This week, Alfa announced its latest software update with release 5.7 Alfa Systems, a software platform for asset finance.

Alfa highlighted the latest release follows two years of new enhancements in key areas of the product, with new offerings in the user experience, charges and billing, and configuration among the highlights.

Meanwhile, changes to existing functionality include wholesale, integration and Alfa Systems’ highly valued reporting solution.

The company noted that many of the features in the 5.7 release come directly as a result of market or customer needs, but plenty have come about as a result of opportunities identified by Alfa’s own developers and architects to keep improving how the cloud-native Alfa Systems delivers to customer needs, how it communicates with other systems, and how it can improve the day-to-day lives of its many users.

“We’re committed to helping our clients achieve as much as they can, as painlessly as possible,” Alfa chief technology officer Andrew Flegg said in a news release. “This is because we know they don’t want to worry about systems — they want to get on with doing business, and staying competitive in the market.

“Each time a customer takes Alfa Systems for the first time or upgrades to a later version, they are taking on a wealth of functionality and technical capability that helps them run their business better, build a more robust operation, save a lot of valuable time, and focus their expertise elsewhere,” Flegg continued. “Our platform gives them the power and flexibility not just to respond to changing business needs, but get ahead of them too.”

Solera Holdings and DigniFi want to ensure customers within a dealership’s service drive have the necessary financial resources to cover vehicle repairs.

On Tuesday, the vehicle lifecycle management company announced a strategic partnership with the fintech platform, as Solera will offer access to DigniFi financing options, funded by WebBank, to consumers seeking payment solutions for a range of vehicle repairs made by auto repair and body shops as well as dealers.

According to a news release, Solera is offering the DigniFi solution through several of its platforms and expects to make DigniFi financing options available across three of its operating pillars — vehicle claims, vehicle repairs, and vehicle solutions.

“Adding this offering is a win for Solera’s customers and car owners because DigniFi provides access to a much-needed financing choice for the millions of people not able to pay for an unexpected repair, insurance deductible, or bodywork without assistance,” said Alberto Cairo, Solera managing director of vehicle and fleet solutions.

DigniFi solutions can provide access to financing for almost any vehicle-related expense, including mechanical repairs, preventive maintenance, bodywork, insurance deductibles, vehicle service contracts, accessories, tires, and prepaid maintenance packages.

Drivers can receive financing from $350 to $7,500 to pay for vehicle-related expenses.

To apply, consumers can complete a simple, four-step process and receive an answer in minutes.

“It’s a real thrill to collaborate with like-minded, industry-leading partners, like Solera, who share our commitment to supporting main street and hardworking people across the country. I’m convinced that together, we can build a world where inclusive, accessible funding for the needs and aspirations of daily life is the norm,” DigniFi chief executive officer Neeraj Mehta said.

“At DigniFi, we strive to spark opportunity for small businesses and to delight their consumers through access to visionary, inclusive financing,” Mehta continued.

Solera dealerships, auto repair facilities, and body shops can enroll for DigniFi financing options by sending an email to [email protected].

Just before Labor Day weekend, Bridgecrest, one of the country’s leading digital financial services providers, announced the launch of its newest affiliate, GoFi, an artificial intelligence-enabled, digital-first financing platform.

Leveraging Bridgecrest’s robust auto financing experience, GoFi is focused on offering its innovative white-label and co-branded auto finance solutions to banks, finance companies and other partners, with the goal of meaningfully expanding partners’ existing buy box to allow them to serve more customers.

“We are incredibly excited to build on our history of creating innovative lending solutions with the launch of GoFi,” Bridgecrest chief executive officer Mary Leigh Phillips said in a news release. “Providing a great customer experience while expanding access to credit enables our partners to increase sales, improve unit economics, and better engage and serve customers long-term.”

Built on a proprietary loan origination system and powered by its integrated machine learning algorithms, GoFi can provide auto-decisioned responses across the full credit spectrum. Through simple, intuitive offers, GoFi aims to help partners expand their brand impact and deliver a better customer experience.

GoFi head of lending Karl Stabler explained that GoFi’s program comes to market at a time when finance companies and other market participants are embracing the challenges associated with adapting to a quickly evolving auto landscape.

“Our flexible, fully automated next gen lending platform provides easy integrations to help increase conversion and enhance the lifetime customer relationship for our partners,” Stabler said.

This week, Solifi, a global fintech software partner for secured finance, announced the launch of its software-as-a-service (SaaS)-based lease and installment contract pricing solution for the U.S. equipment and automotive finance industries.

The company said the SaaS version of Solifi’s pricing tool provides users with enhanced pricing and reporting functionality — from simple contracts to complex leases.

Available on Solifi’s open finance platform, the company pointed out the pricing solution is consumption-based rather than priced per user, in an attempt to make it a cost-effective for any size secured finance organization and provides the ability to quickly scale as needed.

This next-gen product leverages the Solifi Lease and Loan Pricing software suite, which can allow equipment and automotive finance companies to easily generate quotes and create reports in one straightforward process — making it simple to offer tailored finance quotes and factor in complex payment, tax and expense details.

Solifi pricing features and functionality also include:

• Advanced tax calculations that include multiple options for pre-tax and after-tax yields

• A full set of downloadable reports that includes summaries, cash flow, tax, rent, accounting, proof-of-yield reports, and casualty / termination reports that protect after-tax yields

• Flexible payment periods that allow users to select desired payment period – including, but not limited to, weekly and fortnightly

• Expansion of calculations that supports calculations based on actual days

• New SaaS-based technology that streamline processes and is more easily maintained with the latest innovation

• Configurable bonus depreciation to accommodate the upcoming 2023 bonus depreciation rate modifications

“We’re excited to introduce our newest solution in our suite of pricing products for equipment and automotive finance lenders, which allows customers to access pricing functionality anywhere and at any time,” Solifi chief product officer Bill Noel said in a news release.

“Our SaaS-based pricing solution features an intuitive user interface making it easy for field sales to quickly create conditional quotes and secure more business. It is our mission to help our customers win and to provide increasing value through our open finance platform,” Noel continued.

According to a news release a pair of independent dealerships in the Southeast are among the stores already seeing the advantages of using Solera Auto Finance (SAF) after receiving rebate checks as part of the finance company’s rewards program.

Drive a Dream, an independent dealership in Marietta, Ga., earned a rebate check that reduced its DMS cost by 40%.

“Click and get paid. It’s just that simple,” Drive a Dream general manager Bill Dangra said in the SAF news release. “We sent over deals, received good financing terms, and hit our goal numbers with no effort.”

The news release also mentioned Wine Automotive in Chesapeake, Va., saw similar success by utilizing SAF, earning a 19% rebate toward its DMS.

“I’m thrilled with the rebate,” Wine Automotive director of finance Brian Korich said in the news release. “The partnership with Solera Auto Finance helps us close deals quickly, and the rewards program is an added bonus.”

After launching in March, SAF said it has quickly gained momentum and bettered its initial growth estimates, expanding to 37 states with plans to be operational in all 50 states by 2023.

By providing a “captive-like” financing solution to the non-prime segment of used-vehicle buyers, SAF said it can level the playing field for independent and franchised dealers and fund deals quickly.

“SAF’s goal has always been to provide a superior car-buying experience that accelerates the funding process and reduces operating costs for dealerships,” Solera Auto Finance chief executive officer Kenn Wardle said. “Dealers who are using SAF are starting to see the value of our innovative solution.”

Details about SAF’s rewards program, including how to enroll, are available at www.solera.com/solutions/auto-finance/ or via email: [email protected].

A new TransUnion study conducted in collaboration with S&P Global Mobility determined the registered electric vehicle market share is expected to grow from 5% at the end of 2021 to approximately 40% by 2031.

Analysts also found that the increasing popularity of such vehicles will have a marked impact on the auto finance industry, as the credit risk profile of consumers purchasing them differs dramatically from those buying traditional gasoline-powered vehicles.

For the purposes of this research, TransUnion and S&P Global Mobility pointed out in a news release distributed on Wednesday that only fully battery-powered electric vehicles (EVs) are included, and not plug-in hybrids. The firms pointed out that traditional internal combustion engine vehicles (ICE) include gasoline, diesel and ethanol vehicles.

They said the study also accounted for luxury and mainstream vehicle types. Approximately 76% of EVs are classified as luxury compared to 16% of ICE.

“Consumer interest in electric vehicles from Tesla, Ford, Nissan and others is only going to grow in the next decade and meeting the unique demands of these buyers will become a business imperative for auto dealers and lenders,” said Satyan Merchant, senior vice president and automotive business leader at TransUnion.

“Our research clearly shows that electric vehicle buyers have excellent credit risk profiles, but this group also has varying preferences, including a larger appetite in shopping around for vehicle financing by digital means,” Merchant continued in the news release.

Credit profile of EV buyers

TransUnion’s study examined the credit risk of both EV and ICE buyers.

Analysts indicated the average credit scores for EV buyers — both those purchasing mainstream or luxury vehicles — was greater than all ICE buyers.

Furthermore, TransUnion noticed EV buyers secured lower interest rates for their vehicle purchases. This was partly due to having better credit risk profiles and because they have lower loan to value (LTV) rates than typical ICE buyers.

Analysts explained loan-to-value is a ratio that is determined by dividing the amount borrowed (including sales tax, title and licensing fees) by the total cost of the vehicle.

Controlling for credit quality, TransUnion noted both mainstream and luxury EV buyers have lower serious delinquency rates versus mainstream and luxury ICE buyers.

For instance, the 60 days past due rate after 12 months for mainstream contracts originated in 2020 was 0.72% for EV and 0.92% for ICE.

For luxury vehicles in the same timeframe, EV had a 0.27% delinquency rate compared to 0.67% for ICE.

“It’s clear that electric vehicle buyers have a stronger credit risk profile than consumers who purchase traditional autos,” said Eric Kohn, co-author of the study and vice president in TransUnion’s automotive business. “In fact, credit performance as measured by serious delinquency rates for mainstream electric vehicle buyers more closely resembles traditional luxury buyers.

“This points to the overall electric vehicle market being both less risky for lenders as well as a more competitive marketplace in securing consumers’ business,” Kohn continued.

EV Buyers Generally Have a Stronger Credit Profile and Make Larger Down Payments

|

Car Buyer

|

Average Credit Score

|

Average APR

|

Average LTV

|

|

ICE Mainstream

|

735

|

4.3%

|

102.2%

|

|

EV Mainstream

|

775

|

2.8%

|

91.6%

|

|

ICE Luxury

|

769

|

3.1%

|

95.3%

|

|

EV Luxury

|

775

|

2.8%

|

88.8%

|

Source: TransUnion

EV buyers conduct more online shopping

TransUnion’s study also included a survey of 1,480 U.S. vehicle owners for their thoughts on electric vehicles and financing.

The survey found that consumers who own or are considering purchasing an EV are more interested in online car shopping and financing experiences.

TransUnion reported more than one-third of EV owners (35%) and those considering buying an EV (36%) conduct research on vehicle makes/models online while this percentage declined to 28% for all other vehicle buyers.

As for understanding financing and monthly payments and completing financing, survey orchestrators found there was an even more dramatic shift in online use for those owning or considering EVs versus all other vehicle owners.

According to the findings, approximately 36% of EV owners said they go online to understand financing/monthly payments with 32% completing financing online.

For all other vehicle owners, TransUnion said the percentage going online to understand financing/monthly payments dropped to 24% with only 16% completing financing online.

“Electric vehicle owners and considerers are far more likely to want to understand what they can afford online and they are more likely want to complete financing online,” Merchant said.

Online prequalification at the start of the shopping process will help lenders capture more EV buyers. As a result, end-to-end digital retailing in partnership with dealers will be critical for lenders,” he concluded.

Tenet recently made progress on multiple financial fronts.

First, the company unveiled a new financial solution intended to lower the cost of ownership for electric vehicles “that rejects standard car depreciation models and values EVs as clean collateral.”

Tenet also plans to expand into zero-emission home upgrades to help consumers better achieve their financial and sustainability goals.

And to make it all possible, the company also announced that it has raised seed funding of $18 million, led by Human Capital and Giant Ventures with participation from Breyer Capital, Global Founders Capital, Firstminute Capital, and prominent angel investors including Michael Tannenbaum, Gokul Rajaram, Michael Ovitz, and more.

Tenet explained in a news release that the company sees traditional auto financing options not accounting for the long-term value that EVs can retain, “resulting in unnecessarily high monthly payments and a disconnect between the smart financial decision and the sustainable one.”

By leveraging EVs’ residual value, Tenet has looked to redefine the terms of a traditional auto installment contract and create an innovative financial solution that will drive even wider adoption of zero-emission technologies.

“With inflation hitting its highest levels in two generations and people paying record prices at the pump, the demand for EVs will continue to grow exponentially,” Tenet co-founder and chief executive officer Alex Liegl said in the news release. “We’ve created a new model for EV financing that incentivizes consumers to adopt new zero-emission technology and will continue expanding our offerings to support sustainable improvements for the entire home.

“We believe in change — putting more change in your wallet and changing the future of climate-positive financing,” Liegl added.

Tenet highlighted that its finance offerings include:

—Monthly savings: Customers can achieve financial goals without sacrificing sustainability goals by saving up to $200 per month.

—API-enabled decisioning within seconds: Tenet’s financing technology allows for immediate underwriting decisioning for consumers and embedded financing options with partners.

—Tracking financial and CO2 savings: Optimize your EV’s efficiency, track your mileage and battery health, and manage payment settings from anywhere with the Tenet dashboard.

That trio of offerings and the company’s ambitious objectives seemed to have impressed the investment community.

Tenet said the seed funding will be used to accelerate growth, grow its team and roll out additional products to better serve its climate and savings-minded customers.

“We’ve been inspired by Alex’s ambitious vision for building the next generation fintech company that rewards consumers for decarbonizing their lifestyle,” Human Capital co-founder and president Baris Akis said in the news release. “We are thrilled to support Tenet as they build and scale the right team to drive their journey."

Cameron McLain, co-founder and managing partner of Giant Ventures, added, “Tenet is reimagining the financial system to accelerate the adoption of climate-positive products. We are excited to work with Tenet as they unlock scalable access to high-quality ESG assets for their institutional investor partners.”

To learn more, visit www.tenet.com.

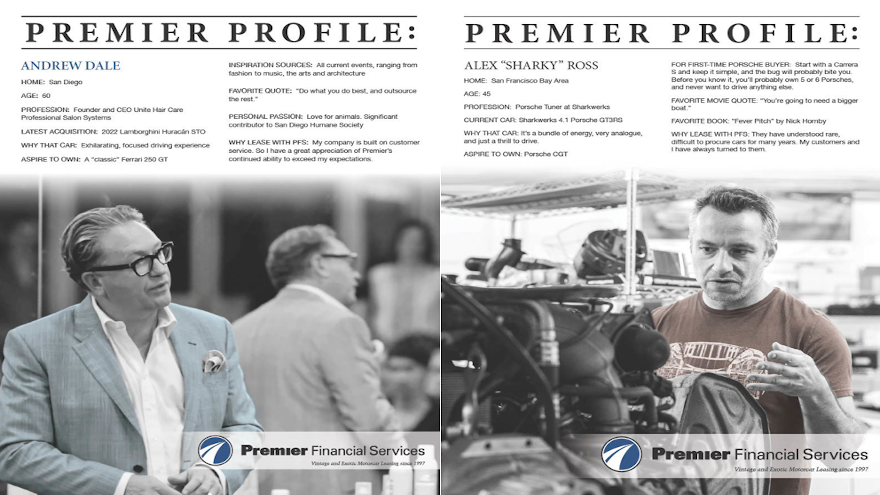

Premier Financial Services (PFS) is celebrating 25 years with marketing campaign featuring some of its most diverse, high-profile customers.

The finance company providing specialty leasing for new and previously owned Ferraris, Porsches, McLarens, Lamborghinis and other exotic, vintage and luxury automobiles recently launched of its “Premier Profiles” campaign to commemorate the company’s 25th year of operation.

A few of Premier’s clients who are featured in the initial phase of the campaign — which has no specific end date — include:

—Alex Ross: owner of Sharkwerks, a custom Porsche shop

—Chad Orso: insurance and financial services consultant

—Andrew Dale: founder and chief executive officer of Unite Hair Care Professional Salon Systems

—Brad Pearson: regional vice president of Coldwell Banker Realty

—Claudio Gambin: president and financial advisor of Gambin Financial Group

—Steve Serio: owner of The Bond Group, rare and classic car consultants

The company said the “Premier Profiles” campaign will run in several publications that cater to serious automotive enthusiasts, as well as social media platforms. None of the clients featured in the campaign receive any compensation or consideration from Premier in exchange for their participation.

Modeled loosely after one of the most successful, longest-running promotional campaigns in advertising history, each “Premier Profile” features individual clients, and includes personal information regarding their careers, as well as personal opinions on topics related to their success and outlook on life.

“The purpose of our campaign is to acknowledge the role that our clients have played in Premier’s success over the past 25 years,” Premier vice president of sales Doug Ewing said in a news release. “Many of them are repeat clients, and some of them, in fact, have been with us since the company started in 1997.”

Ewing also noted that Premier wanted to showcase the wide diversity of its clients’ ages, backgrounds, locations, careers and viewpoints.

“Despite their many differences, they all share a passion for vintage, exotic and luxury cars; and Premier has been honored to provide them with financing that enables them to put those dream cars in their driveways,” Ewing said.

While you might occasionally still see someone with a flip phone attached to their belt, most consumers are walking around with a smartphone in their pockets with the capability on par with a laptop computer.

And the Digital Auto Finance Report Spring 2022 compiled by Lightico and Wolters Kluwer Compliance Solutions showed the majority of those consumers want to use their smartphones to finalize their auto financing.

The report, which surveyed 902 U.S. adults, revealed that 87% of consumers feel that the ability to complete financial transactions on their mobile device was important or very important, with 42% of even the oldest respondents age 65-plus agreeing with that sentiment.

“Auto finance has long struggled with completing loans quickly, efficiently and in a way that is convenient for consumers,” Lightico chief executive officer and cofounder Zviki Ben Ishay said in a news release. “The expectation from consumers for auto loans is the same as for an Amazon purchase — easy, seamless and from anywhere, especially their phones.

“Even after two years of intense digital development and transformation, there are many lenders that need to digitalize the complete customer journey,” Ben Ishay added.

Other key trends from this survey included:

• 71% would not take on auto financing or make a vehicle purchase if it requires a physical visit

• 46% of consumers see ease of completion as important in an auto finance provider

• 57% of auto financing were completed within 24 hours

“Complete mobile transaction solutions today require digital financing that’s efficient, reliable, end-to-end and secure in order to satisfy the expectations of today’s consumers while ensuring full compliance by automotive and finance organizations,” said Tim Yalich, who is head of auto strategy for Wolters Kluwer.

“We are now able to shift focus to digitization as a solution for more automation throughout the vehicle application, financing and securitization process, with robust tools that are built around e-signature, e-contract and e-vault solutions for a complete end-to-end solution,” Yalich said.

Lightico and Wolters Kluwer recently announced a partnership that integrates Wolters Kluwer eVaulting technology with Lightico’s Digital Completion Cloud to provide seamless and compliant services to financial institutions.

A finance company that specializes in the collector car market launched its new website last week in an effort also to work with dealerships that retail vehicles that might not be quite rare.

Woodside Credit highlighted that its new site makes it easier for visitors to estimate the payment on their next dream car without pulling credit.

The website additionally drives home information about the financing program, improved payment calculators and a focus on partnerships and sponsorships, giving visitors more insights.

“We’re committed to making the loan process easy from start to finish,” Woodside Credit president and chief operating officer Mitch Shatzen said in a news release.

“Our company has invested heavily in the digital transformation for our loan process, and we are excited to have a new front door for our clients to quickly learn about our industry-leading loan programs,” Shatzen continued.

Woodside Credit explained how its revamped website is designed to function.

The quick quote feature helps visitors estimate the monthly payment on their next classic, collector, or exotic vehicle. The quick quote estimate does not require a credit pull. Then, when a consumer is ready to move forward, a full application can be easily completed online.

With a focus on mobile-first design, payment examples, and more information at visitors’ fingertips, the new site is designed to provide clients with the information needed to shop for financing of their next collector car.

Included is the company’s exclusive endorsement as Barrett-Jackson’s collector car loan provider. The new site makes it even easier for Barrett-Jackson bidders to get pre-approved to finance a winning vehicle at the auction.

Woodside Credit also serves dealers across the U.S., and the new website provides dealers with resources to sign up to become a Woodside dealer and increase sales using the financing program.

“With payment cards and payment calculator templates, Woodside Credit passes along the marketing expertise directly to dealers of all sizes," the company said.

Woodside Credit invites visitors to explore the new website or get a quick quote on your next collector vehicle by visiting WoodsideCredit.com.