A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Mayer Brown again examines CFPB’s power to determine abusive acts & practices

Wednesday, Nov. 10, 2021, 04:44 PM

SubPrime Auto Finance News Staff

Mayer Brown partners Ori Lev, Brian Stief and Kerri Elizabeth Webb compiled a robust analysis of the Consumer Financial Protection Bureau’s authority to enforce a prohibition against abusive acts and practices in connection with the provision of consumer financial products ... [Read More]

RISC Pro Directory now available to connect repo agents & finance companies

Tuesday, Nov. 9, 2021, 02:45 PM

SubPrime Auto Finance News Staff

With the potential for repossession volume to rise, Recovery Industry Services Co. (RISC) wants to provide finance companies with a path to agents who can complete the task within federal and state guidelines. On Tuesday, the firm launched the all-new ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

CFPB fills 6 key roles with veteran regulators

Tuesday, Nov. 9, 2021, 02:44 PM

SubPrime Auto Finance News Staff

With director Rohit Chopra firmly in place, the Consumer Financial Protection Bureau also has filled several high-profile regulatory positions, including the agency’s assistant director for the office of supervision policy and assistant director for the office of enforcement. Those two ... [Read More]

Westlake Capital Finance lowering rates for qualified dealers

Monday, Nov. 8, 2021, 05:01 PM

SubPrime Auto Finance News Staff

Dealers who are itching to grow their business now might be able to secure more affordable resources from Westlake Capital Finance (WCF). The Westlake Technology Holdings subsidiary announced last week that qualified dealers can be approved for new commercial real ... [Read More]

While interest rates stay steady, what experts now are watching

Monday, Nov. 8, 2021, 04:59 PM

Nick Zulovich, Senior Editor

Not surprising to economic experts, the Federal Reserve stood pat on current policy associated with interest rates. However, Cox Automotive chief economist Jonathan Smoke pointed out one metric that might have an even more pronounced impact on auto financing than ... [Read More]

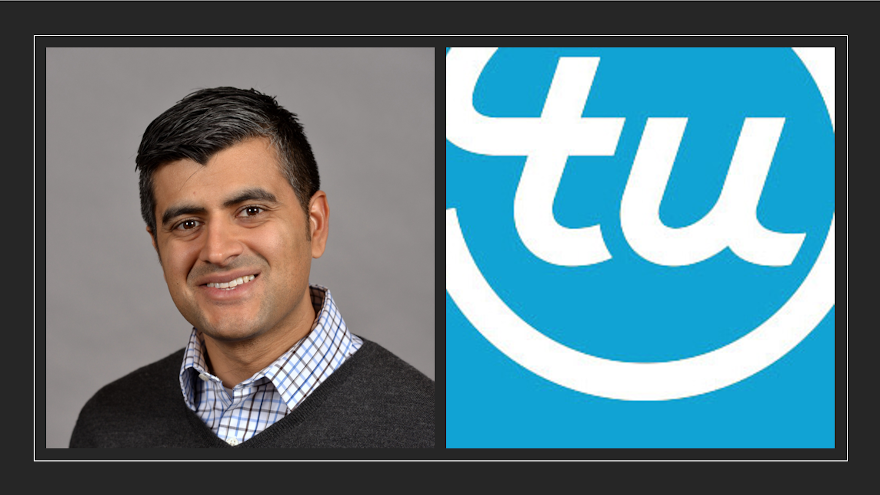

PODCAST: More insights into TransUnion’s Q3 data with Satyan Merchant

Friday, Nov. 5, 2021, 02:49 PM

SubPrime Auto Finance News Staff

After TransUnion released its Q3 2021 Quarterly Credit Industry Insights Report (CIIR), Satyan Merchant made a return appearance on the Auto Remarketing Podcast. The senior vice president and automotive business leader at TransUnion not only delved deeper into the third-quarter ... [Read More]

KBRA reviews First Investors’ outstanding ABS deals

Thursday, Nov. 4, 2021, 01:51 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) weighed in on another element to the completion of Stellantis’ acquisition of First Investors Financial Services Group that created a new captive finance company for the automaker. While First Investors has been renamed Stellantis Financial ... [Read More]

TransUnion pinpoints spillover of rising vehicle prices into Q3 finance data

Wednesday, Nov. 3, 2021, 03:04 PM

SubPrime Auto Finance News Staff

Finance company executives and managers know the impact from rising vehicle prices has to come to roost somewhere. TransUnion’s Q3 2021 Quarterly Credit Industry Insights Report (CIIR) offered some interesting data to illustrate the point. The average amount financed per ... [Read More]

Stellantis completes First Investors acquisition

Tuesday, Nov. 2, 2021, 02:29 PM

SubPrime Auto Finance News Staff

First Investors Financial Services Group now officially is a captive finance company. Stellantis announced late on Monday that it completed the acquisition of the company that previously specialized in subprime auto financing. As a result of the transaction first revealed ... [Read More]

Resolvion makes 3 executive leadership changes

Monday, Nov. 1, 2021, 04:18 PM

SubPrime Auto Finance News Staff

Resolvion began a new month by announcing a variety of high-level executive moves on Monday. The provider of repossession management, skip-tracing, heavy equipment recovery, remarketing, license plate recognition and specialty recovery said the strategic leadership changes involve: — Scott Darling, ... [Read More]

X