“One-size-fits-all” doesn’t work for jackets and shoes, and evidently not for the leasing of new vehicles, either.

J.D. Power said leasing volume now accounts for just 19% of total new-vehicle sales, prompting experts to say that finance companies and dealers need to be more targeted and purposeful than ever in their communication strategies to retain lessees and securing conquest opportunities.

According to the J.D. Power 2022 U.S. End of Lease Satisfaction Study released on Thursday, those experts also highlighted that highly personalized communications based on detailed lease journey analytics are essential to recapturing existing customers and winning new ones.

“The days of the one-size-fits-all lease loyalty strategy are long gone,” J.D. Power director of automotive finance intelligence Patrick Roosenberg said in a news release. “In this market, lenders, dealers and OEMs really need to understand the unique individual journeys of their customers and develop tailored, highly targeted outreach strategies creating the greatest opportunity to retain them.

“Ultimately, successful customer retention and conquest strategies are coming down to detailed analytics,” Roosenberg continued. “Lease providers need to understand the different customer journeys — whether it’s first-time lessees or returning lessees — and offer available incentives to the right customers, at the right moments, via the right communication channels to keep lease volumes flowing.”

So which captives already might be executing in the way Roosenberg suggested?

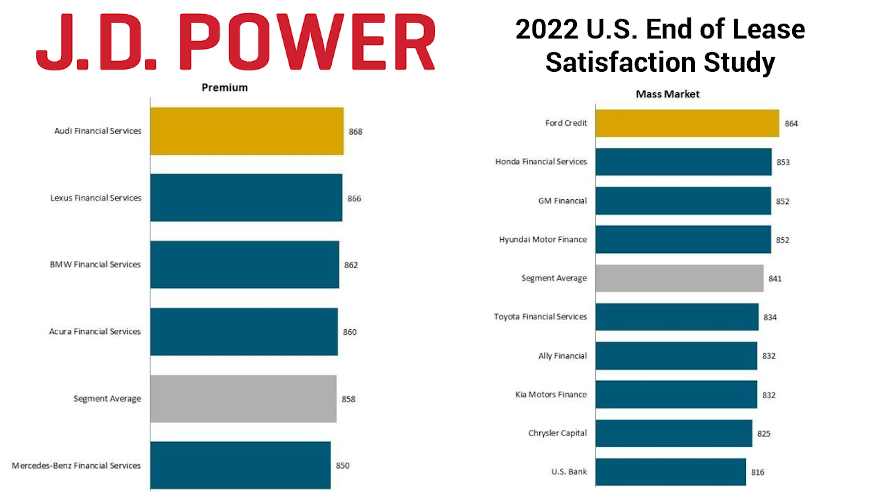

According to this J.D. Power study, Audi Financial Services ranked highest in end-of-lease satisfaction in the premium segment with a score of 868 (on a 1,000-point scale).

Lexus Financial Services (866) came in second, and BMW Financial Services (862) placed third.

J.D. Power said Ford Credit ranked highest in end-of-lease satisfaction in the mass market segment with a score of 864.

Honda Financial Services (853) came in second and GM Financial (852) finished third.

J.D. Power said the 2022 U.S. End of Lease Satisfaction Study identifies lease-end practices and timely marketing opportunities that optimize lease retention for the same brand and at the same dealer.

The company added its study is based on responses from 3,075 mass market and premium vehicle lease customers who are within six months of lease end. It was fielded in November and December.

Our installments of the Auto Remarketing Podcast from NADA Show 2022 in Las Vegas continue with a visit with Credit Union Leasing of America (CULA), which enjoyed a record-setting year in 2021.

CULA president Ken Sopp and vice president of business development Mark Chandler recapped the path to $2 billion in lease originations last year and why that auto financing option works so well at credit unions.

To listen to this conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Credit Union Leasing of America (CULA) enjoyed a record-setting year in 2021.

The company recently tabulated and shared its annual metrics, highlighting that it helped to generate $2 billion in lease originations.

That dollar figure stemmed from originating 50,000 leases in 2021; also, a company first.

For the first time in CULA’s 34-year history the indirect vehicle leasing company exceeded 100,000 active leases in its portfolio; a feat that happened in October.

The company said its volume has nearly tripled in five years to $3.8 billion.

CULA offers leasing through credit unions in 17 states, adding six more states last year. More than 30 credit unions are currently active on CULA’s leasing platform.

Robert Cashman is chief executive officer of Metro Credit Union, which began vehicle leasing on CULA’s platform in 2021.

“Leasing is quickly emerging as an important option for car buyers who are entering a vehicle sales market with constrained inventory and record high prices.” Cashman said in a news release. “We wanted to be in the forefront of offering the affordable and flexible vehicle finance options that leasing provides."

CULA vehicle leasing also proved a key tool for dealers in 2021. CULA said experienced exponential growth in dealer partnerships, increasing the number of dealers in its network more than ten-fold in the past three years.

Cody Carter is internet sales manager at Tustin Toyota in Southern California and works with CULA.

“There are very few customers a lease won’t work for,” Carter said in the news release. “And as the market normalizes, having an alternative bank, such as a credit union, means that we can hit payments that work for our customers and gives us an edge that no one else has.”

CULA’s record growth came during year two of the COVID-19 pandemic, during an increasingly difficult market in which inventory constraints led to record high vehicle prices.

“We have never seen an auto market like this and, while 2022 promises to have its challenges, as we enter a new year on the heels of a record-breaking year, we are optimistic about the future — thanks in no small part to our extraordinary credit union and dealer partners,” CULA president Ken Sopp said in the news release.

“With leasing’s flexible terms, and payments on average $109 less than loan payments, we look forward to supporting our credit union partners as they help even more members into new vehicles in 2022,” Sopp continued. “We also look forward to our continued work with our innovative auto dealer partners as they have a measurable impact in extending leasing’s benefits to car shoppers.

“Vehicle leasing, we believe, is the perfect auto lending product, for consumers, auto dealers, and credit unions alike,” he went on to say.

Sopp also noted that even in a shrinking market, credit unions generated 20.2% of total auto financing during Q3 2021, higher than the pre-pandemic share of 19.6% in 2019’s third quarter.

“Leasing matters for credit union members, and our record-breaking numbers for 2021 prove it,” Sopp said.

Credit Union Leasing of America (CULA) recently set another milestone in the company’s 30-year history amid record prices for new vehicles.

The facilitator of indirect leasing for credit unions said on Wednesday that its portfolio now exceeds 100,000 active leases through its credit union partners, pushing the worth of those contracts to nearly $3.8 billion.

CULA highlighted that portfolio has nearly tripled in five years, as credit unions increasingly embrace indirect vehicle leasing.

With more than 30 active credit unions, CULA’s credit union partnerships are at their highest number to date, and the company has expanded their dealer network across the country by 22% over the past three years.

“These are tremendous milestones for our organization,” CULA president Ken Sopp said in a news release. “With all the upcoming credit unions in the pipeline, these numbers are sure to rise. It’s exciting to see that the industry is embracing the value that leasing brings to the credit union marketplace.”

CULA pointed out that its leasing product is helping credit unions navigate current industry challenges, especially in the new-vehicle market.

According to Kelley Blue Book, new-vehicle prices hit another all-time high in September, marking the sixth straight record-setting month and surpassing $45,000 for the first time.

At $45,031, KBB said the average transaction price (ATP) for a new vehicle in September was up 12.1% (or $4,872) from September 2020 and up 3.7% (or $1,613) from August.

“At a time when inventory challenges remain, and new-car prices continue to skyrocket with no exact end in sight, leasing could very well save the day for many consumers,” CULA vice president of business development Mark Chandler said. “Not only can leasing offer credit union members more financial control, but it can also help grow membership, diversify lending options, and increase yield.”

IAA is trying to make the situation easier for finance companies and insurance providers when a leased vehicle is severely damaged and considered to be a total loss.

On Tuesday, IAA announced an enhancement of the IAA Loan Payoff tool with the ability for insurance carriers to pay off leases from participating finance companies.

IAA estimated more than 5 million vehicles are declared a total loss each year, with up to 70% of those vehicles being attached to a lease or retail installment contract. IAA also said that leases account for about 30% of new-vehicle purchases, adding a level of complexity to the total loss process that can increase cycle time.

The company highlighted through a news release that IAA Loan Payoff is the first platform in the vehicle salvage industry to extend that functionality to pay off leases on total loss vehicles to its partners. The portal can create a seamless process for insurance providers to communicate with finance companies and other institutions that support vehicle leasing.

“With each new digital claims solution, IAA strives to ease pain points for its insurance provider customers,” said Tim O’Day, president of U.S. operations for IAA.

“Offering the ability to pay off leases is yet another way IAA is reducing cycle times for its customers and streamlining the total loss claims process for both providers and lenders,” O’Day went on to say.

Launched in November 2019, IAA indicated IAA Loan Payoff has thousands of finance companies in its multi-tiered network and has shown continuous growth.

“The platform has demonstrated unrivaled benefits by significantly reducing cycle time on positive and negative equity files,” the company said.

For more information on IAA Loan Payoff, visit IAAI.com.

Credit Union Leasing of America (CULA) is on quite a roll after posting its ninth consecutive month of record lease originations in June.

After booking $150 million in lease originations in a single month for the first time in October, CULA said it surpassed $200 million in lease originations in a single month for the first time in its history in May.

Then the company followed that performance by facilitating more than $215 million in lease originations in June.

CULA highlighted in a news release that the first six months of 2021 brought in more than $950 million in lease originations, an 88.8% increase over the same period in 2019, and the highest period of originations in its more than 30-year history.

CULA is the leader in indirect vehicle leasing for credit unions and has originated more than $1 billion in vehicle leases for credit unions annually on average since 2018.

CULA looks to help many of the industry’s most innovative credit unions grow membership, diversify lending options and increase yield, including nine of the top 10 credit unions offering car leasing in the U.S.

“This has been a remarkable six months for credit union vehicle leasing and for CULA. Our success is only possible because of our extraordinary credit union partners whose competitive rates and ability to scale their teams and processes have enabled them to meet consumer demand,” CULA president Ken Sopp said in the news release.

In just the past two months, CULA expanded its leasing footprint into New Hampshire and Texas, and recently helped increase regional coverage for credit unions in Massachusetts, Michigan, Pennsylvania, and southern California, among the many markets it serves.

“As CULA has expanded into new states, bringing on new credit union partners, we are well-positioned to serve a post-pandemic market that is seeking out the affordability and flexibility vehicle leasing offers, all of which is reflected in the record lease volume we have been seeing,” Sopp said.

Meanwhile, CULA noted that it has also increased its engagement with dealerships during the past six months, hitting new records for dealerships submitting leases through CULA credit union partners.

For the first time in its history, CULA said it had dealers that leased more than 100 vehicles in a single month through their credit unions — with one dealer just short of reaching the 200-unit mark.

“CULA’s recent milestones were achieved during the lowest new car inventory level in history,” CULA vice president of business development Mark Chandler said. “These record numbers were greatly helped by the increase in the number of our valued auto dealer partners in new and existing markets, all of whom benefitted from the data, analytics and communication specific to each dealer’s inventory that our team provides every day.”

According to Chandler, the trends that have been fueling credit union success with leasing show no sign of abating.

“For those seeking affordable payments as they emerge from the pandemic’s challenges, leasing’s lower payment (on average $100 or more lower per month) makes a huge difference,” he said. “And for those who can’t find the exact model they want because of inventory constraints, a shorter commitment helps advance their decision.

“Just as importantly, the trusted position credit unions hold in their communities in these uncertain times, is more important than ever and that holds true when members are ready to lease,” Chandler went on to say.

Experian reported that 46.29% of all new vehicles financed during the first quarter were attached to a lease.

And a new partnership could help to raise that level in future quarters.

Credit Union Leasing of America (CULA) further expanded its vehicle leasing footprint through its partnership with Metro Credit Union, which launched vehicle leasing in New Hampshire this month.

According to a news release, Metro Credit Union first started working with CULA at the height of the pandemic last year to implement a leasing program for credit union customers in its home base of Massachusetts.

With exponential growth in leases, month-over-month, Metro Credit Union has become one of CULA’s top performing credit union partners.

Metro Credit Union was formed in Massachusetts in 1926. Since then, Metro has grown into one of the largest state-chartered credit union in Massachusetts with almost $2.5 billion in assets and more than 200,000 members.

CULA has helped to generate indirect vehicle leasing for credit unions for more than 30 years and provides vehicle leasing programs for credit unions to help them grow membership, diversify lending options, and increase yield.

“Leasing is quickly emerging as an important option for car buyers who are entering a vehicle sales market with constrained inventory and record high prices, and we wanted to be in the forefront of offering the affordable and flexible vehicle finance options that leasing provides,” Metro Credit Union chief executive officer Robert Cashman said in the news release.

“Although starting a completely new finance program in the midst of a pandemic, and one as complex as vehicle leasing, is a tall mountain to climb, CULA sped us up the slope,” Cashman continued.

“With CULA handling everything from analytics to insurance to operations to compliance, we were able to launch quickly — and it was an immediate positive for our Massachusetts members, a benefit we are excited to now extend to our New Hampshire members,” he went on to say.

CULA vice president of business development Mark Chandler alluded to the Experian data when elaborating about what the partnership could mean for Metro Credit Union.

“We are so pleased to launch Metro Credit Union’s vehicle leasing program in New Hampshire, a state in which over 40% of all vehicles are leased. We’re not aware of any other credit unions currently offering leasing to their members in the state so it’s rewarding to be able to offer this service here,” Chandler said.

“With their laser focus on improving the banking experience, and deep commitment to the communities they operate in, the opportunity for Metro Credit Union, and for its New Hampshire members, is significant,” he added.

After a record-breaking fourth quarter, CULA started 2021 with its best first quarter ever. While first quarters are typically not good times for auto sales, in Q1 2021, CULA said it recorded nearly $400 million in lease originations for the quarter.

The company went on to highlight this trend is continuing in Q2, with more than $200 million in lease originations from more than 5,300 leases in May alone.

And those trends could continue with this great footprint in the Northeast that ripe for more leasing.

“The most successful credit unions CULA works with are very motivated and want to get up and running quickly and Metro Credit Union is an example of that. From the start, the Metro team was very engaged and enthusiastic, from top leadership on down,” CULA president Ken Sopp said.

“This, combined with their understanding of the value of leasing, meant we could ramp up quickly, so they were able to begin doing significant volume and rapidly see gains from leasing," he went on to say.

Easterns Automotive operates eight locations in Maryland and Virginia near Baltimore and Washington, D.C., and the group is one of the first dealerships to enjoy success stemming from the used-vehicle leasing tool put in motion by DRIVRZ Financial and Roadster.

During the first week since going live with the integration on its website, Easterns Automotive noticed visitors using the lease payment calculator nearly as much as the finance calculator.

“And that’s with no special promotion yet,” said Joel Bassam, director of marketing at Easterns Automotive. “This is crucial. Our website is essentially our dealership — but online. It enables customers to accomplish as much of the sales process as they wish from the comfort of their home.

“We requested this integration with Roadster and DRIVRZ Financial because we wanted to bring that same online convenience to the used-car leasing options we already offer in store,” Bassam continued in a news release distributed by DRIVRZ Financial.

With new branding in place, the leasing and finance division of PowerBand Solutions is taking aim at leveraging used vehicles via successes by retailers such as Easterns Automotive.

On Friday, DRIVRZ Financial — formerly known as MUSA Auto Finance — announced the partnership with Roadster to enhance the digital retail experience with an interactive payment calculator and online application for used-vehicle leases.

DRIVRZ Financial explained that its partnership with Roadster reflects continued focus on using technology to create convenient, modern and transparent customer experiences.

As part of Roadster’s Express Storefront solution, visitors to the dealership website can calculate their exact used-vehicle lease payment based on a set of adjustable factors. These elements include the amount due at signing, miles driven per year and lease term.

The company explained each factor is chosen by the website visitor, and the lease payment is automatically calculated from there. Customers can make as many adjustments to their selections as they wish until they arrive at the best payment.

DRIVRZ Financial pointed out that the same process applies for traditional financing, so the customer can compare their finance and lease payment options side by side.

Once the customer is happy with the deal, he or she can apply for a lease online, without ever setting foot in the dealership.

“We are especially excited about this integration because we don’t know of any other lender that has brought used-car leasing to the digital retail world,” DRIVRZ Financial chief executive officer Jon Lamb said in a news release.

“Used-car leasing is already incredibly rare. Add payment calculators and the ability to apply for a used car lease online, and you’ve got a true unicorn,” Lamb continued.

Lamb believes used-vehicle leasing adds value to dealers like it evidently has at Easterns Automotive since it can increase their customer retention rate and bring the customer back to the dealer for another vehicle much sooner than traditional financing.

Lamb added that consumers like used-vehicle leasing, too, because they can save on depreciation, typically pay a lower monthly payment, and can get into a nicer vehicle — and trade in the unit more frequently — than they could otherwise afford.

Roadster CEO Andy Moss also expressed his thoughts on the integration.

“Our vision is to create a flexible, convenient buying experience where any portion of the process — or all of it — can be completed from home and picked up in the showroom, or vice versa,” Moss said.

“With the DRIVRZ Financial integration, each used-car leasing customer can build their own deal, so they are confident in the numbers and more likely to take the next steps toward closing,” he went on to say.

Thanks to this integration, Roadster’s 2,000 dealerships nationwide will be able to add DRIVRZ Financial used car leasing to their online experience.

In the coming months, DRIVRZ Financial plans to continue its expansion into new platforms and products, including traditional retail finance and direct-to-consumer financing.

With the goal of streamlining financing, retailing, wholesaling and leasing vehicles through a single mobile app, MUSA Auto Finance announced last week that it will rebrand as DRIVRZ Financial.

According to a news release, this new brand will serve as the leasing and finance division of PowerBand Solutions, which acquired a 60% share of MUSA in July 2019.

The company said it will continue growing its indirect lending business while also branching into other business lines.

The company also indicated that it will continue growing its indirect lending business while also branching into direct-to-consumer financing, traditional retail financing, and lending across the full credit spectrum.

Executives went on to mention MUSA’s initiatives will culminate in a one-stop mobile marketplace where consumers and dealers can lease, buy, sell, trade-in, auction and insure vehicles on any digital device. MUSA is looking to provide fast, convenient leasing and financing options through the app.

“Simplifying complex processes through automation has been our hallmark since MUSA opened its doors,” MUSA Auto Finance chief executive officer Jon Lamb said in the news release. “We look forward to bringing the same impeccable user experience to the DRIVRZ mobile app and all our new business lines.”

Lamb added that MUSA will transition to the DRIVRZ Financial brand over the next several months.

Credit Union Leasing of America (CULA) is coming off its two best quarters in company history.

And now the indirect vehicle leasing program provider that empowers credit unions to diversify their existing portfolios is in the Lone Star State.

This week, CULA announced that it now offers vehicle leasing services in Texas through its partnership with InTouch Credit Union (ITCU).

CULA helped ITCU successfully implement its vehicle leasing program in Michigan in the midst of the pandemic, closing the first contract in November.

Based in Plano, Texas, ITCU has close to $1 billion dollars in assets and serves close to 90,000 members across the U.S., as well as more than 20 countries around the world.

“Launching a brand-new auto finance program during the height of a pandemic may seem unusual, but to us it just made sense: the economic uncertainty fostered by COVID meant our Michigan members were looking for the affordable and flexible vehicle finance options that leasing provides,” said Bridger Robinson, senior vice president of lending and branch operations at ITCU. “Plus, we had a partner in CULA who enabled us to ramp up quickly.

“The success of our Michigan program made the decision to offer vehicle leasing to members in our home state of Texas easy,” Robinson continued in a news release.

“CULA’s understanding of the complexities of leasing, and of each market, their commitment to serving our members while helping us improve yield, and their flexibility in customizing services that fit ITCU’s specific member profiles have all been key to the success of our program in Michigan. We anticipate continued success offering our members the best leasing experience in Texas,” Robinson went on to say.

CULA has been facilitating indirect vehicle leasing for credit unions for more than 30 years, providing vehicle leasing programs for credit unions that help them grow membership, diversify lending options and increase yield. The ITCU leasing program marks CULA’s first leasing offering in Texas where vehicle leasing represents about 15% of all new-vehicle sales, according to Experian.

“Texas is one of the largest car markets in the U.S. and, with less than 4% of its credit unions offering vehicle leasing, we believe the opportunity is significant,” CULA vice president of business development Mark Chandler said.

“We are excited to continue to grow our national footprint right here in Texas with such a high caliber, customer-focused partner. ITCU cares about ensuring its members have access to the best financing programs and options available,” Chandler continued.

After a record-breaking fourth quarter, CULA said it started 2021 with its best Q1 ever.

“October 2020 was a record-breaking month for CULA, with more than $150 million in lease originations in a single month, leading to our best Q4 ever,”, of CULA president Ken Sopp said. “The first quarter of the year is typically not a good one for auto sales, but the momentum from Q4 continued. This resulted in nearly $400 million in lease originations for the quarter — our best Q1 ever.”

For more information, visit www.cula.com.