If contract holders in your portfolio do business with Fifth Third Bank, here’s an option to help them stay current.

AutoPayPlus has engaged with Fifth Third Bank to further diversify its portfolio of bank partners that provide money transmission solutions for the company’s F&I program that offers automated payments and early payoff of automotive and other consumer debt.

Along with Signature Bank and Community Federal Savings Bank, these bank relationships have helped AutoPayPlus securely process more than $5.65 billion in payments for its customers.

Headquartered in Ohio, Fifth Third is one of the largest consumer banks in the Midwest.

And according to a news release, Fifth Third brings to the relationship a line of credit for AutoPayPlus to accelerate its growth, especially in the areas of technology enhancements and future fintech projects.

“Our relationship with Fifth Third Bank provides a wealth of benefits for both our customers and our company,” AutoPayPlus CEO Robert Steenbergh said in the news release. “We’re looking forward to building a strong long-term relationship together.”

Greg Dryden is city president for Fifth Third Bank in Orlando, Fla., also where AutoPayPlus is located.

“We appreciate the opportunity AutoPayPlus has given us to provide a consultative-structured solution to best serve their clients’ needs,” Dryden said. “Secure payment processing is foundational to their continued expansion, and we are glad to have been able to assist them.”

Edmunds’ newest auto finance data not only showed the growing share of consumers paying at least $1,000 per month for either a new or a used vehicle, experts also cautioned that they “are only seeing the tip of the negative equity iceberg.”

Edmunds reported on Wednesday that 15.7% of consumers who financed a …

Read more

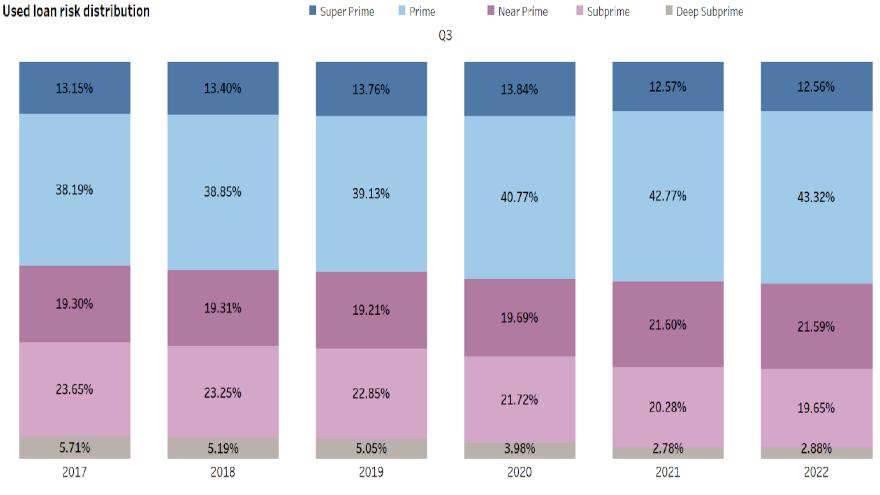

With used-vehicle prices easing a bit, the amount of risk that finance companies are absorbing into their portfolios is starting to abate a bit, too.

According to Experian’s State of the Automotive Finance Market Report: Q3 2022, the average amount financed to deliver a used vehicle during the third quarter came in at

Read more

Many deals and relationships are forged on the golf course, and AutoPayPlus likely is looking to have the same thing happen via its latest marketing endeavoer.

The provider of automated biweekly and early payoff services for automotive, RV, boat, home and student loans recently entered into an endorsement relationship with professional golfer D.A. Points.

According to a news release, the agreement includes featuring AutoPayPlus as a sponsor when Points competes on the PGA Tour and opportunities for agents to interact with him during golf days and other corporate events in Orlando, Fla.

“I’m excited to partner with AutoPayPlus in the coming year,” Points said in the news release. “In addition to getting involved in some of the great events they have planned with their industry partners, I’ll be proudly displaying their logo while I compete on the PGA Tour and other professional circuits.”

AutoPayPlus highlighted Points is one of the most popular players on the PGA Tour with more than $11 million in career earnings. He recorded his first career win at the Pebble Beach National Pro-Am in 2011, followed by a 2013 win at the Houston Open and, most recently, a victory at the 2017 Puerto Rico Open.

Throughout his career, Points has recorded 54 Top 25 finishes, including a Top 10 at the 2011 PGA Championship.

“D.A. is a perfect fit to be a goodwill ambassador for our company. Not only does he embody our core values, including a strong work ethic, caring family man and going above and beyond, but he also shares Orlando as his hometown,” AutoPayPlus CEO Robert Steenbergh said.

“Belonging to the same club and getting the chance to know D.A. personally made this an absolute no brainer. He’s one of us and we’re thrilled to be a sponsor for his career and to get to him involved with our company,” Steenbergh went on to say.

Prompted by record staff growth that is expected to reach 30% year-over-year in 2022, AutoPayPlus by US Equity Advantage recently expanded its corporate headquarters in Orlando, Fla., by 20%.

Last year, the provider of automated biweekly and early payoff services for automotive, RV, boat, home and student loans, grew its staff by 24%, triggering the need for additional space and bringing the company’s total office size to 18,307 square feet.

The company highlighted the sustained staff growth is primarily in the sales and member support departments. It coincides with last September’s launch of AutoPay+PERKS, a fintech solution designed to increase dealer profit and service retention via dealer-branded debit cards, along with increasing demand for the company’s AutoPayPlus F&I service that gives dealers a solution to extended contract terms and rising interest rates.

The open design and other elements reflect the vision and personality of AutoPayPlus CEO Robert Steenbergh, an avid golfer and musician who once played in a rock band. Features include:

• Music-themed conference rooms showcasing Steenbergh’s sizeable collection of signed guitars. They include the Margaritaville room with a Jimmy Buffett-signed guitar, the Meat Loaf room and guitar, and the Ozzy Osbourne room with a signed Hello Kitty guitar.

“That one’s a story,” Steenbergh said in a news release. “I got a last-minute invitation to go backstage at Ozzy’s concert in Tampa, and the only faceplate pick guard I had time to grab was from my daughter’s guitar. Ozzy was amused that the Prince of Darkness was signing Hello Kitty.”

• Indoor putting green adjacent to the office’s wide open reception space.

“I wanted to showcase the ‘wow factor’ that’s our big expansive view of the downtown Orlando skyline and add another fun element that shows yet one more of my vices,” Steenbergh said.

Adjacent to the putting green is a colorful AutoPayPlus Family Tree that illustrates the various department branches, each with specific talents, and how they intertwine with each other with the company’s six core values as its foundation.

“AutoPayPlus is not just a company, but a family constantly seeking new ways to grow and innovate, leading to a one-of-a-kind organization,” he added.

• Onsite media center created specifically to integrate video production into the company’s growth strategy.

“As AutoPayPlus continues to expand its efforts as a fintech company, we believe this will play an integral part in promoting our brand and connecting us better with our members and partners,” chief marketing officer Katherine Pett said.

AutoPayPlus recently achieved a benchmark 2,500 five-star reviews on Trustpilot and dealers have voted it the top biweekly payments company in the industry for seven consecutive years.

“Our office expansion was imperative for us to continue providing the level of service our dealership partners and customers have come to expect,” Steenbergh said.

The customers in your auto finance company portfolio or arriving at your dealership might not be feeling so great about their current family budget situation based on the latest research recently shared by LendingClub Corp. and the BMO Real Financial Progress Index.

Findings from the 14th edition of LendingClub’s Reality Check: Paycheck-To-Paycheck research series, conducted in partnership with PYMNTS.com, showed more than half of Americans earning between $100,000 to $150,000 live …

Read more

Edmunds said its analysts have adjusted their auto finance data cleaning process to include new and used monthly payments up to $2,000 to account for changes to the market, as previously the limit was up to $1,500.

Based on the third quarter data Edmunds shared on Monday, you can understand why.

Edmunds reported 14.3% of consumers who financed a new-vehicle purchase in Q3 committed to a monthly payment of …

Read more

After looking at the new data, it’s probably understandable why Edmunds senior manager of insights Ivan Drury said, “buying a car in 2022 is a whole different ball game.”

Edmunds reported the average amount financed for used vehicles delivered in the second quarter jumped by more than $4,400 year-over-year to …

Read more

With S&P Global Ratings acknowledging that the U.S. economy “could be facing an unhappy summer,” LendingClub Corp. released findings from the 11th edition of the Reality Check: Paycheck-To-Paycheck research series, conducted in partnership with PYMNTS.com.

LendingClub highlighted the Financial Distress Factors Edition examined the financial lifestyle of U.S. consumers who live paycheck to paycheck, the factors that cause financial distress — life-cycle events or life-altering events — and the impact of …

Read more

For your contract holders who still want to make their monthly payment via cash, Payix and Nortridge Software are teaming up to provide a solution.

The REPAY company and provider borrower-facing collections and communications tools recently expanded its exclusive partnership with the software provider for finance companies and other loan servicing firms. The result is the opportunity to provide online cash payment acceptance, known as eCash, to Nortridge clients.

According to a news release, eCash can streamline payment acceptance by enabling contract holders to make payments using cash at thousands of participating retail locations, including major convenience stores, dollar stores and pharmacies. Cash payments are then settled electronically to the system of record to simplify reconciliation and end-to-end payment management all from one place.

Payix eCash technology will be embedded within the Nortridge Loan Management System (LMS), providing clients with enhanced payment acceptance capabilities, robust reporting, streamlined workflows and simpler reconciliation through the real-time integration.

“We are excited to add an online cash payment acceptance offering to our exclusive partnership with Nortridge Software,” Payix co-founder Preston Cecil said in the news release. “As a company focused on enhancing the borrower experience, we aim to improve the loan repayment process by offering convenient payment solutions for lenders and their borrowers.

“Our expanded partnership with Nortridge will continue to provide lenders with the ability to meet consumers’ payment preferences by equipping them with a cash payment option,” Cecil continued.

Nortridge Software president and chief executive officer Greg Hindson added, “Lenders are always striving for ways to improve collections.

“The integration between Nortridge and Payix makes it easy for borrowers to pay anywhere and anytime — benefiting both borrowers and lenders,” Hindson went on to say.