The latest analysis about the health of contract payments and the auto asset-backed securities market from Kroll Bond Rating Agency and S&P Global Ratings showed mixed observations from company experts.

Beginning first with the update from S&P Global Ratings, analysts examined the U.S. auto ABS sector’s performance for the first quarter and discovered …

Read more

Amy Martin, who is sector lead and senior director S&P Global Ratings, is a fixture at the Non-Prime Auto Financing Conference hosted by the National Automotive Finance Association.

Before Martin made her way back on the conference stage, she spent some time with Cherokee Media Group senior editor Nick Zulovich for this episode of the Auto Remarketing Podcast focused on the auto ABS market.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Auto-finance companies looking to gauge collections, delinquencies and defaults continue to get a somewhat murky glimpse of what’s happening in the market.

After the latest update showed a slight dip in defaults, the newest insight from Kroll Bond Rating Agency (KBRA) indicated February remittance reports showed that auto credit performance continued to soften across prime and non-prime securitization pools during the January collection period.

Read more

Kroll Bond Rating Agency (KBRA) and S&P Global Ratings each shared their latest observations of contract performance based on metrics collected through the auto ABS market.

Analysts at both firms spotted similar patterns.

Beginning with S&P Global Ratings, the firm said through a news release that U.S. prime auto ABS saw “strong” results in September, with even lower monthly annualized losses year-over-year due to high recovery rates.

S&P Global Ratings indicated prime month-over-month performance was relatively stable, while subprime performance results were “less favorable but still quite positive relative to historical metrics.”

Analysts determined subprime losses increased year-over-year but were still only about 50% of the September 2019 loss level.

Subprime delinquencies and losses also rose month over month, while recoveries declined, according to S&P Global Ratings.

“Both segments are reporting very low static pool cumulative net losses for the first-quarter 2020 though first-quarter 2021 vintages,” S&P Global Ratings analysts said.

The firm went on to mention “significant” year-over-year changes in the prime pool composition through September included the average FICO score declining slightly to 750 from 760 and used vehicles increasing to a record 63% from 59%.

Analysts added that the used-vehicle composition also increased in subprime pools.

“Of the 25 transactions we reviewed in October, we lowered our loss expectations on 19 and maintained them on six. These reviews resulted in 51 upgrades and no downgrades,” S&P Global Ratings analysts said.

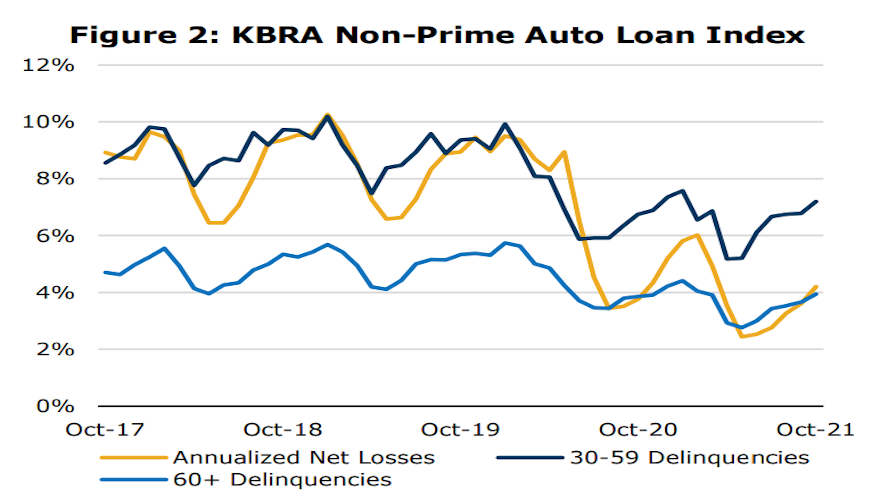

Turning next to KBRA’s analysis of October activity, the firm discovered that early-stage delinquencies (30 to 59 days past due) in KBRA’s Prime Auto Loan Index increased 4 basis points month-over-month to 0.84%, while late-stage delinquencies (60 days or past due) rose 1 basis point to 0.29% .

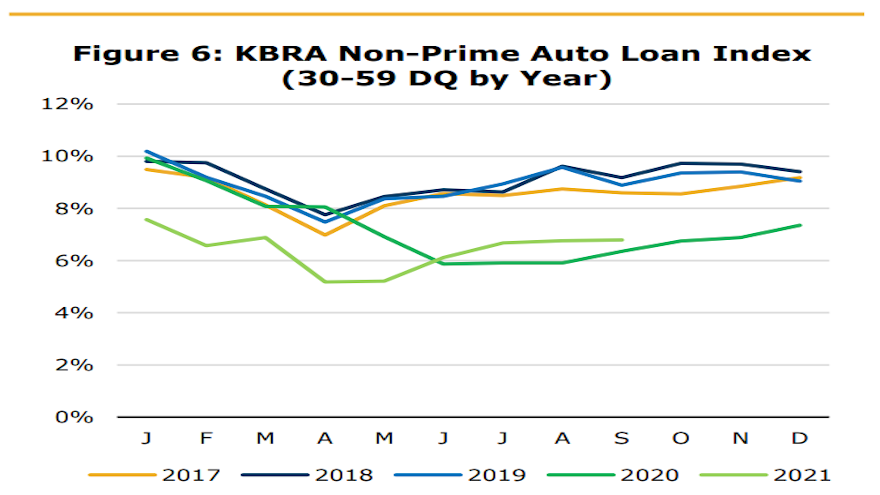

Furthermore, analysts said early- and late-stage delinquencies in KBRA’s Non-Prime Auto Loan Index were up 42 bps and 29 bps month-over-month, respectively, at 7.2% and 3.94%.

“Annualized net losses (ANL) trended somewhat higher in our prime index versus the previous month but remained relatively flat in our non-prime index. However, net loss rates remained well below pre-pandemic levels, as elevated used vehicle values have continued to support loan recovery rates,” KBRA experts said in their newest report.

“It is likely that securitized auto loan credit performance will continue softening into early next year, keeping in line with seasonal trends as holiday spending weighs on borrower finances,” they continued. “Moreover, the termination of extended federal unemployment benefits in early September 2021, coupled with the phasing out of other COVID-related safety net programs like federal student loan forbearance in January 2022, will likely create additional headwinds to consumer credit performance in 2022.”

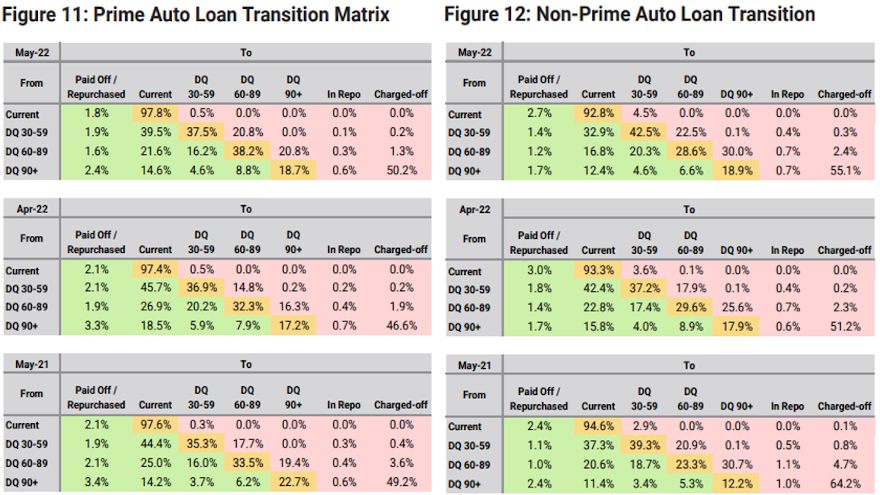

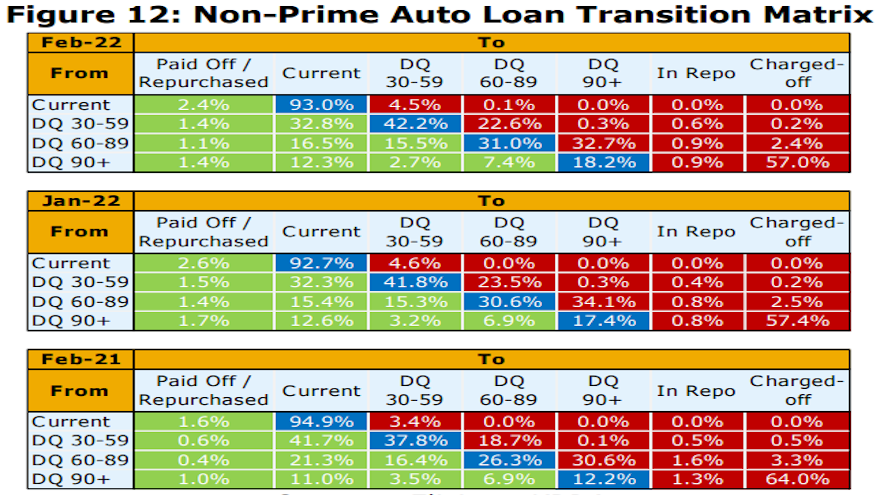

KBRA closed its updated by noting the percentage of prime and non-prime contract holders who transitioned from current to 30 to 59 days delinquent totaled 0.5% in its prime index and 4.4% in its non-prime index.

Finally, the firm said the percentage of prime consumers who rolled from 60 days or more past due to charge-off equaled 12.5%, which was down 162 basis points month-over-month, while the non-prime roll rate into charge-off decreased 20 basis points to 19.3%.

Kroll Bond Rating Agency (KBRA) weighed in on another element to the completion of Stellantis’ acquisition of First Investors Financial Services Group that created a new captive finance company for the automaker.

While First Investors has been renamed Stellantis Financial Services US Corp., the company that specialized in subprime auto financing still has previously deployed asset-backed securities in the market, which is what KBRA examined this week.

KBRA said it has outstanding ratings on nine securitizations collateralized by retail installment contracts originated under the First investors platform.

KBRA pointed out that First Investors acts as the depositor, seller and servicer and is the provider of certain representations and warranties for the transactions.

“Based on publicly available information and discussions with First Investors management team, KBRA does not believe the acquisition will have a negative ratings impact on the ABS transactions but will continue to monitor the situation,” analysts said in a news release.

First Investors was founded in 1988 and originated subprime paper with consumers whose credit bureau scores ranged from 500 to 650.

Kroll Bond Rating Agency (KBRA) is seeing the likelihood strengthen that seasonal payment patterns are coming; that some of your contract holders might purchase holiday gifts rather than maintain their monthly vehicle payment.

Analysts delved into the topic when they shared KBRA’s September index readings based on securitizations in both prime and non-prime.

Read more

Kroll Bond Rating Agency (KBRA) offered a recap of the Structured Finance Association’s annual SFVegas conference, which unfolded last week for the first time since before the pandemic arrived.

Read more

Oftentimes when a federal regulator charges after a subprime auto finance company, it’s the Consumer Financial Protection Bureau or the Federal Trade Commission doing the investigations and handing out enforcement actions.

Last week, it was the Securities and Exchange Commission getting involved in auto-finance oversight.

The SEC announced fraud charges against two former executives of a subprime auto finance company for misleading investors about the subprime retail installment contracts that backed their $100 million securitization offering.

The SEC’s complaint — filed in U.S. District Court for the Northern District of Illinois — involves James Collins and Robert DiMeo, the former principals of Honor Finance.

The complaint alleges Collins and DiMeo were responsible for false and misleading statements about, and engaged in deceptive conduct regarding, Honor’s servicing practices in connection with the Honor Automobile Trust Securitization 2016-1 (HATS).

Officials said the complaint charges that Honor packaged together several thousand installment contracts Honor funded to serve as collateral for the HATS offering, which raised $100 million through the sale of interest-bearing notes to investors.

According to the SEC’s complaint, Collins and DiMeo took various steps designed to “artificially inflate” the value of the collateral underlying HATS. Specifically, the complaint alleges that Collins and DiMeo were responsible for, among other things, including contracts in the deal that were not eligible to be included in the securitization vehicle, extending repayment dates without contract holder’s knowledge, and forgiving payments due from delinquent consumers.

The complaint also claims that, because of these improper practices, the servicing and performance information Honor provided to investors at the time of the offering and in later monthly reports was false.

“Investors in asset-backed securities are entitled to the same full and accurate disclosure as investors in other types of securities,” said Osman Nawaz, acting chief of the SEC’s complex financial instruments unit. “This case reflects our continued and resolute commitment to policing offerings in this space.”

Jennifer Leete, associate director of the SEC’s Division of Enforcement, added these comments in a news release.

“We charge Collins and DiMeo with intentionally misleading investors, the underwriter, and ratings agencies in order to securitize loans that should not have been included in HATS and hide Honor’s improper servicing practices,” Leete said.

“In addition, because of their alleged misconduct, Honor continued to overstate the performance of the deal long after the securitization was issued,” she added.

Officials said the SEC’s complaint charges the defendants with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

The complaint seeks permanent injunctions, officer and director bars, disgorgement with prejudgment interest and civil penalties.

According to the news release, the SEC’s investigation was conducted by Jason Anthony and Amy Sumner, with assistance from Daniel Nigro. The investigation was supervised by Laura Metcalfe and Paul Pashkoff. The litigation is being handled by David Nasse and Christopher Martin.

Is the Consumer Financial Protection Bureau “changing the rules of the game” when it comes to subprime auto finance securitizations?

That’s one of the many questions explored during this podcast with Davis+Gilbert partner Joseph Cioffi, orchestrator of the Credit Chronometer and the recently released market study, summarizing the views of more than 100 originators, investors, servicers, trustees and other securitization market participants on topics such as credit quality, the sufficiency of credit enhancement protections and the ability to obtain and maintain desired credit ratings.

To hear the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Originations aren’t the only part of auto financing accelerating nowadays.

Stephen Bisbee, founder of eOriginal, which is now part of Wolters Kluwer, appeared on the Auto Remarketing Podcast to explain why securitizations are accelerating again as an attractive option for the investment world.

To hear the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.