Cox Automotive chief economist Jonathan Smoke again offered context about the potential influence on auto financing that the Federal Reserve last policy action of the year might have.

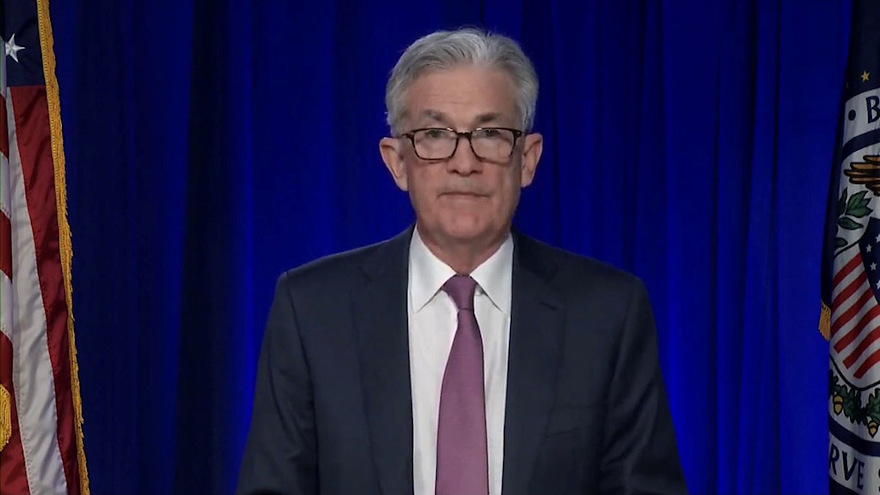

On Wednesday, the Federal Open Market Committee decided unanimously to keep the target range for the federal funds rate at 0 to 0.25%, with Fed chair Jerome Powell appearing in a press conference following the announcement. Powell began his opening statement reinforcing the positives policymakers are seeing.

Read more

Not surprising to economic experts, the Federal Reserve stood pat on current policy associated with interest rates.

However, Cox Automotive chief economist Jonathan Smoke pointed out one metric that might have an even more pronounced impact on auto financing than what the Federal Open Market Committee (FOMC) does involving interest rates.

Last week, the FOMC decided unanimously to keep the target range for the federal funds rate at 0 to 0.25%; the level it’s been for much of the time since the pandemic began in earnest early last year.

“With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen,” the Fed said in its latest statement. “The sectors most adversely affected by the pandemic have improved in recent months, but the summer's rise in COVID-19 cases has slowed their recovery.

“Inflation is elevated, largely reflecting factors that are expected to be transitory. Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses,” policymakers went on to say.

Curt Long chief economist and vice president at the the National Association of Federally-Insured Credit Union (NAFCU) acknowledged that it was broadly expected that the FOMC announced that it would begin tapering asset purchases. Long explained the $15 billion per month pace of tapering also was in line with expectations, and puts the Federal Reserve on track to wind down the process by June 2022.

Long also noted that Fed chair Jerome Powell has said that the committee intends to complete tapering before raising rates, and markets have increasingly begun to look at June as a possibility for the next rate hike.

“However, the statement makes clear that the committee could alter the pace of tapering if economic conditions change,” Long said in a news release from NAFCU. “The prospect of a rate hike in mid-2022 is likely to be complicated by several factors.

“First, the FOMC committed to reach full employment prior to liftoff, and employment remains several million workers shy of pre-COVID levels. Second, although the recent spike in inflation has brought forward market expectations for the next rate increase, it is likely that supply chain disruptions will improve — if only marginally — over the first half of 2022, which could relieve price pressures,” Long continued.

“The committee is clearly divided on its view of the nature of these pressures. September's statement called them ‘transitory,’ while the current statement said they are ‘expected to be transitory.’ If inflationary pressures persist beyond the next month or two, a June date for a rate increase is likely. However, NAFCU continues to believe that liftoff is more likely to occur later next in 2022,” Long went on to say.

Even though new- and used-vehicle supplies are, there certainly appears to be some lift in auto financing, as TransUnion mentioned in its latest quarterly data.

Smoke pointed out in a blog post distributed by Cox Automotive that bond yields moved higher to end the day after the financial markets digested the new information. Smoke — who will appear multiple times during Used Car Week that begins on Monday in Las Vegas — also said yields are currently about 10 basis points lower than the October peak, but that peak was lower than the highs reached in late March and early April.

“Consumer loans like auto loans and mortgages are more directly related to these longer-term yields rather than the Fed’s short-term rate policy,” Smoke said. “The 10-year yield is up 84 basis points year over year. However, consumer rates on auto loans have not moved up so far this year as yield spreads on auto loans have narrowed.

“As spreads have narrowed to be more in-line with spreads prior to the pandemic, most borrowers have seen lower rates even as bond yields have been higher year-over-year,” he continued in the blog post. “The auto market has enjoyed stable and favorable credit trends all year, but moving forward we’re likely past the lowest of the lows, and going forward the year-over-year comparisons will start to turn unfavorable.

“Average auto loan rates moved lower in October but have started November moving slightly higher,” Smoke went on to say. “It is likely that consumers will continue to see relatively low rates and favorable terms at least until the Fed is driving rates higher. However, bond yields can move ahead of the Fed, so credit conditions could change more rapidly if indeed the path of the economy ends up differently than the Fed is currently expecting.”

And in a commentary posted on Monday, Comerica Bank chief economist Robert Dye offered this upbeat assessment.

“It feels like we are at a turning point in the economic history of the global coronavirus pandemic. The U.S. caseload for the delta variant dropped through mid-October. Consumer and business confidence has started to improve. The pace of hiring has picked up. We may have to endure more waves of contagion, yet the potential economic drag from future waves appears to be diminishing,” Dye said.

“Congress is wrestling with what is likely the last piece of significant fiscal legislation in this policy cycle. The Federal Reserve has begun to normalize extraordinary monetary policy. Kids are back in school. Workers are returning to the office. New medicines are being developed. While it is too early to say that we have definitely turned the corner on the pandemic, there is good cause for optimism,” he continued.

The prognosis for the economy, finance companies and investors continues to be mixed since experts and policymakers keep pointing toward a factor that has shown to be incredibly difficult to control.

Cox Automotive, the Federal Reserve, the National Association of Federally-Insured Credit Unions and S&P Global Ratings all have chimed in on the current landscape in recent days, discussing elements such as interest rates, asset purchases, yield and more.

Read more

Earlier this year, compliance expert Randy Henrick dissected the complex new law in Illinois that’s creating challenges for dealerships, finance companies and service providers.

Now some members of the U.S. Senate want to use a similar path to create nationwide policy with lawmakers examining the issue during a hearing on Thursday.

American Financial Services Association president and chief executive officer Bill Himpler cautioned Senators from making that choice when he testified before the Senate Banking, Housing, and Urban Affairs Committee in a hearing titled, “Protecting Americans from Debt by Extending the Military’s 36% Interest Rate Cap to Everyone.”

In his testimony, Himpler warned of the “disastrous effect” a 36% rate cap would have on Americans’ ability to manage their own financial lives.

“When someone who is underbanked or has less than perfect credit is turned down or does not have access to a needed loan, it is not a consumer-protection victory. It is a civil rights loss,” Himpler said. “All consumers deserve access to safe and reliable credit.”

Himpler highlighted recent studies that confirm that millions of Americans would be cut off from reliable small-dollar credit should a national rate cap be imposed, and the growing consensus that rate caps harm consumers, particularly those with subprime credit.

“Nearly one in three Americans do not have a prime or excellent credit score. Fifty-three million adults have thin or no credit files,” Himpler told the committee. “When reputable small-dollar lenders cannot serve underbanked or subprime consumers, the consumers are left to turn to unregulated or illegal predatory lenders.”

Consumer Bankers Association general counsel and senior vice president David Pommerehn also testified during Thursday’s hearing.

“A fundamental aspect of lending and a cornerstone to prudent banking practices is the ability for banks to price for risk,” Pommerehn said during his opening comments.

“While well-intentioned, a cap on interest rates is not an effective policy for protecting against debt traps or other negative outcomes for consumers,” he continued. “Banks in the United States are highly regulated entities that carefully and appropriately price risk before extending credit to anyone. Placing a cap on that price in the form of an all-in maximum annualized percentage rate does not mean that consumers will get lower rates on their loan; it means that in many cases consumers will not have the option to access a loan at all.

“Research today demonstrates that interest rate caps reduce credit availability and create negative outcomes for the populations their proponents intend to benefit,” Pommerehn added.

At the beginning of the hearing, Senate Banking Committee ranking member Sen. Pat Toomey of Pennsylvania made similar points when objecting to the purpose of this lawmaker gathering.

“It is a fundamental principle of economics that markets discover prices. Sellers compete until they reach the lowest prices that will let them stay in business. The only exceptions are under monopoly conditions, which generally only exist when the government creates or facilitates them,” the Republican said.

“Nevertheless, history is littered with examples of government planners’ failed attempts to set prices. They fail because they generate huge unintended consequences, which inevitably harm the very people they are supposed to protect,” Toomey continued.

“Proponents of a 36% interest rate cap seem to think it would result in borrowers getting cheaper credit, but that’s just not the case. In fact, those most in need would simply lose access to credit. If a lender can’t recoup its costs, it won’t make the loan,” he went on to say.

Meanwhile, Sen. Sherrod Brown of Ohio, the Democrat who is the committee chair, pointed out that since 2010, Montana, South Dakota, Colorado, Nebraska, California and Illinois have all passed laws to cap interest rates on consumer loans at 36%. Brown wants passage of the Veterans and Consumers Fair Credit Act, which is a proposal to extend the Military Lending Act’s 36% interest rate cap to cover veterans and all Americans.

“Our legislation builds on the success of the Military Lending Act, and extends its 36% cap to everyone — including to the veterans and surviving family members left out of the original law,” Brown said.

In his opening statement during Thursday’s hearing, Brown took this approach.

“Another argument we hear from the payday lobby is that no one can be profitable offering loans at 36% interest,” Brown said. “Really? 36% is still pretty darn high, and will make any company plenty of money.

“I’d ask my colleagues to think about their own credit cards or mortgages or loans they’ve taken out — I’m betting your rates were a whole lot lower than 36%,” he went on to say.

Experts from Cox Automotive and the National Association of Federally-Insured Credit Unions (NAFCU) each digested actions and comments by the Federal Reserve on Wednesday after the Federal Open Market Committee (FOMC) voted unanimously to keep interest rates unchanged.

Both experts honed in on how policymakers offered a glimpse about when their strategy could change to modify the target range for the federal funds rate that currently sits at 0 to 0.25%.

“Today, the Federal Open Market Committee kept interest rates near zero and maintained our asset purchases. These measures, along with our strong guidance on interest rates and on our balance sheet, will ensure that monetary policy will continue to deliver powerful support to the economy until the recovery is complete,” chair Jerome Powell said during his opening comments of a press conference on Wednesday following the Fed’s latest action.

“Widespread vaccinations, along with unprecedented fiscal policy actions, are also providing strong support to the recovery,” Powell continued. “Indicators of economic activity and employment have continued to strengthen, and real GDP this year appears to be on track to post its fastest rate of increase in decades. Much of this rapid growth reflects the continued bounce back in activity from depressed levels. The sectors most adversely affected by the pandemic remain weak, but have shown improvement.”

After Powell offered his initial assessments, NAFCU chief economist and vice president of research Curt Long issued this statement that focused on the forward-looking parts of the chair’s remarks.

“As expected, the Fed moved forward its expected date for liftoff to 2023, and more than one-third of the committee believes it will occur in 2022,” Long said. “The inflation forecast increased for the current year, but not beyond. It appears that the change in the outlook for rate increases was motivated by dissipating downside risks resulting from progress in vaccine distribution, rather than the recent rise in price growth.”

In anticipation of being asked about how the FOMC is approaching its decision-making process, Powell offered these thoughts.

“Of course, these projections do not represent a committee decision or plan, and no one knows with any certainty where the economy will be a couple of years from now. More important than any forecast is the fact that, whenever liftoff comes, policy will remain highly accommodative,” Powell said.

“Reaching the conditions for liftoff will mainly signal that the recovery is strong and no longer requires holding rates near zero,” he added.

Of course, dealerships need to retail vehicles and finance companies need to fill their portfolios with quality paper now, as well as in 2022 and 2023. Cox Automotive chief economist Jonathan Smoke offered his observations about not only the current state of auto financing, but also how it is connected back to the Fed’s actions.

“Consumer loans like auto loans and mortgages are more directly related to these longer-term yields rather than the Fed’s short-term rate policy,” Smoke wrote in a company blog post. “The 10-year yield was up about 66 basis points during chairman Powell’s press conference compared to the end of last year.

“However, consumer rates on auto loans have not moved up so far this year as yield spreads on auto loans have narrowed,” Smoke continued. “In other words, consumers have seen less movement in rates and, in some cases, improvement in rates that contrasts with the upward movement of the 10-year. This is a result of lenders being willing to accept lower yield spreads with strong loan performance and record vehicle values.

“In fact, subprime borrowers have seen much lower rates this spring than at any point in 2020,” he added.

Smoke then explained movement in spreads is one ingredient Cox Automotive uses in gauging credit availability. Smoke noted that it appears financing is now more readily available now than a year ago.

“Average auto loan rates have moved in different directions by credit tier so far in June, but average rates for most credit tiers continue to be lower than a year ago. The Fed is not changing monetary policy in the near term, so trends in the economy and in the auto market will have more of an impact on the rates consumers see on auto loans this summer,” Smoke said.

“Even with bond yield and mortgage rates higher than the absolute lows last year, auto loan rates are not moving higher for every consumer. Some rates, especially for subprime, have been much lower this spring, and that has contributed to the very strong retail market,” he went on to say.

No matter how much — or perhaps how little — Fed moves impact the day-to-day operations at your dealership or finance company, Powell reiterated the institution’s pledge to all.

“We understand that our actions affect communities, families, and businesses across the country. Everything we do is in service to our public mission. We at the Fed will do everything we can to support the economy for as long as it takes to complete the recovery,” he said.

As finance companies modify their ongoing strategies, perhaps what the Federal Reserve does with interest rates will give executives at least one consistent ingredient on which to build forward-looking plans.

Members of the Federal Open Market Committee (FOMC) decided unanimously to keep the target range for the federal funds rate at 0 to 0.25%. The Fed said this week that the FOMC expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.

Curt Long, chief economist and vice president of research at the National Association of Federally Insured Credit Unions (NAFCU), provided his assessment and a prediction after the FOMC made its latest move.

“The FOMC’s April statement was nearly unchanged from the prior meeting and contained no indication that tighter policy is on the committee’s radar,” Long said in a statement. “Despite acknowledged progress both on the vaccine front and in recent economic data, chairman Powell sounded no nearer to the next rate hike than he was during his last press conference.

“Importantly, the FOMC is still inclined to see any spike in inflation over the coming months as transitory,” Long continued. “Powell emphasized the committee’s triggers for tapering asset purchases (‘substantial further progress’ towards full employment) and liftoff (full employment, inflation at least at the committee’s 2% target, and inflation that is expected to exceed that target ‘for some time’).

“Many observers are anticipating that inflationary pressures will force the Fed to act earlier than it prefers, but the Fed’s messaging has remained consistent. NAFCU continues to believe that it will be at least two more years before the Fed’s next rate hike,” Long went on to say.

As Long referenced, Fed chair Jerome Powell made his regular appearance following a rate decision. He reiterated how policymakers are proceeding as well as how the Fed views the current economic landscape.

“Widespread vaccinations, along with unprecedented fiscal policy actions, are providing strong support to the recovery,” Powell said in his opening remarks on Wednesday afternoon. “Since the beginning of the year, indicators of economic activity and employment have strengthened. Household spending on goods has risen robustly. The housing sector has more than fully recovered from the downturn, while business investment and manufacturing production have also increased. Spending on services has also picked up, including at restaurants and bars.

“More generally, the sectors of the economy most adversely affected by the pandemic remain weak but have shown improvement. While the recovery has progressed more quickly than generally expected, it remains uneven and far from complete,” he continued.

Powell also touched on a few metrics of overall economic activity, noting employment rose by 916,000 jobs in March, as the leisure and hospitality sector posted a notable gain for the second consecutive month.

However, Powell acknowledged that employment in that sector — which likely is connected to a significant portion of current contract holders — is still more than 3 million positions lower than the level recorded at the onset of the pandemic.

For the economy as a whole, Powell said payroll employment is 8.4 million below its pre-pandemic level as the unemployment rate remained “elevated” at 6% in March.

“This figure understates the shortfall in employment, particularly as participation in the labor market remains notably below pre-pandemic levels,” Powell said.

“The economic downturn has not fallen equally on all Americans, and those least able to shoulder the burden have been the hardest hit. In particular, the high level of joblessness has been especially severe for lower-wage workers in the service sector and for African Americans and Hispanics. The economic dislocation has upended many lives and created great uncertainty about the future,” he went on to say.

Powell then added, “To conclude, we understand that our actions affect communities, families and businesses across the country. Everything we do is in service to our public mission. We at the Fed will do everything we can to support the economy for as long as it takes to complete the recovery.”

Finance companies likely remember what happened during the Great Recession 12 years ago when the credit market seized up as bad a car engine without oil.

The Federal Reserve reiterated the significant steps it’s taking to ensure finance companies have the raw material to keep their portfolios growing. But the pace providers might be buying paper still looks a bit uncertain.

Fed chair Jerome Powell made public comments on Wednesday following the Federal Open Market Committee voting unanimously to leave interest rates unchanged.

“The Federal Reserve has also been taking broad and forceful actions to more directly support the flow of credit in the economy for households, for businesses large and small and for state and local governments. Preserving the flow of credit is essential for mitigating damage to the economy and promoting a robust recovery,” Powell said during his opening statement of Wednesday’s press conference.

“Many of our programs rely on emergency lending powers that require the support of the Treasury Department and are available only in very unusual circumstances, such as those we find ourselves in today. These programs serve as a backstop to key credit markets and have helped to restore the flow of credit from private lenders through normal channels,” Powell continued. “We have deployed these lending powers to an unprecedented extent, enabled in large part by financial backing and support from Congress and the Treasury.

“Although funds from the CARES Act will not be available to support new loans or new purchases of assets after Dec. 31, the Treasury could authorize support for emerging lending facilities, if needed, through the Exchange Stabilization Fund. When the time comes, after the crisis has passed, we will put these emergency tools back in the box,” he went on to say.

Cox Automotive chief economist Jonathan Smoke offered his latest assessment later on Wednesday through a blog post titled, “The Fed Will Keep Rates Low, But That Alone Won’t Sell Cars.”

Smoke pointed out that the 10-year U.S. Treasury yield ticked up this week, approaching the highest level he’s seen during the pandemic. He also mentioned that mortgages and auto financing rates have not followed Treasury’s path, meaning that providers are keeping their rates lower despite the underlying yields being higher.

“Yet despite these better conditions, we are not seeing auto demand respond,” Smoke said. “November saw a notable softening in sales, especially in the back half of the month as the third wave of COVID-19 grew. Consumer sentiment has also declined since October as conditions worsened.

“The Fed’s actions may not influence much in the near term as attention focuses more on stimulus, the initial distribution of vaccines and when we see signs that this third wave of the pandemic has passed its peak. The Fed is keeping rates low and credit broadly available, but this alone will not keep Americans buying,” Smoke added.

Meanwhile, Powell acknowledged the points Smoke made as well as the conundrum finance companies face when trying to form strategy for 2021.

“As we have emphasized throughout the pandemic, the outlook for the economy is extraordinarily uncertain and will depend in large part on the course of the virus. Recent news on vaccines has been very positive. However, significant challenges and uncertainties remain with regard to the timing, production, and distribution of vaccines, as well as their efficacy across different groups. It remains difficult to assess the timing and scope of the economic implications of these developments,” Powell said.

“The ongoing surge in new COVID-19 cases, both here in the United States and abroad, is particularly concerning, and the next few months are likely to be very challenging,” he added. “All of us have a role to play in our nation’s response to the pandemic. Following the advice of public health professionals to keep appropriate social distances and to wear masks in public will help get the economy back to full strength. A full economic recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.”

And among those activities could be acquiring a new or used vehicle with some kind of financing attached.

Looking ahead to 2021, Edmunds analysts also noted that there are still uncertainties ahead, but they remain confident that industry sales will continue at a steady pace without a dramatic decline like the one seen at the outset of the pandemic.

“Even if we face another wave of retail shutdowns, the good news is that dealers are far better prepared now for selling virtually than ever before,” Edmunds executive director of insights Jessica Caldwell said in a news release distributed on Thursday. “And vaccines on the way should only help keep consumer confidence high.”

In what one observer described as a policymaker trying “to avoid mistakes of the past,” the Federal Reserve gave an update about how it plans to craft its actions for the next five years.

Following an extensive review that included numerous public events across the country, the Federal Open Market Committee (FOMC) on Thursday announced the unanimous approval of updates to its statement on longer-run goals and monetary policy strategy, which articulates its approach to monetary policy and serves as the foundation for its policy actions.

The Fed explained the updates reflect changes in the economy over the past decade and how policymakers are taking these changes into account in conducting monetary policy. The updated statement is also intended to enhance the transparency, accountability and effectiveness of monetary policy.

“The economy is always evolving, and the FOMC’s strategy for achieving its goals must adapt to meet the new challenges that arise,” Federal Reserve chair Jerome Powell said in a news release. “Our revised statement reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities, and that a robust job market can be sustained without causing an unwelcome increase in inflation.”

Among the more significant changes to the framework document are:

— On maximum employment, the FOMC emphasized that maximum employment is a broad-based and inclusive goal and reports that its policy decision will be informed by its “assessments of the shortfalls of employment from its maximum level.” The original document referred to “deviations from its maximum level.”

— On price stability, the FOMC adjusted its strategy for achieving its longer-run inflation goal of 2% by noting that it “seeks to achieve inflation that averages 2 percent over time.” To this end, the revised statement states that “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

—The updates to the strategy statement explicitly acknowledge the challenges for monetary policy posed by a persistently low-interest rate environment. Here in the United States and around the world, monetary policy interest rates are more likely to be constrained by their effective lower-bound than in the past.

The committee first adopted a framework statement in 2012.

Powell announced this first public review of the FOMC framework back in November 2018, involving three distinct components.

First, the Federal Reserve hosted a series of 15 Fed Listens events across the country to engage with employee groups and union members, small business owners, residents of low- and moderate-income communities, retirees, and others to hear a wide range of perspectives about how monetary policy decisions affect their communities. A report summarizing all of those events is available here.

Second, the Federal Reserve last June convened a research conference where prominent academic experts addressed economic topics central to the review. That conference program, links to the conference papers and presentations, and links to session videos are available here.

Then, the FOMC explored the range of issues that were brought to light during the course of the review in five consecutive meetings beginning last July. Analytical staff work put together by teams across the Federal Reserve System provided essential background for the committee’s discussions. Minutes of those meetings are available here and a collection of those papers is available here.

The FOMC reported it would continue its practice of considering the Statement of Longer-Run Goals and Policy each January and that it intends to undertake a public review of its monetary policy strategy, tools, and communication practices roughly every five years.

Curt Long, who is chief economist and vice president of research at the National Association of Federally-Insured Credit Unions (NAFCU), offered his assessment of the Fed’s intentions.

“The FOMC’s new framework looks to avoid mistakes of the past,” Long said in a news release. “Where some of the tightening which took place during the last cycle was done to short-circuit the inflation that policymakers thought was right around the corner, now they will wait until those stresses manifest more fully before raising rates.

“In focusing on ‘shortfalls’ rather than ‘deviations’ from full employment, it orients the Fed to pursue a tighter labor market without worrying so much about its potential to drive price increases,” Long went on to say.

Edmunds discovered interest rates for new vehicles financed in May dropped to the lowest level seen by the industry in nearly seven years.

Meanwhile, Edmunds indicated that rates for used-vehicle financing remain nearly steady compared to both this time last year as well as five years ago.

Edmunds reported on Tuesday that the annual percentage rate (APR) on new financed vehicles averaged 4% in May, compared to 4.3% in April and 6.1% a year ago. Analysts said this reading is the lowest average interest rate since August 2013 and the third-lowest Edmunds has on record dating back to 2002.

On the used-vehicle side, Edmunds determined that ARP came in at 8.3% in May, slightly lower than the year-ago reading (8.7%) and a bit above what analysts spotted back in May 2015 (7.6%).

Edmunds analysts also mentioned that zero-percent finance offers for new models dipped slightly in May compared to April, but still remained at near-record levels. The firm said these deals constituted 24% of all new financed purchases, compared to 25.8% last month.

Furthermore, Edmunds data also revealed that 47% of all financed purchases received an APR below 3% in May, compared to 41.5% in April.

“Consumers who purchased a car in May got to take advantage of some of the best deals we’ve ever seen, thanks to a combination of Memorial Day weekend sales and generous incentives offered by automakers to spur demand during the pandemic,” Edmunds executive director of insights Jessica Caldwell said in a news release. “Even with 0% finance deals down slightly, more car shoppers got better financing rates than usual.”

Edmunds went on to note that contract term lengths sustained near-record highs in May. The average term length for a new vehicle was 71.4 months, which is the second-highest Edmunds has on record, compared to last month’s average of 73.4 months.

“Car shoppers are showing that they’re comfortable committing to longer loans to get the vehicles that they want right now, especially with the ongoing availability of 0% deals,” Caldwell said. “But these incentives aren’t going to last forever. It’s going to get tougher for car shoppers to find good deals as inventory declines over the new few months.”

Likely sparking the stretching of those new-vehicle terms is the cost of those models.

ALG, a subsidiary of TrueCar, projected average transaction prices (ATP) in May to be up 4.6% or $1,607 from a year ago but down 1.7% or $639 from April.

“Every brand, with the exception of Kia, has increased their average transaction price year-over-year in May mainly attributed to ongoing 0% interest rates. Kia is down likely due to lower inventory levels on their popular Telluride model, which carries one of the highest MSRPs in their lineup,” ALG chief industry analyst Eric Lyman said in a news release.

“It’s important to note that while average transaction prices have increased year-over-year, they are down month-over-month,” Lyman continued. “We can expect a trend of lower inventory on popular models across automakers as production stoppages and higher than expected demand are taking shape based on geography. As a result, we expect automakers to continue to not only pull back, but also shift their incentive strategies from nationally based to regionally and locally based in order to offset those supply shortages.

“We expect the highly incentivized and in-demand SUVs and trucks to be affected more than other segments,” he added.

And finally, the valuation analysts at Kelley Blue Book reported the estimated average transaction price for a light vehicle in the United States came in at $38,940 in May. KBB computed new-vehicle prices increased $1,618 (up 4.3%) year-over-year, while prices dropped $244 (down 0.6%) from last month.

“Though new-car sales will be down significantly for the third month in a row, due to the COVID-19 pandemic, average transaction prices have actually strengthened over this period for several reasons,” Kelley Blue Book analyst Tim Fleming said in a news release. “Incentives, deferred payments, and low APR deals are helping consumers stretch out their monthly payments over longer terms.

“Inventory levels have tightened as the economic recovery has begun, but little new supply has arrived yet from the factories that restarted in May,” Fleming continued. “Finally, the share of pickup trucks has spiked recently, reaching an all-time high in April.”

KBB reiterated these factors all contributed to the 4% increase in transaction prices in. However, KBB predicted gains at these levels are not sustainable.

“If factories are slow to restart and new-vehicle inventories remain low, manufacturers will pare back their incentives, placing pressure on new-vehicle prices,” KBB said. “While trucks have been remarkably resilient, their big spike in market share was the result of sales losses in mid-size cars, compact SUVs and minivans.

“When the market sees sales of these family haulers return will depend on the shape of the economic recovery, but in the meantime, truck manufacturers are likely pushing to get capacity back up quickly to restock their inventories,” KBB went on to say.

New-Car Finance Data (Averages)

|

|

May 2020

|

May 2019

|

May 2015

|

|

Term

|

71.4

|

69.6

|

67.9

|

|

Monthly Payment

|

$570

|

$559

|

$490

|

|

Amount Financed

|

$36,059

|

$32,510

|

$28,908

|

|

APR

|

4.0%

|

6.1%

|

4.6%

|

|

Down Payment

|

$3,925

|

$4,235

|

$3,346

|

Used-Car Finance Data (Averages)

|

|

May 2020

|

May 2019

|

May 2015

|

|

Term

|

67.9

|

67.3

|

66.1

|

|

Monthly Payment

|

$412

|

$412

|

$381

|

|

Amount Financed

|

$22,721

|

$22,191

|

$20,782

|

|

APR

|

8.3%

|

8.7%

|

7.6%

|

|

Down Payment

|

$2,947

|

$2,719

|

$2,331

|

Source: Edmunds

With circumstances changing so quickly, the Federal Reserve on Sunday afternoon cut interest rates to zero percent and announced it would purchase $700 billion in bonds and securities to help stabilize the financial system in light of COVID-19.

Policymakers were on tap to meet later this week for its regularly scheduled gathering but chose to take action earlier.

“Overall economic activity has been expanding at a moderate rate, even though weak growth abroad and trade developments have been weighing on some sectors. U.S. banks are strong, have high levels of capital and liquidity, and are well positioned to provide credit to households and businesses,” Federal Reserve chair Jerome Powell said in a statement following Sunday’s actions.

“Against this favorable backdrop, the virus presents significant economic challenges. Like others, we expect that the illness and the measures now being put in place to stem its spread will have a significant effect on economic activity in the near term,” Powell continued.

“Financial conditions have also tightened markedly. The cost of credit has risen for all but the strongest borrowers, and stock markets around the world are down sharply,” he added.

“The actions we have announced today will help American families and businesses, and indeed, our entire economy weather this difficult period and will foster a more vigorous return to normal once the disruptions from the coronavirus abate,” Powell went on to say. “We will continue to closely monitor economic and financial developments and their implications for the economic outlook. We are prepared to use our full range of tools to support the flow of credit to households and business, to help keep the economy strong, and to promote our maximum employment and price stability goals.

After the Fed made its move, National Association of Federally-Insured Credit Unions (NAFCU) chief economist and vice president of research Curt Long offered this reaction, including a situation likely on the minds of dealerships and finance companies.

“The actions from the Fed ahead of its scheduled meeting on Wednesday reflect the view that a recession is a virtual inevitability,” Long said. “As the Fed has stated previously, it believes it is better to meet such a scenario early and with force, rather than by gradually opening the faucets.

“With such a comprehensive stimulus package, all eyes now turn to Congress for the fiscal response. Much depends on how the health situation evolves, but credit unions should plan for rates to be stuck at zero for most of this year,” Long added.

The Fed’s actions arrived after leading financial executives and bank leaders attended a White House meeting last week to discuss possible fallout from the coronavirus.

“Banks have implemented emergency measures to assist impacted customers and small businesses and appreciate statements from regulators allowing for increased flexibility to do so,” Consumer Bankers Association president and chief executive officer Richard Hunt said in a statement.

“Over the last decade, banks have built strong foundations, including the doubling of capital reserves, passing increasingly strong stress tests and a continued decline in problem institutions,” Hunt added.