Cherokee Media Group senior editor Nick Zulovich reconnected with Agora Data CEO Steve Burke during NADA Show 2023 in Dallas for this episode of the Auto Remarketing Podcast.

Burke shared his perspectives on how buy-here, pay-here dealerships are doing financially based on client data and other perspectives. He also mentioned what trends he’s watching beyond rising interest rates.

To listen to the conversation, click on the link available below.

Download and subscribe to the Auto Remarketing Podcast on iTunes.

Agora Data is trying to be an industry pioneer in multiple ways.

After being successful multiple times with group securitizations involving paper originated by buy-here, pay-here dealerships, the company that strives to provide BHPH dealers and small to mid-sized finance companies access to abundant and affordable capital has filed a U.S. patent application with the United States Patent and Trademark Office for a proprietary data-driven business model that may be leveraged to predict the future performance of subprime auto financing.

Agora explained that applying certainty to payment outcomes of a previously unreliable market segment can help to reassure capital markets of results, empowering dealers and finance companies with access to new funding channels and promoting fair lending practices.

Agora said its innovation is unique for the industry, resulting in a “win-win-win solution” for financial institutions, originators, and consumers.

Chief information and strategy officer Daniel Burke and chief technology officer Chad Stilwell are the architects of this business modeling for the subprime market segment.

Their new-to-the-auto-industry model works to identify performance and risk by evaluating contract characteristics and alternative data with a high degree of accuracy.

Agora highlighted the multi-dimensional model powered by artificial intelligence and machine learning performs thousands of simulations daily on every contract and is backtested on more than $15 billion of subprime data.

The company said finance companies and dealers now can predict contract performance and use the information to make better decisions and optimize business operations.

“Agora’s proprietary modeling produces loan performance results for an asset class previously considered volatile and risky,” Burke said in a news release. “The revolutionary approach delivers dependable calculations similar to results observed in prime asset classes.”

“Predicting the unpredictable is a breakthrough for the subprime auto industry,” Stilwell added. “Historically, subprime lending has been difficult to predict due to the reliance on traditional credit scoring models and unfavorable underwriting guidelines. Advanced modeling using data-driven analytics represents the future of subprime lending and opens a large asset class to the broader market.”

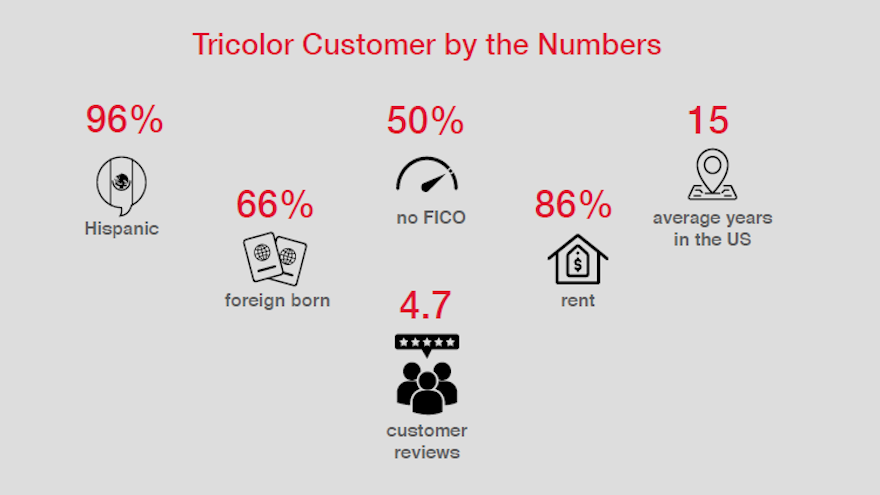

Tricolor — a tech-enabled Community Development Financial Institution (CDFI) and one of the nation’s largest used-vehicle retailers that caters to Hispanic consumers — said in a new white paper that, in fact, 96% of its customers are Hispanic.

And the company explained that the pandemic heightened its mission to be an outlet for Hispanics to secure their own transportation.

“The Tricolor platform breaks the cycle and provides a compelling solution for underserved Hispanic consumers, estimated at 43% of the total US Hispanic population, faced with the challenge of accessing affordable credit for the purpose of addressing their transportation needs,” the company said in its 14-page white paper released this week.

“Clearly, the past year has illuminated on the importance of dependable transportation for this consumer profile, as a large cross section of Tricolor’s target market served on the front lines of the pandemic, given their limited capacity to transition to a remote working environment. Tricolor’s proprietary, AI-enabled technology has demonstrated precision power to identify potentially lower risk borrowers among a pool of underserved consumers,” the company continued.

In a message to BHPH Report, Tricolor founder and chief executive officer Daniel Chu emphasized that it takes a deep commitment and expert use of advanced technologies to effectively and affordably offer credit to this population.

“This paper details our work and shows how we provide a superior and responsible loan and retail experience for these credit invisible customers,” Chu said.

“As we continue to scale our mission-driven platform, we are invigorated by the tremendous support for our vision to leverage technology to meaningfully expand financial inclusion and provide a path to the American dream for hardworking, underserved customers,” he went on to say.

The company’s white papers can be downloaded via this website.

After closing a “challenging year” with “strong fourth-quarter results,” Texas Capital Bank announced a pair of executive leadership appointments, effective immediately, creating roles for experienced professionals who each spent many years in posts at JPMorgan Chase & Co.

Now serving new president and chief executive officer Rob Holmes, who officially took on those roles this week, are Nancy McDonnell, who has been appointed to the newly created position of executive vice president and head of treasury services, along with Tim Storms, who will be in the newly created position of executive vice president and head of risk transformation.

The provider of financial liquidity to scores of buy-here, pay-here dealers made these executive moves after reporting its fourth-quarter performance, which included:

• Net income of $60.2 million ($1.14 per share) reported for the fourth quarter of 2020, an increase of $3.1 million on a linked quarter basis and a decrease of $4.2 million from the fourth quarter of 2019.

• Average mortgage finance loans held for investment (LHI) increased 5% on a linked quarter basis and 21% from the fourth quarter of 2019.

• Credit quality improved in the fourth quarter of 2020, reflecting declines in non-performing assets and criticized loans of $40.0 million and $157.1 million, respectively, on a linked quarter basis.

• Successfully deployed $1.8 billion of excess liquidity into higher yielding investment securities in the fourth quarter of 2020.

“While 2020 was certainly a challenging year, I am pleased with our strong fourth-quarter results,” Texas Capital Bank executive chairman Larry Helm said in a news release. “I want to thank our employees for their hard work and commitment to serving our clients during this unprecedented time. Though we are still navigating the pandemic, I am confident that Texas Capital Bank is well positioned for the future due to the actions we took in 2020.

“Looking ahead, Rob Holmes, our new CEO, officially joins us next week. Under his leadership, I have no doubt that Texas Capital Bank will continue to enhance its level of execution and recruit and develop the best talent, enabling us to drive long term shareholder value,” Helm continued.

And Holmes begins his tenure with two new experienced executives in the fold.

In her newly created role, the company said McDonnell will lead all aspects of Texas Capital Bank’s treasury and liquidity businesses. McDonnell brings three decades of senior leadership experience, having served as global head of commercial banking treasury & security services and other senior client roles at JPMorgan Chase & Co. until she retired last year.

Texas Capital noted that McDonnell brings a diverse and well-rounded skill set and subject matter expertise that will support the company in managing top client and prospect opportunities, training treasury management officers and bolstering an innovative, solutions-focused organization.

“This is an exciting time to be a part of Texas Capital Bank and join a team that is committed to providing important treasury and liquidity management services to a diverse and evolving client base,” McDonnell said in a news release. “Texas Capital Bank plays a critical role in providing innovative solutions as well as treasury management services to clients navigating this challenging period and beyond. The team will work with Rob and the rest of Texas Capital Bank’s leadership as we continue to advance the organization.”

Meanwhile, Texas Capital indicated Storms will provide strategic support to its risk management team, including chief risk officer John Turpen,

Storms also previously worked at JPMorgan Chase & Co. and its predecessor firms for nearly 38 years, serving as chief credit officer of commercial banking and most recently serving as chief risk officer of commercial banking’s real estate businesses, until he retired in 2019.

In his new role, Texas Capital noted that Storms will be focused on maintaining an effective control environment for all Texas Capital Bank risk while reinforcing strong practices and discipline across the organization.

“I am honored to join Texas Capital Bank at this pivotal time for the company,” Storms said. “I believe in the mission of Texas Capital Bank to support our clients, as well as the communities we serve. I look forward to working closely with chief risk officer John Turpen, the risk and compliance teams and the entire organization to further hone the company’s strategic approach to risk management. Together, I am confident that we can ensure best–in-class risk management across all our products and services in this increasingly complex environment while building a solid foundation for future growth and value creation.”

Commenting about Storms, Turpen said: “Over the last two years, our team has made substantial progress in upgrading Texas Capital Bank’s risk management system. Tim brings unmatched risk and compliance acumen and a commitment to talent development, and I look forward to working with Tim as we continue to execute on our journey to building a resilient and scalable business.”

Holmes added this perspective about McDonnell and Storms as well as the prospects for Texas Capital Bank going forward.

“I am pleased to welcome two strong executives, of impeccable character, each of whom brings decades of experience and records of demonstrated success across global platforms,” Holmes said. “I am confident that we will benefit from their expertise and leadership as we begin our deep dive into Texas Capital Bank’s operations and identify our most significant opportunities in this next chapter for the company.

“We are all energized and are ready to learn more about this organization and begin building a strategy that will achieve our long-term goal of returning the company to strong, predictable earnings growth and driving shareholder value while delivering an enhanced experience to our clients,” Holmes went on to say.

A little more than a week after rolling out the sixth securitization in company history, Tricolor Auto landed a significant financial commitment from Kennedy Lewis Investment Management.

Kennedy Lewis, which classifies itself as an opportunistic credit manager, has funded a $50 million committed secured corporate loan facility to Tricolor Auto, a Community Development Financial Institution (CDFI) and used-car retailer focusing on the sale and financing of vehicles to Hispanics.

According to a news release, this loan provides financing to Tricolor against its portfolio of auto receivables and highlights Kennedy Lewis’ expertise in structuring complex lending facilities to specialty finance companies.

The firms noted this infusion of funds will support Tricolor’s efforts to continue to scale its platform and retail network, as well as increase access to its auto-financing options.

Dik Blewitt is a partner Kennedy Lewis, head of tactical opportunities and co-head of its environmental, social and governance (ESG) investments.

“We are excited to partner with Tricolor and its outstanding team with whom we have an aligned ambition to extend responsible financial products to underserved communities,” Blewitt said.

“We continue to be impressed by Tricolor’s exceptional reputation, differentiated business model and proprietary technology. We look forward to working with the company to significantly grow its footprint,” Blewitt continued.

Along with the securitization, this loan arrived after Tricolor received a $30 million preferred equity investment from a global institutional investor back in February. Since its founding in 2007, the company has served more than 65,000 customers and originated more than $1 billion in financed contracts.

“We are excited to partner with Kennedy Lewis given its impressive track record and industry expertise,” Tricolor founder and chief executive officer Daniel Chu said.

“This funding comes at a time of rapid growth for Tricolor and will help fuel the continued expansion of our responsible lending platform so that we can provide affordable, credit building auto loans to even more underserved Hispanic consumers,” Chu said.

This week, Agora Data launched a financing solution that chief executive officer Steve Burke said places buy-here, pay-here operators “on the same playing field as the large dealer groups.”

Burke explained that through AgoraCapital, BHPH dealers will have access to low-cost financing through the capital markets. He said this pioneering approach is another way Agora continues to provide industry knowledge and financial solutions to help BHPH dealers reach their goals, reduce risk, grow their business and simply make more money.

“Until now, this highly complex financial option was unobtainable by BHPH dealers,” Burke continued in a news release. “With AgoraCapital, we are connecting the BHPH dealers with the capital markets. Our crowdsourcing technology combined with our deep industry knowledge and predictive AI loan technology is transformational and designed specifically for the BHPH dealer, which results in easy access to capital with very attractive terms.”

The company explained AgoraCapital will make it possible for the BHPH dealer community to compete with larger lenders and dealer groups who have large credit facilities with a low cost of funds. Agora Data went on to mention that its latest product is in addition to the other benefits the BHPH community can receives through Agora’s proprietary technology platform utilizing artificial intelligence and machine learning designed to improve loan valuation and performance outcomes.

“AgoraCapital will have a positive impact for this special group of entrepreneurs wanting to grow their business,” Agora Data chief revenue and legal officer Chris Hawke said.

“AgoraCapital empowers dealers by providing the tools and funding they need to compete and realize their desired potential. BHPH dealerships across the nation have never had this type of financial resource available to optimize their business,” Hawke added.

For more information, go to www.agoradata.com or contact Agora Data at (877) 592-4672 or [email protected].

Independent dealerships now have another option to secure a floorplan.

First Business Financial Services, a Wisconsin-based bank holding company, recently launched its newest product — aptly named Floorplan Financing — and brought in a trio of veteran automotive executives to run it.

The company highlighted Floorplan Financing allows dealers the flexibility to finance their acquisition of used vehicles, preserving cash flow and allowing dealers to buy preferred inventory. Floorplan Financing is the latest expansion of First Business’s specialty finance solutions, offering floorplan programs from $500,000 to $10 million for larger, well-established independent dealers.

“This limited focus, a hallmark of First Business’s business model, facilitates a smaller clientele than large competitors, empowering personalized concierge service,” the company said in a news release announcing the new product.

Industry veterans Jeff Widholm, John Goodyear and Amanda Schreeg have joined First Business to operate Floorplan Financing. Widholm will be the managing director, with Goodyear serving as vice president and Schreeg holding the role of servicing manager.

First Business noted that Widholm has 13 years of experience in dealer floorplanning, primarily serving independent dealers across the United States and Canada, with responsibilities in credit, collections, sales and operations. The bank added he brings a wealth of experience as an executive on the corporate side as a chief operating officer of a floorplan finance company and a chief financial officer of a multi-store franchised dealership.

The bank mentioned Goodyear has 22 years of automotive industry experience, including 14 years in the independent floorplanning finance market, primarily servicing the lending needs of large independent dealers across the United States.

First Business recapped that Schreeg began her career in the accounting world with a small logistics brokerage and then transitioned to the floorplan industry. Over the past six and half year years, she has gained an array of floorplan knowledge through numerous roles. She was nominated as Power Driver of the company and obtained her NIADA Certified Master Dealer certification.

“We’re thrilled with the experts we’ve brought on to build and deliver our Floorplan Financing solutions,” First Business Financial Services chief operating officer Dave Seiler said. “They have so much experience and share the First Business vision of focus and client service.”

Widholm added, “Joining First Business has been an exceptional experience. First Business is a perfect alignment for how we differentiate ourselves from our competition — through concierge service, expertise, and competitive pricing.”

Floorplan Financing is offered through First Business Equipment Finance, a subsidiary of First Business Bank. The offices are located at 9465 Counselors Row, Suite 200, in Indianapolis and can be reached at (844) 418-2493.

Buy-here, pay-here operators who use DealerSocket now have a streamlined path to tools from Agora Data.

On Tuesday, Agora, a Texas-based provider of data, analytics and liquidity solutions for the BHPH industry, announced an integration with DealerSocket’s IDMS web-based dealer management system (DMS).

The companies highlighted this integration will increase dealer visibility into portfolio and loan performance, as well as create access to much-needed capital and cashflow. The addition of DealerSocket further expands the number of Agora integrated DMS partnerships.

“Access to reliable analytics is the difference between success and failure in today’s market,” Agora founder and chief executive officer Steve Burke said in a news release. “Trying to run a business without all of the information is like trying to build a puzzle without knowing what the picture is — it’s possible, but far more difficult.”

AgoraInsights is Agora’s portfolio and loan valuation analytics suite that is designed to empowers BHPH dealers to manage more effectively their most significant asset — their loan portfolio — and confidently manage liquidity negotiations. By combining this technology with DealerSocket’s innovative IDMS, the companies say dealers will now have a more holistic picture and greater control of their business operations.

Historically, dealers have relied on book value guides to buy and sell vehicles. Now, BHPH dealers can leverage AgoraInsights to understand the current value of their contracts. Additionally, they can gain the ability to compare their underwriting strategies with their industry peers through Agora’s benchmarking analytics.

“The partnership with Agora’s Insights platform provides incredible opportunities for our dealers to be empowered to better manage their business. More importantly, they gain access to capital through various finance channels,” DealerSocket vice president of product Jeff McCurry said.

“Agora’s program is one of a kind and is an exciting addition to the IDMS platform,” McCurry added.

For more information, contact Agora Data at (877) 592-4672 or email [email protected].

Agora Data and Ignite Consulting Partners took another step together in their working relationship on Monday to help buy-here, pay-here dealers and other operations that specialize in subprime auto financing.

The companies have entered into an agreement whereby Ignite will provide compliance services in support of AGORA’s Certified Member initiative. The companies highlighted the AgoraCertified program can enable BHPH dealers to create a more valuable portfolio by providing the tools and expertise to help “recondition their loans.” AgoraCertified works closely with dealers and their data, assisting them with valuations, the accuracy of data and best practices regarding loan files.

“Just as it does with your auto inventory, reconditioning your auto loans can significantly increase the value of your entire portfolio,” Agora senior vice president of sales Chris Barry said in a news release. “This service is provided free of charge to Agora members, and Agora does all the work.”

“Our program allows dealers to have their accounts examined to identify patterns and practices that may be holding back portfolio value,” Barry continued. “Sometimes that involves resolving compliance issues, so we’ve asked Ignite to work with us and our dealers in support of our program.”

This week’s move arrives after Agora and Ignite first collaborated last March on a compliance program to help BHPH dealers and bulk paper sellers.

“We are excited to have the opportunity to bring our compliance acumen to Agora’s national dealer network,” Ignite chief legal and compliance officer Steve Levine said, “Agora’s program is one of a kind and gives dealers access to opportunities they’ve never had before, and we are honored to be asked to play a role.”

For more information, contact Agora Data at (877) 592-4672, or email [email protected].

For years, independent and buy-here, pay-here dealerships did business with customers who might work multiple jobs or use their income tax return as funds to put toward a down payment. New ways are arriving for those operators to still do business with those individuals even if one of their sources of income disappeared or their cash injection from the Internal Revenue Service softened.

About a year ago, the National Independent Automobile Dealers Association (NIADA) entered into a strategic partnership with DriveItAway, a current NIADA National Member Benefits partner.

DriveItAway can provide NIADA members with the tools to offer a subscription model car sharing platform. The partnership with DriveItAway adds seamless turnkey self-service software, all insurance coverages and training to allow dealers to quickly and profitably add a cents-per-mile model to the traditional one car sale/one profit scenario.

NIADA members using DriveItAway’s turnkey program can also offer the Lyft Your Down Payment program, which provides new Lyft drivers with immediate temporary vehicles to drive at a daily or weekly rate as a path to ownership, allowing them to raise money for a down payment to buy the vehicle of their choice — offered by the participating dealership.

BHPH Report caught up with NIADA senior vice president of member services Scott Lilja this spring to get an update on program success and what kind of lift — pun intended — dealers are experiencing.

“There’s definitely a possibility there,” Lilja said. “Really it drives a whole new customer base to our dealerships that in many cases they might not have been serving. That customer, the Lyft driver and the perspective Lyft driver, those are only going to grow exponentially over the next few years. There are millions of them already and millions more to come.

“We see it as a great new sales segment and as a way to drive sales growth and inventory turn,” he continued. “I think the other thing is it gives our dealers a chance to test the waters around this Mobility-as-a-Service industry and get a little flavor for how it works to get them more comfortable in an area of the business that is only going to continue to evolve and become a bigger part of the auto retail sector. We’re giving them some tools, education, resources and ways to get started that are not really expensive and fit into their current infrastructure of their operation to make it a seamless process to get started and up and running.

“Our charter is to help dealers evolve, grow and stay relevant in an ever-changing marketplace,” Lilja went on to say. “This is one of those areas where there are some new trends coming at them, a new customer base and how they want to transact business is somewhat different. Sometimes it’s a challenged customer base from a credit scoring perspective. We’ve created some tools that can help them repair that credit history and help them get up and running as a Lyft driver and be successful.”

DriveItAway founder and chief executive officer John Possumato described how the program has been particularly beneficial this year with tax-refund turbulence being in play stemming from the longest federal government shutdown in history.

“Historically, large tax refunds have stimulated used-vehicle sales, as this provided the usually not available lump sum down payment cash required for a subprime customer, so much so, that whole business were created in getting that cash early to stimulate a sale,” Possumato told BHPH Report. “Lower refunds, less sales, until you factor our ‘new way’ for a cash/credit strapped consumer to buy a vehicle — by using our car-sharing program that creates extra income from on-demand driving, spreads out the down payment requirement in small increments over a series of weeks, and repairs credit all at the same time, while allowing the potential buyer to drive the vehicle they wish to own on a rental basis, to create the means by which to purchase it.

“Our program offers a multifaceted solution for dealers,” he continued. “It creates a new, money making shared mobility department that satisfies and leverages the immediate need of a new Lyft or Uber ride share driver to begin earning money, if they lack a vehicle, but, more and more, with our ‘path to ownership’ including free credit repair at the platform level, our ‘Lyft Your Down Payment’ incentives, etc., it is becoming a new way for subprime buyers, and those with little down payment money to buy a vehicle.”

Lilja shared some anecdotal stories about NIADA members who have leveraged these kinds of program, noting that some operators are seeing an extra 10 to 15 turns a month. Lilja also mentioned that it’s helping dealerships retail vehicles that have been in inventory for as long as 50 days.

Furthermore, for dealerships that also have a service drive, Lilja noted bays are busier because these customers are returning for maintenance.

And perhaps what might be most valuable, Lilja pointed out, is that independent and BHPH stores using a program like the one that’s being promoted via NIADA are enjoying the positive benefits of satisfied customers.

“They’re seeing a lot of new clientele coming through the door,” Lilja said. “That’s really excited some of our dealers. It’s made them look like the hero. It put them in a good light with these customers. You can really get a customer for life.

“They’re working two or three different jobs, and our dealers serve those client bases in some cases, especially our buy-here, pay-here operators. They’re comfortable working with a credit-challenged clientele and building some flexibility into the terms,” he continued.

Lilja summed up independent and BHPH dealers getting deeper into the Mobility-as-a-Service space by saying, “It’s a whole new horizon and opportunity.”

DriveItAway lands partnership to get free credit repair for Lyft and Uber drivers

Lyft and Uber drivers not only might have a path to generate funds for a down payment when acquiring a vehicle at certain dealerships, but they also could take advantage of a solution to help their credit situation.

DriveItAway, a company concentrating on dealer-focused shared mobility, announced in January that it is partnering with Get Credit Healthy to pilot what the operations say is the first “no strings” free national credit repair/rehabilitation service for Lyft and Uber drivers.

The companies explained this opportunity to rebuild personal credit is free to all drivers in a dealer-supplied vehicle on the DriveItAway Car Sharing platform, with no obligation to use any particular vehicle, dealership provider or any vehicle purchase commitment.

After a week in good standing, all drivers on the DriveItAway dealer Car Sharing platform can receive a free invitation to utilize Get Credit Healthy’s credit rehabilitation service, which has been seamlessly integrated into the DriveItAway driver app. The service remains free as long as the driver remains a DriveItAway customer.

On the dealer side, DriveItaway has integrated Get Credit Healthy’s leading fintech platform, to provide its dealer partners with data intelligence and sales lead recovery that turns credit “fall out” into funded vehicle loans and sales.

Possumato insisted this life-improvement service is a true differentiator and fits right in line with DriveItAway’s mission to put all of its clients on a “path to ownership.” Possumato explained all ride share drivers will be able to access it right from the platform, free of charge, and it will help all dealers facilitate a vehicle sale to all those drivers who are looking to buy.

“This is an industry first, in that this type of service has not yet been offered in this ‘no strings’ way. Partnering with a company like Get Credit Healthy in order to offer the best comprehensive credit remediation program for our longer-term drivers is a natural step for us,” Possumato said.

“This fits perfectly with exclusively car dealer clients who provide temporary vehicles for Lyft and Uber drivers,” he continued. “It is fully compliant, as there is no obligation for a renter-recipient to buy a vehicle from any specific car dealer, nor is there any obligation to buy a vehicle at all.

“Our goal is to make it a win for all and, with the ‘on-demand’ employment ride sharing provides, improve lives by making it easy for everyone to increase income and improve credit,” Possumato went on to say.

Get Credit Healthy CEO Elizabeth Karwowski elaborated about why her company chose to align with DriveItAway.

“Get Credit Healthy’s traditional partners have been financial institutions, mortgage companies and municipalities,” Karwowski said. “The common mission of our two companies is to provide our clients with the means to improve their financial lives and provide them with the necessary tools and education to help them sustain those improvements.

“At Get Credit Healthy, we are passionate about providing consumers with the tools and resources they need to eliminate debt, build credit and make sound financial decisions,” she continued.

“That’s why we are delighted to be launching this new program with DriveItAway, and to make this life improvement option available for the first time to members of the new ‘gig economy’ in shared mobility,” Karwowski added.