Dealerships that use Auto/Mate and Dealertrack now might have a smoother workday when putting deals together for potential buyers.

On Monday, the companies announced a new integration that connects Auto/Mate’s dealership management system (DMS) to Dealertrack’s digital contracting.

The DealerSocket business unit and the F&I solutions firm that’s part of Cox Automotive explained that the real-time data exchange is designed to streamline and automate a dealer’s digital contracting process, resulting in seamless contract submission, reduced errors from manual data entry,and faster deal funding.

Auto/Mate users now can log into Dealertrack digital contracting and enter the deal number to import the contact information from the DMS and populate the required data fields. All that is left is contract validation, having the customer sign electronically and submission to the finance source for funding.

“Since the acquisition of Auto/Mate, we have directed significant investments toward streamlining workflows, reducing keystrokes, and addressing what matters most to dealers when it comes to their F&I operations: faster funding and reduced contracts in transit,” DealerSocket chief product and technology officer Alok Tyagi said in a news release.

“Today’s announced integration with Dealertrack digital contracting accomplishes all three while giving our customers access to one of the industry’s leading providers of digital contracting,” Tyagi continued.

Recent Dealertrack user studies showed that 60% of dealership F&I staff who have not yet adopted an eContracting solution feel DMS integration is the most important capability they lack.

“We view the DMS as the core of a dealer’s business and an enabler of everything they do. That’s why this integration with Dealertrack is so important, as digital contracting and eContracting represent a critical step toward delivering a digital car-buying experience,” said Tony Graham, executive vice president and general manager of Auto/Mate.

“Enabling a seamless flow of data while preserving data integrity is equally critical for dealership employees operating in a fast-paced, results-oriented environment, and the elimination of unnecessary paper-pushing and user errors often results in steadier cash flow for the dealer,” Graham continued.

Cheryl Miller, vice president of operations for Dealertrack F&I Solutions, added: “With the addition of the Auto/Mate DMS integration, we advance our goal to have as many dealerships as possible benefitting from the ease of use of the completely digital contracting workflow that Dealertrack Digital Contracting can provide.”

Executives added that Auto/Mate DMS customers must be on Dealertrack uniFI and signed up for the platform’s digital contracting enhancement to take advantage of the new integration.

For many of us, it feels like 2021 cannot get here soon enough. While we all are ready for a fresh slate, a robust end-of-year auto lending strategy to close out 2020 on a high note and enter 2021 on the right footing will be essential to setting your business up for success in the months to come.

And with 76% of consumers open to the idea of buying a vehicle 100% online, it is no surprise that lenders will need to continue to position themselves to support digital transactions without letting compliance fall by the wayside.

However, the landscape is changing at a record pace and today’s news is quickly becoming tomorrow’s history. To get ahead and stay ahead of the pack going into 2021 and beyond, lenders will need to make sure they are evolving their business strategies to account for the following three virtual auto lending trends.

1. New Security Measures for a Digital World

According to the 2020 Cox Automotive COVID-19 Digital Shopping Study, consumer likelihood to apply for a car loan or get financing online has risen by 30% post-COVID. And that was from May. The growing adoption of remote signing and delivery technology since then has likely pushed this number even higher. But as more dealerships and lenders strive to deliver on a purely digital F&I process, identity fraud and compliance concerns have also risen. And it’s easy to understand why. Will dealerships be able to keep up with anti-fraud and compliance measures online and remotely? How will responsibility for verifying identities shift between the dealer and lender in a virtual environment? The questions go on.

Ultimately, the truth is that there are scammers out there looking to take advantage of the current situation and digital migration. It will be on both the dealer and the lender to stay vigilant and diligently run OFAC checks and Red Flag alerts. Lenders should also be leveraging structured stipulations as a tool to, in part, confirm the legitimacy of a customer’s identity before a deal is executed. On the other side, these stipulations can help dealership staff better communicate which documents a customer will need for the funding process.

Lastly, it is also important to remember that even once a contract is signed, compliance concerns remain. Take same-day delivery as an example. If the customer signs the contract prior to delivery, they will start to accrue interest before they even own the car. Because dealerships are typically unable to pre-date contracts, they have a responsibility to ensure delivery the same day as signing. Lenders should therefore make sure to work closely with their dealer partners to guarantee a seamless same-day delivery process.

2. Automating the Funding Process

Many lenders are fast-tracking their digital transformation and adjusting business processes to do what is necessary to remain competitive, profitable and efficient in the current economy. Several OEMs have followed suit as well, partnering with their captive finance arms and franchise dealers to go more digital, with some even charging dealerships a fee for using a paper contract.

We as an industry must continue to make progress toward the larger goal of a fully automated funding process. In a shrinking economy, dealers and lenders must be as effective as possible in their margins. By pushing more data into the loan origination system, an automated funding process leads to increased capacity and fewer errors, enabling lenders to provide a higher level of service and move contracts more efficiently. In fact, Dealertrack is seeing a less than 1% return rate on digital contracts.

When the funding process can be done in a systematic, automated fashion, you eliminate the need for the lender to review every nook and cranny of a contract. Instead, they will be able to quickly eye a contract and move it forward to funding. Key areas where automation can be applied to ‘perfect’ the contract funding process and eliminate the time-consuming tasks that come with manual data entry and validation include:

• The collection, preparation and verification of the contract data

• The digitization of all ancillary documents, such as extended service contracts and GAP insurance, to guarantee all data is accurate and everything has been signed

• The verification of all stipulations and loan collateral

3. A Shift in the Auto Lending Dynamic

The rising popularity and necessity of digital retailing is fundamentally changing where consumers are completing credit applications. This used to be done exclusively in-store at the dealership but now it is increasingly done online elsewhere. As a result, the way dealers and lenders work together has also shifted. How exactly? Well, traditionally consumers found a car to buy at a dealership and the dealership helped them find lending options. Today, lenders are working harder to retain more of their customers by pre-approving them for auto financing first and then directing them to the dealership. Consequently, what was once a linear relationship between the dealership and lender has now become a triangle between the dealer, lender and consumer. The new dynamic requires all three parties to partner together for a successful transaction.

As lenders today look to engage with car buyers earlier in the process in an effort to pre-approve them for auto financing, they are also delivering a value-added service for their dealer partners. This shifting dynamic also requires dealers to leverage a deeper pool of lenders and credit unions.

Embracing this changing landscape and adapting business strategies accordingly will ultimately lead to an improved, symbiotic relationship between lenders and their dealer partners — the result being more originations for the lender and more sales for the dealership.

There is no getting around the facts. Yes, the SAAR is forecasted to be down for 2020, but U.S. auto sales have proven to be nothing short of resilient. That means there are still originations to be had this year. However, with fewer originations to go around overall, lenders will be competing at the service level to come out on top. Those who are closely tracking virtual auto lending trends and using them to shape their business strategies will be best positioned for success when the new year comes ringing.

Andy Mayers is a lender solutions strategist at Dealertrack.

When it comes to digital financing through dealerships and finance companies, the genie is out of the bottle. The toothpaste is out of the tube. Pick whatever analogy you want to use, as J.D. Power put it: customers “won’t go back to the old way of doing things.”

According to the J.D. Power 2020 U.S. Consumer Financing Satisfaction Study, more vehicle buyers than ever have turned to digital channels when it comes to pre-transaction research and lining up financing options for a vehicle.

Study orchestrators explained that meeting with the dealership’s finance department — the one in which vehicle buyers are presented with the dealer’s recommended financing options and offered add-ons — is evolving to more of a digital experience and is being dictated by consumer demand.

J.D. Power also discovered a growing percentage are securing direct financing prior to their purchase. While some of this behavior has been driven by the COVID-19 pandemic, an increasing number of buyers say they prefer a digital origination process for their next vehicle purchase.

“The pandemic accelerated a trend toward digital auto loan origination that has been developing for some time,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power.

“Many buyers who have secured financing digitally had a great experience and won’t go back to the old way of doing things — even when COVID-19 is no longer a factor,” Roosenberg continued in a news release.

“To improve satisfaction and lower the cost to serve during these changing times and beyond, providers need to build a robust digital platform that addresses borrower needs, from research and origination through account management and billing.”

Four other key findings from the 2020 study include:

• More consumers complete digital credit applications, and like it: Nearly one-third (32%) of auto loan borrowers completed a digital credit application, with 22% using the finance company’s website and 10% using a mobile app.

J.D. Power indicated the frequency of digital applications has increased 8 percentage points from last year. The average customer satisfaction score for those applying for an auto loan digitally is 887 (on a 1,000-point scale), while the average customer satisfaction score for those applying at a dealership is 842.

• A trend that signals staying power beyond the pandemic: A total of 40% of borrowers say they prefer at least part of the financing origination process to be digital when they purchase their next vehicle.

The number of borrowers who say they will apply for financing digitally (via website or mobile app) in the future is up 3 percentage points from 2019, while the number of consumers who say they will secure financing through the dealership is down 4 percentage points year-over-year.

• Direct financing gains traction, led by luxury segment: While 85% of auto-finance customers still secure their financing through the dealership, more borrowers than ever are pursuing direct financing.

J.D. Power indicated a total of 15% of participants in this year’s study secured direct financing, up 3 percentage points from a year ago. In the luxury segment, that number is up 3 percentage points to 26% of all eventual contract holders.

• Digital account management and bill pay improves customer satisfaction: A growing number of borrowers also are turning to digital channels for loan account management and bill pay.

During the past two years, J.D. Power use of finance company mobile apps for account management has increased 8 percentage points and use of the website has increased 2 percentage points, while offline account management has declined three percentage points.

The study also showed customers have the highest levels of overall satisfaction (884) when using finance company’s mobile app.

Finance company rankings

Lincoln Automotive Financial Services ranked highest in customer satisfaction among luxury brands with a score of 899.

Capital One Auto Finance (885) came in second and BMW Financial Services (881) finished third.

BB&T now Truist ranked highest among mass market brands with a score of 879. Capital One Auto Finance (870) and Ford Credit (870) finished in a tie for second place.

The J.D. Power U.S. Consumer Financing Satisfaction Study measures overall customer satisfaction in five factors, including:

— Billing and payment process

— Mobile app experience

— Onboarding process

— Origination process

— Website experience

The study was fielded in July and August and is based on responses from 10,103 customers who financed a new or used vehicle through an installment contract or lease within the past three years.

Luxury Rankings

Lincoln Automotive Financial Services: 899

Capital One Auto Finance: 885

BMW Financial Services: 881

Infiniti Financial Services: 876

Lexus Financial Services: 876

Audi Financial Services: 875

Bank of America: 866

Wells Fargo Auto: 866

Segment Average: 886

Mercedes-Benz Financial Services: 862

Chase Automotive Finance: 850

Acura Financial Services: 849

General Motors Financial: 849

Mass Market Rankings

BB&T now Truist: 879

Capital One Auto Finance: 870

Ford Credit: 870

Honda Financial Services: 866

Bank of America: 860

General Motors Financial: 859

Chase Automotive Finance: 857

Southeast Toyota Finance: 855

Ally Financial: 853

Segment Average: 850

NMAC: 847

Toyota Financial Services: 845

Hyundai Motor Finance: 842

Wells Fargo Auto: 839

TD Auto Finance: 836

Chrysler Capital: 834

Kia Motor Finance: 833

U.S. Bank: 832

Volkswagen Credit: 831

PNC Bank: 823

Huntington National Bank: 822

Fifth Third Bank: 811

Citizens One Auto Finance: 805

Santander Auto Finance: 801

Market Scan Information Systems’ newest partnership is with one of the world’s largest automakers.

On Monday, the automotive solutions and data provider announced it will integrate with General Motors’ Shop.Click.Drive digital retailing platform. Shop.Click.Drive will be powered with Market Scan’s mScanAPI solution — a database and payment calculation technology tool.

“We are honored General Motors recognized that our data, technology and solutions can help enhance the Shop.Click.Drive shopping experience” Market Scan president and co-founder Rusty West said in a news release.

“We are excited to work with such an iconic company as General Motors,” West continued. “We commend GM for having the insight and vision to provide their dealerships and consumers with solutions that usher in a new era in automotive retail.”

Market Scan offers unique and proprietary software, data, analytics and calculation technology. Market Scan can electronically track all the data in the five critical sectors of the market — manufacturer, finance company, dealer, municipality and consumer.

Shop.Click.Drive is GM’s tool for providing a simple way to purchase or lease a Chevrolet, Buick, GMC or Cadillac vehicle online. Shop.Click.Drive can enable consumers to model payments, personalize their vehicles, request a test drive, apply for credit, get a value for their trade and other services online.

And at the end of the simple, online process, buyers can have their vehicle prepped and delivered to their home through participating dealers, where available.

“GM has been continuously improving Shop.Click.Drive to make it the best online shopping experience in the industry and the simplest possible way to purchase or lease a new or used Chevrolet, Buick, GMC or Cadillac vehicle online,” said Ed Vogt, director eCommerce for GM’s customer experience organization.

“Integrating Market Scan’s mScanAPI solution will help us deliver payment and pricing information available to our customers and give our dealers an even more powerful tool to enhance the shopping, purchasing and delivery experience,” Vogt continued.

The automaker acknowledged the ongoing coronavirus pandemic heightened the convenience and importance of Shop.Click.Drive to GM, its dealers and vehicle shoppers. GM reported that its dealers have found a nearly five-fold increase in the number of leads in 2020 from Shop.Click.Drive, and the company has consistently cited the online tool as a key to its results.

“Today’s consumers expect immediacy, transparency, consistency, selection and pricing and payment accuracy,” West said. “Similarly, dealerships are desperate for the tools and solutions to help them deliver such an experience.

“The opportunity to collaborate and work with GM and to bring real improvements for dealers and consumers is extremely exciting for us,” he went on to say.

To learn more about Market Scan, visit www.marketscan.com.

Tech startup Carsfast is positioning itself as a contactless and digital service to help consumers buy and finance their next vehicle.

To provide strategic guidance and a progressive growth strategy, Carsfast on Tuesday announced the formation of its advisory board; a group that includes some of the most well-known figures in the industry.

Chairing this group is Marguerite Watanabe, who is the president of Connections Insights and one of this year’s Women in Auto Finance honorees. Previously, Watanabe managed the auto finance practice at BenchMark Consulting, auto related sales at Equifax and strategic partnerships at BarNone.

The other four members include:

— Michael Benoit, who is chairman of Hudson Cook. Benoit and the firm advise industry clients on legal and regulatory compliance and assist clients regulated by the Consumer Financial Protection Bureau.

— Anil Goyal, who has a deep background in risk management, marketing, technology and portfolio optimization. Goyal served as executive vice president of analytics, technology and operations at Black Book until earlier this year and now is currently the president of Corser, a company he co-founded in 2009.

— Paul Rindone, who is a senior executive at CDK Global and has more than 30 years of automotive experience working with dealers, OEMs, finance companies and data, software and analytic providers that improve consumer purchase experiences.

— Adem Yilmaz, who is currently director of enterprise testing technology, analytics and reporting at Wells Fargo. Yilmaz’s prior roles span across multiple fields such as compliance, collections and artificial intelligence business activities within automotive finance companies.

Carsfast gave an explanation of how its tool is designed to function.

After answering some simple questions via text message, Carsfast’s artificial intelligence can communicate to and match shoppers with a range of vehicles that suit their personal and financial needs. Vehicles are delivered directly to the buyer's door, making Carsfast a unique, convenient and safe way to shop and buy vehicles in an era of COVID-19.

Carsfast chief executive officer and co-founder Shaun Sumaru also touched on how valuable the advisory board will be.

“We are forming the advisory board at an exciting time as we continue to drive our exclusively digital channel strategy forward and build deeper relationships with customers and stakeholders,” Sumaru said.

The interaction with dealerships and finance companies is likely intense as ever, especially considering how much happens online nowadays because of the coronavirus pandemic.

How have dealership needs of finance companies adjusted? How have what finance companies need from dealers changed? Dealertrack lender solutions strategist Andy Mayers addressed those topics and more during this episode of the Auto Remarketing Podcast.

To listen to the entire conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

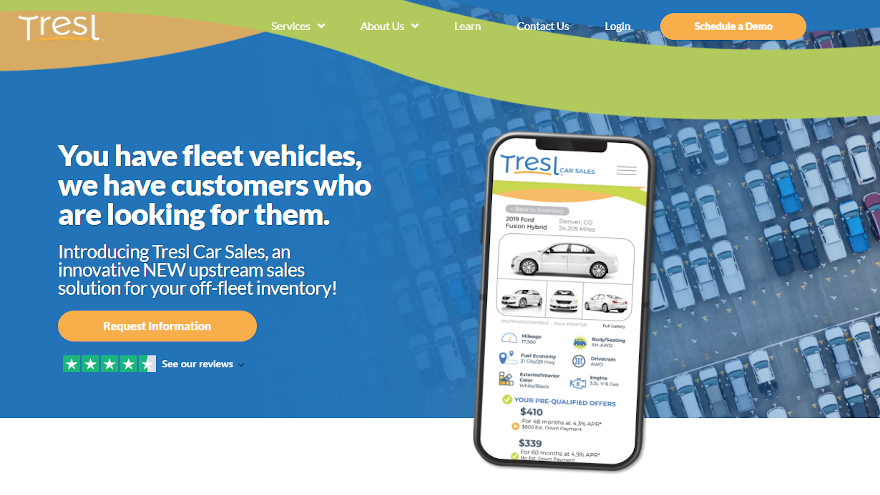

After announcing its new name and branding back in May, Tresl recently launched its newest offering to augment its menu of services that include auto refinancing, lease purchases and off-fleet purchases.

The company described Tresl Car Sales as an innovative new digital web application aimed at “forever changing the way consumers shop and purchase a vehicle.”

According to a news release, the official launch included 24 states with additional states to be added every month.

Tresl explained its platform can enable in-market consumers to pre-qualify for financing, view and purchase inventory from fleet operators partnered with Tresl.

The company emphasized its new proprietary platform is built on a robust pre-qual engine. It can enable the customer to easily pre-qualify for auto finance through Tresl and then instantaneously see a variety of off-fleet vehicle offers they qualify to purchase for vehicle within up to a 200-mile radius.

The platform will offer Tresl’s customers:

• A realistic preview of vehicle pricing, APR estimates, and payment estimates unique to them (with no credit impact)

• Vehicles offered at thousands below list price

• The ease of the overall Tresl Car Sales shopping and purchasing experience, which includes all aspects of the sale, including titling of vehicles

• A truly digital, end-to-end car buying experience that gives the customer the ability to start and finish the actual vehicle purchase process from anywhere

While Tresl Car Sales will offer vehicles from a variety of vehicle fleet sources, the company said will manage the actual vehicle purchase process. The benefits of the platform for inventory partners include the following:

• See higher resale gains by selling inventory to a large audience of in-market, pre-qualified buyers

• Experience lower days-to-sell with an upstream selling experience optimized for the customer

• An end-to-end transaction experience to simplify the sale for both the customer and the inventory partner

• A highly cost-effective way to market vehicles to millions of in-market customers across the country (no upfront marketing expense)

“Since 2007, Tresl has simplified auto finance transactions,” chief executive officer Christine Pierson said. “With this new platform, we are shifting two paradigms.

“First, we are flipping the traditional concept that a customer should find a car before seeking financing,” Pierson continued. “On our platform, we will be pre-qualifying customers instantly, so they see the cars they can finance.

“Second, we are challenging the notion that off-fleet inventory can’t be sold en masse directly to consumers online. We want to forever change the way people shop for and purchase a car, for the better,” she went on to say.

For more information or to inquire about becoming a fleet partner, visit mytresl.com/tresl-car-sales-fleet-inventory-partners.

As digital retailing intensifies, CDK Global wants its dealer clients to have a robust team of representatives at the ready when leads arrive through their respective online channels.

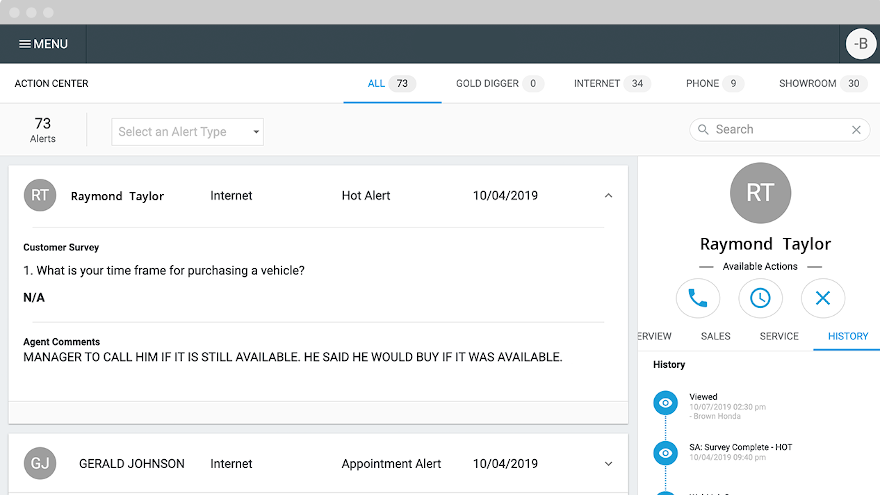

On Monday, CDK announced the launch of BDC Pro, a new addition to its Elead ecosystem. BDC Pro can provides a standardized 90-day lead nurturing program designed to manage the full cycle of internet leads for dealerships that use Elead as their CRM provider.

The company highlighted the solution offers dealers an operating model that is efficient and fully integrated inside the Elead CRM. Dealerships can deliver a better experience by engaging online shoppers with consistent, productive conversations while giving their sales staff more time to focus on providing a VIP experience to guests in the showroom.

According to a news release, BDC Pro can handles first responses, workflow, task management, delivery of confirmed appointments, warm handoffs and no-show follow up. The program has a support network that consists of trained agents for follow-up activities, plus a team of sales operation consultants that help dealerships identify successes and areas of opportunity to improve appointment traffic and gain competitive market share.

“Our vision for the future of BDC is to continuously evolve to keep dealership needs central to the solutions we offer,” said Scott Thompson, senior vice president, CRM and layered applications at CDK.

“As the economy continues to reopen, competition is at an all-time high, and dealers are hyper-focused on expense management,” Thompson continued. “BDC Pro gives them the ability to take advantage of every opportunity, get more showroom appointments, and close deals quickly and efficiently. That’s crucial right now.”

CDK said that BDC Pro can give dealers an affordable way to access a large pool of professionally trained live agents that work as an extension of the in-house dealership sales team. BDC Pro agents are assigned follow-up workflows and tasks based on their training level and skill set to provide superior coverage and lead handling.

The company went on to mention this tool is designed for short- and long-term follow-up strategies for online inquiries with a robust cadence of live calls, texts and emails. BDC Pro can accelerate lead conversions by using advanced software technology to deliver messages at the time most optimal to trigger a response from the auto shopper.

CDK added that each workflow and task completion are connected to the customer record, giving instant visibility into the full history of communications with the car buyer and detailed notes on the interactions.

BDC Pro is currently available in the U.S.

To learn more about to tool or to set up a demonstration, go to this website.

AutoFi says more than 10% of franchised dealerships now use its digital car sales and finance platform, as the fintech firm has enjoyed client growth of more than 125% so far this year.

With the coronavirus pandemic forcing dealers and finance companies to adopt more online practices to keep vehicles rolling over the curb and contract flowing into portfolios, AutoFi also added four technology and auto industry veterans to its leadership team. The newest hires include:

— Matthew Orlando, vice president of major accounts and strategic partnerships

Orlando joined AutoFi after more than 13 years with RouteOne, a joint venture created by Ally Financial, Ford Motor Credit, TD Auto Finance and Toyota Financial Services. He most recently served as RouteOne director of major accounts and director of OEM and partner strategy, focused on business growth in the areas of credit, eContracting, digital retail, and open integration strategy.

Earlier in his career, Orlando served in leadership positions within Blue Cross Blue Shield of Michigan, United Technologies, AlliedSignal, and Motion Industries.

— Michael Helgesen, vice president of dealer success

Helgesen arrived at AutoFi with a history of industry leadership. He most recently departed Cox Automotive as senior divisional manager for Northeast and enterprise partnerships. He created a new Cox division to improve retail performance and operational effectiveness of digital retail applications for over 175 dealer groups, OEM partners, and major account groups.

Prior to Cox Automotive, Helgesen served as chief operating officer of Joe Rizza Ford and for the Grossinger Auto Group. Earlier in his career, he spent nearly 17 years with KIA Motors Americas, finishing as director of central region operations.

— Julia Link, vice president of marketing

Link brings two decades of experience at fast-growing technology companies encompass product marketing and management around business intelligence, security and SaaS platforms to her post at AutoFi.

Link previously was head of product marketing for the website security business unit of Symantec. She has held roles with SAP, McAfee (Intel), Jaspersoft (TIBCO), and Hyperion Solutions (Oracle).

— Ilan Dar, chief information security officer and vice president of engineering

Dar also possesses more than 20 years of experience, leading teams across engineering, product management and information security functions. Prior to joining AutoFi, he was the vice president and chief information security officer at risk management software platform company Sphera.

Dar also previously held leadership roles to drive product innovation and organizational efficiency at Avaya, LiveOps (Serenova), KACE (Dell) and Sybase (SAP).

Along with the new hires and growth within the franchised-dealer community, AutoFi’s recent milestones also include:

— Supporting two of the top four online-only dealers by using the AutoFi finance API to power their digital purchase process

— Automated decisions for more than 40 banks, captives and specialty finance companies

— Checkout experience served to customers 45 million times on 420,000 unique vehicles in August to date

— More than 100 integration partners

— 45% team growth in 2020 in support of dealer customers and product investment

Since the pandemic took hold in March, AutoFi said it has seen monthly submitted credit applications on its platform increase by 80%.

AutoFi chief executive officer and co-founder Kevin Singerman responded in a news release by saying, “2020 has been a disruptive year presenting so many unpredictable obstacles. We’re committed to helping our customers overcome these challenges through technology innovation.

“Digital sales is the fastest-growing segment of automotive retail, and we welcome our new leaders to join us in our mission of helping dealers thrive with digital sales and financing,” Singerman went on to say.

If your state allows it, Dealertrack wants to provide your store the option of letting customers digitally sign documents to complete financing and delivery.

Or as Bridgewater Chevrolet finance manager Christopher Klein puts it: “I can now truly give our customers what they have been asking for — less time at the dealership doing paperwork.”

Dealertrack recently launched Dealertrack Ready Sign, giving Dealertrack uniFI platform users the flexibility to remotely sign and submit any deal document digitally as permitted by their state.

Adding to this enhanced functionality, the company said Dealertrack DMS Laser Forms will now also seamlessly integrate into Dealertrack uniFI to provide dealer staff with one continuous digital workflow.

Combined, Dealertrack highlighted these enhancements streamline F&I and DMS forms into a single signing ceremony for consumers either in-store or remotely, enabling the enhanced and touchless customer experience critical to keeping deals on track regardless of the current environment.

Furthermore, Dealertrack pointed out that it now offers the ability to create and save signature templates for frequently uploaded documents — which can save more time and steps from the deal workflow — especially for stores that complete deliveries in buyer’s driveways or other places besides the showroom.

Over the past few months, Dealertrack acknowledged digital solutions have quickly shifted from “nice to have” to “essential” for dealerships. In fact, according to Dealertrack sales and transaction data, between mid-April and mid-July, interest in e-contracting grew 94% while the number of contracts signed remotely rose by 97%.

“The Dealertrack Ready Sign functionality and Dealertrack DMS Laser Forms integration are the next steps in our ongoing effort to help dealerships adapt to an ever-accelerating shift online,” said Cheryl Miller, vice president of operations for Dealertrack F&I Solutions.

“With the ability to more securely upload, sign and submit all deal documents digitally from a single location, delivering an adaptable and paperless customer experience has never been simpler,” Miller continued in a news release

Using Dealertrack Digital Contracting with the new Ready Sign functionality, sales staff can add a signature block, date and initials to any deal document uploaded to Dealertrack uniFI. This enhancement significantly expands dealerships’ eSigning capabilities beyond the traditional funding and compliance forms.

Dealertrack users can now eSign — from anywhere — any dealership, state or other document that is eligible to be electronically signed by state law, including:

• Credit application, credit bureau authorization and privacy notice

• Aftermarket contracts and final menu documents

• State specific forms such as odometer statement and buyer’s guide (in states where digital signing is allowed)

• Dealership specific forms such as we owe, buyer’s order and GPS disclosure

Streamlining the workflow further, Dealertrack DMS Laser Forms that previously needed to be signed in a separate session within the DMS now be can imported and signed in Dealertrack uniFI. As a result, what has historically been a frustrating process of printing and signing documents across multiple platforms is now possible virtually in a single signing session, according to the company.

Klein, the finance manager for Bridgewater Chevrolet in Bridgewater, N.J., elaborated in the news release about what the Dealertrack tools have done for his store.

“I have been in the car business for 10 years and never thought I would have a single digital signing session,” Klein said.

“With the Dealertrack DMS Laser Forms integration and Dealertrack Ready Sign technology, I can now truly give our customers what they have been asking for — less time at the dealership doing paperwork. Getting them in and out — whether virtually or in-person — in no time with a simple, easy, streamlined experience is giving our customers that ‘wow factor,’ which to me is priceless,” he went on to say.

The release also contained the user experience from another dealership manager. David Barash is finance director for the Glassman Automotive Group in Michigan.

“Dealertrack Ready Sign allows us to be a more versatile and accessible retailer. It has removed obstacles and turned them into opportunities so our sales staff can sell more cars,” Barash said. “With Dealertrack Ready Sign, we can offer a simple, seamless, single signing experience for our customers and business managers either remotely or in-store.

“Enhancing the delivery experience puts the final touch on our version of digital retailing so our tech-savvy clientele can, if they choose, buy a vehicle in their pajamas from home,” he went on to say.

For more information on Dealertrack Digital Contracting and these new enhancements, visit go.dealertrack.com/godigital.