NextGear Capital recently announced that the NextGear Floorplan Master Owner Trust successfully completed the sale of $400 million of privately placed 144A Asset-Backed Notes, Series 2017-1.

Officials indicated the company’s sixth successful securitization transaction, which further broadens the investor base, included the issuance of $400 million of Aaa/AAA/AAA rated Class A Notes.

“Since our inaugural bond securitization in 2014, NextGear Capital has been a regular issuer in the term markets as we support the substantial growth of our lending platform,” NextGear Capital chief financial officer Dave Horan said. “We continue to be delighted with the level of interest from current and new investors, as well as the bond market’s overall receptivity to our business model.”

NextGear Capital provides $20 billion in annual funding to more than 22,000 dealers throughout the United States, Canada, United Kingdom, and Ireland.

The National Automotive Finance Association is organizing the 21st annual Non-Prime Auto Financing Conference with the same mandate organization leadership has held for more than two decades.

“This is the industry event where all the non-prime auto financing company executives gather for information on the most relevant issues affecting non-prime financing, where vendors servicing the industry gather and where 21 years of networking continues,” NAF Association executive director Jack Tracey said in a message to SubPrime Auto Finance News.

“It’s exciting to see how this conference over the past 21 years has grown in prominence,” Tracey continued. “It’s where everyone comes. Nonprime auto financing leaders attend the conference because they know they’ll see the rest of the industry there.

“We strive each year to pull together a conference program that addresses issues facing nonprime auto industry and to provide education and solutions on the problems confronting the industry,” he went on to say. “Our objective is to have everyone go home with a least one good idea for improving their business.”

This year’s event, which carries the theme, “Optimizing NonPrime Performance,” is scheduled to run from May 31 through June 2. The event again is to unfold in Plano, Texas, but at a new facility — the Hilton Dallas/Plano Granite Park.

Some of the conference sessions includes the release of the 2017 Non-Prime Auto Financing Survey as well as a discussion about how finance companies can raise capital. Another segment has the title, “CFPB in Their Own Words.”

Among some of the notable conference speakers scheduled to appear are:

■ Rep. Jeb Hensarling, a Texas Republican and chairman of U.S. House Financial Services Committee

■ Tom Webb, retiring chief economist at Cox Automotive

■ Amy Martin, senior director of the structured finance ratings group at Standard & Poor’s

Complete registration details for the 21st annual Non-Prime Auto Financing Conference can be found at www.nafassociation.com.

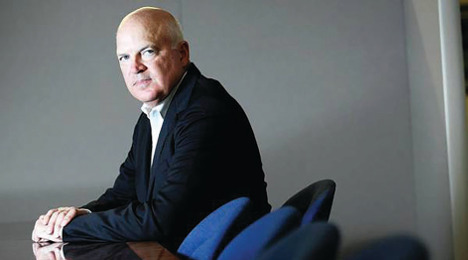

Consumer Portfolio Services chairman and chief executive officer Brad Bradley likes the position where the subprime auto finance company sits after the first quarter.

And it’s not just because CPS posted its 23rd consecutive quarter of positive earnings.

Bradley pointed to the difference where CPS stands with more than 25 years in the subprime business versus newer operations that might have only a fraction of that the portfolio seasoning.

During the company’s Q1 conference call conducted last week, Bradley touched on some similarities in the competitive landscape he’s seeing now that percolated back in 2008 and 2009.

“Both of those were some result of a recession. We haven't had a recession this time, but certainly feels a lot like there is going to be some consolidation in industry. We’re going to lose some of the competitors in the industry,” Bradley said.

“There is a lot of competitors in our industry struggling. Lots of small ones that came into the industry over the last couple of years are now having some real significant problems as the paper they’ve bought hasn’t performed,” Bradley continued a couple of moments later during his opening comments when he often shares his assessment of the entire subprime industry.

“They’re going to have more difficult access to the capital markets. And that also applies to some of the larger players in our industry who have grown real fast and haven’t really done as well as people might have expected. And so again many folks are waiting to see how that shakes out,” he said.

In terms of how the first quarter shook out for Consumer Portfolio Services, the company reported earnings of $4.5 million, or $0.16 per diluted share.

Meanwhile, revenue jumped 6.9 percent year-over-year to land at $107.6 million. However, the company’s Q1 operating expenses spiked 12.9 percent to $99.8 million; impacting in part on the year-over-year decline in net income.

A year earlier, CPS said, its net income came in at $7.2 million, or $0.24 per diluted share.

During the first quarter of 2017, CPS purchased $229.6 million of new contracts compared to $215.3 million during the fourth quarter of 2016 and $312.3 million during the first quarter of 2016. The company's managed receivables totaled $2.323 billion as of March 31, an increase from $2.308 billion as of Dec. 31 and $2.142 billion as of March 31 of last year.

“In terms of originations, as I mentioned, we haven't seen too much signs of tightening overall in the industry,” Bradley said. “I think some of the bigger folks, some of the larger banks have certainly talked about tightening, and you may be seeing a little bit of it there. Down in our end of the neck of woods, you really haven't seen too much of it lately.”

Bradley mentioned that CPS did tighten its loan-to-value ratio to the lowest point it has been since Q2 of 2014.

“We think LTV is one of the real indicators of what you're buying,” he said. “So, that would be an easy way to indicate that we certainly did do some tightening in the first quarter.

“I think other players will tighten as they go or maybe we’ll see more tightening, but at the moment certainly through the first quarter we haven’t seen too much other than sort of ourselves,” Bradley said.

Also noted in the company’s latest financial statement, CPS indicated annualized net charge-offs for the first quarter of 2017 stood at 7.91 percent of the average owned portfolio as compared to 7.57 percent for the first quarter of last year.

The company added its delinquencies greater than 30 days (including repossession inventory) involved 9.74 percent of the total owned portfolio as of March 31, as compared to 8.97 percent on the same date a year earlier.

CPS announces $225.2M securitization

In other company news, Consumer Portfolio Services also announced the closing of its second term securitization in 2017. The transaction is CPS’ 24th senior subordinate securitization since the beginning of 2011 and the seventh consecutive securitization to receive a triple-A rating on the senior class of notes from at least two rating agencies.

In the transaction, qualified institutional buyers purchased $225.17 million of asset-backed notes secured by $230.0 million in automobile receivables originated by CPS. The sold notes, issued by CPS Auto Receivables Trust 2017-B, consist of five classes.

Ratings of the notes were provided by Standard & Poor’s and Kroll Bond Rating Agency, and were based on the structure of the transaction, the historical performance of similar receivables and CPS’s experience as a servicer.

Note

Class |

Amount |

Interest

Rate |

Average

Life |

Price |

S&P

Rating |

KBRA

Rating |

| A |

$101.660 million |

1.75% |

.71 years |

99.99332% |

AAA |

AAA |

| B |

$38.985 million |

2.33% |

1.87 years |

99.99341% |

AA |

AA |

| C |

$34.155 million |

2.92% |

2.57 years |

99.98493% |

A |

A |

| D |

$27.715 million |

3.95% |

3.26 years |

99.97496% |

BBB |

BBB |

| E |

$22.655 million |

5.75% |

3.94 years |

99.98065% |

BB- |

BB- |

The company indicated the weighted average coupon on the notes is approximately 3.45 percent.

CPS said the 2017-B transaction has initial credit enhancement consisting of a cash deposit equal to 1.00 percent of the original receivable pool balance and over-collateralization of 2.10 percent.

The final enhancement level requires accelerated payment of principal on the notes to reach overcollateralization of 7.45 percent of the then-outstanding receivable pool balance.

Officials went on to note the transaction utilizes a pre-funding structure, in which CPS sold approximately $145.7 million of receivables in April and plans to sell approximately $84.3 million of additional receivables during May.

“This further sale is intended to provide CPS with long-term financing for receivables purchased primarily in the month of April,” the company said.

Financial advising firm UBS used the grim illustration of the “canary in the coalmine” at the beginning of a report it released this week involving the subprime auto finance space. To recap, that illustration stems from miners using caged canaries as a crude toxic gas detection method.

While birds didn’t appear to be harmed as UBS analysts compiled their report, they did acknowledge that a combination of factors has created an interest spike in subprime auto finance five times the normal level the firm typically receives from the investment community. The combination of deteriorating subprime auto finance metrics and results from its first-quarter consumer survey shedding light on the likelihood people will default sometime this year triggered the Wall Street fervor, according to the report obtained by SubPrime Auto Finance News.

“There are increasing signs that risky assets are vulnerable at elevated levels, from upticks in consumer delinquencies, to a major slowdown in bank and non-bank lending, to a stubborn increase in delinquent working capital loans,” UBS strategists Matthew Mish and Stephen Caprio wrote in the report.

The sentiment about defaulting came from UBS’ own research. Its Q1 survey revealed that 17 percent of participants said they either “strongly agree” or “agree” with the statement that "I am likely to default on a loan payment over the next year.” That question about payment not only includes auto financing but also other non-mortgage categories such as credit cards and student loans.

While the reading softened by 1 percentage point on a sequential basis, UBS pointed out the level soared about the survey mark generated in Q3, which was 12 percent.

And in terms of demographics, UBS’ survey showed that consumers between the ages of 21 and 34 told the firm they were most likely to default this year. Also of note, the annual income level of participants who acknowledged a default was coming this year was the highest segment among the three designated by UBS — individuals making $100,000 or more annually.

Mish and Caprio also referenced a previous report they compiled that mentioned many elements regarding delinquency and default previously highlighted by SubPrime Auto Finance News. The trends touched on S&P Global Ratings reporting that collateral performance in the U.S. subprime auto loan asset-backed securities (ABS) sector weakened in 2016 for the fourth straight year.

Also of note, the Federal Reserve Bank of New York indicated the amount of consumers who had a bankruptcy added to their credit reports during the fourth quarter softened to a new low going back 18 years.

The New York Fed reviewed Equifax data and found about 204,000 consumers had a bankruptcy notation added to their credit reports in the fourth quarter; an amount 4 percent below the same quarter in 2015 and a new series low that goes back to 1999.

In its UBS report, Mish and Caprio wrote, “Academic literature and recent data suggest the stigma associated with bankruptcy has declined post-crisis, particularly for the millennial generation.”

So with so much interest in the topic, what are Mish and Caprio telling UBS clients?

“We would limit corporate debt exposures in autos, auto lenders, rental car companies, credit card lenders, and non-bank providers of consumer loans and mortgages,” they wrote.

Along with offering a glimpse into some overall quarterly metrics, S&P Global Ratings reported that collateral performance in the U.S. prime and subprime auto loan asset-backed securities (ABS) sectors improved in February, relative to January.

Analysts determined that losses, delinquencies and recoveries performed better month-over-month due to year-end seasonality coming to an end and consumers using tax refunds to catch up on their payment obligations.

“Tax refunds also created demand for used vehicles, thereby bolstering recovery rates on a month-over-month basis. On a year-over-year basis, both sectors continued to weaken, with delinquencies and losses increasing and recoveries declining,” the firm said, according to a report published last week.

S&P Global Ratings noticed prime net losses decreased month-over-month to 0.73 percent in February from 0.88 percent in January and increased year-over-year from 0.57 percent.

“We attribute much of 28 year-over-year uptick in losses to a couple of regional banks whose auto loan ABS transactions are becoming a slightly larger share of the prime index and their 2015, as well as 2016, securitizations experiencing weaker performance than their 2014 deals,” analysts said.

“We’re also seeing higher losses for some captive finance entities on their 2016 transactions and lower recovery rates,” they added.

Meanwhile, S&P Global Ratings noted the subprime net loss rate decreased to 7.51 percent in February from 9.12 percent in January but increased from 7.00 percent registered in February of last year.

“This 7.3 percent year-over-year increase in losses is due to lower recoveries and deep subprime lenders representing a greater share of the subprime index,” analysts said.

In a separate report, S&P Global Ratings found that total U.S. ABS issuance — including the credit card and mortgage spaces — reached $59 billion in the first quarter, up sharply from $44 billion in Q1 2016. The report attributed the gain to “healthy employment and consumer credit.”

Analysts said auto-related issuance “may continue to surprise” as the segment “continued to dominate other sectors,” totaling $26 billion in Q1. The figure marked a rise of $2 billion year-over-year.

S&P Global Ratings indicated auto loan issuance reached $20 billion, including $13 billion in prime transactions and $7 billion in subprime transactions. Auto lease issuance was roughly in line with last year’s total, at $5 billion, and rental car deals added another $1 billion.

Earlier this week, NextGear Capital selected the Moody’s Analytics ABS System securitization issuance platform to enhance its efforts as a floor plan finance provider in the U.S. and Canada.

The Moody’s Analytics ABS System can automate reporting and enhance internal controls for the administration of an issuer’s structure finance transactions. NextGear Capital plans to use it for collateral calculations, accounting, cash management and investor reporting.

“Moody’s Analytics has experience with issuer in the auto industry, which was instrumental in our choice to work with them,” NextGear Capital chief financial officer Dave Horan said in a news release. “Their willingness and ability to understand our business and address our requirements will help drive NextGear’s continued success.”

In addition to the ABS System, Moody’s Analytics can provide issuers, investors and other structured finance market participants with a full suite of solutions, including the Moody’s Analytics Structured Finance Portal, which can offer cash flow analytics, benchmarking, credit modeling and an extensive loan-level database.

And now the company has a new client in NextGear Capital, which serves more than 20,000 dealers in North America who acquire the vehicle inventory at more than 1,000 auctions where the floor plan provider currently has relationships.

“We’re pleased to support NextGear’s securitization activities and provide the firm with the infrastructure it needs to execute on its more than $20 billion in annual funding to auto dealers,” said Marc Levine, senior director at Moody’s Analytics.

“Our ABS System will bring NextGear a best-in-class securitization administration system with the control and automation to implement its structured funding strategy effectively,” Levine went on to say.

Last summer, NextGear Capital closed a $1.95 billion securitized bank facility led by The Bank of Tokyo-Mitsubishi in a move the company said was a two-year securitized facility designed to provide “flexibility and tremendous lending capacity” through a large, six-bank syndicate.

Within a week of leveraging additional vehicle location data and analytics to mitigate its risk, Westlake Financial Services announced on Tuesday that the finance company issued a $700 million asset-backed securitization backed by approximately $748.7 million of automotive loans and installment contracts.

The transaction — Westlake’s largest-ever securitization — was led by BMO Capital Markets (structurer), Wells Fargo Securities and J.P. Morgan Securities. It is the latest of Westlake’s 13 securitizations, which have been comprised of approximately $5.1 billion in cumulative note sales.

“This is Westlake Financial Services’ largest ABS ever,” Westlake chief financial officer Paul Kerwin said. “With Westlake’s rapid growth, our credit performance continues to remain strong despite competitive and economic pressures. This combination is what attracts investors to our portfolio.”

Westlake indicated the securitization has an expected annualized cost of 2.73 percent, including the initial purchaser’s fees, which is in-line with prior ABS deals despite higher benchmark interest rates.

“Westlake’s ABS continue to perform and investors keep supporting our portfolio,” added Sean Morgan, Westlake’s AVP of Finance. “This is demonstrated by how closely we price to our largest competitors.”

Westlake Financial Services director of treasury Elias Drucker went on to say, “We upsized our deal by $100 million with 38 investors on WLAKE 2017-1, which is a reflection of strong investor demand for Westlake’s ABS. It is a credit to our strength as an originator and servicer, and shows that investors respect Westlake’s continued focus on growth and profitability.”

Westlake noted that it maintains six borrowing facilities funded by 10 banks with combined capacity of $1.48 billion. Facility capacity has increased from $1.05 billion in March 2016 to support continued growth in its full-spectrum lending platform.

Westlake Financial Services mentioned that it continues to see strong growth through its nationwide network of dealers. As one of the largest privately-held automotive finance companies, Westlake is active in all 50 states with a dealer base of more than 10,000 franchise and independent dealerships.

Westlake’s current portfolio of $3.7 billion includes originated vehicle installment contracts, portfolio purchases and dealer flooring lines.

Along with taking a longer-term look and investigating how all pools would perform through a credit cycle, S&P Global Ratings reported that collateral performance in the U.S. subprime auto loan asset-backed securities (ABS) sector weakened in 2016 for the fourth straight year.

According to a report published by S&P Global Ratings, both annualized metrics and vintage data — which show performance by year of securitization — demonstrated the decline.

“While the deterioration in the aggregate subprime auto loan statistics had been largely due to deep subprime lenders representing a greater share of issuance (though this is still a factor), about half of the subprime issuers are now reporting higher losses on their 2015 and first half 2016 securitizations as compared with 2014,” analysts said in the report.

S&P Global Ratings explained looser credit standards after several years of low losses (from 2010 through 2013), as well as heightened competition and lower recovery rates on defaulted loans, are contributing to higher losses.

“Some lenders are countering these effects by reducing origination volume and moving up the credit spectrum. Several have also reduced their loan-to-value ratios, especially on their longer-term loans, but we have yet to see a measurable and sustained improvement across the board," said S&P Global Ratings credit analyst Amy Martin.

The report pointed out that another “exacerbating influence” has been the relaxation in collection policies that some companies have adopted in light of increased scrutiny from various regulatory bodies. As a result, S&P Global Ratings said some finance companies have found it more difficult to contact delinquent borrowers and locate their vehicles for repossession and liquidation.

Despite a challenging business environment and the prospect of higher collateral losses, S&P Global Ratings insisted that ABS credit ratings are expected to remain generally stable, especially at the higher investment-grade levels.

“First, for those issuers reporting higher losses, the credit deterioration has been modest, and the transactions' robust structures have generally offset weaker performance,” analysts said. “Auto loan ABS transactions are structured with a sequential-pay mechanism and floors to the reserve and overcollateralization amounts that build credit enhancement for the most-senior classes relative to the declining pool balance.

“In addition, credit enhancement levels have generally kept pace with the higher expected loss levels,” they added.

Examining how auto ABS pools will perform through a credit cycle

As the U.S. economy approaches its eighth year of recovery, S&P Global Ratings acknowledged that the rate of light vehicle sales continues to register at or near record levels. The firm also said the strong pace of sales has benefited ABS issuance, but market participants have started questioning how long auto loans can continue to exhibit solid performance and whether the sector has too much consumer leverage.

Therefore, S&P Global Ratings investigated how these pools would perform through a credit cycle. The firm explained its process.

First, analysts determined the economic factors that would most contribute to loan losses: the national unemployment rate, used-vehicle values, as measured by the Manheim Used Vehicle Value Index, and the household debt service ratio. Then, they created scenarios to forecast losses under different economic environments.

In the base-case scenario, Martin indicated that S&P Global Ratings assumed household debt increases slightly to reflect the trend in worsening credit standards.

“Furthermore, used-vehicle values are likely to decline given the high levels of off-lease vehicles that are expected over the next three years,” Martin said.

Therefore, per the firm’s base-case scenario, S&P Global Ratings’ outlook calls for slightly higher losses. In the base-case, forecast annual net losses drift upward to a little over 1 percent for prime and to an annual average of 6.8 percent for subprime.

“The wide range of outcomes provided in this analysis offer market participants a better understanding of how the three independent variables we examined could affect losses,” S&P Global Ratings said. “However, the analysis doesn't explicitly assume how lenders respond to a worsening employment or used vehicle environment.

“Depending on the success of such lender actions, a potential increase in losses could be mitigated. Again, lender-specific losses would vary depending on individual underwriting and servicing policies,” the firm went on to say.

During the past three years, analysts have noticed credit standards degrade among both prime and subprime finance companies. While this could be viewed as a normalization of underwriting standards, S&P Global Ratings emphasized that auto financing has simultaneously become much more abundant.

Analysts mentioned that outstanding auto finance balances stood at a record level of $1.135 trillion as of Sept. 30, and quarterly originations averaged $140.9 billion for the first three quarters of 2016, up from $138.7 billion for the same period in 2015 and double the 2009 average of $70.5 billion.

In the past six months, Martin indicated some finance companies have tightened their credit standards.

“We view this positively; however, these corrective steps have only helped to offset lower recoveries, she said. “They have not led to a material or sustained improvement in losses. Nonetheless, they are a step in the right direction.

“At present, the competitive environment, prolonged economic recovery of nearly eight years and tremendous availability in auto credit are contributing to higher losses than what we would otherwise see given current low unemployment levels,” Martin went on to say.

S&P Global Ratings reported on Thursday that collateral performance in the U.S. prime and subprime auto loan asset-backed securities (ABS) sectors continued to weaken in January.

“Surprisingly, delinquencies did not decline from December to January as they usually do,” the firm said in a report sent to SubPrime Auto Finance News. “At the same time, losses and recoveries worsened month-over-month. On a year-over-year basis, both sectors continued to falter, with delinquencies and losses increasing and recoveries declining.

“Even the modified subprime composite, which excludes large, deep subprime pools and had been showing near stable performance, reported year-over-year weakness for the three performance metrics,” analysts added.

S&P Global Ratings indicated that prime net losses increased month-over-month to 0.88 percent in January from 0.76 percent in December. The year-over-year rise stemmed from the reading of 0.63 percent in January of last year.

In fact, analysts pointed out that January's loss rate of 0.88 percent is the highest since January 2010.

“We attribute most of the year-over-year uptick in losses to a couple of regional banks (whose auto loan ABS transactions we began rating in 2014) becoming a slightly larger share of the prime index,” according to the S&P Global Ratings analyst team led by Amy Martin, who again will be one of the experts on hand during the 21st annual Non-Prime Auto Financing Conference orchestrated by the National Automotive Finance Association beginning on May 31.

“Also, not only do these issuers have slightly higher losses than the more-established prime securitizers, but their 2015 securitizations are experiencing weaker performance than their 2014 deals,” the report continued.

“In addition, prime recoveries are declining on a year-over-year basis and this is affecting some of the captive finance pools. Also, as we've stated before, some lenders have normalized their lending standards,” analysts added.

Meanwhile, S&P Global Ratings found that the subprime net loss rate increased to 9.12 percent in January, up from 8.50 percent in December and 7.94 percent recorded during the opening month of 2016. Analysts explained this 118-basis-point year-over-year increase in losses is due to lower recoveries and deep subprime finance companies representing a greater share of the subprime index.

Therefore, as a supplement to its subprime index, S&P Global Ratings created the modified subprime index, which excludes certain high-loss deep subprime issuers (DRIVE, ACA and Exeter Automobile Receivables Trust). However, despite removing the deep subprime issuers, analysts indicated modified subprime net loss rate “does not show a better picture.”

The firm determined losses increased 112 basis points year-over-year to 7.80 percent in January from 6.68 percent a year earlier.

Prime & subprime recoveries deteriorate

S&P Global Ratings noticed the recovery rate for the prime sector decreased in January to 47.85 percent — the lowest reading since January 2010. The rate in December was 51.97 percent and 49.01 percent in January of last year.

Analysts determined subprime recoveries decreased to 34.79 percent in January from 39.89 percent in December.

“While one deep subprime transaction had very lower recoveries during its first month (which is not unusual), two large issuers reported lower average recovery rates on their outstanding deals for January 2017 compared to January 2016,” analysts said.

After netting out the DRIVE, ACA and Exeter transactions, S&P Global Ratings computed that modified subprime recoveries stood 36.73 percent in January but still down from 40.36 percent in December and 41.62 percent in January of last year.

“In our view, lower recovery rates are due to longer loan terms and some lenders increasing their loan-to-value ratios (LTVs), although we've recently seen some improvement in the LTVs on certain subprime auto pools,” the report said.

“Further, the increase in off-lease vehicles has affected used-vehicle values and auction prices,” analysts continued. “We expect used-vehicle values to continue to decline for the next two years due to the high volume of off-lease vehicles, which are projected to reach record levels of 3.6 million units in 2017 and 4.0 million in 2018, up from 3.0 million in 2016 according to Manheim.”

Impact of tax refunds on delinquency

S&P Global Ratings recounted that generally delinquencies decline from December to January due to tax refunds. But the firm found that the prime 60-plus-day delinquency rate increased slightly to 0.57 percent in January from 0.54 percent in December 2016 and 0.53 percent last January. Also, the subprime 60-plus-day delinquency rate was nearly stable at 5.09 percent in January compared to 5.06 percent in December. The subprime reading did tick up from the same month a year earlier when it was 4.66 percent.

Analysts added the modified subprime 60-plus-day delinquency rate inched up slightly to 4.11 percent from 3.93 percent in December and 3.85 percent for January of last year.

S&P Global Ratings recapped the situation Cox Automotive chief economist Webb explained, too. Tax refunds involving the Earned Income Tax Credit or the Additional Child Tax Credit were held until Feb. 15 this year, and as a result, year-to-date tax refunds though Feb. 10 were down 69%, or $65 billion.

“This likely contributed to higher month-over-month delinquencies in January. We expect them to decline in February,” S&P Global Ratings analysts said.

Consumer Portfolio Services chairman and chief executive officer Brad Bradley not only summarized how his company navigated the fourth quarter, but the outspoken industry veteran also perhaps gave a concise assessment of what’s happening at other subprime auto finance companies and the dealerships within their networks.

First, here are CPS numbers to give a backdrop of how Bradley approached his remarks during the company’s quarterly conference call with the investment community.

CPS posted its 22nd consecutive quarter of positive earnings, generating $7.5 million, or $0.26 per diluted share. The figure marked a bit of a drop-off from the $9.0 million, or $0.29 per diluted share, in net income the company posted during Q4 of 2015, but Bradley insisted the performance was in line with company expectations.

CPS’ revenue climbed 13.5 percent during Q4 and 16.1 percent for the full year, landing at $108.2 million and $422.3 million, respectively.

During the fourth quarter, CPS said it purchased $215.3 million of new contracts compared to $242.1 million during the third quarter of 2016 and $269.2 million during the fourth quarter of 2015. The company’s managed receivables totaled $2.308 billion as of Dec. 31, an increase from $2.292 billion as of Sept. 30 and $2.031 billion as of the close 2015.

The company’s annualized net charge-offs for Q4 stood at 6.97 percent of the average owned portfolio as compared to 6.23 percent for the fourth quarter of 2015. Delinquencies greater than 30 days (including repossession inventory) ticked up to 10.96 of the total owned portfolio as of Dec. 31 as compared to 9.53 percent a year earlier.

Bradley opened his remarks to the Wall Street watchers by referencing a Chinese proverb that states in part, “May you live in interesting times.”

He continued with, “We at least at CPS — and the industry — are living in interesting times. Again everything you see — higher delinquency, higher losses — now in the fourth quarter everybody slowed down as everybody dropped something between 15 percent and 20 percent in volume.

“There’s a lot concerns, regulatory and the economy and the industry in general. So these are interesting times,” Bradley went on to say.

Having been in the subprime auto finance business since 1991 is part of the reason why Bradley is confident CPS will navigate through whatever challenges might be coming later this year.

“Generally speaking that’s a lot of what the fourth quarter came out at, that’s a lot of what 2017 is going to come out at,” Bradley said. “(The company will be) trying to stay the course and just see how the rest of these moving pieces shake out and hopefully be in a position to take advantage of it and maybe be in a position to have done the best of everyone there. So we’ll see how it goes but that is kind of the focus we’re going to have.”

As mentioned previously, CPS bought less paper during Q4 and Bradley explained why — again referencing what might be the case for other companies, too.

“The business was slow in the fourth quarter, significantly slower than we would have expected. Again our focus is on quality over quantity,” Bradley said. “You can almost feel the other companies reaching to provide their earnings or the growth that they’re expected to have, (but) we’re not in that kind of position. And so we’re not trying so hard and as a result our numbers are down a bit. But again we would rather have the quality over the quantity any day of the week.”

Later in the call, Bradley went on to say. “Lot of people in the originations area are seeing more and more sort of challenging or bad loans that we don't want to buy, and that’s a real good indicator of what's coming out of the dealership. And the way it works is if we’re seeing a lot of good loans, it means we get what we want to the extent, and also it means that dealers have lots of loans to send you.

“To the extent that problems are getting more difficult, dealers start trying to push through riskier and not-as-good loans. And so when you start seeing more of those, you can almost tell that in the marketplace, the dealers are struggling just as much as we are because they’re trying to push through bad deals that we don't want and they know most times we’re not going to buy them,” he continued.

“So that gives you an idea that they're even trying to send and shows you that the market is difficult. But again keeping our originations model the way we want it, and buying what we want to buy, in the end will pay off much better than any other course,” Bradley said.

View of collections

Bradley also touched on how CPS is handling collections. It’s been nearly three years since CPS agreed to pay more than $5.5 million to settle charges from the Federal Trade Commission that the company used “illegal tactics” to service and collect consumers’ contracts.

“In terms of collections, I think everybody is now, at least we are, comfortable with the new dynamic that given all the technology our customers are a whole lot smarter and a whole lot more aware of what's going on. And so when we’re looking for them, they just look at their iPhone and decide whether or not to take the phone call,” Bradley said. “However, when we then tell them we’re going to take their car, they pay.

“And so we’ve now for over a year or more run this higher (delinquencies), but not with horribly higher loss rates,” he continued. “If the loss rates truly tracked the (delinquencies) that we’ve been seeing, the losses would be much, much worse. And so there really is this new thing or new dynamic where customers pay you when you’re going to take their car as opposed to just paying you as soon as you start calling them. We’ve gotten used to that.

“We’ve redone the way we collect and certainly part of that is the regulatory environment, the way you now have to speak to customers and how often you can call them and things like that,” Bradley went on to say. “That whole thing is now settled in as our culture has changed and so we’re real happy with that.”

Update on securitizations

Back in January, CPS announced the closing of its first term securitization in 2017. The transaction was CPS’ 23rd senior subordinate securitization since the beginning of 2011 and the sixth consecutive securitization to receive a triple-A rating on the senior class of notes from at least two rating agencies.

In the transaction, qualified institutional buyers purchased $206.3 million of asset-backed notes secured by $210.0 million in automobile receivables purchased by CPS. The sold notes, issued by CPS Auto Receivables Trust 2017-A, consisted of five classes.

Ratings of the notes were provided by Standard & Poor’s, DBRS and Kroll Bond Rating Agency, and were based on the structure of the transaction, the historical performance of similar receivables and CPS experience as a servicer.

Note

Class |

Amount |

Interest

Rate |

Average

Life |

Price |

S&P

Rating |

DBRS

Rating |

KBRA

Rating |

| A |

$99.12 million |

1.68% |

.87 years |

99.99906% |

AAA |

AAA |

AAA |

| B |

$29.92 million |

2.68% |

2.14 years |

99.98567% |

AA |

AA (high) |

AA |

| C |

$32.66 million |

3.31% |

2.84 years |

99.98111% |

A |

A |

A |

| D |

$24.57 million |

4.61% |

3.59 years |

99.99845% |

BBB |

BBB (low) |

BBB |

| E |

$20.05 million |

7.07% |

4.14 years |

98.98958% |

BB- |

BB (low) |

BB- |

The weighted average coupon on the notes was approximately 3.91 percent.

The 2017-A transaction has initial credit enhancement consisting of a cash deposit equal to 1.00 percent of the original receivable pool balance and over-collateralization of 1.75 percent.

The final enhancement level requires accelerated payment of principal on the notes to reach overcollateralization of 5.15 percent of the then-outstanding receivable pool balance.

Bradley mentioned in a company news release that the securitization CPS completed last October “achieved the lowest blended cost of funds of any deal since the second quarter of 2015.”

During the quarterly conference call, CPS chief financial officer Jeffrey Fritz added, “The asset-backed market continues to be very liquid, and so we continue to take advantage of that.”