While smaller than the increases policymakers unfurled last year, the Federal Reserve made the expected move on Wednesday of pushing the target for the Federal Funds Rate up by another 25 basis points to the 4.50% to 4.75% range.

The move is likely to make it more challenging both for consumers to secure auto financing as well as small businesses like dealerships to get the financial resources they need, according to analysis from Cox Automotive and Cornerstone Advisors.

Federal Reserve chair Jerome Powell reiterated …

Read more

With another lift of 50 basis points on Wednesday, the Federal Reserve now has pushed the federal funds rate higher by 425 basis points this year to the 4.25% to 4.50% range.

While Federal Reserve chair Jerome Powell emphasized the importance of getting inflation under control, Cox Automotive chief economist Jonathan Smoke cautioned that “the Fed is now risking that monetary conditions, once rates reach the …

Read more

While some retailers seemingly started Black Friday sales promotions before Labor Day, dealerships and finance companies likely are bracing for some additional business this week as consumers feel the urge to shop and make big purchases.

As Cox Automotive noticed access to auto credit expanded slightly for the second month in a row, Edmunds shared its latest financing data to help dealerships and finance companies brace their new customers for what it will take to complete delivery of a used or new vehicle.

According to new Edmunds data, average transaction prices for …

Read more

Edmunds executive director of insights Jessica Caldwell and Cox Automotive chief economist Jonathan Smoke made comments before and after the Federal Reserve pushed interest rates higher again on Wednesday.

The latest 75-point rise pushed the year-to-date increase in the target rate to 375 basis points, which Smoke pointed out as the most in any single year since 1981.

Both Caldwell and Smoke arrived at the same assertions that subprime and other budget-constricted consumers are going to …

Read more

Both Cox Automotive and Edmunds shared intriguing data and insights — such as how much more per month consumers have to pay for a $30,000 retail installment sales contract — following the Federal Reserve raising the target range for the federal funds rate by another 75 basis points, marking the second straight hike of that magnitude when policymakers had the opportunity.

Before Cox Automotive and Edmunds explained the potential impact of these actions at your dealership or finance company, let’s first recap what …

Read more

Experts from Agora Data, Comerica Bank, Cox Automotive and Edmunds gave a variety of insights about two of the top current economic trends that can impact auto financing — inflation and interest rates.

As expected by these companies, the Federal Reserve raised the federal funds rate by 50 basis points on Wednesday, marking the largest increase in the target rate in 22 years, according to Cox Automotive chief economist Jonathan Smoke.

Fed chair Jerome Powell began a Wednesday afternoon news conference with this message after policymakers voted unanimously to raise the rate.

“Before I go into the details of today’s meeting, I’d like to take this opportunity to speak directly to the American people …

Read more

The Federal Open Market Committee (FOMC) at the Federal Reserve raised the federal funds rate target to a range of 0.25 to 0.5%, marking the first push higher by policymakers in three years.

The move prompted Cox Automotive chief economist Jonathan Smoke to say Wednesday’s action is likely the first of seven increases by the FOMC this year, sharing in a blog post that his rate projections indicate that the target rate would be near …

Read more

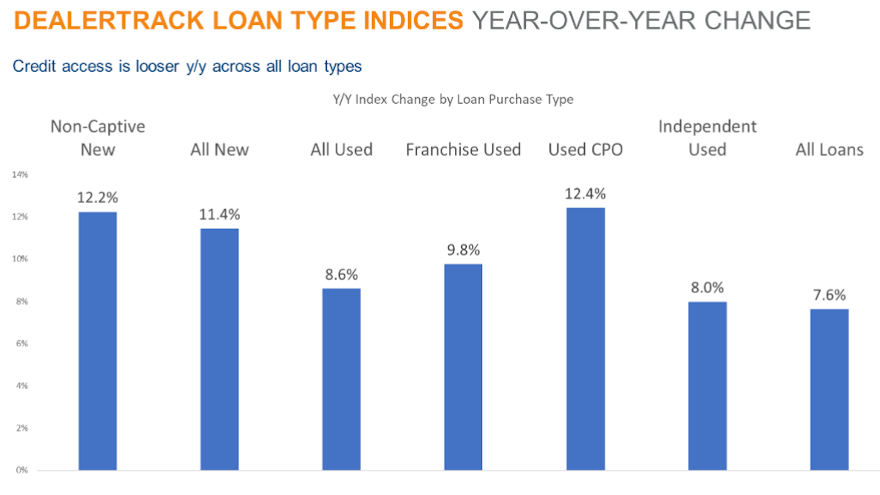

Access for all types of auto financing expanded in January, according to the newest Dealertrack Credit Availability Index.

But change might be coming with the likelihood of interest rates rising, with one economist calling it a “coin toss” as to how much the increase will be when the Federal Reserve announces its decision next month.

Cox Automotive reported that the Dealertrack Credit Availability Index increased 0.4% to 102.0 in January, reflecting that auto credit was easier to get in the month compared to December.

Analysts said access was looser by 7.6% year-over-year. And compared to February 2020, Cox said availability was looser by 2.9%.

Furthermore, analysts said the last time the time Dealertrack Credit Availability Index was this high was November 2018.

“A key reason for the improvement in credit availability in January was that the average yield spread on auto loans narrowed to the lowest level since January 2018,” Cox Automotive said in its index report.

“Even though the average auto loan saw a higher rate in January compared to December, bond yields increased by a larger amount, resulting in the lower observed yield spreads,” analysts continued.

“Credit access also improved across lender type in January with auto-focused finance companies having loosened the most,” Cox added. “On a year-over-year basis, all lenders had looser standards with auto-focused finance companies having loosened the most.”

Each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and loan details including term length, negative equity and down payments.

The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Across all auto lending in January, yield spreads narrowed, and terms lengthened, and the moves in those factors made credit more accessible,” Cox Automotive said. “However, down payments increased, the approval rate declined, and the negative equity share declined, and the moves in those factors made credit less accessible.

“The subprime share was unchanged in January from December,” analysts added.

Cox Automotive mentioned some other trends that can play a factor in auto financing, noting first that consumer sentiment fell in January.

Analysts recapped that consumer confidence declined 1.2% in January, according to the Conference Board, erasing some of December’s 2.9% gain. The movement left confidence down 14.2% compared to February 2020.

“The underlying measures of present situation and future expectations moved in opposite directions as present situation declined but future expectations improved,” Cox Automotive said. “Plans to purchase a vehicle in the next six months increased to the highest level in six months and was higher than a year ago. Plans to purchase a home also improved to a record level.”

Analysts also pointed out that the sentiment index from the University of Michigan declined 4.8% in January as both current conditions and expectations declined.

The Michigan reading was the lowest since November 2011, according to Cox.

Analysts went on to mention that the Morning Consult daily index of consumer sentiment declined 2.1% in January, leaving it down 3.3% year-over-year and down 24.1% from the end of February 2020.

Meanwhile, Comerica bank chief economist Bill Adams also chimed in with a discussion about interest rates and what the Federal Reserve might do.

“With economic activity looking resilient to Omicron in early 2022, inflation gaining momentum, and energy prices rising, the Fed is pivoting rapidly to withdraw stimulus from the U.S. economy,” Adams said in an analysis released on Thursday.

Adams recounted that the minutes of the Federal Open Market Committee’s meeting on Jan. 25-26 lay out a potential FOMC course for the Fed to start shrinking their balance sheet later this year.

Adams also explained that the meeting minutes reaffirm that asset purchases (known as quantitative easing or QE) will end in March. He recapped that the FOMC said, “participants generally noted that current economic and financial conditions would likely warrant a faster pace of balance sheet runoff than during the period of balance sheet reduction from 2017 to 2019 and a number of participants commented that conditions would likely warrant beginning to reduce the size of the balance sheet sometime later this year.”

The Comerica Bank expert closed by stating the FOMC minutes confirm that a federal funds rate hike is very likely at the FOMC’s next meeting on March 15 and 16, but “shed no light on whether members are considering a 0.50% hike (as opposed to a ‘normal’ 0.25% hike).

“By extension, FOMC members’ recent discussion of a 0.50% hike in public statements could be part of a deliberate strategy to guide the public’s expectations toward a half percentage point hike. Comerica Economics sees the March rate decision as a coin toss between a 0.25% hike and a 0.50% hike,” Adams went on to say.