Lane watch: Record pump prices leaving imprint at auction

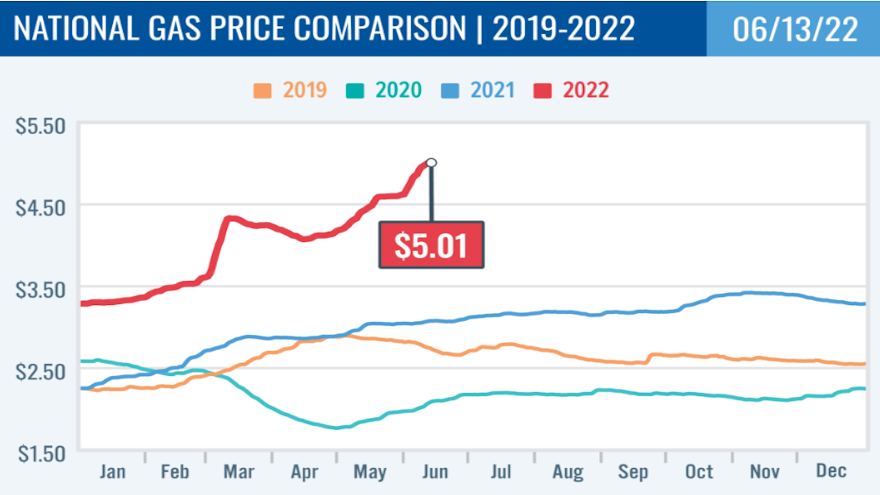

Chart courtesy of AAA.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With the average price for a gallon of gas now above $5, Black Book’s newest installment of Market Insights highlighted how wholesale prices for vehicles such as compact cars and full-size SUVs are moving in distinctly different directions.

“Fuel prices appear to still be having a heavy influence on the demand in the wholesale marketplace,” analysts said in the new report distributed on Tuesday. “Compact cars continue to perform very well along with subcompact crossovers, but the gas-guzzling full-size SUV segments continue to experience the heaviest depreciation, as demand in the lanes wanes for these vehicles.”

All told, Black Book said overall wholesale prices rose 0.10% last week.

Meanwhile, AAA reported on Monday that the national average for a gallon of gas surged and is 15 cents more than a week ago, 58 cents more than a month ago, and $1.94 more than a year ago.

AAA said the national average is $5.01 — an all-time high never seen since AAA began collecting pricing data in 2000.

“Based on the demand we’re seeing, it seems high prices have not really deterred drivers,” AAA spokesperson Andrew Gross said in a news release. “If prices stay at or above $5, we may see people start to change their daily driving habits or lifestyle, but it hasn’t happened yet.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

If driving habits haven’t change much, perhaps what potential vehicle buyers might do is shifting, so dealers are making adjustments accordingly in the wholesale market.

On a volume-weighted basis, Black Book overall car segment values increased 0.26%, as seven of the nine car segments rose last week.

Analysts indicated prices for compact cars climbed another 0.76% to extend the streak of value gains to 12 consecutive weeks. They computed the average gain during that stretch to be 0.58% for those gas-sipping models.

Black Book pointed out that sporty cars had “another impressive week,” as prices jumped another 0.51% after increasing 0.62% during the prior week.

While eight out of the 13 truck segments generated price increases last week, Black Book determined that its volume-weighted data showed only a 0.03% overall uptick in truck values.

Analysts noticed prices for sub-compact luxury crossover generated the highest price increase a week ago, moving up by 0.41%. Values for the mainstream sub-compact crossover segment weren’t far off that pace, recording the second highest gain at 0.28%.

In sharp contrast, Black Book spotted the value tumbles in the crossover/SUV segments, with full-size down 0.40% and full-size luxury off by 0.26%.

Resilient despite high fuel prices were the pickup segments, as values for both small (up 0.15%) and full-size (up 0.14%) pickups moved higher week-over-week.

Turning back to the latest AAA update on gas prices, the organization said the nation’s top 10 largest weekly increases by state included:

—West Virginia (up 28 cents)

—Montana (up 27 cents)

—Colorado (up 25 cents)

—Kansas (up 23 cents)

—Virginia (up 23 cents)

—Missouri (up 22 cents)

—North Dakota (up 22 cents)

—Indiana (up 22 cents)

—Ohio (up 22 cents)

—New Mexico (up 21 cents)

AAA added that the nation’s top 10 most expensive markets for gas include:

—California ($6.43)

—Nevada ($5.65)

—Alaska ($5.56)

—Illinois ($5.56)

—Washington ($5.54)

—Oregon ($5.53)

—Hawaii ($5.53)

—Arizona ($5.31)

—Washington, D.C. ($5.26)

—Indiana ($5.05)

Despite those ominous figures, Black Book rounded out its latest update by mentioning the estimated average weekly sales rate is rising again, currently sitting at 71% after a few weeks of declines.

“The wholesale channels have remained somewhat consistent as new-vehicle inventory continues to be scarce,” Black Book said. “Some key trends have been identified including increases of clean MY22 vehicles going through the lanes, increase of closed sales for franchise dealers, increase of announced repossessions, and the noticeable absence of some large independent dealerships.

“Franchise dealers are most active in the closed sales and have not been overly competitive in other lanes,” analysts continued. “Rental companies are still actively buying inventory in the wholesale lanes. Sellers seem to be holding on to their floors, waiting for the right buyer or for prices to increase. Clean, low mileage vehicles continue to be desirable, especially for newer model years (MY20-MY22) and also some of the older models (MY14-MY16).

“It has been speculated that late federal income returns have some typical-spring market buyers still looking for affordable vehicles. The auction lanes will most likely continue these trends until the new MY23 vehicles start to launch in masse,” Black Book went on to say.