This summer certainly has been a season of change for Primeritus Financial Services, which now has a new chief executive officer and chief financial officer.

Taking on the CEO post is Steve Norwood, who previously led Consolidated Asset Recovery Systems (CARS) until it was acquired by Primeritus in the spring of 2019.

Norwood brought a key executive with him, as Jennifer Turnage has been named as Primeritus’ new CFO. Turnage served in the same capacity with CARS.

Norwood spent part of Tuesday afternoon chatting with Cherokee Media Group senior editor Nick Zulovich for an episode of the Auto Remarketing Podcast, explaining why he’s now leading Primeritus and what the top tasks on his new work agenda are.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

The American Recovery Association’s new leadership tandem made time for this episode of the Auto Remarketing Podcast.

Installed earlier this summer, president Vaughn Clemmons and executive director Joel Kennedy offered their perspective on taking these leadership roles for an industry segment that facing some notable challenges.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

After recently releasing its monthly indices, Kroll Bond Rating Agency (KBRA) asked a question that your finance company might be pondering, too.

Considered through the prism of the auto securitization market, KBRA titled a new report, Auto Loan ABS: Rough Road Ahead?

Analysts began their response by giving their assessment of the current auto finance landscape.

“Government stimulus, a strong labor market and a sharp rise in used-vehicle prices helped to push auto loan delinquency and loss rates to historic lows in 2020 and 2021,” KBRA began in the report. “However, given the recent and expected rate hikes as central banks desperately battle inflation, improving vehicle manufacturing logistics, and strong recessionary signals, the benign credit environment of the past two years may be in the rearview mirror.”

KBRA arrived at that rearview mirror analogy after recapping its latest metrics. Analysts said the percentage of securitized contracts sitting 60 days or more past due rose to 1.52% in June. That’s 86 basis points higher year-over-year and 40 basis points above the same month in 2019, according to KBRA’s tracking via auto ABS data.

“However, we have not yet seen a corresponding rise in securitized net loss rates, as net losses have remained near historic lows,” KBRA said. “We believe the current divergence between delinquencies and losses — which typically track in lockstep — has been driven by two main factors.”

Analysts then articulated those two factors, including:

— High wholesale prices, which have boosted recovery rates

— Higher delinquency churn rates because some delinquent consumers have avoided repossession by making at least a portion of their monthly payments

KBRA explained that second reason is likely due to inflated replacement costs and elevated vehicle equity.

“However, we believe both factors are transitory, and as both metrics normalize, auto loan net losses will likely move higher over the coming months,” analysts said.

After noting those trends, KBRA turned its attention toward how portfolios and resulting securitizations germinated, especially considering trends other firms such as Edmunds have highlighted in recent weeks.

“Surging vehicle prices and rising interest rates have led to increased initial loan amounts and higher monthly payments for borrowers,” KBRA said. “Originators have been cognizant of the potential negative credit implications that increased monthly payments may create. In some cases, originators have extended loan terms to keep monthly payments affordable.

“Additionally, many lenders have payment-to-income (PTI) thresholds built into their credit underwriting to further mitigate borrower cash flow risks. That said, we have observed rising PTI ratios across all credit segments, indicating that monthly payments have risen at a faster pace than borrower incomes,” KBRA continued.

If vehicle retail prices remain at current levels, KBRA is expecting recovery rates to settle back to their pre-pandemic norm of 45% to 50%, which will naturally place some upward pressure on net loss rates, according to analysts.

“However, if the pandemic-related supply and demand imbalances abate — causing used vehicle prices to soften — loans originated in today’s market will likely experience meaningfully lower recoveries than we have seen over the last 18 months, placing additional pressure on securitized credit performance,” analysts said.

KBRA wrapped up its report by elaborating about how it believes underwriting is currently unfolding and how those strategies helped to form its latest forecasts.

“Many of the loan originators in KBRA-rated transactions have indicated that valuation-related underwriting criteria, such as PTI, loan-to-value (LTV), and debt-to-income (DTI), have been appropriately considered as vehicle values rose,” analysts said. “For example, many auto finance companies have retained the same maximum borrower DTI or PTI knock-out rules in their underwriting criteria.

“If the value of the financed vehicle increases more than the borrower’s income, the maximum financed amount will be capped to maintain PTI and DTI ratios within required thresholds. If PTI or DTI criteria is exceeded, the loan will be declined, the term would be extended, or the customer would be offered a less expensive vehicle or required to pay a higher down payment,” analysts continued.

“Many loan originators have increased the down payment a borrower is required to make, helping to reduce initial LTVs. Only a handful of issuers have contributed loans to securitizations that were originated since vehicle prices began to plateau in the first few months of this year, as originators typically warehouse new loans for four to 12 months before transferring to a securitization,” KBRA went on to say.

“Although there may be a rough road ahead, as auto loan losses will likely trend higher in the coming months, any movement should be fairly gradual, and we do not expect losses to rise meaningfully above levels from the years immediately preceding the pandemic, as we believe most originators have factored many of these rising risks in their underwriting decisions,” analysts added.

How a piece of technology goes from an initial idea, through development to a product launch can be a winding path.

John Nethery and Oscar Nunez shared their personal experiences on those past and present journeys for this episode of the Auto Remarketing Podcast.

The two executives from insightLPR, a technology company providing proprietary license plate recognition (LPR) software, hardware and data products to help companies and communities increase their value and safety, also shared how quickly the firm is gaining traction since an industry launch about a month ago during the North American Repossessors Summit.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

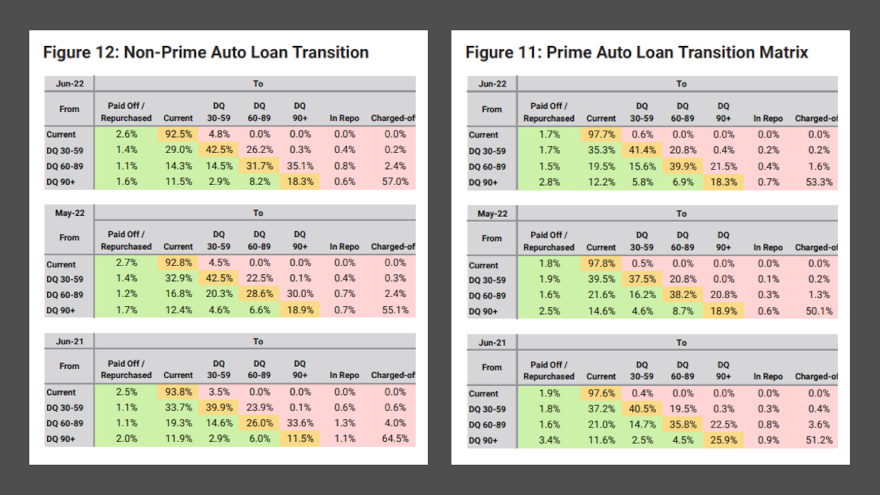

The newest data and analysis from Kroll Bond Rating Agency (KBRA) might be reinforcing the observations and comments made by finance company executives and repossession agents during the North American Repossessors Summit a little less than a month ago.

KBRA reported that June remittance reports showed softening credit performance across securitized prime and non-prime auto securitization pools during the May collection period, especially in …

Read more

Senior editor Nick Zulovich spent part of his time in Denver for the North American Repossessors Summit sharing another conversation for the Auto Remarketing Podcast with Jeremiah Wheeler, who is president of DRN and MVTRAC.

In light of inflation pushing up the costs of gas and other life necessities, Wheeler offered insight stemming from company data about how much consumers are looking to relocate.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Tip of the conference cap to the American Recovery Association and the North American Repossessors Summit planning committee. They scheduled a pair of intriguing panel discussions to begin the 2022 edition of NARS, which unfolded for the first time at the foot of the Rocky Mountains.

The opening panel on Tuesday afternoon featured a diverse trio of executives from the finance community; representatives from a captive, a credit union and a bank. Leading the conversation was newly bearded Joel Kennedy, who served in similar capacities during Used Car Week as well as when he was president of the National Automotive Finance Association.

The NARS gathering of close to 500 repossession agents, collections and recovery managers at other finance companies as well as leaders from an array of industry service providers listened intently to comments made by Joel Bowen, who has served as the loan resolution manager at Caltech Employees Federal Credit Union since August 2002.

While the latest data shows stability in payments, delinquencies and defaults, Bowen shared that he asked his supervisors and colleagues to increase loss reserves significantly based on the expectation that the credit union’s portfolio could sustain some turbulence during the next nine to 12 months.

“It’s better to have more than enough in reserves,” Bowen said.

And speaking of data, looking for trends is what Anthony Payne of Southeast Toyota Finance is doing. Payne joined the captive in 1998, serving currently as collateral return manager, so he is responsible for repossession activities as well as lease-end servicing and vehicle returns.

Payne acknowledged that trying to find sources to be an accurate predictor of what might happen with delinquencies in auto finance has been challenging during the past two years, especially in light of accommodations finance companies of all stripes have given to their customers during the pandemic. So, Payne said he’s watching the credit card market as a barometer of current consumer health.

Tom Thornton, who is senior vice president within the customer asset management group for M&T Bank, mentioned that the institution no longer has pandemic-connected payment accommodations in place for its customers. However, Thornton pointed out that the bank is not going to ignore the plight of its customers, especially if they’ve hit a rough patch. (And who isn’t feeling the impact of $5 per gallon gas?)

“We’re still trying to make sure we have a good customer experience. We try to do the right thing,” said Thornton, who also appeared on stage during the Repo Con portion of 2021 Used Car Week.

Bowen, Payne and Thornton all are expecting repossession volume to rise in the coming months since defaults still remain well below pre-pandemic readings and are on a trajectory to normalize.

“We’re working closely with our partners, repo agents and auto auctions, to make sure we’re ready,” Thornton said.

The next panel featured three active repossession agents, including current ARA president Dave Kennedy.

Kennedy focused much of his comments on the successes of the Repo Alliance, the grassroots funded lobbying organization based in Washington, D.C. He rattled off many successes for the endeavor, which he said has triggered several “we didn’t even think of that” comments from both federal lawmakers and regulators.

Starr Sawalqah runs Alpha Recovery in Phoenix and offered several recommendations to her fellow repossession agents. Sawalqah insisted that agents “shouldn’t be afraid to be vulnerable” when describing their escalating costs to finance companies. But she emphasized that agents need to back up their claims with plenty of data to show just how much it costs to skip-trace a customer and repossess a vehicle.

James McNeil is the chief executive officer of Day Break Metro, which provides repossession, locksmithing and transportation services from seven lot locations in California. McNeil might have made the most poignant statement of the day.

“We’re in an industry that’s going to be surprised by how much we’re going to be overwhelmed with assignments,” McNeil said, suggesting that fellow agents get their trucks and other physical resources as well as their workforces as strong as their finances will allow.

McNeil agreed with the timeline Bowen made during the previous panel discussion about the potential rise of repossessions.

“The industry is shrinking,” Bowen said. “Are we going to have enough agents to handle the volume?”

For ARA members in the room at the Omni Interlocken Hotel in Denver, they should take comfort in what Bowen said next.

“As long as you’re an ARA member, you’re someone to do business with in my book,” he said.

Nick Zulovich is senior editor with Cherokee Media Group and can be reached at [email protected].

Intellaegis, which does business as masterQueue, announced on Wednesday that it has signed a consulting agreement with former Santander Consumer USA senior vice president and director of business control and risk management Kelli Edmonds.

One of the 2020 Women in Auto Finance honorees, Edmonds joins a strategic team that Intellaegis has built over the years that consists of experts whose deep industry knowledge helped propel Intellaegis’ recent growth. That team includes former Core Logic co-founder and chief executive Steve Schroeder, former Ally executive Bill Ploog, and Intellaegis’ current chief operating officer Lance Suder.

“Our strategic consultants complement our experienced staff of industry veterans. They have all been key pieces in helping Intellaegis continue to build masterQueue into one of the leading SaaS platforms in the risk management aspect of the fintech space,” Suder said in a news release.

Edmonds brings nearly 35 years of experience in her prior roles, which also includes being a director over bankruptcy and recovery at Hyundai Capital, and as the vice president at Chase Bank who was responsible for $1.3 billion in auto and student loan debt managed by an internal staff, and an outsourced network of collection agencies and law firms.

Edmonds started her career as a collector and team lead for 10 years at Sallie Mae, and then was a process improvement manager at GE Capital, where she was first introduced to the debt recovery vertical. From there she became a vice president in product strategy over debt recovery at Citi, where she managed $6 billion in annual outsourced debt amongst 30 nationwide vendors.

“Kelli is as knowledgeable and well respected as anyone in the debt recovery space, whether you’re collecting the debt in-house or through third-party vendors” Intellaegis founder and CEO John Lewis said.

“As we’re seeing more lenders using masterQueue to internalize deficiency collections while complimenting their existing outsource network of third-party vendors who can also utilize masterQueue, we’re excited to turn Kelli loose to help our team continue to innovate masterQueue as the leader in skip tracing and debt recovery software,” Lewis continued.

Suder added, “When all the data, calling, compliance and security transpires in a single-tenant environment shared by lenders and their vendors, it reduces cost and creates a more secure and efficient process for everyone”.

Edmonds recently left her position at Santander to form Kota Business Solutions, following in the entrepreneurial footsteps of her parents and brother.

“I am very excited to partner with this team of industry veterans in an entrepreneurial environment that focuses on innovation to improve process management through technology,” she said.

For additional information you can reach Suder at [email protected] and Edmonds at [email protected].

Dealerships and finance companies that use PassTime technology now have a refreshed tool to use to maintain contact with their assets and mitigate risk.

The GPS solutions provider announced last week the launch of Encore 3, the third generation of its Encore platform.

PassTime highlighted that this third generation of Encore builds upon the device platform that was first introduced in 2019 with the first version of Encore.

In addition to the enhancements and improvements achieved through previous Encore generations, the company mentioned in a news release that Encore 3 features technology advancements with new, improved GNSS (GPS plus others) for better satellite location accuracy and performance, giving customers even better ability to locate mobile assets.

PassTime explained Encore’s components are specifically selected and designed to achieve extremely low power-consumption, resulting in the ability to attain several years of battery life, in a compact design.

With the ability to select and switch between four different power modes, the company pointed out that customers can choose the features and reporting frequency they desire while balancing the battery life options that meet their business objectives.

While the Encore platform is completely self-powered, PassTime also noted Encore has an optional, external power cable that enhance the device’s functionalit, offering customers the ability to place an Encore device on an endless number of mobile assets within seconds.

PassTime went on to say Encore 3 features an updated, modern USB-C connector design for this optional external cable for improved ease of use and connectivity.

“PassTime has always had innovation at the core of everything we do. We continuously look for ways to improve and enhance our solutions, utilizing the most up to date technologies and components,” PassTime president and chief operating officer Chris Macheca said in the news release.

“Encore 3 is the result of that never-ending drive to provide our customers with innovative products and solutions and an affordable price point,” Macheca went on to say.

Macheca added that Encore 3, along with the previous versions, are built with Cat-M1 LTE cellular technology for connectivity and provides 5G compatibility, giving the solution platform impressive longevity.

For more information, visit https://passtimegps.com.

Five repossession industry executives with time at companies such as DRN, RDN and PAR North America on their resumes have formed the leadership team of insightLPR, a technology company providing proprietary license plate recognition (LPR) software, hardware and data products to help companies and communities increase their value and safety.

This group that includes John Nethery, Oscar Nunez, Stephen Nethery, Eric Balsa and Jon Armstrong explained that insightLPR has built its reputation deploying LPR fixed and mobile camera solutions for a myriad of private and public entities, including law enforcement, parking enforcement, international airports, and residential communities.

The company now is introducing a unique business model and LPR strategy to the repossession industry in an effort to help recovery agents have more control over the LPR data they collect, enabling them to complete quicker repossessions, increase recovery rates and add value to their businesses.

Leading the team is president John Nethery, who brings more than 25 years of experience to the company building partnerships and delivering growth.

Prior to insightLPR, Nethery served as chief operating officer and chief financial officer of DRN, where he was instrumental in growing the company from the startup stage to a successful acquisition by Motorola Solutions.

“There are tremendous opportunities ahead and I’m looking forward to leading insightLPR in its next stage of growth,” John Nethery said in news relase. “We have an outstanding team and a talented organization of professionals, and I am confident that we will set the standards for excellence and drive innovation in the industry for our partners.”

Joining insightLPR as chief product officer is Nunez, who is an accomplished product, strategy and operations leader that brings expertise in data analytics, auto finance, lease programs, repossession operations, and commercial use of LPR technology.

Before being a part of insightLPR, Nunez served as vice president of product and new markets for DRN and held senior roles with UBER and Capital One.

With a track record of building successful teams and customer facing products, insightLPR said Nunez will lead product strategy and development as well as strategic partnerships.

Stephen Nethery joined insightLPR as the company’s chief revenue officer.

The company highlighted Stephen Nethery has built his career cultivating relationships and leading sales for large organization, as he previously served as senior vice president of business development for DRN and held business development roles with Lockheed Martin and various other companies.

“(Stephen) Nethery has a track record of communicating with customers to understand their needs and equip them with the right products and services,” insightLPR said, while adding that he will assist with insightLPR’s entrance into the auto repossession industry and lead its expansion within the commercial and residential real estate business verticals.

Serving the team as chief data officer is Eric Balsa, who is an accomplished software engineer and technologist with expertise in repossession case management, LPR and software as a service delivery.

Before coming to insightLPR, Balsa served as vice president of engineering for DRN, where he managed day-to-day technology operations for the entire DRN technology stack.

Before DRN, Balsa was an original owner and the technology architect of RDN, leading up to the OPENLANE acquisition in 2010. In both instances, Balsa helped usher in the transactions by leading technical due diligence, eventual integration, and technology vision post-acquisition.

Balsa also served as senior software engineer at Yahoo and has held various IT and technology roles over the course of his career.

Jon Armstrong closes out insightLPR’s management additions as the company’s vice president of vendor management.

The company mentioned Armstrong has more than 18 years of leadership experience in customer service, business process improvement, strategic planning and operations management.

Ahead of joining insightLPR, Armstrong served as the director of operations for Indiana Recovery Services and played an instrumental role on the senior leadership team at PAR North America, where he served as the senior recovery services manager for seven years.

“Armstrong’s expertise, leadership, and knowledge of the repossession industry position him to lead the development of insightLPR’s recovery agent network,” the company said.

John Nethery mentioned what’s immediately ahead for insightLPR

“We are in active discussions with multiple participants in the repossession industry and the feedback we have received in response to our model has been overwhelmingly positive,” he said. “The insightLPR team will be attending the North American Repossessors Summit June 21-22 in Denver, Colorado, and we look forward to officially releasing our solution to the auto repossession industry.”

For more information on insightLPR’s model and strategy for the auto repossession industry, visit insightlpr.com.