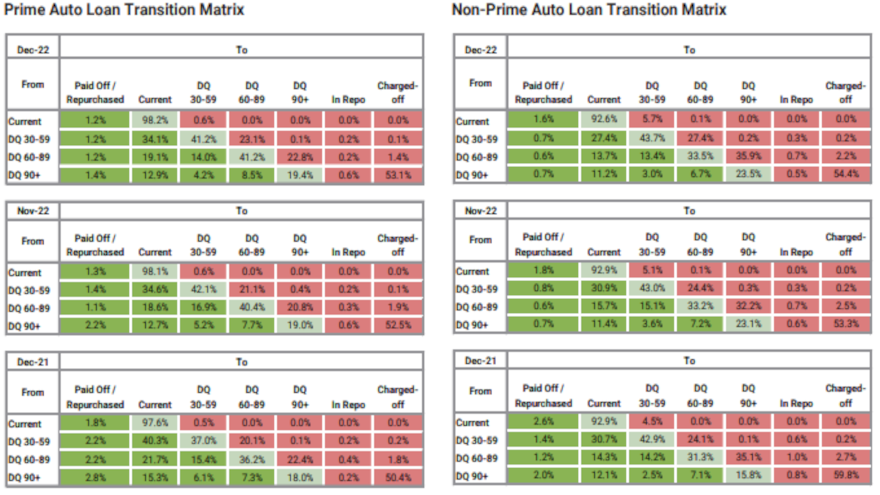

During the same week as S&P/Experian Consumer Credit Default Indices noted the December auto reading, the newest analysis Kroll Bond Rating Agency (KBRA) revealed more performance softening based on data from the securitization market.

KBRA said December remittance reports showed mixed credit performance across securitized prime and non-prime auto pools during the November collection period.

Analysts indicated annualized net losses in …

Read more

This week, Fitch Ratings and Kroll Bond Rating Agency (KBRA) offered their latest analysis of recent and potential future auto finance performance based on securitizations, with Fitch seeing the possibility of the subprime segment remaining “resilient,” while KBRA is anticipating some seasonal performance deterioration.

Beginning first with KBRA’s update, firm analysts indicated November remittance reports showed that securitized prime and non-prime auto credit performance continued to …

Read more

S&P Global Ratings went to its investment research laboratory recently because market participants have become increasingly concerned about subprime auto ABS given that the economy may be on the precipice of a recession wherein unemployment levels would likely rise and inflation could persist.

Given the established relationship between unemployment and losses on collateral backing auto loan ABS, as evidenced in the 2007-2009 recession, S&P Global Ratings acknowledged there is market interest in understanding the likely impact of expected higher unemployment on consumer affordability, collateral performance and auto ABS ratings.

To test the resiliency of U.S. subprime auto ABS ratings to a potential economic downturn — the length and depth of which are unknown — S&P Global Ratings ran three hypothetical economic stress scenarios on 54 transactions issued from 2019 through April of this year.

Under the hypothetical base case, analysts said there were no downgrades and a high percentage of the classes rated in the AA to BBB categories were upgraded by one or more categories.

Under the hypothetical mild stress wherein losses increase by 30%, S&P Global Ratings said upgrades exceeded downgrades for classes with investment-grade ratings, and a significant percentage of those in the 'BB' category were downgraded into a lower category.

Under the BBB hypothetical stress, S&P Global Ratings indicated there was an increasing percentage of downgrades as moved from AAA rated classes to B, and a high percentage of the noninvestment grade classes were vulnerable to defaults.

“Even under this stress scenario a significant portion of the AA rated classes were upgraded due to the deleveraging inherent in these transactions as a result of their sequential-pay structures,” S&P Global Ratings said in a news release.

Kroll Bond Rating Agency (KBRA) released research on Monday assessing changes in the auto loan asset-backed security (ABS) sector, prompting experts to say the segment has demonstrated “both stability and volatility over the past decade.”

The firm’s resulting report evaluated how auto ABS attributes such as loan-to-value (LTV) ratios, initial balances, terms, annual percentage rates (APR) and monthly payments have evolved over this time, with a focus on performance since the pandemic’s onset.

KBRA assessed these attributes in relation to four FICO score-based credit categories: prime, near prime, mid subprime and deep subprime. Analysts also examined trends in connection to used-vehicle values and recovery rates.

Analysts then arrived at six key takeaways, including:

• LTV ratios have generally trended upward toward pre-pandemic levels this year after declining for some time due to increasing vehicle values beginning in Q2 2020, as well as higher borrower down payment amounts.

• Unsurprisingly, weighted average (WA) initial loan balances have also trended upward. This has occurred across a wide range of FICO scores, with the exception of the deep subprime category, where loan balances have actually dipped by approximately 1% as finance companies tighten origination standards.

• For those same deep subprime borrowers, loan terms have also decreased to eight-year lows. Meanwhile, contract terms for consumers with FICO scores above 550 have trended upward modestly and are above pre-pandemic levels.

• Despite rising interest rates, APRs charged to consumers have remained steady through October 2022, as competitive pressures in the industry made it challenging for lenders to pass higher issuance costs to consumers. However, KBRA expects this trend to change as rates continue rising and credit performance softens.

• With higher loan balances and modest increases in original terms, WA monthly payments have steadily increased.

• Recovery rates reached record highs in Q1 2022, benefiting from strong used vehicle prices from Q2 2020 through Q1 2022. This trend began reversing in Q2 2022 amid declining vehicle prices, which has pushed recovery rates down as well. However, while used-vehicle prices are expected to continue declining, they will likely remain elevated compared to recent years.

KBRA complete research report titled, Auto Loan ABS Trends: Shifting Gears Ahead of the Turn, can be found via this website.

Last week, both Kroll Bond Rating Agency (KBRA) and S&P Global Ratings shared intriguing findings based on analysis of September and October data generated by the automotive securitization market, noting trends about originations, extensions, collections and delinquencies.

SubPrime Auto Finance News obtained additional information from S&P Global Ratings, which said in a news release, “U.S. ABS prime auto loan performance strengthened in September 2022, recording …

Read more

At least one part of the subprime auto finance market is starting to resemble what the landscape was before the pandemic.

S&P Global Ratings published a report last week highlighted the U.S. auto ABS sector’s performance for August, noting that it weakened, with prime and subprime losses increasing month-over-month.

Analysts explained the deterioration in subprime was …

Read more

S&P Global Ratings acknowledged this week that it is too early to assess the full impact of Hurricane Ian on rated U.S. auto asset-backed securities (ABS).

However, firm analysts currently believe that rating downgrades are unlikely, based on their assessment of …

Read more

Fitch Ratings, Kroll Bond Rating Agency (KBRA) and S&P Global Ratings each shared their data and projections about auto delinquencies, the securitization market and the general U.S. economy through separate reports and news releases distributed in recent days.

Before getting into greater detail about the subprime space, Fitch reported that …

Read more

Consumer Portfolio Services (CPS) and United Auto Credit Corp. (UACC) each made moves to shore up their flexibility to book more paper.

Beginning with CPS, the company announced that it renewed its two-year revolving credit agreement with Citibank, N.A., and doubled the capacity from $100 million to $200 million.

The company explained through a news release that contracts under the renewed credit agreement will be secured by automobile receivables that CPS now holds, will originate directly, or will purchase from dealers in the future.

CPS said it may borrow on a revolving basis through July 15, 2024, after which CPS will have the option to repay the outstanding loans in full or to allow them to amortize for a one-year period.

Meanwhile over at UACC, an indirect wholly-owned subsidiary of Vroom, the company last week priced an auto securitization of $255.080 million in aggregate principal amount of automobile receivable backed notes.

Vroom explained in another news release that the Q3 2022 securitization is a private offering under Rule 144A in which UACC offered approximately $242.325 million of the Notes. The transaction represents UACC’s 14th securitization overall and second since its acquisition by Vroom on Feb. 1.

Vroom noted the transaction features five classes of sequential-pay securities with expected ratings of AAA/AAA through BB/BB by S&P Global Ratings and DBRS Morningstar, respectively.

UACC said it expects to sell approximately $285.000 million in principal balance of auto loans to a special purpose trust and receive proceeds from the issuance and sale of the rated Notes.

UACC added that it will retain a 5% vertical risk retention interest in each class of notes in order to satisfy the U.S. credit risk retention regulations.

“Completion of UACC’s second securitization under Vroom ownership demonstrates UACC’s ability to leverage its substantial capital markets experience to opportunistically deploy securitization transactions and maintain capital flexibility” Vroom chief executive officer Tom Shortt said in the news release.

“As we develop the UACC business into a full captive financing operation, we look forward to delivering enhanced unit economics for Vroom and a seamless experience for our customers,” Shortt added.

The company added transaction settlement for the notes is expected to be on or about Wednesday.

J.P. Morgan Securities, Capital One Securities and Wells Fargo Securities acted as joint lead managers of the transaction. UACC is represented in this transaction by Katten Muchin Rosenman as issuer’s counsel.

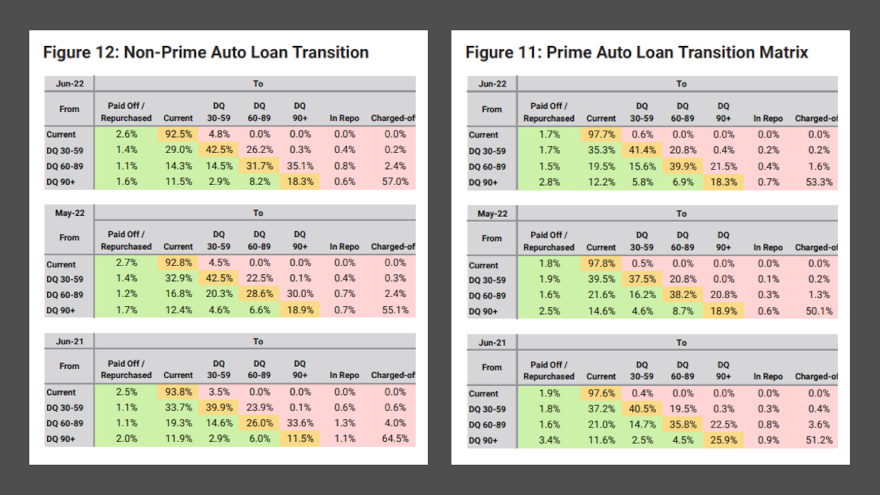

The newest data and analysis from Kroll Bond Rating Agency (KBRA) might be reinforcing the observations and comments made by finance company executives and repossession agents during the North American Repossessors Summit a little less than a month ago.

KBRA reported that June remittance reports showed softening credit performance across securitized prime and non-prime auto securitization pools during the May collection period, especially in …

Read more