After TransUnion released its Q3 2021 Quarterly Credit Industry Insights Report (CIIR), Satyan Merchant made a return appearance on the Auto Remarketing Podcast.

The senior vice president and automotive business leader at TransUnion not only delved deeper into the third-quarter metrics, but also gave perspectives on how much impact pandemic-triggered customer assistance programs have been based on the latest data.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Finance company executives and managers know the impact from rising vehicle prices has to come to roost somewhere. TransUnion’s Q3 2021 Quarterly Credit Industry Insights Report (CIIR) offered some interesting data to illustrate the point.

The average amount financed per contract originated during the third quarter as well as the average balance still held by consumers in Q3 both made notable year-over-year rises, according to the report released on Wednesday.

Read more

Experian senior director of automotive financial solutions Melinda Zabritski returned for another episode of the Auto Remarketing Podcast to explain some similarities between second-quarter data and trends analysts noticed before the pandemic.

Zabritski also tackled a hypothetical scenario of a consumer who has had their finances impacted drastically during the past year.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

The financial services industry — including auto financing — is rebounding strongly from the early impacts of the COVID-19 pandemic, according to TransUnion’s Q2 2021 Quarterly Credit Industry Insights Report (CIIR).

In fact, analysts discovered the metric that many finance company executives might be watching closest nowadays — delinquencies — is at a rate on par with what they observed before the pandemic.

Read more

While the pandemic has hindered face-to-face contact in many ways, Nicholas Financial reiterated that its branch-model system and how the subprime finance company interacts with dealers and consumers again helped its quarterly performance.

Nicholas reported figures from the first quarter of its 2022 fiscal year, highlighting that its net income for the three months that ended June 30 came in at $1.4 million compared to $0.6 million during the opening quarter of the previous fiscal year.

The company said its diluted net income per share grew year-over-year from $0.07 to $0.18.

Nicholas acknowledged its revenue softened 15.0% to $14.2 million to start the 2022 fiscal year after the previous year began with $16.6 million in revenue.

During the quarter, the company said it originated $19.2 million in finance receivables, collected $28.4 million in principal payments, reduced debt by $4.6 million and increased cash by $7.6 million.

Nicholas also highlighted accounts 60 days or more delinquent decreased to 2.5%, excluding Chapter 13 bankruptcy accounts, compared to 3.0% as of the prior year first quarter.

The company went on to mention net portfolio yield during Q1 increased to 17.2% compared to 16.6% during the first quarter of the previous fiscal year.

“There is no doubt that the COVID-19 pandemic had an impact on our operations overall and particularly on our new loan originations,” Nicholas’ president and chief executive officer Doug Marohn said in a news release. “However, times like these prove out our business concepts and validate our branch-based model nicely.

“We finance primary transportation to and from work for the subprime borrower through the local independent dealer,” Marohn continued. “Our loans tend to be smaller than most of our competitors and therefore payments are lower and exposure on those accounts is shorter. The vehicle is one that they need — not just want — and the payments are affordable even in times of economic crisis. Our local presence allows us to maintain a better relationship with the customer, as well.”

Marohn also shared how Nicholas gained momentum as its Q1 closed.

“Although the pandemic had an early negative impact on new loans and originations in April and May, we were able to outproduce both 2018’s and 2019’s loan volume for the month of June,” he said. “From a portfolio management perspective, we enjoyed decreases in 31+ delinquency, 61+ delinquency, repossessions and losses.

“Out of an abundance of caution we added over $3 million of provision expense to bolster our reserves in case the pandemic has a more negative impact on our receivables in the upcoming quarters,” Marohn went on to say. “Even with the $3 million of provision expense, we were able to turn out the best earnings quarter in recent history.”

Even though Credit Acceptance watched its second-quarter origination volume drop by 28.7%, leadership of the subprime auto finance company is committed to maintaining its underwriting strategy, which played a role in it generating healthy income gains.

Last week, Credit Acceptance announced its consolidated net income totaled $288.6 million, or $17.18 per diluted share, for the three months that ended June 30. In the same period a year earlier, the company said consolidated net income was $96.4 million, or $5.40 per diluted share.

For the first half of 2021, Credit Acceptance reported that its consolidated net income totaled $490.7 million, or $28.96 per diluted share, compared to consolidated net income of $12.6 million, or $0.70 per diluted share, for the same period in 2020.

The company also noted in a news release that its adjusted net income — a non-GAAP financial measure — for Q2 was $230.3 million, or $13.71 per diluted share, compared to $154.1 million, or $8.63 per diluted share, during Q2 of 2020.

For the first six months this year, Credit Acceptance said its adjusted net income was $395.1 million, or $23.32 per diluted share, compared to adjusted net income of $329.8 million, or $18.29 per diluted share, through the halfway mark of last year.

Other developments from the second quarter included:

— An increase in forecasted collection rates for contracts assigned in 2017 through 2021, which increased forecasted net cash flows from its portfolio by $104.5 million.

— Forecasted profitability per contract assignment consistent with its initial estimate for contracts assigned in 2021 and significantly in excess of its initial estimates for contracts assigned in 2018 through 2020.

— A decline in origination volume, as unit and dollar volumes declined 28.7% and 20.5%, respectively, as compared to the second quarter of 2020.

— Stock repurchases of approximately 598,000 shares, which represented 3.6% of the shares outstanding at the beginning of the quarter.

“Although the immediate impact of the COVID-19 virus has subsided, the impact of the COVID-19 pandemic on our business continues to be significant,” Credit Acceptance said in the news release. “Starting in mid-March 2020, we experienced a substantial reduction in demand for our product and a significant decline in cash flows from our loan portfolio that lasted through mid-April 2020, after which collections and new loan volumes improved significantly.

“Starting in late July 2020 and continuing through February 2021, we experienced another substantial reduction in demand for our product as federal stimulus and enhanced unemployment benefit payments lapsed, dealer inventories declined and used vehicle prices increased,” officials continued. “Demand for our product improved again in March and April 2021 as additional federal stimulus payments were distributed.

“Starting in May 2021 and continuing through July 2021, we experienced another significant decline in demand for our product,” company officials went on to say. “We believe that this decline is primarily due to low dealer inventories and further increases in used vehicle prices, which we believe are primarily due to the downstream impact of supply chain disruptions in the automotive industry.”

Those points intrigued investment analysts who participated in Credit Acceptance’s quarterly conference call.

In fact, one Wall Street observer said, “There is an awful lot of capital out there that is chasing loans. And often, people are being a little bit crazy to get volume. And you mentioned market share a minute ago. I’m wondering if you’re seeing any disruptive players disturbing the market where you service your customers?”

Credit Acceptance chief treasury officer Doug Busk replied first, according to the call transcript posted on the company website.

“Well, you’re certainly right that the more capital that the industry has access to, the more competitive it tends to be. I don’t really have any particular insight into the business practices of others in the industry,” Busk said.

Credit Acceptance chief executive officer Ken Booth later added, “It’s really hard to say. I mean there’s lots of participants in the market. We price our business to try to maximize the economic profit. We try to make an acceptable return on what we forecast collections for.

“So, we’ve looked at it from our perspective. We’re disappointed that volume is down, but we view this kind of as a temporary situation. How long it lasts, we don’t really know. But we think the market will stabilize at some point. We feel good about the business that we’re writing,” Booth went on to say.

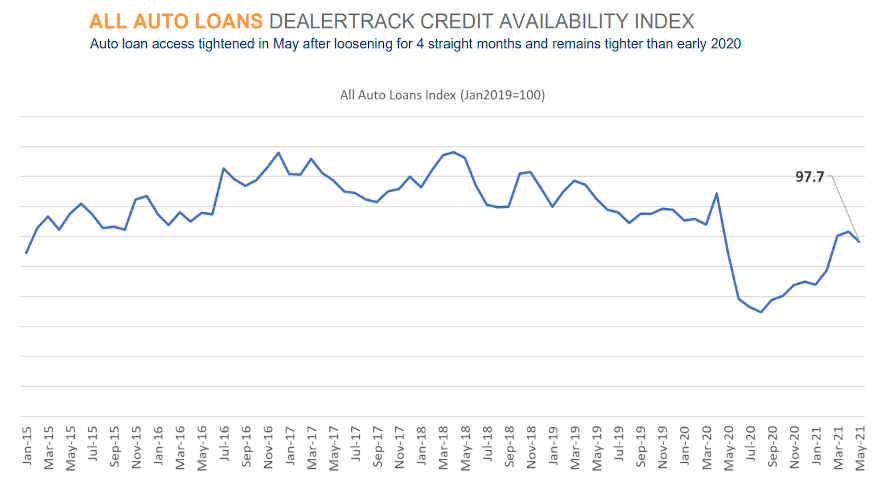

You might have noticed it’s been a little more difficult to get your potential buyer’s deal bought by your network of finance companies.

The newest Dealertrack Auto Credit Availability Index showed just how much of a pinch in paper funding is happening.

Read more

Nicholas Financial made quite a year-over-year rebound when detailing its 2021 fiscal year results last week, including vital metrics like net income and delinquency rates.

Despite a dip in total revenue, the subprime auto finance company reported that its net income for the fiscal year that ended March 31 jumped to $8.4 million compared to $3.5 million a year earlier, while its diluted net income per share went from $0.45 to $1.09 during the same stretch.

The improvements arrived even as Nicholas Financial said total revenue decreased 9.8% to $56.0 million during the 2021 fiscal year from $62.1 million generated in the previous fiscal year.

How did the company do it? Nicholas Financial reported that the company originated $88.2 million in finance receivables, collected $118.6 million in principal payments, reduced debt by a net amount of $35.3 million, repurchased $0.9 million of common stock and increased cash by $8.3 million.

“We are very pleased with our overall fiscal year-end results,” Nicholas Financial president and chief executive officer Doug Marohn said in a news release. “We continue to produce excellent portfolio performance, recognizing very low delinquency and net write-offs, the likes of which we have not seen in years.

“We were also able to enjoy year-over-year increases in both indirect and direct originations and loan volumes,” Marohn continued. “The year-over-year increase on indirect originations was the first we have seen since my return to Nicholas, and it was especially gratifying to see this during the pandemic.”

As Marohn referenced, Nicholas Financial cut its total delinquency rate in half by the finish of the 2021 fiscal year, slicing it to 5.67% from 10.22% a year earlier.

And the 7,307 contracts that came into its portfolio had similar characteristics as the previous fiscal year, including:

— Average term: 46 months versus 47 months a year earlier

— Average amount financed: $10,135 versus $10,035 a year earlier

— Average APR: 23.4% in both fiscal years

Nicholas Financial finished its 2021 fiscal year with 22,760 active contracts.

And just before the fiscal year closed, the company also opened a new location in West Jordan, Utah. Along with Utah, Nicholas Financial now is licensed in Arizona, New Mexico and Texas and has recently initiated expansion efforts in each of those states.

“It is with great pleasure we welcome the Salt Lake City market to our branch network,” Marohn said. “It is a wonderful area with great people and a robust economy, and we have assembled a very talented team to service both our dealer partners and borrowing customers. We are committed to growing our company, and one way we will do that is through growing our footprint throughout the United States.”

With plenty of positive momentum going into its 2022 fiscal year, Marohn is upbeat about Nicholas Financial maintaining and growing its presence in the subprime space.

“The ability to once again report substantially increased earnings is a testament to our core business strategy as well as to the hard-working men and women who execute that strategy every day,” Marohn said. “Our commitment to the branch-based model with a local office in every market we service allows us to better support our dealer partners and our borrowing customers. This approach has also facilitated the expansion of our direct loan products to virtually every NFI branch office.

“As we continue to increase our core product market share in the existing branch markets, we remain focused on growing the direct loan business, as well as expanding our branch network in western states.”

Along with highlighting how total outstanding balances are approaching $1.3 trillion, Experian’s Q1 2021 State of the Automotive Finance Market report also delved into some metrics based on geography.

Experian pinpointed the average credit score of used-vehicle paper bought in Q1 by state. The top 10 lowest averages where perhaps the most subprime financing took place included:

1. Mississippi: 635

2. Alabama: 640

3. Georgia: 643

4. North Carolina: 645

5. Texas: 645

6. Maryland: 647

7. South Carolina: 647

8. Oklahoma: 651

9. Tennessee: 652

10. Florida: 658

On the new-vehicle side, Experian noticed the average crept out of the non-prime space but involved many of the same states, including:

1. Maryland: 708

2. Mississippi: 710

3. New Mexico: 710

4. Texas: 710

5. Georgia: 711

6. West Virginia: 712

7. Alabama: 713

8. Louisiana: 714

9. Oklahoma: 715

10. North Carolina: 716

Experian also share a breakdown of regional percentages by provider, including banks, credit unions, captives, as well as what analysts classify as finance companies that often serve the subprime market along with a final category simply dubbed, other.

Here are those figures for used financing:

West

Bank: 26.58%

Captive: 11.12%

Credit union: 31.78%

Finance company: 15.55%

Other: 14.95%

Midwest

Bank: 36.42%

Captive: 6.65%

Credit union: 28.23%

Finance company: 14.95%

Other: 13.75%

South

Bank: 31.69%

Captive: 7.91%

Credit union: 19.01%

Finance company: 18.87%

Other: 22.52%

Northeast

Bank: 41.98%

Captive: 14.90%

Credit union: 20.54%

Finance company: 14.30%

Other: 8.28%

And as you might expect since they’re directly connected with the automaker, Experian highlighted that captives led the way in each region for new-vehicle financing in Q1. Here are those details

West

Bank: 24.27%

Captive: 54.13%

Credit union: 13.61%

Finance company: 1.59%

Other: 6.41%

Midwest

Bank: 28.60%

Captive: 55.66%

Credit union: 9.36%

Finance company: 5.58%

Other: 0.80%

South

Bank: 29.48%

Captive: 49.20%

Credit union: 11.43%

Finance company: 8.85%

Other: 1.05%

Northeast

Bank: 22.36%

Captive: 67.69%

Credit union: 5.63%

Finance company: 2.02%

Other: 2.30%

Escalating vehicle prices are impacting auto-finance data, too, as Experian’s Q1 2021 State of the Automotive Finance Market report showed outstanding balances jumped 10.3% year-over-year from $1.168 trillion to $1.288 trillion.

So, SubPrime Auto Finance News posed this one to Experian:

In light of rising prices for both new and used vehicles, how close is the market to the point of consumers saying, “I can’t afford this,” followed by sales and financing momentum softening?

In response …

Read more