Cherokee Media Group senior editor Nick Zulovich reconnected with Agora Data CEO Steve Burke during NADA Show 2023 in Dallas for this episode of the Auto Remarketing Podcast.

Burke shared his perspectives on how buy-here, pay-here dealerships are doing financially based on client data and other perspectives. He also mentioned what trends he’s watching beyond rising interest rates.

To listen to the conversation, click on the link available below.

Download and subscribe to the Auto Remarketing Podcast on iTunes.

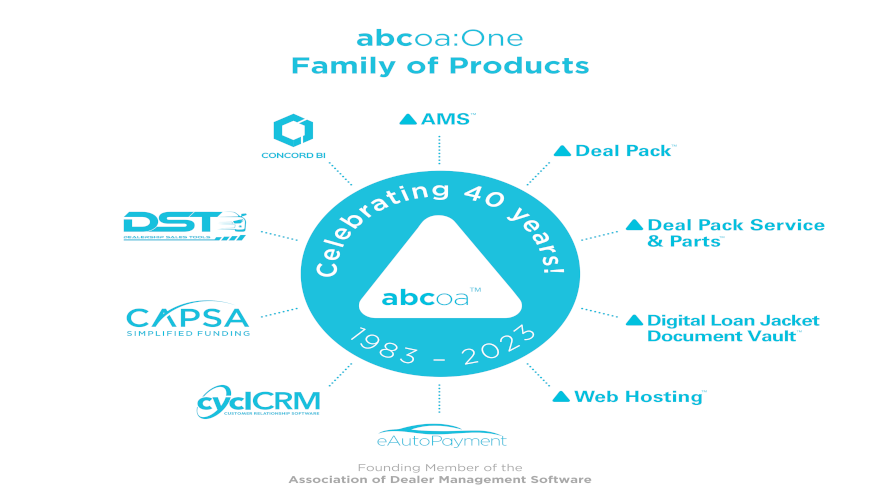

Advanced Business Computers of America (ABCoA) is kicking off its 40th anniversary by hosting its fifth Deal Pack User Conference on Feb. 27-28 at its headquarters in Jacksonville, Fla.

The software-as-a-service company dedicated to the used-vehicle and special finance industries and known for Deal Pack and cyclCRM highlighted that its User Conference is designed to be a unique learning experience for independent dealers, much like a dealer performance group.

According to a news release, attendees will be taken through Deal Pack’s sales, collections, general ledger, service and parts modules and cyclCRM by ABCoA’s customer success specialists.

ABCoA said the dealer-centric approach can allow buy-here, pay-here and lease-here, pay-here operators to learn and experience the latest features and innovations that Deal Pack and cyclCRM has added for its customers, in addition to learning how the application can improve their daily operations and best practices for success.

“The Deal Pack User Conference is a special experience for our customers and prospects,” ABCoA head of human resources and public relations Karolina Jarvis said.

“Our users get the chance to network, learn from our speakers and fellow dealers, learn how ABCoA’s robust ecosystem can improve their operation’s daily functions, and how Deal Pack gives them complete financial visibility of their operation at any given moment in time, anywhere in the world," Jarvis continued.

A recent Tip of the Week from Ignite Consulting Partners delved into the social media world your children might know well — TikTok.

Ignite recapped that during the last few weeks, a TikTok video went viral and gave consumers some “bad ideas and created even more headaches for dealers and finance companies.”

The video recommended that consumers send letters directly to dealers and finance companies, claiming a “right to rescission” regarding their retail installment sales contract (RISC) and vehicle.

Ignite explained what a “rescission” is, noting that the law cited in these letters is rooted in Truth in Lending Act.

“Rescission is basically a written notice to terminate or cancel a contract or agreement that was previously signed, with some requirements and exceptions,” Ignite said in an industry message. “It’s a formal notice of the consumer’s intention to undo the agreement and return to the previous situation as if it never existed. All because the creditor omitted important disclosures. Sounds serious, doesn’t it?

“Not in these cases. See, the devil’s in the details,” the compliance firm continued. “And the security interest has to be retained or acquired in a consumer’s principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction.”

Generally, Ignite said the word dwelling means a residential structure, whether or not that structure is attached to real property. Examples include a condo unit, coop unit, mobile home, and trailer, if they are used as a residence.

“A car is not considered a dwelling under the law because it is not intended for permanent or long-term habitation. Cars are primarily designed for transportation and not equipped or intended for use as a permanent living space. Fortunately, these letters were sent in the context of a motor vehicle RISC,” the firm said.

Ignite acknowledged that if a dealership or finance company received one of the TikTok-inspired letters, it might have caused a compliance ruckus.

“Where people get tripped up is in the filler. The letter is usually combined with multiple claims of fraud, lack of disclosure, etc. You should be incredibly careful when responding to them as they are written to be confusing. A best practice is to separate each claim in the document with brackets and address them individually,” Ignite said.

“Also peppered in the letters were additional claims that the terms of the deal weren’t disclosed and that a laundry list of itemized fees from the RISC were not allowed under law and were, therefore, a hidden finance charge,” the firm continued.

“The letters all end in some version of a statement that says the car belongs 100% to the buyer and that the dealer must send them a $10,000 check for everything they have paid to the dealer, including ancillary items like CPI. Our advice is to stay calm and dissect each claim methodically. You never know when a missed assertion could come back to haunt you. It can be difficult to respond citing the correct law that governs each claim,” Ignite went on to say.

If you need help writing a response or don’t know how to start, contact Ignite via email at [email protected] or call (817) 900-8754.

The newest Byrider location opened this week in the Sunshine State.

The franchise chain of buy-here, pay-here dealerships made its way into the South Florida market with a new store at 2008 Okeechobee Blvd. in West Palm Beach, Fla.

Byrider now has seven locations in Florida.

This is the fourth dealership for the franchise ownership group, Garber Ventures, which also operates additional locations in Kentucky and Tennessee.

According to a Byrider news release, a fifth store in Kentucky is slated to open later this year.

“We are very excited to operate in the West Palm Beach area,” says Jeremy Dodson, an owner-operator with Garber Ventures. “The entire team is excited about our new employees, the location, and the community. We can’t wait to meet our future customers and introduce Byrider to a great market.”

Byrider West Palm Beach features a welcoming and modern environment for sales, service, and finance, inclduing a sales lot that can stage more than 40 vehicles for sale.

Byrider highlighted the dealership features significant upgrades to the existing property, including a state-of-the-art service department. The new location plans to employ five associates to start with plans to grow to as many as 15.

If a picture is worth 1,000 words, perhaps dealers might use that many to describe the state of their vehicle images used to highlight their inventory.

Dealer Image Pro, a leader in professional photo, video and 360-degree software for automotive dealerships, recently announced results from a survey it commissioned to better understand the level of satisfaction dealers are having with their preferred vendors and how using a preferred vendor has influenced dealership vehicle inventory photo and video decisions.

Dealer Image Pro presented an online survey to more than 3,000 dealer professionals in December, and 40% said they are currently dissatisfied or very dissatisfied with their current preferred vendor managing the vehicle inventory photo and video process.

Furthermore, Dealer Image Pro found that 33% of dealership preferred vendor decisions are primarily influenced by preexisting relations, while another 31% said they don’t only use preferred vendors and still look at outside vendors to take the dealership’s vehicle photos and videos.

“OEMs and auto groups continue to look for the best ways to merchandise their vehicles online for their omnichannel sites and a lot of dealers now simply want the opportunity to work with non-preferred vendors that have new technologies and an expanded reach into other markets.” said Louis Norman, director of operations at Dealer Image Pro.

“Dealer Image Pro has been affected by preferred vendors firsthand, as we’ve been forced into auto groups, but have also been ripped away from happy customers, so we wanted to understand what exactly pushes dealers to a preferred vendor and if it is based on successful results,” Norman continued.

For more information on how to streamline your merchandising for a whole auto group or an individual dealership, like Dealer Image Pro, visit https://www.dealerimagepro.com/demo/ to request a demonstration of the company’s dealership merchandising solutions.

Immediately after the National Automobile Dealer Association wrapped up NADA Show 2023, the National Independent Automobile Dealers Association made a major move.

On Monday morning, NIADA and Buckeye Dealership Consulting announced an integration of the NIADA 20 Groups with Buckeye’s Dealer Performance Groups.

According to a news release, all existing Dealer Performance Groups, including those focusing on retail, buy-here, pay-here, service and finance, will move under the leadership of NIADA’s Dealer 20 Group program.

“This is a significant step in executing a vision shared by both NIADA and Buckeye of a unified industry in support of the independent used car dealer. We’re very excited about the strength the Dealer Performance Groups’ portfolio adds to our Dealer 20 Group program,” NIADA interim CEO Melanie Wilson said in the news release.

Buckeye owner and CEO Robert Fox Sr. agreed the move will benefit all independent dealers and the industry as a whole.

“Buckeye invested significant effort and resources into building a strong Dealer Performance Group program based on feedback dealers provided,” Fox said. “With a strong program, combining DPG with the NIADA 20 Group program makes both stronger, for we are truly better together.”

Fox worked closely with NIADA president Scott Allen to come to this agreement.

“This is really great news for the industry to bring everyone together. I couldn’t agree with my good friend Rob more, ‘We are truly better together,’” Allen said.

NIADA 20 Groups brings dealers of all sizes and business models together with other like- minded dealers to exchange ideas, identify best practices, resolve challenges and discover hidden opportunities. Buckeye will continue to support those efforts.

Used-vehicle prices are falling, inventory is still difficult to acquire, and economic conditions continue to weaken. These are challenging times for independent dealers.

In times like these, inventory management is key to staying profitable. Here are a few tips to improve inventory management in 2023.

Stay in your wheelhouse

When inventory is scarce, it’s tempting to acquire makes and models that you would not normally sell. This strategy might result in a lot full of vehicles, but slower turn rates.

Dealers spend years building a brand and reputation. If you are known for carrying a good selection of pick-up trucks, you will not be top of mind when customers think economy cars, and vice versa. When it comes to inventory, something is not better than nothing. I’d rather have fewer vehicles that turn faster than a lot filled with vehicles that just sit there.

Another downside of having unfamiliar vehicles on your lot is that your sales team probably doesn’t know how to sell them. Stick to makes and models that your team knows.

Sprinkle in hot vehicles

For every rule there is an exception. Now that I’ve recommended sticking with what you know, I am also going to encourage breaking that rule—on occasion.

If you have the opportunity to acquire a hot car such as a Ford Mustang, Tesla or any hybrid for that matter, you know that vehicle is in demand.

If you work with a marketing company, they should be able to tell you key phrases that car shoppers are using to search for vehicles, as well as the most popular makes and models. Check these terms monthly and adjust inventory strategy as necessary. Google Trends is another source that can tell you which vehicles are trending.

Any time you have a vehicle that is not part of your regular inventory mix, go the extra mile in merchandising. Place the vehicle up on a pedestal at the front of your lot so it can be seen from the road, and make an inventory video to post on your vehicle display pages (VDPs), third-party listings and social media pages.

Track turn time

When inventory costs are high, turn rate becomes more important than ever because every day that a vehicle sits on your lot cuts into profit.

While some dealers count turn rates from the first day the vehicle is on the lot after recon, I encourage tracking turn rates from the day the vehicle is acquired. The day you acquire the vehicle is the day it begins costing you money. The bank doesn’t care when the vehicle is ready to sell, so tracking from acquisition helps to create urgency during the recon process.

The advantage of tracking turn times is that it takes the emotion out of the decision to acquire a vehicle. It’s very easy to let personal bias and recent activity enter into the equation. For example, if you acquire one Ford Mustang and sell it for $3,000 in profit after three days, you might run out to look for another Mustang to acquire—even though historically, Mustangs sit on your lot for 45 days.

Remember, it’s better to sell three cars in 45 days making an average of $1,500 per vehicle, than it is to sell one car every 45 days and make $3,000 per vehicle.

Ramp up marketing

Let’s face it, marketing is an area where there is always room for improvement. For dealers, it is a better strategy to stock fewer vehicles and use the extra time to ramp up marketing efforts so those vehicles turn faster.

First, do an honest assessment of your inventory photos. If you take photos of your vehicles in a cluttered lot with power lines and a busy road in the background, you might want to rethink location. After recon, take the time to drive your vehicles to a nearby park so the photos are attractive and the vehicle is the center of attention.

Please don’t use stock photos. Some dealers still post stock photos as a tactic to force consumers to come down to the lot to see the actual vehicle. This is bad for business because from the consumer perspective, it looks like you’re hiding something. Transparency is always the best policy.

Speaking of transparency, if you want to stay competitive with the Carvanas of the world, post vehicle prices. If you ask the customer to send you their email address in exchange for a price, that customer is gone. In today’s world, transparency is mandatory if you want to attract and retain customers.

If you have a certified pre-owned (CPO) program, make sure all CPO vehicles are featured on the home page of your website with badges that identify them such. On the vehicle VDP, insert two or three slides into the photo carousel that highlight the features and benefits of your CPO program and vehicles.

In 2023, we hope to see an easing of the supply crunch that has affected inventory availability, but it might happen just as the U.S. enters a recession, impacting consumer demand. Smart inventory management allows dealers to maximize profit on every deal, so they can operate efficiently in lean times.

James Virgoe, who is senior vice president of GWC Warranty Sales, has more than 20 years of experience in the automotive industry. Virgoe has a strong track record of managing top-performing territories, developing new channels of business, and building revenue-producing relationships. GWC Warranty is a part of the APCO Holdings family of brands.

Earlier this month, Byrider presented awards to its franchise dealer body during the company’s annual convention in Aventura, Fla., honoring more than a dozen professionals who operate buy-here, pay-here dealerships with its franchise system.

Byrider highlighted its franchise of the year award recognizes the best overall performance by a franchise group based on internal store rankings and a measure of how the business has contributed to the Byrider franchise community.

The honorees included:

• 4 or more locations: Russ Larson, Jeff Lee, and Winston Sleeth with dealerships in Burlington, Iowa; Davenport, Iowa; Des Moines, Iowa; Cedar Rapids, Iowa; Columbia, Mo.; Joplin, Mo.; and Springfield, Mo.

• 2 to 3 locations: John Chalfant and Thomas Loughran with dealerships in Boise, Idaho, and Nampa, Idaho.

• Single location: Keith Kocourek and Jennifer Freiboth with their dealership in Wausau, Wisc.

The president’s awards recognize dealership locations included in the top 10% of stores as defined by Byrider’s store ranking system. Winners, in order of performance ranking, were:

• Springfield Mo.: Russ Larson, Winston Sleeth Top store nationwide

• Davenport, Iowa: Russ Larson, Jeff Lee

• Joplin, Mo.: Russ Larson, Winston Sleeth

• Burlington, Iowa: Russ Larson, Jeff Lee

• Des Moines, Iowa: Russ Larson, Jeff Lee

• Mansfield, Ohio: Chris McPhie, Greg Barrett

• Cedar Rapids, Iowa: Russ Larson, Jeff Lee

• Akron, Ohio: Chris McPhie, Greg Barrett

• Ashtabula, Ohio: Chris McPhie, Greg Barrett

• Bloomington, Ind.: Roy Wagner, Terry Gerhart

• Wausau, Wisc.: Keith Kocourek, Jennifer Freiboth

• Richmond, Ind.: Roy Wagner, Terry Gerhart

• Traverse City, Mich.: Bill Marsh Auto Group, Jeff Chevalier

• Muncie, Ind.: Roy Wagner, Terry Gerhart

• Canton, Ohio: Chris McPhie, Greg Barrett

The most improved award was granted to stores that demonstrated the most improvement from 2021 to 2022 based on store rankings for earnings, customer advancement, service comebacks, reputation management, portfolio performance, and more.

• Most improved Single Point: Rick Steenbock in Denver

• Most improved with 2 to 3 locations: John Chalfant and Thomas Loughran in Boise, Idaho, and Nampa, Idaho.

• Most improved with 4 or more locations: Mark Morris in Clarksburg, W.Va.; Morgantown, W.Va.; Parkersburg, W.Va.; and South Charleston W.Va.

A new award recognizing top customer satisfaction scores in the network went to Steve Locklear in Panama City, Fla.

Also honored with a commitment to excellence award was Greg Barrett, who co-owns stores in Ohio and North Carolina. The award recognizes Barrett and his team’s dedication and high-performing stores’ contributions to the larger Byrider network.

Byrider CEO Craig Peters said, “We’re proud to recognize our franchisees and their teams each year at our annual convention. Our franchisees are at the heart of Byrider’s success. Their commitment to helping their customers move forward, as well as expertly operating their stores, is truly commendable.”

Vice president of franchising Chris Hadley added, “I am excited to recognize the owners and operators who have been key drivers of the Byrider franchise business in 2022. These franchisees and operators demonstrated their ability to set high customer service standards and grow the business.”

VINCUE recently finalized details for a National Corporate Partnership with the National Independent Automobile Dealers Association (NIADA) to help members optimize the inventory lifecycle.

VINCUE will offer its solutions to NIADA members at a preferred price, giving them access to tools and data so they can manage:

—Inventory

—Pricing and appraisal

—Merchandising

—Advertising with VIN-specific targeting

—Vehicle acquisition

—Private market

—Trade-ins

—Online wholesaling and acquisition

—Dealer websites

—Data analytics and reporting

Danny Zaslavsky is dealer principal of Country Hill Motors and managing partner of VINCUE.

“Independents are innovators, unchained, and carry the potential to risk more and achieve higher. These dealerships grow to better their teams, communities, and industry. That is why I love being an independent,” Zaslavsky said in a news release.

“VINCUE has a great relationship with NIADA, and we look forward to helping more independent dealers through the VINCUE platform. It is about helping each other grow and improve,” continued Zaslavsky, who is among the speakers set to appear during Used Car Week, which begins on Nov. 14 in San Diego.

Zaslavsky added that dealerships of all sizes have relied on VINCUE to improve their profits and develop long-lasting relationships with their customers.

And that’s what struck NIADA about making this partnership to help more than 15,000 dealerships nationwide.

“Together, we are going to revolutionize the way our independent dealerships do business,” NIADA member benefits manager Reginald Allen said in the news release. “We’re excited to offer this solution to our dealerships across the country to help them better compete in their respective marketplaces.”

APCO Holdings wants to help dealers get the most out of what reinsurance programs can provide.

On Monday, the provider and administrator of automotive F&I products and home to the EasyCare and GWC Warranty brands, released a free guide for auto and RV dealers titled, “Building a Profitable Offense: A Playbook for Winning the Reinsurance Game.”

The eBook is designed to help dealers choose the best reinsurance structure for their short-term and long-term goals.

“Many dealers can tell you the advantages that their reinsurance program offers, but not every dealer has aligned their reinsurance structure with an F&I philosophy designed to maximize profits and meet business objectives,” said David DeCredico, senior vice president of wealth building and strategic accounts at APCO Holdings.

“A profitable reinsurance strategy requires a customized game plan involving many factors, which we have detailed in our guide,” DeCredico continued in a news release.

APCO Holdings explained that it developed the guide as a visual playbook using football analogies to simplify the complexities of reinsurance.

From draft day, to choosing an offensive strategy, analyzing defense and developing a game plan, APCO said dealers will gain a better understanding of how to break free from average performance and work with their provider to achieve champion status.

“Whether it’s capital for short-term expansion or higher returns for long-term wealth building, dealers should know which reinsurance structure is best for their needs, how to develop an F&I sales strategy to maximize reinsurance profits, how to train staff and what to expect from their provider,” said DeCredico.

To download the free guide, go to this website.