Open Lending is stretching terms to help credit unions book more paper, especially with potential customers who land in the near or non-prime credit tiers.

Last week, the lending enablement and risk analytics solutions provider announced it will offer its clients the ability to originate 84-month contracts for new models and used vehicles up to four years old and with less than 60,000 miles.

Open Lending pointed out this modification is an increase of nine months from its previous maximum term.

In addition, Open Lending will now provide its clients the ability to offer a higher payment to income (PTI) ratio for indirect financing, increasing full approvals and higher funding ratios due to fewer counter offers.

Open Lending sees both offerings as helping financial institutions increase contract volume, minimize risk and increase return on assets.

“Inflation is impacting everything we purchase, including the cost to own a car,” Open Lending chairman and chief executive officer John Flynn said in a news release. “More than one-third of applications requested terms more than 72-months in 2021, so now we’re offering the ability to provide higher loan amounts, longer loan terms and higher PTI ratio for indirect lending.

“Our motivation and our mission are to help our clients empower more of their near and non-prime members to reach their dreams of vehicle ownership during this uncertain time, and in doing so also help our clients unlock new revenue opportunities.”

One of Open Lending’s clients is CapEd Credit Union. Vice president of consumer lending Jeremy Sankwich recapped his experiences by leveraging the Lenders Protection program, which was first launched in 2003.

Since then, Open Lending said more than 400 financial institutions have used the Lenders Protection consolidated analytics and insurance solution to originate and insure more than $16 billion in near and non-prime contacts

“Partnering with Open Lending allows us to give more opportunities for vehicle loans to members that are near and non-prime or emerging-prime while we leverage the efficiency of Lenders Protection’s instant decisioning,” Sankwich said in the news release. “Amidst a volatile economic climate, we are growing loans, growing yield and helping a wider variety of members access to credit while also mitigating credit risk with Open Lending’s default insurance.”

To learn more about Open Lending and its Lenders Protection program or schedule a demo, go to this website.

TurboPass announced the appointment of two new members to its board of directors this week.

Now part of the leadership structure for the fintech firm that helps dealerships and finance companies during the underwriting process are Mark Vazquez, who is senior vice president of sales and marketing at Westlake Financial Services, and Tyler Lackey, who is general partner with Global Fintech Venture Partners.

TurboPass highlighted through a news release that Vazquez began at Westlake in 2002 and has been a key member of the leadership team that has grown the business by more than 3,000% during his tenure, turning it into one of the largest used-vehicle finance companies in the U.S. and an incubator for fintech companies throughout financial services.

Vazquez is currently responsible for overseeing the 400-member sales and marketing teams and is a member of Westlake’s executive committee.

Now serving on the board of directors at TurboPass, Vazquez’s focus is on strategic growth initiatives to help more dealerships facilitate the funding process and avoid fraud.

“Our relationship with TurboPass is well established,” Vazquez said in the news release. “I’m proud to join the board of directors, and I know this is going to further our synergy and keep both of our companies growing.”

Lackey, is a co-founder of Global Fintech Venture Partners (GFVP), a venture capital firm based in Salt Lake City. The firm invests in fintech startups, with a mission to make finance more accessible, transparent, intuitive, and tailored for people across the globe.

Before GFVP, Lackey was chief legal officer and executive vice president of Finicity, leading the legal team overseeing all aspects of Finicity’s business activities including compliance with federal laws and regulations impacting processing online transactions.

Finicity grew exponentially during Lackey’s tenure, resulting in its $980 million acquisition by MasterCard.

TurboPass mentioned Lackey is an established expert on open banking and payment security and understands the unique needs and goals of a fintech start-up.

Regarding his seat on TurboPass’ expanded board of directors and being a keystone investor, Lackey said, “I’m delighted to be helping the TurboPass team continue its growth path because of its strong team and alignment with the mission of GFVP.

“I know what this company has accomplished already in bringing open banking to the industry,” he continued. “I’m here to further TurboPass’ aims to protect against fraud in American car dealerships, and beyond.”

Mike Jarman is chief executive officer of TurboPass.

“We are very excited to have both Mark and Tyler joining our board,” Jarman said. “They are both leaders in their respective industries and have a wealth of experience that will be invaluable to us as we grow the business. We couldn’t have asked for two better individuals to work with us to help point of sale companies, lenders and consumers thrive.”

Launcher, a technology provider specializing in originations, recently enhanced its integrated access to CARFAX Vehicle History Reports inside its core product — appTRAKER Loan Origination System — so finance companies have “additional ammo in their artillery.”

According to a news release, finance companies now have access to a robust suite of CARFAX data products for vehicles before executing a contract, protecting both the credit provider and consumer.

Launcher’s appTRAKER LOS now provides instant access for finance companies to a robust suite of CARFAX products including:

—Vehicle title report: Used to identify the last known titling state and possible lienholders on the title. VTR includes valuable information such as title records, registration records, liens recorded on the title, liens identified by the lienholders, and odometer readings and an estimate of current mileage.

—Demographic information: Contains basic information about the vehicle tied to the VIN, including the year/make/model, information on most recent titling and ownership location plus the estimated current odometer reading. This is all used to confirm that the correct vehicle has been identified.

—Potential problem indicator file: Delivers insight into specific vehicle history events that can impact a vehicle’s value or operational integrity. Eliminates manual processes like VIN submission and report retrieval. The file also delivers critical information including salvage, flood, and lemon title brands, odometer rollbacks, last reported odometer reading, and accident information.

—History-based value: Provides insight into history events affecting vehicle’s value such as service history, personal vehicle, damage brand, and actual mileage. History-based value also includes comprehensive installed features such as airbags, electronic braking systems, rearview camera and more. Finance companies can use history-based value to protect borrowers from overpaying, improve financing with better loan-to-value ratios, prioritize collections based on resale value and prevent powerbooking.

Launcher acknowledged the concept of finance companies reviewing vehicle data prior to funding a contract is not a new one, but many finance companies still leave out this important part when underwriting a deal.

The integration partnership between Launcher and CARFAX can give finance companies “additional ammo in their artillery” by allowing them to analyze every aspect of a deal to make the best holistic decision on every contract originated.

“An important piece of the origination process is the ability to accurately assess a vehicle’s value as collateral,” Launcher president Nikh Nath said. “Our new enhanced integration with CARFAX provides full access to any data point our Lending customers may require.”

Becky Chernek of Chernek Consulting appeared on the Auto Remarketing Podcast for her monthly visit to discuss F&I strategy.

During this episode, Chernek explained why “rehashing the deal” can be a valuable process that can help dealerships, finance companies and consumers.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

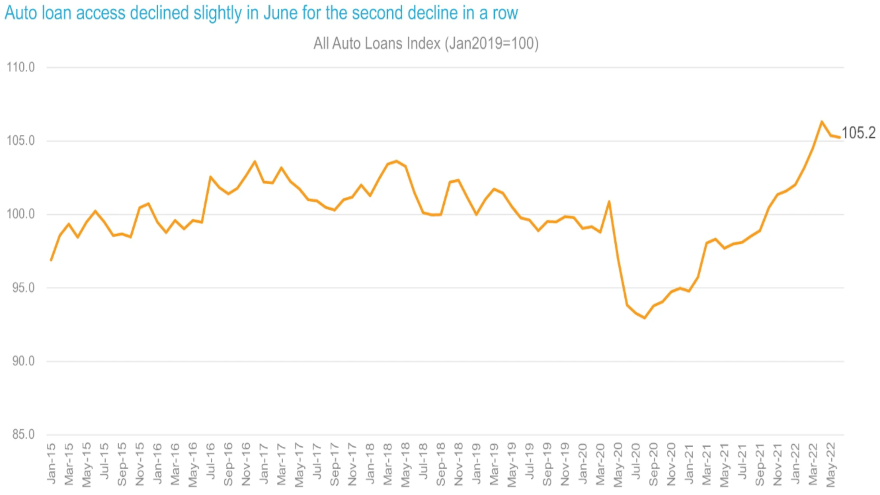

Cox Automotive spotted a potential reason if your store is having more trouble getting deals bought through your network of finance companies.

Access to auto credit declined for the fourth straight month in August, according to the Dealertrack Credit Availability Index.

Analysts determined the index dipped …

Read more

At the beginning of August, Carvana launched the option to add a co-signer during the financing application process for potential buyers in South Carolina with the intention of rolling out the process in more locations before a full nationwide push.

In the past two weeks, the online used-vehicle retailer has added more states and markets to its co-signer program. It’s now available in these states and markets, including:

Florida

Jacksonville

Miami

Orlando

Tampa

Georgia

Atlanta

Augusta

Columbus

Savannah

North Carolina

Charlotte

Durham

Greensboro

Raleigh

Texas

Austin

Dallas

Houston

San Antonio

Carvana’s co-signer option allows customers to apply for vehicle financing with another individual — like a parent, child, partner or family member — as an option to help unlock more attractive financing terms.

The company said this benefit is ideal for new drivers or young adults, especially those looking to build up their credit scores as fall semesters begin or as they get started in their career.

Carvana added this offering also benefits couples or family members looking to expand their selection of affordable inventory, as well as anyone who wants the best possible financing offer to purchase their next vehicle.

“Since day one, Carvana’s core values have guided our mission of creating a better car buying and selling experience for people and we’re thrilled to launch our co-signer offering during a time when the opportunity to help customers is bigger than ever,” Carvana founder and chief executive officer Ernie Garcia said in a news release.

“As we continue our work to improve and modernize the automotive experience for people, this feature provides the opportunity to qualify for lower payments, lower interest rates, or less cash upfront which helps in this economy,” Garcia added.

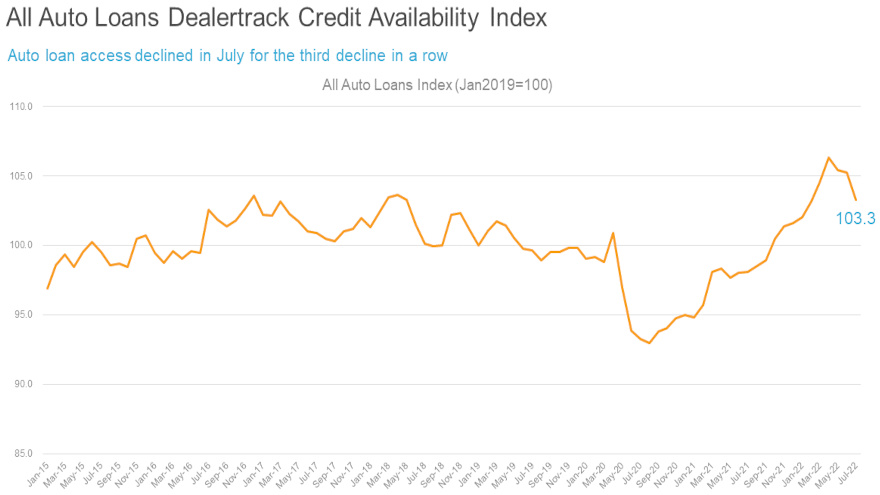

As Cox Automotive senior economist Charles Chesbrough noted, credit availability is one of the headwinds against used-vehicle retail sales.

While still more available than this time last year, the Dealertrack Auto Credit Availability Index declined for the consecutive month in July. According to a Cox Automotive Data Point, the index softened by …

Read more

What’s often been done in special finance departments at physical dealerships now is being leveraged by Carvana — at least in South Carolina.

The online used-vehicle retailer said this week that to make its vehicle financing qualification process easier for South Carolina residents, those potential buyers now have the option to add a co-signer during the application process.

Carvana said co-signer financing is available to qualified South Carolina customers and will soon launch in additional states.

By adding that co-signer, Carvana said those customers who qualify may unlock more attractive financing offers, including lower down payments, lower interest rates, or lower monthly payments.

Customers can apply alongside their co-signer and include the co-signer’s information on Carvana’s website or app. Carvana shared the experiences of one customer via a news release.

“It was simple and convenient, and allowed us to lower our monthly payments,” said Amy, a resident of Charleston, S.C. “I called my husband while he was at work and he went online and signed the documents. The experience was so easy and only took about 20 minutes.”

If eligible customers want to move forward with the co-signer option, Carvana collects driver’s licenses and other documents from both individuals and schedules a delivery where both individuals must be present to check out the new ride.

“Since day one, Carvana’s core values have guided our mission of creating a better car buying and selling experience for people and we’re thrilled to launch our co-signer offering during a time when the opportunity to help customers is bigger than ever,” Carvana founder and chief executive officer Ernie Garcia said in the news release.

“As we continue our work to improve and modernize the automotive experience for people, this feature provides the opportunity to qualify for lower payments, lower interest rates, or less cash upfront which helps in this economy,” Garcia went on to say.

This monthly installment of the Auto Remarketing Podcast focused on fraud with two experts from Point Predictive tackled the world of credit washing.

Justin Davis and Frank McKenna recapped what credit washing is and how it can impact auto financing, as well as a recent case that triggered a major indictment stemming from an investigation that began within a bank’s underwriting department.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

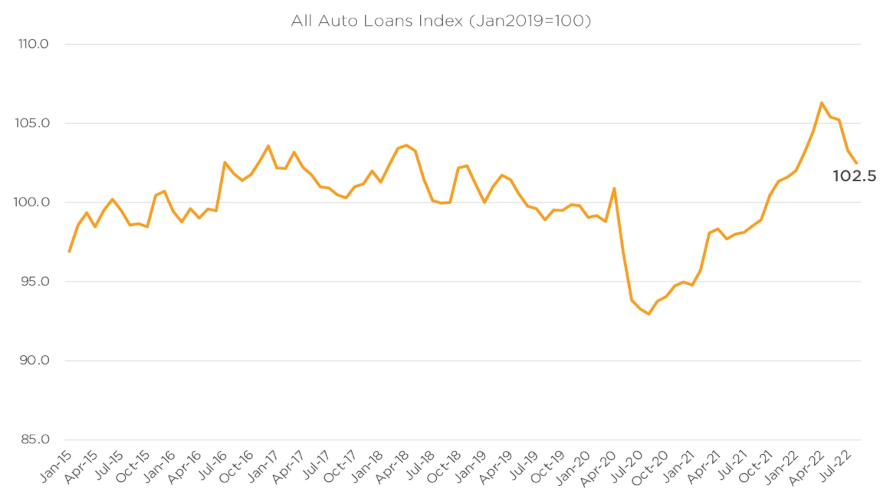

While declining now for two months in a row, Cox Automotive reiterated that the streak connected with the Dealertrack Credit Availability Index began with the measurement at its all-time high.

A Cox Automotive Data Point distributed this week showed the Dealertrack Credit Availability Index ticked lower by …

Read more