During NADA Show 2023 in Dallas, Tanya Sanders and Cynthia Caine spent time with Cherokee Media Group senior editor Nick Zulovich for this episode of the Auto Remarketing Podcast.

Sanders and Caine both discussed the impact of rising interest rates on their consumer and commercial auto customers as well as other topics in this wide-ranging exchange.

To listen to the conversation, click on the link available below.

Download and subscribe to the Auto Remarketing Podcast on iTunes.

AutoFi announced on Wednesday that it has extended its partnership with Santander Consumer USA, bringing to market digital products that are geared to “meaningfully improve” the ability for consumers and dealers to interact with the finance company and simplify the vehicle buying experience.

The Emerging 8 honoree and SCUSA first formed their partnership last year. Within six months of the collaboration, the company said a digital dealer experience was developed featuring tools that enable dealers to interact with Santander in real time and identify vehicles on the lot that fit the consumer’s budget as well as the specifications to complete the deal.

AutoFi explained this ability to self-service the contract decisioning process makes it easier and faster for dealers to solution for their customers and best meet their needs.

Over the course of the past year, AutoFi scaled the solution across more than 13,000 dealers, providing the technology, operational, and inventory management support of the product for the finance company.

Then late last year, AutoFi worked with Santander to pilot a direct-to-consumer marketplace in the Southwest region. This marketplace can allow consumers to shop for a vehicle however, wherever, and whenever they want, and streamlines the financing process.

Based on a soft credit pull, consumers can shop by payment with no impact to their credit score. The technology can enable “penny-perfect” pricing instantly across thousands of vehicles and can remove the “guess work in being approved by pairing consumers with cars they can afford.”

AutoFi said the marketplace will bring new “transaction-ready” vehicle shoppers to Santander dealers and is scheduled to roll out nationally in spring.

“The digital innovation created by partnering with AutoFi has not only enhanced business but allowed Santander Consumer to provide better service to our dealer customers and consumers,” said Bruce Jackson, president of Chrysler Capital and auto relationships for Santander.

“We are excited about future endeavors with AutoFi and being able to offer better, more efficient user experiences,” Jackson continued in a news release.

Kevin Singerman is CEO and co-founder of AutoFi.

“We are very proud of the retail innovation we have brought to market with Santander Consumer over the past year,” Singerman said. “From build to launch, the timeframe is unprecedented for this level of digital transformation for automotive lenders. The market dynamics of the past 12 months, including rising interest rates, further underscore the importance of these solutions in ensuring consumers are matched with cars and financing they can afford.”

Beyond the ambitious plans with Santander, the company highlighted 2023 is shaping up to be a “transformational” year for AutoFi, as other industry partners, including dealers, manufacturers, finance companies and marketplaces, lean in to AutoFi's digital capabilities.

The company explained AutoFi is in a unique position to build impactful solutions faster and more cost-effectively than companies can on their own. The company also pointed out enterprise customers value AutoFi’s understanding of how to drive product adoption at the retail level, while adhering to “Big Bank” standards, like SOC2 Type II compliance and robust operations and infrastructure.

Furthermore, the company noted AutoFi’s in-store dealer platform, Deal Center, can address one of the biggest challenges of the online customer journey, a disconnected in-store experience.

“Deal Center connects the dots between the online and offline experiences and enables Enterprise customers to offer AutoFi’s digital capabilities to their dealer network in the showroom, streamlining the sales process and consumer experience,” the company said.

Experian determined that 40.45% of used vehicles retailed during the third quarter of last year included financing.

To make sure that potential buyers who might fall into that category have plenty of options, CarMax on Tuesday nationally launched pre-qualification capability for shoppers on its website and app.

The retailer highlighted this new online financing experience is designed to empower customers with the ability to shop CarMax vehicles nationwide with personalized financing terms, with no impact to their credit score.

CarMax said through a news release that pre-qualified customers will know their terms on vehicles across CarMax’s inventory within minutes, including monthly payment and APR.

In the current economic environment, inflation and rising interest rates continue to be top of mind for many consumers. With CarMax’s pre-qualification capability, used-car shoppers can know what they can afford from the beginning of their journey and feel confident they are on track to find the right car that fits both their needs and budget.

The experience is available on CarMax.com and the CarMax mobile app.

Once pre-qualified, customers can use their pre-qualification to shop on CarMax.com with their personalized finance terms, adjusting filters like down payment to see how it impacts their terms, or filter to show only vehicles that meet their personalized monthly payment budget.

CarMax’s new pre-qualification capability also includes following features and benefits for customers:

• Pre-qualification decisions come directly from multiple finance companies and are personalized for each customer based on their credit profile, with approximately 95% of customers receiving approvals

• The process is fast and convenient, with most customers getting results in minutes across CarMax’s entire nationwide inventory

• Save time and search efficiently with budgeting answers upfront and the ability to sort and filter vehicles using personalized monthly payment and down payment options

• Soft credit inquiry with no impact to credit score

The new pre-qualification capability is also integrated with CarMax’s “Compare Feature,” which can allow customers to see their monthly payment alongside different model features of their favorite vehicles for which they’re pre-qualified.

Customers have access to personalized results to see how each of their top vehicle choices fits both their budget and style.

“We continue to elevate the used car buying experience by building tools that help improve the car shopping and financing process and make it easier and more efficient for our customers,” CarMax CEO Bill Nash said in the news release. “Our industry-leading online finance experience and new pre-qualification capability, that leverages multiple lenders, saves customers time and provides an added layer of confidence in their journey to find their perfect vehicle that fits both their lifestyle and budget.”

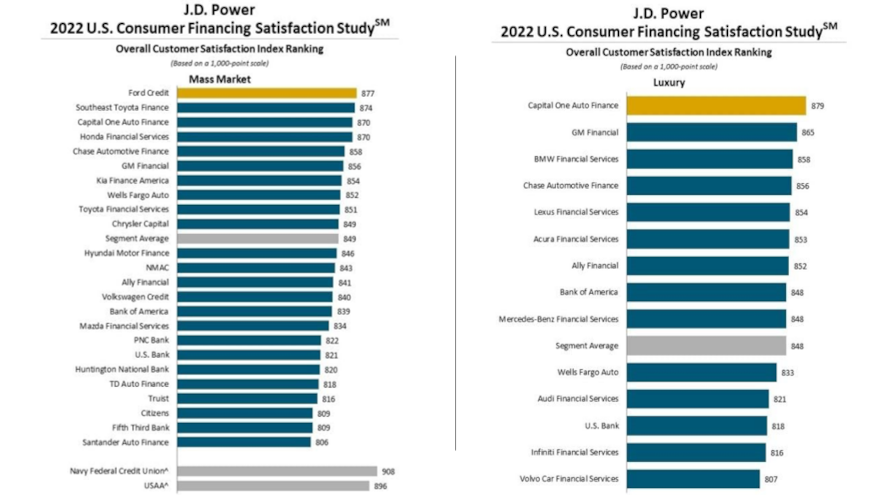

According to the J.D. Power 2022 U.S. Consumer Financing Satisfaction Study, customer retention has become a key focal point for auto finance providers, putting the spotlight on specific actions credit providers can take to drive increased loyalty and brand advocacy.

That focal point surfaced against a backdrop of rising interest rates, slowing origination volumes and increased competition. As a result, J.D. Power explained that auto finance companies are finding that their most valuable future customers are the ones they already have.

“Consumers have more lending choices than ever before,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power. “They’re doing more research and doing that research earlier in the vehicle-buying process. That’s why the customer experiences they are having with their existing lender is so important.

“For lenders that want to secure repeat business with existing customers, it is critical to consistently anticipate and meet their needs at key points in the customer journey,” Roosenberg continued in a news release.

Three key findings of the 2022 study included:

• Captives significantly outperform non-captives for customer advocacy: For a second consecutive year, automotive captive lenders significantly outperform non-captive lenders when it comes to brand advocacy with existing customers.

The average Net Promoter Score (NPS) for captives is 56 and the average NPS for non-captives is 40.

Industry-wide, customers who are promoters (those who say their likelihood to recommend their current finance company as a 9 or 10 (on a 0-10 scale) are nearly twice as likely to say they “definitely will” consider their current lender for their next vehicle when compared to customers who are passive (those who say their likelihood to recommend their current lender as a 7 or 8).

• Most auto financing research begins a month before a purchase: Among auto loan customers who research financing options prior to a purchase, most begin the research process more than 30 days prior to purchasing or leasing a vehicle.

Effective use of both applied for and unsolicited pre-approvals can lead to a greater customer recapture rate and conquest opportunities.

• Key actions to drive brand advocacy: Specific actions taken by auto finance companies that have the most positive effect on customer advocacy include easy-to-use websites; useful account review information; and electronic statements that are easy to set up.

So which providers topped the latest study rankings?

J.D. Power reported Capital One Auto Finance ranked highest in customer satisfaction among luxury brands with a score of 879. GM Financial (865) came in second and BMW Financial Services (858) placed third.

The study showed Ford Credit ranked highest among mass market brands for a second consecutive year with a score of 877. Southeast Toyota Finance (874) placed second, while Capital One Auto Finance (870) and Honda Financial Services (870) finished in a tie for third.

The U.S. Consumer Financing Satisfaction Study measures overall auto financing customer satisfaction in five factors:

—Account management

—Application/approval process

—Billing and payment process

—Customer orientation process

—Customer service experience

The study was fielded in July and August and is based on responses from 10,199 customers who financed a new or used vehicle through an installment contract or lease within the past three years.

NETSOL Technologies, a global business services and enterprise application solutions provider, recently launched its latest product offering called Flex, which is an API-based, ready-to-use calculation engine designed to guarantee precise calculations at all stages of the contract lifecycle through various calculation types.

The company said Flex can provide versatility by covering all the calculation aspects ranging from the pricing for the end customer at inception, in-life financial modifications, the re-creation of the repayment plan, termination, amortizations/re-amortizations, among other calculation types.

“We are extremely excited as Flex has been launched across all regions NETSOL operates in,” said Najeeb Ghauri, founder and CEO of NETSOL Technologies. “It has been launched under the umbrella of Appex marketplace. NETSOL will introduce and launch further products and services under this marketplace in the future.”

Kamran Khalid is chief product officer at NETSOL Technologies.

“Flex is essentially an instant, cloud-based calculation engine for out-of-the-box integration into a client’s products, services and ecosystem,” Khalid said. “With parameter-driven calculations, Flex provides simplistic, multi-dimensional as well as the most complex calculations based on the needs of a client and their business.”

“The pure-play SaaS product is not limited to the global finance and leasing industry, but with native integrations, can become a highly adaptable, scalable and comprehensive solution for various products, services, systems and industries,” he added. “It enables an ecosystem of value across multiple functions and systems to accelerate growth and drive clients into the future by enhancing delivery efficiency and product management.”

To explore Flex, visit www.flexengine.io.

Last week, Tenet announced that the company has secured what it believes is the first-ever electric vehicle (EV) only warehouse facility to make EVs more affordable.

According to a news release, Tenet has entered into a warehouse financing agreement of up to $20 million with Silicon Valley Bank (SVB) to fund Tenet’s EV installment contract.

Tenet said it has “redefined” the financing model for EVs, helping consumers connect to ESG capital markets to save hundreds of dollars each month on their EV payments.

Tenet is looking to leverage a changing landscape.

This year, California approved the Advanced Clean Cars II rule, which states that by 2035, 100% of new vehicles and light trucks sold in California must be zero-emission vehicles.

Company leaders say this sustainable financing facility by SVB empowers Tenet to lead the charge in ESG financing by lowering the cost of ownership for EVs and sustainable home electrification.

“We’re thrilled to work with the Silicon Valley Bank team because this is an industry-first,” Tenet co-founder and CEO Alex Liegl said in the news release. “Our partnership reinforces Tenet’s mission to become the all-in-one ESG financing platform by building financial technology to combat climate change. They have been great collaborators through this process and can help us scale with the potential to significantly upsize the facility over time.

“We are ready to tackle the issue of EV affordability from coast to coast together with the SVB team,” Liegl added.

Nick Christian is head of specialty financing for Silicon Valley Bank.

“Silicon Valley Bank is committed to supporting the climate technology and sustainability economy. Working with companies like Tenet, who are at the forefront of helping consumers fight climate change, is a top priority for us,” Christian said.

“We are proud to support Tenet ‘s growth as they continue to redefine the financing model for EVs and make the switch to driving electric more affordable,” he went on to say.

To learn more about the company, visit www.tenet.com.

Dominion DMS and Market Scan Information Systems now are working together.

The partnership announced this week means Dominion DMS will integrate key data from Market Scan’s APaaS platform, enabling Dominion’s dealers to calculate payments with exact sales tax rates in any ZIP code in every state with scientific precision using the customer’s address.

In today’s market, Dominion and Market Scan pointed out that consumers are willing to travel to various destinations to find a vehicle that meets their needs.

Historically, it has been a challenge for dealerships to quote all-inclusive consumer lease and finance payments accurately. Within VUE DMS, the sales department can accurately calculate payments and the sales tax, whether the buyer is in the dealership, across town, or in another state.

“We are excited to partner with Dominion DMS,” Market Scan president and CEO Rusty West said in a news release. “It has never been more important to present consumers with exact, consistent, and all-inclusive payment quotes online and in the store. Dominion realizes the importance and value of integrating our data into their DMS, resulting in a much-improved consumer experience.”

This relationship with Market Scan came together a few days after Dominion DMS and TruVideo aligned to help dealers in their service drive.

“Our dealer partners praise the value of this integration, especially in today’s challenging market. Dominion DMS looks forward to deepening our integration and improving the workflows through additional value-added services Market Scan offers,” said Arlene Clements, who is vice president of business development at Dominion DMS.

To learn more about Dominion DMS and its VUE DMS platform, visit VUEDMS.com.

Toyota established Toyota Motor Credit Corp. (TMCC) in 1982, a time of bright neon clothes, video arcades, early personal computers, VCRs and lively pop music.

A few months later, the first vehicle financed by the new captive actually was a used car when Burt Toyota in Denver delivered a Toyota Corolla.

Now with four decades of financing and portfolio building, TMCC is celebrating 40 years of growth and success.

As of this month, TMCC — which operates under the brand names of Toyota Financial Services, Lexus Financial Services, Mazda Financial Services, Bass Pro Shops Financial Services and KINTO in the United States — owns a portfolio of nearly 5 million customer accounts, more than 10 million voluntary protection product agreements in force and assets in excess of $135 billion.

“We’d never have been able to achieve such phenomenal success or longevity without the incredible efforts of all our team members over the years,” TMCC president and CEO Mark Templin said in a news release. “Their efforts, coupled with exceptional support from our Toyota, Lexus and private label dealers, as well as our fantastic partners at Toyota Motor North America, have allowed us to thrive.

“We’re looking forward to our next 40 years of supporting dealer needs and helping customers obtain the vehicle of their choice,” Templin continued.

After financing that Corolla back in 1983, TMCC continued a steady pace of expansion, which the captive recapped in the news release:

1984 – TMCC company opens its first branch office in Irvine, Calif.

1985 – Dealer wholesale financing is introduced

1986 – The company expands its product lineup with the launch of Toyota Motor Insurance Services (TMIS)

1987 – Dealer real estate and capital lending programs are introduced

1991 – Lexus Financial Services is established

1996 – Toyota Credit de Puerto Rico begins operations

1998 – The company enters the digital age with the launch of its first online credit application

1999 – Toyota Motor Credit Corporation and Toyota Motor Insurance Services create the umbrella brand Toyota Financial Services (TFS)

2001 – The toyotafinancial.com website launches

2002 – The lexusfinancial.com site goes live

2004 – Partner entity Toyota Financial Savings Bank (TFSB) begins operations

2005 – TFSB introduces the Lexus Pursuits Visa credit card

2007 – The company grows to more than 3,000 team members

2008 – Toyota Rewards Visa credit card launches

2012 – TMCC celebrates 30 years in business

2013 – TMCC issues its first Diversity & Inclusion (D&I) Bond, demonstrating that Toyota’s commitment to diversity and inclusion permeates all aspects of its business

2014 – TMCC issues its first asset-backed Green Bond

2017 – TMCC relocates its headquarters to Plano, Texas, partnering with Toyota Motor North America

2018 – The company introduces its IncomeDriver Notes retail program for investors

2019 – The company rolls out private label financing with Mazda as its first client

2020 – Mazda Financial Services begins consumer retail and lease business

2021 – The company expands its private label business to Bass Pro Shops and Cabela’s

“Our goal has always been to provide the best possible service in every interaction,” TMCC senior vice president and chief operating officer Alec Hagey said. “Our value proposition to dealers is based on enhancing customer loyalty to the brand, and we do that by going the extra mile to keep customers satisfied.”

As TMCC has grown, the company also highlighted it commitment to supporting our communities.

The company has received recognition from the Points of Light Foundation, repeatedly being included on the Civic 50 list of the most community-minded organizations in the nation.

TMCC has long supported the Boys and Girls Clubs of America and Junior Achievement. And, in 2021, it launched the Toyota Leadership Academy, created in partnership with the Lancaster Independent School District in North Texas.

The Toyota Leadership Academy is designed to prepare students for personal, academic and professional success by providing a specialized curriculum designed to increase high school graduation rates; improve college, career and leadership readiness; and introduce students to job opportunities in the global workforce.

“Toyota Motor Credit Corporation isn’t just a company — we’re a group of individuals united by our shared values,” said Ellen Farrell, chief legal and compliance officer and sponsor of the Toyota Leadership Academy program. “We recognize that we only truly attain our full potential when we make a positive impact on those around us.

“Community involvement has been integral to our organization from the beginning. That’s complemented by our commitment to diversity and inclusion as we strive to demonstrate ‘respect for people’ in all that we do. These principles will continue to serve as cornerstones as we set our sights on the future,” Farrell went on to say.

More shops are collaborating to boost financing and ancillary products tailored specifically for electric vehicles.

Tenet, a leading EV financing platform, announced a partnership this week with Xcelerate Auto, a financial technology company with an emphasis on electric vehicles, to couple its EV extended warranty into Tenet’s financing options.

Xcelerate Auto said it designed the first and only electric vehicle service agreement for Tesla in 2019. With this partnership, Tenet customers will now have access to package XCare with their current installment contract.

The provider explained XCare, a comprehensive exclusionary service coverage, is the highest level of coverage that a vehicle qualifies for outside the manufacturer’s warranty, meaning Xcelerate Auto will cover the entire vehicle with the exception of certain excluded items.

Since XCare was originally built for Tesla, it was designed to work around Tesla’s direct-to-customer service model, so owners will not have to worry about servicing their vehicles in any different way than intended by Tesla Service.

“We couldn’t be more excited for this partnership and the opportunity to provide products like XCare EV Protection to Tenet and its drivers,” Xcelerate CEO KJ Gimbel said in a news release. “The moment we met the Tenet team, we recognized the same mission-driven mentality in each other and knew this was the perfect recipe to collaborate. We expect big things to come and can’t wait to work together on our shared mission of making EVs affordable for the average consumer.”

Tenet co-founder and CEO Alex Liegl said, “Working with a company whose mission aligns with ours to revolutionize the EV buying experience is the perfect complement to what we do at Tenet. We are excited to partner with KJ and the Xcelerate Auto team to make Teslas and all EVs more affordable, and look forward to ushering in the mass adoption of electric vehicles.”

To learn more, visit www.tenet.com.

Developments within financial technology nowadays aren’t just driven for consumers’ benefits.

This week, Solifi announced the release of its latest version of Solifi Wholesale Finance SaaS solution, which includes several new automated features to better manage inventory audits, provide real-time reconfirmation of order commitments and further streamline transactions.

As more dealers and wholesale finance companies look to replace manual and repetitive processes with digital solutions, Solifi said these latest features deliver “smarter” ways to finance and manage assets through automation.

This latest quarterly release of Solifi’s Wholesale Finance SaaS offering provides several benefits to enhance the dealer and finance company experience, including:

• Smart audit scheduling with Solifi Wholesale Finance software can replace the traditional time-based dealer inventory audits by intelligently prioritizing higher-risk dealers according to a customized credit and performance-based scoring model. This data-driven solution can minimize disruption caused by onsite audits and reduces the number of audits for low-risk dealers, lowering overall associated cost — while still maintaining collateral controls.

• Audit vendor scheduling management can improve the efficiency and accuracy of audits by allowing lenders to intelligently view, manage, and schedule audits with multiple vendors, reducing risks associated with a single audit provider (such as vendor complacency, not assigning specialists by location or inventory type). The Solifi Wholesale Finance audit dashboard can provide finance companies with visibility to scheduled and waived audits, and the ability to assign and change auditors. Third-party vendor integration enables audit providers improved resource management and optimization capability.

• Automated order re-acceptance can counter unpredictable supply-chain delivery delays and challenges that tie up credit availability and limit sellable inventory. The system can provide automated real-time reconfirmation of order commitments on delayed shipments. Solifi Wholesale Finance reduces the time spent manually tracking delayed shipments, manual lender workarounds, and reentering previously approved credit commitments.

• Bulk transactions functionality can enable in-application processing of high-volume transactions from third-party data sources (such as loan onboarding, payments by asset, waivers, credit scores, vehicle registrations). This automated process can maximize time efficiencies by removing the burden of manual entry and reduces the opportunity for human errors.

“We’re excited about the immediate value our latest automation features will bring to dealers and wholesale lenders as they look for ways to maintain margins, streamline processes, monitor dealer health and inventory, and navigate supply chain issues,” Solifi chief product officer Bill Noel said in a news release.

“With this latest release, our SaaS-based solution allows our customers to better manage risk and expenses related to dealer audits, proactively react to supply chain delays, and efficiently process high-volume transactions,” Noel added.