Generally, Fitch Ratings has an upbeat assessment of automotive asset-backed securities performance, but the subprime segment still has firm experts concerned.

Fitch Ratings said this week that auto ABS has been more resilient than initially expected through the pandemic and economic crisis, as delinquencies and loss levels over the past year have been stable to improving compared with pre-pandemic levels.

Analysts then projected that prime ABS performance is expected to remain strong, while subprime auto ABS asset performance may experience moderately higher defaults given higher unemployment levels among lower-income individuals.

“Subprime borrowers, in particular, have benefited from payment relief in the form of loan extensions from auto captives and other lenders that has kept their loan status current,” Fitch Ratings said in a news release.

“Government support such as enhanced unemployment benefits and stimulus checks also boosted consumer income, benefiting transaction performance and leading to historically low delinquencies and defaults,” the firm continued.

Fitch Ratings explained the utility of vehicles — particularly during the pandemic when public transportation ridership declined — aided auto ABS performance by bolstering vehicle demand, raising prices and keeping monthly payments high in a consumer’s priority.

Fitch’s prime and subprime 60-plus day delinquency indices were down to 0.22% and 3.76%, respectively, as of March, from 0.27% and 5.11% in March of last year.

“Used-vehicle prices, and therefore recoveries, have been near historic highs given robust demand and limited new-vehicle inventory,” Fitch analysts said.

“Production shut downs and sporadic parts availability issues, including the current semiconductor microchip shortage, reduced new vehicles supply and supported used values,” they continued.

Also of note, Fitch’s prime and subprime recovery indices in March moved 14.3 percentage points and 8.6 percentage points higher year-over-year to 71.1% and 51.0%, respectively.

“Repossessions may pick up slightly and lead to additional supply. However, this trend is expected to be minimal and values should remain strong throughout the year,” Fitch said.

“We expect moderate increases in delinquencies and defaults for subprime ABS as loan contract extensions continue to expire and payments come due, and as federal aid to individuals expires,” analysts continued, nothing that the two Fitch-rated subprime platforms are sustaining weakening asset performance outlooks.

Fitch added that those outlooks are softening because losses are reverting higher but are expected to remain within its initial forecasts.

“Our rating outlook is stable due to conservative loss assumptions and structural protections,” analysts said.

Fitch went on to mention that since the outset of the pandemic, the firm has applied stressed assumptions and sensitivities in its credit analysis that more heavily weights the poorer performing 2008-2009 recessionary vintages to account for the pandemic environment.

Analysts explained this strategy resulted in average prime cumulative net loss proxies of 1.69% for transactions issued in 2020, compared with 1.28% and 1.45% in 2019 and 2018, respectively.

“Given the better-than-expected asset performance and a more sure-footed economic recovery, Fitch is beginning to move away from pandemic-related stresses to transaction cumulative net loss proxies,” analysts said.

“There have been no downgrades or negative rating outlook revisions across prime and subprime auto loan ABS since the onset of the pandemic,” Fitch went on to say.

“Deleveraging transactions and building credit enhancement supported upgrades in 2020 for both prime and subprime, and will continue to support ratings in 2021,” analysts added.

As Arivo Acceptance closed on its second securitization, paving the way for continued growth and expansion, S&P Global Ratings revised its outlook on Credit Acceptance to stable from negative after that finance company completed its latest securitization.

Last week, Credit Acceptance announced the completion of a $500.0 million asset-backed non-recourse secured financing. Pursuant to this transaction, the company said it contributed installment contracts having a value of approximately $625.1 million to a wholly-owned special purpose entity, which will transfer the paper to a trust.

The move includes three classes of notes highlighted in this chart.

| Note Class |

Amount |

Average Life |

Price |

Interest Rate |

| |

A |

|

$354,820,000 |

|

2.68 years |

|

99.99980% |

|

0.96% |

| |

B |

|

$51,880,000 |

|

3.52 years |

|

99.99766% |

|

1.26% |

| |

C |

|

$93,300,000 |

|

3.79 years |

|

99.96949% |

|

1.64% |

Credit Acceptance explained in a news release that the financing will accomplish three objectives, including:

— Have an expected annualized cost of approximately 1.4% including the initial purchasers’ fees and other costs

— revolve for 24 months after which it will amortize based upon the cash flows on the contributed contracts

— Be used by the company to repay outstanding indebtedness.

Credit Acceptance said it will receive 4.0% of the cash flows related to the underlying consumer contracts to cover servicing expenses. The remaining 96.0% — less amounts due to dealers for payments of dealer holdback — will be used to pay principal and interest on the notes as well as the ongoing costs of the financing.

The company pointed out that the Financing is structured so as not to affect its contractual relationships with dealers and to preserve the dealers’ rights to future payments of dealer holdback.

“The notes have not been and will not be registered under the Securities Act of 1933 and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements,” Credit Acceptance said in a news release.

“This news release does not and will not constitute an offer to sell or the solicitation of an offer to buy the notes. This news release is being issued pursuant to and in accordance with Rule 135c under the Securities Act of 1933,” the company went on to say.

A day later along with the revised outlook, S&P Global Ratings also affirmed its issuer credit and unsecured debt ratings at BB for Credit Acceptance.

“The outlook revision on Credit Acceptance reflects our view that its financial performance is likely to be stable over the next year,” S&P Global Ratings analysts said in their own news release. “While there could be further credit deterioration in 2021 resulting in the company having to reduce its forecast of expected cash flows, we expect the company will generate more than sufficient earnings to absorb associated loan loss provisions, even if they are higher than current levels.

“The company reported net income for 2020 in line with the previous year, excluding higher provisioning due to current expected credit losses (CECL) implementation. Also, the company reported relatively stable leverage as measured by debt to adjusted total equity despite much higher reserves for loan losses due to CECL,” analysts continued.

“Despite a stable performance, the company has reported reduced volume in 2020 of 7.5% year over year in total consumer loan units. The company has also noted it likely lost market share over the past year in what has been tight competition. Despite this, the company continues to generate ample earnings while maintaining large cushions from all of its financial covenants,” S&P Global Ratings went on to say.

More details from Arivo Acceptance

According to a news release distributed last week, Arivo Acceptance closed on Arivo Acceptance Auto Loan Receivables Trust 2021-1 (ARIVO 2021-1) on Jan. 20. The move represented the finance company’s second subprime auto loan securitization, following its first transaction in October 2019.

The company said this latest securitization included approximately $193 million of fixed-rate notes in one senior class and three subordinated classes rated Single-A down to Single-B by DBRS via a 144a private placement.

Arivo highlighted that the subprime finance company is taking a “big step toward the future” with this second securitization.

Founded in 2017, Arivo said it has been well received as a new entrant into the ABS market due to its strong growth, low loss results and experienced management team.

The 2021-1 deal led by JP Morgan and Cantor Fitzgerald increased Arivo's ABS investor base to 27 unique investors, up from 12 investors in its 2019-1 transaction.

“Proven by this transaction, Arivo has quickly achieved critical milestones as it is rare for a relatively young company to see such strong interest from the capital markets,” Arivo chief financial officer Steve Pachella said in the news release.

The securitization provides liquidity in a recently renewed $250 million warehouse facility provided by JP Morgan. This liquidity also will allow Arivo to continue the rapid expansion of its technology-driven Subprime Simplified platform.

Furthermore, Arivo noted that it is expanding into new markets throughout the country and increasing its dealership base in its current markets.

“We are pleased that our strategic Subprime Simplified business model is gaining widespread acceptance with auto dealers while simultaneously earning the capital market's confidence,” Arivo chief executive officer Robert Avery said.

“Having attained both of these objectives, I expect Arivo will double its growth in 2021 while continuing to provide high levels of service to our dealers, such as one-day funding and maintaining low delinquency and loan losses,” Avery went on to say.

To learn more about Arivo’s Subprime Simplified program, visit www.arivo.com.

S&P Global Ratings is observing what it dubbed “generally better-than-expected loss results,” according to its latest report on the auto loan ABS market.

And analysts gave an upbeat forecast for the trends to continue this year as unemployment levels tick lower and the pandemic gradually subsides because of vaccine distribution.

“The generally better-than-expected loss results, improved employment outlook, and wide variances in extension rates across issuers led us to reduce the fixed incremental adjustment to base-case cumulative net losses that we applied to our auto loan ABS transactions last year beginning in late March,” analysts said in the report.

“In the application of our criteria, we are now factoring into our analysis issuer-specific performance data since the start of the pandemic, among other factors, to determine the degree of the COVID-19-related loss adjustment for a given transaction,” they continued.

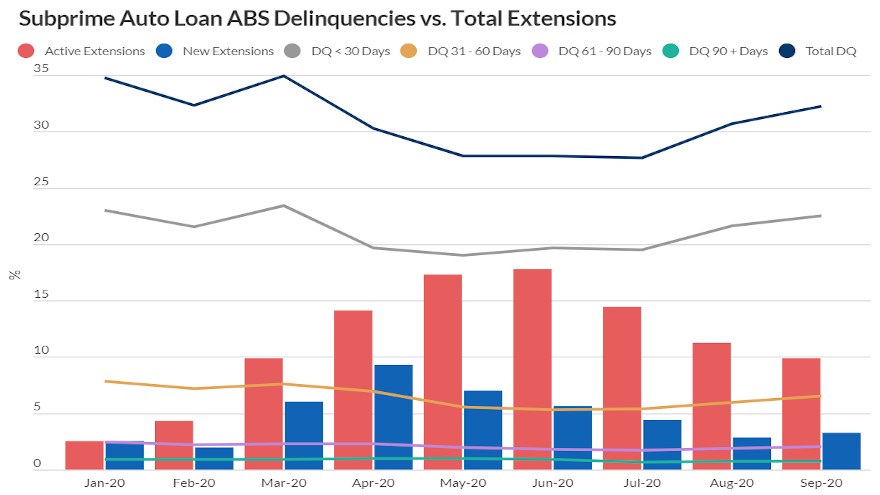

S&P Global Ratings explained that as expected at the onset of the pandemic in March, extension rates increased significantly as finance companies sought to provide payment relief for contract holders that were unemployed due to business closures from the statewide mandated shutdowns. The firm pointed out that monthly extension rates for U.S. prime and subprime auto loan ABS peaked in April, but subsequently trended downward as statewide closures eased in May and through the summer months.

Despite the reduction in extension rates from their peak last spring, analysts acknowledged that they have yet to see delinquencies and losses increase to typical pre-COVID levels, although S&P Global Ratings noticed that they are starting to trend upward.

Analysts explained that strong delinquency and loss performance has been due to a confluence of factors that have occurred since the start of the pandemic, including enhanced unemployment benefits and stimulus checks, unprecedented levels of extensions granted by finance companies and soaring used-vehicle values.

“We are continuing to monitor how COVID-19 is affecting outstanding transactions and considering how it will impact future ones,” analysts said. “As the pandemic has intensified in recent months, we expect monthly extension rates to continue to rise, but not to the levels we saw in the spring of 2020.

“The high rates of infection have led to reduced business activity, which, in turn, has cut working hours and salaries for many of those still employed, and have kept first-time unemployment claims high (at nearly 780,000 for the week ended Jan. 30 — about 3.1 times pre-pandemic levels,” analysts continued. “Still, unemployment levels remain substantially below where they were in April (peaking at 14.7%) and we expect them to average 6.4% this year.

“Also, a potential third round of stimulus checks is currently being discussed by President Biden’s administration that, along with the stimulus check received in January and the upcoming tax refunds, could reduce the need for extensions and limit the potential increase in losses,” analysts went on to say. “We also expect used-vehicle supply to remain constrained throughout most of 2021, which could continue to support strong used-vehicle values and assist with decreasing the severity of losses on charge-offs.”

As important as those ingredients might be to the health of the auto loan ABS market, S&P Global Ratings might be putting its strongest forecasting emphasis on vaccine availability. The firm pointed out that vaccine production and inoculations are ramping up in the U.S. and throughout the world.

“Widespread immunization, which will help pave the way for a return to more normal levels of social and economic activity, looks to be achievable by most developed economies by the end of the third quarter,” analysts said. “However, some emerging markets may only be able to achieve widespread immunization by year-end or later.

“We use these assumptions about vaccine timing in assessing the economic and credit implications associated with the pandemic. As the situation evolves, we will update our assumptions and estimates accordingly,” they added.

Looking through the prism of the public asset-backed securities market (ABS), both S&P Global Ratings and Kroll Bond Rating Agency (KBRA) spotted deterioration when analysts examined subprime auto financing.

However, the softening didn’t trigger an extreme reaction from experts, with some pointing to some seasonality still playing a role.

Beginning with the latest update from S&P Global Ratings, analysts there said extensions on subprime retail installment contracts rose for the third consecutive month in November, increasing 28 basis points to 4.06%. Analysts indicated this reading marks their highest level since July when it stood at 5.29%.

Meanwhile, S&P Global Ratings pointed out that extensions on public prime issuances also moved higher, ticking up 3 basis points to 0.55%. That stopped streak of declines in the prime segment for six consecutive months.

Despite the increases, analysts acknowledged these levels remain significantly below April’s peak levels of 15.75% and 5.76% for subprime and prime, respectively.

Looking closer at the subprime data, S&P Global Ratings spotted a connection of extension rates and rising cases of COVID-19 cases per 100,000 people as tracked by John Hopkins University.

Analysts noted that within subprime, Wyoming and North Dakota had the second- and third-highest extension rates of 5.49% and 5.37%, respectively, in November. And John Hopkins University reported those states the third-highest and highest rates of people becoming infected with the coronavirus during that time.

“We believe contributed to the high extension rates,” S&P Global Ratings said.

In prime, S&P Global Ratings mentioned the states/territories with the highest extension rates in November included New Mexico (1.05%), Wyoming (0.91%), Mississippi (0.85%), Washington D.C. (0.81%) and Texas (0.77%). And all five reported month-over-month increases in cases of COVID-19, according to John Hopkins.

KBRA index readings

The newest KBRA readings showed some seasonality even during the pandemic.

Analysts said in their newest report that early stage delinquencies in the KBRA Prime Auto Loan Index climbed 2 basis points month-over-month to 0.97% in December, while late-stage delinquencies increased 3 basis to 0.38%.

Furthermore, early and late-stage delinquencies in the KBRA Non-Prime Auto Loan Index jumped to 7.37% and 4.22%, respectively, representing increases of 48 basis points and 32 basis points versus the previous month.

However, KBRA pointed out that both delinquency metrics remained “meaningfully” lower on a year-over-year basis, while annualized net loss rates remain “well below” pre-pandemic levels. Analysts explained those assertions arrived as a result of a “strong” used-vehicle market and low delinquency rates throughout the spring and summer months.

“Moreover, recoveries on a large number of loans charged off early in the pandemic were delayed until later in the summer and fall because of repossession moratoriums, another factor that kept annualized net losses from rising in recent months,” KBRA said.

“Seasonal trends typically push delinquency rates to their highest levels in December and January as borrowers use excess cash on holiday spending,” analysts continued.

“However, with tax refund season now approaching and with lawmakers reaching a deal on another round of federal stimulus in December—with the prospect of additional stimulus now that the Democrats control both chambers of Congress — we expect auto loan credit metrics to continue to remain in check for the time being,” analysts went on to say.

KBRA closed its latest update with its usual look at Reg ABS II asset-level disclosures. For December, analysts discovered a mix credit metrics.

Analysts noticed that the percentage of prime and non-prime contract holders who went from more than 30 days delinquent to current came to 30.8% and 27%, respectively. Compared to the previous month, those readings were 244 basis points lower in prime pools and 312 basis points in non-prime pools.

KBRA said those movements pushed those readings back to their pre-pandemic levels.

Meanwhile, analysts added the percentage of prime contract holders who rolled from more than 60 days past due to charge-off dropped to 14.5%, down 65 basis points, while the non-prime roll rate into charge-off increased 79 basis points to 22%. The latter metric also returned to pre-pandemic levels, according to KBRA.

Fitch Ratings, Kroll Bond Rating Agency (KBRA) and S&P Global Ratings each offered perspectives on the securitization market this week.

After sharing metrics their analysts gathered, each firm pointed to two trends moving in opposite directions. All three highlighted how contract modifications are declining and as a result, delinquencies are climbing with the expectation for potential acceleration coming in 2021.

The rundown received by SubPrime Auto Finance News began with S&P Global Ratings publishing its look at the U.S. auto loan asset-backed securities (ABS) sector’s performance for September.

S&P Global Ratings said U.S. prime auto loan ABS performance strengthened in September, with losses declining to an eight-year low due to an extremely strong recovery rate of nearly 80%. Analysts noticed that extensions also decreased for the fifth straight month in this credit space.

Meanwhile, S&P Global Ratings indicated recovery rates started to normalize for subprime paper, causing losses to increase from its lowest recorded level in August. Analysts added this segment reported higher extensions for the first time in five months.

S&P Global Ratings shared more context when the firm elaborated about particular vintages.

“Prime and subprime static pool data indicate that the 2018 and 2019 vintages are currently performing in line with or better than the 2017 vintage,” analysts said in their report. “However, caution is warranted because losses associated with previously extended loans won't appear for several months.

“Additionally, the federal government’s pandemic emergency unemployment compensation, providing an additional 13 weeks of unemployment assistance over what the states offer, is set to expire at year end,” they went on to say.

Update from KBRA

The latest report from KBRA included information from October data.

The firm said early stage delinquencies in the KBRA Prime Auto Loan Index rose 2 basis points month-over-month to 0.91% in October, while late-stage delinquencies remained unchanged at 0.37%.

Furthermore, analysts determined early and late-stage delinquencies in the KBRA Non-Prime Auto Loan Index climbed to 6.76% and 3.86%, respectively, in October. Those readings represented rises of 39 basis points and 10 basis points compared to the previous month.

But KBRA pointed out both delinquency metrics remained “meaningfully” lower on a year-over-year basis, adding that annualized net loss rates are at their lowest levels in years. Analysts explained those findings arrived as a result of a “strong” used-vehicle market and low delinquency rates throughout the spring and summer months.

“Further stimulus, which at this point is uncertain, and a continuing labor market recovery could help soften the blow, but we still expect seasonal trends and the end of payment holidays for many borrowers to push delinquency rates higher (as observed in the past two months) into year end, leading to elevated charge-off rates and annualized net losses in 2021,” KBRA analysts said in their newest report.

KBRA went on to mention an analysis of October’s asset-level disclosures showed mixed credit metrics during the September collection period.

Analysts discovered the percentage of prime and non-prime contract holders who went from 30-days delinquent to current increased to 33.9% and 28.9%, respectively. Those moves marked jumps of 46 basis points and 151 basis points versus the previous month, which in both cases were slightly below their pre-pandemic levels, according to KBRA.

The firm also found that the percentage of prime contract holders who rolled from 60 days or more past due to charge-off fell to 12.5% in October, declining 98 basis points month-over-month.

However, analysts added the non-prime roll rate into charge-off jumped 99 basis points to 19.1%. “But this was still well below pre-pandemic levels,” they said.

Views from Fitch Ratings

Fitch Ratings began its update by projecting a “moderate” increase in delinquencies, particularly for subprime auto ABS because of expiring contract extensions and other forms of payment relief that surged this spring and summer.

“We have not observed a meaningful increase in delinquencies given vehicle utility and priority of auto loan debt repayment during the pandemic, but additional federal stimulus is uncertain and unemployment remains materially elevated,” Fitch Ratings said.

“Slow economic growth over the next few months as a result of additional pandemic-related lockdowns may lead to another increase in extension take rates that masks true delinquency levels,” analysts continued.

The firm noted that the average of new extension requests across Fitch-rated prime and subprime auto loan ABS pools peaked in April at 5.7% and 9.8%, respectively. But Fitch said they have subsequently declined to 0.7% and 3.1% in September.

“Prime extension requests are only slightly elevated from pre-pandemic levels and continue to trend downward, but subprime extension requests began to tick back up in September,” analysts said.

Despite having an active extension, Fitch calculated that an average of 23.4% of prime contract holders and 20.6% of subprime contract are current with their payments, and an additional 19.9% of prime customers and 10.4% of subprime customers have made a partial payment.

Given the unprecedented widespread use of payment extensions, Fitch explained how it arrived at these readings.

The firm said it began using contract-level data to analyze the less than 30-day delinquency buckets in conjunction with extension take rates.

“This can serve as an early warning indicator of potential deterioration in securitized pools and provide further insight to what is provided in the monthly servicer report,” analysts said.

With all of the accommodations in play and an updated tracking strategy, Fitch recapped what they discovered with regard to delinquency rates, with the most pronounced movements being seen in early stage delinquency buckets.

Fitch said the less than 30-day delinquency category averaged 6.0% for prime ABS and 22.3% in subprime pools through the first two months of 2020, but dropped to a low of 5.0% and 19.0%, respectively, in the spring.

“As extensions began to expire, the less than 30-day delinquency bucket trended back up toward pre-pandemic levels, indicating the benefit from stimulus and extensions is fading, and struggling borrowers may again be under pressure,” analysts said.

“We expect a moderate increase in delinquencies, particularly for subprime ABS, given continued high unemployment rates and in the absence of additional federal aid,” analysts continued. “However, delinquencies are not expected to reach levels seen during the prior recession.

At the height of that recession in December 2008, Fitch recollected that 60-day prime delinquencies peaked at 0.9% and subprime at 5.0%. As of September, Fitch pointed out 60-day prime delinquencies stood at 0.2% and at 3.8% for subprime auto ABS pools.

Fitch closed its latest update by trying to crystalize its 2021 forecast, setting an expectation for limited impact on auto loan ABS ratings moving into the new year.

“Our base case credit loss proxies reflect a through-the-cycle rating approach, include a loss cushion and are not expected cases,” analysts said.

“Fitch uses stressed recessionary 2008-2009 loss levels along with more recent vintage performance to derive auto loan ABS base case cumulative net loss proxies,” they continued. “Therefore, we believe there is sufficient cushion to protect against potential negative performance trends.”

To account for contract performance during the pandemic, Fitch explained its approach for both new transaction analysis and surveillance more heavily weights the poorer performing 2008-2009 recessionary vintages.

Analysts said this choice resulted in roughly a 10% to 20% increase in Fitch’s cumulative net loss proxies from pre-pandemic levels, depending on issuer-specific performance and other items such as amortization observed in outstanding prime and subprime transactions.