On Friday, QuotePro joined with the National Independent Automobile Dealers Association as its latest National Member Benefit Partner, offering cash-accepting payment kiosks to the association’s growing buy-here, pay-here dealer base.

QuotePro’s payment kiosks can eliminate the overhead and risks associated with handling cash payments, including the element of human error, safety concerns and scheduling challenges such as cashiers calling in sick.

The kiosks can accept down payments, car loan payments, repair payments and even insurance premiums. They can take cash, checks, debit cards and credit cards.

In addition, QuotePro’s kiosk package includes customized receipts, as well as full transactional and reconciliation reporting.

“Our No. 1 goal is to eliminate every single cash payment frustration among buy-here pay-here dealers, so we’re excited to offer NIADA members a pathway to saving thousands of dollars — and thousands of personnel hours — per month,” QuotePro president Marco Freudman said.

“We’re especially honored to join forces with an organization of such high caliber as NIADA. They have a longstanding reputation for providing the best of the best resources to our industry,” Freudman continued.

NIADA members who sign up for a QuotePro kiosk will receive a free 32-inch high-definition overhead monitor to sit on top.

“The addition of QuotePro to our group of endorsed National Member Benefit partners falls right in line with our expanding focus on the Buy Here-Pay Here market,” NIADA senior vice president of member services Scott Lilja said.

“In that world, cash payments are the norm. So we are thrilled to partner with a company that makes them less of a headache,” Lilja went on to say.

For more information, call (800) 630-8045 or visit www.quoteprokiosk.com.

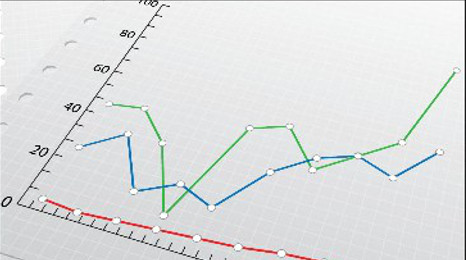

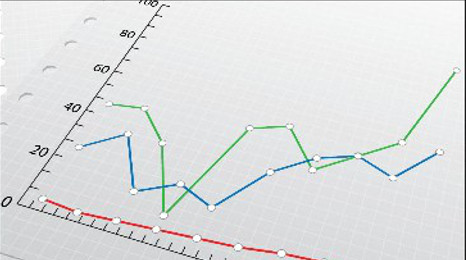

Ken Shilson and Dustin Kerr spent weeks going over performance data from buy-here, pay-here dealerships nationwide along with portfolios from their related finance companies. Now the industry experts have finalized the new Benchmarks and Trends Report that will be shared during next month’s National Conference for BHPH hosted by the National Alliance of Buy-Here, Pay-Here Dealers.

Shilson, NABD’s president and founder, highlighted the latest report contains numerous graphs and charts together with a summary analysis so operators can understand both market and performance changes during last year. The summary also includes a forward-looking forecast of what’s ahead in 2016.

This year, Shilson worked on the project with Kerr, the newest BHPH moderator at NCM Associates. Both experts will be on stage at the Wynn in Las Vegas for NABD’s event that runs from May 24 to May 26.

“This report is the most comprehensive look at the subprime auto finance market we have ever done,” Shilson said. “I thank NCM, SGC Certified Public Accountants, and Subprime Analytics who contributed financial and operating data for the development of the report.

This is the 18th consecutive year we have compiled and issued a report containing financial, operating, and loss metric information which can be used by operators, capital providers, investors and others to evaluate performance and, where applicable, to compare their own results,” he continued.

“We carefully scrutinized the policies and practices used to generate the data to assure that all the information is credible. Although different accounting and operating practices are used in the industry, this report considers and adjusts for the major differences,” Shilson went on to say.

Past benchmark reports can be downloaded free of charge from the Subprime Analytics website at www.subanalytics.com. The archive covers the past five years. The most recent report will be posted in May prior to the NABD National Conference for BHPH.

More information about the conference — including the agenda, registration and links to discounted accommodations — is available at www.bhphinfo.com or by calling NABD at (832) 767-4759.

Shilson reiterated that NABD is a special industry group organized for the betterment of the BHPH industry nationwide, and has more than 13,000 members. Membership is obtained by attending NABD training and conferences, and members pay no annual dues.

“Our services are designed to complement and work with other automotive industry groups on matters pertaining to this segment of the automotive finance industry,” Shilson said.

Just before Thanksgiving, Tax Max highlighted a development that could positively impact buy-here, pay-here operators. After four years on the shelf, the banking industry has revived the Tax Refund Advance for 2016.

To help BHPH dealers take advantage of this opportunity, Chip Wiley — who is the corporate trainer and marketing specialist for Tax Refund Services and Tax Max — answered four questions he has received most about how the Tax Refund Advance is designed to function.

Where can customers get these refund advances?

Dealerships need to contact their tax refund season company partner to verify if they are a participant in this program. Not all tax preparers will be participating as not all tax refund associated banks are expected to offer the Tax Refund Advance product. Ask around, contact your state association, or contact national associations like NIADA or NABD for recommendations.

How can I benefit from this?

The obvious answer will be from the early influx of tax refund dollars into the market. In the past two years, tax refunds started paying out between Jan. 29 and through Feb. 5. Tax Refund Advances are expected to begin in the Jan. 15 through Jan. 22 timeframe. Dealers “in the know” will have the advantage with the timing of their marketing.

People want their refund money yesterday, so the allure of a 24-hour check is a major draw. Dealerships that work directly with a tax refund partner stand to profit the most. These companies thrive on the success of the sale of the vehicle and increased down payments, thus creating an essential partner in this critical time of year. Being able to offer your customers the ability to get their hands on early tax season money is key.

How much will this cost the customer? How much will this cost the dealership?

Ask your tax refund partner company for more details. Some Tax Refund Advance products come at no additional cost to the customer, no additional cost to the dealership, and with no credit checks.

Can I expect increased traffic from this?

That is up to you, your sales staff, your marketing, your online presence, and your vigilance to capture the tax refund customer.

If you are content with the business you attracted last year, then no, you should not expect and increase. In fact, your business should drop again this year. The significant beneficiaries will be the business owners who go after the customers and bring them in the door. This can be used as an opportunity for sales, repairs, collections, special payments, irregular payments or back-end product upgrades.

Remember, $750 is a lot of money, but customers will spend it faster than it arrived. Be proactive with the intent on seizing opportunities such as this one while your competitors sit on the sidelines. Many will not know this money is coming. It is your chance to steal market share.

Finance And Insurance Resources (FAIR) has partnered with KISS Concepts Group to release the Complete Asset Protection (CAP) program — what they believe is a first-of-its-kind, all-inclusive insurance program to protect the collateral of buy-here, pay-here dealers, lease-here, pay-here dealers, auto finance companies, banks, credit unions and related finance and lease companies.

The CAP program is one of several unique insurance offerings to be released this year, resulting from a strategic master agent private label agreement between FAIR and KISS Concepts Group. The two companies are building a platform of insurance programs tailored specifically for auto-related audiences.

“One of the biggest challenges every auto finance company faces is finding affordable, easy-to-implement ways to minimize their normal everyday losses, catastrophic losses and other unique risk exposures that occur in protecting their collateral and profit. The CAP program offers exactly that,” FAIR chief executive officer Rick Mims said.

“For even more peace of mind, the entire policy is backed by Certain Underwriters at Lloyd’s of London, one of the largest specialty insurance providers in the world with underwriting capacity in excess of $31 billion,” Mims conintue.

CAP includes the following coverage for both loans and leases, combined into one policy:

— Guaranteed asset protection (GAP): This coverage can protect both lenders and borrowers, so it can be presented during the sales process as a value-add to the vehicle buyer.

— Lender’s single interest: If the consumer stops making payments, the lender’s investment can be covered against many perils without the cost of having to track insurance.

—Skip: If the lender cannot locate the borrower, co-borrower or the vehicle, the lender’s investment can be covered.

—Physical damage and theft: If the vehicle is damaged or stolen before, during or after repossession (and the consumer’s insurance has lapsed), the lender’s investment can be covered.

—Title errors and omissions: If the insured party or the state makes an error or omission in the processing of the loan or title work that causes a loss, the insured party can be covered.

—Confiscation and seizure: If the vehicle is impounded or seized by police or a public/government/federal office or officer, the lender’s investment can be covered.

—Terrorism: If the vehicle is damaged during an act of terrorism, the lender’s investment can be covered.

—24-hour roadside assistance: This coverage can benefit both the borrower and lender and includes sign-and-drive coverage for items such as towing assistance, flat tire assistance, emergency fluid delivery, lockout assistance, battery service, rental car discounts and more.

Rod Heasley, president and chief relationships officer of KISS (Keep It Simple Successfully) Concepts Group partnered with FAIR to develop the CAP program. Heasley explained the policy offers dealers and lenders a “one-stop shop” to insure their collateral investment.

“Clients now have the convenience of combining multiple insurance coverages into a single policy. That means only one claim form and one point of contact,” he said.

“In addition to expanding coverage, CAP streamlines the dreaded ‘paperwork overload’ from dealing with multiple insurance agencies, thus adhering to our philosophy of keeping it simple,” Heasley went on to say.

CAP policies may be applied to new and/or existing loan portfolios. Coverages within the policy may be customized, mixed and matched depending on the insured party’s needs and preference.

For more information, contact KISS Concepts Group at (844) 857-0869.

Even in today’s competitive marketplace, AutoTrader.com wholeheartedly believes buy-here, pay-here dealers still have the ability to advertise effectively. Brett Kelly contends that operators just have to change their strategies a bit because so many consumers are researching and shopping online.

Up until AutoTrader.com launched its Buy-Here, Pay-Here Center back in May, Kelly admitted that BHPH operators faced significant challenges when advertising on the company’s site, especially if their ads wound up landing next to a franchised store listing that highlighted no-money down or single-digit financing.

“One of the biggest things we strive to do with the Buy-Here, Pay-Here Center is to create an environment where a BHPH dealer can be transparent in their advertising,” said Kelly, who is the director of independent dealer business at AutoTrader.com. “Historically, when you think of the places where a BHPH dealer would advertise or try to reach consumers, they’ve generally been alongside traditional dealers, where the traditional dealers’ messaging might be zero money down or 2.9 percent financing for 36 months.

“You look at an environment like that and it becomes very difficult for a BHPH dealer to be transparent, because in reality a lot of the BHPH dealers need $1,000 or $1,500 down or even $2,000 down, and they’re certainly not going to be offering financing at 2.9 percent,” he continued.

“One of the big opportunities we have with the Buy-Here, Pay-Here Center is because it’s limited to only BHPH dealers, dealers can actually be transparent and fully disclose the real deal terms they have to offer to a consumer. And it’s going to be OK, because the consumer is going to be looking at them compared to like dealers,” Kelly went on to say.

When consumers enter into AutoTrader.com’s Buy-Here, Pay-Here Center, they only see BHPH operators in their market, and only lots that finance their own paper can participate in this section of the website. As of late July, about 400 dealers in 90 different markets joined the Buy-Here, Pay-Here Center, which is free for operators to use for a year.

AutoTrader.com representatives are making the rounds to industry events such as state independent dealer association conventions. Kelly noted that each time a conference passes, the number of Buy-Here, Pay-Here Center participating dealers rises.

“Pretty much every time we participate in an industry event, we see an uptick in dealer participation,” Kelly said. “Kind of like anything else that’s new, we have some dealers who are early adopters and are very proactive with their merchandising and their transparency. Then, there are others who are apprehensive and haven’t done anything to merchandise themselves yet.”

To those BHPH operators who might be apprehensive about leveraging what the Buy-Here, Pay-Here Center can do, Kelly explains the proposition this way:

“You think of your typical used-car transaction, and customer goes in and probably has a short relationship with the dealer. They get financed by a third party or bank, and the only relationship from that point forward is with their bank,” Kelly said. “But BHPH is a unique situation because the dealer is also the bank, and it is going to be an ongoing relationship. When a consumer comes in, it helps to establish that relationship right off the bat based on trust and transparency.

“Imagine a reality where a consumer goes onto the Buy-Here, Pay-Here Center and searches for dealers and cars in their area; they know that for example they have $1,500 they can put down, and they look at everything that’s available in the area based on the budget they know they can afford.

“They go into that dealership, and that car is actually there. It’s available for those terms. They learn about the dealership. That’s a really good solid way to start what is more than likely a multi-year relationship going forward,” he continued.

“In your value proposition, you can talk about the credit approval process, payment terms and rebuilding credit. Dealers can use the display in competitive price environments to speak of their value. They can emphasize credit approval and transparency in payment environments. It’s not advantageous to stress the VIN explosion and price when credit approval is your value. Having the right story in the right environment will help distance yourself from the competition,” Kelly went on to say.

Ongoing Technology Improvements

During a conversation with BHPH Report, Kelly highlighted several technological enhancements that are ongoing with the Buy-Here, Pay-Here Center.

Initially, dealers had to manually add their inventory and descriptions into the platform. Now, Kelly said the platform can accept BHPH listings from a wide array of data providers so the information can be uploaded quicker.

AutoTrader.com is beginning to showcase the Buy-Here, Pay-Here Center in house advertisements on its website. Next, if a visitor comes to the main site from a market where a BHPH operator is using the platform, a tab appears on the visitor’s view of the site so they can go directly to the center.

Furthermore, BHPH operators can use customized templates offered by Auto-Trader.com to create a microsite that’s attached to the Buy-Here, Pay-Here Center. If a dealer doesn’t like the look and feel of his or her current site, they can point their address to this microsite and have it become the store’s main page.

“The dealer microsites are provided because the BHPH is really more dealer first than car first; it’s very important for the dealers to be able to tell their own unique value story,” Kelly said. “So we’re making some improvements to the Buy- Here, Pay-Here Center, including giving the dealer the ability to customize the colors using a template system. They can create their own flavor in their microsite.

“Once a dealer has created their microsite, they’re actually able to use it like their own dealer website. If I pointed that domain name over to my Buy-Here, Pay- Here Center microsite, when the consumer arrives, it would remove the top and bottom navigation bars; it would remove all of the AutoTrader Buy-Here, Pay-Here Center branding, and it would be like the dealer’s own standalone experience,” he continued.

“That’s another thing we want to do to help dealers because No. 1. it gives them the ability to manage their value story, their inventory, everything they need to do in the same place, and they don’t have to go post these things all over. It’s our goal to make these microsites as robust as we can so it will offer the dealer everything they need,” Kelly went on to say.

More Than Just Moving Metal

In an environment where more state and federal regulators are taking a greater interest in how BHPH operators function, Kelly emphasized that AutoTrader.com’s Buy-Here, Pay-Here Center can be more than just another advertising avenue for dealers.

“The big message here is because this is the only marketplace of its kind, it really does give the dealers the opportunity to be transparent,” Kelly said. “I would like to see them try because they think it will work for them. A dealer has the ability to list a car with a true down payment amount, a true weekly or monthly payment amount and the appropriate disclaimers. They don’t have to do this on all of their cars. They can actually list some by down payment and some by selling price, or list some with no information at all.

“I would really encourage them to at least dabble in this notion of transparency because I think that they’ll find that their business becomes much more efficient,” he continued. “The reality is if they need $1,500 down to make a deal on a car, why would they bring in someone who doesn’t have it? It’s like the ultimate dating service. The dealer can say what it takes to make a deal, and a consumer who meets that criteria can come in and buy a car. It’s very simple. It’s a very solid way to start a long-term relationship.

“The big movement we want to accomplish is start to move toward this transparency and trust between dealer and consumer, which is a good thing for them as a business and a good thing for the industry as a whole,” Kelly concluded.

According to the most recent study from the Federal Reserve, the average new-vehicle loan in the U.S. stands at more than $26,700 with a loan to value ratio of a huge 80 percent. So the volume of payments which are there to be collected is vast.

Auto finance companies from huge captives down to smaller buy-here, pay-here dealers in the subprime market are facing this challenge with consumers increasingly using multiple payment methods in other areas of their consumer life, and therefore, bringing the same expectations to auto finance.

Across all other industries, multiple payment options are available to consumers — whether that’s paying your cell phone bill online, scanning a QR code on your most recent electricity bill or paying your healthcare bill over the phone. Statistics from Fiserv’s sixth annual Billing Household Survey 2013 show that 83 percent of consumers use more than one bill payment method monthly — covering e-billing, mobile, check, walk-in and phone.

And while the number of auto finance bills paid via the traditional method of mail has reduced by around 50 percent according to the Aite Group, there has only been a slight increase in the number of bills being paid online. However in mobile payments, although the overall volume is still significantly lower than other channels, there was more than a doubling in the number of bills paid via this channel in 2013.

But perhaps the biggest opportunity for the auto finance industry lies in paperless electronic bills. Currently, according to the Fiserv survey, auto loan e-bill penetration stands at just 19 percent, compared to 58 percent of cell phone bills which are viewed online.

So why the hold-up of using multiple payment channels in the auto finance industry? In the BHPH market or the subprime auto market, a lot of consumers pay by actually going to the dealer, often more than once a month. But they are increasingly demanding and using the convenience of paying online or via a mobile device.

Personalization vs. Productivity

Many consumers already perform price comparisons on their phones while visiting a car lot, and dealerships are in fact operating in a true omni-channel environment — whether they like it or not.

But there’s a huge dichotomy which the smaller BHPH dealerships in particular are now facing between taking a personalized approach of making payments in store, and becoming more efficient in taking payments via the alternative channels suggested above.

And in the case where dealers have a large number of subprime borrowers, there can be a resistance to changing payment methods. Many of these dealers actually like to see the borrowers come in to make a payment, and see the car that is the collateral for the loan. But concerns over risk can be countered by the fact that the technology of more advanced payment channels can assist with PCI compliance and other risk management.

Possible Solutions

Improving efficiency in the auto finance industry is all about relieving pressure in collecting loan payments, as well as making the process more convenient for customers. And BHPH dealers don’t have to jump straight to the latest technology — such as mobile payments — but instead need to focus on using tried and tested technology which is relatively new to the auto finance market.

For example, interactive voice response (IVR) solutions are very popular in other markets in offering an interactive, personalized experience over the telephone, and are easy to implement for auto financiers. IVR allows the caller to interact with an automated telephone-payment system to make ACH, debit and credit card payments 24/7. This can be a great option for customers who want to control their finances through efficient self-service, offering them the opportunity to review balances and receiving immediate payment verification — all of this anytime day or night.

A customer-facing payment ecosystem has evolved, particularly within auto finance, and while we may be beginning to see greater adoption of this payment technology in the larger, independent dealers, the smaller sub-prime and BHPH markets are still lagging behind other consumer markets.

There are of course concerns around compliance issues and understanding the regulation around using different payment channels, but these new channels are now all tried and tested in terms of compliance. It's essential that these smaller dealerships recognize the potential of using multiple payment channels in order to grow their businesses and to attract new customers who want to pay through different channels, and to pay at a time convenient for them.

Marya Lang is the general manager of auto finance at BillingTree. Lang will be part of free webinar at 2 p.m. ET on July 16 highlighting more studies BillingTree has done into the payment behavior of consumers, especially in auto finance. BHPH dealers can register for the session here.

AutoTrader.com executive vice president and chief operating officer Alan Smith boiled down the site's primary objective as being the online catalyst to bring vehicle shoppers and dealers together. The company is sharpening that strategy to cater to the buy-here, pay-here market with a new solution that's been in development for several years.

In an exclusive interview with

BHPH Report, Smith shared details about the Auto- Trader.com Buy-Here, Pay-Here Center, which he called "basically a website within a website." The center will direct shoppers who likely have deep subprime credit histories and need to secure contracts through in-house financing toward BHPH operators who specialize in working with customers who likely have been denied by other lending institutions.

AutoTrader.com is rolling out a soft launch of the center during the National Conference hosted by the National Alliance of Buy-Here, Pay- Here Dealers.

"It's a key innovation for us when you think about being able to segment the audience and segment shoppers," Smith said. "Not all shoppers are created equal. They all have different needs and priorities. Bringing buyers and sellers together, a key part of that is being able to innovate within the different segments that are out there. This is just the beginning of that for us."

How It Works

Many BHPH operators might already be familiar with how AutoTrader.com allows dealers to post inventory on its website. Trough the Buy-Here, Pay-Here Center, operators can take that inventory listing a step further and include elements such as what the required down payment is, or how much biweekly payments would be.

Brett Kelly, director of independent dealer business at Auto- Trader.com, described more details from both the shopper and dealer perspective.

"We have some great things for both consumers and dealers. For consumers they're on site and they're able to search by vehicle type, by down payment and biweekly or monthly payment. They're able to view dealers in their local area. It will automatically pull up the dealers closest to them," Kelly said.

"On the dealer side, we know buy-here, pay-here dealers generally like to do business locally. The dealers are going to be able to designate how far out a consumer is able to see them so they can limit the consumer participation," he continued. "We also have a pretty good collection of marketing and merchandising tools for the dealers. Every participating dealer will have their own microsite that they can list their inventory. They can include photos. They can include video.

"We'll have display ads on the site. In the back end, the dealer tool in our ad manager, dealers actually will be able to create their own display that will automatically display on the site," Kelly added.

"There's a good collection of tools for both consumers and dealers," he went on to say.

Kelly emphasized the center can benefit operator of any size.

"A lot of the smaller buy-here, pay-here dealers don't have websites. If they want to use this Buy-Here, Pay-Here Center microsite as their own website, they can do that just by buying a domain and redirecting it. Then it can be branded with their own experience, he said"

Adding Dealers to the Center

Just like operators want to populate their lot with inventory, AutoTrader.com is out to fill this new center with participating dealers so site officials have enough in the pipeline before turning the solution on for shoppers to use.

"We're only allowing dealers that specialize in in-house financing and buy-here, pay-here to participate," said Smith, mentioning that AutoTrader.com will initially promote the center with house ads on its own website as well as links located on other pages throughout its platform.

"As we begin to have more dealer participation and as we work it into the core AutoTrader.com website, it will become more of a main channel on the homepage," he continued.

Kelly plans to show the development site to dealers who attend NABD's show in Las Vegas. Soon, AutoTrader's field staff will be highlighting the center throughout sales associates' territories.

"From there, it's really driven by dealer participation because in order to promote to consumers, we've got to have enough dealers," Smith said. "Honestly, the number of dealers we need is really going to be determined differently by geography. These are local shoppers shopping in a local market. They're going to want to look locally, and these dealers are going to want to target locally.

"Once we have enough dealer participation, we're hoping within 60 days of the soft launch to be able to start promoting it consumers," he continued. "From there it's really an ongoing evolution. That first 12 months is really critical from a feedback and innovation standpoint. The next year once we get shoppers and dealers using the site, it will even get better because we're going to listen to their feedback."

Kelly didn't hesitate when asked to gauge how many dealers can be associated with the new AutoTrader.com Buy-Here, Pay-Here Center.

"We want the participation of every single buy-here, pay-here dealer in America," he said. " The key importance for us is we want to create that marketplace, essentially that directory of every buy-here, pay-here dealer in the country. That way the 10 percent of consumers who need in-house financing can come to our site and feel confident that they can find a dealer."

High Hopes for Center

Smith acknowledged that creating a solution specifically for the BHPH market has been discussed at AutoTrader.com for close to seven years.

"We've also done research along the way to make sure we understood what the opportunity was, both with dealers and consumers. Because again it's about bringing them together. We've been in development for about a year to be able to come to the market and say we have something to show you," he said.

Kelly also highlighted how much AutoTrader.com is eager to bring this solution to BHPH operators.

"From our sales force, the field staff is very excited. Their attitude has almost been, 'It's about time.' The field has been waiting for this for a long time," Kelly said. "Our dealer solutions center, which is our Dallas support center that is specifically independent dealers, also is very excited about this. They work with many buy-here, pay-here stores. They know that this is a solution that's really long overdue in the market.

" The dealers we've spoken with are also very excited. If you think about it today, a dealer who offers buy-here, pay-here, it's very difficult for them to find a laser-beam focused way to target consumers who need in-house financing. There's a lot of excitement across the board," he went on say.

The numbers point to just how rough the retail sales seas got for some buy-here, pay-here dealers in 2013.

According to the BHPH Industry Benchmarks prepared by the National Alliance of Buy-Here, Pay-Here dealers in association with SGC Certified Public Accountants and NCM Associates, sales volume softened by nearly 7 percent last year, coming on the heels of a 5-percent annual dip a year earlier. Experts point to the significant rise in special financing by a wide array of lenders that took away customers who normally would have had no choice but to seek a vehicle purchase from a BHPH operator.

“I think the big thing is they took a number of our customers. They reduced the sales volume for a lot of operators by taking that business and putting them into vehicles so we had to give up market share,” NABD founder Ken Shilson said.

“Based on Experian’s numbers, we lost over 20 percent of the market share during 2013, and the special finance industry in the short term grew by a corresponding amount,” he continued. “I won’t blame it all on the special finance industry because some of that market share was lost to credit unions, some of which are being very aggressive right now. And also some was lost to new-car franchise dealers who on their used-car operations are being very aggressive themselves.

“The combination took those customers out of play,” Shilson added.

Why did all of a sudden these special finance companies start booking contracts with deep subprime customers? During the worst of the recent recession, reportedly consumers with credit scores approaching 700 had difficulty in securing financing. Now in the past 12 to 18 months, Shilson recollected conversations with BHPH operators who heard about consumers who had credit scores in the low-500 range being able to secure a late-model or even a new car.

“All of the special finance activity was driven by a search for higher yield investments. They were borrowing the money at 2 percent and loaning it out to subprime customers at over 19 percent. The spread there was the attractive part for investors to pour money in, and they securitized a lot of these loans,” Shilson said.

How Successful Operators Managed

Brent Carmichael is the BHPH specialist for NCM and helps to construct the benchmarks. Throughout the year, he moderates 20 Groups that collect stores of similar size for semiannual gatherings of brainstorming and more. Carmichael shared with BHPH Report what successful operators did to stay in business.

“Subprime was back and very aggressive,” Carmichael said. “We’ve also had dealers manage their growth for a cash flow and capital standpoint. We have some dealers who are intentionally selling three less cars a month because they’re focused more on the quality of the portfolio, not necessarily the quantity. Some dealers just wanted to maintain their portfolios, bringing in enough cash to do what they wanted to do. Some aren’t out to be DriveTime or Car-Mart, just wanting the business to pay them back a little bit.”

Carmichael pointed to the benchmarks, numbers to support why some operators chose that path. He mentioned profitability on a per-vehicle sold basis softened to nearly $2,100, representing about a $100 decline per unit.

“A $100 per car doesn’t sound like much, but when you’re talking 600 units per year, now we’re talking about a $60,000 loss in profitability year-over-year,” Carmichael said.

While operators tried to tighten their budgets in many areas, Shilson mentioned how BHPH stores looked to overcome a dwindling customer base by advertising more. The benchmarks showed the average operating expense for advertising ticked up to 3.8 percent in 2013, up from 2.8 percent a year earlier.

“They definitely tried to advertise more as they started to lose market share,” Shilson said. “The only thing that seemed to work successfully was online marketing. Online marketing seemed to be giving them the most bang for their buck. If they just did more radio or television, we didn’t see as much traction there.

“The online marketing in terms of a website and in term of other online marketing is more focused on reconnecting with particular customers or prospective customers,” he continued. “I think that’s where they had the great success. The competitive environment, like we’re seeing with special finance, is every man for himself out there. If you just advertise on TV, so is everyone else. But if you do a more focused thing with your website and your online marketing, maybe you’ll have a better chance of attracting that particular customer.”

Cautionary Signs

Beyond the raw sales numbers, both Shilson and Carmichael spotted trends that caught their attention and reflected just how challenging the BHPH business can be.

“The continuing increase in cash in deal is really one the most telling things,” Shilson said. “For the time since we’ve been doing the benchmarks, the cash in deal averaged more than $5,000.”

To be exact, the average cash in deal at BHPH stores last year climbed to $5,294. A year earlier, the figure stood at $4,672. Back in 2009, it was just below $4,000 at $3,990.

“That’s very significant. Our down payments and our repayments are not moving commiserate with the cost in the industry, so that’s a real challenge for us. We’re spending more, but we’re not taking in more,” Shilson said.

And just one area where BHPH operators are spending more money is on reconditioning. For the fifth year in a row, reconditioning spend increased by at least $100. The 2013 amount broke the $1,000 threshold, settling at $1,026, up from $962 back in 2011.

“That’s one area that concerns me because of what inventory is. I don’t think dealers are doing more to the cars. It’s just costing more to fix the cars,” Carmichael said. “That’s one thing many dealers haven’t thought about. BHPH dealers often look at cars that are about 6 or 7 years old. They’re decent enough with some reconditioning that they can sell, and they are affordable to the customer from a down payment and sale price standpoint.

“There were little to no cars made in 2007 and 2008. That 7-year-old car just isn’t out there. It’s either a 2009 or it’s a 2006. Obviously, 2009 is more expensive, maybe with an (actual cash value) of $7,000 to $8,000. A 2006 is a cheaper car, but they’re also higher mileage and have a little bit more worn off, so to speak. They need a little bit more love to get them ready to make them sellable and safe for a customer,” he continued.

Shilson also shared a theory about why reconditioning costs jumped so much last year.

“What I think is happening in the reconditioning cost area as you recycle more repossessions, your cost to make them ready and to recondition them increases. I think that’s part of what’s happening,” he said.

How Dealers Can Leverage Benchmark Data

Both Carmichael and Shilson explained that operators should use the benchmark data as a reference point, not necessarily as the objectives for how their particular store should be.

“I never want a dealer to set up his business according to a benchmark. Our benchmarks are compiled from hundreds of dealers,” Carmichael said. “You’ve got guys out there who are single-point owner operators who are very involved in the business and run very lean. So there are some areas of the benchmarks that the average dealer selling 50 cars a month and 600 cars a year cannot get to some of the benchmarks.

“I think they’re a great goal to take a look at to see if I can get close as you can to some measure. Some have to be taken with a grain of salt. Some are very attainable for the average dealer. Some aren’t,” he continued.

Shilson emphasized that working each day is crucial, no matter when the benchmarks indicated.

“The big thing to say is a very challenging year in 2013, but are you going to make 2014 better? It’s not going to happen by itself. You can’t sit back and hope that it’s going to get better. You have to get out there and see what’s going to make it better,” Shilson said.

2013 YEAR IN REVIEW

The financial benchmarks for 2013 reflect a higher level of competition within the deep subprime marketplace. The more significant factors that impacted profitability were:

1 Unit sales for most operators were fat or declined (some by up to 25 percent) from 2012, due primarily to increased market competition from special finance sources that extended credit to BHPH customers. Individual operators were affected by varying levels of special finance competition in their local markets. Some operators expanded their facilities (added lots) to increase market share. Market data indicated that the BHPH deep subprime financing market share declined by more than 20 percent in 2013, while the market share for subprime finance companies grew by a corresponding percentage.

2 Subprime finance lenders (including franchise operators) were particularly aggressive in financing deep subprime customers (with credit scores below 550) who purchased new and late-model vehicles (less than three years old) with low down payments, high repayments and terms of more than 60 months. Finance companies originated these “silly loans” in an attempt to “buy” market share quickly.

3 Capital poured into the subprime auto markets making special finance lenders overly aggressive in their underwriting policies and practices in search of high yields.

4 History indicates that higher default rates occur on deals with “too much vehicle and too little customer”. Recent Experian Automotive Data shows that quarterly repossession rates for the second half of 2013 increased dramatically over the corresponding period in 2012 for special finance lenders. Charge-offs for special finance lenders in the fourth quarter were the highest since 2006 and averaged $8,772.

5 BHPH operators again found inventory acquisition to be challenging. Lower new-car sales from 2008-2012 provided a limited supply of BHPH vehicles (usually more than 4 years old), which kept auction prices high. Operators reduced inventory levels commensurate with a limited supply and reduced customer demand.

6 Technology played an important role in 2013 BHPH operating efficiency. Most customers now have smartphones. This cellular link has become an important way for BHPH operators to “connect and collect” with their customers and prospects. In addition, the integration of Internet-based marketing tools, payment device technology, electronic pay portals and other technology into BHPH operations continued. Operators who proactively utilized online marketing fared better than those who did not.

7 New regulatory challenges surfaced in 2013 when the FTC, Consumer Financial Protection Bureau, and various state attorney generals’ offces monitored compliance and investigated alleged deceptive practices. The IRS increased tax audits of used-car operations, focusing on compliance issues. Even the Department of Justice joined in by policing discriminatory lending practices using their “disparate impact theory”. We should expect more compliance scrutiny in 2014 and beyond.

8 Operators with greater financial flexibility (more equity and/or available lines of credit) fared best. Increased competition, the limited liquidity of their customers and a higher cost environment were the major reasons why.

9 Given this overall environment, operators who managed risk successfully and opted to pass on making “silly loans” to maintain market share will beneft by avoiding defaults when these customers don’t perform.

The peak of tax season is over. W-2 forms have been handed out to employees, and the tax refund money is long gone in most cases.

If your business was ready for tax season, the annual opportunity was once again available to cash in. Tens of thousands of cars were moved from October to January in anticipation of the customer’s tax refund jackpot. Thousands more vehicles were moved during the W-2 season of late January and early February.

Planning and preparation can have multiple benefits during the tax season and lead you to the same success. Forward-looking businesses have the opportunity to work with customers and lenders, create a marketing and inventory strategy, and work with an experienced tax refund partner for a much smoother ride.

When you have a plan your team executes, and your strategy is solid, the result can be half of your annual business or more in the first two months of the year.

Tax Season Best Practices

First, know your stuff. Proprietors who look forward to tax season financially also look forward to tax season with a strategy. Research shows that dealers who approach tax time in September and formulate a plan in the late weeks of summer do not simply make more dollars than their competition — they double and triple their neighbors in terms of dollars and traffic.

Now more than ever, tax time starts with Halloween and Thanksgiving with less risk. Dealers move the exact same cars they would normally move, except the customer makes a bonus payment at tax time.

Example: You want $1,500 down and the customer only has $1,000. Most lots will do that deal by extending the payment structure, increasing the weekly payments, or both. But the reality is that you can commit the customer to a second $1,000 payment out of their tax refund come February.

Instead of $1,500 down, you can end up with $2,000 down or more with a little salesmanship.

Where is your risk? No more than any other deal that you come across. Actually, the risk is less than normal. If the customer does not bring back that second payment of $1,000 in February, you are in the same position as any other deal.

Here is the catch. Most tax refunds are Monopoly Money. When children are involved, the average tax refund was more than $5,300 in 2013.Help the customer help themselves when that money arrives in February. Get a bonus payment.

So what if the customer fails to bring you that $1,000 bonus payment? Nothing. You sold the car in November, just like normal.

The final point to remember is that this second payment does not need to be labeled a pickup payment.It is in reality, an optional payment.

What would you normally do if your customer were the recipient of an $8,000 tax refund and wanted to use a piece of it to pay down their car loan to save some money? Nothing. You accept The payment and apply it to the loan. It is nothing but additional cash-flow.

What Happened In 2014?

The fact is that 2014 may have been the smoothest tax season in many years. No IRS computer breakdowns. No fiscal cliff issues. No last minute IRS tax law changes. No significant delays for education credits, itemized deductions or any other specialty forms.

The most significant complaint from taxpayers this year was due to budget cuts with the IRS.Less help was available on the IRS 1-800 lines to help with questions. This is where having a tax partner for your customers can provide you the greatest benefit.

Customers who are directed to tax professional can get paid much faster than taxpayers who file on their own. Fewer mistakes lead to faster tax refunds and fewer regrets.

One new feature was the Identity Protection PIN. This was a six digit code that was required for some taxpayers who had been prior victims of identity theft. The PIN was mailed to the customer in December and was needed to file the tax return at the beginning of the year.

A hold-over from 2013 was the IRS opening date. The traditional kickoff has been the weekend of Jan. 15th. Last year, in 2013, the IRS decided to open later on Jan. 30.

This did tend to ruffle a few feathers for customers who want their tax money yesterday, but it worked out for the best. Tax fraud was down. The illegal claiming of children was down. IRS computer issues were reduced, as well.

So in 2014, it was no surprise to those of us here in the tax industry that the IRS opened at the end of January once again. The negative backlash from the public was almost non-existent.

Obamacare was a non-issue for 2014, as well.The new requirements for customers will start next year. The good news is that most of the burden will be on the professional tax software companies that calculate the tax returns and the people who try to prepare their own tax returns. Customers who use a trusted and reputable tax professional will fare better than most.

The new Obamacare requirements may end up as a blessing in disguise. More dealerships are inviting customers to file taxes with a preferred tax professional that can funnel the tax refund money directly to the dealership. This makes it easier to get paid out of the refund proceeds.

The anticipation is that next year, more customers will be on the lookout for professional assistance.This can create an unprecedented opportunity for dealers in the Special Finance market to monetize the tax refund season in ways they have never seen before.

2014 was another record tax season, but with the proper strategy and planning, 2015 could be huge.

Chip Wiley is the corporate trainer and marketing specialist for Tax Refund Services and Tax Max. Wiley can be reached at (813) 987-2199 or [email protected].