Cherokee Media Group president Bill Zadeits talks with Hugh Hathcock, owner of ReconVelocity, about the challenges of the pandemic, conversations he has had with dealers and how they are faring.

Plus, they discuss the dealer relief program at ReconVelocity, the story behind the company and more.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Through Sunday, month-to-date used-vehicle retail sales for franchised dealers are off 15% from pre-virus forecasts, according to J.D. Power.

But there’s actually some good news to unpack from that, including one particular retailer that anticipates being back to original expectations for used sales by July.

Here is that silver lining from J.D. Power: Not only is that aforementioned used decline much less severe than the drop in new-car sales, which are down 27%, the slowdown in used retail has eased.

“This is a stark improvement from April and evidence that the used vehicle market is in recovery,” the company said in the J.D. Power Auto Industry Impact Report released Wednesday.

In his regular weekly video report, Cox Automotive chief economist Jonathan Smoke said used-vehicle sales saw an estimated 6% year-over-year decline last week, continuing what has largely been momentum in used sales since the beginning of April.

Strong used retail sales have also helped unclog excess inventory at dealerships.

The rolling seven-day used retail supply, “peaked at 115 days of supply on April 8,” Smoke said.

“Normal retail supply is about 45 days. It was down to 41 days as of this weekend,” Smoke said. “Retail used inventories are now lower than at any point in 2019, and that’s because retail sales continue to outpace new inventory additions.”

Wholesale improves, too

On the wholesale side, the downturn has eased as well, with Manheim showing a 22% decline in transactions last week, he said.

The peak in the rolling seven-day wholesale supply was April 9, when it reached 149 days, Smoke said. That has since been sliced to 44 this past weekend. Twenty-three is considered normal, he said.

There were 86,000 wholesale auction sales last week, according to J.D. Power. The pre-virus forecast was 104,000 units, leaving a gap of 18%.

That’s quite an improvement over the last month-and-a-half, when you consider that during the week ending April 5, there were 18,000 wholesale auction sales, compared to the J.D. Power pre-virus forecast of 105,000 units.

In just over two months since the pandemic began, there have been 442,000 wholesale sales, J.D. Power said. That’s a 589,000-unit year-over-year decline. It’s also down 506,000 units from what the company initially forecasted before the pandemic.

While those numbers might seem staggering, things are getting better in the lanes.

“Physical auction activity is steadily approaching pre-virus expectations,” the company said in its presentation.

Sonic, EchoPark continue progress in used

And it’s not just the analytics who are expressing cautious optimism in used cars.

At Sonic Automotive, the decline in same-store used-vehicle sales at its franchised dealerships has been trimmed to less than 15% so far in May, the retailer shared in an update Tuesday, along with noting gains on the new-car side.

The slowdown in same-store pre-owned sales at its EchoPark standalone used-car stores has narrowed to 10%.

These gains continue the improvements Sonic noticed late last month.

“New and used-vehicle gross profit per unit continues to be lower than the prior year, due in part to strategic pricing adjustments we made to increase sales volume,” Sonic and EchoPark president Jeff Dyke said in a news release on Tuesday.

“Fixed operations gross profit is recovering steadily, down less than 30% in May month-to-date compared to the prior-year period. Additionally, the actions we took to right-size our used-vehicle inventory levels have paid off, with a used-vehicle inventory days’ supply of 29 days at the franchised stores and 33 days at EchoPark at April 30, 2020, compared to 37 and 44 days at March 31, 2020, respectively, on a trailing one-month sales basis,” Dyke said.

“We believe that both our franchised stores and EchoPark stores are well-positioned to capitalize on inventory sourcing opportunities that may impact the pre-owned market in the near term, allowing us to drive incremental sales volume and continue to expand our EchoPark footprint.”

In slides updating its 2020 outlook, Sonic said retail used-vehicle sales at its franchised stores are expected to return to their originally forecasted levels by July and then actually exceed original forecasts for July through December.

At EchoPark, used retail sales in April were well below the original forecast, but ended up 23% stronger than the forecast from April 29. Like the franchised dealers, used-car sales for EchoPark stores are expected to meet the original forecasts in July and then outperform original forecasts the remainder of the year.

(The company does note in the slides: “Due To Uncertainty Related To The COVID-19 Pandemic And The Resulting Economic Impact, Actual Results May Differ Materially From Management’s Forecast.”)

Sonic and EchoPark chief executive David Smith noted: “Over the past few weeks, we have continued to see increasing consumer activity in the majority of our markets, as stay-at-home orders have been gradually relaxed. Our new and used vehicle sales volume and fixed operations gross profit have performed at or above our expectations and continue to improve week by week.

“We believe the strategic actions we took at the onset of the pandemic have strengthened our business and positioned us to take advantage of opportunities in the second half of 2020 and beyond,” Smith said. “Our team remains committed to offering an exceptional sales and service experience to our guests to ensure their continued access to safe, reliable transportation as we navigate this crisis.”

In this episode of the Auto Remarketing Podcast, Cherokee Media Group president Bill Zadeits chats with John Possumato, founder and chief executive officer of DriveItAway.

Possumato talks about "an accelerated evolution of innovation" spurred by the business impact of COVID-19, his take on Carvana and Vroom, and more. Plus, he explores the advantages dealers may have over startups and disruptors.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Black Book’s newest COVID-19 Market Update released on Tuesday described how auctions, consignors and dealers all are continuing to acquaint themselves with the “normal” within the wholesale market.

Analysts are seeing more indications of a late spring market regenerating a bit as buyers adapt to relying on online technology to make inventory decisions.

Black Book reiterated that wholesale prices dropped significantly in April as uncertainty over COVID-19 impact and response dampened the demand. Analysts pointed out that wholesale prices declined by 5.9% in April.

“Typically, used prices increase during the spring market,” analysts said in the update while computing that April actual wholesale prices declined 13% below projected values.

“Auctions are starting to return to some semblance of ‘normal’ now,” Black Book continued. “This is typically the time of year that we start to see a decline in sales rates due to the spring market winding down, so the increase in sales rates, after weeks of record lows, are now reaching a point that is typical and somewhat seasonal.”

While workers in all sorts of industries have been forced to make changes with offices and workplaces closed, Black Book that some dealers and wholesalers have experienced some challenges when their typical workplaces are storage lots and auction lanes.

“We’ve heard about positivity from buyers about being able to inspect inventory prior to sale, and that has shown in their willingness to pay a premium for quality vehicles on the lanes. Previously, there was hesitancy to rely solely on condition reports,” Black Book said.

“The few auctions that are allowing physical attendance by buyers and sellers on sale day are seeing the largest improvement in sales volume and prices, with reports of both nearing the averages for this same time last year,” analysts continued.

“There is still a regionality to the success of each auction. The best results are coming from states that have loosened stay-at-home orders,” Black Book added.

“A few weeks ago, we reported that there were bottlenecks at auctions around getting vehicles checked-in, condition reports generated and reconditioning performed, but we are now hearing at some auctions this is improving as auctions can get personnel back onsite to perform these tasks,” analysts went on to say.

Black Book indicated that there appears to be some stability in terms of auction volume, mentioning that sales last week ran at rates about 25% below what analysts spotted at the same time last year. That’s a marked improvement when Black Book said that the number of sales bottomed out at roughly an 80% year-over-year decline when most auctions closed their physical sales — and some closed entirely — at the end of March.

Analysts pointed out that sales rates have improved for six consecutive weeks since April 6. While they’ve improved to 47%, Black Book data also showed that reading is still off from what analysts spotted back at the end of February when it stood at 70%.

“We observed sales rates continuing to climb as the ability to preview inventory, and in some cases be physically present in lane, gave dealers more confidence in their purchase,” Black Book said.

Dealers are caught juggling how to structure their inventory as shopper activity and purchase intension climbs to levels registered before the coronavirus pandemic arrived, according to information and observations shared by Black Book and TrueCar on Tuesday.

And the trends are particularly important considering that the crucial Memorial Day sales weekend is straight ahead.

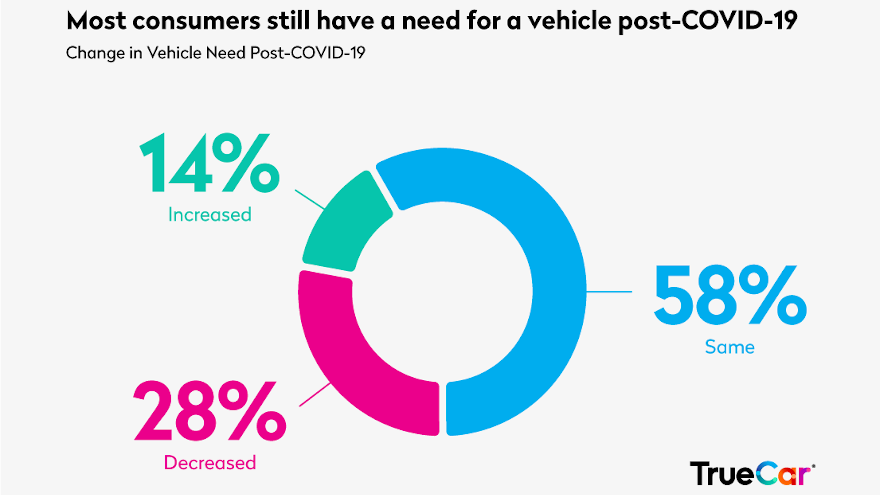

TrueCar analysts began by explaining its COVID-19 vehicle-buying insights arrived based on their marketplace data prior to and after COVID-19 social distancing mandates that began to take effect as well as consumer sentiment from a three-wave study of shoppers during the coronavirus pandemic.

“Website traffic and purchase intent returned to pre COVID-19 levels on the TrueCar marketplace in the last two weeks of April,” said Nick Woolard, director of OEM and affinity partner analytics at TrueCar.

“We’re now seeing those numbers increasing going into Memorial Day weekend to levels closer to what we typically see toward the end of the year,” Woolard continued in a news release.

Of course, dealers want to boost their retail performance, but how stores handle the influx of demand is leaving managers with new challenges. Black Book touched on that part of the situation in its newest COVID-19 Market Update.

“Last week we continued to see and hear about dealers, in areas with loosened restrictions, who need to fill empty spots on their lots after an unexpected uptick in activity at their dealerships,” Black Book analysts said.

“The demand continues to vary by customer. Those customers that typically need transportation and are looking for that price point, under $10,000 vehicle, or they are looking to take advantage of new car incentives, including the headline-grabbing 0% for 84 months,” analysts continued.

“Hesitancy remains when it comes to sending a trade-in or unwanted inventory to the auction for disposal, but with low wholesale values, the auction has become a good source of inventory,” Black Book went on to say.

While the auction might continue to be a place that dealers can secure used inventory, TrueCar’s information that shoppers might be more inclined to purchase a new model. TrueCar indicated purchase intent for new vehicles compared with used vehicles rose 9% in the post-COVID-19 period.

TrueCar defined the pre-COVID-19 period as March 1-12 and the post-COVID-19 period as March 13 through May 5. TrueCar also reiterated that it calls purchase intent as the connection made when a consumer submits their contact information to a dealer for a price offer on a specific vehicle indicating heightened demand and purchase intent for a vehicle.

“Automakers quickly turning on 0% financing offers in response to COVID-19 actually spurred an increase in pickups and utilities in the period after COVID-19 took effect,” Woolard said. “This was clearly a winning strategy to shore up demand and we see incentives as a driver of purchase intent in our consumer research as well.”

Black Book added an observation about pickup demand, too.

“In our conversations with dealers, we have heard that some have resorted to purchasing new, non-upfitted trucks from conversion companies to increase their available truck inventory,” Black Book analysts said.

“These trucks would have originally been ordered new by an aftermarket conversion company or upfitter, but due to demand, traditional dealers have acquired them from these aftermarket companies to sell new to retail consumers,” they continued.

More insights from TrueCar research

TrueCar analysts highlighted five other marketplace insights from their latest research, including:

— TrueCar marketplace traffic and purchase intent returned to pre-COVID-19 impact levels in the last two weeks of April and have continued to increase going into Memorial Day weekend.

— For new vehicles, large and sporty vehicles saw an increase in purchase intent in the post COVID-19 period. Full-size pickup was up 38%, premium performance vehicles like the Chevrolet Corvette Porsche 911 was up 26%, midsize pickup was up 15% and full-size utility was up 11%.

— Domestic brands showed an increase in share of purchase intent on new vehicles in the post-COVID-19 period, with Ram up 38%, GMC up 17% and Ford up 5%.

— In the period after COVID-19 impact, purchase intent shifted toward more expensive vehicles, up by an average of $800 on new vehicles and up $850 on average on used vehicles.

— Across U.S. states, there was an average decline of 26% in combined new and used purchase intent in the post COVID-19 period, with Montana the only state up, at 2%. Recovery varied widely by state based on timing and details around stay-at-home mandates.

“The pace of change we’ve seen recently is unprecedented, so we wanted to capture consumers needs and concerns around car buying as they rapidly evolved,” TrueCar head of research Wendy McMullin said in the news release.

McMullin explained those insights from TrueCar’s three-wave research during COVID-19. Each wave surveyed 1,200 consumers, screened for those planning to purchase a vehicle within the next 12 months.

TrueCar presented its findings in context with Johns Hopkins University data about the pandemic, including:

Wave 1 fielded March 17: 6,421 cases / 108 deaths in the U.S.

Wave 2 fielded April 9: 461,437 cases / 16,478 deaths in the U.S.

Wave 3 fielded May 4: 1,180,375 cases / 68,922 deaths int the U.S.

“Wave one respondents were feeling less of an impact, which is not surprising given that stay-at-home mandates had just begun and the number of cases was still relatively low,” McMullin continued. “Concerns over safety and economic security peaked in wave 2. Two months into the pandemic in wave 3, we’re seeing the proportion of respondents delaying their vehicle purchase has recovered a bit to wave 1 levels, which is promising.”

TrueCar mentioned concern over being exposed to COVID-19 peaked in wave 2, yet remains a heightened concern in wave 3 (57% very or extremely concerned, versus 62% in wave 2).

In wave 3, analysts discovered significantly fewer respondents stated they were delaying their purchase compared to wave 2. However 32% still stated they are delaying their purchase.

TrueCar noted that half of shoppers surveyed said that lower interest rates and increased discounts and incentives may encourage them to purchase a vehicle now.

Analysts pointed out 8% of shoppers stated their primary reason for purchasing/leasing a vehicle is to avoid public transportation, adding this proportion is 10% for lower income consumers.

Across all 3 waves, TrueCar explained consumers selected aspects of remote retailing — such as configuring a deal online, at home test drives, completing the entire purchase online and video conferencing — as the top reasons they would shop with a particular dealership now. At home test drive showed the most significant uptick between the three waves, increasing in interest 44% between wave 1 and wave 3, according to analysts.

TrueCar went on to add that 65% of shoppers surveyed said they would be more likely to shop with a dealership that offers the components of TrueCar’s Buy from Home experience which offers remote paperwork, vehicle sanitization and vehicle delivery.

“With continuing concerns around being exposed to COVID-19 or exposing others, remote retailing capabilities and safety measures around test driving vehicles and home delivery are critical components dealers can offer to get consumers to engage now,” McMullin said.

“In particular, the third wave of the study highlights that consumers are looking for a more customized way to shop that meets their personal safety expectations. It’s encouraging to see how quickly dealerships have responded and how flexible they have been in making these offerings available,” she went on to say.

Dr. Rik Patel is the co-founder and chief operating officer of RideKleen, a mobile vehicle care and fleet services.

But he's also a physician and spent 11 years in sports medicine and orthopedic care.

In this episode of the Auto Remarketing Podcast, hear his take on vehicle sanitization and decontamination, safely restarting various modes of transportation and shared mobility and sustainable vehicle hygiene.

Plus, Patel shares his journey from medicine to automotive.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Along with announcing an enhanced vehicle cleaning and sanitization process, Hertz also revealed it will be looking to navigate through its current financial challenges triggered by the coronavirus pandemic with a new president and chief executive officer.

According to a news release distributed on Monday morning, Hertz said its board of directors has named Paul Stone president and chief executive officer, effective immediately. Stone, most recently Hertz’s executive vice president and chief retail operations officer for North America, also has been elected to the Hertz board of directors.

Stone succeeds Kathryn Marinello, who plans to continue with the company in a consulting position for up to one year to support a smooth transition, according to the announcement.

“After an ongoing succession planning process, the board elected Paul to lead Hertz’s next chapter,” Hertz chairman Henry Keizer said in the news release. “Paul brings a customer-centered approach to growing the business that is driven by process excellence and employee engagement.

"Having successfully run our largest business segment for the last two years, Paul helped strengthen our brands by elevating service standards across the North American car rental operations.” Keizer continued.

Stone, began his 28-year career with Sam’s Club/Walmart as a store manager and was quickly elevated through the ranks to Western U.S. divisional senior vice president. He led operations for more than 200 locations with more than 30,000 employees. Prior to Hertz, he served as senior vice president and chief retail officer at Cabela’s, one of the leading outdoor outfitter retail companies. Over the course of his career, he has delivered strategy, service, people development and full-scale retail operations leadership.

Stone joined Hertz in March 2018 to lead the company’s North American car-rental operations, which encompassed approximately 4,500 locations and 27,000 employees. Hertz noted that Stone simplified operations, re-energized and developed talent, and elevated service standards, resulting in Hertz being ranked No. 1 in customer satisfaction by J.D. Power for the first time in 16 years.

In addition to car rental, the scope of Stone’s responsibilities included Hertz’s transportation network companies and car sales businesses.

“It is a tremendous honor to have the opportunity to lead Hertz,” Stone said. “I thank Kathy and look forward to working with my colleagues to do what Hertz people do best anticipate where transportation, mobility and technology are going and innovate to best serve our customers, stakeholders and communities.”

Stone takes over with Hertz facing unprecedent financial challenges because of travel nearly halted completely because of COVID-19, prompting firms such as Fitch Ratings to consider if the company files for bankruptcy.

Hertz did not mention any of its ongoing hurdles in Monday’s executive announcement.

“We also want to thank Kathy for her contributions as an exceptional business leader,” Keizer said. “Since joining the company in January 2017, she oversaw a successful operational turnaround, transformed Hertz’s culture, and built a best-in-class leadership team. The board wishes her all the best.”

Marinello added, “The hardest part about stepping down is leaving the amazing employees that have earned my respect over the last three-and-a-half years. It was an honor to serve them. I am confident that under Paul’s leadership, Hertz will prosper long into the future.”

Hertz reinforces vehicle cleaning

In a separate announcement distributed on Friday, Hertz introduced what it’s calling Hertz Gold Standard Clean, an enhanced vehicle cleaning and sanitization process that concludes with each vehicle being sealed and certified ‘Hertz Standard Gold Clean’ before each rental.

Hertz is also continuing to innovate to meet customers’ needs and preferences by launching a vehicle delivery service and highlighting its fast and touchless rental solutions.

“At every Hertz location around the world, our focus remains on getting people where they need to go safely and confidently,” Marinello said. “That’s why we’re raising the bar on our high standards for safety and cleanliness with Hertz Gold Standard Clean and continuing to introduce innovative rental solutions that provide our customers with a safer, faster and easier way to travel as they get back on the road.”

To give customers total confidence when they rent a car, Hertz said every vehicle will be sealed and certified “Hertz Gold Standard Clean” after undergoing a 15-point cleaning and sanitization process that follows U.S. Centers for Disease Control and Prevention (CDC) guidelines.

The company explained key steps in the 15-point process entail cleaning and sanitizing the interior and exterior of the vehicle, including all contact surfaces (steering wheel, consoles, door handles) with an Environmental Protection Agency (EPA)-approved disinfectant for use against the virus that causes COVID-19.

“Sealing each vehicle is a first-of-its-kind practice in the car rental industry and one we believe will give customers added peace of mind knowing they are the only person to enter the vehicle after it’s been thoroughly cleaned and sanitized,” Marinello said.

Hertz Gold Standard Clean is rolling out across all Hertz locations in the U.S., according to the company, which also plans to launch the initiative in other countries, too.

In addition to these vehicle-cleaning protocols, Hertz highlighted that it has enhanced its cleaning methods at all locations and in shuttle buses, which includes using approved disinfectant to regularly wipe down high-touch areas such as door handles, counters, kiosks and other hard surfaces.

The company mentioned employees are also following social distancing guidelines and best practices, which are being reinforced through signage at all locations for employee and customer safety.

For customers who prefer to limit personal contact or want a more convenient rental experience, Hertz is now offering Hertz Neighborhood Delivery at nearly 3,000 U.S. neighborhood locations. The vehicle will be delivered to the customer and picked up from their preferred location.

Hertz also offers other low contact or completely touchless rental solutions. At many airports, Hertz Gold Plus Rewards members can skip the counter and go straight to their vehicle. At locations where Hertz Fast Lane powered by CLEAR is available, members can also exit the lot with a quick facial scan, providing a completely touchless experience. When ready to return, members can simply drop off their vehicle and go with Hertz’s eReceipt and Express Return service.

“We’ve always provided a variety of rental solutions and service offerings to meet our customer’s individual preferences and that focus continues,” Marinello said. “As customers begin making travel plans or have other transportation needs, we want them to have total confidence that we’ve taken the right steps to protect their safety and will continue providing the caring and personalized service they know and expect from Hertz.”

Hertz Gold Plus Rewards membership is free, and the benefits are immediately available. To learn more, visit www.hertz.com/RewardsOverview.

To learn more about Hertz Gold Standard Clean, visit www.hertz.com/GoldStandardClean.

With restrictions easing and markets opening back up in many states, some consumers may begin utilizing shared mobility services, including car-sharing during travel.

Still, it would be natural for users of such platforms to be concerned about vehicle cleanliness and safety against COVID-19.

That’s where a partnership between Spiffy and Turo announced Monday comes into play.

Spiffy has partnered with Turo to offer vehicle disinfection services to hosts and users of the peer-to-peer car-sharing marketplace.

Amid the COVID-19 pandemic, Spiffy added vehicle disinfection services to its platform, utilizing hospital-grade disinfectants that are approved by the Environmental Protection Agency and recommended by the Centers for Disease Control to be 99.999% effective against COVID-19, the company said in a news release announcing the partnership.

Among the services include decontaminating known infections and disinfecting hard surfaces and upholstery, among others.

“We are excited to partner with Turo to give their guests and hosts the confidence to get back on the road,” Spiffy chief executive officer Scot Wingo said in a news release. “And the best way to do that is with vehicle cleaning and disinfection services that are EPA-approved and CDC-recommended to be 99.999% effective against COVID-19.

“When someone gets in a vehicle that has been through a Spiffy disinfection, they can have the peace of mind that the vehicle is virus-free and safe for their trip.”

Turo CEO Andre Haddad added: “As shelter-in-place restrictions ease and people start to travel, Turo is committed to providing resources to keep guests and hosts safe.

“We are pleased to partner with Spiffy to offer Turo hosts services at special pricing to help ensure that cars have been properly cleaned and disinfected.”

Wingo discusses the disinfectant and decontamination services in more detail in the podcast below, which was recorded in late March.

Mike Cavanaugh, executive vice president at MAX Digital, returns to the Auto Remarketing Podcast to talk about using data to make smart used-car acquisitions and decisions, metrics to watch, how dealers are getting creative to find the right used inventory and more.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Not to get too philosophical here, but as it turns out, necessity is indeed the mother of invention — and that includes the auto auction business.

What started off as a “tool of necessity” for KAR Global as it rebooted auction sales in early April has emerged as another digital auction sales alternative — and one the company can run remotely, using an automated auctioneer and all-digital interactions between buyers and sellers.

KAR chief executive officer Jim Hallett and chief financial officer Eric Loughmiller discussed this new platform called Simulcast+ and more with Auto Remarketing in a wide-ranging interview that touched on vehicle storage plans, thoughts on a potential Cash for Clunkers program and the possibility of re-opening physical auctions with no vehicles running through the lanes.

From necessity to an extra plus

On March 20, KAR announced a two-week stoppage of all ADESA physical sale operations (which included Simulcast) in response to the COVID-19 pandemic.

As it began to restart auction sales, “we had our first-ever fully digital auction that was operated remotely with an automated auctioneer and all buyers and sellers interacting through our Simulcast platform,” Hallett said during the company’s latest earnings call.

“Simulcast+ has allowed us to sell vehicles from locations that were shut down. KAR Global is the first mover in the use of this technology where there is an automated auctioneer and we’re very encouraged with the initial results,” he said.

Hallett’s a hockey guy, but perhaps the best way to think of the automated auctioneer is a basketball shot clock. But with a lot less time.

The “continuous clock” allows for 10 seconds between bids, counting down from 10 until a bid comes in. Then it restarts. There is also a block clerk who remotely manages the flow of bids.

Among the various features are a chat function allowing buyer and seller to connect and the ability to re-run vehicles that don’t sell.

Sellers also don’t have to wait until sale day, since they have the ability to run a sale any time it’s needed, without having to transport the vehicles to the auction. Simulcast+ also has the capability to be tailored to specific buyer groups, selling vehicles from multiple locations and target sales to a broader audience interested in a specific vehicle.

Perhaps most importantly, this approach has allowed KAR to still sell when state restrictions prevent in-person sales.

“Initially, we were using it in areas where we were not permitted to run a live auction with anybody on site,” Loughmiller said in the interview.

The first use of Simulcast+ was in Des Moines, Iowa, followed by a marshalling yard in Dearborn, Mich. KAR has been running these sales for about six weeks, and as of the earnings call, KAR had run more than 20 auctions on Simulcast+.

“It became a tool of necessity that’s turned into something that is of interest to certain customers,” Loughmiller said.

Hallett added: “When state laws prevented us from being an essential service, which prevented the sale of cars, and prevented dealers from congregating or coming onto the property or being able to touch and see the cars, this was a great tool to get these cars up on Simulcast.

“We couldn’t bring an auctioneer in. We went with the automated auctioneer. and it serves us very well,” he said. “It demonstrated to us that over the sales we ran, there is little to no difference in terms of the proceeds. Sometimes, we might get a percent or two better with Simulcast+. Sometimes, we get a percent or two better with just straight up Simulcast.”

Preparation for storage challenge

On an industry level, when mass volumes of vehicles come back into the market — be it off-lease volumes, off-rental volume, etc. — that can create storage challenges, with or without a pandemic.

But when auction sales are slower, that can exacerbate the challenge in the industry.

Though executives have said the number of cars on KAR properties is increasing, the company was prepared. Hallett explained that during Great Recession, particularly amid the General Motors and Chrysler bankruptcies, KAR was concerned about having enough room to store vehicles.

So, the company took action.

“And we put a contingency plan in place in all of the markets we felt necessary where we could have an overflow or a capacity issue,” Hallett said.

The company has not had to utilize that real estate until this week (and only to a slight degree) since it has been able to keep sales running strong.

“The market actually has been very good. We shut down for two weeks. And then we re-opened our auctions after two weeks … this is now our sixth week in a row for being back up and running our auctions,” Hallett said. “And every week, we have sold more cars. And we’ve had a higher conversion rate. More cars consigned and a higher conversion rate.

“And we’re getting back now to where we’re selling a little bit more than half of the normal inventory that we would typically sell … Last week, if we sold 40,000 cars, we created 40,000 new spaces for inbound cars,” he said. “And we’ve been rolling enough inventory, selling enough inventory, converting enough going out the door that we’ve got room to bring more cars in the door.”

Loughmiller said there are a “couple of locations” where KAR has had to do short-term leases for temporary shortage. But they’re “fairly small” and in larger cities that have had the biggest impact.

“It’s minimal to date. And we think that need might be greater as we get into the summer months when there’s lease returns, repos start picking up again. So, we’re prepared,” Loughmiller said. “But we haven’t had to do much yet.”

Re-opening traditional physical auction sales

Across the wholesale industry, some auctions have re-opened traditional, in-person sales. Some never stopped running them.

So, we posed this question to Hallett and Loughmiller: What would have to be the ideal scenario for ADESA to re-open a traditional, physical, in-person sale?

Hallett boiled it down to three key priorities, in order: First priority is employee safety above all else. Second is adhering to local and state laws, which vary wildly.

“We’re going to stay legal,” Hallett said. “We are not going to violate and we’re not going to try to look for a loophole to try and prove that we’re an essential business.”

Third, he said, “we’re going to listen to our customers. And we’re going to see what our customers want and how they want to be serviced.”

When the time comes for that to happen, “it remains our goal to have the safest environment in the industry, which means we would like to run fewer cars through the block,” Loughmiller said.

Hallett added: “Even before COVID (hit), I’m on the record from last year of saying that we’ve got to make this safer … we continue to push safety in the lanes. We don’t believe we should be running cars through the lane.

“And so, during this COVID period, there’s been no cars running through the lanes. And we’ve proven and demonstrated that we haven’t lost anything as a result of that. We may have gained things that we don’t know about,” Hallett said. “And our hope would be that we don’t run any cars through our lanes as we return to whatever form of auction we return to, whether it be simulcast, Simulcast+ or physical lanes, that we don’t run the car through the lane.”

Cash for Clunkers impact?

Echoing much of what the National Auto Auction Association has said, KAR executives don’t see a potential reboot of the Cash for Clunkers program as a plus for the auction industry.

“Cash for Clunkers might be good for the consumer. And it’s good for the manufacturers. And it might be good for new-car franchises. But for the auction industry, it really isn’t a benefit. Because if you think about it, No. 1, we’re focused on selling used cars,” Hallett said. “So, if somebody’s buying a new car, that’s potentially taking them away from buying a used car. No. 2 is if there’s a trade-in in a Cash for Clunkers program that trade-in has to be crushed or dismantled and we don’t sell those cars.

“So, we possibly lose a used-car sale and possibly lose a trade-in. So, for the whole car auction industry, it’s not a benefit.”

Loughmiller added: “I would argue that it’s a fairly minor negative, but it’s definitely not a positive.”