A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

NCCI & PAVE look to solve 2 repo challenges via strategic partnership

Friday, Mar. 24, 2023, 10:22 AM

SubPrime Auto Finance News Staff

NCCI, a provider of risk resolution outsourcing (RRO) solutions with actionable intelligence to auto finance companies and other firms in the financial services industry for more than 25 years, formed a new strategic partnership with PAVE, a company that leverages ... [Read More]

What another 25 basis points could do to already rising auto finance rates

Thursday, Mar. 23, 2023, 10:54 AM

Nick Zulovich, Senior Editor

Cox Automotive and Edmunds experts explained the potential intensifying challenge for dealerships and finance companies to get consumers the credit they might need to take vehicle delivery amid the rising interest rate environment.

A situation that even the Federal Reserve acknowledged to become even more complicated when policymakers unanimously chose to raise the target range for the federal funds rate to 4.75% to 5%.

“Since our previous meeting, economic indicators have generally come in stronger than expected, demonstrating greater momentum in economic activity and inflation,” chair Jerome Powell said after the Fed announced its latest rate increase on Wednesday. “We believe, however, that ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

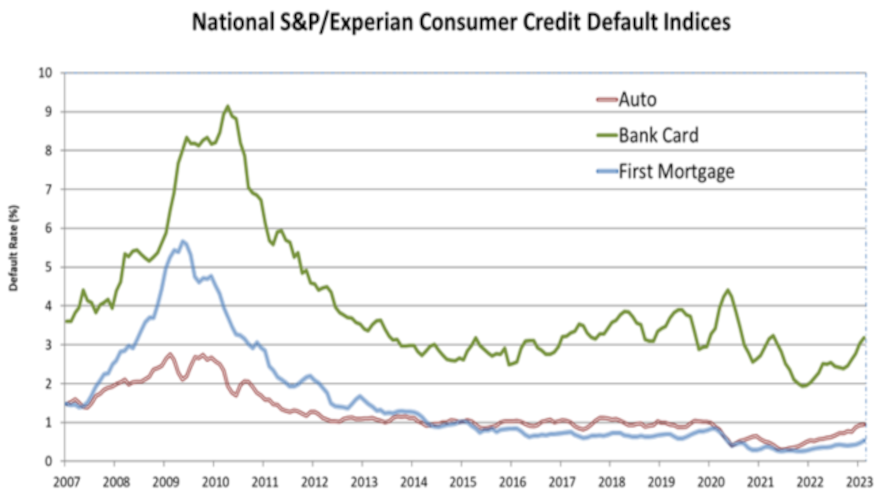

Auto defaults approach 1% reading in February

Tuesday, Mar. 21, 2023, 02:31 PM

SubPrime Auto Finance News Staff

Perhaps normalcy with auto defaults is near since the latest rate reading is just 5 basis points away from being at or above 1%. The rate hasn’t been at that level since the end of 2019. According to data through ... [Read More]

Cox & GfK offer more evidence of new-car affordability issues

Monday, Mar. 20, 2023, 03:37 PM

SubPrime Auto Finance News Staff

New analysis and research from Cox Automotive and GfK AutoMobility showed how potentially out of reach taking delivery of a new vehicle might be for consumers with subprime credit and/or lower income. New-vehicle affordability improved again in February following modest ... [Read More]

10 more highlights of Westlake’s successful 2022

Friday, Mar. 17, 2023, 01:39 PM

SubPrime Auto Finance News Staff

A week after highlighting the 2022 successes of one of its divisions, Westlake Technology Holdings announced strong 2022 results from all companies on Thursday. Executives highlighted each company generated steady year-over-year growth, improved operational efficiency and implemented of new programs ... [Read More]

ARC schedules next F&I training session tailored for independent dealers

Friday, Mar. 17, 2023, 01:39 PM

SubPrime Auto Finance News Staff

Automotive Reinsurance Concepts (ARC) is again giving independent dealers and their finance managers the opportunity to learn F&I from the “best in the business.” The reinsurance and warranty company’s latest F&I Basics Bootcamp will be held May 3-4 at the ... [Read More]

CFPB targets business practices of data brokers with newest inquiry

Thursday, Mar. 16, 2023, 02:09 PM

SubPrime Auto Finance News Staff

An active stretch at the Consumer Financial Protection Bureau continued Wednesday when the CFPB said it has launched an inquiry into companies that track and collect information on people’s personal lives. In issuing this new Request for Information, the CFPB ... [Read More]

Latest views on credit availability & tax refunds

Tuesday, Mar. 14, 2023, 03:35 PM

SubPrime Auto Finance News Staff

During the past week, Cox Automotive touched on two important current trends associated with auto financing — credit availability and tax refunds. Both trajectories might be positives for dealerships getting vehicles delivered and finance companies building their portfolios. First, according ... [Read More]

4 new qualms CFPB has with ‘unlawful junk fees’ in auto financing

Monday, Mar. 13, 2023, 03:33 PM

SubPrime Auto Finance News Staff

Last week, the Consumer Financial Protection Bureau articulated four ways “unlawful junk fees” are happening in auto financing. The bureau shared the details in a special edition of its Supervisory Highlights. The CFPB said during auto servicing examinations that bureau ... [Read More]

5 parts of Western Funding’s record growth in 2022

Friday, Mar. 10, 2023, 03:58 PM

SubPrime Auto Finance News Staff

Praising its team in the process, Western Funding Inc. (WFI), a subsidiary of Westlake Technology Holdings and part of the Nowlake umbrella, announced record growth in 2022. The company’s five primary highlights from last year include: —73% year-over-year growth in ... [Read More]

X