As experts from firms such as Edmunds have discovered, many consumers are committing to a monthly vehicle payment of $1,000 or more.

Becky Chernek of Chernek Consulting made her monthly visit for the Auto Remarketing Podcast to go over the value of refinancing and other F&I strategy that can help all dealerships.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play

While Cox Automotive recently reported that auto credit availability still remains at a record reading, RateGenius indicated another part of auto financing remains pretty healthy, too.

The platform recently released its monthly Auto Refinance Rate Report revealing the current average interest rate on a reconfigured contract has risen 15 basis points to …

Read more

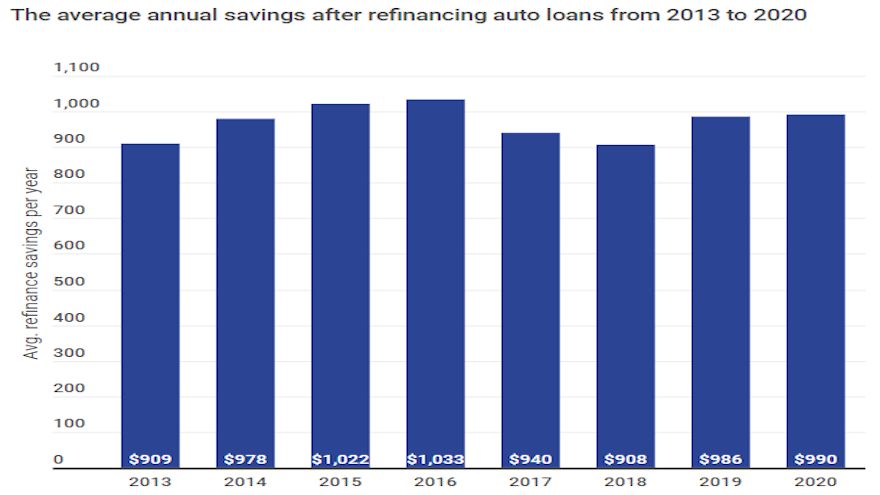

RateGenius shared how much consumers saved when refinancing their vehicle’s retail installment sales contract in 2020.

According to the firm’s report based on activities through its network of more than 150 finance companies nationwide, RateGenius said Americans saved an average of $989.72 percent year via refinancing their vehicle in 2020. That’s the largest amount in RateGenius’ database since 2016.

RateGenius highlighted in the report that 42% of successful refinancing applications generated annual savings of $1,000 or higher.

Furthermore, with an average interest rate of 10.5% on their existing contracts, RateGenius said the average rate on the refinanced contract came in at 5% — the greatest interest rate reduction in eight years.

Also of note, RateGenius said Americans who applied to refinance in 2020 did so only 14.5 months into their existing contract — the shortest time the firm’s database.

While RateGenius said the average credit score of a refinance applicant was 657 in 2020 — three points lower than in 2019 — the average credit score of an approved refinance application in 2020 was 720 — four points higher than in the prior year.

Likely driven by the COVID-19 pandemic, RateGenius noted that 16% more Americans applied to modify their auto financing in 2020 than in 2019.

The firm indicated 38 out of 50 states contained more consumers getting refinancing approved in 2020 versus the prior year with Washington (up 56%), Arizona (up 47%) and Oregon (up 44%) leading the charge.

RateGenius pinpointed that consumers in Odessa, Texas, gained the most by refinancing, getting more than $1,700 in average annual savings.

The report pointed out that contract holders in that west Texas city also held the highest outstanding balance, averaging more than $31,000.

RateGenius went on to mention pickups such as the Ram 1500, Chevrolet Silverado 1500 and Ford F-150 were the most refinanced vehicles in 2020, accounting for nearly 10% of all refinanced contracts in 2020. In fact, the Chevrolet Silverado 1500 was the most common vehicle to refinance in 22 out of 50 states.

The firm added pickup trucks generated the highest savings among major vehicle classes at $1,138 a year.

As a class, RateGenius found that trucks had the best average loan-to-value ratio (LTV) at 104%. SUVs came in second with 116% LTV.

Maserati Ghibli held the most equity, with an average LTV of 80%, according to the report, which added that Mitsubishi Mirage owners found themselves with least equity in their vehicles, with a 141% LTV.

The entire report can be found via this website.

LendingClub Corp., the parent company of LendingClub Bank, is looking to be in a position to capitalize on the growing volume of auto refinancing.

After first launching its auto refinance product five years ago in California, LendingClub recently announced it has expanded its program footprint to include 40 states, covering 94% of the U.S. population.

LendingClub said its auto refinance program can save consumers an average of $4,000 through the term of a contract.

The company highlighted that nearly two-thirds of LendingClub’s members currently have auto financing and it is usually their second highest monthly debt outside of housing costs. The average APR for holders of auto refinance contracts through LendingClub Bank is nearly 5% lower than their previous contracts.

“We see auto refinance loans as an enormous opportunity for our 3.8 million members and for LendingClub,” said Todd Denbo, senior vice president of auto at LendingClub Bank. “Who would not want to save thousands for just a few minutes work?

“Now that we’ve transformed the process for refinancing an auto loan and can sell loans through our marketplace as well as hold loans on our balance sheet, we’re scaling the product,” Denbo continued in a news release. “Auto is a key step in our vision to create a holistic customer experience that seamlessly integrates saving opportunities for our members across our product offerings.”

LendingClub recapped that it spent 15 years building its personal loans business — gathering deep data insights, dialing in the customer experience, improving credit models, building industry relationships, enhancing control and compliance capabilities, and more.

“As a digital marketplace bank with the ability to both hold loans on its balance sheet and sell loans on the marketplace, LendingClub Bank can now bring more of this expertise to other financial pain points that its members face, such as refinancing auto contracts,” the company said.

While consumers with the poor credit profiles didn’t benefit quite as much, RateGenius highlighted through its latest Auto Refinance Rate Report that October contained the lowest average refinancing rate so far this year.

Read more

As Edmunds spotted four record-setting finance trends surfacing from third-quarter activity, RateGenius reported notable developments when it comes to refinancing existing installment contracts.

Read more

As consumers repair their credit profiles, many individuals are looking to improve the terms of their retail installment contract for their vehicle.

RateGenius is looking to help those particular people and other contract holders looking to see if they can make adjustments via a new tool launched this week.

This week, the company announced a new feature that can enable vehicle owners to view pre-qualified refinance offers without providing personal information as they search on RateGenius for a better auto financing.

The service is the latest in RateGenius’ growing suite of digital finance products engineered to help consumers and finance companies by bringing ease and transparency to the vehicle refinancing process.

“One of the things that makes RateGenius stand out against our competitors is our commitment to being transparent with our customers,” chief product officer Christian Lavender said in a news release.

“With Loan Finder, this pre-qualification tool can get consumers a quick estimate of their potential savings without any personal information or a hard credit inquiry,” Lavender continued.

RateGenius explained that Loan Finder works by walking the consumer through five simple, anonymized questions — credit tier, ZIP code, monthly payment, outstanding balance and remaining term — to match them with real auto refinance offers, broken down by best rates and monthly payments.

The pre-qualification offers are provided through a network of more than 150 finance comapnies that work with RateGenius, allowing consumers to preview estimated rates before applying to refinance.

“Customers are savvy and want to take the auto refinance shopping experience into their own hands,” Lavender said. “Shoppers who are hesitant to provide personal information or get a hard inquiry on their credit report may be missing out on opportunities to save hundreds or thousands of dollars on their auto loans.

“With Loan Finder, they answer questions to view auto refinance offers available in their area before committing to start the application process,” Lavender went on to say about the tool that can be found at rategenius.com/loan-finder.

RateGenius’ monthly Auto Refinance Rate Report found that the average overall auto refinance interest rate for August came in the lowest of any month so far this year.

Read more