UPDATE: The story has been corrected to indicate that DealerSelect is DRIVIN’s program, not a company with which it has partnered. Auto Remarketing regrets the error.

DRIVIN is offering a program called DealerSelect that gives dealer partners access to untapped inventory before it goes to auction and provides individualized recommendations optimized for their dealership.

The program, which uses DRIVIN’s proprietary algorithm to weigh more than 980 variables, delivers customized, realtime recommendations on ready-to-sell vehicles based on unique quality standards. The program is delivered via email twice weekly, and dealers are supported by DRIVIN’s core service of acquisition, completed paperwork and transport once a dealer is ready to move forward with purchase.

More than 2,500 dealer partners have signed up to receive DRIVIN-recommended vehicles via DealerSelect.

“DRIVIN is committed to providing realtime solutions that empower dealers to design their optimal lots by identifying the types of inventory that will generate the most demand amongst their customers,” said Shannon Swierczek, vice president of marketing at DRIVIN.

“We are confident our dealer partners are seeing positive results within their dealerships by stocking DRIVIN-recommended vehicles for their lot based on specific data from their lot and local market. We continue to focus on providing valuable solutions that move the automotive business forward for dealers, allowing them to spend more time on the sales floor, less time sourcing inventory and realize increased profits in their used-vehicle operations.”

This fall, DRIVIN plans to launch DRIVIN Marketplace, which will allow dealers to remarket unwanted inventory to DRIVIN’s nationwide network of more than 25,000 dealers. The combination of both acquisition and sales functionality offers dealers the industry’s first intelligent marketplace.

Dealers can click here for more information.

In an era when more and more customers are keeping mobile front and center during dealership visits, Cars.com has announced two new features to its mobile app.

The On The Lot VIN Scanner allows shoppers to scan a vehicle identification number to access information such as price and features. It also gives users the ability to save vehicles as favorites on the app.

Meanwhile, the Price Drop Alerts feature allows shoppers in the market for a specific vehicle to sign up for a push notification alert anytime the price is reduced on that vehicle.

“It’s second nature now for consumers to use their mobile devices while shopping for a car at the dealership,” Cars.com president and chief executive officer Alex Vetter said in a release announcing the new features.

“Shoppers want up-to-date information to compare vehicles and cost,” he continued. “That’s why we’re innovating around the clock to make sure our app serves as a convenient and reliable tool while shoppers are out making one of the biggest purchases of their lives.”

At this spring’s NADA Convention & Expo, Cars.com introduced two other products: Lot Insights, designed to give dealers a better picture of what consumers are doing on their mobile devices while they are at or near a dealership, and Sell and Trade, which gives consumers a way to sell their cars through an app called Quick Offer and gives dealers a way to stock up on used inventory.

“The whole game has changed with the advent of mobile, so we wanted to start sharing information with the dealers about what they’re doing while they’re looking at their phones on the lot,” Jeni Pecard, manager of site analytics for Cars.com, told Auto Remarketing during the expo.

“Lot Insights is a report that really helps dealers understand consumer behavior from a mobile perspective.”

So, what are consumers looking at? Inventory, for one.

In fact, Pecard said more than half are still browsing inventory while they’re on the lot. Beyond that, many also are checking out dealership information.

Often they’re checking out the competition, too, she noted.

Evolution of mobile

Launched in 2010, the Cars.com app receives about 7 million visits a month.

But how has the customer journey changed since the app was born?

“Car shopping has evolved tremendously since 2010, largely due to mobile technology and real-time information sharing,” said Chhaya Dave, senior director of product at Cars.com. “When smartphones hit the market and consumers had the world at their fingertips, shopping for everything from a TV to a car became much more involved. Consumers are more informed than ever because they have the tools and information needed to make a confident purchase decision.”

Dave noted that 56 percent of consumers shopping on the lot turn to independent research sites like Cars.com to help them make their buying decisions. And about half of total visits to Cars.com are from mobile phones.

“Over the last few years we’ve seen car shoppers mimic showrooming behavior that’s happening in the retail space. Consumers are using mobile on dealership lots to compare vehicles, look at dealership information, read reviews and use pricing tools.

“They’re also confirming that they’re getting the best deal,” Dave continued. “If they don’t find what they want, read a poor review or find a better deal down the street, they may go elsewhere to make their purchase.”

What it means for dealers

Today’s digitally connected car shopper often arrives at your dealership with mounds of research under his or her belt. Not only that, but dealers are faced with the challenge of knowing how to reach a customer who may be tied to a mobile device while perusing the lot.

Dave cited data from Placed Inc. that determined 81 percent of shoppers use a mobile device to research their vehicle purchase. And 63 percent of shoppers research and shop using a smartphone while at the dealership. This can be anything from inventory and reviews to finance.

“The shift in consumer behavior has definitely caused dealers to evolve many of their in-store processes to be better prepared for today’s well-informed car shoppers,” Dave said. “But most importantly, mobile has forced dealers to adjust how they reach and influence car shoppers — now with a greater emphasis on targeted digital marketing tactics.”

First, Dave said, and perhaps obviously: Dealers must have a presence on mobile. They need to understand what resources shoppers are using to make decisions so that they can effectively market to those customers and measure what’s working.

“Modern consumer behavior means that it’s time to depart from a sole focus on traditional metrics like email leads, phone calls and map views,” she continued. “Mobile shoppers are using a wide variety of tools while on the lot, including reviews, calculators and check availability options, and paying closer attention to these metrics will allow dealers to adjust marketing tactics and messages to better reach their target audience.

"Auto retailers should continue to look at innovative ways — such as mobile apps — to engage with well-informed consumers on the lot.”

Auto Remarketing senior editor Joe Overby contributed to this story.

Automotive Internet Media (AIM), which creates and manages websites for auto dealers, recently developed a one-stop dealership website for both auto shoppers who speak English and Spanish without leaving the main dealership site.

Translation services for websites might only swap out words, the company said, but the language is not written for the specific audience. The AIM site pages, content and images are built for a specific audience. With a click the site changes from English to Spanish or vice versa.

Tony French, AIM president, said: “We wanted to make it easy for Spanish-speaking auto shoppers to maneuver the website and learn about inventory, specials and services offered by our client’s dealership.

“Hispanic marketing is becoming an important part of new-vehicle OEM advertising campaigns,” continued French. “Dealerships need to align part of their marketing budget to drive Hispanic shoppers to their website but most important they need to have a site that converts those shoppers. Speaking directly to the Hispanic market builds credibility and lets them know you want to earn their business and service them as customers.”

AIM’s responsive website platform was designed to be a multilingual site. The banners, buttons, images, inventory pages and informational pages are all original content for each language. Because of the nature of changing vehicle descriptions, a language conversation tool is in place to translate every description dynamically only for the vehicle detail pages. This platform can be set up for other languages.

More information about AIM may be found here.

On Tuesday, Edmunds launched what the company called Edmunds Ad Solutions, a new mobile-optimized ad product for dealers to target in-market vehicle shoppers on Facebook and Instagram.

Site officials explained Edmunds Ad Solutions uses exclusive first-party shopping data from Edmunds to serve shoppers with highly relevant native ads on Facebook and Instagram to drive buyer traffic directly to dealer sites.

The data also is used to identify and target “lookalike” shoppers — individuals who show similar shopping behavior — on those premium partner sites.

Edmunds explained its engineers worked closely with Facebook’s solutions engineering team to design and build an end-to-end automatic ad-buying system that leverages Facebook’s marketing APIs and dynamic ads platform. As a result, Edmunds Ad Solutions can give subscribing dealers added exposure to Edmunds’ vast audience of highly qualified shoppers.

Officials highlighted that a national pilot found that Edmunds Ad Solutions delivered 20 times more click-through traffic to dealer sites when compared to a Google-rich media gallery display automotive click-through benchmark study from November to December of last year.

Dealers in the pilot program also enjoyed up to a 61 percent increase in new visitors to their sites, as well as a 50 percent increase in overall visitor site engagement.

“Edmunds Ad Solutions is proving to be an indispensable tool for a dealer’s comprehensive digital marketing strategy,” Edmunds.com vice president of dealer sales Scott Fanelli said.

“Not only does it get dealer inventory in front of Edmunds’ rich audience of in-market shoppers, it also gives them exposure to other shoppers who perform similar ready-to-buy behaviors on other sites,” Fanelli continued. “There’s no better way for a dealership to expand its inventory’s digital footprint to an audience of relevant shoppers.”

The site went on to mention Edmunds Ad Solutions is specifically optimized for mobile devices, which have quickly become a popular tool for vehicle shoppers.

According to a Facebook IQ study, 71 percent of all respondents used mobile during the purchase process. And 58 percent say that in the future, their smartphone is likely to be the only device they use for all their vehicle research.

Edmunds said it’s no surprise, then, that early testing found an overwhelming 90 percent of Edmunds Ad Solutions traffic comes from mobile devices.

“Edmunds Ad Solutions is one of the best ways that dealers can keep their inventory top of mind for consumers from the beginning of their online shopping journey, right through the moment they're ready to purchase,” said Mike Miller, digital marketing manager at John Elway Dealerships.

“The product delivers serious and engaged customers who spend far more time on our vehicle detail pages than other paid marketing campaigns,” Miller continued. “The bottom line: Edmunds is helping us to deliver highly targeted ads that are getting the right cars in front of the right buyers.”

With millions of visitors every month, Edmunds insisted it has built a powerful network that both shoppers and dealers have come to trust.

An estimated 59 percent of all new-vehicle shoppers will visit Edmunds at some point in the shopping process, and a study by CDK Global found that shoppers who visit both Edmunds and dealer sites are four times more likely to buy than shoppers who visit a dealer site only.

Dealers interested in subscribing to Edmunds Ad Solutions can reach out to their Edmunds account executive or contact [email protected].

Flick Fusion has announced the integration of its SmartFlicks video marketing platform with the DealerHosts Technology Management Solution (TMS) 5.0, a hybrid lead management and CRM system.

The integration allows car shoppers’ video viewing data to be captured from auto dealers’ websites, third-party listing sites such as Autotrader or Cars.com, or any other touchpoint from which a video is viewed. The data is then transmitted to the DealerHosts CRM in real time, where it is matched with customer records.

Sales teams are alerted to customer video viewing behavior as it is occurring, giving them the ability to communicate with a shopper while they are still on a website and looking at a vehicle.

“Millions of people watch videos during the car purchasing process, but until now there hasn’t been a way for auto dealers to track and leverage that information in real-time back to existing customer data,” said Tim James, chief operating officer of Flick Fusion.

“This integration adds a new level of visibility for DealerHosts customers that doesn’t exist in any other automotive CRM.”

The integration of video viewing data with a CRM elevates a dealership’s video content from a marketing tool to a lead generator. Dealership marketers will be able to directly attribute Key Performance Indicators (KPIs) and ROI to their video marketing campaigns.

SmartFlicks provides access to the data and analytics behind dealership engagement videos so dealers can see how a shopper interacts with their video content, including:

— Did the shopper watch a video in its entirety?

— Did they re-watch any product-specific portions?

— Did they watch multiple videos in a row?

— For how long did they watch?

This information can now be stored in the CRM contact records, giving the industry the most comprehensive analytics tool and giving dealers the most complete picture of their new and existing customers.

Once video viewing data is matched to existing customer records in the DealerHosts CRM, real-time alerts are triggered and sent to the sales team. If there are no previous customer records to match, a new record is created when a shopper contacts the dealership. The dealership can immediately send that lead a video email, capturing their data and matching them against their database.

“The integration with Flick Fusion’s platform provides our dealership customers with a level of actionable intelligence they can use in their lead follow-and marketing processes, greatly increasing the number of lead responses and appointments,” said Tony Ray Munson, chief executive officer of DealerHosts.

The integration of video viewing data with a CRM is an effective means of reviving cold leads. A typical CRM may contain thousands of fdorman leads. With SmartFlick’s advanced behavioral tracking capabilities, the DealerHosts CRM is able to notify its sales team that a cold lead is watching a Flick Fusion vehicle inventory video. The salesperson will instantly know that person is back in the market and what type of vehicles they’re interested in, and will be able to contact them with offers appropriate for their needs.

Based upon the data captured, dealerships can create targeted, behavior-based marketing campaigns. Behavior-based marketing technology uses web analytics, cookies, browsing histories and IP addresses to create user profiles of individual consumers. When matched to customer profiles in a CRM, dealers are able to generate relevant and targeted messages that appeal to individual buyer interests, and to send real-time alerts to the sales team throughout the entire buying cycle.

Car dealers will be able to create virtual reality vehicle videos through a new service launched by video marketing solutions provider Flick Fusion.

On Monday, the company announced the launch of 360VR, a platform that lets dealers generate VR inventory videos for use on their websites, in email marketing and mobile ads, and on social media and third-party car shopping sites.

“Virtual reality images are three-dimensional with a sense of depth that gives viewers a feeling of complete immersiveness,” Flick Fusion chief operating officer Tim James said in a news release. “Auto shoppers feel like they're actually sitting in a vehicle, giving them a realistic experience and helping to set expectations for that vehicle.”

A 360-degree camera is required to produce a 360VR inventory video. These typically cost anywhere from $200 to $1,000, Flick Fusion said.

Once the VR video is recorded, the user uploads it to Flick Fusion’s SmartFlicks video marketing platform. Additional information can be added to the video, as well.

SmartFlicks distributes the video to vehicle details pages, social media and third-party car-shopping sites using the Flick Fusion 360VR player. The videos are hosted on the video marketing platform.

“Dealerships that are first to offer virtual reality inventory videos will be marketing trail blazers,” James said. “VR videos offer an incredibly high level of engagement and are especially appealing to millennials, who are the fastest-growing consumer segment in the U.S. and who purchased more than 4 million vehicles last year.”

Carfax’s new Snapshot tool aims to help consumers on car-shopping websites make faster, more informed buying decisions.

Carfax Snapshot puts key vehicle history details such as reported accidents, number of owners, service records and open recalls right in front of potential buyers on the search results (SRP) and vehicle details (VDP) pages. Car shoppers then can click to access the full Carfax Report.

“Building customer confidence in our inventory starts with Carfax information,” Gary Lindsey, sales director at Graff Chevrolet, said in a news release announcing the product. “With Carfax Snapshot, we’re putting the vehicle history details that buyers want to know about most front and center on our site. It’s getting us more eyes on our cars online and more down-funnel shoppers on our lot.”

Auto manufacturers including Audi and GM have enhanced their certified pre-owned websites with Carfax Snapshot.

For dealers, every vehicle that Carfax Advantage Dealers advertise for sale on Carfax.com with Carfax Used Car Listings includes Carfax Snapshot. The tool also can be added to online listings created with the following companies:

—Autoblog.com

—Auto Ad Manager

—AutoCorner

—Autofusion

—AutoMall.com

—Dealer Car Search

—Higher Turnover

—LotBrowser.com

—LotPro.com

—Recycler.com

—V12 Software

“We’re constantly looking for new ways to help our dealers boost buyer confidence,” said Larry Gamache, communications director at Carfax. “Carfax Snapshot gives online shoppers an up-front, instant overview of the vehicle history information that matters most to them. Seeing this information helps people find the right vehicle faster and gets them one step closer to buying from the selling dealer.”

AutoAlert announced it is now a certified partner in the Audi of America Tier III Co-Op Program.

The program allows Audi dealerships to be reimbursed for certain OEM-approved expenses, provided they follow certain guidelines and have funding available. This process can give their teams more spending power elsewhere, according to news release.

AutoAlert equity- and data-mining customers can benefit from valuable consumer insights such as knowing the makes and models searched, previous dealership interactions, existing social connections with dealerships and insights on previous purchases.

“This is an exciting time for AutoAlert’s software and our dealerships, as we are able to offer equity- and data-mining insights, sophisticated communications, and alerts right to our dealerships’ desktop,” Kendall Billman, AutoAlert senior vice president, said in the release.

“Now, with our certified partnership with Audi of America Tier III Co-Op Program, we offer our dealers the opportunity to extend their budgets while increasing sales opportunities and client retention," Billman added.

Automakers are investing heavily in autonomous and connected-car technology, but with these potentially exciting developments comes an increased possibility for cyber-attacks against vehicles.

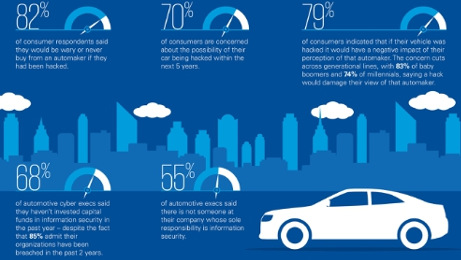

Among the consequences of failing to protect against cyber attacks is loss of business. In fact, 82 percent of consumers surveyed said they would be wary of buying from or would never buy from an automaker that had been hacked.

Of 449 car owners surveyed in the 2016 KPMG Consumer Loss Barometer study, 70 percent said they are concerned about the possibility of their car being hacked within the next five years. Additionally, 79 percent indicated that if their vehicle was hacked it would have a negative impact of their perception of that automaker. The concern transcends generational lines, with 83 percent of baby boomers and 74 percent of millennials saying a hack would damage their view of that automaker.

“Cars and trucks have evolved into highly complex computers on wheels, with increased connectivity that presents some real and important cybersecurity risks, the most significant of which is safety,” Gary Silberg, KPMG’s automotive sector leader, said in a news release announcing the results.

“Unlike most consumer products, a vehicle breach can be life-threatening, especially if the vehicle is driving at highway speeds and a hacker gains control of the car. That is a very scary, but possible scenario, and it’s easy to see why consumers are so sensitive about cyber security as it relates to their cars.”

In conjunction with the consumer survey, KPMG conducted a survey of 100 automotive senior cybersecurity executives distributed evenly between chief information officers, chief information security officers, chief security officers and chief technology officers.

KPMG found that 68 percent of automotive cyber execs said they haven’t invested capital funds in information security in the past year — despite the fact that 85 percent admit their organizations have been breached in the past two years. Additionally, 55 percent said there is not someone at their company whose sole responsibility is information security.

“Automakers are playing catchup when it comes to cyber security," said Silberg. “But the threat is real, and the implications of a vehicle breach could be catastrophic for consumers and the automakers alike. Car companies need to take action now and make cyber security a strategic imperative to ensure they are doing everything possible to protect the drivers of their vehicles.

“Due to the potentially enormous damage to their brands and their sales, addressing cybersecurity concerns is a critical priority for automakers, and one they cannot afford to get wrong,” he continued.

Additional survey findings

— In the event of a hack, 41 percent of consumers said their No. 1 fear would be someone else taking control of the car, followed by 25 percent who indicated financial information being stolen.

— 46 percent of respondents said the owner or driver of the car should be the guardian of consumer and vehicle data.

— 47 percent said the software and technology company whose products are in the car should be responsible for the security of ones connected car information.

Coinciding with software provider Recall Masters enhancing its tracking solution, J.D. Power through its SafetyIQ platform combed through data generated by the National Highway Traffic Safety Administration. Analysts found that more than 45 million vehicles subject to safety recalls issued between 2013 and 2015 are still un-remedied.

On Monday, J.D. Power described the situation created by a record number of vehicle safety recalls, parts shortages and inaction on the part of the owners of recalled united as leaving automakers and dealers with “a serious challenge.”

During the past 20 years, J.D. Power indicated more than 437 million vehicles have been affected by safety recall decisions in the U.S. In 2015 alone, more than 51 million vehicles were the subject of safety recalls, more than in any previous year.

By analyzing NHTSA and proprietary J.D. Power benchmarking data using its SafetyIQ platform, analysts identified that primary factors impacting completion rates for those recalls are vehicle age, vehicle type, overall population of recall and type of recall.

“The steady surge in recalls, combined with NHTSA's stated goal of 100 percent recall completion rates, have made the number of un-remedied recalls still on the road a critical statistic for automakers and dealers," said Renee Stephens, vice president of U.S. automotive at J.D. Power.

“By understanding the behavioral trends of vehicle owners, as well as recall completion rates among different vehicle and recall types, as an industry we can better tailor communications to improve those completion rates,” Stephens continued.

The following four points are the key findings in the J.D. Power SafetyIQ analysis. All data is based on recall decisions made from 2013-2015, as reported through six quarters of completion information.

1. Un-remedied vehicles more common in older models: The total recall completion rate for vehicles with model years between 2013 and 2017 is 73 percent. This compares with a completion rate of just 44 percent for vehicles manufactured between 2003 and 2007.

2. Vehicle type plays a big role in recall completion: Among vehicle segments, large/work vans have the highest overall recall completion rate at 86 percent, followed closely by compact premium SUVs at 85 percent. This contrasts with the mid-premium sports car segment, which has a completion rate of just 31 percent, and with large SUVs, which have a completion rate of 33 percent.

3. Larger populations present bigger completion challenges: The completion rate for individual recalls affecting more than 1 million vehicles is 49 percent. This reading compares with a 67 percent completion rate for individual recalls affecting less than 10,000 vehicles.

“It is sometimes difficult to obtain parts to launch large campaigns,” J.D. Power said. “In addition, customers can more easily receive a targeted communication method, such as a phone call, with a smaller population of vehicles.”

4. Powertrain and electrical system recalls most likely to get fixed: Of the major safety components, the groups with the highest recall completion rates are powertrain (71 percent), electrical (62 percent) and hydraulic brakes (66 percent). Airbags and suspension issues have the lowest completion rates at 47 percent and 48 percent, respectively.

“By better understanding the specific factors driving recall compliance among vehicle owners, manufacturers and dealers can better tailor their communications and manage the recall process much more efficiently,” Stephens said.

“This is a critical level of intelligence for the industry, which we believe will ultimately help reduce the number of un-remedied vehicles still on the road,” Stephens went on to say.

For more information on J.D. Power SafetyIQ, visit www.jdpower.com/safetyiq.

Recall Masters adds tracking to its software system

As J.D. Power shared its data analysis, Recall Masters added “Don’t Drive” and “Stop Sale” recall tracking into its software system, claiming to be the first software company to digitize this data into its SaaS API and batch processing platforms.

The company emphasized the tracking of recalled vehicles has greatly increased in the United States and new severity warnings such as “Don’t Drive” recalls are increasingly published in the news so as to inform consumers.

For example, certain vehicles with Takata airbags become more susceptible to malfunction as they age, which has prompted a public notice by NHTSA warning consumers to “Don’t Drive” these vehicles until the requisite repairs are made, especially in high-humidity states. Subaru also recently issued a “Don’t Drive” recall for steering column malfunctions.

Recall Masters is now tracking and making this vital information available for instant lookup via its API and data processing service.

“Recalls have become such a widespread problem across the United States that a Silicon Valley Big Data approach is needed to tackle the problem, and that is where Recall Masters comes in,” Recall Masters chief executive officer Christopher Miller said.

At every touch point from vehicle sales, to inventory management, repair scheduling and service lane visits, to rental and corporate fleets, Recall Masters highlighted that it now can place actionable information at the fingertips of automotive sales and service centers, as well as consumers, nationwide.

“As the government, manufacturers, automotive repair centers and Big Data software companies like Recall Masters better unite to tackle the recall epidemic faced across the United States and beyond, we are continually evolving our systems and database to provide the most relevant information possible to consumers and their automotive service providers,” Miller said.

“The addition of ‘Don’t Drive’ and ‘Stop Sale’ recall tracking into our data set is just one more step in the right direction to ensure consumer safety and to mitigate risk of automotive-related injuries,” he added.

To learn more about Recall Masters’ complete solution, schedule a demo or receive a free trial, call (888) 651-4480; send a message to [email protected] or visit www.recallmasters.com.