Latest Ally survey reinforces how owners value vehicles nowadays

Graphic courtesy of Ally Financial.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

DETROIT and ORLANDO, Fla. –

AAA projected a decline of at least 10% in travel for Thanksgiving — the largest one-year decrease since the Great Recession in 2008.

For individuals who did go somewhere to see family and friends for the holiday, AAA Travel senior vice president Paula Twidale said the majority went by car, “which provides the flexibility to modify holiday travel plans up until the day of departure.”

Thanksgiving reinforced findings from a new survey from Ally Financial about how cars and personal transportation are more essential to people’s lives than prior to the COVID-19 pandemic.

According to a survey of 2,000 American adults conducted by OnePoll on behalf of Ally Financial, 72% of vehicle owners say that going for a drive alone allows them to clear to their head.

The survey also indicated nearly three-quarters of men (73%) and more than half of women (53%) consider their vehicle to be their personal “fortress of solitude.”

In addition, the pandemic has caused Americans to rethink their desired mode of transportation.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

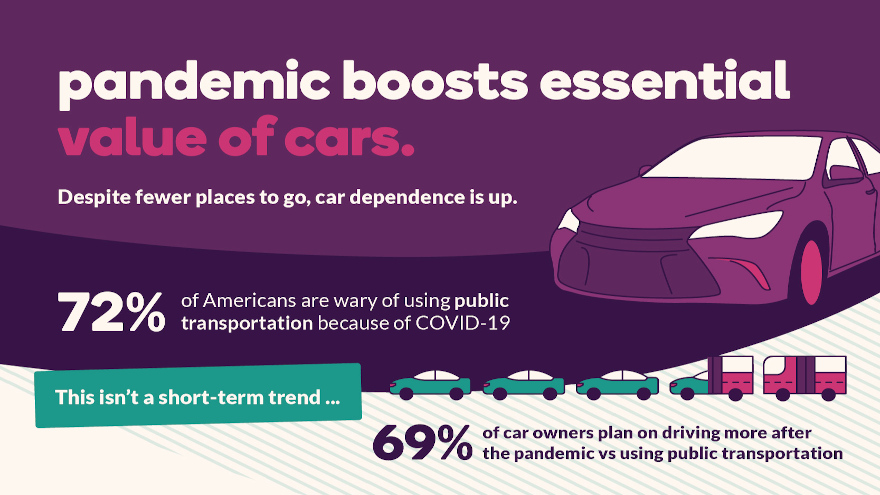

The Ally survey showed nearly three out of four Americans — 72% to be exact — are wary of using public transportation because of COVID-19. The finance company pointed out this finding isn’t just a short-term trend, since 69% of car owners say they plan on driving more after the pandemic ends rather than use public transportation.

“The pandemic has forced Americans to rethink how we use cars, and why,” Ally Insurance president Mark Manzo said in a news release. “Even though many of us are using our vehicles differently, cars are more vital than ever, serving as a source of solitude and providing a safe means of travel for us and our families.”

When it comes to work-related driving, the Ally survey revealed 45% are spending less time driving — or not driving at all — to and from work. Meanwhile, the survey also showed 26% of gig-job drivers, such as DoorDash or Instacart, have increased their time behind the wheel.

While driving plays an important role helping Americans ease their minds, Ally’s survey noted that many vehicle owners are dealing with stress concerning expenses.

More than half of drivers (57%) are worried about unexpected repair costs, and 58% may hold on to their current vehicle longer than originally planned.

The survey results also highlighted the tough choices many vehicle owners have made due to the pandemic: More than one in three (36%) have had to choose between an installment payment or repair.

“Too many Americans are struggling with financial uncertainty,” Manzo said. “To help ease the anxiety of an unexpected and expensive car repair bill, drivers should consider vehicle service contracts. These types of protection plans provide peace of mind, keep budgets on track and vehicles on the road.”

Ally reiterated that vehicle service contracts (VSCs) help cover expenses such as repairs and replacement parts that fall outside the factory warranty.

Ally Premier Protection VSCs cover over 7,500 vehicle components and offer additional benefits, including rental car reimbursement, roadside assistance and reimbursement for trip interruption caused by a breakdown. Levels of coverage vary by plan and are available for new and used vehicles.

Additionally, Ally noted VSCs can be used to manage repair costs over an extended period of time, making these expenses more predictable and easier to fit into a household budget.

To help consumers make the most of their money, Ally provides additional information on vehicle service contracts, plus additional savings and budget strategies.