Origence and credit unions are on quite a roll with auto financing.

For the third consecutive quarter in 2022 and for the fourth straight quarter overall, Origence said it has delivered a record amount in credit union auto finance contracts through its platforms.

According to a news release, credit unions funded 2 million contracts through the Origence arc OS consumer LOS and CUDL platforms through the third quarter of 2022, representing a 24% year-over-year increase.

The activated generated a record $62.1 billion in auto paper for in credit unions during the quarter, Origence said..

Credit unions using the CUDL auto lending network funded 1.5 million indirect auto loans through September and continue to be the nation’s largest auto finance provider as an aggregate, experiencing 27% loan growth through August, according to data from AutoCount.

CUDL credit unions have been the nation’s largest auto finance provider over the last five years, based on the same database.

The CUDL Network includes 1,100 credit unions and 16,000 auto dealers nationwide.

“Credit unions continue to be a driving force in auto lending, capturing 26% of market share in the second quarter, their highest market share in five years,” Origence president and CEO Tony Boutelle said in the news release.

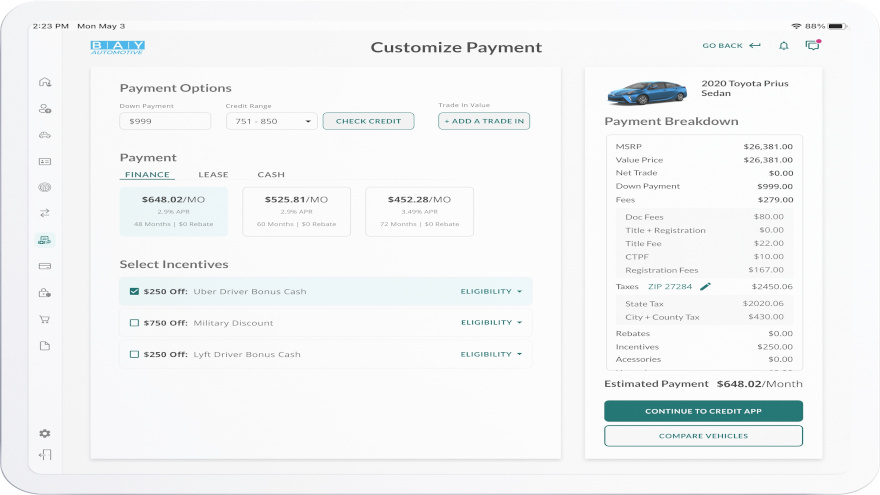

Origence also introduced its Origence arc platform in the third quarter. The platform is comprised of arc OS (formerly Lending 360), arc MX (formerly Intuvo Marketing Automation), and the company’s new arc DX member-facing digital origination portal.

Combining these three applications, the company said Origence arc has set the foundation for its products, providing credit unions with the technology to transform the entire origination journey for their institutions and their members.

“We’re committed to delivering lending technology that helps our credit union partners make more loans, advance the digital experience for their members, and gives them a true marketplace advantage today and in the future,” Boutelle said.

Upstart is making great strides in growing its client base, according to data released by Automotive Market Data.

The company has been named the fastest growing auto retail software in the U.S. for Q2 2022, From April to June, nearly 240 dealerships went live using Upstart Auto Retail, which was the highest level of growth among dozens of auto software platforms in the survey.

“Our market data shows Upstart Auto Retail had the highest net growth in dealer count in the second quarter of this year, including preferred and exclusive OEM digital retail providers,” said Pete Batten of Automotive Market Data, a leading supplier of automotive market insights.

The provider highlighted rapid adoption of Upstart Auto Retail among dealerships is thanks to its unique combination of in-store customization for dealerships and online access for customers.

Earlier this year, Upstart announced that it added mobile-first retail capabilities to its platform, further optimizing the customer experience.

Subaru and VW were the latest OEMs that announced support for Upstart Auto Retail, joining Toyota, Lexus, Mitsubishi, and Kia, as well as top franchised dealers from 37 brands including Ford, Honda and BMW.

The provider noted the growth marks an important milestone for Upstart, which introduced an artificial intelligence-powered financing platform last year, so dealerships could help their customers find affordable financing.

Upstart Auto Retail general manager Michia Rohrssen explained that AI models take into account more than 1,000 data points “to paint a more accurate picture of creditworthiness than traditional credit scores.

“We saw an early opportunity to create a more transparent, seamless experience for both dealerships and customers, which is now being realized in the market,” Rohrssen said. “With inventory shortages, dealerships, OEMs, and customers are all looking for a retail experience that reduces time, cost, and complexity.

“The rapid growth of the Upstart Auto Retail platform indicates a bigger opportunity to enhance how people are buying and financing their cars, which we look forward to bringing to innovative dealer groups across the country,” Rohrssen went on to say.

Origence is on quite a record-setting streak.

After establishing new marks in 2021 and during the first quarter of this year, the CU Direct brand announced last week that it had delivered a record amount in credit union auto financing through its platforms during the second quarter.

According to a news release, credit unions funded a record 1.3 million contracts through the Origence Consumer LOS and CUDL lending platforms during the second quarter. That figure represented a 23% year-over-year increase, generating $39.5 billion in credit union paper.

Credit unions using the CUDL Network funded 610,819 contracts through the first five months of 2022, and remain the largest auto finance provider in the nation as an aggregate, experiencing 20.8% growth through May, according to data from AutoCount.

The software provider also highlighted credit unions on the CUDL Network are outpacing the origination growth of the remaining top 10 finance companies noted by data from AutoCount, and are the only finance provider experiencing double-digit growth year-to-date.

The CUDL Network includes 16,000 auto dealers nationwide.

Through the second quarter, 1,132 credit unions, serving 64 million members nationwide, utilized Origence’s technology solutions, including its CUDL and Consumer LOS platforms, Origence Lending Services, Origence marketing automation platform, and AutoSMART auto shopping program.

Origence reported that used vehicles comprise 76% of all cars financed through the CUDL system year to date, with the remaining 24% being new models.

“Credit unions continue to demonstrate their ability to gain market share in the auto lending marketplace,” Origence president and chief executive officer Tony Boutelle said. “Our foremost focus is delivering innovative lending technology that helps our credit union partners make more loans, create a better member experience, and gain a competitive marketplace edge.”

Francis Gojcaj spent nearly eight years with Cox Automotive after being with RouteOne for almost six years. Now he’s one of the founders and chief revenue officer at LenderAuto, a new service provider that’s out to help banks gain more traction in auto financing.

While in North Carolina for this year’s Auto Intel Summit, Gojcaj joined the Auto Remarketing Podcast to discuss the current standing and potential growth that banks have in originating auto paper.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Origence — a CU Direct brand that provides technology to enhances the origination experience to increase volume, create efficiencies and grow accounts — is reporting continued growth and market strength of credit unions using its CUDL auto lending network to originate indirect financing.

According to a news release, credit unions through the third quarter of 2021 have funded 1.6 million deals through the CUDL auto lending network, generating $42.6 billion in contracts and representing an increase of 14.3% year-over-year.

Origence highlighted that applications also rose in the third quarter, as 5.8 million applications were submitted through the CUDL system, an increase of 4.6% year-over-year.

Further reflecting their growing marketplace strength, Origence credit unions have increased auto financing volume 100.8% since 2013.

Origence reports that used vehicles comprise 74% of all cars financed through the CUDL system year-to-date, with the remaining 26% being new vehicles.

“Credit unions continue to demonstrate their ability to win in the auto lending marketplace,” said Tony Boutelle, president and chief executive officer of Origence. “We remain focused on delivering innovative lending technology that helps our credit union partners make more loans and create a better member experience.”

Origence went to mention that more than 1,120 credit unions, serving 52 million members, are utilizing the company’s network of financing technology.

Origence also noted that its CUDL AutoSMART auto shopping program has grown to include 940 credit union branded digital storefronts in the third quarter, connecting 14,000 dealers and 1.5 million vehicles to millions of credit union members.

The program had a 40% increase in lead generation activity for dealers between year-end 2019 and year-end 2020, according to Origence.

For more information, visit www.origence.com.

The robust fruit of Enterprise Car Sales working with credit unions for four decades recently reached a major milestone

The division of Enterprise Rent-A-Car announced that week that it has generated more than $12 billion in total origination volume for its credit union partners during the past 40 years.

Executives highlighted in a news release that the announcement underscores the importance of the enduring relationships Enterprise has established with more than 1,000 credit unions nationwide.

“The work we do in partnership with credit unions represents a significant aspect of our business,” said Mike Bystrom, vice president at Enterprise Car Sales. “We’re grateful for the relationships we’ve forged over the years and look forward to continuing to work alongside our credit union partners to help them grow their used-car portfolios.”

With more than 147 dealership locations nationwide, Enterprise Car Sales said that it specializes in offering competitive, transparent pricing on a wide selection of high-quality inventory of vehicles 3 years old or newer.

As Enterprise Car Sales continues to expand into new markets, Bystrom noted that this growth is due in part to the brand’s laser focus on providing exceptional customer service — an attribute it shares with its credit union partners.

“Our longstanding relationship with Enterprise Car Sales is an additional benefit of being a Golden 1 member that offers immense value,” said Reva Rao, senior vice president of consumer lending at Golden 1 Credit Union.

“Golden 1 is committed to providing convenience and exceptional service to our members, and our partnership with Enterprise is one we can trust to do the same,” Rao continued.

The retailer is striving toward the next $12 billion in credit union originations, too.

Enterprise Car Sales recently announced the completion of its nationwide rollout of the Accelerated Customer Experience (ACE) digital platform.

This new in-dealership technology solution, coupled with the launch of “Start My Purchase” functionality on the Enterprise Car Sales website, has enabled customers to complete their purchases as quickly as they’d like.

What’s more, Enterprise Car Sales indicated that buyers now have the flexibility to start their purchase from home (with delivery, where available) or complete their entire purchase inside a dealership location.

Many customers are now able to complete their purchase in 45 minutes or less and some in as little as 15 minutes, according to Bystrom.

“We’ve invested in technology that makes the car-buying process as flexible, easy and transparent as possible for our customers,” Bystrom said. “And we’ll continue to listen to our customers and employees as we look for innovative new ways to meet their evolving expectations.”

Furthermore, to provide drivers with greater peace of mind, Enterprise Car Sales has also introduced its Complete Clean Pledge — a promise to go above and beyond Enterprise’s already rigorous cleaning protocols, including the use of a disinfectant to sanitize more than 20 high-touch points after every test drive and before the customer takes possession of their vehicle.

While other segments of the economy are struggling, Equifax highlighted that vehicle sales showed strength at the end of 2020 in spite of the economic impacts of the COVID-19 pandemic.

And Equifax is trying to help make sure the industry stays in that position through its latest solutions.

To assist dealers and finance companies more effectively manage the increased volume of applications, Equifax rolled out StipClear Employment and StipClear Income this week.

Tailored to meet the verification needs of the auto industry, Equifax highlighted both products include The Work Number database information, which can help to automate the origination process and verify information provided on applications.

According to a September McKinsey study, Equifax noted that digital processes are becoming more important along the entire vehicle-purchase funnel. The study concluded that two-thirds of younger consumers prefer a digital format for conducting car purchases.

This trend, combined with a recently reported rise in fake pay stubs submitted with auto-finance applications along with current social distancing sensitivities, has led many dealers and finance companies to begin making more committed moves toward digital processes, according to Equifax.

“It’s clear that the automotive industry is moving very quickly towards more simple, streamlined and online auto financing environments,” said Lena Bourgeois, senior vice president of automotive services at Equifax.

“Dealers and lenders alike want and need to incorporate digital solutions into their process,” Bourgeois continued in a news release. “Digitizing the verifications process with The Work Number helps them to structure new and used auto loans more efficiently and offer their customers quick decisions.”

Equifax said automated employment and income verifications through The Work Number database can benefit dealers, finance companies and consumers.

Digital verifications tap into more than 111 million active employment records in The Work Number database, including many small- to medium-sized businesses as well as hundreds of thousands of 1099 records that can help to accelerate funding decisions and help to eliminate the need for phone calls and pay stubs.

Data analysis from Equifax also showed that when applicants’ income and employment are verified by The Work Number, those auto applicants are 40% more likely to be funded.

“With automated verifications of income and employment, paper pay stubs may be taken out of the equation,” said Joel Rickman, senior vice president of verification services for Equifax.

“When information is provided by The Work Number, consumers don’t have to collect pay stubs and lenders don’t need to spend extra time validating them,” Rickman continued. “Digital delivery of employment and income verifications helps reduce uncertainty, clear stips and allows the buyer to close the transaction and drive off in their new car.”

Equifax went on to mention the finance company may place a stipulation on the contract approval, indicating that the applicant is approved, and the deal will be funded.

Equifax added credentialed finance companies also can clear the stipulation quickly and seamlessly using one of its auto products to verify income or employment information through The Work Number database.

For more information on automotive verification solutions from Equifax, go to this website.

For many of us, it feels like 2021 cannot get here soon enough. While we all are ready for a fresh slate, a robust end-of-year auto lending strategy to close out 2020 on a high note and enter 2021 on the right footing will be essential to setting your business up for success in the months to come.

And with 76% of consumers open to the idea of buying a vehicle 100% online, it is no surprise that lenders will need to continue to position themselves to support digital transactions without letting compliance fall by the wayside.

However, the landscape is changing at a record pace and today’s news is quickly becoming tomorrow’s history. To get ahead and stay ahead of the pack going into 2021 and beyond, lenders will need to make sure they are evolving their business strategies to account for the following three virtual auto lending trends.

1. New Security Measures for a Digital World

According to the 2020 Cox Automotive COVID-19 Digital Shopping Study, consumer likelihood to apply for a car loan or get financing online has risen by 30% post-COVID. And that was from May. The growing adoption of remote signing and delivery technology since then has likely pushed this number even higher. But as more dealerships and lenders strive to deliver on a purely digital F&I process, identity fraud and compliance concerns have also risen. And it’s easy to understand why. Will dealerships be able to keep up with anti-fraud and compliance measures online and remotely? How will responsibility for verifying identities shift between the dealer and lender in a virtual environment? The questions go on.

Ultimately, the truth is that there are scammers out there looking to take advantage of the current situation and digital migration. It will be on both the dealer and the lender to stay vigilant and diligently run OFAC checks and Red Flag alerts. Lenders should also be leveraging structured stipulations as a tool to, in part, confirm the legitimacy of a customer’s identity before a deal is executed. On the other side, these stipulations can help dealership staff better communicate which documents a customer will need for the funding process.

Lastly, it is also important to remember that even once a contract is signed, compliance concerns remain. Take same-day delivery as an example. If the customer signs the contract prior to delivery, they will start to accrue interest before they even own the car. Because dealerships are typically unable to pre-date contracts, they have a responsibility to ensure delivery the same day as signing. Lenders should therefore make sure to work closely with their dealer partners to guarantee a seamless same-day delivery process.

2. Automating the Funding Process

Many lenders are fast-tracking their digital transformation and adjusting business processes to do what is necessary to remain competitive, profitable and efficient in the current economy. Several OEMs have followed suit as well, partnering with their captive finance arms and franchise dealers to go more digital, with some even charging dealerships a fee for using a paper contract.

We as an industry must continue to make progress toward the larger goal of a fully automated funding process. In a shrinking economy, dealers and lenders must be as effective as possible in their margins. By pushing more data into the loan origination system, an automated funding process leads to increased capacity and fewer errors, enabling lenders to provide a higher level of service and move contracts more efficiently. In fact, Dealertrack is seeing a less than 1% return rate on digital contracts.

When the funding process can be done in a systematic, automated fashion, you eliminate the need for the lender to review every nook and cranny of a contract. Instead, they will be able to quickly eye a contract and move it forward to funding. Key areas where automation can be applied to ‘perfect’ the contract funding process and eliminate the time-consuming tasks that come with manual data entry and validation include:

• The collection, preparation and verification of the contract data

• The digitization of all ancillary documents, such as extended service contracts and GAP insurance, to guarantee all data is accurate and everything has been signed

• The verification of all stipulations and loan collateral

3. A Shift in the Auto Lending Dynamic

The rising popularity and necessity of digital retailing is fundamentally changing where consumers are completing credit applications. This used to be done exclusively in-store at the dealership but now it is increasingly done online elsewhere. As a result, the way dealers and lenders work together has also shifted. How exactly? Well, traditionally consumers found a car to buy at a dealership and the dealership helped them find lending options. Today, lenders are working harder to retain more of their customers by pre-approving them for auto financing first and then directing them to the dealership. Consequently, what was once a linear relationship between the dealership and lender has now become a triangle between the dealer, lender and consumer. The new dynamic requires all three parties to partner together for a successful transaction.

As lenders today look to engage with car buyers earlier in the process in an effort to pre-approve them for auto financing, they are also delivering a value-added service for their dealer partners. This shifting dynamic also requires dealers to leverage a deeper pool of lenders and credit unions.

Embracing this changing landscape and adapting business strategies accordingly will ultimately lead to an improved, symbiotic relationship between lenders and their dealer partners — the result being more originations for the lender and more sales for the dealership.

There is no getting around the facts. Yes, the SAAR is forecasted to be down for 2020, but U.S. auto sales have proven to be nothing short of resilient. That means there are still originations to be had this year. However, with fewer originations to go around overall, lenders will be competing at the service level to come out on top. Those who are closely tracking virtual auto lending trends and using them to shape their business strategies will be best positioned for success when the new year comes ringing.

Andy Mayers is a lender solutions strategist at Dealertrack.