repaid over time as the collections on the loans securing the facility are received,” Credit Acceptance officials said. “No borrowings were initially made on the facility.”

The company noted borrowings under the facility will bear interest at a rate equal to LIBOR plus 200 basis points.

Credit Acceptance said it receive a servicing fee of 6.0 percent of the cash flows related to the underlying consumer loans. The company added the remaining 94.0 percent, less amounts due to dealers for payments of dealer holdback, will be used to pay principal and interest on the notes as well as the ongoing costs of the financing.

“Using a unique financing structure, our contractual relationships with our dealers remain unaffected with the dealers’ rights to future payments of dealer holdback preserved,” company officials said.