At NADA Show 2022 earlier this month in Las Vegas, CARFAX public relations director Emilie Voss and head of dealer marketing Rob Bois joined senior editor Joe Overby for an epsidoe of the Auto Remarketing Podcast.

They discussed the launch of the CARFAX 100 dealer recognition program, what makes top-rated dealers stand out, updates on the CARFAX Lifetime Dealer program and much more.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page. Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

At the NADA Show in Las Vegas earlier this month, CARFAX recognized a select group of its dealer partners that stand out when it comes to consumer reviews.

The company launched “The CARFAX 100,” which spotlights dealers who had more than 100 verified reviews last year and averaged at least 4.9 stars out of 5 on those reviews.

These stores were among the 2021 CARFAX Top-Rated Dealers announced in February, a program recognizing dealers averaging at least 4.6 stars.

“The CARFAX 100 are all 2021 Top-Rated Dealers being recognized for not only for the exceptional volume of reviews but also their top-notch customer satisfaction,” the company said in a release.

CARFAX vice president of dealer business Gregg Cleary said, “It’s truly impressive when you dig into the review numbers on these dealerships. The CARFAX 100 dealers are taking customer service to the next level. Receiving more than 100 reviews, averaging at least 4.9 stars, is no easy feat and it’s something to be proud of.

“These dealers are raising the industry bar when it comes to cultivating relationships with their customers and providing next-level service,” Cleary said.

One of the dealer groups represented on the CARFAX 100 list is Penske Automotive Group.

“One of our key differentiators is to provide a superior customer experience while establishing trust and loyalty with our customers,” Penske president Robert Kurnick said in a news release. “Being recognized by CARFAX with 11 dealerships that received a total of nearly 1,900 five-star reviews through CARFAX last year is an extraordinary acknowledgement of our team members that strive to exceed expectations of every customer.”

The complete CARFAX 100 list can be found here. For more about the award and other CARFAX programs, see the podcast below with CARFAX public relations director Emilie Voss and head of dealer marketing Rob Bois, who sat down with senior editor Joe Overby for an episode of the Auto Remarketing Podcast during the NADA Show.

This person has more than 27,000 followers on Twitter, a contingent that includes auto industry executives, journalists, companies and dealers, along with consumers, investor-types and more.

But it’s likely you have no idea who this person really is — and that’s by design.

Since joining Twitter in December, the pseudonymous CarDealershipGuy account (@GuyDealership) has created a following of approximately 27,400 as of Wednesday afternoon.

CarDealershipGuy has taken the automotive Twitterverse by storm with insider insights on car-buying, dealer operations and the inner-workings of the used-car business — generally busting through the “opaque” walls of the auto industry with humorous quips, car-buying advice and unvarnished takes on industry news from the vantage point of a car dealer.

Auto Remarketing spoke with the person behind this account last week. And no, we’re not going to reveal this person’s name, but for the purpose of this story, we’ll use the name “Guy.”

“I’ve been in the industry for 15 years … I’ve seen a lot of different types of experiences, different types of dealerships, and customers that leave happy, (as well as) customers that are not happy with their experience,” Guy said. “One day, I was sitting there and i said, ‘I want to tell the world what I know.’”

Guy had never been very active on social media, but decided to create the pseudonymous account, which is not affiliated with Guy’s day job or company.

It was simply a way to connect with people and share knowledge gained through experience in auto retail.

“With no expectation — I didn’t go into this with a plan. I just went in and I said, ‘I’m going to just share my knowledge, and if it brings value to people, then they’ll follow me,’” Guy said.

And that they did.

Guy said the account went “viral” a week later and had 25,000 to 26,000 followers within a matter of months, “and it’s growing like a weed.”

This growth, Guy said, is like a “a microcosm for the fact that people are thirsty for this type of knowledge … They just feel like there’s a lot that they don’t know about the industry. It’s very opaque to the average consumer.

“And I feel like, from what i hear at least, that it’s very refreshing to hear a very authentic and genuine takes from someone who’s been an operator and a dealer for many years.”

Guy’s tweets have quite the range.

Some share his take on matters like how car dealers can beat Carvana, his opinion on major industry developments or humorous automotive irony, while others offer car-buying advice for consumers or threads on how geopolitical events might impact automotive at-large.

But what really moves the needle is “either stuff that’s very opaque, that your average consumer or even your sophisticated consumer would simply never know, or real-time anecdotes that I’m seeing on the ground floor that are as accurate and truthful as possible,” Guy said.

Or when the projections and forecasts come “to fruition.”

Guy has not tried to monetize the account and isn’t selling anything (other than cars to consumers), so that helps foster trust and create a sense of authenticity.

“Other than offering to sell cars to customers, which you’re providing real value with that, I haven’t made money, I haven’t sold courses. I’m not doing it for this,” Guy said. “I’m doing it genuinely because, No. 1, I enjoy teaching others and sharing my knowledge. And No. 2, it’s been an incredible networking tool for me.

“So, I’m growing a company. And from a recruiting perspective, from a relationship perspective, from an investor perspective, I think people get an inside look into my brain and into my thoughts and they see and it shows them how I operate, how I think through things,” Guy said. “You enter a relationship in (a warmer) stance because you feel like you know the person. It’s been really incredible from that perspective.”

Though Guy acknowledges that “I’m a capitalist, just like many of us,” making money from the Twitter account is not what it’s all about.

Guy says, “there’s no amount of money that I could make directly or nor would I want to make that will exceed the amount of value that I can create through the relationships and the people that i meet on this app.”

The “North Star” for Guy is sharing knowledge and building relationships.

“Everything that I know as an operator, all the dirty secrets, I just want to share everything … there’s been some confrontation, meaning I’ve had like probably once every two weeks, a dealer reaches out to me and threatens me or yells at me or gets pissed at me, saying I’m betraying my brothers, which is a complete load of [expletive],” Guy said.

“Because the best dealers that offer the best experience love what I’m doing and they’re reaching out to me with the opposite stuff. They’re saying, ‘This is incredible, I want to do something similar.’ And so, I think that if anything, it’s shown me, the honest dealers versus the dealers that are shaking in their pants because they’re scared of everyday car dealer knowledge being exposed. Which, again, I don’t think is bad; I think it’s great for the entire industry and it builds a stronger reputation for us as dealers.”

Twitter being what it is, there’s going to be the occasional attack.

But Guy says criticism, when done professionally, is welcome. The key for Guy is to respond with thoughtfulness, not snark. Criticism can be, “an opportunity as an operator, as a dealer to have a very real-time feedback loop with potential consumers,” Guy said.

Guy said the account has received attention from large automotive retailers, executives, Wall Street and “many different types of cohorts.”

Guy also has the attention of folks who have signed up for a weekly enewsletter outlining thoughts on the industry.

“I’m going to start curating my weekly thoughts into an email, along with observations from the auctions and from the retail floor. And really packaging that all up into one note, which I’ll then put in and shoot out to my followers,” Guy said.

“I’ve gotten 2,000 subscribers in like 20 days and maybe like four posts (of promoting it), which is incredible … the interest in the community has been astonishing, and the fact that I’m able to gain people’s trust is an amazing feeling and I want to give more, because people trust me, so I want to give them more and just continue providing value,” Guy said. “It’s been really an incredible experience, just seeing it grow that fast.”

There are other mediums through which Guy sees parlaying the popularity of the account — for example, podcasts and live Twitter Spaces.

“This is an amplifier. This is a way for me to give back. To tell people, to show people everything I’ve learned over so many years of grinding in this industry,” Guy said.

“I don’t have any formal plans for this right now, but I do think that what I’m most excited about is ultimately when I’m going to remove the veil, start showing who I am, the progress I’m making at my company, share day-to-day stories and anecdotes from a real, operating dealer,” Guy said. “That’s what I’m really excited for.

“But other than that, i just want to continue bringing, grow the account, creating a different type of reputation and sort of stigma for what it means to be a dealer in 2022.”

What it means to be a dealer in 2022 (and beyond) likely would involve savvy use of social media and influence therein.

Take another dealer, Kelly Stumpe, for example. She grew up the dealership world and began her own auto industry career at a BMW store in 2016. And in 2020, she used that dealership savvy and automotive know-how to launch The Car Mom, a multi-platform resource to help moms and families make informed and confident car-buying decisions.

It has resonated with consumers, to say the least: The Car Mom Instagram account has 257,000 followers.

So is the auto retail space and automotive, in general, ripe for more social media influencers?

Guy thinks so.

“I think any industry that consumers feel disadvantaged or it’s opaque, there's an opportunity for a real practitioner, a real operator to share, I call it, asymmetric knowledge,” Guy said. “It’s stuff that I know that you don’t.

“And I think naturally, automotive has historically been that way. Yes, there's been a lot more transparency in the last five to 10 years, or increasing amount of transparency, but … we have not fully shaken off that stigma yet. And so, i think an account like this, with genuine authentic takes, not being scared to say what I think, even when it's not consensus, or it's just being very blunt and candid. I think that's refreshing to consumers, and they love it.”

So, about that reveal.

When will Guy’s true identity be known? Guy’s playing it by ear for now. But the big reveal eventually will happen.

“I’m not going to stay pseudonymous forever … I think realistically, yeah it will help my business, because people will finally know, who’s the man or who’s the person, behind the account, the voice,” Guy said

“I’m just not ready for that now and that’s just a personal decision. I still want to build. And not that I will want to stop building, but I think ultimately, it’s going to be really cool to see how when I start sharing day to day pictures and stories on me building my actual company.”

After meeting with a host of dealer principals and mangers during NADA Show 2022, ACV chief executive officer George Chamoun said through a company news release that, “Dealers are the most resilient business leaders.”

But even the most resilient operators are starting to show a little weariness as shown in the latest Cox Automotive Dealer Sentiment Index (CADSI).

While the current market index remains above the positive threshold, Cox Automotive explained how the combination of facing a slow start to the year and concerns over inflation and the economy resulted in dealer sentiment softening in the first quarter, marking the third consecutive quarter-over-quarter decline in current market sentiment.

Still, Cox Automotive pointed out that the index reading of 57 indicated that more U.S. dealers feel the current market is strong compared to the number who feel the current market is weak. The key drivers of sentiment saw marginal shifts in Q1.

Analysts said the three-month, forward-looking market outlook index rose modestly — reflecting the typical spring bounce — and, at 64, is above the 59 recorded in Q1 2021.

The overall profit index saw a small decline to 54, down from 57 last quarter, but remains well above any point before the COVID-19 pandemic.

The price pressure index, likewise, increased slightly in Q1 but remains historically low, indicating fewer dealers feel pressure to lower their prices.

“As we enter the spring market, we can see the small green shoots of optimism from the U.S. auto dealers,” Cox Automotive chief economist Jonathan Smoke said in another news release.

“Most dealers have weathered the storm well, and we suspect there is hope the pandemic may finally be waning. Views of the economy weakened modestly, but dealer profits are historically strong and demand remains robust. Those are good signs for the industry,” Smoke continued.

Cox Automotive mentioned that the Q1 2022 CADSI research was in market from Jan. 24 to Feb. 7, just past the height of the Omicron variant.

Importantly, though, analysts noted the research was done before the Russian invasion of Ukraine and before gasoline prices in the U.S. moved into record territory.

Even before the situation worsened, Cox Automotive said the U.S. economy index score dropped from 52 in Q4 2021 to 49 in Q1, indicating more dealers felt the economy was weak compared to those who thought it was strong. The score of 49, however, is higher than it was a year ago in Q1 2021 when the index score was 44.

“The tragic situation in Ukraine, of course, adds a level of uncertainty to the U.S. economy that will impact the U.S. consumer,” Smoke said. “Higher gas prices, a struggling stock market, inflation, and the potential for more supply chain disruptions — these factors will slow any anticipated market recovery and may impact dealer sentiment in Q2.

“Right now, though, it’s too soon to know how long the situation will last or how bad it will get,” Smoke added.

Talking inventory

Cox Automotive highlighted that one positive sign in the latest CADSI report is a notable jump in the new-vehicle inventory index for franchised dealers.

While still historically low at 25, the index increased by 11 points and marked the highest score since the first quarter of 2021. The index for the new-vehicle inventory mix also increased quarter over quarter.

“Inventory issues have been the biggest concern for dealers for more than six months now,” Smoke said. “In our latest study, inventory remains a top priority, but the initial signs of a recovery are there. And that is a positive for the market.”

On the used-vehicle side, Cox Automotive said the inventory index jumped up in Q1 2022 as well, reaching 36, the highest score in the past 12 months. The used-vehicle inventory mix index improved also.

However, Cox Automotive said all index scores associated with inventory remain well below the 50 threshold, indicating dealers are still facing inventory challenges.

The view of new-vehicle sales improved for the first time in two quarters, increasing from 45 to exactly 50, meaning dealers were evenly mixed on their opinions of new-vehicle sales. One year ago, the index score was 61, meaning more dealers saw the market as good.

The new-vehicle incentives index dropped by one point quarter over quarter, to 23, the lowest level since the question was added to the CADSI in Q3 2019. The incentive index measures if OEM incentives are large (above 50) or small (below 50).

The used-vehicle sales index, on the other hand, fell one index point to 52.

For franchised dealers, the used-vehicle sales index has now dropped for three straight quarters and is below year-ago levels. There was no change in the used-vehicle sales index for independent dealers, which held steady quarter over quarter at 48, meaning more independent dealers see the market as poor than see it as good.

In the ACV news release, Chamoun said, “Facing global supply chain challenges for new cars, franchise dealers are seeking additional pathways to acquire vehicles more effectively and to better merchandise vehicles online. Connecting with dealers at NADA this past weekend was inspiring.

“We feel honored to be the digital partner for such incredible companies and continue to support them with innovative technology and our talented and rapidly scaling team,” he went on to say.

Potential spring bounce

Cox Automotive reported that the market outlook for the next three months increased to 64 in Q1, up from 60 in Q4. Analysts explained the score indicates that most dealers feel that the outlook for the next three months is positive, which reflects the springtime optimism routinely seen in the report.

In fact, Cox Automotive indicated the Q1 outlook is higher than it was one year ago — ahead of a year of record profits — and at the highest point since Q1 2020, before the pandemic began.

Analysts pointed out that the quarter-over-quarter increase, however, was driven mostly by independent dealers. The franchised dealer outlook was, in fact, flat quarter over quarter at 69. Still, the market outlook index score of 69 for franchised dealers is above pre-pandemic levels.

“While profits remain historically strong, particularly for franchised dealers, tight inventory and no quick fix in the making are likely weighing on dealers,” Cox Automotive said. “Overall, limited inventory continues to be the top factor holding back business according to the Q1 2022 CADSI.”

Analysts said the factors saw little change from last quarter, with the top four factors unchanged from Q4, including limited inventory, market conditions, economy and COVID-19 impacts. In Q1, political climate dropped out of the top five, replaced by expenses, according to Cox Automotive

Costs and staff

In Q1, Cox Automotive said the cost index — specifically the cost of running a dealership — was at the highest level since the survey began in 2017.

After reaching a record low in Q2 2020 of 51, at the height of the pandemic, the cost index has been steadily increasing.

“One factor contributing to rising costs may be staffing,” said analysts, which pointed out that the staffing index, at 46, improved slightly from Q4, but generally remains below pre-pandemic levels.

With a score below 50, analysts noted that the metric indicates more dealers feel their staff is declining rather than growing.

As a factor holding back business, Cox Automotive said more dealers noted staff turnover was an issue in Q1 than in the same timeframe last year.

In fact, 11% of dealers point to staff turnover as a factor holding back business in Q1, compared to only 7% in Q1 of last year and 8% in Q1 2020.

In terms of staffing issues, service is the top area of concern, particularly for franchised dealers, followed by sales, according to Cox Automotive research based on 1,146 U.S. auto dealer respondents, comprising 591 franchised dealers and 555 independents.

The complete survey results can be downloaded via this website.

Electric vehicles were discussed so much at NADA Show 2022, a portion of the shiny, new Las Vegas Convention Center was rebranded as Electric Avenue.

As franchised dealers and their association learned more about the availability of and best practices for retailing EVs, the National Automobile Dealers Association also honored one of its own as the 2022 TIME Dealer of the Year

The honor from TIME and Ally Financial was given to Bob Giles, owner of Giles Automotive in Lafayette, La., at the 105th show, which wrapped on Sunday.

Now in its 53rd year, the TIME Dealer of the Year award is one of the auto industry’s most prestigious and highly coveted honors.

Keith Grossman, president of TIME, and Doug Timmerman, president of dealer financial services at Ally, announced Giles as the winner at a ceremony honoring all the dealer nominees. Giles was chosen from a field of nearly 16,000 franchised dealers across the country, 47 of whom made the nominee list.

Timmerman said in a news release, “Even as America’s auto dealers adapt to a rapidly changing auto market, the commitment to their customers, employees, and communities remains unparalleled. The TIME Dealer of the Year nominees stand out for doing it right in their industry and steadfastly giving back to their communities.”

In addition to Giles, the four dealers recognized as TIME Dealer of the Year finalists included:

— Robert Sickel, Pine Belt Chevrolet, Lakewood, N.J.

— Todd Ouellette Sr., Long-Lewis Ford of the Shoals, Muscle Shoals, Ala.

— Gregg Kunes, Kunes Country Ford-Lincoln, Delavan, Wisc.

— Chris Wilson, Wilson Motor Company, Logan, Utah

Ally, the exclusive sponsor of the TIME Dealer of the Year Award, will give $10,000 to the charity of Giles’ choice.

The company also will donate $5,000 to nonprofit organizations selected by each of the four finalists. Will Green, president of the Louisiana Automobile Dealers Association who nominated Giles for the award, will also select a charity recipient.

In recognition of their achievements and generosity, Ally also gave $1,000 to the charities of choice for each of the 47 nominees.

Officials said the Louisiana dealer’s extraordinary business and community leadership earned Giles the most prestigious award in the automotive retail industry. A standout of his many contributions was the launch of the Giles Essential Errand Running Service, which offers grocery and essential item deliveries by dealership staff to senior citizens and immunocompromised individuals.

Giles earned a degree in accounting from Texas A&M University in College Station in 1976, but his training in the retail automotive industry began at age 11, when he was paid 25 cents an hour to wash vehicles on the lot at his dad’s Ford dealership in Denison, Texas.

From there, Giles spent time working in all departments, learning how to operate a dealership from the ground up. That experience, paired with his accounting degree, led Giles to start selling vehicles after graduating from college and landed him a role as sales manager at 24 years old.

A few years later, Giles was awarded a Volkswagen, Porsche and Audi store in Lafayette, and he moved to the city on his 28th birthday to establish what would become Giles Automotive.

Today, the auto group includes three stores in Lafayette, one in Opelousas, La., and one in El Paso, Texas, representing Nissan, Subaru and Volvo brands.

Giles has been an active member of both his state and local dealer associations.

For the Lafayette Auto Dealers Association where he was named chair of the board four times, Giles was instrumental in launching the group’s annual car show and sale in 1984. Giles has also advocated for his fellow dealers during his time as a member of the Louisiana Automobile Dealers Association.

“I worked with the state association to put forth initiatives to benefit all dealers in the state, and focused on warranty reimbursement rates, technician training, purchasing groups and beneficial legislation impacting auto dealers,” he said in the news release.

Beyond his industry, Giles is a community leader who has initiated campaigns to help local organizations grow and expand. He partnered with a local TV station to create the Acadiana Community Heroes campaign, which recognized deserving individuals or nonprofit organizations that have made a difference in his area. The recipients received a monetary prize and exposure for their cause.

Giles also has been active in the Outreach Center, which provides shelter and services to the homeless in the Acadiana region for many years helping to increase their annual fundraiser from around $100,000 annually to more than $500,000.

Other organizations Giles supports include:

— Dreams Come True of Louisiana, which grants dreams to children with life-threatening illnesses

— Acadiana Animal Aid, a no-kill animal shelter in Carencro, La.

— Hunters for the Hungry, as local sportsmen provide fish and game for meals at homeless shelters

— Love Our Schools

Officials reiterated the TIME Dealer of the Year winner and finalists were chosen by a faculty panel from the Tauber Institute for Global Operations at the University of Michigan. Dealers are nominated for the award by state and regional automotive trade association executives.

NADA launches dealership electric vehicle education program

Beyond displays of EVs at the event, NADA showed another way it’s charged up about electric vehicles.

The association launched a new program, in collaboration with the Center for Sustainable Energy and Plug In America, that’s designed to enhance EV education at franchised dealerships nationwide.

Officials explained the dealership EV training program developed through this partnership is supported by the Alliance for Automotive Innovation, which will engage all vehicle manufacturers to further dealership participation across the U.S.

While automakers continue to bring more EVs to market, NADA acknowledged that providing future EV buyers with the information and expertise to get them comfortable and confident with their first EV purchase is far more crucial to mass-market adoption and fleet turnover than just product alone.

“By bringing these two EV-focused powerhouse organizations together with NADA, we will efficiently educate dealers and help accelerate the mass market adoption of electric vehicles in the U.S.,” NADA president and chief executive officer Mike Stanton said in another news release. “The dealership training program leverages the strengths of each organization and will ensure dealers are more than prepared to sell and service the EV future.”

NADA highlighted the online, interactive program will be designed to complement OEM model-specific training and will serve as a brand-agnostic review of essential content that dealership sales staff need to be able to communicate with customers to efficiently close EV sales.

The association mentioned the program will offer quick, easily digestible talking points that can allow sales staff to encourage potential EV buyers. The program also will include short modules to appeal to different learning styles.

“The electric vehicle market is moving beyond early adopters to consumers who have lots of questions about what it’s like to own an EV,” CSE president Lawrence Goldenhersh said. “Auto dealer sales staff sit at the nexus in this market transition, and will be called upon to provide confidence-creating, point-of-sale education to millions of auto buyers considering the move to an EV. We are honored to be working with NADA to provide the training that will empower these sales teams to be a trusted resource to the auto buyers they serve.”

Plug In America executive director Joel Levin added, “The transition to electric vehicles is now inevitable and dealers play an important role in helping consumers as they make the switch. We are excited to work with NADA and CSE to help dealers educate consumers about the many benefits of EVs, from cleaner air to convenience to the great driving experience.”

As a result of successfully completing the course, NADA said dealership sales staff will receive a program certification that documents their full understanding of and proficiency in various core competencies.

Additionally, successful program participants will also receive Plug In America’s PlugStar certification. Sales staff who earn a certification will be eligible to participate in the all-new Dealer Referral Network, a consumer resource for identifying dealerships with staff trained and certified in EV sales.

“The auto industry is undergoing a significant transformation, and preparing the workforce will be key as new electric vehicle technologies come to market,” Alliance for Automotive Innovation president and CEO John Bozzella said. “We look forward to working with our dealer partners on this program.”

Winner of Women Driving Auto Retail Video Contest

Bob Giles wasn’t the only one involved with NADA Show 2022 to claim an award.

On the event’s closing day, NADA named Carmen Hinton as the winner of the fifth annual Women Driving Auto Retail Video Contest, sponsored exclusively by Stellantis. Hinton is the service manager at Carter Myers Automotive’s Valley Subaru Service Manager in Staunton, Va.

“Every year, it is amazing to see the caliber of women working in the auto retail industry through this contest,” said Val Bowen, president of ValMark Chevrolet in New Braunfels, Texas and NADA board of directors member. “These videos are truly inspiring and make me proud to be a woman working in this industry.”

“Women purchase more than 60 percent of all new cars sold in the U.S. and influence more than 85 percent of all car purchases. I’ve always been surrounded by strong intelligent women in my family and I am a strong ally for women in all dealership roles,” said Wes Lutz, president of Extreme Chrysler/Dodge/Jeep, RAM Inc. in Jackson, Mich, who presented the award alongside Bowen.

Launched in August 2019, the video contest is part of NADA’s Women Driving Auto Retail initiative, which highlights the current voices of women working in dealerships and encourages other women to pursue automotive careers.

The video contest celebrates women who work in all areas of dealerships and aims to encourage more women to pursue a career in auto retail.

“I love what I do” said Hinton, who joined the auto retail industry with little experience and has been with Carter Myers Automotive for 11 years. “I am still learning every day. There are still obstacles that I am overcoming, but I feel like it has made me a better person.”

Stellantis agrees that gender diversity in the automotive space is crucial.

“Building a diverse employee talent pool continues to be a critical focus for Stellantis, its dealers, and its business partners,” said Phil Langley, who is vice president of the Stellantis dealer network. “Improving the diversity of our dealer network within all roles in the dealership starts with having a strong bench of qualified candidates who are excited to represent the Stellantis brands and products.”

In a video of three minutes of less, NADA highlighted that this year’s contest called on women working in the auto retail industry to share their experience, how their auto retail career journey began and why the industry is a great career path for other women.

“If you are a woman or know a woman interested in learning more about the successes Stellantis brands have had in the marketplace and want to join the family, I would encourage you to reach out to your local dealer and learn more about available opportunities,” said Eric Wong, Stellantis senior manager of dealer market representation, diversity and technology.

Hinton’s winning video can be watched here.

To view submissions from the 10 semifinalists on this website and find more information on NADA’s Women Driving Auto Retail initiative online here.

It’s likely been experienced by you first-hand or by one of your dealership colleagues or managers. It’s the test drive that turned wild; almost into something from Hollywood.

Well, perhaps now we can have a chuckle about the incident and make a comparison to some of the most famous movie segments that involved vehicles traveling at high speeds.

To help your explanation, new research conducted by Quotezone.co.uk compiled a list of the most memorable superhero car chases based on a study that evaluated the number of YouTube views, likes, dislikes and IMDb ratings to determine the biggest car chase scenes from superhero films.

So, when a potential buyer pretends to be Batman in that Chevrolet Malibu or Hyundai Accent, here are some comparisons to make from that Quotezone.co.uk study:

|

Rank

|

Movie: Scene

|

YouTube Views

|

IMDB Film rating / 10

|

No. of Likes per Dislike

|

Total score / 10

|

|

1

|

The Dark Knight Rises (2012): Batman's first appearance chase

|

17,477,506

|

8.0

|

41

|

7.9

|

|

2

|

Captain America: The Winter Soldier (2014): Nick Fury and police chase

|

37,449,403

|

7.7

|

33

|

7.5

|

|

3

|

Deadpool (2016): Car fight scene

|

4,366,550

|

8.0

|

41

|

7.1

|

|

4

|

The Dark Knight (2008): Batpod sequence chase

|

3,241,605

|

9.0

|

34

|

6.6

|

|

5

|

Batman Begins (2005): Black tank, Tumbler chase

|

3,142,976

|

8.2

|

39

|

6.2

|

|

6

|

Captain America: Civil War (2016): Black Panther chase

|

4,272,740

|

7.8

|

28

|

6.1

|

|

7

|

Black Widow (2021): Budapest car chase scene

|

2,331,366

|

6.7

|

159

|

5.6

|

|

8

|

Batman v Superman: Dawn of Justice (2016): Batmobile chase

|

5,182,909

|

6.4

|

20

|

5.7

|

|

9

|

The Avengers (2012): Loki escaping with Tesseract

|

174,234

|

8.0

|

93

|

4.8

|

|

10

|

Ant-Man and The Wasp (2018): Car chase scene

|

494,593

|

7.0

|

46

|

4.5

|

According to the U.S. Census Bureau, three of the four most populated states are California, Texas and New York.

Coincidently, highlights from Urban Science’s 2021 Automotive Franchise Activity Report (FAR) showed those three states generated the most significant state-level changes, too.

Overall, Urban Science indicated last year produced continued stability and slight growth for the U.S. automotive retail network despite far-reaching inventory shortages.

As of Jan. 1, Urban Science reported there were 73 more dealerships (rooftops) in the country compared to the same date in 2021 (18,230 compared to 18,157).

Experts said the number of franchises — brands a dealership sells — decreased slightly from 31,959 to 31,646 during the same period.

Based on the Urban Science report, 85% of core-based statistical areas (CBSAs) in the U.S. remained stable and did not experience net changes related to their respective dealership counts.

Experts then pointed out that the most significant state-level changes were all net increases with California (up 28), Texas (up 12) New York (up 10) accounting for the majority of the U.S. market’s 73 new (net) stores.

In addition to the U.S. dealership footprint’s slight year-over-year growth, Urban Science calculated that average throughput — the number of vehicles a dealership sells — also rose (19 units) to a total of 826 units per store, a level similar to 2012.

And according to the National Automobile Dealers Association, the average U.S. dealership reported a net pretax profit of $3.38 million through October 2021 — a number Urban Science said that’s more than twice what the average store tallied in 2020.

“There’s no doubt 2021 was a lucrative year for franchise dealerships in the U.S., but now more than ever, it’s critical that automotive manufacturers leverage the power of science in informing their network planning strategies,” said Mitch Phillips, global director of data at Urban Science.

“As the chip shortage resolves and additional inventory levels the playing field for consumers in purchase negotiations, a right-sized dealership network — not a reliance on short-term, pandemic-driven consumer willingness to pay more — will continue to be the underpinning of sustainable success now and in the future,” Phillips continued in a news release.

On Friday, new enhancements arrived for the flagship automated sales and marketing platform from automotiveMastermind (aM), which is part of IHS Markit.

The provider of predictive analytics and marketing automation solutions for dealerships highlighted that the updates to Mastermind are designed to help dealership partners attract customers, maintain profits and sell more vehicles, as well as offer a more streamlined platform.

The enhancements include:

Navigation and Market Conquest

The company explained aM dealer partners should see an improved user experience thanks to a more modern and intuitive navigation design.

Designed to offer seamless navigation through the platform and to support future updates, this release comes after a successful pilot that included more than 50 of aM’s dealer partners over the past two months.

The company mentioned that aM’s new Market Conquest updates can “put dealers back in the driver’s seat by empowering them to take control of their conquest leads.”

The dashboard includes new filters that can enable dealers to segment their audience to find the leads they want based on customer engagement, brands customers already own, customers likely to purchase or sell a vehicle and more. These changes can allow dealers to see who in their audience is most likely to return to the market and at what stage of the sales cycle they are in based on engagement.

“With the Market Conquest enhancement, dealers can talk to a more relevant conquest audience than ever before using a multi-channel approach with email and direct mail over a six-month campaign,” aM said.

Behavior Prediction Score

Another update is an enhanced Behavior Prediction Score (BPS).The company said it can enable advanced predictability, highlighting aM’s commitment to continuously evolving this distinctive component of the Mastermind platform.

Mastermind’s proprietary algorithm can provide a unique and compelling BPS that ranks buyers on a scale of 0 to 100 — empowering dealers to close more deals by predicting future buyers with confidence and consistently marketing to them.

“The BPS enhancement builds on providing dealers with even deeper insights to know when a customer is ready to buy: Through Mastermind’s in-market modeling, dealers can accurately determine when individuals are ready to purchase a car, even if they already have one or just recently purchased,” the company said.

Upcoming enhancements

Looking ahead, aM has additional enhancements planned for the coming months, including a Conquest Facebook component.

Dealers will be able to have their Conquest audiences populated directly onto their Meta Ads manager to create custom ads targeting those buyers on Facebook and Instagram.

“Our goal through these new product enhancements and future ones is to make the complex simple and to remove the guesswork and legwork from our dealer partners,” automotiveMastermind vice president of product Aaron Baldwin said in a news release.

“Mastermind’s enhanced workflow and user experience, combined with our company’s continuous investment in providing the most accurate and expansive data available, will continue helping our dealer partners do what they do best — sell more cars,” Baldwin added.

For more information, visit automotiveMastermind.com.

Dealer reviews potentially could go one step further in helping stores maintain their reputations via a new tool from Widewail.

On Monday, the customer review and reputation management solution introduced a new offering targeted to automotive dealers called Invite Video.

Widewail explained Invite Video can empower dealer managers and staff by capturing customer video testimonials and leveraging social media sharing to shape the message about their dealerships.

“Research shows more than 90 percent of customers look up reviews before visiting an automotive dealership,” Widewail chief executive officer Matt Murray said in a news release. “In today’s competitive market with inventory and staff shortages coupled with surging vehicle prices, customers are looking to their peers to confirm if they can trust a dealer.

“With fake profiles and reviews fueling distrust amongst consumers, video reviews are the single best solution for an automotive dealer to gain trust in this competitive market,” Murray continued.

Widewail highlighted that its Software-as-a-Service (SaaS) marketing platform cab proactively pursue customer feedback, distribute positive reviews on appropriate forums like Google and Facebook and shape a broader message around a company through the words of its customers.

Directly integrated into point-of-sale systems, Widewail’s solution also automatically can pull customer data and generate mobile-friendly review requests to drive review engagement with customers.

“What makes this trust marketing solution stand out even more is that it doesn’t require the dealer to lift a finger. Dealers can automate the solution to secure reviews and distribute accordingly without having to think about yet another item on their already growing checklist,” Murray said.

To learn more about Invite Video and Widewail’s other marketing solutions, visit www.widewail.com.

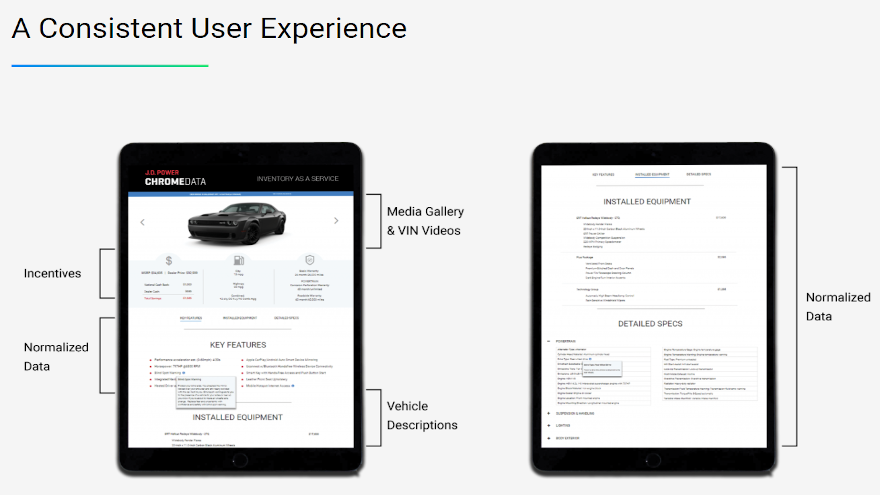

A new year means a revamp of industry services available from J.D. Power stemming from moves made in 2021.

The company announced on Monday that it’s relaunching three major automotive data products maintained by the its Autodata Solutions division. These include solutions for vehicle identification number (VIN) descriptions, inventory management and payment and incentives data for digital retail and desking applications.

J.D. Power highlighted the launch of ChromeData VIN Descriptions and ChromeData Certified Inventory are the result of the combined capabilities formed by the artificial intelligence (AI) and VIN-data engineering aptitude of EpiAnalytics, the comprehensive inventory management platform from Inventory Command Center (ICC) and the 30-year vehicle ChromeData catalog.

The company explained the relaunch of ChromeData Lender Desk is a result of a major data expansion and upgrades to the offering that address the industry’s need for pricing and payment accuracy.

Executives said these developments allow J.D. Power to offer “next-generation” data products to the automotive industry, mentioning that each of these products offer seamless integration with the full ChromeData solution suite.

“Our recent acquisitions have elevated our leading ChromeData VIN Descriptions to a place where we provide exceptionally precise data for all the features, options, packages and equipment on a specific VIN, even in instances where use of OEM build data is not an option,” said Craig Jennings, president of the Autodata Solutions Division of J.D. Power.

“This high-resolution data is being used in conjunction with our ChromeData Lender Desk service to provide precise pricing and payments for digital retailing, desking and loan origination and with our ChromeData Certified Inventory service to provide accurate branded vehicle listings across the industry,” Jennings continued in a news release.

EpiAnalytics, a firm that uses artificial intelligence and machine learning in an effort to transform unstructured data into critical business intelligence, was acquired by J.D. Power in March. The company already had differentiated itself in the marketplace by delivering highly detailed, comprehensive vehicle build specification data associated with the 17-digit VIN.

“With online car shopping on the rise, the need for a definitive source to determine how vehicles are actually equipped as they roll off the production line is needed now more than ever,” said Jim Vecchio, head of VIN products at J.D. Power. “We’ve taken our AI and machine learning capabilities and combined them with our comprehensive vehicle catalog data to deliver the industry’s most complete and accurate VIN decoding on the market today.”

Here is a recap of what each of the tools is designed to do:

ChromeData VIN Descriptions

ChromeData VIN Descriptions are built to identify and describe vehicles accurately based on their VIN. Powered by deep and comprehensive vehicle data, configuration rules and data-engineering capabilities, ChromeData VIN Descriptions are fully configurable and available in a tiered approach to provide precise data needed to serve — and streamline — the demands of a business and its operations.

ChromeData Lender Desk

ChromeData Lender Desk is a multi-level API data service solution that can facilitate instant access to all OEM rates, rebates, incentives and independent finance companies to power more effective vehicle advertising and better consumer experiences — whether it involves researching, shopping or purchasing in-store or online.

ChromeData Certified Inventory

ChromeData Certified Inventory is structured to deliver consistent vehicle listings for effective digital merchandising. Integrated with hundreds of dealer inventory feed providers, the platform can ingest data from dealer sources, consolidating disparate data feeds from multiple sources to create complete, normalized and comprehensive inventory records. These records include price mapping, vehicle data, photos, video, comments and more.