J.D. Byrider recently announced Brad White and Jeff McKay have been added as franchise consultants at the company’s headquarters.

Executives highlighted both new additions will be responsible for supporting J.D. Byrider franchisees, advising for operational and financial improvement and building leadership teams in each region.

“Brad and Jeff round out our team of seven franchise consultants who are experts in our field support system, helping our franchisees achieve their goals while ensuring our customers nationwide receive exceptional experiences,” said Tom Welter, vice president of franchising at J.D. Byrider.

“As both men have grown within our system, we look forward to using their strategic and operational insights to help achieve our double-digit store growth goals,” Welter continued.

White has worked for J.D. Byrider since June 2006. The company noted White has built his understanding of franchise operations on past positions within the company, including credit manager, collection manager, finance manager and training manager of credit operations.

Before coming to J.D. Byrider, White was a store manager for Rent-A-Center.

McKay began with J.D. Byrider in sales and was promoted to managing partner of the Lafayette, Ind., company-owned store in 2011. Last year, he operated a newly acquired company-owned store in Nashville, Tenn.

Before joining J.D. Byrider, McKay was a sergeant with the Kokomo Police Department for 15 years.

Buy-here, payhere dealership software provider AutoStar Solutions recently acquired 50 percent interest in SecureClose, a designer of innovative compliance technology.

Together, the two companies are finalizing plans to provide a new tool that automates the contract closing process for dealers.AutoStar Solutions president and chief executive officer Allen Dobbins highlighted this new technology comes at a time of increased regulation in the independent auto industry, which typically provides vehicle financing to customers without access to traditional options.

“In this climate of increased regulatory scrutiny, we believe that SecureClose has developed the product of choice to aid dealers in their efforts to mitigate risk and streamline closings,” Dobbins said. “We look forward to bringing this compliance solution to an industry already burdened by increased regulatory scrutiny.”

This new solution, designed by Secure- Close, can assure consistent communication of legal disclosures by using a customized avatar to walk a customer through the contract closing process. At the same time, the customer’s image and keystrokes are captured by the system, which also utilizes e-signature technology to ensure that the necessary documents are properly signed. All of this information is then stored so that both the dealer and the customer have access to the actual closing process in the event of a regulatory dispute or legal action.

“We believe this is the most advanced, cutting edge closing product on the market, and we are excited to collaborate with Auto- Star as we take this product nation-wide,” said Ace Christian, founder of SecureClose and also a BHPH dealer.

Christian will assume the role of chief vision officer with responsibility related to product development.

The SecureClose solution will initially be available to AutoStar’s existing clients through an integration with its dealer management solution, AutoStar Fusion.

Officials highlighted a general industry release is planned for later this year.

AutoStar Solutions chief legal officer Steve Levine added “In my experience, one of the dealer’s biggest risks is inconsistent delivery of disclosures at closing. The litigation costs are staggering. The exciting thing about this product is it takes the he said – she said variable out of the closing process and provides the dealer with an irrefutable tool to rebut consumer complaints.”

For further information, contact Edward Viator at (817) 439-6164 or visit www.secureclose.net, where dealers can also view video interviews about the product and future plans.

Two buy-here, pay-here operators who say they have more than 80 years of experience ended up in serious trouble with the Federal Trade Commission.

Earlier this month, the FTC charged Arkansas dealer, Abernathy Motor Co., and its two principals, Wesley Abernathy and David Abernathy, with failing to display federally mandated buyer’s guide on used vehicles offered for sale.

Those guides are required by the FTC’s Used Car Rule.

Officials indicated each violation could result in a civil penalty of up to $16,000.

“Used-car dealers are required to post a buyer’s guide providing warranty and other important information on the cars they offer for sale. That’s the law,” said Jessica Rich, director of the FTC’s bureau of consumer protection. “Consumers have a right to receive this information up-front to help them make an informed buying decision.”

The FTC’s Used Car Rule, which took effect in 1985, specifically requires dealers to disclose whether the vehicle comes with a dealer’s warranty or is being sold “as is.”

If the vehicle is sold with a dealer’s warranty, the rule requires the buyer’s guide to list its basic terms and conditions, including the duration of coverage, the percentage of total repair costs to be paid by the dealer and the exact systems covered by the warranty.

Back in January, the FTC announced that its Southwest Region Office had warned 11 dealerships in Jonesboro, Ark., that their sales practices violated the Used Car Rule.

Officials said all but Abernathy Motor Co.Subsequently came into compliance.

Abernathy Motor Co. Has four BHPH locations in Arkansas: two in Blytheville, one in West Memphis and one in Jonesboro. The FTC’s complaint also names the company’s owners and an affiliated dealership, Ab’s Best Buys AMC as defendants.

According to the complaint, the FTC visited the Abernathy dealership in Jonesboro in November 2012, and found that none of the vehicles offered for sale displayed a buyer’s guide.

The agency said it informed the dealership of that fact, and sent the dealership a copy of the guide and the FTC publication, “A Dealer’s Guide to the Used Car Rule.”

Then last May, FTC officials said they revisited the Abernathy dealership and also visited Ab’s Best Buys. They found both dealerships were offering used vehicles for sale that did not display a buyer’s guide.

According to the store’s website, Abernathy Motors first incorporated in 1966 as a Dodge dealership in Jonesboro. Then 10 years later, Abernathy started to finance vehicles for customers who did not qualify for financing through Chrysler’s captive or a commercial bank.

By 1996, Abernathy sold the franchised store to focus solely on BHPH. The operation set up its own related finance company Instant Auto Corp., having since accumulated more than 1,800 accounts through annual gross sales of more than $15 million.

Abernathy highlighted an A-1 status with the Better Business Bureau.

The operation closed its website description by saying, “We are owner operated and our family friendly staff enjoys working with our customers to find a good payment plan for them. We set up deals so that the customer always wins.”

Working with customer disputes isn’t an unfamiliar situation to most buy-here, pay-here operators. Dealers have become accustomed to smoothing out situations about repairs, payments and a host of other issues.

Another customer concern happening more often stems from individuals who had their vehicle repossessed and the loan balance forgiven (or discharged under state law). That process forces operators by federal law to file with the IRS and send to the borrower Form 1099-C showing that the discharged balance is considered income potentially subject to tax. These customers are notified by the Form 1099-C that they may have a significant tax liability when they file their individual return, despite losing ownership of their car.

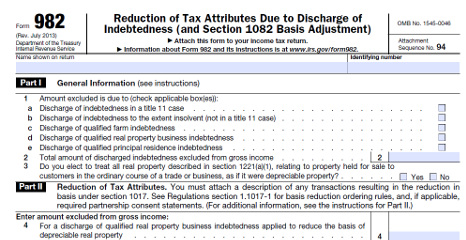

However, there is an IRS form that may brighten the day for both the upset customer and the BHPH operator — Form 982 titled, “Reduction of Tax Attributes Due to Discharge of Indebtedness.” If the customer is insolvent immediately before the debt is cancelled and the car is repossessed, the amount reported on the Form 1099-C is not taxable. For this purpose, a customer is insolvent if all of his/her liabilities were more than the value of all assets (including the repossessed car) immediately before the debt was cancelled.

Ken Shilson, founder of the National Alliance of Buy-Here, Pay-Here Dealers who spent decades as a practicing certified public accountant, recently mentioned Form 982 to some veteran operators who were unaware of the potential impact of customers utilizing this process.

“When they hear about it, they say, ‘That’s genius.’” Shilson said.

Potential of Form 982

McGladrey’s Scott Ruby explained to BHPH Report what Form 982 is in a nutshell.

“The income tax law has an insolvency exclusion that says that if your liabilities exceed your assets, you are probably excused from paying tax on cancelled debt,” Ruby said.

Especially in deep subprime where many BHPH customers reside, insolvency might be extremely common. Ruby shared information from the Taxpayer Advocate Service, which is an independent organization within the IRS aimed at making sure that every taxpayer is treated fairly. Each year the Taxpayer Advocate makes a report for Congress that lists changes that the IRS should consider.The 2010 Annual Report to Congress indicates that many taxpayers overlook the

benefit of the insolvency exclusion.

“Based on a study done by the Taxpayer Advocate Service, 47 percent of the taxpayers that received a Form 1099-C would likely qualify for the insolvency exception,” Ruby said. “Our expectation, because this is deep subprime, is that we’re probably talking about an insolvency figure much higher than 47 percent. I expect in deep subprime the level may be as high as 90 percent.”

The bottom line, customers who receive a Form 1099-C probably do not have to pay additional income taxes.

Shilson agreed with Ruby’s estimation.

“When I mentioned the exception to a couple of dealers, they responded by saying nearly everyone in deep subprime is insolvent,” Shilson said.

However, an accounting professional as experienced as Ruby cautioned about the potential pitfalls of Form 982.

“I think that the form is unbelievably confusing” Ruby said. “Customers probably want to talk to their tax accountant to help them compute the amount of their insolvency. If they are insolvent, some or all of the income may be excluded from taxable income. Their tax savings are probably going to far outweigh the cost of the tax preparation.”

Ruby suggested that operators can include Form 982 (and its instructions and worksheets) to customers along with the Form 1099-C, or instruct customers on how they Can obtain it from the IRS.

“You can have a simple handout at the dealership saying, ‘We can’t provide tax advice, but ask your tax advisor and if the Form 1099-C amount can be excluded from income under the insolvency rules.’ Tax preparers are generally pretty busy this time of year and it can be easy to overlook this exception. Sharing this simple phrase ‘please check the insolvency rules’ will be a helpful clue your tax advisor.” Ruby said.

Helping Customers in Financial Trouble

As explained in previous installments in this BHPH Report series, operators who have a related finance company are required by federal tax law to send Form 1099-C when an uncollectable balance has been discharged.Shilson described how BHPH operators can Point to Form 982 to potentially help a customer who experienced an extreme financial hardship such as divorce or mounting medical expenses, causing the repossession and eventual charge-of .

“That’s the customer you want to have this exception,” Shilson said.

And at the same time, Shilson pointed out that operators also can use the power of Form 1099-C. For example, it might be beneficial when some customers default on their installment contract and skip with the vehicle or if a competing dealer sells them a different vehicle and encourages them to abandon the old obligation.

Shilson said these “abandonment” situations have happened more frequently in the current highly competitive environment where deep subprime buyers are being offered newer vehicles by competitors.

“They deserve to get a Form 1099-C.That’s the customer you want to have a tax liability,” Shilson said.

The National Independent Automobile Dealers Association made sure to craft a detailed response when the Consumer Financial Protection Bureau allowed time for comments regarding possible changes to federal rules governing debt collection. Regulators sought the input as they consider the option of changing rules that enforce the Fair Debt Collection Practices Act.

NIADA regulatory counsel Shaun Petersen expressed the association’s opposition to rules designed to regulate creditors such as buy-here, pay-here dealers in the same way as third-party collectors. Petersen noted that when Congress passed McGladrey the FDCPA in 1977, he said lawmakers deliberately excluded creditors from the law’s requirements.

“In November the CFPB released what they call an advanced notice of proposed rule making (ANPR). In essence, what the ANPR is the agency is alerting the world, ‘We’re thinking about doing rules in the arena, and here are some of the questions that we’re asking internally and externally.’ They ask for interested parties to respond back based upon these questions relative to them,” Peterson said in an interview with BHPH Report.

“There were certainly things included in that group of information that wasn’t germane to us as buy-here, pay here dealers, but there were other things being said that were very much of interest to us,” he continued. “Our process, certainly we get input from our board.We get some of their thoughts. We talked to other members of the association, in particular buy-here, pay-here folks, on this particular issue.

“We got some good input from dealers that would be affected by any change that the CFPB would make if they started to change things that impacted creditors collecting on their own debts. That was our primary concern,” Petersen added.

Addressing Specific CFPB Questions

NIADA’s comments covered nearly a dozen specif c questions offered by the CFPB. Petersen of en referenced language contained in the FDCPA to articulate the association’s concerns.

“Congress believed the risk of reputational harm to the creditor is sufficient to deter the creditor from engaging in the types of debt collection practices the FDCPA intended to prohibit,” Petersen wrote to the CFPB. “NIADA believed then and continues to believe that Congress’s logic is sound. Dealers collecting their own debt are deeply concerned about their reputation." Petersen explained that BHPH dealers “will often go to great lengths to ensure a positive customer experience,” including spending their own money to repair customers’ vehicles because “experience has shown that often, if a customer’s car breaks down at any point while a loan balance exists, the risk that the customer ceases to make the required installment payments increases dramatically.Thus, dealers invest heavily in the postsale customer relationship as an incentive to repayment.”

In addition, Petersen said the CFPB provided no evidence or statistics that showed first-party auto loans — or any auto loans — are a source of debt collection concerns, or even a significant source of debt collection activity.

NIADA provided input on other issues, as well, opposing unnecessary burdens such as a debt verification process for first-party auto lenders, who have a direct relationship with the customers from which they are collecting.

Meeting with Bureau Officials

Along with the comments, Petersen along with NIADA executive vice president Steve Jordan visited with CFPB officials earlier this month. Petersen described the encounter as quite positive.

“We were very clear that we’re very much interested in working with them in anything that they do in the debt-collection sphere, in the military relations sphere and the hot issues that were communicated at (the Vehicle Finance Conference hosted by the American Financial Services Association) with the fair lending issues and disparate impact,” Petersen said.

“We want to be a tool and a resource for the bureau and what they’re doing to gather information about the industry and certainly as they make decisions that would impact the regulations of the industry and especially the enforcement of those regulations on the industry.We want to be abreast of those issues and to let them know we can be a resource for them,” he went on to say.

Signal of What Might Be Ahead

At the same time, while no official rule change proposal has been made by the CFPB, Petersen is hoping BHPH dealers will maintain current practices and be aware that they might have to be altered depending on what federal regulators do.

“I feel confident that the buy-here, pay-here industry is aware of the ‘common-sense’ things you could do when collecting on your own debt that could be construed as abusive, things like threatening people with criminal action. I would hope that the vast majority of them would understand those are practices that nobody condones,” Petersen said.

“What we are hopeful for and what we’re spending a lot of time as an association is to educate and this response to rule making,” he continued. “Look, this is something the CFPB is just collecting comments on right now.There’s been no proposed rule. There’s been no statutory change in regulation. They’re just gathering information. But this is the first step.

“This should be the blinking light on the horizon saying here’s where we’re going and it’s something to be aware of,” Petersen went on to say. “I guess I almost liken it to that this is the lighthouse and the ship in the ocean sees the lighthouse. The details aren’t there until you get a little closer. Then you get the light along the shore to point out the details of the rocks. But certainly the advanced notice of proposed rule making is that lighthouse where I can see something on the horizon is coming. The next step is to see if the CFPB decides to go down that road and propose specific rules in very detailed language to say this is how they’re going to regulate.

Petersen indicated to BHPH Report that There is no specific timetable as to when the CFPB may propose rules changes regarding the FDCPA. For now, he is waiting just like the rest of NIADA and the BHPH industry.

“I’m sure the CFPB will take whatever appropriate time they feel they need to consider comments that have been submitted,” said Petersen, who added that more than 300 comment submission were made by consumers, industry groups, service providers and other interested parties.

“They certainly have some study time.We’ll see if they make any proposed rule changes. We certainly hope they don’t,” he added.

You probably have heard that running cocktail hour joke about the two sure things in life — death and taxes.

Well that chuckle starter came up again during the BHPH Report’s conversation with McGladrey’s Scott Ruby when he discussed how important it is for buy here, pay-here operators who have a related finance company to file Form 1099-C as dictated by Internal Revenue Service guidelines revamped nine years ago.

“To my knowledge, there are only two things that have an indefinite statute of limitations. One is murder, and the second is the failure to file a tax form,” Ruby said. “If you have not filed Form 1099- C, your statute is open forever so the IRS right now can audit all the way back to 2005 and assess you penalties.”

Assuming that the missed filing is not intentional, there is a $100 penalty for failing to provide a borrower with a Form 1099-C by the end of January and a separate $100 penalty against the dealership for failing to file with the IRS by the end of February. Ruby emphasized that penalties can add up quickly, but there is potential relief if operators missed those initial deadlines.

“If you’ve missed the deadline for 2013 related filings, your time considerations are still important because penalties increase. The penalties are lower if the late filings are made before Aug. 1. After Aug. 1, it’s at least a $200 penalty per missed Form 1099-C,” he said.

He went on to explain that “penalties increase substantially if the failure to file is intentional. Intentional disregard is based upon all the facts. There is always the concern that continued non-filing is an indication the omission is intentional. Intentional disregard is the larger of $500 per omission or 10 percent of the amount that would have been reported on the 1099s. The amounts really add up quickly.”

To ease the burden of preparing the Forms 1099-C, operators could use the same service provider that handles their payroll and other 1099 matters.

There’s a clear point emphasized by Ruby as well as Ken Shilson, founder of the National Alliance of Buy-Here, Pay-Here Dealers.

“If you haven’t filed in prior years, and you’re filing this year, you need to consult with your lawyer and tax adviser,” Shilson said.

Tennessee Bankruptcy Case Clouds Issue

Last May, Tennessee’s Eastern District Bankruptcy Court issued a ruling that might have muddied the situation.

Tennessee-based attorney Ernest Williams explained the state’s Eastern District Bankruptcy Court latched onto the “defined policy” exception and determined that the issuance of a Form 1099-C reflects that a financial institution has discharged an indebtedness, which must then be reported by the debtor as taxable income.

“But legally, unless the debt is truly ‘discharged’, it is still owed,” said Williams, who runs EWIV Law in Nashville, Tenn.

Williams added that this bankruptcy case is likely to be cited by borrowers seeking to avoid repayment. He encouraged his clients “to ensure their ‘defined policies’ are not to ‘cancel debt’ unless discharged.”

Avoiding Forbearance Agreement

Shilson mentioned a few states that are prime BHPH markets, including Texas and the Carolinas, have state statutes that prohibit recovery measures beyond repossessing the vehicle. In these states and a few others, garnishing wages and remedial recoveries such as property liens simply aren’t possible. And as a result, Shilson has seen many operators use what’s known in the industry as a voluntary forbearance agreement.

“Basically it’s an agreement signed with the customer and the finance company in which the customer agrees to gives the car back voluntarily and in return the operator agrees not to pursue him any further, not to report negative credit and not to do certain other things which sometimes includes an agreement not to file a Form 1099-C with the Internal Revenue Service,” Shilson said.

“The problem is that the IRS doesn’t recognize the forbearance agreement as a federal exemption,” he continued. “You’re making a hollow promise. It doesn’t relieve the operator from the responsibility of reporting that the debt was cancelled. It’s not a smart move because the operator can incur significant penalties.”

Ruby took a similar position, citing federal guidelines associated with Form 1099- C as a general recommendation to any BHPH operator.

“Operators should not agree to omit the filing of Form 1099-C because it’s required by federal law. Do not include language in the settlement agreement suggesting that they will exclude the settlement from the Form 1099-C reporting,” Ruby said.

“Don’t get sucked into breaking the law,” he added.

Importance for Sale of Dealership

Beyond the annual tax filing, Ruby mentioned another reason why BHPH operators need to monitor the filing of Form 1099-C closely.

“At some point in time, operators want to retire, and that may mean they want to sell their business. If they’re not filing Form 1099- C (and we’ve already determined that statute of limitations hasn’t started), any knowledgeable buyer will adjust the sales price for the exposure they’re going to inherit on the purchase of the business,” Ruby said.

“Likewise, anyone who is buying a business will be looking for any liabilities that aren’t disclosed on the financial statements. Missed Form 1099-C or penalties for not filing are the types of liabilities a knowledgeable buyer will check,” he added.

Inconsistent Enforcement Application

Both Ruby and Shilson indicated to BHPH Report that each have has worked with clients who have encountered varying degrees of enforcement of Form 1099-C compliance.

“IRS auditors of en approach the issue differently and can arrive at very different conclusions. Scott and I have been comparing notes on our respective experiences and we have found some very different approaches and results,” Shilson said.

“As I’ve talked with other CPAs, they’re also experiencing some differences. The IRS does not seem to be taking a clear approach to this matter,” Shilson continued.

“It’s a case where it is complicated and it doesn’t seem that there is a clear position that the IRS is asserting. It doesn’t appear that there is any guidance makes it easier for operators to understand how to comply or for IRS auditors to understand how to that helps us either comply or them to enforce the rules,” he went on to say.

If the IRS does contact a BHPH operator, Ruby recommended the dealership contact its tax adviser and legal counsel immediately.

“Because of the difficulty applying or interpreting the rules, the application may be inconsistent from one IRS audit to another,” Ruby said. “The point is the buck stops with the operator to know the rules and to be able to crisply explain how they have complied with the reporting requirements. I know that Ken and I share the same objective — helping operators understand these rules. Hopefully these articles are helping.”