If your shop wasn’t already the target, it might be now based on TransUnion’s latest quarterly analysis of global online fraud trends found that since the COVID-19 pandemic began.

TransUnion said fraudsters are increasing their rate of digital schemes against businesses. In addition, TransUnion’s recent Global Consumer Pulse Study found that more than one in three global consumers have recently been targeted by digital fraud related to COVID-19.

TransUnion came to its conclusions about fraud against businesses based on intelligence from billions of transactions and more than 40,000 websites and apps contained in its flagship identity proofing, risk-based authentication and fraud analytics solution suite — TransUnion TruValidate.

Analysts found the percent of suspected fraudulent digital transaction attempts against businesses worldwide increased 46% when comparing the following two periods: March 11, 2019 and March 10, 2020) as well as March 11, 2020 — when the World Health Organization declared COVID-19 a global pandemic — and March 10 of this year.

In the U.S., this percentage increased 22% in the same timeframe, according to TransUnion.

“Fraudsters are always looking to take advantage of significant world events. The COVID-19 pandemic and its corresponding rapid digital acceleration brought about by stay-at-home orders is a global event unrivaled in the online age,” said Shai Cohen, senior vice president of global fraud solutions at TransUnion.

“By analyzing billions of transactions we screened for fraud indicators over the past year, it has become clear that the war against the virus has also brought about a war against digital fraud,” Cohen continued in a news release.

Globally across industries, TransUnion found the countries with the highest rate of suspected fraudulent digital transactions during the pandemic (from March 11, 2020 to March 10, 2021) included:

1. The Seychelles

2. Kazakhstan

3. Turkmenistan

In the U.S. overall during that same time period, TransUnion discovered the cities with the highest percent of suspected fraudulent transactions included Tempe, Ariz., Hamtramck, Mich., and Colonial Park, Pa.

More details about consumers targeted by COVID-19 schemes

TransUnion’s Global Consumer Pulse Study also found that as of March 16 the 36% of consumers who said they are being targeted by digital fraud related to COVID-19 in the last three months is higher than approximately one year ago.

In April of last year, TransUnion said 29% said they had been targeted by digital fraud related to COVID-19. In the U.S., this percentage increased from 26% to 38% in the same timeframe.

Gen Z — individuals born from 1995 to 2002 — is currently the most targeted out of any generation at 42%, according to TransUnion. They are followed by millennials (37%).

Similarities were observed in the U.S. where Gen Z was most targeted at 53% followed by millennials at 40%.

“TransUnion documented a 21% increase in reported phishing attacks among consumers who were globally targeted with COVID-19-related digital fraud just from November 2020 to recently,” said Melissa Gaddis, senior director of customer success of global fraud solutions at TransUnion. “This revelation shows just how essential acquiring personal credentials are for carrying out any type of digital fraud.

“Consumers must be vigilant and businesses should assume all consumer information is available on the dark web and have alternatives to traditional password verification in place,” Gaddis continued.

For more details about TransUnion’s recent studies, go to this website.

Point Predictive chief fraud strategist Frank McKenna returned for another episode of the Auto Remarketing Podcast to diagnose how badly auto financing is infected with fraud.

McKenna also shared an update on how the firm’s auto-finance consortium is working toward finding an anecdote.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

FICO continues to receive recognition for its fight against fraud.

This week, FICO announced that it has been named the category leader for enterprise fraud solutions in the Chartis 2021 RiskTech Quadrant report for the third year in a row.

FIC highlighted that the report ranks the financial services industry’s leading financial crime risk management systems based on Chartis’ analysis of market trends, expenditure patterns and best practices, which is validated through several phases of independent verification.

FICO said in a news release that it was recognized for both market potential and completeness of solution offering.

“FICO’s ranking as category leader reflects its best-in-class enterprise fraud management solutions, which had the highest possible ratings for advanced fraud detection techniques, libraries of pre-packaged fraud rules, and card fraud,” said Phil Mackenzie, senior research specialist at Chartis Research.

“FICO also delivers advanced fraud-detection capabilities in mobile fraud, electronic payments fraud, and real-time transaction monitoring, via an integrated cloud-ready platform,” Mackenzie continued.

FICO mentioned that its fraud solutions protect more than 9,000 financial institutions, telecommunication organizations, auto financers and government agencies from financial losses as well as damages caused by criminal behavior.

Since the onset of the COVID-19 pandemic, the company said more enterprises are relying on FICO’s analytics software platform to make smarter decisions, streamline operations, and protect organizations against the latest fraud and financial crime threats.

“FICO is proud to have its cutting-edge solutions recognized by Chartis as the category leader in financial crime risk management systems,” FICO vice president of product management Tim Van Tassel said.

“At FICO, we are committed to helping our clients use our award-winning solutions to prevent fraudulent activity as well as developing an industry leading AI, machine learning and analytics platform,” Van Tassel continued.

Published annually, Chartis’ RiskTech Quadrant reports are prepared by analysts with extensive hands-on experience of selecting, developing, and implementing risk management systems for a variety of international companies across multiple industries including banking, insurance, capital markets, energy and the public sector.

“Recognition as the category leader for three years in a row further highlights FICO’s ongoing investment in innovation, our close partnership with clients and our dedication to delivering the industry standard for enterprise fraud solutions,” FICO chief marketing officer Nikhil Behl said.

For more information, you can download the complete Chartis report on this website.

As automotive shoppers move more of their buying process online, it is important to understand their identity throughout the entire car-buying journey to provide a more personalized shopping experience that provides more confidence to dealers and lenders about who their customer is online.

As customer interactions move online in record numbers, dealers and lenders are challenged with accurately ensuring they are working with the same digital shopper on multiple devices, verifying identity and preventing fraud, assessing an online shopper’s buying capacity, and customizing the right offer that fits their needs. In fact, a 2019 Neustar and Forrester report said only 10% of marketers say they are confident in building a 360-degree view of their consumers.

Impacting this process further is the customer buying journey, which leverages online more but reduces the time a shopper spends in-market. According to the 2020 Cox Automotive Car Buyer Journey study, consumers now spend 89 days in-market, compared with 118 in 2017. Furthermore, consumers are averaging nearly fifteen hours total in spending time researching online, up from 13:55 in 2019.

Because of the increased time spent online, dealers and lenders must target their promotions and messages earlier on, and in a more personalized way that uniquely speaks to each shopper individually. Advanced analytical data and insights are increasingly being leveraged to accomplish this stronger targeted marketing, as well as offering better digital identity and verification solutions and protections against fraud.

What’s needed today is a thorough and complete understanding of a shopper’s identity. As a result, comprehensive and validated meta data-driven identity graphs based on all of these personalized criteria provide the digital technology needed to help create a more complete consumer profile to engage persona-based marketing and omnichannel strategies. This process helps the automotive ecosystem establish transaction-able identifiers along with all necessary requirements for consent management.

Knowing the customer’s individual needs

New target-marketing data resources help dealers better identify consumers that are likely to be ready to take on new financing for an auto loan or lease. It can also better match those consumers to vehicle models that dealers have in supply based on how many of those consumers are likely to be able to afford. This is important because dealers and their marketing partners must re-evaluate their strategies in 2021 to better align with the changing consumer needs and financial capacities.

One of these strategies in 2021 is through the use of the more highly personalized identity graph. Dealers, lenders and marketing partners want to scale these unique shopper identity graphs to build better insights, resolution, personalization and targeting efforts that leverage metadata-rich shopper insights or a proprietary ID. Privacy remains a critical factor in the entire process and a key area that must be adhered to by all parties involved.

Driven largely by the impact from COVID-19 last year, financial durability remains an important way to segment the economic health of households within the same credit bands. It considers a consumer’s assets, income from dividends and interest, retirement income, and the relationships between income, debt and spending. Today’s sophisticated economic anonymized marketing data resources tap into this information to help dealers make better and more precise decisions when putting an incentive-driven offer in front of a specific customer.

This deeper level of identity graph-powered insight is helping dealers and agency partners shift their traditional media strategy to a programmatic audience one.

Changing target marketing strategies

Successful programmatic strategies are based on truly understanding their in-market shopping audience. However, just because a consumer is shopping for a car online doesn’t mean they can purchase it. For example, first-time buyers may have no idea if or what they can afford, and these waters have been muddied further by the pandemic economy. They may be shopping for a vehicle online without knowing if the payment fits into their budget or if they can get credit. Dealers and their marketing agency partners need to identify several intent signals, as well as financial capacity to target consumers who have income and assets; discretionary spending ability; credit capacity; and propensity to buy.

A stronger focus for online fraud protection

Even with this higher level of personalization power, dealers and lenders must be wary of fraud and synthetic fraud because of the increased presence online. According to Cox Automotive in a recent edition of Auto Remarketing, nearly 40% of buyers want to finalize their vehicle price online, up from just 25% in 2017.

Fraudsters create new, fictitious identities by using different components of real identities — such as a name from one person, an address from a different person or the SSN of a minor or deceased person. Fraudsters then attempt to gain credit with the fictitious identity to monetize it. These manufactured identities are used for short term gain and then abandoned. When this is the case, there is no one for the lender to contact to collect funds. This poses a problem for organizations as misclassified non-payment matters get sent to collections, further wasting resources.

Today’s fraud-prevention technologies leverage alerts delivered in batch or real time, using patent-pending machine-learning algorithms to detect synthetic ID behaviors and patterns at various entry points. The alerts can be used during account origination to sort applications that trigger an alert into a manual review process. For example, when used in waterfall with a credit report, auto dealers and lenders can leverage these real-time alerts to vet new customers opening or applying for an auto loan or when trying to get financed for a vehicle.

Auto lenders can also leverage these alerts during account/portfolio management. The alerts can be used as a “back book” or “clean up” append for an existing portfolio to pinpoint accounts that may have been opened using synthetic identities. Once identified, lenders can use existing strategies for further verification/authentication.

The expedited growth in digital retailing means customers will be spending more time online shopping for their perfect vehicle. With these advanced analytical insights along with uniquely personalized identity graph technology, dealers and lenders will have more power in reaching them on a personalized level while also protecting against the threat of fraud.

Lena Bourgeois is automotive general manager for Equifax, responsible for driving customer value and accelerating company growth in the automotive market. For more information, visit www.equifax.com.

Accuity already was part of the LexisNexis Risk Solutions group of companies, but executives recently announced they are merging operations in an effort to focus their resources in the global financial crime compliance sector with complementary solutions.

Already operating in more than 100 countries, Accuity and LexisNexis Risk Solutions highlighted four potential benefits of their new streamlined approach.

To recap, LexisNexis Risk Solutions is a data analytics provider for organizations seeking actionable insights to manage risks and improve results, delivering targeted solutions that can empower well-informed decisions while upholding the highest standards for security and privacy.

Meanwhile, Accuity powers compliant and assured client transactions to help build an interconnected and trusted financial ecosystem through financial crime screening, global payment services and financial asset verification and fraud prevention solutions for government benefit programs.

Now bonded even closer, Accuity and LexisNexis Risk Solutions look to provide:

— Combined solutions further leverage and extend high-value data and analytic capabilities from both companies to provide comprehensive risk management and payments solutions.

— Future integrated offerings will better address critical customer needs across know your customer, anti-money laundering and payments by providing more comprehensive global solutions to address the sophisticated and evolving methods criminals use to commit financial crimes.

— Combining two differentiated and distinct data sets will enrich a joint product suite to drive greater customer value by enabling more actionable decisions through effective customer portfolio monitoring.

— The combined organization will create one of the largest global providers of compliance risk solutions.

The move drew a positive assessment by Aite Group senior analyst Colin Whitmore in a news release distributed by LexisNexis Risk Solutions.

“In today’s evolving world of financial crime and risk, there is a growing industry-wide requirement for compliance, risk and payments solutions that seamlessly use and integrate with comprehensive, trusted and in-depth data sets,” Whitmore said.

“The combined offerings of Accuity and LexisNexis Risk Solutions financial crime compliance and risk offerings promise to meet this growing need,” Whitmore added.

That kind of reaction likely reinforced why this decision was made.

“Accuity is an excellent strategic fit for our business,” said Rick Trainor, chief executive officer of business services at LexisNexis Risk Solutions. “Both companies share a common vision — enabling financial transparency and inclusion around the world using innovative technology and comprehensive data to help our customers control risk, enhance and empower compliance and optimize business processes.

“The Accuity suites for payments and compliance professionals will complement our existing global solutions, including financial crime compliance and fraud and identity management,” Trainor went on to say.

Mixed news on the fraud front recently surfaced, and not surprisingly, it’s tinged with pandemic impact

New TransUnion research found instances of synthetic fraud and outstanding balances for suspected synthetic accounts at U.S. financial institutions have declined significantly after the World Health Organization (WHO) declared COVID-19 a global pandemic on March 11.

However, new analysis by technology analyst firm Aite Group discovered the cost of synthetic fraud will rebound post-pandemic, reaching new highs.

Experts reiterated that synthetic identity fraud involves fraudsters creating fictitious identities by piecing together real identity attributes and fake information with the intent to open fraudulent accounts.

“The dip in synthetic fraud during the pandemic was a continuation of our 2019 findings that showed synthetic fraud was slowing amid the emergence of solutions that connect personal and digital identities,” said Shai Cohen, senior vice president of global fraud solutions at TransUnion.

“We believe this slowdown was compounded by fraudsters who went elsewhere and could be lying in wait to take advantage of pandemic loan forbearance programs that may not have come due yet,” Cohen continued in a news release. “Once synthetic fraud reemerges, which we think it will, companies must be ready.”

The latest TransUnion analysis of outstanding balances attributed to suspected synthetic identities for auto, credit card, retail credit card and personal loans determined them to be at their lowest levels since Q1 2016.

As of the third quarter, which was the latest data analysts had available, synthetic fraud balances in those sectors stood at $855 million, down from a high of $1.05 billion in Q3 2018.

The TransUnion analysis also indicated instances of synthetic fraud dropped markedly for most credit products for two consecutive quarters.

In the third quarter of last year, analysts said the percent of new auto finance and credit card accounts linked to a synthetic fraudster declined to their lowest points since TransUnion began tracking them in 2016.

TransUnion documented a 32% decrease in new credit cards and a 23% decline in new auto-finance contracts linked to synthetic fraud from Q3 2019 to Q3 2020.

Beyond financial services, which TransUnion documented had by far the highest amounts of digital synthetic fraud in 2020, analysts determined e-commerce and iGaming were the industries with the second and third highest amounts of synthetic fraud last year.

Despite the recent drop in synthetic fraud at financial institutions, a new TransUnion-sponsored Aite Group report finds the cost of synthetic fraud will rise in the coming years.

Aite Group estimated that business losses due to synthetic identity fraud for unsecured U.S. credit products — those contracts that don’t require businesses or individuals to put up any collateral for the loan — will reach $1.8 billion in 2020 and grow to $2.42 billion in 2023.

“Synthetic fraud is an extremely difficult problem to solve,” Aite Group research director Julie Conroy said in the news release. “Out of financial services firms that we recently surveyed, 72% said that they believe synthetic identities are a much more challenging issue to identify and address than identity theft.”

Dropping Outstanding Balances for Suspected Synthetic Accounts

Loan Category

|

Q3 2020

|

Q2 2020

|

Q1 2020

|

Q4 2019

|

Q3 2019

|

Q2 2019

|

Q1 2019

|

Q4 2018

|

Q3 2018

|

Total

|

$0.85 billion

|

$0.89 billion

|

$1.02 billion

|

$1.03 billion

|

$1.04 billion

|

$1.02 billion

|

$0.99 billion

|

$1.02 billion

|

$1.05 billion

|

Breakdown by Credit Product

|

Auto Loans

|

$543.8 million

|

$549.5 million

|

$623.9 million

|

$623.3 million

|

$649.5 million

|

$630.5 million

|

$606.1 million

|

$623.6 million

|

$651.9 million

|

Credit Cards

|

$220.2 million

|

$244.0 million

|

$279.5 million

|

$288.1 million

|

$284.0 million

|

$277.5 million

|

$275.1 million

|

$283.3 million

|

$284.1 million

|

Retail Credit Cards

|

$63.8 million

|

$64.7 million

|

$75.8 million

|

$77.3 million

|

$76.6 million

|

$76.0 million

|

$77.5 million

|

$80.3 million

|

$78.2 million

|

Unsecured Personal Loans

|

$27.0 million

|

$32.5 million

|

$38.0 million

|

$37.3 million

|

$34.7 million

|

$33.6 million

|

$33.8 million

|

$33.7 million

|

$34.7 million

|

Source: TransUnion

Potential solutions from TransUnion

TransUnion emphasized that mitigating synthetic identity fraud risk requires a layered approach to secure trust in digital channels.

To continue helping businesses combat synthetic fraud, TransUnion recently added a non-credit synthetic fraud algorithm to its synthetic fraud services, which historically relied heavily on Fair Credit Reporting Act (FCRA) regulated credit data.

In addition to the credit and non-credit models, TransUnion said that it also intends to offer full integration of Electronic Consent Based Social Security Number Verification (eCBSV) capabilities in the near future.

The TransUnion TruValidate Synthetic Fraud Models can detect potential synthetic identities by analyzing consumer behaviors and uncovering anomalies or suspicious risk, offering a real-time indicator of the threat level before fraud is committed while still supporting a great consumer experience for genuine consumers.

The TransUnion TruValidate synthetic fraud solutions include both Fair Credit Reporting Act (FCRA) and now Gramm-Leach-Bliley Act (GLBA) compliant models.

“With almost every consumer’s information for sale on the dark web, today’s fraudsters are extremely adept at creating synthetic identities with fabricated or compromised identity elements,” said Bala Kumar, vice president of product management of global fraud solutions at TransUnion.

“Most consumer-facing businesses rely on a variety of identity and digital verification methods to assess initial fraud risk. None of these are adequate to truly identify suspected synthetic identities since they can behave like legitimate accounts,” Kumar contained

TransUnion recently launched its GLBA Synthetic Fraud Model which further ensures a friction-right experience for the majority of consumers who carry little to no synthetic fraud risk and do not warrant additional authentication steps. It can analyze Social Security Numbers and other personally identifiable information sharing across identities, looking for anomalies such as large numbers of consumers sharing an address or unusual address tenure patterns.

In its efforts to thwart synthetic fraud, TransUnion also is finalizing authorization by the U.S. Social Security Administration to be an eCBSV service provider. This will enable TransUnion to help financial institutions electronically verify an individual’s SSN with the SSA based on the holder’s consent.

The TransUnion synthetic fraud solutions are part of its flagship identity proofing, risk-based authentication and fraud analytics solution suite —TransUnion TruValidate.

Formerly IDVision with iovation, TruValidate is designed to unite personal and digital data into one of the most comprehensive data identity platforms in the world.

By integrating the TransUnion Synthetic Fraud Model into TruValidate, finance companies and other businesses can:

• Optimize new customer onboarding with a friction-right consumer experience

• Orchestrate their entire synthetic fraud strategy with a single point of implementation in concert with existing TransUnion credit and fraud solutions

• Make smarter decisions with the full context of a consumer credit profile, public record data, phone and email risk intelligence, and other identity data sources

For more details about the TruValidate Synthetic Fraud Model, go to this website or register to attend this March 9 webinar.

Point Predictive recently rolled out a new tool that it says can be a simple but effective fraud and borrower misrepresentation solution that can help finance companies assess the validity of an employer stated by a consumer or third party on an application.

Now available through EmployerCheck, Point Predictive said every U.S auto finance company as well as mortgage originator, personal finance company, and bank now can receive a comprehensive report detailing nine risk factors for any reported employer without transmitting personally-identifiable information (PII).

Point Predictive highlighted that EmployerCheck was developed in response to the growing use of potentially fictitious employers on applications. In 2020 alone, Point Predictive said it identified a 300% increase in the use of potentially fictitious employers on consumer loan applications.

In one case, the firm indicated a single suspicious employer appeared on 667 different applications, exposing 19 lenders to more than $11.5 million in potential loan losses.

Point Predictive said eight different lenders ultimately funded a portion of those loans, resulting in a 50% charge-off rate for those contracts.

In recent months, Point Predictive’s fraud analysts have investigated hundreds of cases of potential fictitious employers. Many of these cases are the result of professional fraud ring activity, and it is easy to understand why this activity slips past unsuspecting loan review agents.

The firm said fraudsters easily set up genuine-looking internet presences and even have agents who answer telephone calls from lenders to fraudulently “confirm” employment and income.

According to Point Predictive, easily doctored paystubs complete the crime, while lenders and finance companies are left holding the bag.

“Misstated and fraudulent assertions by borrowers or third parties about employment or income costs lenders upwards of billions of dollars in losses,” Point Predictive co-founder and chief executive officer Tim Grace said in a news release.

It is no surprise that EmployerCheck is one of the most highly-anticipated new product offerings by our consortium lenders,” Grace continued. “Our team developed an incredibly effective and extremely lightweight solution.

“An EmployerCheck inquiry requires only two non-PII fields, and most lenders will see an astounding 84% exact match rate,” he added.

The firm highlighted the risk-detecting horsepower of EmployerCheck is the result of what the firm described as a broad, fit-for-purpose data set derived from Point Predictive’s innovative anti-fraud consortium.

The firm explained this consortium’s data contains employer information derived from 94 million recent and historical loan applications and grows at a rate of over two million applications per month.

Point Predictive mentioned every EmployerCheck inquiry scans more than 17 million true and fictitiously-asserted employers, five million business records sourced from the U.S. Small Business Administration, and a suspicious employer “hot list” that is updated daily by Point Predictive fraud analysts who investigate fraud activity across the U.S. every day.

Point Predictive co-founder and chief risk officer Frank McKenna said he delights at the ability to offer lenders and finance companies a convenient but powerful way to detect one of the most common and costly loan fraud tactics.

McKenna said, “60% of all fraud losses, or roughly $5 billion per year, involve a suspicious statement of income or the income’s primary source — employment — on a loan application.

“It has become so easy to submit and substantiate fictitious employers that an entire economy of ‘fraud-for-hire’ is emerging,” he continued. “It is a testament to the collaborative and innovative spirit within our consortium lenders that we are able to deliver such an effective solution.

“Every lender should make EmployerCheck part of its originations process,” McKenna added.

Point Predictive reiterated that EmployerCheck is available to any U.S. finance company and lender in either a file-based integration or through an application programming interface (API) integration.

The firm said an EmployerCheck inquiry requires only four inputs — the employer name and employer phone number, along with an application identifier and date — in order to receive a report with multiple alerts and risk scores.

Point Predictive mentioned that it can further accelerate customer onboarding with a single-page customer agreement and convenient month-to-month subscription for the first three months of use.

Point Predictive invites any finance company or lender that wishes to try EmployerCheck to contact the firm at [email protected].

Fraud and its prevention are gaining more attention, especially since the pandemic arrived.

LexisNexis Risk Solutions unveiled findings about what it classified as the current state of fraud, detailing key fraud trends occurring in 2020 for organizations in the United States and Canada while also looking ahead at what to expect in 2021.

LexisNexis Risk Solutions compiled these findings from a review of multiple studies it conducted last year. The consolidation of the report findings showed what it called a “perfect storm” of trends that have impacted fraud throughout the past year and those that may linger into 2021.

Experts said the COVID-19 pandemic caused 2020 to be a year of unique circumstances and disruption to the global economy. One thing that has stayed the same is fraudsters’ willpower to gain access to money and confidential information.

While many believe that fraud victims are mostly the technologically naïve, experts also said 2020 validated that anyone can be a victim. LexisNexis Risk Solutions examined consumer behavior, popular fraud methods, social uncertainty due to the pandemic when compiling this data and suggests what organizations of all shapes and sizes can do to protect their business.

The shift of consumer behavior towards digital transactions

LexisNexis Risk Solutions acknowledged that 2020 saw major changes in the ways in which consumers behave.

The firm’s data showed digital transaction in the U.S. and Canada increased 42% year-over-year leading up to June, with 60% representing mobile transactions; 67% made via a mobile app and 33% made by a mobile browser.

LexisNexis Risk Solutions explained consumers now engage in more digital transactions and use different payment methods that fraudsters leverage to target a broader set of businesses through more sophisticated and complex fraud methods. These actions often involve the mobile channel and the purchase of digital goods and services, according to experts

“Difficult to detect fraud methods like synthetic identities, identity fraud rings, multiple device linkages and bot attacks create identity proofing challenges for businesses,” LexisNexis Risk Solutions said.

“Identity proofing could prove to be a significant challenge for organizations in 2021, as fraudsters leverage digital channels to launch more sophisticated and complex types of fraud,” the firm continued.

According to the Federal Reserve, 86%-95% of applicants identified as potential synthetic identities escape flagging by traditional fraud models.

“This is something every organization should be on the lookout for particularly with the rise in digital transacting,” LexisNexis Risk Solutions said.

Breached consumer data fuels sophisticated fraud methods

LexisNexis Risk Solutions explained this category is more than just about PINs and passwords as this data is valued for both the physical and digital identity attributes linked to transactions and devices, such as email addresses, billing addresses and phone numbers.

The LexisNexis Digital Identity Network indicated a risk in fraudulent events through emails are likely from data breaches and are used by multiple fraudsters.

“Fraudsters are no longer always hidden — they can take the form of a visible business or a network of businesses or devices,” LexisNexis Risk Solutions said. “Physical and digital consumer data is fuel for fraudsters.”

According to analysis from LexisNexis Risk Solutions, 45% of people in the United States having had their personal information compromised by a data breach in the last five years.

“Fraudsters have a trove of personally identifiable information that enables them to use this sensitive information to launch account takeovers and new account creation attacks,” the firm said.

Meanwhile, Javelin estimated that account takeover attacks are up 72% year-over-year while the LexisNexis Risk Solutions Cybercrime Report from January to June found that that one in seven new account creations are likely fraudulent.

Bad actors exploit weaknesses as economic uncertainty continues

Last year, LexisNexis Risk Solutions pointed out overall market and economic uncertainty due to COVID-19 significantly increased successful fraud attempts. Expert said this spike is especially true for the e-commerce, retail, financial services and lending sectors.

“We expect the trend will continue in 2021,” experts said. “While professional fraudsters are always ready to attack, economic hardships can also induce others to engage in fraudulent activities. These can be individuals with no criminal behavior history.”

Typically, LexisNexis Risk Solutions acknowledged, organizations are more sensitive to customer friction during slower economic periods and more concerned about lost opportunities.

“That does not mean they can let their guard down,” experts said. “In addition to those who attack with intent, consumer stress and fear can lead consumers to riskier transaction behaviors, which may increase successful tactics for malware infection on devices and theft of personal identification information.

“This presents more opportunities for fraudsters leading to more attacks,” experts went on to say.

Suggestions of what service providers can do to curb fraud

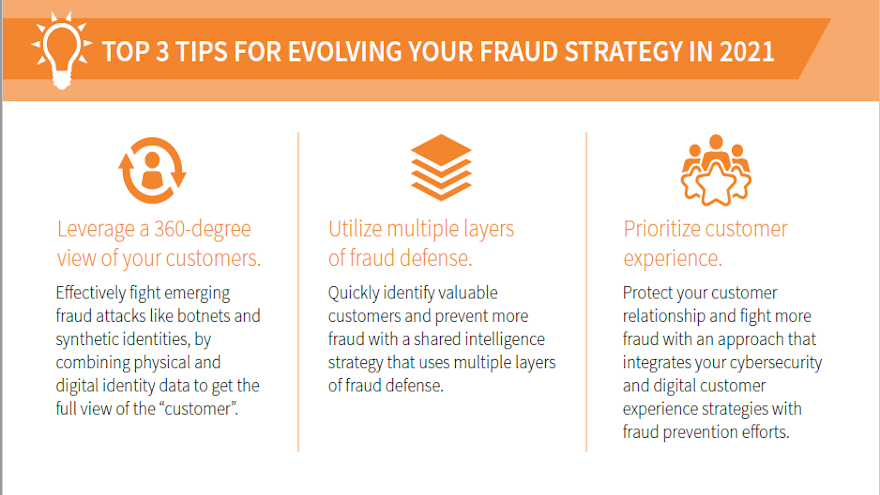

LexisNexis Risk Solutions recommended that businesses must use both physical and digital identity data to get a full view of their customers to effectively fight emerging fraud attacks.

Experts added that businesses should also utilize multiple layers of fraud defense like actionable decision analytics and investigation tools. This strategy, coupled with integrating their digital customer experience and cybersecurity strategies, will protect the relationships that businesses have with their customers and their information, according to LexisNexis Risk Solutions.

“Businesses can no longer use a check-the-box, incremental approach towards addressing these challenges and trends one at a time because fraud always evolves,” said Kimberly Sutherland, vice president of fraud and identity management strategy at LexisNexis Risk Solutions.

“These factors feed on each other and require an integrated and holistic approach to detecting, assessing and mitigating fraud risks moving forward. 2021 will likely be another challenging year for the world in many ways, but organizations can and should make sure they take a comprehensive view of their customers so that they can effectively fight fraud,” Sutherland went on to say.

Point Predictive recently landed another working relationship with a commercial bank that is looking to weed out fraud from its operations and portfolio.

The Emerging 8 honoree that provides machine learning solutions to the lending industry, announced that M&T Bank has adopted the company’s Outsourced Fraud Mitigation (OFM) service “to maintain the upper hand” in the fight against auto-finance fraud.

Point Predictive explained OFM is a fraud prevention service that can alert finance companies about suspicious applications at “very low” false positive rates. This service is delivered through Point Predictive’s seasoned fraud analyst team using the company’s patented Artificial + Natural Intelligence (Ai+Ni) technology with its unique consortium data set.

Point Predictive said in a news release that OFM can give finance companies a more powerful fraud prevention strategy by identifying the riskiest applications and recommending or performing the appropriate verification measures.

“At M&T Bank, protecting our customer’s accounts and information and detecting where there may be a risk is a top priority,” said Michael McClintock, group vice president and director of consumer lending credit operations at M&T Bank.

“By partnering with Point Predictive and investing in advanced security tools, we’re providing frictionless fraud detection capabilities that seamlessly integrate into the customer journey, to stop fraudulent activity before it starts,” McClintock continued.

Point Predictive co-founder Frank McKenna, a recognized and respected fraud industry expert and frequent contributor to Auto Fin Journal, conceived of the Outsourced Fraud Mitigation service, which combines Ai+Ni technology with a consortium data set encompassing 80 million loan applications, billions of data points, and a multi-dimensional database of fraudulent activity.

Point Predictive highlighted that finance companies using this proprietary fraud prevention technology to analyze industry-wide consortium data can detect 30-40% more fraud while eliminating annoying and time-consuming verifications and stipulations on 50% or more low-risk, legitimate consumer applications.

The company added that finance companies have seen a substantial benefit to dealer and consumer experiences by reducing the friction on those low-risk applications.

“Lenders will always be targets of fraudsters, but Outsourced Fraud Mitigation can minimize the impact of fraud and material misrepresentation to lenders while keeping risk operations costs lower,” Point Predictive chairman and chief executive officer Tim Grace said.

“It’s a pleasure to work with an innovative bank that is committed to keeping fraud at bay. With OFM, M&T Bank will be able to prevent difficult-to-detect fraudulent loans from sneaking onto the books and deliver a smooth loan decision process to trustworthy borrowers,” Grace went on to say.

For more information about Point Predictive, send a message to [email protected].

The Financial Crimes Enforcement Network (FinCEN), which is a part of the Treasury Department, is encouraging banks and credit unions to share information about financial crimes.

ID Insight, a Minneapolis-based firm that develops solutions to prevent account takeover and new-account fraud, announced this week that it is applying its award-winning fraud-mitigation technology to launch the Fraud Investigation Network, creating what it hopes is an “unprecedented” level of industry collaboration needed to detect and shut down fraud rings and schemes that target financial institutions.

Fraud was the focus of the annual American Bankers Association/American Bar Association Financial Crimes Enforcement Conference in December.

FinCEN director Kenneth Blanco discussed how information sharing is critical to identifying, reporting, and preventing financial crime. In his prepared remarks during the conference, Blanco provided important clarification on FinCEN’s information sharing program under Section 314(b) of the USA Patriot Act, and announced that FinCEN is issuing a new 314(b) Fact Sheet and rescinding previously issued guidance (FIN-2009-G002) as well as a former administrative ruling (FIN-2012-R006) (parts of which are incorporated into the guidance in the new 314(b) Fact Sheet).

“At the end of the day, we all want the same thing: to be effective, to be efficient, to confront and address risk, to prioritize, to protect our national security, and to protect our families and communities from harm,” Blanco said.

Blanco explained Section 314(b) of the USA Patriot Act is an important tool for combatting financial crime. He noted that it provides financial institutions with the ability to share information with one another, under a safe harbor provision that offers protections from civil liability, in order to better identify and report potential money laundering or terrorist financing.

After carefully considering feedback from the financial industry, FinCEN provided three main clarifications, including:

— A financial institution may share information relating to activities that it suspects may involve possible terrorist financing or money laundering. Although this may include circumstances in which a financial institution has information about activities it suspects involve the proceeds of a specified unlawful activity (SUA), financial institutions do not need to have specific information that these activities directly relate to proceeds of an SUA, or to have identified specific laundered proceeds of an SUA. Nor do financial institutions need to have made a conclusive determination that the activity is suspicious in order to benefit from the statutory safe harbor. Further, financial institutions may share information about activities as described, even if the activities do not constitute a “transaction.” This can include an attempted transaction, or an attempt to induce others to engage in such a transaction. This allows financial institutions to avail themselves of Section 314(b) information sharing to address incidents of fraud or cybercrime, and other predicate offenses, where appropriate. In addition, there is no limitation under Section 314(b) on the sharing of personally identifiable information, or the type or medium of information shared, to include sharing information verbally.

— An entity that is not itself a financial institution under the Bank Secrecy Act may form and operate an association of financial institutions whose members share information under Section 314(b). Notably, this includes compliance service providers.

— An unincorporated association governed by a contract among the group of financial institutions that constitutes its members may engage in information sharing under Section 314(b).

Blanco went on to note that financial institutions subject to an anti-money laundering program requirement under FinCEN regulations, and any qualifying association of such financial institutions, are eligible to share information under Section 314(b). Although sharing information pursuant to Section 314(b) is voluntary, he said FinCEN “strongly encourages” financial institutions to participate to enhance their compliance with anti-money laundering/counter-financing of terrorism requirements.

For additional questions related to 314(b) information sharing, institutions can contact FinCEN at (866) 326-8314 or [email protected].

More details about Financial Institution Fraud Investigation Network

In light of what Blanco and FinCEN shared, ID Insight highlighted that the Fraud Investigation Network expands upon its fraud intelligence platform utilized by thousands of financial institutions across the country. For more than 15 years, banks and credit unions have improved their fraud detection by leveraging ID Insight solutions with a built-in velocity network that captures the repeated submission of identity attributes across participating institutions nationwide.

With this new level of collaboration, ID Insight said fraud investigators nationwide will now easily and automatically benefit from the investigative efforts and insights of their industry peers as they fight together to stop sophisticated fraud rings and schemes related to account takeover and new-account fraud.

The firm indicated that available investigation insights around suspicious behavior from other institutions in the network are automatically shared in real-time as alerts and messages to the entire network, bringing added authority to every inquiry result.

According to ID Insight co-founder and president Adam Elliott, because completed investigations can be marked in one of two ways, either “fraud” or “not fraud,” it is possible to convert investigation results into a simple, binary variable — a 1 or a 0.

“Each 1 or 0 packs an incredible predictive punch,” Elliott said in a news release. “Because our fraud intelligence platform already captures and codifies how investigations are ultimately resolved, all participating banks will benefit when these warning signals are provided back to other investigators in the network.”

Elliott emphasized that fraud investigators are critical to the ecosystem of fraud prevention and detection, working on the front lines to save banking systems millions of dollars each year.

“The Fraud Investigation Network utilizes and amplifies their expertise for the entire network in the most efficient way possible. The outcome — for both financial institutions and the entire industry — is truly greater than the sum of its parts,” Elliott said.

With the launch of the Fraud Investigation Network, Elliott thinks financial institutions will improve the fraud catch rate, reduce fraud losses, reduce customer friction through fewer false-positive results and improve the fraud investigators’ efficiency by pinpointing where they should focus their investigations.

ID Insight’s analysis identified multiple benefits for network users to defend against both new-account fraud and account takeover.

One example: Through the use of this network, one major banking system would have found 4,000 additional fraudulent account opening cases representing more than $600,000 in fraud savings over the course of one month.

Because of the real-time alerts, ID Insight said financial institutions using the network will be able to act more quickly to prevent new-account fraud loss. Investigators are informed of likely fraud that happened up to several months before an inquiry, and ongoing monitoring alerts them to fraud found by peers up to several weeks afterward.

ID Insight added that it is important to note that no immediate adverse action is taken based solely on what investigators have shared as part of the Fraud Investigation Network. Although investigators will use the data to focus their investigations, they will still conduct full due diligence, reviewing all aspects of the case before determining whether it is “fraud” or “not fraud.”

ID Insight pointed out that its fraud screening solutions come after and are distinct from the various consumer reporting/decisioning solutions governed by the Fair Credit Reporting Act (FCRA).

“Account takeover fraud continues to be a challenge, and more information sharing across departments as well as across institutions is necessary to thwart fraud across the board,” said Tracy Kitten, director of fraud and cybersecurity at Javelin Strategy & Research. “Receiving information about emerging fraud schemes in real-time can only stand to benefit fraud and cyber teams.”

To view a short demonstration of the Fraud Investigation Network, watch this four-minute video, or contact the firm for more information or to schedule a personalized demo. To learn more about ID Insight, visit idinsight.com.