A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

FTC distributing more than $3.5M to consumers harmed by ‘The Credit Game’

Wednesday, Jul. 9, 2025, 09:57 AM

SubPrime Auto Finance News Staff

The Federal Trade Commission basically said, “Game over,” in connection with what officials dubbed a credit-repair scheme called, “The Credit Game.” The FTC recently announced it is sending more than $3.5 million in refunds to consumers harmed by the operation. ... [Read More]

F&I Sentinel makes third major move of the summer, hiring VP of account management

Wednesday, Jul. 9, 2025, 09:51 AM

SubPrime Auto Finance News Staff

A busy summer for F&I Sentinel continued Tuesday, as the provider of tech-enabled solutions associated with F&I products in automotive finance appointed Keishawn Batts as vice president of account management. The company said Batts, who F&I Sentinel described as a ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

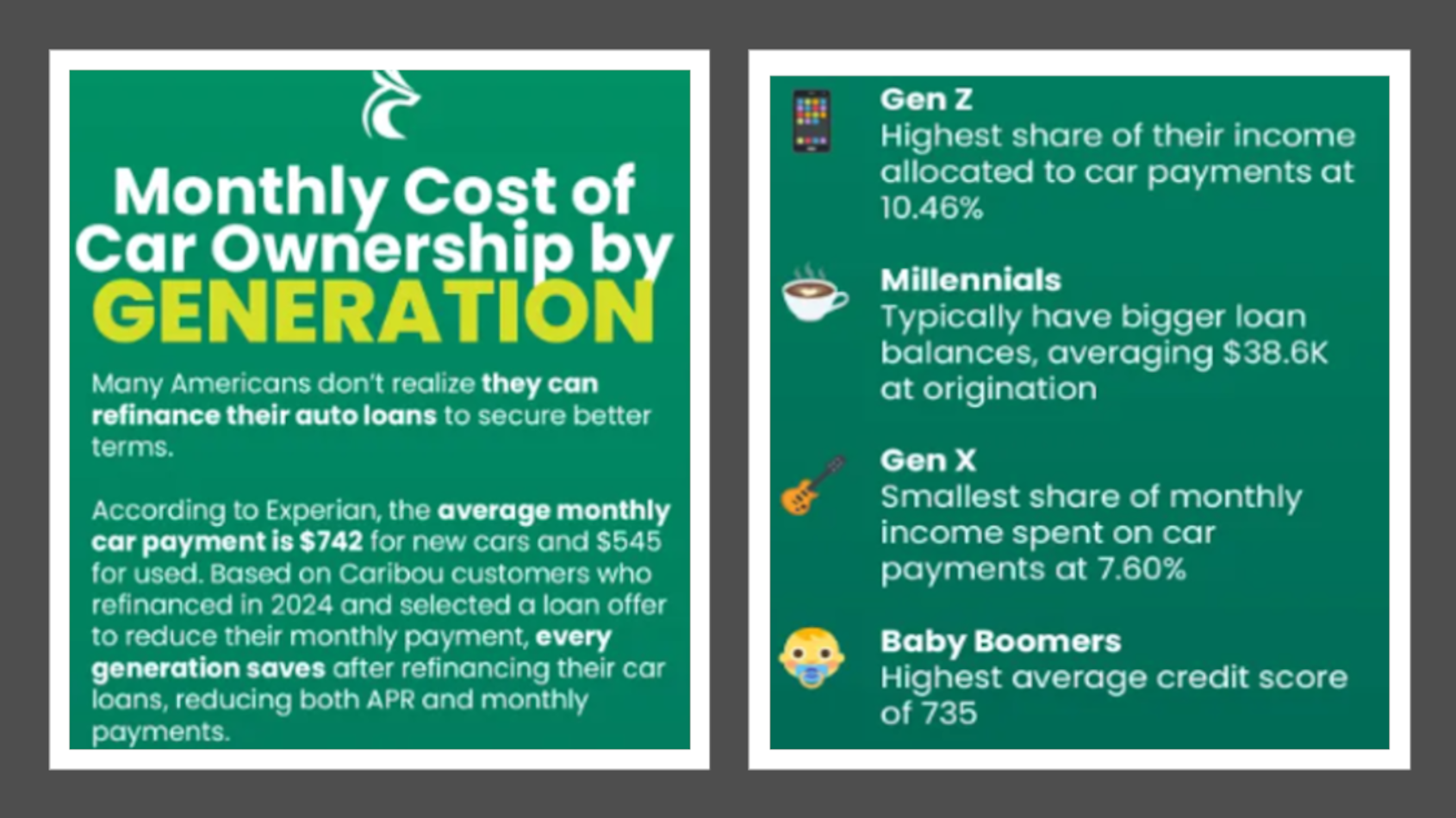

Caribou sees plenty of opportunities for auto refinancing

Monday, Jul. 7, 2025, 04:20 PM

SubPrime Auto Finance News Staff

While there’s some stability in used-vehicle financing, Edmunds recently highlighted multiple all-time highs registered during the second quarter for consumers to take delivery of a new vehicle, including the percentage of individuals paying more than $1,000 monthly. At Caribou, the ... [Read More]

One Big Beautiful Bill signing cuts CFPB budget nearly in half

Monday, Jul. 7, 2025, 10:39 AM

SubPrime Auto Finance News Staff

Fireworks exploding near the White House and Capitol Hill during Fourth of July were more than just recognizing Independence Day. President Trump and Republicans cheered passage and the signing of the One Big Beautiful Bill into law, which included a ... [Read More]

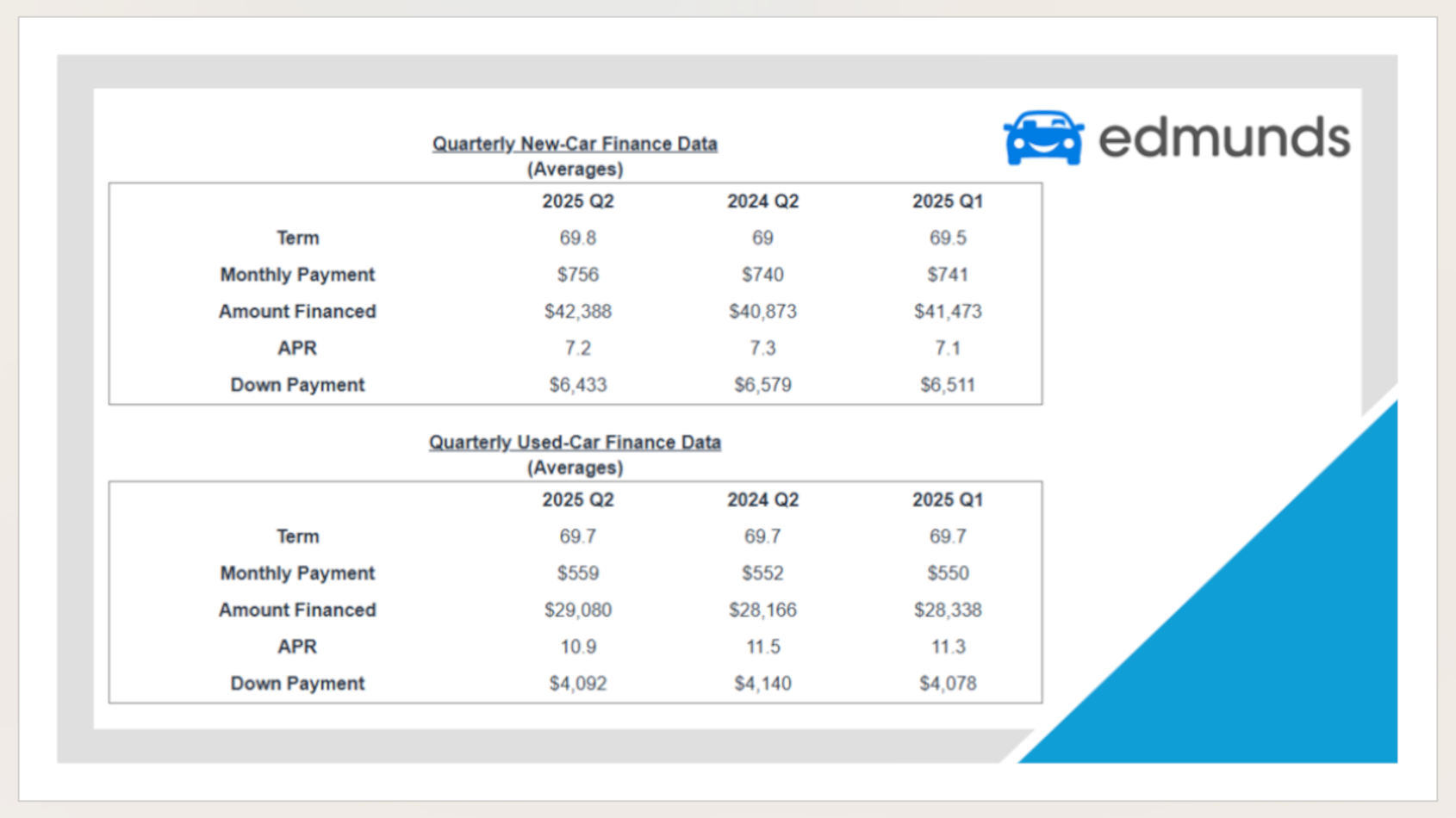

Edmunds spots multiple new all-time highs for new-car financing in Q2

Thursday, Jul. 3, 2025, 10:30 AM

SubPrime Auto Finance News Staff

Used-car financing might be even more appealing for lenders and consumers, especially since Edmunds reported this week that the number of individuals committing to monthly payments of $1,000 or more hit an all-time high during the second quarter. Edmunds noticed ... [Read More]

ARA president urges caution when handling client directives

Wednesday, Jul. 2, 2025, 11:22 AM

SubPrime Auto Finance News Staff

Vaughn Clemmons might not be an attorney, but the president of the American Recovery Association urged members to use caution when receiving client directives. “Whether from lenders, forwarders, or others, some instructions could place your business or employees in legal ... [Read More]

Winslow now officially AFSA’s president & CEO

Wednesday, Jul. 2, 2025, 10:35 AM

SubPrime Auto Finance News Staff

The American Financial Services Association started the second half of the year by making it official. Celia Winslow is the trade group’s new president and chief executive officer. Winslow succeeds Bill Himpler, who late last year announced plans to retire. ... [Read More]

PODCAST: Why Agora Data’s Steve Burke is so bullish about automotive

Tuesday, Jul. 1, 2025, 09:44 AM

SubPrime Auto Finance News Staff

Agora Data’s Steve Burke is one of the most upbeat executives you can find in auto finance. When asked about his outlook for the car business during a conversation at the National Independent Automobile Dealers Association’s annual convention last week ... [Read More]

2025 Non-Prime Automotive Financing Industry Survey is ‘more than just numbers’

Monday, Jun. 30, 2025, 10:17 AM

SubPrime Auto Finance News Staff

Produced through a joint effort by the National Automotive Finance Association and the American Financial Services Association, officials said the annual Non-Prime Automotive Financing Industry Survey contains “more than just numbers.” Now available complimentary for participants and for purchase by ... [Read More]

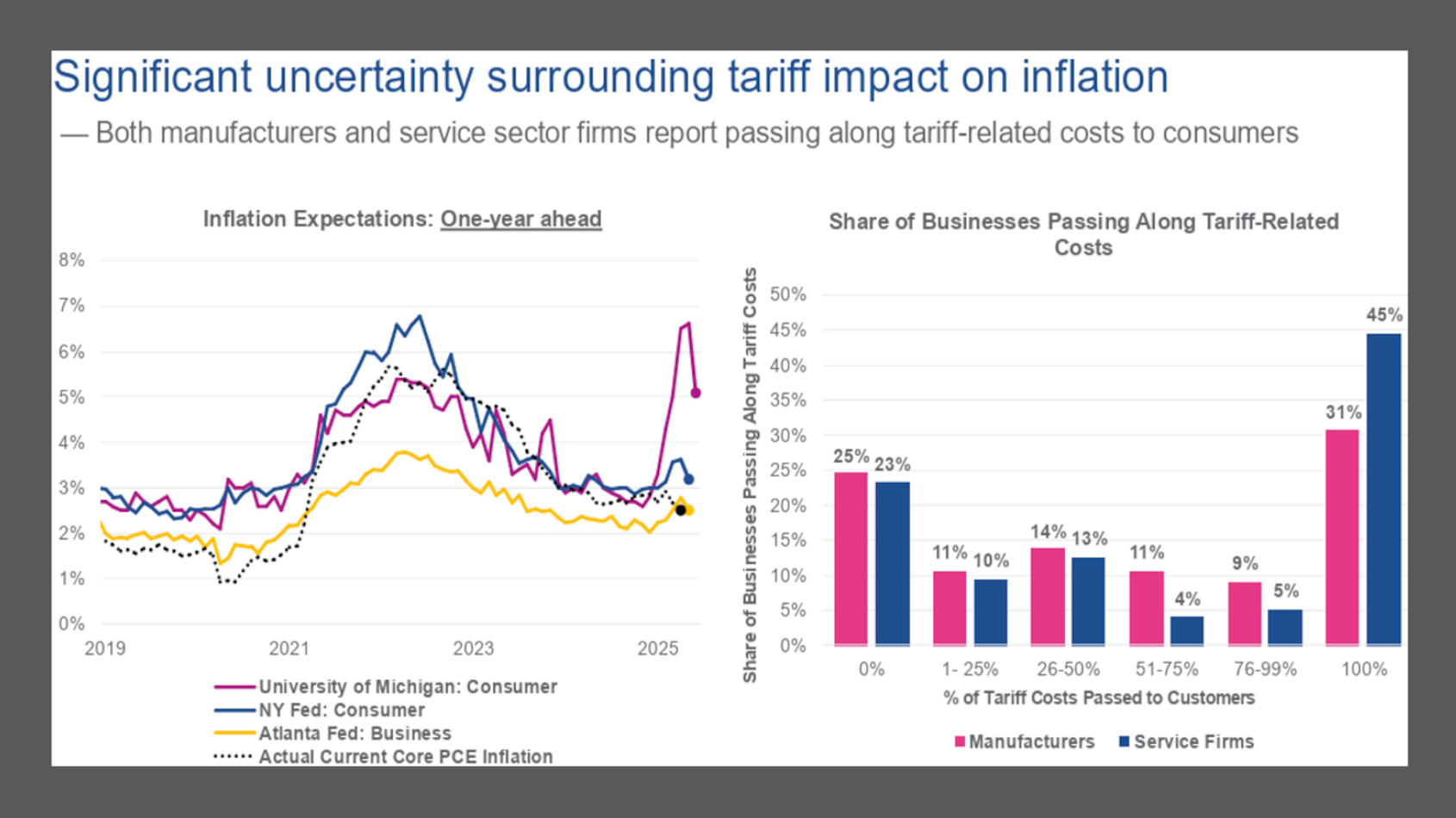

Uncertainty permeates newest auto-finance & economic projections

Friday, Jun. 27, 2025, 10:52 AM

Nick Zulovich, Senior Editor

Economic experts from Cox Automotive, Experian and S&P Global Ratings keep using a word that might not reassure dealerships and finance companies about their roads ahead. Uncertainty. Four separate reports from the three firms discussed some cracks forming in the ... [Read More]

X