Alfa, provider of the asset finance software platform Alfa Systems, recently published the third and final paper in its thought leadership series, “AI in Equipment and Auto Finance.”

The whitepaper titled, “Part 3: Moving Forward with Machine Learning” was produced in association with Alfa iQ, which is a partnership between Alfa and Bitfount.

Bitfount works with some of the world’s leading auto and equipment finance companies to build and deploy machine learning models.

Combining the theoretical insights from Alfa’s position paper, “Balancing Risk and Reward” with the use cases explored in the technical paper, “Using Machine Learning in the Wild,” the company highlighted the new white paper explores the trajectory of machine learning, its uses in auto and equipment finance, and how machine learning will continue to advance in the near future.

The project also includes in-depth exploration of federated learning and how organizations can use private data to train machine-learning models without ever compromising the privacy of that data.

Martyn Tamerlane, author of “Moving Forward” and a solution architect at Alfa said: “AI and ML represent an exciting shift for finance providers and, while the benefits are better understood now than they were a couple of years ago, the practical side to acquiring those benefits is still unclear for many.

“Alfa’s aim for this series has been to expose that practical side; to demonstrate where ML can help solve problems and make lenders more competitive, through its ability to detect patterns in vast amounts of data and feed that into higher-quality, sometimes fully automated, decision making. Then, to show ML taking different forms; first as an in-house framework, and secondly relying on AI-as-a-Service,” Tamerlane continued.

“Now we consider ML's continued success, particularly in the context of the ever-increasing volume and variety of data that is being collected; but with complex challenges posed by data privacy, fairness and the high level of expertise required to analyze the data effectively. By illuminating the key characteristics of this technology, we’re providing a platform from which people can effect major change,” Tamerlane went on to say.

The series can be downloaded at alfasystems.com/ai3.

Lithia Motors isn’t just buying franchised dealerships. The company also is investing in Driveway.

On Tuesday, executives announced three new features powered by artificial intelligence now are live on driveway.com.

Driveway’s upgraded shopping experience can enable customers to shop and filter vehicles by monthly payment, customize a payment with a new budget and payment calculator and achieve a higher likelihood of credit approval with an artificial intelligence-based feedback tool.

“Driveway’s three new features promote transparency and address customer desires to better understand affordability,” Lithia and Driveway president and chief executive officer Bryan DeBoer said in a news release.

“Financing is one of the most complex components of the vehicle buying process and these Driveway features allow the customer to solve for their financing needs quickly, easily and independently,” DeBoer continued.

Here are more details about each of the three enhanced features:

Shopping by monthly payment

The company explained Driveway’s shopping experience is designed to make it easy for shoppers to navigate and find inventory based on monthly payment.

Potential buyers now can filter Driveway’s nationwide inventory by price or monthly payment making it much faster to choose a vehicle that fits their budget.

Budget and payment calculator

After selecting a vehicle, the company indicated customers can immediately personalize a payment with Driveway’s new budget and payment calculator.

This feature can allow customers to adjust their down payment, contract terms and identify how their credit score may affect their monthly payment.

The calculator utilizes the selected vehicle’s purchase price, the customer’s actual trade-in value and loan balance, shipping costs, estimated taxes and licensing fees in one intuitive and powerful tool.

“Personalization is critical since the vehicle shopping transaction has multiple components. We have designed the Driveway experience to anticipate and address all customer needs,” said George Hines, chief innovation and technology officer at Lithia and Driveway.

AI-powered financing approval likelihood indicator

Prior to submitting a credit application, the company went on to mention Driveway’s new AI-powered engine can inform customers of their likelihood of online approval based on their identified down payment amount, loan term and credit score.

This new tool uses data from more than 2.5 million vehicle transactions Lithia has originated to enable customers to independently achieve a higher likelihood of online approval.

“These proprietary Driveway enhancements empower the customer’s vehicle shopping experience,” DeBoer said. “Combined with our vast selection of vehicles at all affordability levels and our growing network that’s providing in-home delivery throughout the nation, Driveway is well on its well to becoming the leader in ecommerce automotive retail.”

Artificial intelligence is certainly on the collective radar of the largest federal regulators.

Five federal financial regulatory agencies announced this week that they are gathering insight on financial institutions’ use of AI..

According to a news release, the agencies seek information from the public on how financial institutions use AI in their activities, including fraud prevention, personalization of customer services, credit underwriting and other operations.

The Federal Reserve Board, the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA) and the Office of the Comptroller of the Currency (OCC) announced the request for information (RFI) to gain input from financial institutions, trade associations, consumer groups and other stakeholders on the growing use of AI by financial institutions.

More specifically, the agencies explained the RFI seeks comments to better understand:

— The use of AI, including machine learning, by financial institutions

— Appropriate governance, risk management, and controls over AI

— Challenges in developing, adopting, and managing AI

— Whether any clarification would be helpful

Comments will be accepted for 60 days following publication in the Federal Register.

The RFI can be viewed here.

Inovatec Systems Corp. rebranded its cloud-based software solutions back in October. This week, the fintech firm launched a major enhancement designed to save time and manual labor.

Inovatec announced its JAVELIN platform now offers optical character recognition (OCR) for automatic document indexing and sorting. The company highlighted the OCR technology uses custom-built artificial intelligence and machine learning to allow financial institutions and lenders to sort incoming documents at any hour.

Inovatec estimated the OCR function will save approximately three to five minutes of manual sort time per transaction with accuracy while maintaining current funding processes. For lenders processing thousands of loans at any given time, the OCR feature could save significantly on valuable working hours, according to a company news rease.

The feature encompasses three different phases:

— Automatic document indexing includes automatic document indexing and sorting through custom-built artificial intelligence and machine learning. The automatic document indexing feature can allow sorting of incoming documents 24/7 while maintaining speedy and accuracy.

— Meta data validation takes the next step in validating crucial data for funding. This data validation can allow financial institutions to “automatically fund” using data analytics. By isolating the necessary data elements for funding, a transaction can automatically be completed using validations that align with lenders current processes.

— Auto Fund is the process that can complete the journey to automated funding by taking a submission or automatic approval to funding without human touch. Inovatec said it is the first and only technology provider to offer automatic funding as part of its LOS offering.

The company went on to mention other benefits of an OCR-capable system include:

• Decreased funding turnaround time and headcount required for indexing and data validation. Use those FTE to fund or adjudicate more deals.

• Increased efficiencies through automated solutions. Get a completely paperless environment through digital document from any source (fax, text, email) with 100% accurate validations.

• Increased customer satisfaction through faster automated status communications to and from the originating portal. Expose missing or incorrect data and documents.

“Providing the most accurate data for our customers while helping them to save in a quantifiable and scalable way always been a fundamental value at Inovatec,” Inovatec U.S. director of sales Brendon Aleski said in the news release.

“We are constantly improving and perfecting our product offering to include proprietary modules, analytics and cutting-edge machine learning capabilities that become smarter with each transaction,” Aleski added about JAVELIN by Inovatec, which can help finance companies select the right deals, while only paying for deals that are booked.

To learn more about Inovatec and its complete suite of lender-centric technologies, visit www.inovatec.com.

Alfa acknowledged that some auto-finance companies still have questions about what artificial intelligence can do for their operation.

To offer some potential answers, the provider of Alfa Systems, a technology platform for equipment and auto-finance companies, recently released its second whitepaper about artificial intelligence in the industry.

The firm highlighted that its new whitepaper titled, Part 2: Using Machine Learning in the Wild, is a more technical follow-up to Part 1: Balancing Risk and Reward, which Alfa released last year.

The second segment explores in detail two specific use cases that take different approaches to machine learning implementation. It features a foreword from Blaise Thomson, whose speech technology start-up VocalIQ was acquired by Apple and formed an important part of the Siri development team.

Martyn Tamerlane, a solution architect at Alfa and co-author of the paper, said: “AI and machine learning are front and center in the asset finance conversation at the moment, but many don’t know where to start — how much expertise they need, what they can outsource, and where they should concentrate their efforts and costs.

“Our worked-through examples convey genuinely useful and practically applicable advice for people wanting to kick off their own machine learning projects. By comparing the approaches used, we offer advice on what’s right for others,” Tamerlane continued.

The first example, which addresses automated license plate recognition and its ongoing embedding in business processes, takes an off-the-shelf approach to training machine learning models, drawing heavily on tools provided by AWS.

Meanwhile the second, which analyses Alfa’s internal code tests, is carried out wholly in-house with existing resources and knowledge.

The paper also features a decision aid to help readers clarify how their projects might compare.

Alfa is offering its material on this website.

Artificial intelligence (AI). In recent years, it has been touted as the future of nearly every industry. It is certainly the future of auto finance. In fact, it has already begun to transform several of the sector's key processes, such as credit decisioning. But there is some distance to go before AI can reliably underpin the vehicle credit process from end to end.

At this point, auto lenders should be using AI to supplement the existing underwriting process. Why? Because the technology can draw on data, such as customer spending habits, to supplement standard credit ratings and help underwriters to make determinations about whether to extend a loan. The goal is to integrate AI to support, not replace, the human in the loop.

Augmented intelligence

Today, auto lenders use AI most heavily in the pre- and post-underwriting stages of the credit process. For example, before the credit decision they use AI to segment customers into risk groups in order to prevent fraud. After the decision, they use it in end-of-lease inspections — to more speedily and consistently assess damages and excessive wear and tear – or to run analyses on lost deals, when the customer chooses to seek credit elsewhere. And this is its best use — for now.

In the middle portion of the underwriting process – the yes/no decision on whether to grant credit — auto lenders should use AI in addition to current, robust, and replicable regression models, which use statistics to determine a customer’s credit worthiness. AI can help to feed more data into those models, or to challenge their outputs. For this reason, we like to think of AI as augmented, rather than artificial, intelligence.

But why place a go-slow on the implementation of AI in credit, when the potential gains in underwriting are so great? Because the opportunity for getting it wrong is significant. And because any industry that deals with regulatory compliance will benefit hugely from co-creating deep structural changes with regulators.

For regulators, the outcome is what matters

Fortunately, regulators are very supportive of the use of AI in credit processes. But that doesn't mean they are blind to the downside. Machine learning models are known to discriminate if the training data set is not carefully curated. So, regulators are understandably cautious.

As a result, regulators require that the same validation processes that apply to traditional regression models also apply to AI. Specifically, auto lenders should be able to easily explain and interpret AI models. And AI models should yield consistent and reproducible results. It is not good enough to implement 'black box' models that consume scores of data points and deliver a decision that cannot be unpacked.

With current, traditional models, the provider can explain to the customer which parameters fed the model (such as payment history, for example), what happened during the decision process, and why they were given a particular answer. And this will remain the standard. Generally speaking, regulators will focus on outcomes. If these outcomes appear to be discriminatory, the regulatory risk, financial penalties, and reputational damage for lenders could be devastating.

So yes, engaging with regulators may mean moving a little slower. But it also means that the industry will ultimately adopt standards that are best-in-class. Regulators don't want uniformity in the way auto lenders use AI – as long as it is fair. Rather, they desire a vibrant industry that isn't brought low by bias.

AI in auto: Four key considerations for lenders

If AI is the future of our industry, what should auto lenders consider on their AI journey?

1. Make sure your use of AI is explainable. Be prepared to explain how AI is being used right through the credit process, end-to-end. Genpact’s recent AI360 research shows that the majority (67%) of consumers worry about AI discriminating them, and most also fear that AI will make decisions that affect them without their knowledge. To allay concerns, be transparent with your customers. And know that regulators' attention won't just be on the decisioning portion of the credit process.

2. Engage with regulators, soon and sincerely. Describe your goals for the use of AI to regulators and explain the likely challenges. Regulators will want to be helpful.

3. Don't be made to feel like a laggard by fintech providers. The best use of AI in auto finance, for now, is pre and post-credit decision and as a challenger model to powerful, stable regression models. Over-implementing could go very wrong, very quickly. And buying software that builds black box models that you can't explain won't go down well with customers or regulators.

4. Keep a human in the loop. AI is here to augment human decisions, not to replace decision-makers. Supporting your underwriters with enhanced information provided by AI and good governance processes will allow your firm to spend more time on strategic, relationship-based activities that provide the best experience and outcome for the customer who, after all, is the focus of these efforts.

Proceed, prudently

When it comes to using AI in credit decisioning, therefore, auto lenders should put the pedal to the metal on neither the gas nor the brakes. Don't hit the accelerator and haphazardly apply AI to all aspects of the credit decision process. On the other hand, don't slam on the anchors and neglect to reap the enormous speed and accuracy benefits of including AI in the process.

Instead, apply AI prudently. To automate rote tasks in the pre- and post-decision phases of the credit process. And to supplement traditional regression models and augment the decision making of human underwriters along the way. And don't forget to engage with regulators on your AI journey.

Do this, and your auto finance company is sure to have a smooth ride. All the way to the bank.

Enrico Dallavecchia is the head of risk practice for North America and Niraj Juneja is the analytics consulting leader for banking and capital markets at Genpact, a global professional services firm.

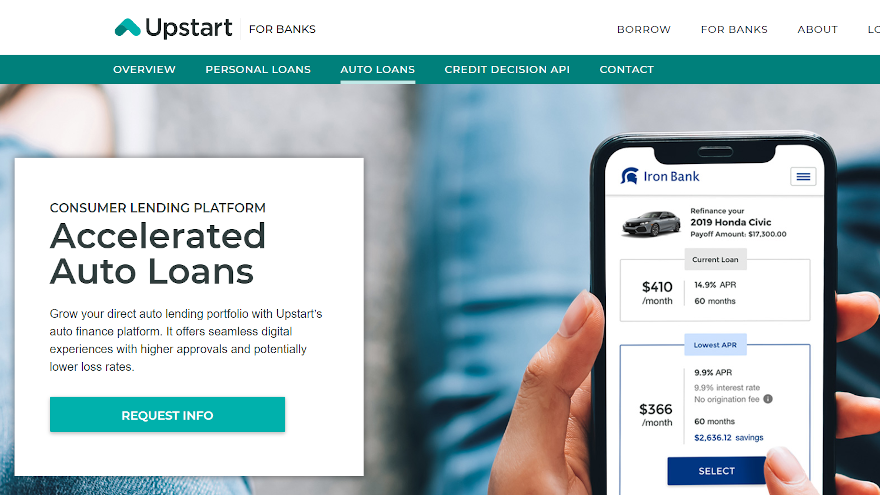

Artificial intelligence continues to work its way into auto financing.

On Wednesday, Upstart, a leading AI lending platform, announced support for auto financing as part of its consumer lending platform. With Upstart’s new service, the firm highlighted banks can offer refinance and purchase financed contracts with a seamless digital experience, higher approvals and potentially lower loss rates — all enabled by AI.

Upstart explained in a news release that its new service can eliminate the need for consumers to track down and enter their VIN or license plate number. Banks no longer need to manage detailed paperwork including title transfer, lien placement, or payoff of the borrower’s existing installment contract (in the case of refinance).

Upstart’s AI model for auto financing builds off its personal loan model, which has shown itself to be five times more predictive than FICO during the COVID-19 pandemic, according to an internal study by Upstart.

Upstart’s auto model combines a time-delimited probability of default (or prepayment) with the vehicle’s modeled residual value to generate a custom financing offer for each applicant.

In addition, thanks to Upstart’s seamless digital experience, banks can achieve Net Promoter Scores (NPS) scores far higher than published benchmarks for the largest banks. The Net Promoter Scores for its bank partners’ current lending programs are approximately 80 compared with less than 30 NPS at top-tier banks, based on a survey of loan applicants administered by a third party.

Features of Upstart’s auto platform also include:

— Bank branded, mobile-friendly application that allows users to finish their application in one sitting

— Seamless vehicle lookup via integration with DMV records without requiring VIN or license plate from applicants

— Risk-based AI model prices customers within the bank’s credit and vehicle policy resulting in higher approvals and lower losses

— Automated fraud and verification of customer application information mean borrowers can finish their application in as little as 20 minutes

— Integrated title management including placing and releasing liens plus transferring titles

— Seamless disbursement of funds either to dealerships, the borrower, the prior lender (for refinance)

“Personal loans were the right first step for AI lending — now, we’re expanding to auto,”, of Upstart co-founder and chief executive officer Dave Girouard said. “The days of randomly priced auto loans with confusing and laborious processes both for consumers and banks are nearing their end.”

For more information, visit www.upstart.com/for-banks/auto-loans/.

Maxwell and Graves Solutions (M&G Solutions) recently announced a partnership Remitter, which offers a white-labeled SMS and email communications platform powered by artificial intelligence and used by providers in the financial services industry to improve collection and recoveries performance.

Officials highlighted the partnership between M&G Solutions and Remitter will further add to Remitter’s expertise in the accounts receivables space within the Unites States.

Under the agreement described in a recent news release, M&G Solutions will help champion the Remitter brand and assist financial service institutions with the implementation of Remitter’s product into existing strategies. The partnership brings together M&G’s expertise in the collections and operations space with a leading non-voice solution to help clients implement a best in class non-voice collections experience for the consumer.

“Remitter’s solution immediately resonated with our entire team, M&G Solutions managing partner Brad Bone said. “As operations executives, we often observe companies with an over-dependence on voice-only collections strategies. This is particularly true given the challenges we are currently facing in the industry.

Remitter’s product provides a solution in the collections space and leverages a communication channel preferred by most consumers today,” Bone continued. “We could not be more thrilled to be partnering with Simon and team to help tell the Remitter story and the value it can bring to our client base.

Remitter founder Simon Scalzo added, “M&G Solutions expertise in receivable management represents an exciting addition to Remitter’s growing team. The M&G Solutions team brings over 100 years of experience in supporting collection strategies for a diverse range of financial services companies.

“We’re excited to partner together to further improve recovery performance, while also enriching the customer experience and strengthening brand affinity, for our clients,” Scalzo went on to say.

For more details, go to remitter.com.

New research from Genpact showed there’s no doubt commercial banks are using artificial intelligence (AI). In fact, the global professional services firm focused on delivering digital transformation reported 97% of commercial banks leverage AI.

However, Genpact also discovered most financial institutions are not implementing the technology effectively for competitive advantage.

More than half of the survey respondents who participated in Genpact’s latest project — 51% to be exact — are using AI simply for point solutions and individual tasks, with 27% testing in pilots, and only 19% leveraging it across the bank holistically.

With pressures mounting from fintechs and other non-bank disruptors, Genpact explained these AI trials raise concerns about how effectively commercial banks can use the technology to improve customer experience and better compete.

Genpact’s study titled, “Commercial Banking: The Customer Experience Imperative,” surveyed 500 senior commercial banking executives on the industry’s changing landscape. The research revealed that while many banks understand the growing importance of customer experience and AI, questions remain regarding their ability to use AI for greater value and mine data effectively to embrace digital transformation and enhance service.

Genpact emphasized the good news is most banks are optimistic about the future.

Survey orchestrators indicated two-thirds of respondents say they expect to use AI across their organization in the next 12 to 18 months, compared with fewer than one in five today. Yet, some executives surveyed seem hesitant about whether AI will deliver on its promises to drive new personalized services to improve customer experience.

Notably, 13% said their organizations have no plans to use AI in the next 12 to 18 months, up from 3% today, which may suggest a lack of confidence in current pilots and long-term execution.

“With digital technology opening new access to sales and payment data, non-traditional players have leapfrogged many established commercial banks in delivering quality customer experiences,” said Mark Sullivan, global business leader of banking and capital markets at Genpact.

“Banks must do a better job at anticipating and quickly incorporating customer experience innovations,” Sullivan continued in a news release. “AI can be a major driver given its ability to interpret droves of data to develop highly-tailored solutions that businesses want.”

Genpact’s research also looked at fintechs’ impact on the commercial banking industry.

Survey orchestrators found that opinions are split. Nearly half of the executives surveyed perceive fintechs as potential partners (cited by 56%), with others saying they are a competitive threat (44%).

Genpact acknowledged that most financial institutions are responding to this with a combination of competitive and adaptive measures. Genpact’s research showed many banks are ramping up their value propositions with enhanced customer experiences such as more responsive credit assessments.

Survey results also mentioned other commercial banks are unbundling their offerings and considering a “platform strategy” to provide customers with a channel for individual products in one place, including services provided by other companies. While “banking as a platform” may be effective to compete with fintechs, only 20% of respondents said they have a holistic strategy in place.

And, just a little more than a third (35%) have mapped the customer journey across both treasury and lending product lines, which the study identified as key growth areas.

“Our research shows that while leading commercial banks overwhelmingly see customer experience as a competitive advantage, many others are in danger of missing opportunities to build deeper customer relationships,” Sullivan said.

“Few financial institutions are mining data effectively across products and other information sources to develop personalized services — which is exactly what fintechs and techfins deliver today,” he went on to say.

To obtain a copy of Genpact’s report, go to this website.

Before 2019 closed, another Software-as-a-Service (SaaS) company targeting buyers in the automotive retail industry released its proprietary search engine fueled by artificial intelligence (AI).

And it’s a solution that’s designed to function similar to how music might flow through your favorite streaming service.

The leadership team at myautoIQ said its technology can provide targeted customer acquisition and personalized engagement to dealers across the United States. The company explained myautoIQ uses behavioral predictions, targeted recommendations and lead scoring to help auto businesses improve customer acquisition, retention and satisfaction.

The solution is designed to provide three key capabilities to dealers, including:

— Identify: Dealers can now target customers in specific regions for specific vehicle models and options.

— Score: Scan, score and identify sales leads from incoming opportunities in real-time.

— Engage: Provide behavioral predictions and recommendations for customer engagement.

The company’s software is powered by an AI-engine that uses machine and deep learning and data science algorithms to provide targeted, accurate data on potential customers. The company’s AI-engine works on a proprietary big data model combining offline and online attributes of buyers.

The result is this powerful technology can provide behavioral predictions, scoring, and recommendations for the U.S. vehicle-buying population, according to myautoIQ.

The compamy noted its intelligence is delivered through a SaaS platform that works simultaneous to customer interaction within the auto business workflow. The software’s predictions include:

— Which vehicle the customer is likely to buy next

— Customization preferences

— How much each customer is likely to pay

— Which vehicle in inventory fits the buyer’s profile

— Dozens of other metrics that can improve automotive sales

“This data-backed tech changes how franchise and independent dealers engage and acquire their customers,” myautoIQ said in a news release. “Auto dealers today are heavily reliant on customers finding them, whether through posting inventory online or in their broad marketing efforts.

“myautoIQ makes things easier and more effective by enabling dealers to reach out to the right customer for the right car at the right time,” the company continued.

Vikrant Pathak, chief executive officer and chief data scientist at myAutoIQ, acknowledged that dealers are flooded with thousands of opportunities generated through online inventory placement. Pathak insisted myautoIQ’s behavior prediction models can predict a score for every lead and customer in real-time to identify the dealer’s top leads, providing them with data and insights needed to make every sale a success.

“Over the past few years, we have seen the power of AI and machine learning working the right big-data and transforming online business model,” Pathak said.

“Customers are hooked on their favorite media streaming and online shopping channels,” he continued. “Think of myautoIQ as your favorite movie or music channel, only instead of recommending a film, it recommends potential customers in your target area. And instead of scoring movies or music for you, it scores your leads to identify likely buyers.

Pathak went on to say, “myautoIQ does not need dealer data or complex integrations to get started. It comes packaged with proprietary big data for the U.S. auto-buying population, along with pre-built connections to online inventory placement platforms.”

For more details, go to myautoIQ.com.