The award-winning TV sitcom "Schitt’s Creek" stems from the financial downfall of a husband and wife who live in a motel with their adult children.

Capital One is leveraging the family celebrity duo in the first national advertising campaign for Capital One Auto Navigator in hopes consumers have a much more pleasing result when financing a vehicle.

The spot featuring Eugene and Sarah Levy launched today, highlighting a humorous early morning exchange between father and daughter, showcasing how easy it is to buy a vehicle when you start by using Capital One Auto Navigator.

“It was an easy decision to do an ad for Capital One Auto Navigator. It’s one thing that could help make buying a car less stressful!” Eugene Levy said in a news release. “And doing this ad with my daughter Sarah made the whole Capital One experience such a joy.”

With Capital One Auto Navigator, shoppers can pre-qualify instantly and see their real rate and monthly payment on millions of vehicles — all without impacting their credit score and before visiting a dealership.

“It was fantastic being on set with my dad again,” Sarah Levy shared in the news release. “I hope everyone sees that with the right tools, buying a car doesn’t have to be complicated!”

Capital One chief brand officer Marc Mentry explained what it was like to work with the family for this campaign.

“We know people will love seeing the natural humor and charm of Eugene and Sarah on screen once again,” Mentry said. “We are so excited to bring them together for Capital One Auto Navigator’s first national ad.”

Capital One Auto Navigator is available online and via app from the Google Play Store for Android and App Store for iPhone, respectively.

“We created Capital One Auto Navigator to simplify the car buying experience for our customers and empower them to feel confident when making this major decision,” said Sanjiv Yajnik, president of financial services at Capital One. “Buying a car is one of the most important purchases a person will make, so they often talk with those they trust to help guide them.

“Eugene and Sarah brought this experience to life in such a compelling, entertaining way. We’re thrilled to have such amazing talent supporting Capital One Auto Navigator,” Yajnik went on to say.

The spot can be watched here or through the window at the top of this story.

One of this year’s Emerging 8 honorees updated one of its tools that generated some of the reasons why the firm earned the accolade.

Darwin Automotive this week announced that the most recent update to its digital retailing application ensures “truly integrated” chat for the entire dealership website journey.

According to a news release, dealers now can offer customers guided digital retailing through deep integration between Darwin and ActivEngage. The companies said this combination can provide “unparalleled” functionality for dealers utilizing both digital retailing application and customer engagement tools.

“Darwin’s top priority is to help dealers move their customers further down the sales funnel in a profitable manner. Our partnership with ActivEngage gets us one step closer to that goal,” Darwin Automotive chief strategy and success officer Chris Grimes said in the news release. “Sometimes, it’s as simple as a single question that needs to be answered before they proceed.

“The experts at ActivEngage have proven time and again they can handle these effectively and help convert shoppers into buyers. Combining the power of the Darwin digital retailing platform with the skilled communication of ActivEngage truly takes digital retailing to the next level,” Grimes continued.

ActivEngage chief executive officer and founder Ted Rubin also commented about the integration.

“Dealers can organically move customers from an intro or research conversation to a guided retailing experience. This is a massive game-changer for the industry,” Rubin said. “Our highly skilled customer engagement experts have customer service backgrounds and are trained to fully understand automotive buying processes. So, shoppers never miss out on a highly personalized experience.

“We work side-by-side with the shoppers to help them through the processes as far as they want to go. We can even collaborate on forms and send hard financing approvals from within the chat window,” he continued.

Darwin reiterated that its digital retailing can allow online consumers to interact anywhere, any time with the dealership, just as if they were with a dealership employee.

“The entire process is swift and user-friendly for the customer. With Darwin’s digital retailing, the dealership provides customers with the option to handle more of the process online, putting them in the driver’s seat,” the company said.

The Darwin digital retailing platform also is designed to mimic all areas of the deal, including F&I.

In this year, potential buyers can select tailored offerings such as maintenance, vehicle service contracts and tire & wheel.

“If at any point the shopper needs assistance in these areas, they can quickly turn to the customer engagement expert who’s standing by,” Darwin said. “During the deal creation process, the customer can share the deal with their significant other, a parent, or friend, anywhere in the world.

“Then, they can choose to transact online or schedule an appointment at the dealership, test drive the vehicle, sign the paperwork, and can drive away in as little as 15 to 30 minutes,” the company added.

Darwin Automotive currently operates in all 50 states with more than 9,000 active sites subscribed to its programs and is on track to deliver 8.5 million units on the platform. It’s that trajectory that prompted the company to collaborate with ActivEngage since technology oftentimes still need people to use it.

“Unlike other solutions, Darwin integrated with ActivEngage mainly for their powerful and heavily trained human team,” Grimes said. “Their customer engagement experts have all the training and intelligence necessary to analyze and interpret a shopper’s needs.

“This ability means dealers capture more leads that already have a jump-start on the purchase process,” Grimes went on to say.

For more information or to schedule a product demonstration, call (732) 781-9010 or visit https://darwinautomotive.com.

With the goal of streamlining financing, retailing, wholesaling and leasing vehicles through a single mobile app, MUSA Auto Finance announced last week that it will rebrand as DRIVRZ Financial.

According to a news release, this new brand will serve as the leasing and finance division of PowerBand Solutions, which acquired a 60% share of MUSA in July 2019.

The company said it will continue growing its indirect lending business while also branching into other business lines.

The company also indicated that it will continue growing its indirect lending business while also branching into direct-to-consumer financing, traditional retail financing, and lending across the full credit spectrum.

Executives went on to mention MUSA’s initiatives will culminate in a one-stop mobile marketplace where consumers and dealers can lease, buy, sell, trade-in, auction and insure vehicles on any digital device. MUSA is looking to provide fast, convenient leasing and financing options through the app.

“Simplifying complex processes through automation has been our hallmark since MUSA opened its doors,” MUSA Auto Finance chief executive officer Jon Lamb said in the news release. “We look forward to bringing the same impeccable user experience to the DRIVRZ mobile app and all our new business lines.”

Lamb added that MUSA will transition to the DRIVRZ Financial brand over the next several months.

RouteOne senior vice president of business development Jeff Belanger stopped by for a conversation, reflecting on how technology helped the industry navigate the pandemic.

And in this episode of the Auto Remarketing Podcast, Belanger also discussed how the pandemic potentially accelerated some permanent changes in how vehicles are financed and retailed.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

While Lightico’s latest consumer survey illustrated how leery potential buyers remain about going to a vehicle location to complete financing paperwork and take delivery, findings gathered by the facilitator of next-generation digital customer interactions showed rising confidence in being able to maintain payments.

Lightico discovered a 33% drop in the level of consumers concerned about making their monthly payments. Lightico’s survey in October indicated 91% of participants had that concern. When the firm conducted another survey in March, that level declined to 62%.

Lightico sought insights into that improvement, asking consumers about what they’re doing to handle their financial distress. Here are the results the firm uncovered, according to a report shared with Auto Fin Journal:

— 56% cut back on expenses

— 48% working extra hours

— 36% seek accommodations from their current finance company or additional credit

— 32% looking for a second job

Lightico looked deeper into how much consumers are trying to change the terms of their installment contract, and the firm found that volume is down dramatically. In October, 71% of consumers Lightico surveyed were trying this strategy. In March, the level dropped to just 31%.

For consumers more financially stable and looking to finance a vehicle acquisition, Lightico learned that the majority of respondents would rather not have the entire process happen physically at a dealership with just 36% stating that intention.

While 27% of respondents told Lightico they still might go back to a dealership if extra precautions were taken, another 27% of consumers want as much of the transaction completed remotely as possible.

Furthermore, 11% of survey participants told Lightico that they only would make a financed acquisition if it could be finalized and delivered completely remotely.

Lightico offered some details about the 1,202 consumers who participated in the March survey. They included:

Age breakdown

18-24 (61)

25-34 (459)

35-44 (373)

45-54 (178)

55-64 (101)

65 and older (30)

Annual household income breakdown

Less than $35,000 (189)

$36,000-$60,000 (407)

$61,000-$85,000 (294)

$86,000-$125,000 (195)

More than $128,000 (117)

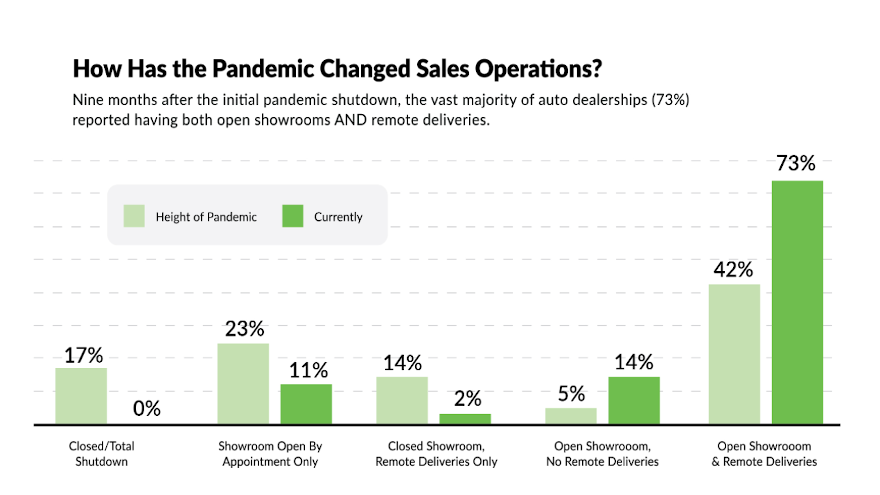

Capital One discovered that perhaps not everything about the financing and retailing of vehicles changed because of the pandemic.

While buyers are increasingly using digital tools to shop for a vehicle, Capital One compiled data that shows U.S. consumers say they still value the in-person experience at dealerships. That assertion came via Capital One’s inaugural Car Buying Outlook, what the bank called the first-ever survey of both consumer and dealer preferences, attitudes and behaviors around auto financing.

Capital One said 77% of respondents reported they will research financing options and pre-qualification online more than before as a result of COVID-19.

At the same time, Capital One indicated in-person dealer experiences like test driving and negotiations are still important, with 82% of respondents saying they will visit more than one dealership.

“For most Americans, buying a car is one of the biggest purchases they’ll ever make, so it’s not surprising that they want to see, feel and experience this investment for themselves in person, alongside a trusted dealer advisor,” said Sanjiv Yajnik, president of financial services at Capital One.

“The future of car buying requires embracing a model that marries digital tools with physical experience, empowering customers to have the car buying journey they want,” Yajnik continued in a news release.

Additional survey findings delved into three crucial topics.

Value of the in-person experience

Capital One discovered consumers value in-person elements of the vehicle-buying experience and visited the dealership even in the midst of COVID-19, reinforced by these data points:

— 94% of buyers are most comfortable purchasing a vehicle from a dealership.

— 92% of buyers say the test drive is an important part of the buying process.

— 82% of future buyers say they plan to visit more than one dealership.

— 43% of future buyers plan to have financing discussions at the dealership.

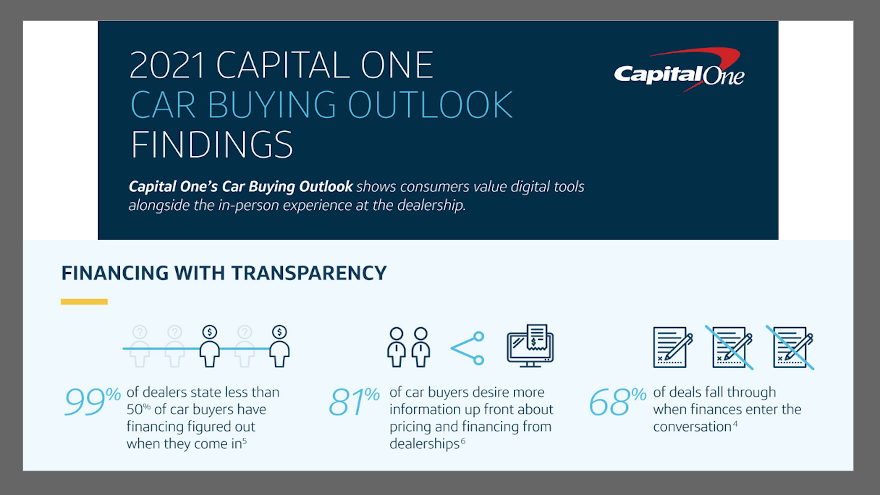

Financing with transparency

Capital One emphasized that dealers play an important role in how vehicle buyers understand their financing options as shown by:

— 68% of deals fall through when finances enter the conversation, according to both dealers and buyers.

— 99% of dealers state less than half of their consumers have their financing figured out when they arrive.

— 54% of buyers state they think about financing after settling on a vehicle, an increase from 43% in 2019.

— 81% of buyers say dealerships should provide more information up front about pricing and financing.

Dealers digitize to meet customer demands

Dealers are adopting digital tools to enhance customer engagement as more consumers turn online for shopping.

— 69% of dealers say the role of technology and digitization in dealer operations will be more important post-COVID-19.

— 56% of dealers have permanently increased their use of digital tools to combat business challenges brought on by COVID-19.

— 38% of dealers agree that the need to improve customers’ experience with technology has been accelerated by COVID-19.

Capital One’s Car Buying Outlook was compiled from findings from two surveys targeted to consumers and dealers.

The consumer survey of 1,000 U.S. adults ages 18 and older was conducted on behalf of Capital One Auto Finance using Ipsos. Of the 1,000, 348 have bought or leased a vehicle in the past 6 months and 652 self-reported that they’re planning to buy or lease a vehicle within the next two years.

The dealer survey of 401 current dealers was conducted on behalf of Capital One Auto Finance using Beresford. Of the 401 respondents, 132 were self-reported as owners, 133 as general managers, 30 as F&I directors, 83 as sales managers and 23 as internet managers.

Pete MacInnis came back for another podcast episode to recap not only what dealerships have learned about digital retailing from pandemic, but also how eLEND Solutions found ways to generate year-over-year gains while COVID-19 impacted the automotive industry.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Digital financing innovator eLEND Solutions highlighted more than 10 findings from its latest dealer survey, reiterating how the COVID-19 pandemic has encouraged dealerships to embrace digital retailing as a low-touch transaction alternative and how this adoption of technology has changed traditional dealer process and perception.

Based on a survey fielded by eLEND Solutions among dealers during the fourth quarter, eLEND Solutions indicated that perhaps one of the most important findings in the report is how dealer perceptions have shifted as a result of the change to digital retailing.

According to the survey results released on Monday, 53% now see digital retailing as a deal generator — what study dubbed “the start of the deal” — while 47% continue to view digital retailing as little more than enhanced lead generation.

The resulting survey report titled, “The Pandemic Drove a Great Leap Forward in Digital Retailing Adoption” explored the shift in dealer acceptance and application of digital retailing, while also investigating whether this forced innovation has been a blessing — or curse — for dealers.

“Confronting change can be a painful challenge for dealers, which is understandable given the risk inherent to implementing a new process, retraining staff, and the application of technology which can cause significant upheaval and anxiety in a store…so I can see it could be viewed as a ‘curse,’” eLEND Solutions chief executive officer Pete MacInnis said in a news release.

“What this study reveals, however, is that while dealers were forced into change by the pandemic, they quickly saw the value and have embraced it as a blessing in disguise,” continued MacInnis, referencing that among those digital retailing blessings is a trend toward higher profit-per-vehicle retailed (PVR) and reduced transaction times.

Other key highlights from the newest eLEND Solutions digital retailing survey include:

• 80% of auto dealers said the pandemic has accelerated their adoption of digital path-to-purchase experiences.

• 90% say they expect to continue, or accelerate, digital retailing at their dealership

• 53% see digital retailing as deal generation, “the start of the deal”

• 20% define digital retailing’s ‘relative finish’ as contracting and remote delivery

• 90% of say their websites are more transactional today than they were pre-pandemic.

• 87% report that digital retail-initiated transactions have resulted in unchanged, or higher, PVR (profit-per-vehicle retailed)

• 64% said they reduced total transaction times compared to the pre-COVID average

• 38% reported a reduction of at least 30 minutes off the transaction time

• 56% of dealers said that ‘process change’ was the most difficult aspect of transitioning to a digital-first sales process

• 23% said CSI scores improved with digital retail adoption

“Old habits die hard in the auto industry, so this shift in perception is pretty extraordinary,” MacInnis said. “It’s inspiring to see dealers evolve to, and embrace, technology that will expand the power and value of their business model. Getting to over 50% of auto dealerships viewing digital retailing as ‘deal’ versus ‘lead’ generation is huge.”

The survey showed that dealer acceptance of digital retail as a “deal” maker is supported by their opinions about the actual steps in the experience: Only 14% of dealers see digital retailing ending at the first pencil, and almost 30% see its “relative finish” as getting to a qualified deal structure — including trade and down payment.

“The positive impact that digital retailing has on PVR is a clear myth-buster,” MacInnis said. “Dealers should view this as a signal that it’s time to rethink the common belief that digital retailing has an adverse impact on PVR, and realize that — pandemic or not — consumers now think digital retailing is a normal and necessary part of their vehicle transaction.”

The report also mentioned another silver lining of COVID-19 has been the industry’s rapid adoption of digital buying experiences to meet consumers' demands for a low-touch transaction.

“The survey findings tell us that the pandemic was key to digital adoption,” MacInnis said. “It’s entirely likely that the same level of adoption, without a pandemic, could have taken up to five years.”

MacInnis pointed out that the survey also showed that challenges remain with the in-store process.

Just 23% of dealers surveyed said that CSI scores had improved, with 66% seeing no change at the time of the survey. MacInnis noted that one possible explanation is that digital retailing technology, and the required process changes, had not yet been widely implemented.

While most dealers ranked the transition to a digital-first sales process as “not extremely difficult,” 56% said that the hardest aspect was process change. MacInnis suggested the customer experience could well be hampered by online to in-store redundancies.

“Customers don’t want to do what they did online at the dealership,” MacInnis said. “They have expectations that starting the deal online means that they’ll save time at the dealership.”

To download the full survey report, go to this website. Officials from eLEND Solutions will be at the 2021 NADA Virtual Expo, with details available on this website.

It is certainly an understatement to say the world has been turned on to online shopping and digital retailing. According to Adobe Analytics, during the 2020 Black Friday event, online sales increased 22% over the previous year. What’s more, the National Retail Federation expected this year’s online holiday sales totals would increase 20% and reach $202 billion.

The automotive industry is experiencing this same phenomenon, much of it fueled by the shelter in place orders associated with the COVID-19 pandemic.

Internet shopping is now normal

Particularly for younger car shoppers, digital retailing has increasingly grown in popularity. According to McKinsey, less than a third of younger consumers today want to shop for their next car in-person at the dealership, and a larger number of these individuals are interested in contactless service as well.

Furthermore, according to Cars.com, 48% of consumers today would like to handle price negotiations online, and another 42% say they want to handle financing online, including being able to obtain accurate payments online.

In order to truly deliver the optimal automotive retail experience for consumers in an online environment, there are many components that must be artfully tied together to deliver consistent, transparent messaging for every step of the customers’ journey.

Automotive retailers are ready

Expedited by COVID-19, the automotive retail ecosystem is currently undergoing its own shift toward a more consumer-friendly model that promises to mimic the convenience of online shopping found in many of today’s popular Internet retail portals. To successfully tap into this ecosystem and deliver on this promise, the industry is beginning to leverage science, technology and data to create a frictionless automotive shopping experience.

One key is certainly data. The industry has plenty of data that can tell you what the trends were 90 days ago; perhaps even statically advise what is available for a particular circumstance. Yet, all of that data without science is just noise. Now, however, there is a platform that ties together all the pertinent data points necessary to arrive at a scientifically perfect, transact able solution for your customer. After all, there’s a reason why the windshield is much larger than the rear-view mirror. Today, the industry has access to the most powerful analytics platforms ever created to make educated, tactical and profitable decisions.

The best solutions today are designed to empower and enable dealerships to excel in digital retailing and revolutionize the way manufacturers and lenders construct offerings to win market share — without overspending.

The technological ecosystem

What’s empowering and driving this ecosystem of digital retailing for automotive is a comprehensive database containing every parameter, policy and factor that can influence an automotive sale or lease transaction – every lender program, every manufacturer rebate and incentive, every municipality tax and fee and every term and condition under which each dealership is willing to transact. Additionally, today’s trusted platforms enable the seamless representation of all five major automotive sectors required for a successful transaction, online or in-store:

• Manufacturer: Every model and trim offered by every manufacturer; all respective incentives and rebates including compatibility and “stackability” rules, as well as VIN-specific, option package specific, regional specific and dealership specific targeted offers.

• Lender: Every published program offered by each lender in the country, including all parameters, policies and factors that can influence any automotive transaction.

• Dealer: Each dealer’s individual selling price rules, lender relationships, fees, reserve policies, and all other required terms and conditions.

• Municipality & Government: All state, county and local laws, rules, regulations, calculation methodologies, tax percentage rates and registration fee and DMV calculations.

• Consumer: All consumer credit bands and how those are segmented and considered by every manufacturer and Lender.

Pulling all the pieces together

Dealers, lenders and manufacturers all need to be seamlessly tied together in a comprehensive system that offers a dashboard and a portal of all pertinent data necessary to build, offer and transact. This technology includes a solution that mines, analyzes and manages the billions of combinations and iterations of all lender and manufacturer programs available in the marketplace and finds truly superior, scientifically perfect solutions for all stakeholders: consumers, dealers, lenders and manufacturers.

Furthermore, today’s best and most comprehensive solutions enhance the consumer experience and the showroom process by electronically presenting all payment and purchase options to customers with full compliance and transparency — on any computer, tablet or mobile device — at any/all points along the consumer’s shopping journey. As a result, the process can dramatically shorten transaction times, raise dealership efficiencies and margins, and elevate customer satisfaction as a result of a more streamlined process.

With these new technologies available to the entire automotive value chain, digital retailing is poised to see a tremendous lift in 2021.

Rusty West is president of Market Scan Information Systems and has more than three decades worth of experience developing leading data and technology-based solutions for the automotive industry. For more information, visit www.marketscan.com.

On Tuesday, Walser Automotive Group, in partnership with PICO Venture Partners, announced the launch of a cloud-based predictive finance management system fueled by artificial intelligence that’s designed to cut the delivery process down from an average of three hours to 30 minutes.

Along with that time savings, company leaders said the FUSE Autotech fintech software platform can enable other dealerships to convert more deals with higher margins while simultaneously improving the customer experience.

According to a news release, Walser partnered with PICO Venture Partners to develop a SaaS business platform that combines Walser’s in-depth operational and market knowledge of the automotive industry with PICO’s expertise in building and scaling automotive retail software companies.

FUSE Autotech can enable dealers to provide consumers with a fully automated online and in-store retail experience.

PICO Venture Partners led the Series A investment in FUSE Autotech. PICO Venture Partners managing partner Elie Wurtman joined the company as executive chairman alongside Andrew Walser, chief executive officer of Walser Automotive Group.

Wurtman has more than 27 years of experience as an entrepreneur, executive and investor and is one of the co-founders of online used-vehicle retailer Vroom.

Colton Ray will serve as CEO of FUSE Autotech, according to the news release.

Another member of the Walser Automotive Group — partner Paul Walser — is set to become the 2021 chairman of the National Automobile Dealers Association. Walser discussed digital retailing and other topics in a special Q&A that’s set to be included in the February edition of Auto Remarketing that delves into how dealer groups of all sizes are trying to leverage online and in-store opportunities to keep vehicles turning.

Meanwhile, you can find the January edition in digital form by going to this website. Or to subscribe to the print version, go to www.autoremarketing.com/subscribe.