TransUnion is pretty bullish about the future prospects for the subprime segment of auto financing.

While discussing the metrics contained in the Q1 2021 TransUnion Industry Insights report, senior vice president and automotive business leader Satyan Merchant explained how that data coupled with a handful of other trends could lead to a lift in originations within subprime.

First, let’s get into the information TransUnion shared on Wednesday.

Analysts indicated the broader auto-finance market continued to recover during the first quarter, with average outstanding balance per contract topping $20,000 for the first time since TransUnion began tracking the metric.

TransUnion noted that originations — viewed one quarter in arrears to account for reporting lag — continued to increase in Q4 2020, though at a slower rate than Q3. Analysts acknowledged the slowdown is primarily due to fewer contracts originated in subprime.

However, TransUnion said in a news release that early counts in Q1 point to some recovery happening for this subset of the population.

Analysts also determined serious delinquency rates for contracts 60 days or more past due increased in Q1, moving to 1.51% from 1.37% year-over-year. They explained the slight rise in aggregate delinquency rates is, in part, driven by lower subprime originations.

Vintage analysis is showing that auto portfolios across all risk tiers remain healthy, according to TransUnion.

“The auto finance market continues its recovery after encountering the depths of the pandemic last year,” Merchant said in the news release. “The strength of originations, balances and loan performance point to a market where lenders have continued to make credit available to borrowers; while government stimulus, falling unemployment and tax refund season have all helped strengthen household balance sheets.

“All of these factors point to rebound in subprime originations in Q1 2021 and beyond,” he continued. “While overall delinquency rates continue to rise, they appear to be at manageable levels.

“At the onset of the pandemic, there was a fear that we might see a major spike in auto delinquency rates, especially as most consumers were locked down in their homes,” Merchant went on to say. “That fear never materialized and we anticipate more auto loan growth and continued good performance in the near future.”

TransUnion plans to get deeper into its report during a free webinar on May 26. Registration for the session can be completed on this website.

Q1 2021 Auto Loan Trends

|

Auto Lending Metric

|

Q1 2021

|

Q1 2020

|

Q1 2019

|

Q1 2018

|

|

Number of Auto Loans

|

83.2 million

|

83.8 million

|

82.2 million

|

79.7 million

|

|

Borrower-Level Delinquency Rate (60+ DPD)

|

1.51%

|

1.37%

|

1.31%

|

1.32%

|

|

Average Debt Per Borrower

|

$20,001

|

$19,302

|

$18,845

|

$14,837

|

|

Prior Quarter Originations*

|

6.7 million

|

6.9 million

|

6.7 million

|

6.6 million

|

|

Average Balance of New Auto Loans*

|

$24,677

|

$22,764

|

$22,128

|

$21,678

|

*Note: Originations are viewed one quarter in arrears to account for reporting lag. Source: TransUnion.

Experian senior director of automotive financial solutions Melinda Zabritski returned for another appearance on the Auto Remarketing Podcast to discuss not only the credit bureau’s auto-finance data collected throughout 2020, but also how she and her team are navigating through the uniqueness of compiling data during a pandemic.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

The auto-finance industry’s appetite for the highest-risk paper declined to close 2020.

According to Experian’s Q4 2020 State of the Automotive Finance Market report, analysts discovered deep subprime originations of all contracts booked in a quarter dipped below 2% for the first time. The fourth-quarter level came in at 1.98%.

Experian classifies deep subprime as consumers with credit scores between 300 and 500.

The latest level of deep subprime originations is considerably lower than what Experian recorded in a closing quarter of a year going back to 2016. The report shared these metrics for deep subprime booked during the fourth quarter of the year:

2016: 4.32%

2017: 3.77%

2018: 4.27%

2019: 3.39%

The subprime segment — consumers with credit scores between 501 and 600 — is softening, too, according to Experian’s newest report released on Thursday.

Analysts said subprime originations made up 14.35% of all contracts booked in Q4. That’s down from 16.53% of all contracts falling into subprime during Q4 of 2019 and 18.68% during Q4 of 2018.

Meanwhile, what Experian classifies as non-prime — individuals with scores between 601 and 660 — is generating originations at nearly a steady pace.

The report indicated non-prime originations constituted 17.30% of all Q4 contracts; the same level as what analysts recorded in the last quarter of 2019. The segment had similar readings to close three other years as noted in the report:

2018: 17,56%

2017: 17.61%

2016: 17.82%

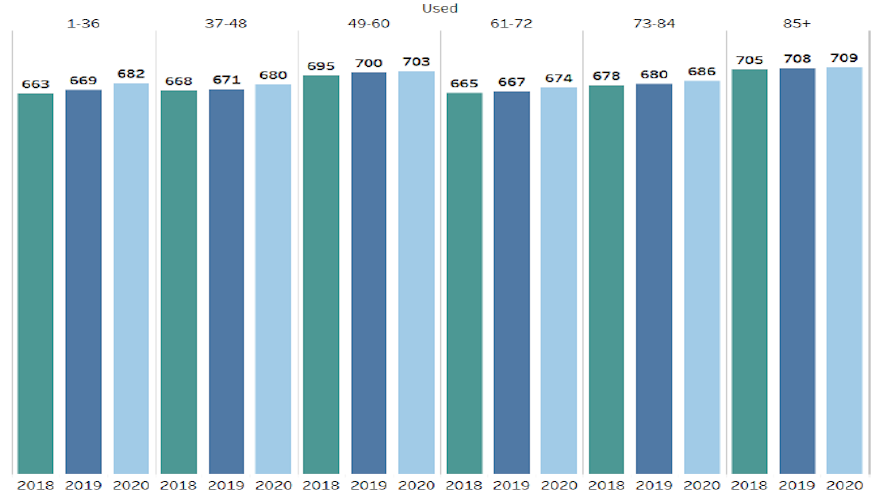

Though affordability remains a concern in the automotive industry, Experian found consumers with strong credit are shifting away from used vehicles, back into financing new vehicles.

Experian determined 44% percent of super prime consumers selected used vehicles in Q4 2020, down from 47.03% in Q4 2019. Similarly, 60.38% of prime consumers chose used, compared to 63.75% during the same period last year.

“The events of 2020 disrupted the automotive industry and we’ve seen some consumers shift away from patterns that have been cemented over previous quarters such as opting for used vehicles,” Experian’s senior director of automotive financial solutions Melinda Zabritski said in a news release.

“While we can likely attribute some of the change to stimulus checks, carry-over incentives and tight inventory, we find ourselves in uncharted territory,” Zabritski continued. “Leveraging data to better understand patterns and trends will help lenders and dealers make the most strategic decisions in the days to come.”

Overall, Experian observed similar trends and patterns to previous quarters. Total originations for prime and super prime consumers increased in Q4, reaching 44.24% and 22.13%, respectively.

Analysts also pointed out that average amounts financed and monthly payments continue to rise, likely driven by consumers continued preference for larger vehicles such as pickups and SUVs.

In fact, Experian said more than 50% of new vehicles financed in Q4 were small and mid-sized SUVs.

According to the report, the average amount financed for a new vehicle increased nearly $2,000 year-over-year to reach $35,228 in Q4, while the average monthly payment increased $13 to $576 over the same period.

Similarly, analysts discovered the average amount financed for used vehicles grew from $20,824 to $22,467 year-over-year, while average monthly payments increased $18 to surpass $400 for the first time, reaching $413 in Q4.

“With the increases in average loan amounts and payments, affordability will continue to be an important topic to pay attention to, particularly as market conditions continue to develop in 2021,” Zabritski said.

“To keep the industry moving forward, lenders and dealers need to rely on data to ensure that they have the right options to fit consumers’ needs,” she went on to say.

Experian highlighted a few additional findings for Q4, including:

• Total open automotive finance balances grew 2.8% year-over-year, reaching $1.27 trillion in Q4.

• Average contract terms continued to increase for both new and used vehicles in Q4, rising to 69.68 months for new vehicles and 65.58 for used vehicles.

• Interest rates dropped in Q4. The average interest rate for a new-vehicle contract dropped from 5.25% in Q4 2019 to 4.31% in Q4 2020, while the average interest rate for used vehicles dropped from 9.05% to 8.43% in the same time frame.

• Captive finance companies saw the largest amount of growth in Q4 2020, from 26.22 % in Q4 2019 to 30.14% in Q4 2020.

Experian plans to delve into the entire Q4 2020 State of the Automotive Finance Market report during a webinar. Registration for the session can be completed here.

TransUnion discovered that finance companies originated paper at an overall pace during the third quarter of last year resembling what analysts spotted during Q3 of 2019.

When looking closer at the subprime market, however, TransUnion found originations are lagging. Analysts pegged the year-over-year decline at about 21% since subprime originations made up approximately 860,000 of the 7.32 million contracts flowing into portfolios during Q3.

For reference, TransUnion indicated 1.09 million of the 7.45 million contracts booked in Q3 2019 fell into the subprime category.

The data arrived through TransUnion’s Q4 2020 Industry Insights Report released on Thursday.

“A tightening in auto lending standards would generally be the primary reason for such a precipitous drop in subprime origination activity,” TransUnion senior vice president and auto line of business leader Satyan Merchant said in a news release, which reiterated originations are viewed one quarter in arrears to account for reporting lag.

“We’ve conducted further analysis that demonstrates that, in this case, it could be a combination of lagging consumer demand and adjustments in lending criteria,” Merchant continued. “This revelation points to the outsized economic impacts some subprime borrowers are feeling as a result of COVID-19.”

Meanwhile, TransUnion was able to share Q4 metrics for auto delinquencies, which include contract payments that are 60 days or more past due.

TransUnion’s overall 60-day delinquency rate rose to 1.57% in Q4 2020 from 1.50% the previous year. Looking closer at the subprime segment, the increase was even more pronounced. Analysts said it climbed from 7.41% to 9.05% year-over-year.

All told, TransUnion determined there were 83.5 million outstanding installment contracts at the close of 2020, down slightly from the close of 2019 (83.8 million) and up from the end of 2018 (82 million).

Furthermore, TransUnion said balances continued to grow on a year-over-year basis, rising 3.5% to $1.33 trillion. Analysts added the average outstanding balance on those current contracts sat at $19,818, which is more than $1,200 higher than the end of 2017.

“The recovery observed in the auto lending market since the height of the pandemic has been a positive sign,” Merchant said. “The auto marketplace is unique in that originations activity may be more impacted by a lack of demand, whereas some of the other credit products have seen slower loan activity due to limited supply.

“We will likely have a better picture of what is to come in the auto lending industry as more accounts exit both auto and mortgage accommodation programs,” he went on to say.

Q4 2020 Auto Loan Trends

|

Auto Lending Metric

|

Q4 2020

|

Q4 2019

|

Q4 2018

|

Q4 2017

|

|

Number of Auto Loans

|

83.5 million

|

83.8 million

|

82 million

|

79.4 million

|

|

Borrower-Level Delinquency Rate (60+ DPD)

|

1.57%

|

1.50%

|

1.44%

|

1.43%

|

|

Average Debt Per Borrower

|

$19,818

|

$19,202

|

$18,858

|

$18,597

|

|

Prior Quarter Originations*

|

7.3 million

|

7.5 million

|

7.2 million

|

7.1 million

|

|

Average Balance of New Auto Loans*

|

$23,727

|

$22,232

|

$21,520

|

$20,909

|

*Note: Originations are viewed one quarter in arrears to account for reporting lag. Source: TransUnion.

Other credit market performances

As Merchant referenced, TransUnion’s report delved into other parts of the credit market, including personal loans that sometimes are held by subprime consumers, too.

Analysts indicated unsecured personal loan lenders continue to be cautious as originations in Q3 2020 were 30.7% lower than the prior year, but grew strongly quarter-over-quarter, indicating a gradual ramp-up in volume.

TransUnion determined serious delinquency rates increased slightly by 15 basis points in Q4 2020 on a quarterly basis, though remained 78 basis points lower than Q4 2019. The relatively low level of lending resulted in total outstanding balances falling again in Q4 2020 to $148 billion.

TransUnion senior vice president and consumer lending business leader Liz Pagel mentioned that continued availability of lender hardship programs, in addition to eviction moratoriums and decreased consumer spending, helped keep delinquencies and new charge-off balances low.

“The recent approval of another stimulus package and the potential for additional payments and the extension of federal unemployment benefits should help keep delinquencies and charge-offs at low levels in the near term even as lenders re-enter the market,” Pagel said.

“High savings rates and low credit card balances may continue to depress demand for debt consolidation loans, which could impact originations until lockdowns subside and consumers begin spending more,” she continued. “The end to lender forbearance programs, particularly mortgage, could impact delinquency rates, and later could drive more demand for credit as current liquidity sources are depleted.”

Also of note, TransUnion reported that mortgage originations continued to surge in Q3 2020, reaching nearly 4 million loans. Analysts said that’s the highest level of originations since the Great Recession and 67% higher than last year at the same time.

According to the report, mortgage originations were spread out evenly between refinancing and new purchases, with a 52% refinance share and 48% purchase share.

“On the surface, the consumer credit market is performing quite well. Serious delinquency levels remain near record lows while balance and origination activity is picking up,” said Matt Komos, vice president of research and consulting at TransUnion. “Additional stimulus and flattening unemployment rates point to a continuation of this trend.

“However, the performance of those accounts still in accommodation will help shape the true consumer credit picture,” Komos continued. “With many accounts expected to come out of accommodation between March and May, most notably mortgage accounts, we will soon see the true impact of those programs for both consumers and the credit marketplace.”

For more information about the report, register here for a webinar TransUnion is hosting on Wednesday.

Exeter Finance is in a celebratory mood and rightfully so. The non-prime auto finance company now has originated contracts with 1 million customers since it was founded in 2006.

To commemorate this milestone, Exeter identified its 1-millionth customer as Raul Trevino Jr. of Ennis, Texas, and awarded him a $10,000 cash prize and the vehicle he purchased this month at Toyota of Dallas and financed with Exeter free of charge.

“Exeter will celebrate its 15th anniversary later this year, and I am incredibly proud of the work our team has done helping customers purchase the vehicles they need,” Exeter Finance chief executive officer Jason Grubb said in a news release distributed this week.

“When we learned we would hit the 1-million-mark sometime in January, we decided to kick-off 2021 by awarding that customer the vehicle they had just purchased,” Grubb continued.

Exeter determined Trevino was that special customer on Jan. 15.

The company then arranged to waive all of his payments for the 2018 Toyota Camry and give him $10,000 to help pay for the taxes — effectively giving him a free car.

Exeter president and chief operating officer Brad Martin officially presented the vehicle to Trevino during a brief ceremony at Toyota of Dallas a few days after the purchase and financing were complete.

“Working with thousands of auto dealers nationwide, our mission is to make vehicle ownership possible for everyone,” Martin said. “It was a pleasure to meet Mr. Trevino and his family, learn how Exeter was able to help them and announce we were going to pay for their car. We are pleased to be able to do something special for an incredibly deserving family.”

After he received the car and cash prize from Exeter, Trevino said, “I didn’t know what to do when they said I had won. I was in shock! It was my first time to win something in my life. I feel very happy and am grateful to Exeter.”

Martin also appreciated Toyota of Dallas for its cooperation in hosting the celebration and for its strong, ongoing partnership with Exeter.

Toyota of Dallas managing partner Darren Dortch said the dealership was happy to take part.

“Exeter is a great partner for us. For them to pick a customer and actually give a car away to the 1-millionth customer was amazing. It was incredible for us to be a part of it,” Dortch said.

Exeter also recorded the festivities on video, which can be viewed on this website.

At the onset of the pandemic, many industry pundits made comparisons to the Great Recession; though we quickly learned that the similarities were few and far between. The underlying causes and economic impact of COVID-19 are vastly different from those more than a decade earlier, yet some experts still find some of the trends in the automotive industry — which resemble trends in 2008 — a bit concerning; the most noteworthy being the decrease in subprime originations.

History might suggest that automotive lenders have tightened credit standards and pulled back on lending to the highest risk borrowers; all designed to mitigate potential losses down the road. But that’s not necessarily the case. We’ve actually observed a gradual decline in subprime originations since Q2 2015 — it’s not a byproduct of the pandemic.

According to Experian’s Q3 2020 State of the Automotive Finance Market, subprime and deep subprime originations accounted for 17.5% of the total automotive financing market, with overall volume for subprime dropping 17% and deep subprime 35%, compared to last year. Broken out by risk segment, during Q3 2020, subprime and deep subprime originations accounted for 15.19% and 2.34%, respectively.

There are myriad reasons for the gradual decline.

First, over the past few years, consumers have prioritized their financial health. More and more consumers are educating themselves on sound financial habits and ways to improve their credit standing. In fact, many have leveraged services like Experian Boost to incorporate alternative data, such as utility, telecom and streaming service accounts into their credit reports, which is helpful for consumers with limited credit history. We’ve seen these efforts have a substantive impact. The average credit score for a new vehicle loan in Q3 2020 was 725, up 11 points from Q3 2016. Meanwhile, the average score for a used vehicle loan was 665, up from 656 in 2016.

But, it’s not just the improvement in consumers’ financial position. Unlike more than a decade ago, when lenders had a surplus of high-risk loans in their portfolios, the reasons for the decline in the subprime market can also be attributed to declines in volume. Lower volumes of vehicle inventory and business restrictions minimized the opportunity for car shoppers across risk tiers to take out loans. Add to that, with high unemployment rates, some consumers (particularly those that fall within high-risk tiers) may not have been in the market for a vehicle.

Let’s also remember, there are options for subprime borrowers to secure financing. Amid the Great Recession, we saw lenders across the board become hesitant to take on additional risk. Consumers turned to specialists in subprime financing, such as buy-here, pay-here lenders and finance companies, particularly in the used market. In Q3, buy-here, pay-here lenders accounted for 7.9% of used financing, up from 7.4% a year ago, while financing companies accounted for 13.2%, down from 14.03% in 2019.

While lenders haven’t pulled back on subprime and deep subprime originations, we’re not suggesting that lenders shouldn’t be mindful of the risk in their portfolios. With the average loan amount for new and used vehicles continuing to increase, along with the unknowns that lie ahead, it’s important for lenders to understand the market and find ways to help make vehicles more affordable and manageable for car shoppers, while minimizing risk.

Making an informed decision built on data and trending insight, ensures that consumers will have available financing options and dealers and lenders can continue to move cars. The future is still uncertain, but the more we understand about the market, the better positioned we will be to move forward.

Melinda Zabritski is the senior director of automotive financial solutions at Experian.

TransUnion sees auto-finance companies having less appetite for risk in the coming year.

The auto component of TransUnion 2021 consumer credit forecast released on Thursday projected that origination activity in the first and second quarters of next year is expected to generate 6.8 million and 7.4 million new accounts, respectively.

Analysts think a greater share of contracts will shift to the prime and above risk tiers.

TransUnion explained this origination mix shift is a reflection of changing consumer demand and adjustments to finance-company strategies due to the pandemic.

As subprime originations decline, analysts added that the total share of non-prime balances is expected to gradually decrease throughout the year.

“New auto originations will shift toward lower risk consumers as auto lenders continue to grapple with the aftermath of the pandemic,” said Satyan Merchant, senior vice president and TransUnion’s auto line of business leader.

“However, the forecasted origination activity represents a fairly healthy rebound for the industry given the challenges seen in 2020,” Merchant continued in a news release. “As long as supply issues do not persist, auto-loan originators should expect a steady 2021.”

Merchant noted that current portfolio performance should also stabilize as accommodations continue to decline. While a tool finance companies leverage significantly at the beginning of the pandemic, TransUnion sees just 3.8% of contracts currently sitting in some kind of modification.

“While consumers with a mortgage forbearance may impact auto loan delinquencies, we are anticipating this to be relatively small,” Merchant said.

“Over the years our research has shown that, especially in a time of need, many consumers prioritize auto payments more so than other credit products,” he continued.

“And now, during the COVID-19 pandemic, it’s clear that many Americans will continue to value having access to a vehicle, as it is the lifeblood of many consumers,” Merchant went on to say.

Editor’s note: More insights from TransUnion about its forecast are scheduled to be included in the first print edition of SubPrime Auto Finance News of 2021. To subscribe, go to www.autoremarketing.com/subscribe.

Experian senior director of automotive financial solutions Melinda Zabritski made a suggestion to finance companies after Experian released its Q3 2020 State of the Automotive Finance Market report on Thursday.

The recommendation came in connection with a metric that providers might already watch with a laser focus — delinquencies — even as the subprime segment continues to shrink to a new low.

According to the report, 30- and 60-day delinquency rates improved in the third quarter, coming in at 1.56% and 0.51%, respectively.

Comparatively, a year ago, Experian reported the 30-day delinquency rate stood at 2.25% and the 60-day delinquency rate sat at 0.75%.

“While the decline in 30- and 60-day delinquency rates is a positive trend for the industry, particularly with some of the accommodation programs coming to an end, we do need to consider the impact these programs have had on consumers,” Zabritski said in a news release.

“Some consumers likely leveraged financial assistance programs to manage through hardship, so it’s important for lenders to keep a close eye on how delinquency rates evolve over the coming quarters,” she continued. “Nonetheless, the improvement is a positive sign for the country’s economic recovery.”

Overall, the industry is taking on less risk as Experian pegged the subprime segment of all financing at 19.23% in the third quarter, representing a record low in its database.

And in Q3, analysts added that deep subprime financing remained below 3% of the overall market.

Beyond influencing consumers’ ability to manage monthly payments and perhaps how much appetite finance companies have for subprime, Experian pointed out the pandemic also has impacted overall volume.

However, despite fewer vehicle sales, analysts discovered outstanding balances still grew 2.8% from a year ago, reaching $1.2 trillion. This increases also comes at a time where a smaller percentage of vehicles are being financed.

Experian indicated the percentage of new vehicles with financing was 82.43% in Q3 compared to 86.99% the previous year. Similarly, the percentage of used vehicles with financing was 33.71% in Q3 compared with 39.79% over the same period.

“It is important to note, the drop in the percentage of vehicles with financing can also be attributed to an increase in cash transactions,” Experian said.

Prime consumers continue to opt for used vehicles

During the first few months of the pandemic, Experian recapped that automakers offered new-vehicle incentives to improve sales. As a result, analysts saw prime borrowers opt for new vehicles, reversing a trend they observed in previous quarters.

With fewer incentives offered during the third quarter, Experian found that a higher percentage of prime consumers shifted back to used.

In fact, analysts reported prime and super prime contract holders made up 55.3% of used vehicles financed during the quarter, a new high for used-vehicle financing.

Experian sees the shift back to the used vehicle market is likely driven by continued affordability conversations; a metric that Cox Automotive and Moody’s Analytics recently chose to track more closely.

The newest Experian report showed both the average amounts financed for both new and used vehicles increased in Q3.

The average amount financed for a new vehicle rose more than $2,000 over the previous year, reaching $34,635, while the average amount financed for a used vehicle climbed $945 to $21,438 over the same period.

Analysts explained the increases could also be attributed to consumer preference, with buyers leaning toward larger, more expensive vehicles.

Experian noted that small SUVs were the most purchased vehicles, making up 26.01% of contracts in Q3, followed by midsize SUVs at 24.15%.

Despite the increases in average amounts finance, Experian mentioned the increases in average monthly payment weren’t as sharp.

To be exact, analysts said the average new-vehicle payment amount increased $11 year-over-year, reaching $563 in Q3. The average used-vehicle payment ticked up $6 to $397.

To keep those monthly payment manageable, finance companies are absorbing more risk by stretching terms and edging rates lower.

Experian determined the average term for new vehicles financed during the third quarter increased slightly to 69.68 months, up from 68.98 months a year earlier. And the average term for used vehicles financed in Q3 increased from 64.49 months to 65.15 months.

Analysts went on to note that the average interest rate for a new-vehicle contract booked in Q3 saw sharp decrease, sliding from 5.38% in Q3 of last year to 4.22% in Q3 of this year. The average interest rate for used-vehicle paper originated in Q3 dropped from 9.09% to 8.43% year-over-year.

“With affordability still top of mind, particularly during the pandemic, lower interest rates have certainly helped consumers keep monthly payments at a manageable level,” Zabritski said.

“As the market evolves and financial situations shift, it’s important for lenders and dealers to stay close to the trends and make strategic decisions that help keep the industry moving forward and consumers in their vehicles.”

Additional findings for Q3

Experian closed its latest update by mentioning a trio of other trends, including:

• Average credit scores saw a sharp increase for new vehicles, jumping from 728 in Q3 2019 to 732 in Q3 2020. The average credit score for used vehicles also saw a one-point increase from 664 to 665 year-over-year.

• New-vehicle leasing continued decrease in Q3 2020, comprising 26.2% of new-vehicle financing, compared to 30.27% in Q3 2019.

• Captive finance companies continued to increase market share, rising from 30.85% in Q3 2019 to 34.49% in Q3 2020. The buy-here, pay-here segment saw a slight increase from 4.32% to 4.69%, while all other provider categories sustained year-over-year decreases.

To view the entire Q3 2020 State of the Automotive Finance Market report webinar, go to this website.

A TransUnion financial hardship survey in late October showed that more than half of Americans — 54% to be exact — said they have been financially impacted by the COVID-19 pandemic.

And TransUnion’s origination data for both auto financing and personal loans reflect that effect.

Looking at originations booked during the second quarter, TransUnion reported that the auto-finance market experienced an 11.9% year-over-year decline with 6.5 million new contracts opened in Q2 2020, compared to 7.3 million in Q2 2019.

While originations decreased across all tiers, analysts pointed out this drop was particularly noticeable among subprime consumers as this risk tier declined 28.1% over the same period last year.

Despite the recent decline, TransUnion said originations are expected to improve quarter over quarter in Q3 as the auto market moves past the large-scale shutdowns from earlier this year that contributed to dealership closures.

Analysts added that subprime origination growth will likely continue to lag other risk tiers as finance companies skew their portfolios toward lower-risk consumers.

“While the overall percentage of auto accounts leveraging financial accommodation programs has been declining, there were approximately 3.8 million auto accounts in some form of accommodation at the end of September,” said Satyan Merchant, senior vice president and automotive business leader at TransUnion.

“The consumers that are still enrolled in such programs are the ones likely experiencing the greatest financial hardship as the risk mix of these consumers has been increasingly shifting toward subprime over the last few months,” Merchant continued in a news release that accompanied the Q3 2020 Industry Insights Report.

“Performance has largely held steady, but as economic stimulus funds evaporate and consumers exit accommodation, future delinquencies may see an impact,” he went on to say.

Q3 2020 Auto Loan Trends

|

Auto Lending Metric

|

Q3 2020

|

Q3 2019

|

Q3 2018

|

Q3 2017

|

|

Number of Auto Loans

|

83.7 million

|

83.4 million

|

81.9 million

|

78.6 million

|

|

Borrower-Level Delinquency Rate (60+ DPD)

|

1.45%

|

1.40%

|

1.36%

|

1.40%

|

|

Average Debt Per Borrower

|

$19,646

|

$19,145

|

$18,835

|

$18,567

|

|

Prior Quarter Originations*

|

6.5 million

|

7.3 million

|

7.3 million

|

7.1 million

|

|

Average Balance of New Auto Loans*

|

$23,850

|

$21,953

|

$20,998

|

$20,653

|

*Note: Originations are viewed one quarter in arrears to account for reporting lag. Source: TransUnion

Meanwhile, TransUnion discovered personal loan balances decreased, too, as lenders and consumers navigated COVID-19.

Analysts determined total balances in the consumer-lending industry declined to $151 billion in Q3 2020, down from $156 billion in Q3 2019, following a dramatic drop off in originations due to the COVID-19 crisis

TransUnion explained the first full quarter of COVID-19 impacted originations — which was Q2 2020 — created a decline of 46.2% year-over-year as lenders temporarily exited the market, tightened underwriting and shifted their portfolio mix toward lower risk consumers.

Analysts noted that decreased consumer demand for credit also contributed to the drop-off as stay-at-home orders drove decreased spending and stimulus funds provided additional liquidity.

TransUnion mentioned that performance has remained stable as serious delinquencies improved to a 10-year low of 2.53% in Q3. Delinquencies were down across all risk tiers, with the exception of super prime, which remained low, but ticked up to 0.03% from 0.02% in Q2.

“The pandemic drove a nearly 50% reduction in consumer lending originations in Q2 2020 versus the prior year,” said Liz Pagel, senior vice president and consumer lending business leader at TransUnion.

“Lender pullback and decreased consumer demand continued over the past quarter as we saw total balances in the consumer lending market contract for the first time since early 2012,” Pagel continued in the news release.

“Lenders are expected to ramp up originations in Q4 for the holiday season as investor demand returns to the sector,” she went on to say. “The loans outstanding continue to perform well with delinquencies at the lowest point in a decade even as consumers begin to exit forbearance programs.”

Q3 2020 Unsecured Personal Loan Trends

|

Personal Loan Metric

|

Q3 2020

|

Q3 2019

|

Q3 2018

|

Q3 2017

|

|

Total Balances

|

$151 billion

|

$156 billion

|

$132 billion

|

$112 billion

|

|

Number of Unsecured Personal Loans

|

21.4 million

|

22.5 million

|

20.3 million

|

17.5 million

|

|

Number of Consumers with Unsecured Personal Loans

|

19.4 million

|

20.2 million

|

18.5 million

|

16.4 million

|

|

Borrower-Level Delinquency Rate (60+ DPD)

|

2.53%

|

3.28%

|

3.41%

|

3.13%

|

|

Average Debt Per Borrower

|

$9,067

|

$8,998

|

$8,338

|

$8,017

|

|

Prior Quarter Originations*

|

2.6 million

|

4.8 million

|

4.5 million

|

3.6 million

|

|

Average Balance of New Unsecured Personal Loans*

|

$6,092

|

$6,382

|

$6,253

|

$6,140

|

*Note: Originations are viewed one quarter in arrears to account for reporting lag. Source: TransUnion.

Equifax recently offered a week-long snapshot of auto financing originated during the middle of September, revealing the amount of subprime financing providers are booking.

According to Equifax estimates during the week of Sept. 13, the industry generated 14,100 retail installment contracts and leases, totaling $401.8 million.

Of that amount, analysts determined 1,400 contracts and leases were originated with to consumers with a VantageScore 3.0 credit score below 620, what Equifax generally considers to be subprime accounts. Equifax said those subprime accounts represented a corresponding total balance of $41.5 million.

Equifax also discovered the subprime volume was slightly lower when using the FICO Auto 8 credit score as the guide.

Analysts said 1,200 contracts and leases were originated during that week in September with consumers with a FICO Auto 8 credit score below 620; again, generally seen as subprime. Those deals had a corresponding total balance of $36.5 million.

Equifax also determined the average origination balance for all auto financing generated during that week in September came in at $28,408. The average for a subprime account was a little higher, sitting at $29,924.

When looking specifically at leases during that particular timeframe, Equifax indicated the average origination balance was $15,028. For a lease with a subprime consumer, the average lease amount was $15,974, according to analysts.

All told, Equifax estimated that leasing accounted for 38.3% of all auto accounts and 20.3% of all auto balances during its September reporting period.