New research from LexisNexis Risk Solutions reinforced how the use alternative data often focuses on deep subprime, subprime and near-prime consumers

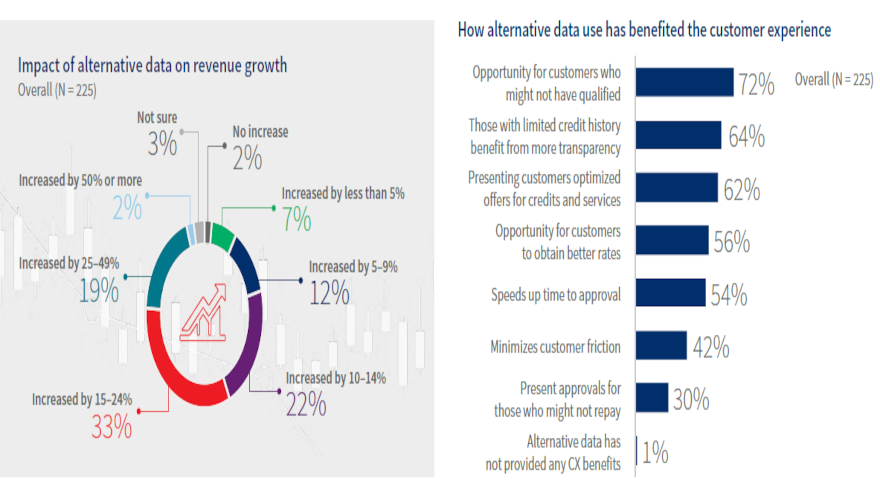

Last week, LexisNexis Risk Solutions unveiled the findings of its Alternative Credit Data Impact Report, a nationwide survey assessing the adoption, utilization and impact of alternative credit data for credit portfolio growth and management in consumer and small/mid-sized business (SMB) lending.

The report surveyed those who identify as senior decision makers for marketing, lending and credit risk in U.S. financial institutions such as banks, credit unions, non-bank lenders and fintechs.

LexisNexis Risk Solutions recapped that alternative credit data encompasses a broad range of credit risk insights. Experts said these insights are typically not included in traditional credit reports and scores including life event insights such as professional licenses and asset ownership and modern credit seeking behaviors from markets like online lending and short-term lending, rental data, consented data and more.

When paired with the traditional credit behaviors currently used in conventional credit scores, LexisNexis Risk Solutions explained these non-traditional credit insights can deliver a more comprehensive view into a consumer’s creditworthiness.

LexisNexis Risk Solutions discovered at least two-thirds of financial institutions surveyed use alternative data in their credit risk assessments for underwriting and portfolio management.

In fact, 84% of respondents use alternative credit data in prescreening and credit risk across the customer lifecycle, with credit unions taking the lead in using alternative credit data at 91%.

Three other key findings from the Alternative Credit Data Impact Report include:

1. Adoption of Alternative Credit Data

Alternative credit data usage is becoming more common as financial institutions adopt financial inclusion initiatives.

Of the 37% of self-identified leading adopters of alternative credit data, the survey showed 55% named financial inclusion as their top objective, followed by improving segmentation (37%) and improving the ability to swap in/swap out applicants (24%).

LexisNexis Risk Solutions said financial institutions are most likely to use alternative data in their credit risk assessment of deep subprime, subprime and near-prime consumers.

Leaders of alternative data adoption are also particularly likely to use it when assessing the credit risk of prime consumers, according to the survey.

2. Data as a business driver

LexisNexis Risk Solutions pointed out business drivers for alternative data use include improving pricing strategies, increasing financial inclusion, risk mitigation and gaining a competitive advantage.

Nearly all financial institutions surveyed indicated that alternative data has increased revenue growth by at least 15% and improved customer experience.

The report also indicated that lack of alternative data usage could lead to lost opportunity, customer friction and limited risk mitigation.

3. Financial institutions satisfied yet challenged

While there is overall satisfaction with alternative data, LexisNexis Risk Solutions acknowledged there are challenges and barriers associated with utilizing alternative credit data for credit risk assessment.

Experts said larger tier 1 banks are significantly more likely than smaller banks to be very satisfied with their data, as a result of having more resources to invest in to obtain alternative types of data.

“The high rate of alternative data adoption across the customer lifecycle reflects how lenders of all sizes are increasingly unsatisfied relying solely on the status quo of traditional credit data to grow and manage their businesses,” said Kevin King, vice president of credit risk and marketing strategy at LexisNexis Risk Solutions.

“The vast majority of institutions are now using alternative data to assess the creditworthiness of subprime consumers and those with limited credit history, while forward-thinking organizations are achieving significant advantages applying these insights in near-prime and prime segments,” King continued in a news release.

“This benefits not only the financial institution but the customer experience, helping to ensure lenders present the most appropriate offers to consumers or SMBs, particularly those who might not appear qualified through the lens of traditional data alone,” he went on to say.

LexisNexis Risk Solutions conducted its first nationwide survey to assess the adoption and utilization of alternative data across different financial institutions for credit portfolio management and growth.

Two phases of research occurred.

The first phase involved quantitative surveys; the second phase involved follow-up qualitative interviews. Data collection was performed online and by phone from July to August with a total of 225 completions in the United States.

Respondents included senior decision makers for lending and credit risk in U.S. financial institutions.

Upon completion of analysis with the quantitative findings, researchers interviewed 10 consumer credit lending decision makers to provide further context around certain survey results.

To download a copy of the Alternative Credit Data Impact Report, go to this website.

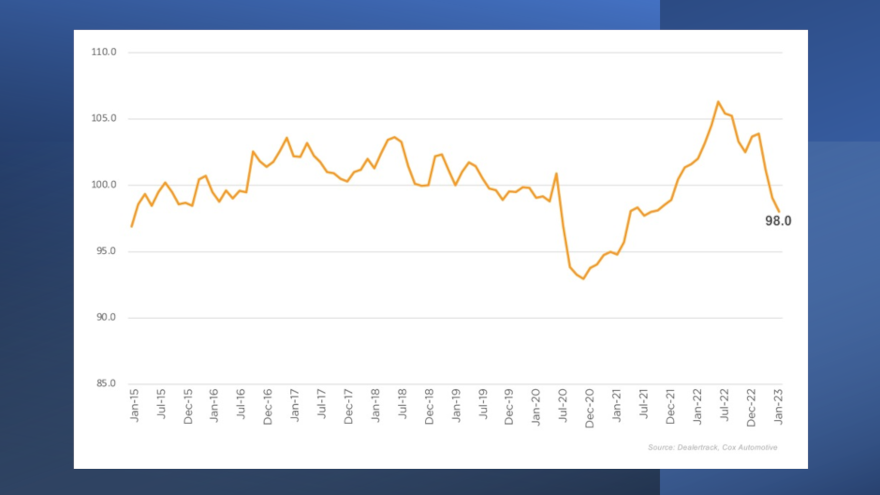

You likely weren’t overreacting if it seemed like it was more difficult to get your dealership’s contracts bought last month.

Cox Automotive reported access to auto credit tightened again in January, according to the Dealertrack Credit Availability Index for all types of auto financing.

The index declined 1% to 98.0 in January, reflecting that auto credit was harder to get in the month compared to December.

Analysts said the decline in access reflected conditions that were tightest since …

Read more

Perhaps that older model included in the pitched paper from a dealership in your network now looks a little more appealing when viewed through the updated tool from Open Lending Corp.

Last week, the enablement and risk analytics solutions provider for financial institutions announced that it has increased its allowable vehicle age from 9 to 11 years.

Powered by Lenders Protection, the company said this increase in vehicle age builds on Open Lending’s commitment to make vehicle ownership more accessible for those in near and non-prime credit segments.

The company added the change also allows financial institutions to grow their portfolios while maintaining protection through Open Lending’s default insurance and risk management program.

Driven by pandemic-induced supply chain disruptions, vehicle affordability issues have prompted many vehicle shoppers to purchase older vehicles. With Open Lending’s expanded vehicle age limits, financial institutions can engage a wider range of consumers by offering risk-mitigated contracts on longer terms for more used vehicles at affordable price points.

“As chronic inflation and supply chain issues persist, Open Lending is committed to supporting our lenders and serving underserved borrowers,” chief revenue officer Matt Roe said in a news release. “Although used-car prices have begun to recede from all-time highs and record increases, valuations remain inflated.

“With our risk mitigation offering, lenders can boost loan originations and seed new borrower relationships — and borrowers, particularly those who are underserved, are able to pursue better lives and careers through car ownership. Under our new vehicle age terms, these relationships can flourish even in constrained market conditions,” Roe continued.

According to data from S&P Global, vehicle shoppers with FICO scores below 640 are driving demand for financing on older vehicles: From 2020 to 2022, the average age of vehicles financed in this credit segment jumped from 5.4 years to more than 6.4 years.

In the coming years, Open Lending said finance companies can expect to see this trend continue.

“In today’s macroeconomic climate, buyers are happy to choose an older vehicle if it means monthly payments that fit within their household budget,” said Michael Higgins, AVP of underwriting at Space Coast Credit Union.

“With Open Lending’s expanded product offering, we now have a better chance of meeting the needs of our members,” Higgins continued in the news release.

Launched in 2003, Lenders Protection offers consolidated analytics and insurance solutions to help credit unions, banks, automotive finance and refinance companies and captives originate and insure near and non-prime auto loans.

To learn more about Open Lending and its Lenders Protection program, go to this website.

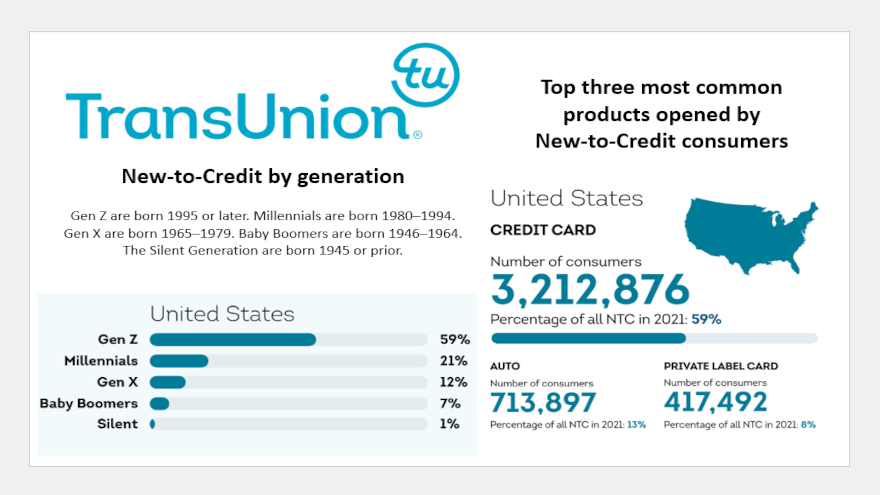

Perhaps those new-to-credit consumers — individuals early in their credit journeys — might be some of the best applicants to land in your finance company’s underwriting department.

The main finding from a newly released TransUnion global study showed new-to-credit consumers generally perform as well or better than ones with established credit and similar risk scores.

TransUnion said its study titled, “Empowering Credit Inclusion: A Deeper Perspective on New-to-Credit Consumers,” may give …

Read more

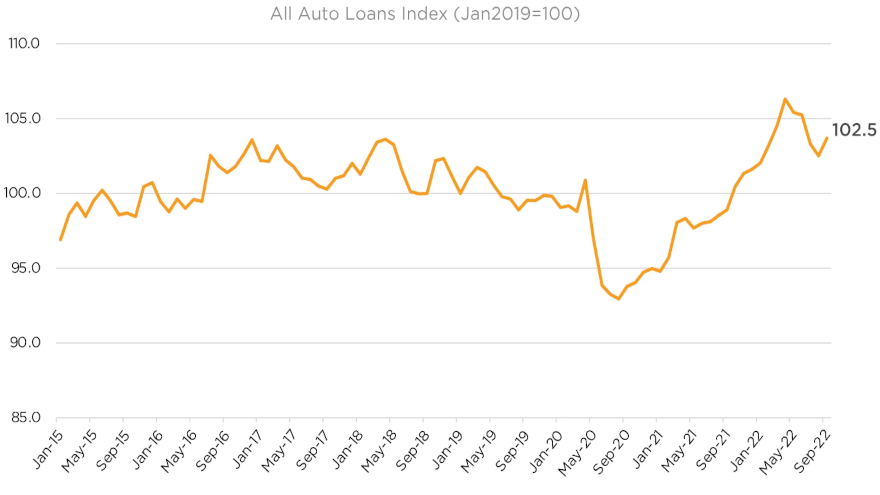

Following a month when the auto default rate remained steady, credit availability for new paper tightened. Those findings are among the latest observations from Cox Automotive, S&P Dow Jones Indices and Experian.

Based on data through November for the S&P/Experian Consumer Credit Default Indices, the auto default rate remained unchanged at 0.77%.

The November reading also still is …

Read more

Equifax vice president of verification services Shelly Nischbach made time for the Auto Remarketing Podcast to discuss how finance companies are sharpening their underwriting in light of the recessionary and rising interest rate environment they’re facing.

Nischbach also touched on how important it is for dealers and finance companies to put consumers into a vehicle and credit offering they can afford.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

This week, LAUNCHER.SOLUTIONS and Creative Business Decisions (CBD) finalized their full integration to help mutual clients make better underwriting decisions by incorporating generic or custom-developed scorecards created by CBD within Launcher’s appTRAKER Loan Origination System (LOS).

The company reiterated appTRAKER LOS was designed for finance companies needing a more efficient way to consume data while originating contracts to build a stronger portfolio. CBD was Launcher’s choice for a scorecard partner because of their reputation and achievements in the credit risk management business.

Having developed more than 400 products and serviced more than 100 clients during the past 30 years, CBD is a top choice for subprime and prime finance companies in many verticals, including auto, consumer lending and telecommunications.

Finance companies using appTRAKER LOS will be able to obtain a credit score on their applicants, based on data from both the bureau report and application (demographic) data. Clients also will be provided with the probability of default for the CBD score obtained for the applicant, which can be used to set risk tiers, programs and pricing. More than 500 bureau attributes can be selected and used to make appropriate underwriting decisions.

These scorecards can integrate seamlessly within appTRAKER’s processes and workflows to provide finance companies with multiple ways to automate the entire funding process as much or as little as they want.

The scorecards are ready to deploy so lenders can quickly leverage CBD’s risk management expertise.

“CBD has been able to address issues pertaining to ‘insignificant’ bureau data and create models, screens and rules that have helped clients gain confidence in their venture of targeting applicants with ‘marginal’ credit,” CBD CEO Pat Nanda said in a news release. “CBD’s products have provided not only the computed score, but also generated automatic decline and review rules, price of the deal, decline reason codes, and parameters within which alternative deal structures could be offered.”

Nanda pointed out that the CBD score has many advantages from increasing acceptance rates to providing more informed, consistent, and balanced decisions. These scores help finance companies to reduce charge-offs, improve receivables, and effectively market to good customers.

Moreover, these scores are superior to FICO as they utilize variables from both the credit application and the credit bureau, and are optimized for the lender’s portfolio, location, and type of lending. CBD has now started including artificial intelligence (AI) tools as well as alternative data in their development methodology to enhance their products.

“CBD will give lenders using appTRAKER LOS the ability to evaluate hundreds of data points, assessing risk in a more thorough manner than by a credit report alone,” said Nikh Nath, president of LAUNCHER.SOLUTIONS. “Our integrations with third party data providers are invaluable to our lenders.

“The applicant score provided by CBD can be run automatically or manually, during the underwriting phase or the verification phase. The enhanced partnership provides the quality data that lenders need, to build stronger portfolios,” Nath went on to say.

After Informed.IQ recently made inroads in subprime with Consumer Portfolio Services and DriveTime, this week the provider of artificial intelligence-based software for financial institutions finalized a partnership with F&I Sentinel, leading compliance and regulatory risk mitigation solutions provider.

According to a news release, Informed.IQ will combine efforts with F&I Sentinel’s CITADEL solution to provide a turnkey compliance solution with respect to the financing and resolution of F&I products.

The service providers are looking to address the rapidly changing regulatory environment triggered by the Consumer Financial Protection Bureau and state regulators, limit class action exposure and protect financial institutions and consumers.

As a result, Informed.IQ and F&I Sentinel see contracts being processed faster and more accurately with less fraud and audit risk, providing real-time verifications backed by compliance experts who possess more than 50 years of combined regulatory compliance experience specializing in the compliance of F&I products at both the state and federal levels

“We continue to see an increased need for lenders to implement an end-to-end compliance management system concerning the financing and resolution of F&I products F&I Sentinel CEO Stephen McDaniel said in the news release.

“Together, we will provide faster, more effective financing and continued investment in products and platforms within the vehicle financing ecosystem,” continued McDaniel, who is among the speakers at Used Car Week, which begins Nov. 14 in San Diego.

Informed’s AI and modeling can perform complex calculations, ensuring accuracy, identifying omissions, reducing bias and combating fraud. With a 99% accuracy rate and guaranteed service rates, the service provider said finance companies and dealers can focus less on legal and regulatory concerns and more on developing strong customer relationships.

“F&I Sentinel adds an additional mitigation layer against litigation and reputational risk, providing cutting-edge compliance solutions. We are excited to continue providing innovative technology and proprietary analytics to impact the future of consumer finance,” Informed.IQ CEO Justin Wickett said.

Sales might have softened in September, but Cox Automotive indicated credit for auto financing improved as the third quarter closed.

According to the newest Dealertrack Credit Availability Index released this week, access to auto credit expanded in September for the first time in …

Read more

For the second time in September, Launcher enhanced its technology geared to streamline originations via collaboration with an industry partner.

After earlier boosting integrated access to CARFAX Vehicle History Reports, this week the company announced an expanded integration of Launcher’s appTRAKER Loan Origination System (LOS) with The Work Number from Equifax, the credit bureau’s centralized commercial repository of income and employment information in the U.S.

Launcher reiterated in a news release that appTRAKER LOS was designed for finance companies looking for a more efficient way to consume data to originate contracts and build a stronger portfolio.

This expansion between appTRAKER LOS and The Work Number offers additional products for finance companies, including:

—The Work Number Select – Gold: Provides all employment and income information such as employer name, employment status, rate of pay and more.

—Employment Indicator: Provides the status of an employment record on The Work Number database.

—Employment & Income Verifications: Instant access to data direct from employers and payroll providers.

Launcher noted that finance companies utilizing appTRAKER LOS are able to automatically access employment and income information, helping to reduce time and errors that can occur in a manual process.

Launcher also pointed out that finance companies need the ability to automatically verify employment information on potential borrowers for a faster, lower friction customer experience.

With more than 573 million income and employment records from 2.5 million employers across a variety of industries, The Work Number can allow finance companies utilizing the appTRAKER Loan Origination System to have the information that they need at their fingertips to make smarter, faster credit decisions.

“We are proud to deepen our relationship with Equifax by offering additional products from The Work Number,” said Nikh Nath, president of LAUNCHER.SOLUTIONS. “Our integrations with third party data providers are invaluable to our lenders.

“The verifications provided by The Work Number can be run automatically or manually during the underwriting phase or the verification phase. The integration allows the quality and flexibility needed to book loans quickly and efficiently,” Nath went on to say.