The relationship involving AutoFi and Santander now is international.

After the bank was part of the investment round that pushed AutoFi’s valuation to near $700 million, the digital platform that helps to facilitate auto financing announced on that Santander Consumer Canada has joined its network of North American auto finance partners.

Santander Consumer Canada, based in Edmonton, Alberta, is part of global financial group Banco Santander based in Madrid, Spain.

Executives highlighted that participating in AutoFi’s program reflects Santander Consumer Canada’s progressive approach to digital financing, allowing customers to receive fast, easy and convenient automotive financing options and approval from anywhere.

AutoFi’s comprehensive platform can provide automotive commerce solutions for dealers, marketplaces, OEMs and finance companies, integrating the online, remote, and in-store sales experiences.

Customers shopping or researching vehicles online can obtain instant credit approval and a firm financing offer from Santander Consumer Canada through Canada’s top automotive dealers.

After selecting the financing terms and monthly payment that work best for them, customers can easily shop for their vehicle, learn the value of their trade-in vehicle, and select F&I products entirely online.

“We’re pleased to have Santander Consumer Canada join our network of more than 40-plus lending institutions in North America,” AutoFi chief executive officer and co-founder Kevin Singerman said. “Santander Consumer Canada shares in our vision of bringing innovation to the automotive purchase experience and digital finance is a large part of that.”

The two companies certainly know each other well. Coinciding with the investment made earlier this month, Santander announced the expansion of its partnership with AutoFi in the U.S.

According to a separate news release, the new Santander Consumer USA, digital experience will include mobile, desktop and in-dealership tools to identify vehicles on a dealer’s lot that fit a consumer’s budget, as well as specifications to complete deals — streamlining the financing process and allowing consumers to shop for a vehicle however, wherever and whenever they want.

Galen Gower is vice president of corporate strategy of Santander Consumer Canada and is interested to see what AutoFi’s platform can do in Canada.

“Santander Consumer is pleased to partner with AutoFi in Canada as it supports our initiatives to provide innovative lending solutions to our dealer partners and consumers nationally,” Gower said.

“We look forward to expanding our lending reach and continue our growth with prime to full-spectrum programs in automotive and powersports. Santander Consumer is now in Canada, on AutoFi and here to help dealers and consumers thrive,” Gower went on to say.

Continuing our episodes of the Auto Remarketing Podcast recorded during the Vehicle Finance Conference hosted by the American Financial Services Association in Las Vegas, senior editor Nick Zulovich shared a conversation with two leading executives at Wells Fargo Auto.

While Cynthia Caine focused on the commercial and dealer sides of Wells Fargo’s auto business, Tanya Sanders discussed the ongoing evolution of the consumer auto finance journey.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

What’s been an annual tradition during the Vehicle Finance Conference hosted by the American Financial Services Association, senior editor Nick Zulovich reconnected in Las Vegas with GM Financial’s Kyle Birch.

For this episode of the Auto Remarketing Podcast, Birch offered an update on GM Financial operations not only in the U.S., but also how the market is faring in Canada.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Mitsubishi Motors North America (MMNA) and Santander Consumer USA are looking to make the vehicle-buying experience “fast, fair and fun.”

To achieve that goal, the automaker and finance company announced a new partnership to provide customer and dealer financing programs.

“Our experience creating and managing relationships, supporting dealer success and delivering industry-leading platforms, programs and training makes Santander Consumer USA the perfect finance and servicing partner to support the tremendous momentum that Mitsubishi Motors is experiencing,” Santander Consumer USA president of auto relationships Bruce Jackson said in a news release.

“We look forward to putting more customers in Mitsubishi vehicles, providing best-in-class service and celebrating many more successes in the future,” Jackson added.

Mark Chaffin is MMNA’s chief operating officer.

“Mitsubishi Motors is celebrating 40 years of doing business in the U.S. in 2022, and our future has never been brighter. We are turning heads with one of the freshest showrooms in the industry, we are shattering sales records, and our new partnership with Santander is going to play a key role in taking our success to the next level,” Chaffin said.

“Santander’s history of delivering outstanding customer service to both dealer partners and customers will be the foundation for the next chapter in MMNA’s growth.”

J.D. Power wants a vehicle shopper to do more on the dealership’s website or the automaker’s online presence than just peruse through a vehicle’s photo gallery or review the model’s technology specifications.

Last week, J.D. Power rolled out what the data analytics and consumer intelligence provider is calling Shop With Ease, which is designed to be a complete Digital Retailing as a Service (DRaaS) platform that allows manufacturers, dealerships, finance companies and shoppers the ability to search, purchase and finance vehicles without having to leave the dealer’s or manufacturer’s website.

J.D. Power Shop With Ease, powered by the Darwin Automotive division of J.D. Power, contains a suite of tools meant to empower consumers during their shopping experience.

The DraaS-based platform of J.D. Power Shop With Ease is designed to help OEMs, banks, credit unions and others to design a custom solution using services such as:

• Payment calculations for all 50 states including fees, taxes, incentives, rates and residuals

• F&I products and marketing using prescriptive selling that’s driven by patented predictive analytics

• Reservation system for in stock and inbound vehicles

• Stand-alone trade-in service and vehicle acquisition tool

• A shop-by-payment functionality for the entire vehicle inventory with penny-perfect payments that match the dealer management system for thousands of vehicles

• Instant trade payoffs for 261 finance companies and credit unions

• Buy now electronic contracting with full sign-and-drive capabilities

• Technology-enabled data (TED), the industry's first fully enabled hyper-targeted intelligent marketing

By putting buyers at the center of a highly customized, multi-channel purchase experience, J.D. Power said that Shop With Ease can enable OEMs, dealers, finance companies and shoppers to have more transparent and accurately priced shopping experiences while delivering world-class customer service.

“Innovation from the combination of Darwin Automotive’s industry-leading software and consumer insights from one of the most recognized consumer brands, J.D. Power, has created an empowered automotive shopping experience,” said Phillip Battista, president of dealership technologies at J.D. Power.

“Powered by the data and analytics of J.D. Power, this technology is an industry game-changer. Digital Retailing as a Service is the next evolution that our industry needs — and we are the first to offer this suite of solutions.”

Solera Holdings specializes in providing services across the vehicle lifecycle management spectrum.

At the NADA Show last week, the company announced its launch into one of the most important pieces of that process with the debut of Solera Auto Finance.

This new service will provide franchised and independent dealers with access to “captive-like” financing solutions on used vehicles, something Solera says can help dealers compete with used-car disruptors.

“We believe Solera Auto Finance's commercial value proposition for franchise and independent used car dealers will positively impact the automotive industry,” said Alberto Cairo, who is Solera’s managing director of vehicle and fleet solutions, in a news release.

“Solera Auto Finance provides our dealer customers with an integrated solution that creates a seamless journey for car buyers, accelerates the financing and funding processes, provides a superior car-buying experience, and reduces operating costs,” Cairo said.

The Solera Auto Finance service fully integrates into the Solera dealership management systems: Auto/Mate for franchised dealers and iDMS for independents.

It will launch initially in Georgia, Indiana, Kentucky, North Carolina, Oklahoma, Virginia, and Washington, with plans to launch in over a dozen more states in the near future.

Additional details and enrollment can be found at: solera.com/solutions/auto-finance.

This move continue a busy season of growth for Solera.

Last year, the company acquired Omnitracs (a fleet management platform), DealerSocket (a SaaS provider to the auto industry) and eDriving (digital driver risk management platform for commercial fleets).

And early this year, Solera announced that it had signed a definitive agreement to acquire Spireon from Greenbriar Equity Fund. Spireon is likely familiar to both finance companies as well as fleet operators that use its services to track vehicles.

After nearly two decades, Credit Union Loan Source decided it was time for a change.

The auto finance company that originates and services installment contracts with more than 1,500 franchised and independent dealers in its 25-state footprint announced on Wednesday that it has rebranded.

The company now operates as Cinch Auto Finance, as leadership explained the new name, logo and website reflect its increased focus on simplifying the dealer-customer financing experience during the market’s continued growth.

“We have been fortunate to realize steady growth over the past few years, and we are taking the opportunity to reposition ourselves to better reflect our future growth potential,” Cinch president and chief executive officer Bill Moniz said in a news release.

“Our team works hard to ensure that the loan administration process is seamless for our customers and dealers, and we think the new brand truly reflects this idea,” Moniz continued about the company founded in 2004 that has originated more than $10 billion in paper during that stretch.

Cinch also launched what it intends to be an engaging new website that can provides customers with updated tools and resources to make paying their monthly obligation and managing their account easier and more convenient.

Learn more by visiting www.cinchautofinance.com.

Vroom made two moves in December to extend both its financial and physical reach.

Along with a hub in Orlando, Fla., the online platform for buying and selling used vehicles announced an amendment to its inventory financing agreement with Ally Financial.

Ally increased the line of credit to Vroom to $700 million, up from $450 million.

The company highlighted Ally’s extension of additional financing supports Vroom’s continued national growth. Ally has provided floorplan financing to Vroom since 2016.

“We’re thrilled to be broadening our financing relationship with Ally, so we can expand our offering of thousands of high quality, affordable vehicles with delivery straight to customers,” Vroom chief executive officer Paul Hennessy said in a news release.

“Car buyers and sellers are turning to ecommerce solutions more than ever, and Vroom is well positioned as we deliver a seamless online experience,” Hennessy continued.

And Vroom is looking to make sure it’s well positioned in Florida.

A week before Christmas, Vroom announced its first Extended Mile hub in Orlando. Similar to Vroom’s Last Mile hubs but with broader reach, the new Extended Mile hub in Winter Garden, Fla., can provide a more customized driveway experience for 4.2 million people in more than 300 ZIP codes across Florida.

Vroom pointed out that it has delivered in the Orlando area since the company was founded in 2012, then launched one of the first Last Mile hubs there in 2018. The previous Last Mile hub has now been upgraded to become the first Extended Mile hub, where customer advocates transport cars directly to even more car buyers’ driveways on Vroom-branded trucks and show them how to use their new vehicles.

After the Orlando Last Mile hub’s success, Vroom began rolling out more hubs across the country last year, with 25 launched so far and more coming soon.

The company explained the Extended Mile program is the next tier of growth for Vroom’s customer delivery and pickup experience, and the company plans to launch it in more locations in the coming months.

The Last Mile and Extended Mile hub expansion efforts are led by Vroom chief logistics officer Mary Kay Wegner.

“After successfully opening dozens of Last Mile hubs across the country, starting right here in Orlando, we’re excited to be leveling up to the next phase of concierge service with our new Extended Mile offering,” Wegner said in another news release. “Orlando has been an important market for Vroom for years, and we’re proud to be part of the recent wave of tech companies that are expanding their presences in Florida.”

Vroom reiterated its mission is to offer the best driveway experience possible for both delivery and pickup.

The company mentioned purchases by Orlando-area Vroom customers increased by 83% year-over-year from the first half of 2020 to 2021, and vehicle sold to Vroom by Orlando-area consumers increased by 475% during that time.

With an emphasis on customer service, Vroom is taking a unique approach by recruiting employees with hospitality and client service experience for its hubs.

Along with delivering thousands of vehicles this year, Vroom noted that the Extended Mile hub team also has helped local customers celebrate big moments, including surprise birthday and graduation deliveries.

“We are committed to meeting the growing customer demand for our vehicles with the service they deserve,” said Hanif Saad, senior manager of hub operations at Vroom.

“We have doubled the number of delivery trucks and employees, and are actively recruiting locally to fill open roles,” Saad continued. “This will allow us to ensure that many of the Vroom vehicles arriving in Florida can make a pit stop at our Orlando hub for quality inspections and reconditioning, and timely delivery.”

MagnifyMoney’s most recent survey found nearly 70% of Americans celebrated financial accomplishments in 2021, with one of the top achievements being vehicle acquisition.

Although many Americans accomplished their goals of paying off debt in 2021, the survey from the LendingTree subsidiary showed many consumers still have financial regrets from the year.

Five key findings from the survey included:

— Nearly 70% of Americans celebrated a financial achievement in 2021. Paying off credit card debt and growing savings topped the list, followed by buying a vehicle.

— Despite these celebrations, 78% still had financial regrets. This metric was led by not saving enough money, spending above means and racking up credit card debt.

— Fewer Americans are making 2022 financial resolutions. Just over a third of consumers (36%) are setting a money resolution for the new year, compared with 51% last year and 47% in 2019.

— As in previous years, getting out of debt is consumers' top financial resolution for the new year. That's followed by increasing their credit score and saving more money.

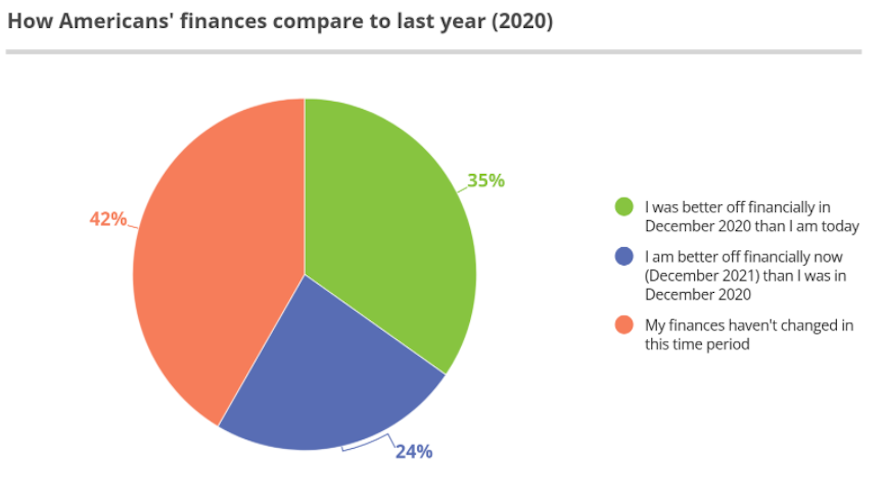

— More consumers say they're worse off financially than this time last year. Of the respondents, 35% say they were better off last year, while 24% say they're better off now. However, two exceptions are Gen Zers and those earning $75,000 or more, who say their finances are better now than they were this time last year.

MagnifyMoney commissioned Qualtrics to conduct an online survey of 2,050 U.S. consumers from Nov. 9-15. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population.

The firm said all responses were reviewed by researchers for quality control.

MagnifyMoney defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby Boomer: 56 to 75

MagnifyMoney added that while the survey also included consumers from the silent generation (those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

The entire report is available via this website.

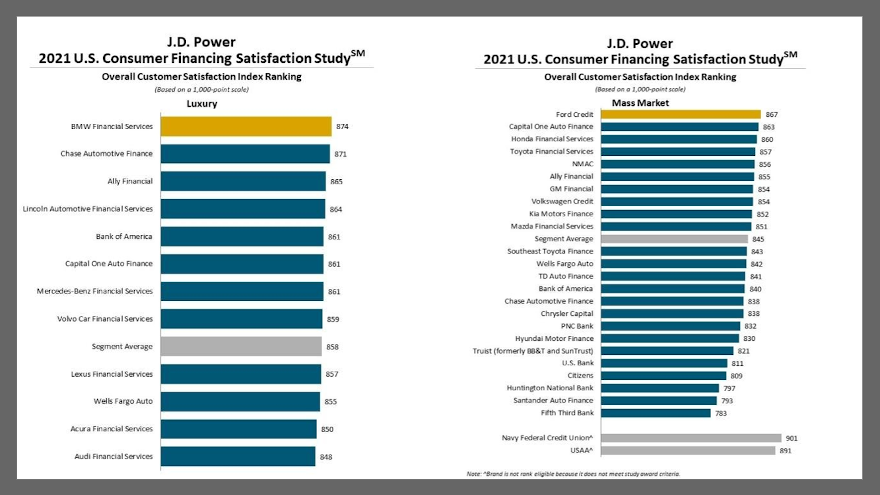

J.D. Power pointed out that potential buyers’ ability to secure financing is even more crucial nowadays in an automotive market beset by supply shortages and record high prices.

Firm experts said more vehicle shoppers than ever have started to look for vehicle financing before ever setting foot in a dealership, reinforcing findings from the newly redesigned J.D. Power 2021 U.S. Consumer Financing Satisfaction Study.

The study showed auto financing pre-approval has become the top of the funnel for auto customer acquisition and brand loyalty, putting the focus on digital channels as the starting point for the consumer financing journey.

“Auto financing customer behavior has fundamentally shifted from an exercise that largely took place in a dealership finance department to one that takes place online upwards of 30 days prior to a vehicle purchase,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power.

“Nearly half — 45% —of all customers now do research prior to financing a vehicle and their experiences with lenders can have a tremendous influence on that process,” Roosenberg continued in a news release. “That really puts the onus on lenders to deliver a superior customer experience to existing customers and to position their websites and consumer marketing initiatives to maximize conversions.”

Other key findings from the 2021 study included:

• Pre-approval becomes lynchpin to auto financing journey: Nearly half (45%) of all auto finance customers do some type of research on financing options prior to purchasing a new vehicle. The proportion jumps to 62% among members of Generation Z. Ultimately, 60% of customers who shop online for auto financing options end up applying for a pre-approval.

J.D. Power defines generational groups as pre-boomers (born before 1946); boomers (1946-1964); Gen X (1965-1976); and Gen Y (1977-1994); and Gen Z (1995-2004). Xennials (1978-1981) and millennials (1982-1994) are subsets of Gen Y.

• Auto financing research begins a month before a purchase: Among most auto loan customers who research financing options prior to a purchase, the research process begins more than 30 days prior to purchasing or leasing a vehicle. Effective use of both applied for and unsolicited pre-approvals can lead to a greater customer recapture rate and conquest opportunities, according to J.D. Power.

• The memory remains: Current and past experiences with auto finance companies matter now more than ever as many customers begin the shopping process because of marketing information or incentives they’ve received from their existing lender or auto manufacturer.

• Personalization is next frontier: Customers have different preferences for how they want to manage their accounts and be contacted by finance companies. As this interaction continues to shift to digital channels, J.D. Power said finance companies will need to tailor their outreach to the needs of individual customers.

In terms of study rankings, J.D. Power said BMW Financial Services came in highest in customer satisfaction among luxury brands with a score of 874. Chase Automotive Finance (871) ranks second and Ally Financial (865) ranks third.

Ford Credit ranked highest among mass market brands, with a score of 867. Capital One Auto Finance (863) came in second and Honda Financial Services (860) took third.

The U.S. Consumer Financing Satisfaction Study measures overall customer satisfaction in five factors:

— Billing and payment process

— Mobile app experience

— Onboarding process

— Origination process

— Website experience.

The study was fielded in July and August and is based on responses from 10,462 customers who financed a new or used vehicle through a retail installment sales contract or lease within the past three years.