A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

StoneEagle promotes another exec, this time to be chief customer officer

Friday, Jan. 14, 2022, 03:43 PM

SubPrime Auto Finance News Staff

For the second time this week, StoneEagle elevated one of its internal executives into an expanded leadership role. On Friday, the provider of F&I and service metrics for the past 35 years named Kathy Burns as its new chief customer ... [Read More]

PODCAST: Talking the economy & credit unions with NAFCU’s Curt Long

Thursday, Jan. 13, 2022, 02:25 PM

SubPrime Auto Finance News Staff

Curt Long, chief economist and vice president at the National Association of Federally-Insured Credit Unions (NAFCU), put the general economy into car terms, explaining in this episode of the Auto Remarketing Podcast if the economy is like a car that’s ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Car Capital opens 2022 with 2 new financial resources

Wednesday, Jan. 12, 2022, 04:17 PM

SubPrime Auto Finance News Staff

Car Capital began 2022 by staying on the brisk development trajectory it established when launching last spring. The new auto-finance technology company that strives to get any deal bought no matter the consumer credit background closed on another round of ... [Read More]

PODCAST: Dangerous and disgusting scenes repo agents face nowadays

Wednesday, Jan. 12, 2022, 04:06 PM

SubPrime Auto Finance News Staff

Bryanna Cox takes listeners of the Auto Remarketing Podcast into one of the most difficult, yet vital, parts of the automotive industry. The vice president of Asset Resolutions, a full-service repossession and recovery agency in Kingwood, Texas, described how repossession ... [Read More]

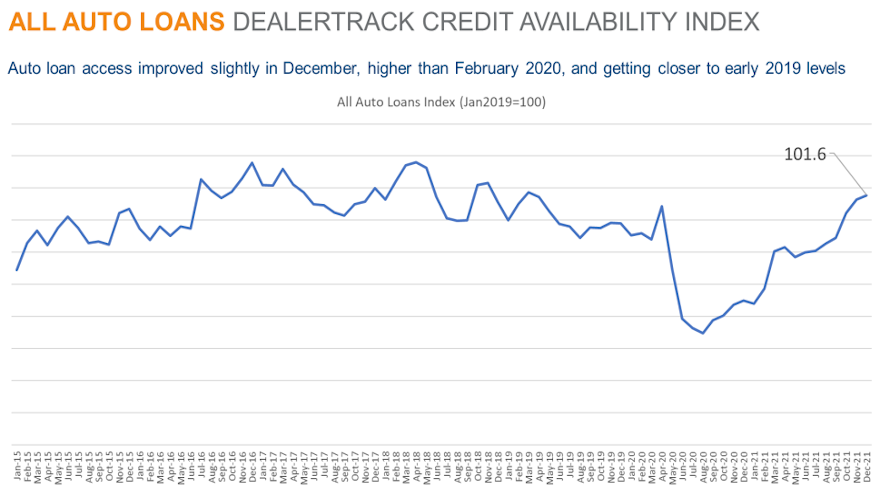

Auto financing availability ticks slightly higher to finish 2021

Tuesday, Jan. 11, 2022, 03:17 PM

SubPrime Auto Finance News Staff

Well, perhaps auto financing is starting to look more like it did before the pandemic wreaked havoc on so much of our daily lives. Cox Automotive said that access to auto credit expanded slightly in December, based on the Dealertrack Auto ... [Read More]

AutoPayPlus hires another former EFG Companies executive

Monday, Jan. 10, 2022, 04:34 PM

SubPrime Auto Finance News Staff

Another executive who spent time at EFG Companies now is a part of the leadership team at AutoPayPlus by US Equity Advantage. The provider of biweekly payment processing announced through a news release on Monday that Hollis Goode has joined ... [Read More]

StoneEagle elevates VP of product to be next COO

Monday, Jan. 10, 2022, 04:32 PM

SubPrime Auto Finance News Staff

On Monday, StoneEagle announced the promotion of one of its executives to be its new chief operating officer. Selected for this role for the provider of automotive menu, F&I and service metrics is Damar Christopher, who will work cross-functionally to ... [Read More]

Hudson Cook names 2 new partners

Friday, Jan. 7, 2022, 03:43 PM

SubPrime Auto Finance News Staff

In a move that became effective on the first day of 2022, Hudson Cook promoted two of its attorneys to equity partners of the firm that serves dealerships and finance companies. According to a news release, the firm’s two newest ... [Read More]

Edmunds projects new records for monthly payments

Wednesday, Jan. 5, 2022, 04:36 PM

SubPrime Auto Finance News Staff

Monthly payments for both used- and new-vehicle financing is projected to break records, according to data gathered and tracked by Edmunds. [Read More]

Equifax to incorporate BNPL info into credit reports

Tuesday, Jan. 4, 2022, 03:20 PM

SubPrime Auto Finance News Staff

Scores of consumers now are leveraging Buy Now, Pay Later (BNPL) offerings by some retailers. To help auto finance companies evaluate applicants who might have BNPL commitments during the underwriting process, Equifax recently announced that the company is furthering its ... [Read More]

X