A deep subprime finance company that has been working with both franchised and independent dealerships, especially to cater to their Hispanic customers, now is venturing into securitizations.

In business since 2007, Credito Real USA Finance announced last week that it closed on its first securitization. The company said the investor action totaled $130 million.

The company explained in a news release that this new “financial horsepower” will provide Credito Real USA Finance the chance for growth and to be competitive in the subprime market with the ability to book more paper with consumers involved with bankruptcies as well as potential buyers who do not have a Social Security Number.

Chief executive officer Scot Seagrave emphasized that Credito Real USA Finance’s No. 1 priority is helping its network of dealerships retail more vehicles, and the securitization will help the company accomplish that objective.

“A big thank you to all our dealer partners, customers, banks, vendors and, of course, our awesome employees for helping us achieve an important milestone,” Seagrave said in the news release.

“We look forward to using this as a springboard to growing our dealer base and helping more customers obtain financing,” Seagrave added.

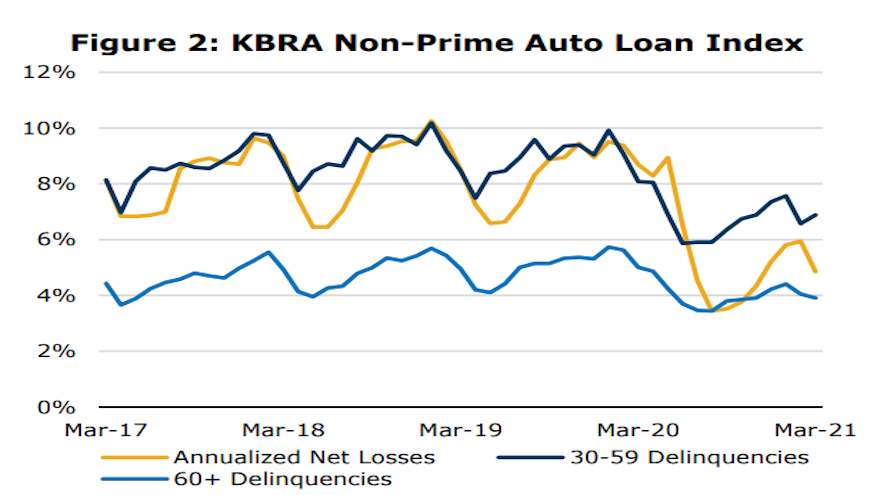

Similar to an extensive response by the American Financial Services Association, Kroll Bond Rating Agency (KBRA) also refuted recent assertions by the Wall Street Journal that extrapolated TransUnion data to say that more than 9% of subprime auto financing was more than 60 days past due in the closing quarter of last year, which the article said was the highest quarterly figure since 2005.

However, KBRA explained when analysts detailed their monthly ABS indexes showed that the delinquency readings are not that high. In fact, KBRA said March remittance reports indicated auto credit trends remained strong during the February collection period.

According to its latest report, early-stage delinquencies (30-59 days past due) in the KBRA Prime Auto Loan Index rose 1 basis point month-over-month to 0.90%, while late-stage delinquencies (60 days or more past due) declined 1 basis point to 0.35%.

Furthermore, early- and late-stage delinquencies in the KBRA Non-Prime Auto Loan Index moved in different directions, up 31 basis points and down 14 basis points, respectively. The actions left those delinquency readings at 6.88% and 3.91%, respectively.

“Annualized net losses in both indices came down from the prior month due to range-bound roll rates and favorable delinquency metrics earlier this year,” KBRA said.

“In both indices, delinquency rates remain meaningfully lower than year-ago levels, as government stimulus and hardship assistance programs have helped to keep many borrowers current on their loan payments,” analysts continued.

The recent Wall Street Journal article certainly triggered an industry response, as AFSA delved into a large well of data to form a completely different argument about the current status of auto financing.

KBRA pointed out that its non-prime index shows that 60-day delinquencies have remained around 4% over the past year, below pre-pandemic levels, as well as pre-crisis levels when adjusted for issuer composition.

Why did the Wall Street Journal create such a stir? KBRA explained the divergence is likely the result of several key factors:

▪ Credit score: The KBRA Non-Prime Index tracks the performance of securitizations with a weighted average credit score of below 680, and analysts estimated that the weighted average credit score of the index is approximately 620. Meanwhile, KBRA the article cited the performance of contracts with a much lower borrower credit score ranging from 300 to 600.

▪ Credit drift: While the KBRA Non-Prime Index considers the credit score of a consumer at the time of origination, TransUnion’s reporting, “in our understanding,” uses the borrower’s current credit score, according to KBRA, meaning borrowers can drift in and out of TransUnion’s definition of subprime.

“Since subprime is TransUnion’s lowest credit cohort, performing borrowers may improve their scores and transition to a higher credit tier, while underperforming borrowers may fall from a higher tier at origination into this cohort, resulting in adverse selection within the subprime category,” KBRA said.

▪ Securitization accounting: KBRA noted that most securitization documents specify that a contract must be charged-off at 120 days delinquent, at which time the contract is no longer counted as delinquent in servicer reports, and by extension, in its nonprime index.

“Once a loan meets this criterion, the charge-off amount will be reflected in our index’s annualized net loss (ANL) rate. This is in contrast to TransUnion’s data, which may continue to count borrowers as delinquent past 120 days,” KBRA said.

▪ Denominator and seasoning effect: KBRA said it has observed positive consumer score migration through the pandemic as well as fewer originations in the subprime cohort due to lender credit tightening.

“As a result, we expect the total number of borrowers with a credit score below 600 (which is the denominator in the delinquency rate formula) to have fallen meaningfully and may have pushed the TransUnion delinquency rate higher in recent months,” KBRA said.

“Furthermore, as new originations slow, the average seasoning of loans in this cohort increases, and delinquencies as well as losses generally rise as months-on-book increases,” the firm went on to say.

With all of those factors in place, KBRA acknowledged that the auto-finance landscape could change since an analysis of March’s asset-level disclosures showed mixed credit metrics.

Analysts said the percentage of prime and nonprime contract holders who went from 30 days delinquent to current rose to 34.7% and 28.6%, respectively, down 314 basis points in prime pools and 560 basis points in non-prime pools versus the previous month.

But, KBRA discovered the percentage of prime contract holders who rolled from 60 days past due to charge-off dropped to 13.1% — down 8 basis points month-over-month — while the non-prime roll rate into charge-off jumped 228 basis points to 22.7%.

AFSA closed its blog post with this assertion about what reports such as what the Wall Street Journal article can do.

“AFSA member companies have always been there to support consumers through trying times, from a job loss to life-altering natural disasters. It is one of the great differentiators between traditional installment lenders and auto-finance lenders and less reputable payday or vehicle title lenders. It is a good story to tell. We are happy to share it and would hope fact-based reporters would find it compelling. This incident highlights another important component to our industry,” AFSA wrote.

“Trust is a big part of the relationship between a lender and a customer. Trust is earned. It is also diminished … in this case when reporters choose to not do basic due diligence to get the facts right,” AFSA concluded.

Among a host of other projections and assessments, six main highlights surfaced on Tuesday when Black Book and Fitch Ratings released its joint U.S. vehicle depreciation and auto asset backed securities (ABS) report.

With wholesale prices setting records, Black Book is forecasting an annual depreciation rate of 5% this year as the effects of the pandemic continue to be felt. That prediction is down from a record strong 2.0% depreciation rate registered in 2020.

Analysts highlighted these other six main highlights, including:

• Manufacturing shutdowns impacted new sales, and this, coupled with the government stimulus payments and added benefits, led to an uptick in demand of used inventory.

• On the other hand, lack of repossessions and delayed lease returns created used inventory shortages.

• Full-size trucks and luxury segments outperformed depreciation expectations, with full-size trucks appreciating 8.7%. Additionally, the premium luxury car segment depreciated a mere 8.1% last year, compared to 25.9% in 2019.

• Fitch Ratings believes auto loan and lease ABS (auto ABS) asset performance will be supported by strong used-vehicle values containing loss severity, and resulting in positive asset recovery and residual value (RV) performance.

• Fitch auto ABS rating outlooks are stable for 2021, which are consistent with 2020 and reflect expected steady asset performance, transaction structural protections and the firm’s conservative establishment of transaction base case loss proxies.

• Prime auto ABS asset performance demonstrated considerable resiliency in 2020, and both frequency and severity continue to contain loss levels.

2020 depreciation trends

Black Book reiterated that the annual depreciation rate on 2- to 6-year-old vehicles fell by only 2% in 2020, a sharp contrast to the 16.8% annual depreciation spotted in 2019.

Analysts explained market strength was felt largely in Q3, due to the federal stimulus benefits and constrained new-inventory levels.

“Additionally, moratoriums on repossessions and delayed lease returns kept the available used supply low and further fueled the appreciation of used vehicles,” Black Book said.

“The compact car segment fell sharply in the fall amid low fuel prices and increased new inventory levels, depreciating 10.6% in 2020,” analysts continued. “Full-size trucks and SUVs remained strong as continuing inventory shortages put a premium on used units.”

Black Book also pointed out that it Used Vehicle Retention Index decreased 0.8% from 115.4 in January 2019 to 114.5 in January 2020. The index began 2020 strong, but the effects of the pandemic began to be felt by the end of March 2020.

Throughout the summer months, the index climbed to a record 130.08 points before stabilizing and finishing the year at 128.8 points, up 13.7% compared to December 2019.

A look ahead at 2021 trends

As the economy continues to recover from the COVID-induced recession, Black Book projected that wholesale and retail prices are expected to be strong in 2021 with projected annual depreciation of just 5%.

“This will leave wholesale prices at the end of 2021 well above pre-COVID levels,” analysts said.

“Used inventory levels will remain tight throughout this year, contributing to the strength of the used market,” Black Book continued. “New-vehicle production and sales will return to some normality later this year, and we expect the wholesale market to return to typical seasonal depreciation in Q4.”

U.S. auto ABS outlook for 2021

Fitch Ratings noted that prime auto loan ABS demonstrated considerable resiliency in 2020, and both frequency and severity continue to contain loss levels.

“Vehicle utility, including a reduction in the use of public transportation and priority of debt, along with support via payment relief programs and other government assistance, is expected to continue to lead to stable-to-strong performance in 2021,” analysts said.

Meanwhile, analysts acknowledge that Fitch Ratings’ subprime auto loan ABS performance outlook is weakening driven by elevated unemployment and reduced borrower ability to service debt.

“Despite this, Fitch-rated subprime auto ABS transactions are expected to perform in line with expectations and the rating outlook remains stable,” analysts said.

“Government assistance and temporary payment relief programs have served to support performance, but uncertainty on future support poses risks to performance going forward,” Fitch Ratings went on to say.

The Black Book-Fitch Ratings vehicle depreciation report can be downloaded from this website.

Two long-standing subprime auto finance companies each made moves last week to give themselves the financial horsepower they need to continue originations and other business activities.

After Consumer Portfolio Services launched its first securitization of 2021, Credit Acceptance announced the completion of a $100 million asset-backed non-recourse secured financing.

Pursuant to this transaction, Credit Acceptance said it contributed approximately $125.1 million of installment contracts to a wholly-owned special purpose entity that will pledge the contracts to an institutional lender under a loan and security agreement.

Credit Acceptance explained in a news release that the financing will accomplish three objectives, including:

—Bear interest at one-month LIBOR plus 200 basis points;

—Revolve for 24 months after which it will amortize based upon the cash flows on the contributed loans

—Be used by the company to repay outstanding indebtedness and for general corporate purposes

Credit Acceptance said it will receive 6.0% of the cash flows related to the underlying consumer loans to cover servicing expenses. The remaining 94.0%, less amounts due to dealers for payments of dealer holdback, will be used to pay principal and interest to the institutional lender as well as the ongoing costs of the financing.

“The financing is structured so as not to affect our contractual relationships with our dealers and to preserve the dealers’ rights to future payments of dealer holdback,” Credit Acceptance said.

Additionally, the company announced that it extended the date on which its $300 million revolving secured warehouse facility will cease to revolve. The date moved from July 26, 2022 to Nov. 17, 2023.

Credit Acceptance noted the interest rate on borrowings under the facility has been increased from LIBOR plus 200 basis points to LIBOR plus 210 basis points.

“There were no other material changes to the terms of the facility,” the company said, while adding that it did not have a balance outstanding under the revolving secured warehouse facility as of Friday.

CPS closes its first securitization of year

In other industry news, Consumer Portfolio Services (CPS) announced the closing of its first term securitization in 2021.

According to a news release, the transaction is CPS’ 38th senior subordinate securitization since the beginning of 2011 and the 21st consecutive securitization to receive a triple-A rating from at least two rating agencies on the senior class of notes.

In the transaction, the company highlighted qualified institutional buyers purchased $230.5 million of asset-backed notes secured by $245.0 million in automobile receivables originated by CPS.

The sold notes, issued by CPS Auto Receivables Trust 2021-A, consist of five classes. Ratings of the notes were provided by Standard & Poor’s and DBRS Morningstar, and were based on the structure of the transaction, the historical performance of similar receivables and CPS’s experience as a servicer.

| Category |

Amount

(in millions) |

Interest Rate |

Average

Life (years) |

Price |

S&P's Rating |

DBRS Rating |

| A |

$105.228 |

0.35% |

0.60 |

99.99777% |

AAA |

AAA |

| B |

$43.855 |

0.61% |

1.72 |

99.98596% |

AA |

AA |

| C |

$36.137 |

0.83% |

2.50 |

99.99122% |

A |

A |

| D |

$26.705 |

1.16% |

3.41 |

99.97942% |

BBB |

BBB |

| E |

$18.620 |

2.53% |

4.05 |

99.98246% |

BB- |

BB |

The company said the weighted average coupon on the notes is approximately 1.11%.

CPS mentioned the 2021-A transaction has initial credit enhancement consisting of a cash deposit equal to 1.00% of the original receivable pool balance and overcollateralization of 5.90%.

The company added that the transaction agreements require accelerated payment of principal on the notes to reach overcollateralization of the lesser of 9.30% of the original receivable pool balance, or 32.05% of the then outstanding pool balance.

The company went on to mention the transaction utilizes a pre-funding structure, in which CPS sold approximately $184.4 million of receivables at inception and plans to sell approximately $60.6 million of additional receivables in February.

“This further sale is intended to provide CPS with long-term financing for receivables purchased primarily in the month of January,” officials said.

“The transaction was a private offering of securities, not registered under the Securities Act of 1933, or any state securities law. All of such securities having been sold, this announcement of their sale appears as a matter of record only,” they continued.

S&P Global Ratings discovered contract extensions in both the prime and subprime credit segments are trending lower, according to its latest report released on Friday.

Analysts found that extensions in U.S. public auto loan asset-backed securities (ABS) declined for the fourth consecutive month in August. They made that assertion based on portfolio data filed with the Securities and Exchange Commission.

Across the 17 prime shelves tracked by S&P Global Ratings, extensions dropped 27% to 0.63% from 0.86% in July.

For the four public subprime shelves in their analysis, experts said extensions decreased 39% to 3.22% from 5.29% in August.

Also of note, S&P Global Ratings pointed out the outstanding balance of contracts remaining in extension status also decreased.

For prime paper, analysts spotted a 42% decline with the August reading coming in at 0.99%, after a reading of 1.71% in July. For subprime deals, the firm noticed a 34% drop with the August figure coming in at 7.88%, compared to 11.90% in July.

“This is an especially informative metric given that many of the prior months’ extensions were for multiple months — four months at a time in some cases,” S&P Global Ratings said.

Analysts mentioned a couple of other key observations, including:

• For public issuers, monthly extension rates declined for the fourth consecutive month in August due to the unemployment rate dropping to 8.4% from 10.2%. However, half of the subprime issuers reported an increase.

• The level of 60-day delinquencies for previously extended contracts whose deferral periods have ended increased to 1.58% from 1.29% in the prime segment and 4.27% from 3.46% in the subprime space as of the end of August.

“Despite mounting delinquencies on these loans, more are being repaid in full than are defaulting,” analysts said.

The investment community is maintaining close observations on subprime auto financing.

S&P Global Ratings on Monday said that its ratings on 27 classes from 20 U.S. subprime auto ABS transactions will remain on CreditWatch, where they were placed with negative implications on May 12. The finance companies connected with these transactions include:

— American Credit Acceptance

— Consumer Portfolio Services

— DriveTime Automotive

— Exeter Finance

— First Investors Financial Services

— Flagship Credit Acceptance

— Global Lending Services

— Prestige Financial Services

— Sierra Auto Finance

— Westlake Financial Services

“We are continuing to assess the impact of the COVID-19 pandemic on collateral performance, including the impact of extension rates, delinquencies, recovery rates and net losses, on these transactions,” analysts said in a news release.

“The CreditWatch listings reflect the COVID-19 economic downturn, which we expect to negatively affect the performance of all auto loan originators and lead to higher cumulative net losses and reduced excess spread over the life of each transaction. As a result, the tranches placed on CreditWatch may not have sufficient enhancement to support the current ratings,” they continued.

S&P Global Ratings acknowledged a high degree of uncertainty about the evolution of the coronavirus pandemic.

“The consensus among health experts is that the pandemic may now be at, or near, its peak in some regions, but will remain a threat until a vaccine or effective treatment is widely available, which may not occur until the second half of 2021,” analysts said.

“We are using this assumption in assessing the economic and credit implications associated with the pandemic. As the situation evolves, we will update our assumptions and estimates accordingly,” they added.

S&P Global Ratings closed by noting that the firm expects to resolve its CreditWatch listings during the next 90 days, “focusing on each transaction's buildup of enhancement in comparison to potentially higher expected cumulative net losses in the context of our evolving view of the severity and duration of the COVID-19 pandemic.”

Kroll Bond Rating Agency (KBRA) and S&P Global Ratings continued to use their examinations of the U.S. auto loan asset-backed securities (ABS) market to offer a look not only at that particular segment but also views on what the overall health of auto financing might be.

Beginning with S&P Global Ratings, analysts there said May brought what they called “a glimmer of hope” for the auto ABS market with a substantial reduction in extension rates, which appear to have peaked in April, according to their latest report.

For prime paper, S&P Global Ratings indicated the extension rate dropped 62.5% to 2.16% in May from 5.76% in April.

For the four subprime auto ABS shelves the firm watches — AmeriCredit, Santander's DRIVE and SDART and World Omni's Select — S&P Global Ratings said extensions dropped 43.5% to 8.9% from 15.7%.

S&P Global Ratings attributed the tremendous decline in new extensions in May to a number of factors, including:

• The lifting of stay-at-home orders brought some furloughed employees back to work.

• The government's enhanced unemployment benefits of $600 per week gained momentum after initial delays at the state level.

• Stimulus/relief checks of up to $1,200 were received by many consumers.

• Some of those who needed hardship relief in March or April received multi-month-long extensions, thereby obviating the need for another extension in May.

“However, even with May's drop in deferments, the percentage of loans receiving extensions remained higher than February's pre-COVID-19 levels. Further, for some issuers, the percentage of their pools in extension status remains high at 10% or more,” S&P Global Ratings said.

“The big question at this point is whether loans, when they come out of extension status, will be able to resume normal payments,” S&P Global Ratings continued. “This will depend upon how quickly the COVID-19 spread can be contained and business activity can more fully resume, unemployment levels and whether enhanced unemployment benefits, namely the extra $600 per week, remain intact or are replaced with some other form of additional income to compensate those who remain out of work due to the pandemic.”

Meanwhile, KBRA determined June remittance reports showed improving securitized auto finance delinquencies during the May collection period.

Analysts indicated early-stage delinquencies (30 to 59 days past due) fell 10 basis points month-over-month and 44 basis points year-over-year to 0.70% in the KBRA Prime Auto Loan Index, while the percentage of non-prime borrowers in the early stages of delinquency fell to 5.87%. That’s down 105 basis points month-over-month and 260 basis points year-over-year.

KBRA discovered later-stage delinquencies (60 days or past due) also dipped month-over-month in both indices, but the decreased were more modest.

Furthermore, as fewer contract holder have become delinquent over the past few months (resulting in fewer defaults), KBRA went on to note that both indices posted a month-over-month and year-over-year decline in annualized net loss rates.

“As discussed last month, we believe enhanced unemployment benefits and federal stimulus checks likely helped some borrowers catch up or stay current on their auto loan payments,” KBRA analysts said in their latest report.

“The large percentage of borrowers receiving payment relief during the month (in the form of loan extensions) was also likely an important driver in keeping delinquency rates subdued,” analysts continued.

While S&P Global Ratings indicated they might have peaked in May, KBRA asserted that the percent of non-prime borrowers enrolled in a hardship assistance program continued to climb in June, reaching 23.09% or up 451 basis points month-over-month and 1,952 basis points year-over-year, while the percent of prime borrowers enrolled in an assistance program remained relatively flat, at 8% in June, up 15 basis points month-over-month and 748 basis points year-over-year.

KBRA wrapped its analysis by reviewing June’s asset-level disclosures that showed mixed credit metrics during the May collection period.

Analysts found that the percentage of prime and non-prime contract holders who went from 30+ days delinquent to current dropped 649 basis points to 40.9% and 101 basis points to 39.8%, respectively, versus the previous month, but are still well above pre-pandemic levels.

Finally, the percentage of prime contract holders who rolled from 60 days or more past due to charge-off rose 377 basis points to 17.4%, while the percentage of non-prime contract holders moving from 60-day delinquency to charge-off increased 9 basis points to 20.1%.

Kroll Bond Rating Agency is seeing some finance companies — especially in non-prime — holding securitized pools of auto paper with contract modification levels as high as 21%.

The noteworthy trends came via KBRA’s May auto loan indices when analysts examined the asset-backed securities market. KBRA indicated May remittance reports showed improving securitized auto loan credit performance during the April collection period, despite the unemployment rate rising to a “previously unimaginable” 14.7% during the month.

Analysts determined early-stage delinquencies (30 to 59 days past due) fell 30 basis points month-over-month and 27 basis points year-over-year to 0.80% in their prime index, while the percentage of non-prime contract holder in the early stages of delinquency fell to 6.97%, down 108 basis points month-over-moth and 140 basis points year-over-year.

KBRA then shared that later stage delinquencies (more than 60 days past due) also decreased month-over-month in both indices, but the declines were more modest.

“Enhanced unemployment benefits and federal stimulus checks likely played some part in lowering delinquency rates in April, as we believe most securitized auto loan borrowers were eligible for at least some level of stimulus,” analysts said in the latest report.

“However, we think the large percentage of borrowers receiving payment relief during the month, in the form of loan extensions, was the main driver,” they continued.

KBRA elaborated about that assessment by uncovering information from those ABS shelves that report asset-level disclosures.

Analysts discovered the percentage of consumers with an actively modified contract ranged from 2.0% to 12.1% for securitized prime auto pools and 7.1% to 21.3% for non-prime pools at the end of April. As KBRA put it, that’s “up significantly from prior months.”

Those efforts to help consumers further showed when KBRA pointed out its analysis of May’s asset-level disclosures also showed credit metrics improving during the April collection period.

The percentage of prime and non-prime contract holders who went from 30 days delinquent to current rose 903 basis points to 47.4% and 1,167 basis points to 40.8%, respectively, versus the previous month, according to KBRA.

Meanwhile, analysts added the percentage of prime contract holders who rolled from more than 60 days past due to charge-off fell 164 basis point to 13.7%, while the percentage of nonprime contract holders moving from 60-plus days delinquent to charge-off tumbled 343 basis points to 20.0%.

In a separate letter where the firm’s president and chief executive officer acknowledged, “the news will not always be positive,” Kroll Bond Rating Agency (KBRA) compiled a lengthy report this week, examining the potential long-term ramifications of finance companies making contract modifications with their customers because of COVID-19.

While analysts applauded the modification efforts finance companies are utilizing, KBRA also cautioned the auto-finance industry that “if used incorrectly, modifications simply delay the inevitable.”

Analysts said in the report, “In general, we believe loan modifications are an important loss mitigation tool for loan servicers and, when used appropriately, ultimately benefit borrowers and ABS investors. From a positive perspective, they can reduce default rates and maximize long-term cash flow.

“On the other hand, deferrals may delay or reduce short-term cash flow, avoid trigger breaches, delay recognition of losses and dilute overcollateralization,” they added.

KBRA explained that April asset level disclosures showed that early-stage delinquency rates were relatively stable across securitized auto finance pools in March. Analysts contend that the relative month-over-month stability in delinquency rates was likely driven by payment timing, “as we believe most borrowers made their March loan payments prior to the first U.S. states issuing statewide stay-at-home orders, beginning with California on March 19 and, to a lesser extent, loan servicers granting loan modifications for those paying later in the month.”

Meanwhile, KBRA discovered May’s asset-level disclosures — which reflect collections in April and the first full month of pandemic-related stress — showed that early-stage delinquencies fell sharply month-over-month for each of the 21 auto finance issuers that provide asset-level disclosures to KBRA.

The firm added most of those issuers also reported a year-over-year decline.

“At first glance, the month-over-month and year-over-year decline in early-stage delinquencies posted in April seems extraordinary against the backdrop of the unemployment rate skyrocketing to a previous unimaginable 14.7% during the month,” KBRA said in the report.

“Enhanced unemployment benefits and federal stimulus checks likely played some part in lowering delinquency rates in April, as we believe the majority of securitized auto loan borrowers were eligible for at least some level of stimulus,” analysts continued. “However, we think the large percentage of borrowers receiving loan modifications during the month was the main driver.

By the end of April, KBRA determined the percentage of consumers with an actively modified contract ranged from 2.0% to 12.1% for securitized prime auto pools and 7.1% to 21.3% for non-prime pools, up significantly from prior months.

“Based on our discussions with issuers, we believe borrower modification requests began to level off in April. However, given that most issuers provided borrowers with two to four months of payment relief, we expect portfolio modification rates to remain elevated into the summer months,” analysts said.

“To reiterate, we believe that loan modifications can be a helpful tool for reducing delinquency and default rates, as it allows borrowers to manage a period of short-term financial difficulty. However, if used incorrectly, modifications simply delay the inevitable, pushing out losses and increasing tail risk to a securitization,” analysts went on to say.

KBRA supported its assertions by pointing out that approximately 95% and 80% of customers in prime and non-prime pools, respectively, who received a contract modifications in April were one to 29 days past due on their monthly payment.

“This suggests that lenders are not managing the timing of losses by giving already serious delinquent borrowers a loan extension,” analysts said.

Letter from KBRA’s president and CEO

Meanwhile, a day after releasing that auto-finance report, KBRA president & CEO James Nadler sent a letter to its industry customers. The body of the message is published here:

To our valued customers:

On behalf of the entire KBRA global organization, I would like to extend our heartfelt thoughts to anyone who has been personally affected by this unprecedented virus and civil unrest. As countries around the world collectively move toward brighter and more stable times, we must keep alive the memories of those who succumbed to the virus, even as we comfort our family and neighbors, and honor the everyday heroes who are helping in the recovery.

KBRA started 10 years ago this summer in the aftermath of the great financial crisis that was building over many years. Our founding principle was a simple promise to investors: provide the market with timely, valuable, and transparent research and ratings. Your response over the interim years has been humbling as not only have you accepted our core values —innovation, collaboration, and integrity to drive forward-looking market research and credit ratings—but your belief in our mission has helped our company become the world’s largest post-crisis rating agency.

Our commitment to you is equally as strong and we view your trust as our primary responsibility. As the world has awakened to turmoil and uncertainty, KBRA has worked diligently to produce investor research that looked beyond the headlines. We are proud to say that our countless outreach calls and engagement with market participants across the entire spectrum of our rating universe has led to the publication of more COVID-19 impact research than any of our competitors. And rest assured that our commitment to you will not end when the crisis is over. We will always provide you with the research and analysis you need to understand the markets during stressful times and good times.

The news will not always be positive. We are in the middle of an unprecedented crisis and some credit trends continue to deteriorate. We believe rating actions that are ill-timed or too broad can be misleading; timing and transparency are critical. At KBRA, all of our rating actions include a thorough and robust explanation backed by experienced analyst teams.

If one positive thing can come out of this crisis, it is that we have broadened and deepened our relationships with all of our valued clients. As we look to the future — one that may look very different — we promise to maintain our renewed and deeper relationships, along with providing you the best that KBRA has to offer.

Again, I thank you for your support over the last decade and look forward to building stronger relationships over the many decades to come.

Kroll Bond Rating Agency (KBRA) noticed seasonal improvement in February as analysts released their auto loan ABS update this week.

However, much of KBRA’s latest discussion revolved around the impact COVID-19 is going to leave. But first, analysts reviewed their latest data that showed credit performance showed signs of improvement as annualized net losses and 60-day delinquency rates declined in both of its auto loan ABS indices.

Annualized net losses and 60-day delinquencies in KBRA’s Prime Auto Loan Index for February dipped 3 basis points and 1 basis point month-over-month to 0.72% and 0.48%, respectively.

Meanwhile, KBRA’s Non-Prime Auto Loan Index posted readings for annualized net losses and 60-day delinquencies of 9.37% and 5.62%, marking declines of 13 basis points and 10 basis points, respectively, versus the previous month.

Looking at the year-over-year comparisons, KBRA determined prime index losses and delinquency rates remained either flat or slightly lower versus February of last year. On the non-prime side, annualized net losses dropped 15 basis points year-over-year, but analysts mentioned contract holders 60 days or more past due rose 20 basis points compared to last February.

Also of note, KBAR reported that the percentage of prime and non-prime contract holders who went from 60-days delinquent to current in February climbed 354 basis points and 187 basis points month-over-month to 21.8% and 13.5%, respectively.

Furthermore, the percentage of prime and non-prime contract holders who rolled from delinquency to charge-offs in February came in at 14.5% and 21.9%, respectively, down 78 basis points and 105 basis points versus January.

And now, the main topic facing finance companies during these unprecedented times. KBRA offered its initial glimpse.

“Historically, auto loan delinquency and loss rates fall between February and May (corresponding to the January t0 April collection periods) as borrowers receive their tax refunds, providing an additional source of cash to catch up on late payments,” KBRA said in its latest report.

“However, we believe the seasonal improvement in auto loan credit performance may be short-lived this year, as labor market pressures precipitated by the effects of the coronavirus (COVID-19) — rising unemployment and a reduction in hours worked — could more than offset any tax refund and/or government relief related benefit, as well as any loan modifications and forbearances provided by servicers,” analysts continued.

“That said, we do not expect to see the impact of the coronavirus in our index for another two months, as next month’s index will reflect the February collection period (March reporting period) and the virus containment measures only came into force during the week of March 9,” analysts went on to say.