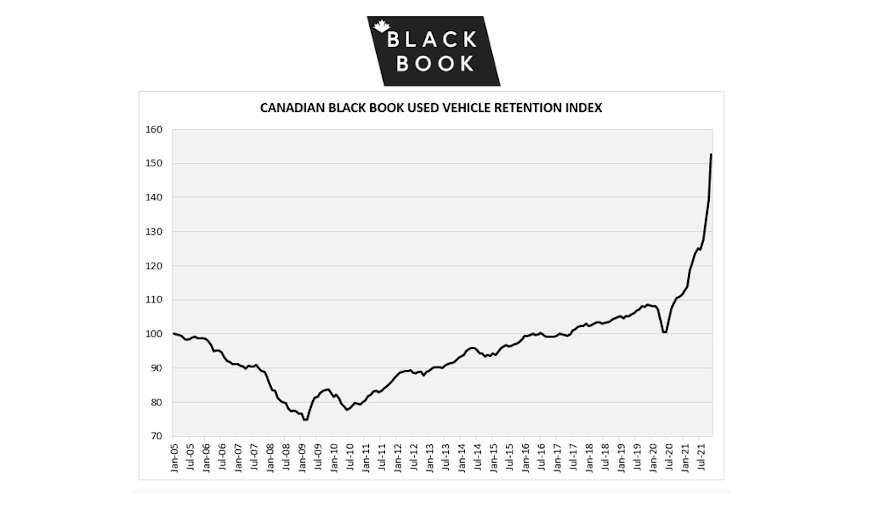

Not only did Canadian Black Book’s Used Vehicle Retention Index reach another record high in November, the month-over-month and year-over-year increases in the index were all-time highs, as well.

Specifically, the CBB index was at 152.6 points for November, which beat the prior record set in October by 13.2 points. Fourteen of the last 17 months have been record highs in the index, CBB said.

And there have been month-over-month gains in the index for 16 of the last 17 months.

The month-over-month hike of 9.5% in November set the record for sequential gains in the index, CBB said, while the 38% year-over-year hike was an all-time high, too.

“It is exceptional that since the low point in May 2020 at the infancy of the pandemic, we have seen a 65% increase in average retained value across all models in Canada,” CBB director of OEM strategy and analytics James Hancock said in a news release.

“The Index graph clearly illustrates how extreme this growth is compared to any other time since CBB began the Index in 2005,” Hancock said, referring to the graph in the above window.

Compact cars showed the most growth during November, climbing 13.25% month-over-month. Subcompact cars were next at 12.83% and compact crossovers/SUVs were up 12.7%.

The only segment not to see an increase was the premium sports car segment (down 0.86%), which CBB said was driven by seasonality.

If one message can be taken from the Canadian Black Book 2021 Best Retained Value Awards, with winners announced Wednesday, it is that used vehicles today are holding far more value than ever before.

That is the case even as Canadian Black Book vice president of sales Yolanda Biswah said the past year has been a wild ride in terms of retained values.

Economic phenomena directly related to the global pandemic have propped up much of the gains, Biswah said.

“We have been through steep record-setting declines last spring, followed by rapid increases culminating in record level retained values in Canada across the board,” Biswah said in a news release.

The Canadian Black Book Best Retained Value Awards quantify retained value for every model of 4-year-old vehicles in Canada in 23 segments. Three “overall brand awards” are presented to OEMs that hold the most value among their full product line.

For 2021, the overall brand awards for cars goes to Honda.

Toyota wins the award for trucks/SUVs, and Porsche wins in the luxury brand category.

On average across all car segments overall, they held 53.1% of original MSRP after four years across nearly 3,000 trims.

Trucks/vans/SUVs held a much-higher 63.6% across nearly 13,000 trims.

CBB said supply, or lack thereof, has been the overarching factor contributing to the major gains in retained value.

Supply disruptions have been a boon to the industry since the early days of the pandemic, CBB said.

Retail traffic slowed because of COVID-19 related restrictions. That stalled any trade-in activity for months.

Rental agencies saw major business loss and held onto units longer. That kept those vehicles out of the used market. During the tough times, repossessions were mostly put on hold for consumer relief. have still not gotten back to pre-pandemic levels, which has again kept those vehicles away from auction and used lots.

“People have been driving less and therefore keeping cars longer and therefore not trading in,” CBB said.

Through the past 18 months, supply from OEMs and parts suppliers (microchips, for example) has been slowed and delayed. That has caused shortages of new units and increased demand for used.

“Couple this with a general increase in demand for slightly used models in good shape, and we find these units turning quickly off of used lots,” CBB said.

These quick sales are depleting what CBB says is an already-low supply, which has resulted in historically high retained value, as illustrated by the 2021 Canadian Black Book Best Retained Value Awards and the monthly CBB Used Vehicle Retained Value Index which has posted record levels for many months straight.

CBB said the zero emission category has made progress since it was first included as a category in 2019. The Chevy Bolt was the winner in the segment, taking a leap forward with 56%. The Ford Focus won the category last year at 51%.

The category itself held 47% of original MSRP on average versus 45% last year and only 40% in 2019.

“Used EVs and BEVs are becoming more valuable,” CBB said.

The full list of winners can be found here and below.

2021

Overall Brand Awards |

| Car |

Honda |

| Truck & Crossover/SUV |

Toyota |

| Luxury |

Porsche |

| MODEL |

1st |

2nd |

3rd |

| Sub-Compact Car |

Honda Fit |

Toyota Yaris |

Hyundai Accent |

| Compact Car |

Toyota Prius v |

Honda Civic |

Toyota Corolla |

| Mid-Size Car |

Honda Accord |

Toyota Camry |

Nissan Altima |

| Full-Size Car |

Toyota Avalon |

Dodge Charger |

Nissan Maxima |

| Entry Luxury Car |

Lexus IS-Series |

Mercedes-Benz

C-Class |

Mercedes-Benz

CLA-Class |

| Luxury Car |

Mercedes-Benz

E-Class |

BMW 5 Series |

Volvo V90 |

| Premium Luxury Car |

Porsche Panamera |

Mercedes-Benz

CLS-Class |

Mercedes-Benz

S-Class |

| Premium Sports Car |

Porsche 911 |

Chevrolet Corvette |

Porsche

Cayman |

| Sports Car |

Ford Mustang |

Dodge Challenger |

BMW 2 Series |

| Small Pickup |

Toyota Tacoma |

Chevrolet Colorado |

Honda Ridgeline |

| Full-Size Pickup |

Toyota Tundra |

Ford F250 S/D |

Ford F150 |

| Minivan |

Honda Odyssey |

Toyota Sienna |

Kia Sedona |

| Full-Size Van |

Mercedes-Benz

Sprinter 2500 Cargo |

RAM ProMaster |

Mercedes-Benz

Sprinter 3500 Cargo |

| Compact Commercial Van |

Ford Transit Connect |

Mercedes-Benz Metris |

RAM ProMaster City |

| Compact Crossover/SUV |

Honda CR-V |

Mazda CX-5 |

Toyota Rav4 |

| Mid-Size Crossover/SUV |

Jeep Wrangler |

Toyota 4Runner |

Toyota Highlander |

| Full-Size Crossover/SUV |

GMC Yukon |

Toyota Sequoia |

Chevrolet Tahoe |

| Compact Luxury Crossover/SUV |

Porsche Macan |

Mercedes-Benz

GLC-Class |

Lexus NX Series |

| Mid-Size Luxury Crossover/SUV |

Lexus GX460 |

Lexus RX Series |

Mercedes-Benz

GLE-Class |

| Full-Size Luxury Crossover/SUV |

Mercedes-Benz

G-Class |

Lexus LX570 |

Range Rover Sport |

| Sub-Compact Luxury Crossover |

MINI Countryman |

Audi Q3 |

Mercedes-Benz

GLA-Class |

| Sub-Compact Crossover |

Honda HR-V |

Mazda CX-3 |

Jeep Renegade |

| Zero Emission |

Chevrolet Bolt |

VW eGolf |

Kia Soul EV |

SOURCE: Charts courtesy of Canadian Black Book.

Canadian Black Book vice president of research and analytics Brian Murphy summed up the latest reading of the CBB Retained Value Index with six words.

“What goes up, must come down,” Murphy said in a news release sent to Auto Remarketing Canada this week.

Coming off a record high established in September, the seven-month winning streak of month-over-month gains for the CBB Retained Value Index ended in October. Murphy and the CBB team noted the industry-wide decline was small, only 0.2 index points.

That said, the firm noted the streak ending does follow some of the negative sentiment being heard from Canadian Black Book clients in recent weeks. As a reminder, the index tracks the actual retained value of 2- to 6-year-old vehicles in the Canadian marketplace.

“We’ve experienced an impressive run of used-vehicle value success over the past seven months,” Murphy continued. “Even though the Index has dropped, it is very slight, and overall retained value is still just below record-high levels.”

CBB highlighted the biggest winners this month include the compact car segment, which is up 10 points from the same time last year and 0.9 points from last month. Subcompact cars had a tiny decline in October, however, they're still up 9 points from last year.

Compact Luxury CUV/SUV inched up 0.6 points from September but dipped 3 points compared to October of last year. Analysts added prestige luxury cars, a struggling segment recently, moved up 1 point in October.

On the down side, CBB pointed out the luxury car segment decline 2 points in October and is down 7 points from the same time last year.

Analysts also mentioned minivans continue to show signs of weakness, as the segment is off by 6 points compared to October of last year. Small pickups also declined 1 point in October and gave up 6 index points compared to last year.

CBB closed its latest update by noting the Canadian dollar hit a 3-month high at the end of October at 0.765 USD.

“The higher dollar does make exporting used vehicles to the U.S. market less attractive, yet still at a level where profits can be had,” analysts said. “Stay tuned to next month’s index as we track the trends heading into the winter selling months.”