A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

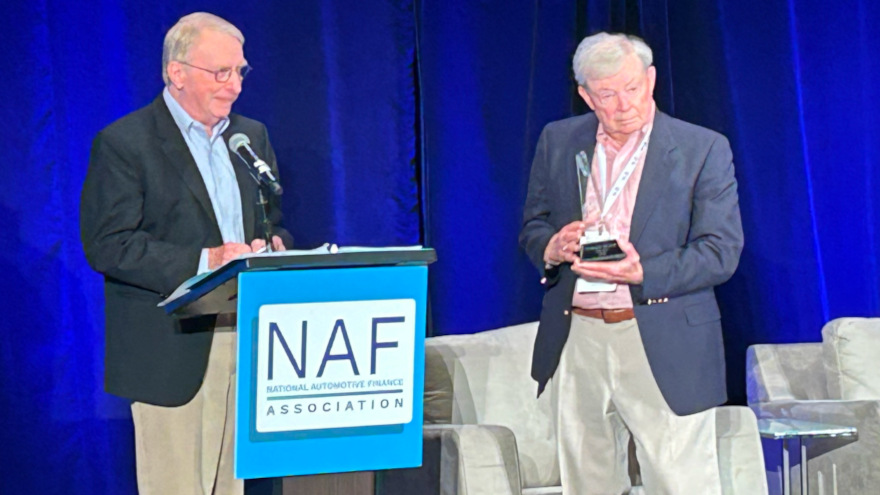

From the editor: Dry humor but few dry eyes when Tom Hudson receives Jack Tracey Pinnacle Award

Monday, Jun. 12, 2023, 11:56 AM

Nick Zulovich, Senior Editor

There was dry humor but few dry eyes when the National Automotive Finance Association gave the first Jack Tracey Pinnacle Award to Tom Hudson last Thursday at the Non-Prime Auto Financing Conference in Plano, Texas. After playing a 10-minute tribute ... [Read More]

8 characteristics ARA wants in new executive director

Tuesday, Jun. 6, 2023, 06:15 PM

SubPrime Auto Finance News Staff

The American Recovery Association is seeking a new executive director. According to an industry message the organization sent last week, ARA highlighted eight characteristics it is looking for among potential candidates, including: —A self-starter with the ability to work independently ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Cox Automotive examines how current labor market could influence next interest-rate decision

Tuesday, Jun. 6, 2023, 10:55 AM

SubPrime Auto Finance News Staff

The next opportunity for the Federal Reserve to modify interest rates arrives next Wednesday. Cox Automotive chief economist Jonathan Smoke recapped some of the most important information policymakers likely might consider when deciding whether or not to lift rates again, ... [Read More]

StoneEagle acquires Pencilwrench to smooth OEM warranty claims & more

Monday, Jun. 5, 2023, 12:00 PM

SubPrime Auto Finance News Staff

StoneEagle grew its operation on Monday. The orchestrator of administration systems for F&I product providers as well as metrics and menus solutions for dealers nationwide, announced the acquisition of Pencilwrench, whose technology can help technicians and service advisors write accurate, ... [Read More]

6 agencies form Acrisure Protection Group

Monday, Jun. 5, 2023, 11:36 AM

SubPrime Auto Finance News Staff

Late last week, Acrisure, which combines people and high tech to deliver an array of products including insurance, reinsurance and cyberservices, announced the formation of the Acrisure Protection Group. The group is designed to be a full-service finance and insurance ... [Read More]

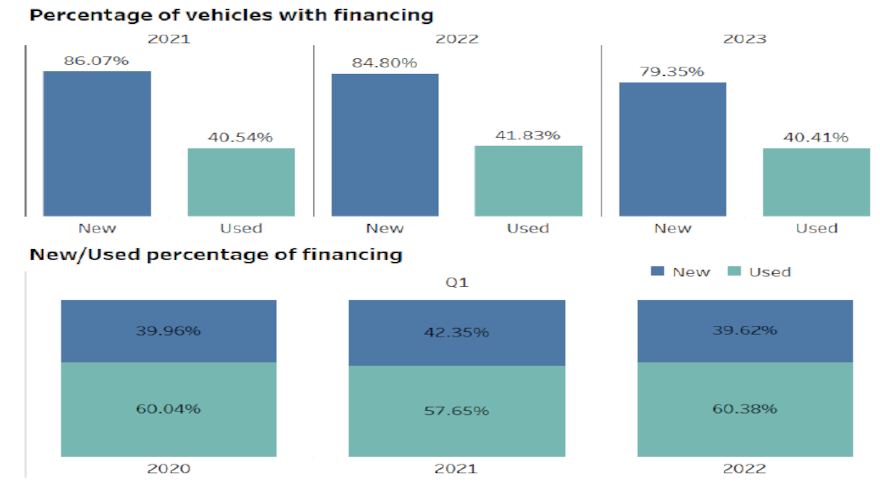

Experian: Stronger credit consumers opting for shorter terms

Thursday, Jun. 1, 2023, 11:42 AM

SubPrime Auto Finance News Staff

It’s not uncommon for consumers with softer credit scores to seek the longest contract terms possible to get a manageable monthly payment. Conversely, Experian is seeing consumers with strong credit scores ask for shorter terms to offset rising interest rates. ... [Read More]

FTC acknowledges regulatory petition involving spot deliveries

Wednesday, May. 31, 2023, 12:00 PM

SubPrime Auto Finance News Staff

Spot deliveries now are back on the radar of federal regulators. The Federal Trade Commission acknowledged on Wednesday and began the request for comment process involving a petition it again received from six consumer advocates to create regulation involving what ... [Read More]

CFPB hands OneMain $20M penalty involving personal loan business

Wednesday, May. 31, 2023, 11:58 AM

SubPrime Auto Finance News Staff

OneMain Financial is being penalized by the Consumer Financial Protection Bureau (CFPB) for its infractions the regulator found associated with its personal loan business. The CFPB announced on Wednesday that OneMain — which also has a notable subprime auto finance ... [Read More]

Protective Asset Protection rolls out training schedule for remainder of 2023

Thursday, May. 25, 2023, 03:03 PM

SubPrime Auto Finance News Staff

Protective Asset Protection recently expanded its F&I professional development program for dealers, with added in-person and online curriculum and an additional new team member for its training team. Protective’s training team created an advanced class for F&I Skills. As the ... [Read More]

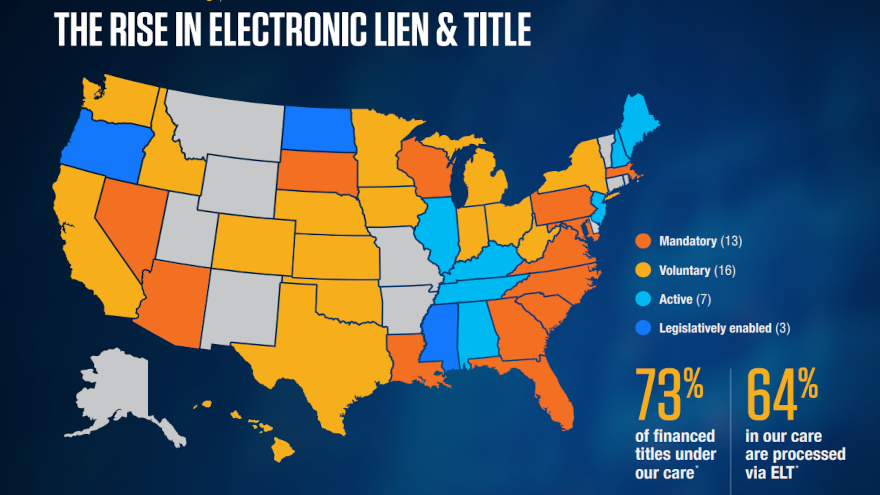

Mandatory ELT processing gaining momentum

Thursday, May. 25, 2023, 11:45 AM

SubPrime Auto Finance News Staff

Cox Automotive senior director of government affairs Sarah Hunsicker gave both historical background and forward-looking perspectives about electronic lien and title (ELT) processing, which is now mandatory in 13 states. Hunsicker recapped in a company podcast with Deshaun Sheppard, a ... [Read More]

X