Nacha commissioned a study earlier this year to determine how younger consumers are securing their income that’s key to lining up auto financing and maintaining monthly payments.

The organization that governs the ACH Network learned that the sizable majority of the nation’s younger millennials are paid by direct deposit. But Nacha’s study also revealed a stark contrast between W2 employees and gig workers.

According to a news release about the study, overall, 97% of workers ages 22-34 have a bank or credit union account, with 83% receiving their pay by direct deposit. However, among W2 employees, 88% use direct deposit, while only 47% of gig workers are paid this way.

Of the respondents who receive direct deposit payments, Nacha said more than three-quarters cite key attributes of reliability, trustworthiness, ability to be paid on time, security and ease of use.

“Among younger W2 workers, direct deposit is widely understood, used and appreciated,” Nacha president and CEO Jane Larimer said. “There is an opportunity to educate younger gig workers on the value of Direct Deposit as a fast, convenient, reliable and environmentally-friendly way to receive their pay.”

“The study also found that ACH usage increases as workers progress in life when they are more likely to purchase a home or car, pay bills and save for retirement,” Larimer continued. “When factoring the entire millennial population, including those 35-40, ACH usage would be even greater than what was reported.”

Nacha pointed out that millennial workers can also use direct deposit for receiving other payments, including tax refunds and government benefits, app-based payments, travel and expense reimbursements, and bonuses and commissions. They can also benefit by using ACH for expenses (known as direct payments), including loans, rent and mortgage, utilities, credit cards and insurance premiums.

Other key findings from the research on American workers ages 22-34 included:

—71% keep their money primarily in a bank account as almost all have deposit accounts, and the vast majority have savings accounts.

—Seven in 10 use direct payment for bill payments at least once a month.

—56% of gig workers still primarily store their money in bank accounts, but the remainder store it in other non-bank payment app alternatives.

—The top use cases for direct deposit are salary/wages (82%) and taxes/other refunds (53%).

—Among those with direct deposit, the top three use cases for paying bills with Direct Payment are utilities (53%), rent/mortgage (48%) and credit cards (44%).

The nationwide survey by Quadrant Strategies was conducted from April 14 to May 1 on behalf of the Nacha. The survey was conducted online among 700 American adults, ages 22-34, who are either W2 employees and/or gig economy workers.

Based on the research, Nacha has launched a campaign to educate younger millennial gig workers on the value of direct deposit. The campaign page can be found at DirectDeposit.org/GigWorkers.

Cover Genius found a new path to an industry relationship last week.

A leading insurtech for embedded insurance and a 2020 Emerging 8 honoree announced a partnership with Zip, a global buy now, pay later (BNPL) player, to offer customers tailored protection embedded into the payment process and Zip’s wallet experience.

According to a news release, the partnership expands Zip’s BNPL offering by not only protecting purchases in the moment, but also allowing customers to add protection to their recent purchases.

“With the global BNPL market expected to reach $680 billion by 2025, we’re thrilled to partner with Zip to protect the growing number of worldwide BNPL customers,” Cover Genius co-founder and chief executive officer Angus McDonald said in the news release.

“Zip is a popular payment option and is uniquely positioned to protect their customers at point of sale but it also has a tremendously loyal and engaged customer base, meaning they’re able to further develop the relationship with embedded protection in their popular wallet, while also doing away with arcane multi-year products backed by traditional insurers who produce poor customer outcomes,” McDonald continued.

The partnership integrates XCover, Cover Genius’ global insurance distribution platform, into Zip’s alternative payment platform for a seamless customer experience that is designed for ultimate flexibility.

The feature will give Zip Pay and Zip Money customers the ability to add protection to their Zip purchase, either during checkout or after checkout on select purchases, making it an affordable and timely alternative.

In an initial launch, customers will be offered transaction monitoring, where they can protect their recent purchases — with a solution that leverages transaction data to offer protection that is tailored for relevance and renewed on an annual, recurring basis. Insurance options will also be available for Zip customers at checkout, with XCover’s Natural Language Processing utilized to identify relevant items.

“We’re excited to collaborate with Cover Genius to offer Zip’s customers real time, relevant offers for their online purchases,” said Larry Diamond, co-founder and global CEO at Zip. “We understand our customers want flexibility and peace of mind when making major purchases, and Cover Genius’ embedded technology does exactly that in a seamless and convenient way.”

“This partnership also perfectly aligns with our ethos of creating a financially fearless world. We put our customers at the center of everything we do, so it is important to us that we can arm them with the ability to shop confidently and protect the items that they care about in a way that is affordable and tailored to their purchases,” Diamond went on to say.

Through this partnership, Cover Genius has the potential to address Zip’s more than 11 million BNPL customers, giving them access to real time protection that’s embedded into their purchase journey. Amid the rapid growth of the fintech sector, there is a huge demand (up to 96% according to the survey) for banks, neobanks, wallets, accounting platforms, BNPLs and other fintechs to protect their customers in this way.

For more information visit, covergenius.com.

The industry continues to strive toward making payments instantaneous.

Open Payment Network (OPN) and North American Banking Co. (NABC) recently announced the capability to deliver instant payments to and from any financial institution on The Clearing House’s Real Time Payment (TCH-RTP) network through NABC’s ExcheQ application.

By leveraging OPN’s certified interoperability with TCH-RTP, NABC can offer customers more payment options along with the payment speed for which ExcheQ is known.

“We’ve been working closely with OPN to develop this instant payment solution for our customers,” NABC chief executive officer Michael Bilski said. “Now that OPN is officially certified on the TCH-RTP network, we can dramatically expand the number of financial institutions that our customers can interact with via ExcheQ.”

Leveraging OPN’s interoperability with the TCH-RTP network, financial institutions can gain access to all of the other financial institutions on the RTP Network. Using OPN’s open API, financial institutions can easily create custom instant payment applications for their customers and rely on OPN to power those solutions across the RTP network.

“The Clearing House recently certified our platform to interoperate with the RTP network,” Open Payment Network CEO Bradley Wilkes said. “With our ability to connect to this expansive real-time payment network, we can now deliver the benefits of instant payments to more financial institutions, like North American Banking Company.”

Real-time payments are facilitated by The Clearing House RTP network and soon by the FedNow service. OPN is interoperable with RTP and is part of the FedNow pilot program.

Last week, ACI Worldwide and IR extended their partnership to include enriched end-to-end enterprise transaction monitoring

Part of the ACI Enterprise Payments Platform, ACI Payments Monitoring powered by IR Transact can give banks and financial institutions visibility into the health of their systems and status of payments in real time — covering high-value and low-value real-time payments, as well as card payments.

The announcement of full enterprise monitoring capabilities follows more than two decades of successful partnering by ACI and IR.

“Our global customers are seeking new levels of insight and real-time analysis to help them adapt to changing consumer behaviors,” said Sam Jawad, head of banks and intermediaries at ACI Worldwide.

“By extending our long-standing and successful partnership with IR, we have also further enriched our real-time analytical capabilities, delivering comprehensive and actionable business insights,” Jawad continued in a news release.

The companies pointed out that the COVID-19 pandemic dramatically accelerated the trend toward real-time payments around the world.

ACI Worldwide’s 2022 Prime Time for Real-Time global payments report forecasted that real-time payments transaction volume will rise from 118.3 billion in 2021 to reach 427.7 billion annually by 2026.

As governments and central banks enable the shift toward real-time payments to unlock economic growth, the companies said they are providing further impetus for cashless and real-time digital payments.

Executives added the real-time monitoring capabilities that ACI and IR provide is geared to position banks to respond to this change.

“The continuing shift towards cashless payments, the emergence of new payment schemes and growing customer expectations are all putting pressure on organizations to deliver a seamless payments experience,” said David Guiver, head of transact and infrastructure products at IR. “Through our expanded partnership with ACI, banks and financial institutions benefit from real-time monitoring that helps them glean actionable insights on a single pane of glass.

“This enables them to continuously optimize their services and resolve issues before they impact customers,” Guiver went on to say.

Constant, a provider of digital loan servicing solutions, announced a partnership with Celerit, a veteran provider of technology services to the financial services industry.

Celerit, which has a 30-year history of supporting bank loan servicing shops and their core software platforms, will leverage Constant’s borrower self-service platform to help banking clients provide digital, personalized experiences that can allow customers to self-serve when managing their debt.

The companies said banks and credit unions are under increasing pressure to expand their digital presence, respond to borrowers faster and scale with less resources. However, Constant and Celerit pointed out that many institutions still rely on legacy core platforms that don’t support automation or self-service for bank customers.

Constant’s Modern Loan Servicing platform (MLS) can integrate with any core servicing platform to empower customer service agents to reduce the time to service an account through back-office automation and allow customers to self-serve for most loan servicing tasks.

“Celerit has an excellent reputation for improving loan servicing outcomes for financial institutions. We’re delighted to expand their offering with our MLS platform, which among many things moves high volume tasks to customer self-service channels,” Constant chief executive officer Catherine York Powers said.

“We redefine loan management across all debt types through automation in the back-office and delightful customer experiences that together drive down servicing costs,” York Powers continued.

Celerit chief executive officer Terry Rothwell added, “For more than 30 years banks and credit unions have trusted Celerit to bring them the most state-of-the-art technology and solutions. It’s not a responsibility we take lightly.

“In today’s crowded fintech space, Constant’s solution and its team stood out to us for their truly innovative technology,” Rothwell went on to say.

Fintech firms aren’t just trying to connect dealerships and finance companies. Some shops also are looking to bring private individuals together who are seeking to complete a vehicle sale.

On Wednesday, PrivateAuto launched what it believes is the first self-service, peer-to-peer payment app for private vehicle sales that can allow users to verify a driver’s license, eSign the bill of sale, and instantly transfer funds anytime, anyplace.

The web app is now live and available nationwide, and the downloadable version will be on the App Store in the summer, according to a company news release.

In a YouTube video released on April 1, PrivateAuto founder and chief executive officer Brad Parker purchased a Porsche 911 Carrera, transferring more than $100,000 in the parking lot.

While most payment apps allow users to transfer up to $5,000, PrivateAuto said it is the first fintech solution to provide instant and secure payment processing for private party vehicle transactions above $5,000.

Some of the app’s features include driver license verification with facial recognition technology, a test drive scheduler, accept/reject/counter offer functionality, eSignable bill of sale, and integrated vehicle financing options.

Users can even generate unique window-sticker QR codes for their vehicles and advertise without sharing personal contact information.

“For decades, the private sale has been a clunky and awkward experience for many people. We are proud to be the first true fintech for the private sale allowing two users to safely transact on their terms and not rely on a third party,” Parker said in the news release.

“Our journey is just beginning as we introduce dealer-like services to the private sale without the added cost or hassle,” he went on to say.

For more information, visit privateauto.com.

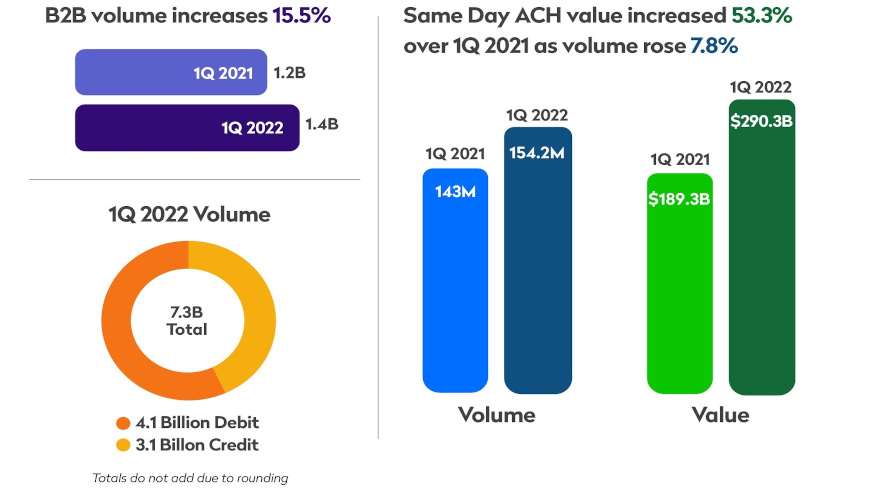

Money moving electronically continues to be on an upward trajectory.

According to a news release distributed by NACHA on Monday, the ACH Network experienced overall growth in the first quarter of 2022, even as recent forms of pandemic-related government assistance have ended.

Officials said growth in the first quarter was fueled by business-to-business (B2B) payments and the increase to the same day ACH dollar limit.

B2B payments increased by 15.5% from the first quarter of 2021, with more than 1.4 billion ACH B2B payments made. That also is a 35.5% increase from the first quarter of 2020, when COVID-19 initially closed many workplaces.

“Many businesses and organizations have come to realize that ACH payments are not just the new normal, but the best way of doing business, given their reliability and convenience,” NACHA president and chief executive officer Jane Larimer said.

The same day ACH per payment limit increased to $1 million on March 18, contributing to a 53.3% increase in same day ACH dollar value over a year earlier, to $290.3 billion, along with a 7.8% volume increase to 154.2 million payments.

“The payments community has welcomed the new $1 million limit and put it to immediate use,” Larimer said. “The ACH Operators and financial institutions have worked hard to make same day ACH the successful modern payment option that it is.”

Overall volume on the ACH Network totaled 7.3 billion payments, up 2.2% from a year earlier, and moving $18.5 trillion, a 7.1% increase.

Larimer pointed out this growth occurred even in the absence of the pandemic-related assistance payments that existed in 2021, when economic impact payments were being made and expanded unemployment benefits were available.

“Adding 154 million payments in a single quarter, with additional value of $1.2 trillion, speaks to the strength of the ACH Network, as it meets the needs of consumers, businesses and governments to make and receive payments,” Larimer said.

Here’s a development where new technology is helping payments to be processed at time of service and potentially stretched over time in another part of the automotive space.

AutoVitals, a digital vehicle inspection and shop workflow solution, recently formed a partnership with Facepay, a relational payments platform that helps business owners substantially increase profits by eliminating credit card processing and transaction fees.

According to a news release, AutoVitals became interested in Facepay’s technology because it can allow auto shop owners to adopt a modern payment structure with a low-cost, fixed monthly subscription.

In turn, Facepay offering can provide repair shops with a touchless, more streamlined process for their consumers that will also add to their bottom line.

AutoVitals said it is committed to providing solutions and technologies that allow shops to grow profitably. The company explained Facepay’s management system can be easily integrated into an auto shop’s existing workflow.

Facepay also can allow shops to offer multiple payment options, including contactless payments, monthly installments, and service subscription plans.

AutoVitals highlighted that some shops are already experiencing the benefits of this partnership. Brittany Schindler at Rod’s Japanese Auto Care said 82% of its sales went through AutoVitals and Facepay.

“Our customers love it and so do we,” Schindler in the news release. “It’s so seamless and easy.”

Top executives at both AutoVitals and Facepay are hopeful more shops such as Rod’s Japanese Auto Care can experience similar successes.

“Focusing on customers is your one chance for profitable growth; after all, you only get one chance to wow them,” Facepay founder Mark Hale said.

“Facepay works best when incorporated into your existing workflow. We couldn’t be happier than to work with the leading provider of workflow software, AutoVitals, to deliver real profits to the shop owners,” Hale continued.

AutoVitals chief executive officer Jon Belmonte added, “AutoVitals is known as a true innovator in the automotive aftermarket and so is Facepay.

“We want to make sure our clients have access to all the top financial service options to help them best support their customers as well as save money when possible. We’re excited to be partnered with the Facepay team,” Belmonte went on to say.

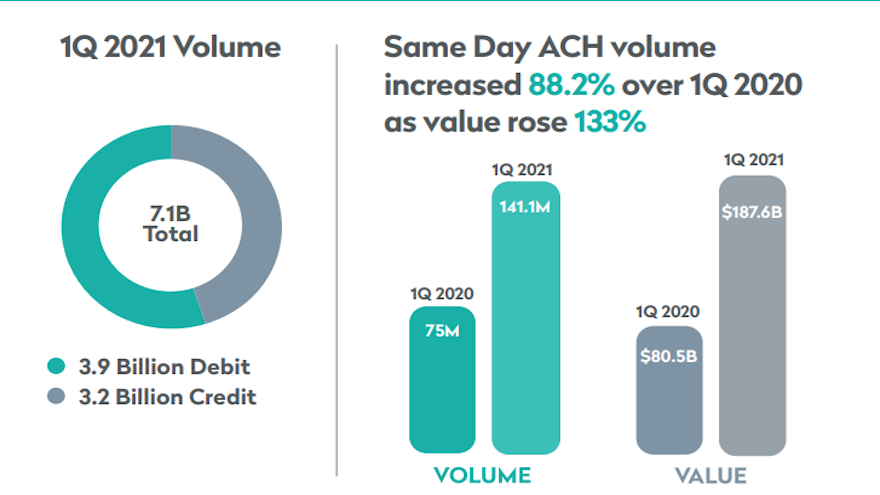

It delights auto-finance companies when their customers set up an ACH path for monthly payments.

And providers likely are excited about that stream potentially growing since Nacha, which governs the ACH Network, saw total volume soar during the first quarter of the year, setting two new records in the process.

Nacha said quarterly volume of 7.1 billion payments represented an increase of 11.2% from the same period in 2020. The value of those payments totaled $17.3 trillion, reflecting a nearly 19% increase from a year earlier.

According to a news release, the first new record was set in February when ACH volume averaged more than 118 million payments per day, the ACH Network’s highest daily average for a month.

The second was in March when ACH volume hit 2.7 billion payments, the largest monthly volume in ACH Network history. Nacha said this figure included approximately 110 million economic impact payments by direct deposit from the federal government.

“While these have been some of the most challenging times we have seen, the modern ACH Network has again shown itself to be not only resilient but industrial strength,” Nacha president and chief executive officer Jane Larimer said in the news release. “The ACH Network is doing its part to get Americans the assistance they need while keeping billions of other payments moving seamlessly.”

Nacha highlighted the ongoing migration from checks to ACH continued for the nation’s businesses, as business-to-business ACH payments climbed 17.3% to 1.2 billion.

The organization also noted the number of same-day ACH payments passed the milestone of 1 billion since inception, as well as transferring more than $1 trillion in value.

Nacha pointed out same-day ACH volume increased 88% in the first quarter as the number of payments exceeded 141 million. The value of these payments — $187.6 billion — marked a 133% increase above Q1 2020.

Operating hours for same-day ACH were extended on March 19, and the ACH Network now settles payments four times a day.

“Ongoing adoption and surpassing the 1 billion payments mark show that same-day ACH is a significant contributor to meeting the nation’s demand for faster payments,” Larimer said.

“Our next enhancement, increasing the per-payment limit to $1 million in March 2022, is another step to expand the reach of same-day ACH,” she went on to say.

FIS and Reynolds and Reynolds now are working together through a multi-year agreement the companies recently finalized to help dealerships with accounting chores and more.

According to a news release, FIS has been selected as the exclusive payments provider for Reynolds and Reynolds, a leading provider of dealership software, documents and professional services.

The agreement means Worldpay from FIS has assumed all payment processing activities for Reynolds and Reynolds’ integrated payment solution, ReyPAY, which can provide fast, convenient and contactless payment options for dealerships and their customers.

Officials said ReyPAY will now have Worldpay’s cloud-based data security and dynamic reporting to better manage payment operations.

Through the new Worldpay partnership, Reynolds and Reynolds dealership customers also can benefit from new accounting capabilities, including the ability to more efficiently manage the payables process, further streamlining payment and reconciliation processes.

“ReyPAY is an integral part of the Reynolds Retail Management System and delivering the type of overall consumer experience that our dealership customers want to deliver,” said Jon Strawsburg, vice president of product management for Reynolds and Reynolds.

“We have a lot of confidence in Worldpay’s innovation and vision for the future,” Strawsburg continued. “It’s the type of partnership that we’re confident can lead to operational excellence and accelerate time-to-revenue for dealers, as well as be a major convenience for their customers.”

Dan Brames, head of North America and international merchant solutions at FIS, added, “Working with Reynolds and Reynolds, we are able to deliver smarter payment experiences for automotive dealerships and their customers in a secure and seamless way.

“Reynolds and Reynolds has a long history of excellence in the automotive industry, and we look forward to working collectively to help modernize dealers’ everyday operations with advanced payments and accounting processes,” Brames went on to say.