Lane watch: Dealers approach auctions looking for ‘quality over quantity’

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Using the description “quality over quantity” happens often inside and outside of automotive.

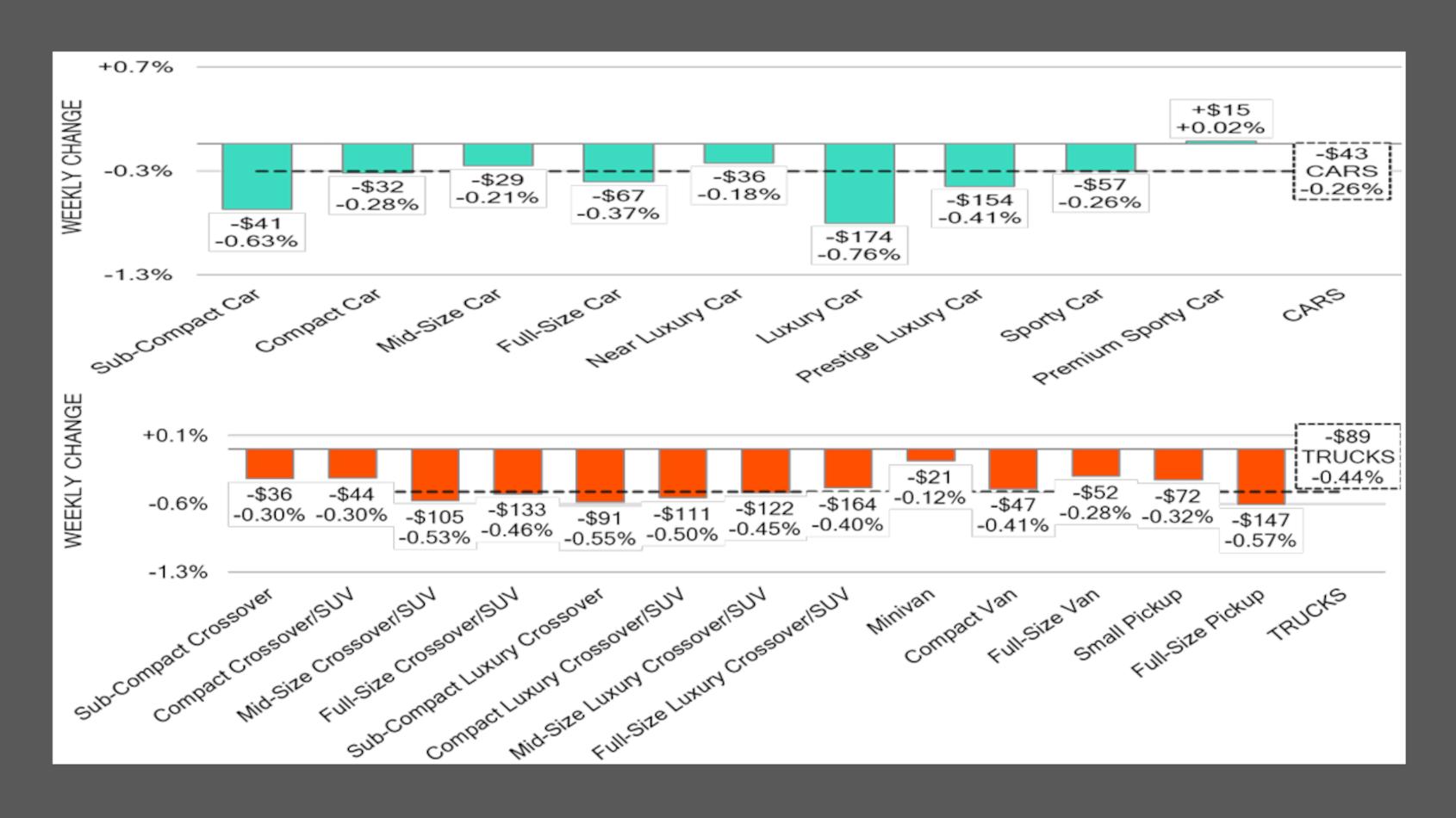

Black Book also used it to recap last week’s wholesale scene, which had values soften by 0.39%. And the auction conversion rate slid by 3 percentage points to 56%.

“Wholesale activity last week underscored the industry’s ‘quality over quantity’ dynamic,” Black Book analysts said in their newest installment of Market Insights released on Tuesday.

“Buyers stayed active across most lanes, but their willingness to pay premiums was concentrated on retail-ready units with clean histories, while average condition vehicles drew more cautious bidding,” analysts continued in the report. “This selectivity reflects a market that is still competitive but increasingly disciplined.”

Black Book pointed out that auction conversion rates now have dropped for three consecutive weeks, “reflecting tighter buyer selectivity.” But analysts mentioned there are vehicles in the lanes nowadays that are keeping ringmen busy.

“Low-mileage older models continued to outperform, often selling above book values,” Black Book said, while adding that, “2025 model-year inventory underperformed, frequently trading below average book.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Overall, demand remained firm for affordable, retail-ready units, while newer and higher-value segments faced pricing pressure,” Black Book added.

Previously, Black Book mentioned that repossessed vehicles were filling the lanes at some sales, influencing values for certain parts of the market. Perhaps that’s still the case, as analysts said that values for 8-to 16-year-old cars decreased 0.49%, while prices for trucks in that age bracket dropped by 0.35%.

Black Book noticed values for luxury cars decreased by 0.76% last week, representing the sharpest single-week decline for those high-line units since December 2024. During the previous four weeks, luxury cars posted an average depreciation rate of 0.26%.

Also of note, analysts said values for compact luxury crossover/SUVs that are less than 2 years old plunged 0.82% last week, marking the largest single-week decline for those specific vehicles since January 2024.

One specific segment posted a notable price increase last week, as Black Book said values for minivans between 8 and 16 years old rose 0.32%, extending an upward streak to two weeks in a row.

All told, eight of the nine car segments and each of the 13 truck segments tracked by Black Book posted a decrease in values a week ago.

What might dealers do next? Especially considering Black Book saying its estimated used retail days to turn held steady at roughly 35 days.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book said.