An announcement from the Credit Union National Association (CUNA) detailed how buy-here, pay-here dealers in two states might see more competition from a specific credit union.

The organization indicated the Community Development Financial Institutions (CDFI) Fund orchestrated by the U.S. Department of the Treasury awarded Cutting Edge FCU (CEFCU) a $600,000 in grant funding to expand the credit union’s affordable used-vehicle program for low-income members.

CEFCU has branch offices in Milwaukie, Ore., and Lewiston, Idaho.

Officials indicated CEFCU could impact a projected 921 consumers with its enhanced used-vehicle program through 2022.

Approximately 80 percent of consumers in CEFCU’s area rely on a car to drive to work, according to a news release.

Because many individuals in these particular communities have lower earnings, tighter cash flow and challenged credit, CEFCU indicated these individuals often use BHPH dealers, check cashers and payday lenders when they need credit.

“It’s no secret that reliable transportation provides access to jobs, and allows families to work extra shifts,” CEFCU chief executive officer Brady Howe said. “Unfortunately, many families are disadvantaged because of limited public transportation and the unwillingness of some financial institutions to serve the lower-income, credit-challenged and unbanked.

“This damages the community, considering many families here are minimum-wage workers more likely to fall victim to predatory auto-loan programs,” Howe continued.

“CEFCU is honored to have been selected to receive this important source of funding,” he went on to say. “We’re beyond excited for the opportunity to continue to live the credit union mission to serve the underserved.”

Alongside its increased capacity to serve its low-income members, CEFCU added that it continues to move forward on a new program aimed at improving overall financial wellness. The credit union’s outreach will be performed in conjunction with its community partner, Exceed Enterprises, an organization that works with people of diverse abilities.

The Treasury’s CDFI Fund makes capital grants, equity investments and awards for technical assistance to certified CDFIs. It was funded at $250 million for fiscal year 2018, which CUNA successfully fought for earlier this year.

The volume of consumers without a bank account is now at an all-time low.

For the third consecutive survey period, the number of U.S. households without a bank account fell, according to the results of the 2017 biennial National Survey of Unbanked and Underbanked Households released by the Federal Deposit Insurance Corp. (FDIC).

Officials reported the percentage of U.S. households that were unbanked in 2017, the most recent year of the survey, was 6.5 percent, the lowest rate recorded since the FDIC began conducting the survey in 2009. It was down from 7.0 percent in 2015, and down significantly from a high of 8.2 percent in 2011.

The FDIC explained the unbanked numbers for 2017 equate to 14.1 million adults in 8.4 million households not having a checking or savings account.

Officials believe the decline in the unbanked rate from 2015 to 2017 can be explained almost entirely by improvements in the socioeconomic circumstances of U.S. households.

The number of underbanked U.S. households was also down compared to 2015 levels. In 2017, 18.7 percent of U.S. households were considered underbanked, or approximately 48.9 million adults in 24.2 million households.

For purposes of the survey, the term underbanked refers to households that had an account at an insured institution but also obtained financial products or services outside of the banking system.

Consistent with previous surveys, the FDIC found that the banking status in 2017 varied considerably across the U.S. population.

For example, unbanked and underbanked rates were higher among lower-income households, less-educated households, younger households, black and Hispanic households, households headed by working-age individuals with a disability, and households with incomes that tend to vary from month to month.

Officials mentioned mobile banking continues to become an increasingly important way for consumers to access their accounts. In 2017, mobile banking was used by 40.4 percent of banked U.S. households to access their account, almost double the 23.2 percent four years earlier.

According to the survey results, 86.0 percent of banked households visited a bank branch in the past 12 months, and 35.4 percent visited ten or more times. Officials determined this figure held true for households that used online or mobile banking as their primary means for accessing their accounts: 81.0 percent of banked households that used mobile banking as their primary method visited a branch in the past 12 months, and nearly one-quarter (23.0 percent) visited ten or more times.

Other key findings in the survey include:

— Nearly 13 percent of households (14.8 million households) demonstrated unmet demand for mainstream small-dollar credit, and a majority of these households (57.2 percent) reported staying current on bills in the prior year. The report notes that new underwriting technologies, such as those that rely on transactions in consumers’ checking accounts, could help expand credit availability for some of these households.

— One in five U.S. households (22.7 million households) did not use mainstream credit in the prior 12 months and, consequently, may lack a credit score. Black and Hispanic households at every income level evaluated in the survey were more likely to be in this condition than white households. The report notes that helping these households establish and build a credit history can make it easier for them to access credit on reasonable terms when a need arises.

— Along with 86 percent of banked households, almost one in six unbanked households visited a bank branch in the past year. The report notes that these visits may represent key opportunities to inform unbanked households about products and services that can meet their needs.

— While unbanked rates have fallen in recent years, those that remain unbanked have proven more and more likely to respond that they are “not very likely” or “not at all likely” to open a bank account in the next year (75.0 percent in 2017 versus 62.1 percent in 2013). This fact, along with evidence that certain population segments remain much more likely to be unbanked, suggests that strategies targeted at addressing barriers to bank account ownership for specific groups may help further reduce unbanked rates.

— The share of households reporting that they turned to nonbank firms in the last year for the provision of credit and transaction services tracked in the survey dropped to 22.1 percent, down from 24.0 percent in 2015 and 24.9 percent in 2013. The drop was evidenced in both the use of credit and transaction services.

“The good news is that our nation’s banking system is serving more American households than ever before. The bad news is that even as the overall number of people who are unbanked has declined, 8.4 million households continue to lack a banking relationship,” FDIC chairman Jelena McWilliams said.

The impact of TransUnion’s acquisition of FactorTrust last November is still creating developments nearly a year later.

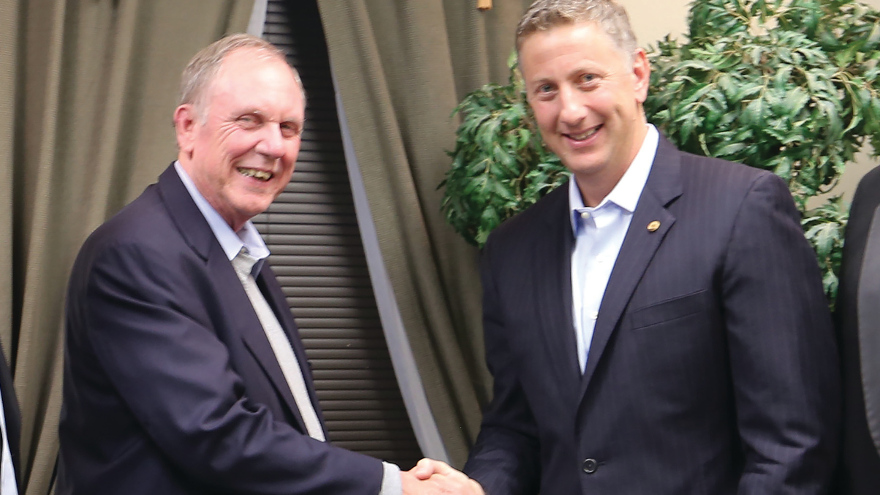

On Monday, TransUnion joined with the National Independent Automobile Dealers Association as its latest Bronze-level National Corporate Partner, expanding its commitment to provide the most complete and multidimensional information available to independent vehicle dealers nationwide.

TransUnion creates and provides solutions designed to give auto finance companies and dealers the tools to succeed, knowing that understanding consumer demands and behavior is key to engaging the right customers, making competitive offers and building long-lasting loyalty.

TransUnion looks to go beyond traditional credit information to deliver the insights dealers need to make informed decisions. Its broad array of solutions — credit risk management, alternative data, marketing segmentation, digital marketing, fraud and identity solutions, collections and recovery solutions and business intelligence — can allow dealers to operate with efficiency and security while creating a smooth customer experience.

“Through its acquisition of FactorTrust, TransUnion now brings substantial and immensely relevant alternative risk mitigation data for our buy here, pay-here members,” NIADA senior vice president of member services Scott Lilja said.

“TransUnion is committed to providing our members with the best in market credit scoring, risk mitigation and ID and fraud solutions,” Lilja continued.

For more information, visit www.transunion.com/business.

AGORA recently landed another industry connection to help establish itself as a prominent platform for bulk portfolio transactions.

AGORA, a Texas-based provider of technology solutions for the financial services industry, announced a joint, newly launched integration functionality relationship with DealerCenter.

“Protecting our dealers from exposing loan data when they make their portfolios available for sale and giving dealers more liquidity is the mission of AGORA,” AGORA founder and chief executive Steve Burke said.

“DealerCenter is an exceptional dealer management system, and we are excited to have them as one of our key integration partners, who enable dealers to seamlessly and securely offer their loans for sale to our 60-plus banks, finance companies and credit unions — avoiding unsafe emails of data files,” Burke continued.

“The DealerCenter integration continues to expand AGORA’s ability to help sellers sell faster, sell more profitably and sell securely,” he went on to say.

DealerCenter is a web-based dealer management system (DMS) designed specifically for independent dealers. With direct integrations with other solutions, DealerCenter’s 11,500 dealer clients can receive all relevant services through a single platform.

Through the integration with AGORA, dealerships on DealerCenter can have their loan information concurrently available on AGORA, where they can securely select loan pools for bidding or financing from more than 60 finance companies that acquire loan pools or finance them on the AGORA platform.

The entire placement, bidding and acquisition of loan pools can be completed inside the AGORA platform, without exposing private customer data, transaction activity and collection notes to outside parties.

“DealerCenter is committed to providing strategic integrations that enable our dealer customers to converge their operation into a single platform. Partnering with AGORA aligns perfectly with our focus on adding value for our buy-here, pay-here dealers,” DealerCenter senior vice president of sales and marketing Jesse Martin said.

Earlier this year, AGORA finalized relationships with other BHPH industry service providers such as Frazer, as well as Ignite Consulting Partners.

An operation with deep roots in buy-here, pay-here is rolling out a solution within the alternative-data space.

Tricolor, one of the nation’s largest used-vehicle retailers focusing on Hispanic consumers, announced that it has reached a licensing agreement with WorkRecords to broaden the company’s platform and develop what leaderships contends will be a proven and reliable mass market credit score for hourly workers and credit invisibles.

According to the Consumer Financial Protection Bureau, more than 45 million people in the United States lack a credit score or are unable to be scored effectively by traditional credit bureaus. Tricolor insisted these customers are often locked out of mainstream financial services.

Dallas-based WorkRecords is an innovative technology platform company connecting workers and employers with an enterprise-class, labor supply chain application for sourcing, tracking and payments for labor deployed by large employers.

WorkRecords contends the hourly labor market is vast with 77 million people in the U.S. being paid hourly at a total spend greater than $2.2 trillion annually. WorkRecords added that 60 percent of the current workforce earns less than $16 per hour.

“Our conviction is that ‘ability to pay’ is the best predictor of loan performance for this demographic profile, and we intend to apply our experience in lending to the unbanked consumer and utilize WorkRecords’ data to provide access to more affordable credit for this highly underserved segment,” Tricolor chief executive officer Daniel Chu said.

“WorkRecords has created a world-class solution to automate the workflow for employers while providing the hourly worker with an efficient tool to optimize earning potential,” Chu continued. “In doing so, WorkRecords has assembled a uniquely powerful and valuable set of data which potentially offers deep insights into credit worthiness.”

Chu went on to note that Tricolor’s proven and proprietary credit decisioning engine demonstrates its advanced analytical competency and serves as the foundation for this new risk model.

For nearly a decade, Tricolor has successfully scored no-file and thin-file Hispanics, validated by four ABS securitizations. Its segmentation model assesses unique, nontraditional attributes for no credit and low-income consumers in order to successfully gauge intent and ability to repay.

Chu added this innovative concept will potentially remove the current low ceiling on this segment’s access to affordable credit, and Tricolor has engaged in the process of assembling a network of financial services providers which will utilize the score to provide more attractive terms.

“The positive impact on these consumers’ lives can be significant by providing a path to fair credit and affordable lending,” Chu said. “Based upon reactions from potential lender partners, we expect our strategy will be embraced by those financial services providers seeking to improve their value proposition and more effectively serve this segment.”

Operators can get some treats ahead of Halloween as the biggest buy-here, pay-here specific event of the year is headed back to Las Vegas.

The NABD Buy-Here, Pay-Here Subprime Conference, powered by the National Independent Automobile Dealers Association, is set for Oct. 8-10 at the MGM Grand in Las Vegas, offering the industry’s best BHPH-specific training for both new operators and BHPH veterans.

The conference features education from the BHPH experts at the National Alliance of Buy-Here, Pay-Here Dealers and NIADA, including Ken Shilson, Ingram Walters and Chuck Bonanno, as well as top names from the subprime sphere.

Attendees will learn about new industry technology, the latest marketing strategies including digital marketing, collections and underwriting, and best practices that work today – and in the future.

There are also opportunities to network with industry experts, explore ways to secure capital to fund your operation, get updates on compliance and legal issues, and check out an exhibit hall filled with the latest products and services to improve any BHPH business.

“NABD continues, bigger and better than ever,” said Shilson, NABD president and founder. “You can't afford to miss this event. Opportunity knocks for BHPH operators who capitalize on it — and this conference will show you how to do it.”

The discounted early registration rate of $495 per person applies through Sept. 22. Group discounts are also available.

For more information or to register, visit www.nabdsubprimeconference.com or call (832) 767-4759.

Is there a “wisdom” app for my phone? What’s the relative value of intelligence and wisdom?

If there is anything that experience teaches, it is that wisdom has a far greater value than intelligence. Even Solomon prayed for wisdom knowing that intelligence alone would not achieve his goals. Every buy-here, pay-here dealer is confronted with the same reality.

Intelligence is knowing how to read. Wisdom is understanding what the words really mean.

Your brain is capable of learning how to think wisely. You may have heard the expression that if your only tool is a hammer, then every problem or opportunity requires a nail. Think about that a moment. If you only have one tool, the hammer, then your only solution to anything is a nail. The more tools we have the better solutions we find. (By the way the only difference between a problem and an opportunity is how you react.)

Here’s a simple brain tool that reaches the wisdom lever. I call it, “The Question Tool.” It’s very simple. It only takes a minute to learn. Once you have made it best friends with your “Habit Tool” it works all the time.

Step No 1: Ask your customers, friends, family, partner, banker, vendor; everyone in your life, “What’s really important?”

Step No. 2. Ask “Why?”

Step No. 3. Be silent verbally and mentally as you listen to the two most important questions you can ask. (You are not listening if you know what you are going to say in reply and are waiting for your turn to speak)

The result will be understanding, which is the cornerstone of wisdom.

When I make local speeches, I pass out simple business cards that have “The Question Tool” explained on them. Make some yourself. Pass them out to people you know.

Julian Codding is a member of the National Alliance of Buy-Here, Pay-Here Dealers Hall of Fame, possessing more than 40 years of industry experience. More about him can found at juliankcodding.com.

When the National Independent Automobile Dealers Association (NIADA) finalized its acquisition of the National Alliance of Buy-Here, Pay-Here Dealers (NABD) this past December, the last thing Ken Shilson wanted to do was just power down his computer and never look spreadsheets or other financial documents and portfolio metrics.

But now Shilson, one of NABD’s founders, will continue to leverage his analytical and accounting backgrounds as NIADA announced on Thursday that it has contracted with Shilson and Subprime Analytics to provide analytical services for the association’s 16,000 members.

“I wanted to get back more into the analytics area,” Shilson said during a phone conversation in January. “I want to expand my analytical data to support the important positions of the industry

“It is data that will drive the decisions that regulators have to make that will impact the industry,” he added.

Subprime Analytics, a Houston-based company that analyzes subprime automotive portfolio performance using data-mining technology, has analyzed more than $20 billion in subprime auto installment contracts during the past 10 years. The firm provides nationally recognized automotive benchmarks that measure industry performance and trends.

“I am pleased to prepare and issue our used-car benchmarks and other analytical reports to assist NIADA in its representation of the used car industry,” said Shilson, who is president and founder of Subprime Analytics.

“At Subprime Analytics, we intend to develop data and analytical information in support of important legal and regulatory initiatives by NIADA that will impact the used-car industry. NIADA and Subprime Analytics, working together, plan to expand analytical reporting for its members.”

For the past 19 years, Shilson had served as president and founder of NABD, which was recently acquired by NIADA. Shilson will continue to assist both organizations and will participate in NIADA training and conferences planned for 2018 and beyond.

“We are now working together on the agenda for the 2018 NIADA/NABD Convention and Expo at Rosen Shingle Creek in Orlando, Fla., June 18-21,” Shilson said in a news release. “It promises to be the largest used-car show in history, and I am delighted to join the NIADA team in helping design and conduct the educational sessions and to continue to provide NABD attendees the highly valuable specialized training they have come to expect.

“NIADA is also planning a subprime auto conference this fall in Las Vegas and other dealer training events. In the highly competitive subprime auto industry of today, education has never been more important and valuable,” he continued.

NIADA chief executive officer Steve Jordan said that that he is “thrilled Subprime Analytics is now the de facto data arm of NIADA" and that Ken Shilson is adding his 20-plus years of data mining and analytics expertise to the NIADA playbook of service to our members.

“Through Subprime Analytics, Ken has created an extremely valuable service platform for dealers and finance companies in the subprime automotive space that can help them better understand how data trends can impact their businesses and customers,” Jordan continued. “Aggregating data is one thing, but Ken’s expertise in interpreting the data and its operational trends is what puts him in a class by himself.

“As a real-life data ninja, Ken is a hugely valuable asset to NIADA, our members and the industry, and I look forward to our continued work together,” Jordan went on to say.

For more information about the 2018 NIADA Convention and Expo or to register, visit www.niadaconvention.com or www.bhphinfo.com or call (832) 767-4759. Availability is limited.

Independent dealers went into 2018 with an upbeat mood.

Why? The economic and retail sales growth expectations of independent dealers have improved substantially, according to the National Independent Automobile Dealers Association’s business confidence survey for the fourth quarter of 2017.

The survey of NIADA members is conducted each quarter in partnership with Equifax to gauge the viewpoint of used-vehicle dealers regarding general economic conditions and business concerns.

The association highlighted that 50 percent of the dealers surveyed said they expected economic conditions to improve in Q1 2018, up from 36 percent in the Q3 survey.

The results showed retail sales growth expectations improved from 55 to 67 percent, and the number of dealers who expected to increase their inventory investment this quarter rose 17 percentage points — a 42.5 percent increase from Q3.

NIADA pointed out that its dealer sentiment results align with a recent survey of members of the National Federation of Independent Business that showed optimism near an all-time high, at a level not seen in 34 years, according to NFIB president and chief executive officer Juanita Duggan.

NIADA determined the big drivers of that renewed positivity include expectations of tax relief from the new tax bill passed by Congress, positive consumer sentiment due to the lowest unemployment rate in more than 30 years and confidence in the current administration’s pro-growth, anti-regulation policies.

The association acknowledged used-vehicle inventory costs remain robust, with the latest Manheim Index climbing 7.8 percent year-over-year.

NIADA noted that inflationary inventory situation continues to put pressure on the business expense side of the ledger, which is one reason 57 percent of dealers expected their cost of doing business to increase, up from 45 percent in Q3.

Survey orchestrators explained that jump also reflects the significant investment independent auto dealers continue to make in their digital showroom — as reflected in the survey, which shows 56 percent planned to increase their digital marketing spend.

And like any entrepreneur might say, NIADA’s latest project to gauge dealer mindsets emphasized how the cost of doing business weighs heavily on operators.

The expectation of rising expenses also showed up in dealers’ perception of the single most important problem facing their business — 25 percent said it was the increased cost of doing business — by far the most popular choice.

The cost of doing business was followed by heightened competition from franchised dealers (17 percent), lack of customer prospect traffic/leads and lack of quality retail inventory (12 percent).

NIADA mentioned government regulations/red tape — usually one of the most popular responses — was near the bottom of the list at 6 percent.

The overall picture shows NIADA members expected business to improve heading deeper into 2018.

That optimism is bolstered by strong 3.9 percent holiday retail sales growth — well above the 10-year average of 2.6 percent — as well as rising wages, stock market strength, increasing employment and a generally positive economic outlook.

The complete survey data from NIADA and Equifax can be viewed here.

Lyft and NIADA partner to help dealers turn metal

In other association news, ride-sharing provider Lyft has joined with NIADA as its latest National Member Benefit partner.

The partnership, what NIADA contends is unprecedented in the ride-sharing industry, provides dealer members with opportunities to improve their bottom line through referral incentives and improved transportation solutions for customers while also supporting Lyft’s efforts to expand its driver community and providing economic opportunities for dealership customers.

NIADA member dealerships can sign up to be a Lyft referral partner and receive bonuses for each driver they refer. Customers who sign up for the program will also receive a bonus shortly after they begin driving for Lyft, which they can put toward their down payment and monthly costs of purchasing a vehicle.

The partnership enables dealerships to increase sales through the Lyft referral program.

In addition, Lyft’s Concierge program can offer NIADA members an easy, reliable and inexpensive way to provide transportation for customers whose vehicles are laid up in service.

Concierge can enable the dealership to request rides for its customers to get where they need to go while their car is being serviced, whether it’s running errands, going to work or heading home to take care of their children.

Increased mobility provides a better experience for the customer in a cost-efficient way, according to both Lyft and NIADA.

“We are excited to work with NIADA in a unique partnership that’s helping 20,000 independently owned dealerships increase profits and elevate their customer service while expanding our driver community and growing our Concierge portfolio,” said Gyre Renwick, vice president of Lyft Business.

“By leveraging our holistic business solutions strategy, NIADA is able to provide independent dealers across the country with referral opportunities for every driver sign-up, with the potential to lead to an increase in sales,” Renwick continued.

“Simultaneously, we’re also helping improve the overall customer experience by giving dealerships the ability to dispatch Lyft rides for customers whose vehicles are being serviced, through our Concierge platform,” Renwick went on to say.

NIADA senior vice president of member services Scott Lilja insisted teaming with Lyft provides an “unparalleled opportunity” for NIADA members to profit from the growing opportunities created by the emerging ride-sharing industry.

“Forging new, innovative partnerships that foster synergies between emerging and traditional mobility solutions while helping our membership sell more vehicles and satisfy more customers fits perfectly with our National Member Benefit partnership mission,” Lilja said.

Registration open for NIADA/NABD Conference

Now that the National Alliance of Buy-Here, Pay-Here Dealers has been acquired by NIADA, independent operators need to make only national conference trip this summer.

The NIADA/NABD Convention and Expo, set for June 18-21 at the Rosen Shingle Creek Resort in Orlando, Fla., is a product of the National Independent Automobile Dealers Association’s acquisition of the assets and operations of the National Alliance of Buy Here-Pay Here Dealers, a deal that merged NABD’s conference and educational services into those of NIADA.

“We believe the combined Mega-Conference will be the largest in the used car industry and will provide unmatched resources for all dealers and allied industry partners,” NIADA chief executive officer Steve Jordan said. “Our goal is to provide a true one-stop shop for dealer education and specialized training for any automotive dealer business model, including the BHPH-specific topics and information you’ve come to expect from NABD over the past 19 years.”

In addition to NABD’s BHPH education, attendees can look forward to sessions offering training from the industry’s best and brightest in retail operations, compliance, certified pre-owned, business operations and much, much more.

It will also include the largest Expo Hall in NIADA Convention history, packed with more than 200 exhibitors offering the latest cutting-edge technology, products and services designed to help dealers stay on top of the ultra-competitive used car market.

NIADA acquired NABD on Dec. 14, completing more than two years of review, strategic discussions and due diligence and providing a succession plan for NABD, founded in 1998 by Ken Shilson.

“Success in this industry is about working together,” said Shilson, NABD’s president. “It’s about using our collective resources to help our members succeed. And that’s exactly what we’ve done here. We’re working together for the success of the used car industry, which is what this merger is about.”

NABD’s Ingram Walters agreed the deal embodies what NABD has always been about.

“Our goal at NABD has always been the dealers’ success,” Walter said. “This combination will provide even more basis for that and an ongoing plan for their success.”

The NABD staff will transition into NIADA and continue in expanded roles to serve the needs of NABD members, NIADA members and the BHPH industry.

“NABD has provided a strong voice and specialized educational resources to more than 14,000 members over the past 19 years,” Jordan said. “I am pleased that the NABD legacy will live on within NIADA as we continue to develop new ways to serve the entire used motor vehicle industry.”

A fall conference in Las Vegas is also under development, with plans to be announced in the coming months.

To register for the upcoming NIADA/NABD Convention and Expo or for more information, visit www.niadaconvention.com or www.bhphinfo.com.

Ken Shilson, president of the National Alliance of Buy-Here, Pay-Here Dealers, reported that more than 50 percent of the surveyed attendees who came to the recent Fall BHPH Conference had never been to an NABD event previously.

Evidently, those operators left Orlando, Fla., as quite satisfied customers.

“Attendee evaluations unanimously indicated that the program will help them succeed in 2018 and beyond,” Shilson said. “Our speakers and sponsors did an outstanding job and made the event one of the most popular conferences in our 20-year history.”

At least one of those attendees appears to be ready to come to future NABD conferences, as well.

“It was great. I found out I’ve been operating in the dark for a few years now. I will never miss it anymore,” said Ivan Tello of Irotema Holdings in Land O’Lakes, Fla.

Vincent Lewis of Crown Auto Sales & Finance of Charlotte, N.C., added, “The NABD Conference organizers truly understand the needs of the dealers. The BHPH business is a very diverse business.”

The three-day event with the theme, “Opportunity Knocks – Best Ways to Respond,” began with a session orchestrated by Shilson and NABD’s Ingram Walters that also featured BHPH Hall of Fame inductions of Rick Potter and Stan Schwarz, who made life-long contributions to the BHPH industry and were inducted posthumously.

The conference included 14 different concurrent workshop Sessions covering inventory acquisition and financing, national reconditioning survey results, ways to increase sales, F&I products for success, GPS collection tools, DMS software solutions, capital acquisition, integrated technology solutions, regulatory protection by state dealer associations, an accounting/tax update, maximizing recoveries, best underwriting practices and collection “hot spots” to avoid.

All these workshops were interactive so attendees could ask questions and get answers on these important topics.

“Great training. I came last year, and it is one of the best, more educational conferences I have attended,” said Kim Frederick of Motory Group in Gainesville, Fla.

“Don’t be good, be better. The NABD will help you and your business be better," said Irma Gamboa of Fresh Start Finance in El Paso, Texas.

Thomas Rainey, of McNair McLemore, Middlebrooks & Co., in Macon, Ga., added, “Very educational and informative. Learned a lot and realized there is a lot I need to learn.”

The event also featured a “first timer” reception with more than 150 attendees.

Another highlight was the charity auction of a customized golf cart donated by Manheim. The proceeds from the auction went to the hurricane relief fund established by the National Independent Automobile Dealers Association and the Texas Independent Automobile Dealers Association for the benefit of victims of these recent natural disasters.

NABD announced that a portion of the conference proceeds will be donated to the relief fund, too.

“The NABD Orlando conference continues to bring important information and training to the buy-here pay-here dealer attendees. As the industry continues to mature, the relationship between vendors and dealers becomes more critical. Thanks to NABD and NIADA for making conferences like this possible,” said Bill Murphy of Collateral Protection Insurance and Associates of Huntsville, Texas.

Conference presentations, photos and more are now available on NABD’s website at www.bhphinfo.com.