This week, personal finance website WalletHub released the first quarter installment of its Auto Financing Report, pinpointing the top 25 cities where consumers hold the highest amounts of auto-finance debt when analyzed against their income.

The vast majority of the cities on that list of 25 — 14 locations to be exact — can be found in Texas.

Topping the analysis from WalletHub was the Lone Star State’s Rio Grande City, which is located along the Mexican border about 120 miles west of the Gulf of Mexico.

After Texas, the other states with cities on this top 25 list included Georgia (3), Arizona (2), Florida (2), Louisiana (2), New Mexico (1) and North Carolina (1).

Here is the list with other metrics gathered by WalletHub and shared in this report:

| Location |

Median Auto Debt |

Income |

Debt-to-Income Ratio |

| Rio Grande City, Texas |

$23,457 |

$27,419 |

86% |

| Willis, Texas |

$20,814 |

$25,570 |

81% |

| Livingston, Texas |

$22,660 |

$31,007 |

73% |

| Alice, Texas |

$24,859 |

$34,056 |

73% |

| Bastrop, La. |

$15,666 |

$21,583 |

73% |

| Donna, Texas |

$18,805 |

$26,558 |

71% |

| San Juan, Texas |

$21,976 |

$31,681 |

69% |

| Leesville, La. |

$21,374 |

$31,341 |

68% |

| Uvalde, Texas |

$20,341 |

$30,423 |

67% |

| Alamo, Texas |

$21,922 |

$32,810 |

67% |

| Raeford, N.C. |

$20,660 |

$31,063 |

67% |

| Mercedes, Texas |

$18,067 |

$27,351 |

66% |

| Pharr, Texas |

$20,909 |

$32,456 |

64% |

| Douglas, Ga. |

$20,678 |

$32,270 |

64% |

| San Luis, Ariz. |

$19,262 |

$30,106 |

64% |

| Brownsville, Texas |

$19,449 |

$30,409 |

64% |

| Tolleson, Ariz. |

$20,109 |

$31,738 |

63% |

| Deming, N.M. |

$17,919 |

$28,328 |

63% |

| Weslaco, Texas |

$21,731 |

$34,556 |

63% |

| Big Spring, Texas |

$23,636 |

$37,636 |

63% |

| San Benito, Texas |

$19,046 |

$30,530 |

62% |

| Lake Placid, Fla. |

$16,554 |

$26,563 |

62% |

| Cordele, Ga. |

$17,755 |

$28,687 |

62% |

| Palatka, Fla. |

$17,863 |

$29,066 |

61% |

| Dahlonega, Ga. |

$16,708 |

$27,266 |

61% |

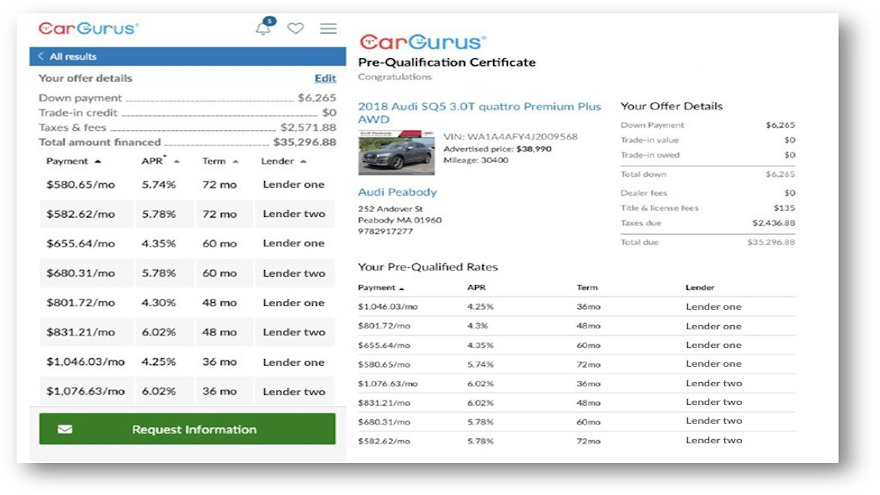

The next development in the working relationship involving CarGurus, Capital One, Westlake Financial and Global Lending Services (GLS) surfaced on Friday.

CarGurus announced a new feature that can enable shoppers to pre-qualify for financing as they search on CarGurus for their next vehicle; a program dubbed Finance in Advance. Pre-qualification offers are provided through CarGurus’ listing dealers that book paper through Capital One, Westlake Financial and Global Lending Services.

CarGurus forged a relationship with Capital One in May 2019 and then with Westlake later that year. CarGurus welcomed GLS into its portfolio of integrated financing providers in August.

Site leaders highlighted the service is the latest in CarGurus’ growing suite of digital retail products engineered to help consumers and dealers by bringing ease and transparency to the vehicle-shopping process.

“Financing is a critical, yet often forgotten about, part of purchasing a car. As the pioneers of trust and transparency in automotive retail, we believe that providing shoppers with information about financing rates will help guide better purchase decisions,” CarGurus vice president of consumer products Josh Berg said in a news release.

“Shoppers that use CarGurus’ pre-qualification tool will know the real costs of their desired vehicle and can go to the dealer ready to complete their financing. That results in saved time for both consumers and dealers,” Berg continued.

According to the CarGurus 2020 Buyer Journey report, 61% of consumers that buy at a dealership finance their purchase, and more than half (53%) do so through the dealership where they buy.

CarGurus explained Finance in Advance is designed to an easy-to-use feature for eligible shoppers to obtain pre-qualification for vehicle financing. Shoppers can go to https://www.cargurus.com/Cars/finance to pre-qualify for free and with no impact on their credit score.

Participating finance companies include Capital One, Westlake Financial and Global Lending Services, which in combination provide almost 90% coverage of all dealership listings on the CarGurus site.

CarGurus indicated the majority of shoppers are notified in a matter of minutes when they are pre-qualified and their personalized, pre-qualified offers are automatically applied to their vehicle search on CarGurus.

“This enables shoppers to filter their search results to vehicles where they are eligible for financing and ultimately compare real financing rates across those eligible vehicles,” site officials said.

Additionally, CarGurus mentioned shoppers also can customize the vehicle purchase terms like their down payment, estimate the value of their trade-in vehicle and apply that value to their deal.

Once a shopper has selected a vehicle and created a customized offer, they can print or email to themselves a certificate with their rates. Then, the shopper brings their certificate into the dealership where they complete the credit application and finalize the financing terms for that vehicle with the dealership.

The American Financial Services Association, in collaboration with the Illinois Financial Services Association, the Independent Finance Association of Illinois and the Illinois Automobile Dealers Association, sent a letter on Friday to Gov. J.B. Pritzker to state their “grave concerns” about a measure about to become law in Illinois that would create a rate cap on loans, including auto financing.

The associations asked Pritzker to veto Senate Bill 1792, which would create the Predatory Loan Prevention Act and institute a 36% rate cap based on the federal military annual percentage rate for all loans not exceeding $40,000.

“While SB 1792 contains many admirable provisions aimed at creating a more equitable Illinois, the proposed rate cap would leave Illinois consumers worse off and immediately cut off access to credit for those most in need,” the associations wrote in their letter.

The associations explained their position by noting the confusion potentially triggered by how this act is crafted.

The letter stated that for more than 50 years, the federal Truth in Lending Act (TILA) has provided a standard of how to calculate the annual percentage rate (APR) of loans, ensuring that all references to APR are consistent and require little interpretation.

“This allowed consumers to have a clear understanding of the terms and cost of credit and to compare costs of similar loan products,” the associations said. “TILA expressly excluded the costs of voluntary products from the APR calculation.”

The letter goes on to note that the federal Military Lending Act introduced a military APR (MAPR) that, unlike TILA, includes the cost of voluntary goods, services, or insurance that are unrelated to the cost of credit and “are not comparable across credit products.”

The associations pointed out that, “Whereas traditional TILA APR applies to all consumers and all credit products, MAPR is only applicable for certain small loans to active-duty servicemembers and their dependents.

“Importantly, this distinction exists, in part, because certain types of insurance and protection products are already available to members of the military as a benefit of their service. For this reason alone, MAPR is not appropriate for broader application beyond servicemembers,” they added.

The letter goes on to specify a host of metrics finance companies consider when deciding whether to extend credit such as average charge-offs, cost of service and cost of capital — all data points that can vary depending on the consumer’s credit standing.

The associations then offered a rudimentary example to give the top Illinois lawmaker another point to consider. It went as follows:

For example, say you lend me $100 today and charge me $1 in interest:

— If I pay you back in one year, the APR is 1%

— If I pay you back in one month, the APR is 12%

— If I pay you back tomorrow, the APR is 365%

— If I pay you back in an hour, the APR is 8760%

Same dollar in interest, vastly different APRs.

Should the act become law, the associations cautioned Pritzker about other potential ramifications.

“While elite borrowers in Illinois may be able to find other sources of credit or afford larger loan sizes, lower-income individuals will likely be left in credit deserts and forced to turn to more dangerous, or illegal, options like pawnbrokers and loan sharks,” they wrote.

“Because our members report to credit bureaus, they help hundreds of thousands of Illinois adults graduate out of subprime credit scores each year—so we deeply understand the effects of this bill,” they continued. “This will have a ripple effect in those communities where unregulated lenders will operate and proliferate, credit mobility will decline, debt costs will increase as will overall debt loads, and long term wealth will decline when people lose access to both affordable credit and means to improve their credit scores.”

Signing the letter were AFSA senior vice president Danielle Fagre Arlowe and Mark Dapier of the Independent Finance Association of Illinois as well as Illinois Financial Services Association executive director and general counsel Brett Ashton and IADA president Pete Sander.

The entire six-page letter can be found here.

Several industry forecasts already have been released, including one focused on overall used-vehicle sales, retailing of certified pre-owned models as well as the potential swelling of repossessions.

This week, six executives from EFG Companies shared their expectations for how the first half of 2021 might unfold in the F&I space. The group acknowledged several market uncertainties are in place due in part to the pandemic-impacted economy, consumer confidence, the unemployment rate and a new, incoming government administration.

Company leaders recommended that dealer principals, agents and finance companies approach the year with a flexible strategy designed to maximize revenue, compliance and employee effectiveness. They also considered economic forecast from The Conference Board issued Dec. 9 that mentioned several factors, including:

■ Scale of the ongoing COVID-19 resurgence and any resulting lockdowns

■ Status of labor markets and household consumption

■ Size and timing of additional fiscal stimulus

■ Timing and availability of a COVID-19 vaccine

■ Degree to which volatility in the U.S. political transition affects consumer and business confidence.

“While there are many factors at play, smart business owners will plan for a variety of strategies in 2021, keeping their teams nimble and customers squarely in their sights,” EFG Companies chief revenue officer Eric Fifield said in a news release. “Regardless of how these factors play out, there remain numerous opportunities for revenue in the first half of next year.”

Fifield and other EFG executives emphasized that consumers will continue to look for added value in automotive and powersports purchases.

“Economic uncertainty exists on both sides of the negotiating desk,” Fifield said. “From the consumer demand for digital retailing to the impacts of a reinvigorated Consumer Financial Protection Bureau, dealers, agents and lenders must ensure their teams are trained to maximize value while maintaining the highest level of local, state, and federal compliance oversight.”

EFG went on to note that the Federal Reserve has signaled that it will keep interest rates near zero through at least 2023 in an attempt to prevent the economy from sliding further into a pandemic-induced recession.

Meanwhile, unemployment rates will continue to be high through at least the first quarter, according to the Bureau of Labor Statistics. And federal officials also think that savings rates will continue to remain strong through the first quarter with consumers staying home and spending less.

EFG executives added more perspectives in an effort to guide clients toward the best outcome.

Retail automotive with Scott Kaskocsak, executive vice president of dealer services

Overall, unit sales will be very difficult to predict throughout the first half of next year. The good news is that because of the pandemic and resulting manufacturing shutdowns, new inventory is actually right-sized for the first time in years. As a result, dealers currently are not swimming in excess and are expected to generate more front-end new gross revenue in the near-term. However, as manufacturers ramp up production, we can expect a flood of new vehicles hitting dealerships later in 2021. Economic uncertainty will continue to make market-differentiating F&I products vital in the race to generate sales and revenue. Today’s buyers are more educated about the vehicle buying process and F&I products than ever before; and they are searching for added value and confidence in their purchase decision. As consumer demand for an online or hybrid online/in-store sales model continues, we can expect to see the technology for online retailing improve. There are still significant roadblocks for the industry to overcome with regards to verifying identity and maintaining compliance in online transactions. With that in mind, we are already in discussions with clients to ramp up compliance training as we expect regulatory compliance oversight to be a focus of the new presidential administration.

Independent agents with Adam Ouart, vice president of agency services

Both the retail auto and independent agency industries experienced an increase in merger and acquisitions activity in 2020, prompting a reshuffling in businesses and relationships, and a greater need for agents to provide demonstrable value to their dealership client base. Pandemic restrictions also forced agents to adopt a technology-based service model. In 2021, agents have the opportunity to ‘be the expert’ for their clients, advising on everything from new products and digital sales models to training and compliance matters. Those agents who effectively utilize their product administrative partners to provide a multi-service model for their clients have a greater opportunity to acquire and maintain more clients by becoming a highly-valued partner.

Auto finance companies with Brien Joyce, vice president of lender services

With interest rates remaining at near zero percent for the foreseeable future, financial institutions will need to be creatively competitive to capture market share. Lenders looking to differentiate themselves will need to build value into their auto loans with products such as WALKAWAY vehicle return. Also, with demand from both consumers and dealers for easier digital retailing lending solutions, we should see lenders beef up their online lending solutions. If a pandemic stimulus package is offered in the first quarter of 2021, we can expect pent-up demand for vehicle purchases to result in greater opportunity to capture market share. Lenders who actively promote their loans with value-added products will gain the sale.

Independent dealers with Gary Biskup, vice president of independent services

Independent dealerships experienced significant market share gains in 2020, competing nearly on par with franchise dealers as consumers sought more value in their vehicle purchase. This trend will continue with strong revenue opportunities for those dealerships utilizing vehicle service contracts and certified pre-owned protection products as market differentiators. Independent dealers are no longer willing to leave money on the table by focusing only on front-end profit via unit sales. To maximize F&I product revenue opportunities and further differentiate themselves in the market, independent dealers are getting wiser about selecting their inventory, buying vehicles that are still within factory warranty. They are also emphasizing F&I and compliance training.

Powersports dealers with Glenice Wilder, vice president of powersports

Powersports dealers experienced a historic sales windfall in 2020. According to the Motorcycle Industry Council, through the third quarter of 2020, off-road recreational purchases were up 37.2% and dual on-road/off-road units up 23.8%. However, on-road vehicles declined by 3.7%. This trend is expected continue through at least the first half of 2021, as consumers seek new recreational outlets for family adventures. A mild winter and continued pandemic stay-at-home mentality should sustain the trend. Dealers who focus on F&I sales and back-end profitability will see their revenue grow higher, encouraging repeat sales. Strong used sales will occur if unemployment spikes further, but inventory issues could hamper deals. Additionally, compliance and regulatory oversight will gain increased attention from powersports dealers as the year progresses.

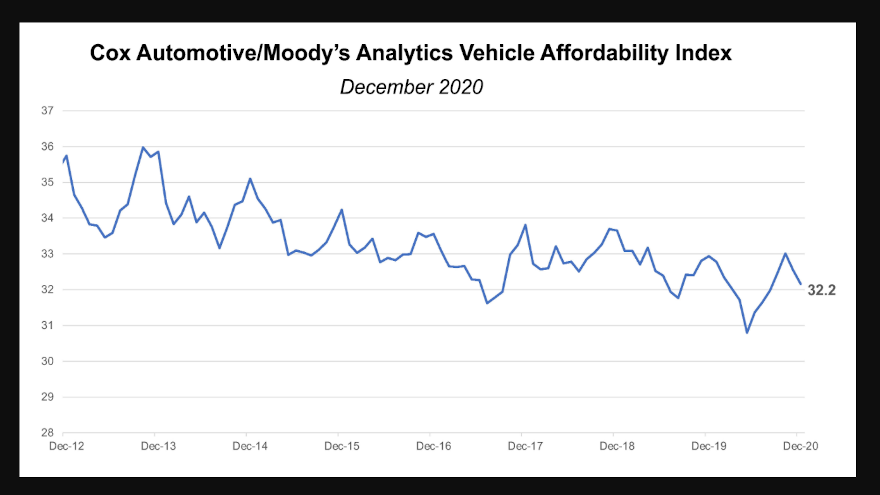

For consumers hoping they could stretch their finances to acquire a new vehicle, the newest Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) offered a bit of uplifting news on Friday.

Analysts discovered affordability improved in December, as represented by median weeks of income needed to purchase a new vehicle declined to 32.2 weeks from 33.8 weeks in November. Cox Automotive and Moody’s Analytics indicated the index was below the mid-point for the extreme highs and lows experienced in 2020 as every key variable — price paid, interest rate, incentives and income — posted substantial shifts throughout the year.

“In addition to higher incentives and lower rates, the December improvement was primarily driven by higher incomes assisted by projections of additional stimulus payments and enhanced unemployment benefits from the $900 billion package that was signed into law in December,” analysts said in commentary that accompanied the latest index reading.

With the improvement, Cox Automotive and Moody’s Analytics noted that the index is almost where it was in February before the pandemic, and affordability was slightly better this December compared to December 2019.

“The year-over-year change is due to lower rates and higher incomes, as prices are up, and incentives are down,” analysts said.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book.

The next reading will arrive on Feb. 15.

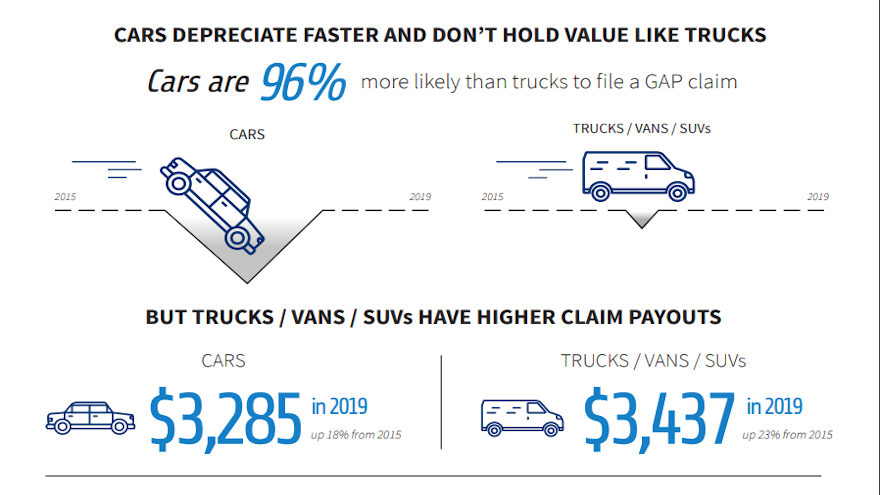

A report compiled by AmTrust Financial Services showed how much value consumers are getting from F&I products, especially guaranteed asset protection (GAP) coverage as well as owners who operate their vehicles where weather and road conditions are poor.

The AmTrust 2020 Extended Auto Warranty Advisor identified common trends for extended warranties and claim payouts based on more than 2.4 million auto warranty claims totaling approximately $1.5 billion across all major vehicle manufacturers over the five-year period from 2015 to 2019.

The global specialty property and casualty insurer and leading underwriter of extended warranties discovered car owners are almost twice as likely as van, truck or SUV owners to file a GAP claim — a 96% higher frequency of a claim to be exact. AmTrust noted that one of the leading reasons for this trend is that vans, trucks, and SUVs, on average, are holding more value, depreciating less than cars and leading to less total losses.

However, once GAP claims are filed, AmTrust determined the claim payout for a van, truck or SUV ($3,437 in 2019) is slightly higher than for a car ($3,285 in 2019) due to a higher average price for a van, truck, or SUV versus a car.

AmTrust reiterated that GAP coverage can help consumers protect their investment from the moment they drive off the lot. GAP protects the driver in cases where primary auto insurance carriers deem a vehicle “totaled” or stolen and there is a “GAP” between the amount the owner owes on financing or leases and what the vehicle is worth.

“Analyzing five years of data has given us new insights into what vehicle owners need to consider when evaluating whether they need all forms of extended auto warranty,” said Bruce Saulnier, president of AmTrust Specialty Risk, a division of AmTrust Financial.

“GAP average claim payouts are rising and more vehicle owners are getting value from these policies,” Saulnier continued in a news release.

AmTrust also analyzed vehicle service contract (VSC) claims across the U.S. by region — Northeast, Midwest, South and West.

The report showed claim payouts in the Midwest increased by 94% over the five-year period. The largest increase in claim payouts was related to windshield protection offerings, with claims increasing by 79% from 2015 to 2019.

Although the Northeast had by far the lowest average windshield claim payouts at $368, AmTrust pointed out this region had the highest costs for the repair and replacement of wheels covered by tire and wheel protection offerings, with an average claim payout of $321. The company suggested that this reading likely reflects winter weather conditions that create and worsen potholes and other bad road conditions.

The AmTrust 2020 Extended Auto Warranty Advisor also found that claims for repairs on new cars are lower than for used cars — $947 versus $1,169 in 2019. As vehicles age, report orchestrated acknowledged the likelihood of a major component breakdown such as engine or transmission increases, causing the average claim payouts of used cars to exceed new vehicles.

“Whether or not to purchase an auto extended warranty can be a challenging decision for consumers,” Saulnier said. “Our analysis of 2.4 million claims provides quantitative proof that GAP is needed now more than ever for borrowers taking out loans greater than their cars are worth and that the continued rise in vehicle repair costs over the last five years prove that auto extended warranties protect against out of pocket costs.

“There are also regional differences in claim frequency and repair costs for different components that should also be considered,” he continued.

“We hope our inaugural study of claims paid provides good insight for consumers, dealers and administrators on the value of these important protections,” Saulnier concluded.

The complete report can be downloaded here.

The financing metrics Edmunds compiled and shared this week might have reinforced why more budget-limited consumers likely made a used-vehicle purchase rather than going for a new model.

According to Edmunds data, December financed new-car purchases represented the highest average monthly payment of the year at $587 and the highest average down payment of the year at $4,876.

“Consumers historically lean toward purchasing pricey luxury cars, trucks and SUVs during the holiday season, which is partially why we’re seeing this lift. But we’re also just seeing a broader trend of consumers gravitating toward bigger purchases during the pandemic,” said Jessica Caldwell, Edmunds’ executive director of insights.

“It might seem at odds with unemployment levels and the harsh financial conditions that so many Americans are finding themselves in right now, but the consumers who are buying new cars during the pandemic are clearly on the other side of the economic divide,” Caldwell continued. “They’re likely qualifying for the lowest promotional rates and feeling secure enough to put down more money to get the bigger vehicles and features that they want.”

As Caldwell noted, consumers in the financial position to buy a new vehicle during the coronavirus pandemic aren’t holding back on upsizing their purchases in favor of bigger vehicles with more amenities.

Expanding the timeframe of its analysis, Edmunds discovered the average down payment for a new vehicle climbed to $4,734 during the fourth quarter, compared to $4,458 in the third quarter and $4,329 a year ago.

Analysts found that the average amount financed for new vehicle purchases increased as well, climbing to $35,373 in the fourth quarter compared to $34,692 in the third quarter and $33,525 a year ago.

And Edmunds data showed that monthly payments increased, reaching $581 on average in the fourth quarter compared to $568 in Q3 and $570 a year ago.

Now let’s compare those new-model figures to what Edmunds pinpointed in the used market.

Analysts pegged the average down payment at $3,283 during Q4, rising by $593 year-over-year and representing an increase of more than 22%.

Edmunds indicated the average amount financed for a used-vehicle delivered in the fourth quarter came in at $24,406, creating an average monthly payment of $437.

“We’re seeing more consumers who typically would fit the bill as new-car shoppers turning their focus on the used-car market thanks to a good supply of near-new, off-lease vehicles hitting the market,” Caldwell said.

Quarterly New-Car Finance Data

(Averages)

|

|

Q4 2020

|

Q3 2020

|

Q4 2019

|

|

Term

|

69.9

|

70.2

|

69.3

|

|

Monthly Payment

|

$581

|

$568

|

$570

|

|

Amount Financed

|

$35,373

|

$34,692

|

$33,525

|

|

APR

|

4.6%

|

4.6%

|

5.5%

|

|

Down Payment

|

$4,734

|

$4,458

|

$4,329

|

Quarterly Used-Car Finance Data

(Averages)

|

|

Q4 2020

|

Q3 2020

|

Q4 2019

|

|

Term

|

68.1

|

67.7

|

67.5

|

|

Monthly Payment

|

$437

|

$420

|

$415

|

|

Amount Financed

|

$24,406

|

$23,235

|

$22,611

|

|

APR

|

7.7%

|

7.9%

|

8.3%

|

|

Down Payment

|

$3,283

|

$3,308

|

$2,690

|

Source: Edmunds

Finance companies likely remember what happened during the Great Recession 12 years ago when the credit market seized up as bad a car engine without oil.

The Federal Reserve reiterated the significant steps it’s taking to ensure finance companies have the raw material to keep their portfolios growing. But the pace providers might be buying paper still looks a bit uncertain.

Fed chair Jerome Powell made public comments on Wednesday following the Federal Open Market Committee voting unanimously to leave interest rates unchanged.

“The Federal Reserve has also been taking broad and forceful actions to more directly support the flow of credit in the economy for households, for businesses large and small and for state and local governments. Preserving the flow of credit is essential for mitigating damage to the economy and promoting a robust recovery,” Powell said during his opening statement of Wednesday’s press conference.

“Many of our programs rely on emergency lending powers that require the support of the Treasury Department and are available only in very unusual circumstances, such as those we find ourselves in today. These programs serve as a backstop to key credit markets and have helped to restore the flow of credit from private lenders through normal channels,” Powell continued. “We have deployed these lending powers to an unprecedented extent, enabled in large part by financial backing and support from Congress and the Treasury.

“Although funds from the CARES Act will not be available to support new loans or new purchases of assets after Dec. 31, the Treasury could authorize support for emerging lending facilities, if needed, through the Exchange Stabilization Fund. When the time comes, after the crisis has passed, we will put these emergency tools back in the box,” he went on to say.

Cox Automotive chief economist Jonathan Smoke offered his latest assessment later on Wednesday through a blog post titled, “The Fed Will Keep Rates Low, But That Alone Won’t Sell Cars.”

Smoke pointed out that the 10-year U.S. Treasury yield ticked up this week, approaching the highest level he’s seen during the pandemic. He also mentioned that mortgages and auto financing rates have not followed Treasury’s path, meaning that providers are keeping their rates lower despite the underlying yields being higher.

“Yet despite these better conditions, we are not seeing auto demand respond,” Smoke said. “November saw a notable softening in sales, especially in the back half of the month as the third wave of COVID-19 grew. Consumer sentiment has also declined since October as conditions worsened.

“The Fed’s actions may not influence much in the near term as attention focuses more on stimulus, the initial distribution of vaccines and when we see signs that this third wave of the pandemic has passed its peak. The Fed is keeping rates low and credit broadly available, but this alone will not keep Americans buying,” Smoke added.

Meanwhile, Powell acknowledged the points Smoke made as well as the conundrum finance companies face when trying to form strategy for 2021.

“As we have emphasized throughout the pandemic, the outlook for the economy is extraordinarily uncertain and will depend in large part on the course of the virus. Recent news on vaccines has been very positive. However, significant challenges and uncertainties remain with regard to the timing, production, and distribution of vaccines, as well as their efficacy across different groups. It remains difficult to assess the timing and scope of the economic implications of these developments,” Powell said.

“The ongoing surge in new COVID-19 cases, both here in the United States and abroad, is particularly concerning, and the next few months are likely to be very challenging,” he added. “All of us have a role to play in our nation’s response to the pandemic. Following the advice of public health professionals to keep appropriate social distances and to wear masks in public will help get the economy back to full strength. A full economic recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.”

And among those activities could be acquiring a new or used vehicle with some kind of financing attached.

Looking ahead to 2021, Edmunds analysts also noted that there are still uncertainties ahead, but they remain confident that industry sales will continue at a steady pace without a dramatic decline like the one seen at the outset of the pandemic.

“Even if we face another wave of retail shutdowns, the good news is that dealers are far better prepared now for selling virtually than ever before,” Edmunds executive director of insights Jessica Caldwell said in a news release distributed on Thursday. “And vaccines on the way should only help keep consumer confidence high.”

AUL Corp. senior vice president of agency and dealer sales Paul McCarthy makes his debut on the podcast to describe how dealerships have pivoted their F&I marketing and presentations in light of the pandemic’s impact on vehicle sales.

McCarthy also shared some details about what the company plans to offer in 2021.

To listen to the entire conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

A company that says it’s reshaping asset management using machine learning and big data analytics to manage institutional money now is getting involved with auto financing, too, by leveraging a relationship with a provider that specializes in the subprime market.

On Tuesday, Pagaya publicly announced the expansion of its consumer credit offering into auto financing, with hundreds of millions of dollars already invested in the space and multiple partners, including Flagship Credit Acceptance and Foursight Capital.

And chosen to serve as Pagaya’s new general manager of auto finance is Robert McDonald, who previously was vice president and head of auto and equipment-structured finance at Goldman, Sachs & Co.

The company highlighted that McDonald brings a wealth of invaluable experience, which management sees as helping to drive Pagaya’s expansion in this space.

Pagaya pointed out that its expansion comes at a time when American consumers rely on their vehicles more than ever and are purchasing new and used vehicles in droves.

“The automobile’s importance has been elevated during the pandemic. It is no longer just a means of transportation, but a safe way to experience concerts, weddings, rallies, movies and graduations,” Pagaya said.

In addition to unlocking new opportunities with financing providers, Pagaya noted that this move into auto finance has enabled the company to work with OEMs and their captive finance companies to bring more potential contract holders into their ecosystem.

Pagaya said its ability to partner with OEMs to increase consumer conversion into an OEM’s ecosystem creates sustainable long-term value.

“Pagaya’s investment in auto finance ultimately increases the availability of credit to borrowers. This means that auto manufacturers and auto dealers will be able to get more cars on the road, Pagaya’s lending partners will be able to better monetize their marketing spend, and more consumers will have access to better-priced loans,” McDonald said in a news release. “Everyone wins.”

With a focus on fixed income and alternative credit, Pagaya offers a variety of investment vehicles to institutional investors, including pension funds, insurance companies and banks.

Pagaya’s unique technology platform, Pagaya Pulse, runs on a suite of artificial intelligence technologies and state-of-the-art algorithms that can consistently deliver a high and scalable performance edge. Founded in 2016, the firm’s total assets under management currently sits at more than $2 billion.

Pagaya co-founder and chief executive officer Gal Krubiner also elaborated about the move into auto financing.

“We are excited to take the lead in this space and to provide better options for lending platforms looking to issue more loans and for consumers in need of a reliable means of transportation,” Krubiner said.