Payix co-founders Chris Chestnut and Preston Cecil made their debut on the Auto Remarketing Podcast and shared an array of observations and anecdotes from their clients about how finance companies are handling collections during the coronavirus pandemic.

Chestnut and Cecil also projected what factors could impact collections most during the remainder of this turbulent year.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

How about this for a change in our coronavirus-impacted world? Experts noticed some consistency in the latest auto-finance trends.

According to July auto-finance data Edmunds compiled and shared with SubPrime Auto Finance News, metrics such as term and the amount financed for both used- and new-vehicle financing held steady on a sequential basis.

And as of July 13, Equifax also told SubPrime Auto Finance News that portfolios continue to grow as the number of outstanding retail installment contracts stood at 79.19 million, up 1.6% from the previous week.

The balances connected with those contracts came in at $1.266 trillion, according to Equifax, also marking a 1.6% rise from July 6 to July 13.

Edmunds indicated that average used-vehicle finance terms for paper booked in July came in at 67.4 months with the average down payment registering at $3,722, resulting in the average balance coming into a portfolio being $22,702. For June, Edmunds reported those figures were 67.3 months, $3,167 and $22,337.

On the new-car side, Edmunds pegged the average term for paper financed in July at 70.1 months with $4,486 in average down payment and an average balance of $34,733 coming into a portfolio. In June, Edmunds had those new-vehicle financing averages at 69.9 months, $4,451 down and $34,911 in outstanding balance.

Perhaps what might be even more encouraging are the delinquency readings Equifax shared.

Again as of July 13, Equifax said the severe delinquency rate — the share of balances 60 days or more past due stood at 0.89%, representing a 2.4% decrease from the previous week and 34 basis points lower than what analysts spotted at the end of February.

“Overall, delinquency rates have been rising slowly over the past nine years (since 2011) with regular seasonal variations. Relative to historical values delinquencies are still low, less than rates seen in the first quarter of 2010,” Equifax said while mentioned the recession peak delinquency rate was 1.58% in February 2009.

Along with its director giving testimony to both House and Senate committees, last week also included the Consumer Financial Protection Bureau issuing a request for information (RFI) to seek public input on how best to create a regulatory environment that expands access to credit and ensures that all consumers and communities are protected from discrimination in all aspects of a credit transaction.

The bureau reiterated that the Equal Credit Opportunity Act (ECOA) and Regulation B make it unlawful for any creditor to discriminate against any applicant, with respect to any aspect of a credit transaction on the basis of race, color, religion, national origin, sex, marital status, or age; because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act.

“The information provided will help the bureau continue to explore ways to address regulatory compliance challenges while fulfilling the bureau’s core mission to prevent unlawful discrimination and foster innovation,” officials said in a news release.

The CFPB added the RFI is in lieu of a symposium the bureau had planned to host on ECOA issues this fall.

To read the RFI, go to this website.

Meanwhile, director Kathleen Kraninger also gave federal lawmakers updates when the Senate Banking Committee and the House Financial Services Committee conducted separate hearings. Kraninger offered details stemming from bureau’s spring 2020 semi-annual report, which included activities from last October through March.

“Clearly, the COVID-19 pandemic had a profound impact on the bureau’s work during the reporting period, one that will continue well into the future. These remain challenging times facing our nation and the world. Yet the uncertainty and dramatic change underscore the importance of the Bureau’s mission on behalf of American consumers,” Kranginer said.

Kraninger also mentioned that from Jan. 1 through July 26 consumers have submitted more than 270,000 complaints to the bureau and more than 14,000 complaints specifically reference coronavirus.

Each month from March through June also set a new monthly record for complaints, according to the CFPB director.

“Our consumer contact center and our online portal have operated efficiently and effectively throughout the pandemic to take consumer complaints and refer the complaints to companies for response,” Kranginer said.

While many of the developments that happened during the semi-annual report period involved the mortgage space, Kraninger also emphasized a CFPB activity that certainly can involve auto financing — its supervision authority.

“Supervision is the heart of this agency – something underscored by the percentage of our personnel and resources dedicated to conducting exams,” Kraninger said. “I am focused on ensuring we use this tool as effectively and efficiently as possible and that we apply it in a consistent way. Heading trouble off at the pass may not grab big headlines, but it will prevent a lot of headaches for consumers and industry.”

More details about the CFPB’s semi-annual report to Congress can be found here.

Ally Financial and Santander Consumer USA are just two examples of what Cox Automotive chief economist Jonathan Smoke said finance companies have been doing for the past four months amid the coronavirus pandemic.

Smoke said underwriting has tightened since April. Perhaps a reversal is not likely any time soon since the Labor Department reported on Thursday morning that initial claims for unemployment benefits rose for the second consecutive week, coming in at 1,434,000 and surpassing the 1-million threshold for the 19th week in a row.

The Labor Department did point out that the total number of people claiming benefits in all programs for the week ending July 11 was 30,202,498, a decrease of 1,601,699 from the previous week.

“The downturn has not fallen equally on all Americans, and those least able to bear the burden have been the most affected. In particular, the rise in joblessness has been especially severe for lower-wage workers, for women, and for African Americans and Hispanics. This reversal of economic fortune has upended many lives and created great uncertainty about the future,” Federal Reserve chair Jerome Powell said on Wednesday following a unanimous vote to keep interest rates unchanged.

No matter what the rate might be, finance companies do not appear to be booking every potential piece of paper that arrives in its underwriting department. Here is what Smoke wrote in a blog post on Wednesday following the Fed’s latest action.

“While credit remains available and has been supporting the recovery in retail vehicle sales, the composition of credit has been shifting towards higher credit tiers as lenders tighten standards and become more selective in which loan applications they approve. Likewise, even those with higher credit scores are seeing slightly higher rates and less beneficial terms than available in April and May,” Smoke said.

“The Fed’s actions have led to lower rates, and it looks like they will try to keep rates low,” he continued. “However, not everyone can get the lower rates, and credit tightening seems to be leading to modestly higher, not lower, auto loan rates. Combined with higher new- and used-vehicle prices, payments are likely to drift higher. Higher payments will limit the strength of demand and will likely remain this way as long as supply and credit conditions are tight.”

This week when Santander Consumer USA shared its second-quarter financial statement, chief financial officer Fahmi Karam explained how the finance company is approaching underwriting.

“I think it’s still prudent for us to take a cautious approach, similar to what we discussed, in April. We're seeing signs that things are improving. But there's a lot of signs that give us a lot of caution that, we should be very diligent in our underwriting,” Karam said.

“We mentioned this a few times. We have to appropriately price for the risk that we put on our balance sheet, and we have to monitor our risk-adjusted return,” Karam continued. “So for now, we still continue to be very cautious. We're going to be very disciplined in our underwriting approach and utilize all the different tools that we do to assess risk. I think you’ll continue to see that until we get further clarity on the market.”

Ally Financial chief financial officer Jennifer LaClair offered a similar anecdote when that company reported its Q2 performance earlier this month.

“Specifically, we increased manual underwriting in lieu of automated decisioning and adjusted our buy box across our riskiest credit segments. As we closed the quarter, we were pleased to generate higher year-over-year volume in June at an appropriate risk adjusted return,” LaClair said.

The credit availability for consumers with steady employment, solid credit histories and healthy income is even more pronounced, especially with offers made by captives.

According to the newest J.D. Power Auto Industry Impact Report, incentive spending per new unit retailed for the week ending July 26 was $4,230, an increase of $57 from the prior week. Analysts explained the week-over-week change stemmed mostly by supported lease and finance mix edging higher.

Despite rising take-rates for supported finance offers, J.D. Power also mentioned 84-month APR mix of all retail sales dropped 1.8 points to 6.5%, lower than pre-virus levels.

TransUnion is noticing that credit-performance metrics are starting to change as various actions taken by finance companies because of the coronavirus pandemic begin to run their initial duration.

A new TransUnion consumer credit snapshot released last week found the percentage of accounts in “financial hardship” started to level off for credit products such as auto financing, credit cards, mortgages and personal loans during the month of June. TransUnion explained some of this leveling off was due, in part, to accounts coming out of financial hardship status in June.

Analysts noted that accounts in financial hardship — defined by factors such as a deferred payment, forbearance program, frozen account or frozen past due payment — have largely kept delinquency numbers in check as consumers continue to navigate the ongoing impacts of COVID-19. For example, auto defaults are now at the lowest reading in 10 years.

TransUnion’s financial hardship data includes all accommodations on file at month’s end and includes any accounts that were in accommodation prior to the COVID-19 pandemic.

Analysts acknowledged accommodation programs have provided consumers with much-needed payment flexibility as external triggers such as rising unemployment and a decrease in government relief funds have started to shape the future outlook of the consumer wallet.

June Industry Snapshot of Financial Hardship Status by Credit Product

| Timeframe |

Auto |

Credit Card |

Mortgage |

Personal Loans |

| June 2020 |

7.21% |

3.57% |

6.79% |

7.03% |

| May 2020 |

7.04% |

3.73% |

7.48% |

6.15% |

| April 2020 |

3.54% |

3.22% |

5.00% |

3.57% |

| March 2020 |

0.64% |

0.01% |

0.48% |

1.56% |

| June 2019 |

0.40% |

0.02% |

0.47% |

0.26% |

Source: TransUnion

“In the early months of the pandemic, unemployment benefits and relief from the CARES Act gave consumers a bit of a cushion, leaving the consumer fairly well-positioned from a cash flow perspective,” TransUnion vice president of research and consulting at Matt Komos said in a news release.

“Lenders have been working with consumers during this time of uncertainty by extending financial hardship offerings that help them understand and manage their financial situation,” Komos continued. “These accommodations have been working as intended and have helped thwart a material breakdown in delinquency performance in the near-term.”

Since the pandemic began in March, TransUnion indicated delinquency performance has held steady, with credit products across auto, credit card, mortgage and personal loans all showing a recent month-over-month improvement in performance from May to June.

TransUnion also reported that credit cards saw the greatest decline in delinquency over this period with borrowers 90 days or more past due decreasing from 1.76% to 1.48% month-over-month. This decrease also held true for accounts in 30-day delinquency status — what analysts classified as an early indication of consumer distress — by decreasing from 3.06% to 2.66% from May to June. That movement is compared to the 30-day delinquency reading of 3.49% recorded last June.

Analysts went on to say consumer balances for credit card also showed a 7.41% year-over-year decline from June of last year to June of this year as well as a monthly balance decrease of $43 since May. TransUnion pointed out these decreases may signify that consumers are continuing to manage debt prudently and are paying down their existing card balances.

At the same time, TransUnion reported overall consumer credit lines have declined from $24,641 in June 2019 to $23,724 in June 2020, which is also down from $23,800 in May of this year.

“These are signs of a credit market that continues to function despite the spike in consumer unemployment,” said Paul Siegfried, senior vice president and credit card business leader at TransUnion.

“When there is uncertainty in the market, consumer credit performance is highly scrutinized and new accounts generally will not receive the same type of credit limit as they might have prior to a crisis,” Siegfried continued. “However, the longer individuals who are not in an accommodation program perform well, the more likely additional credit will be extended.”

June Industry Snapshot of Consumer-Level Delinquency Performance by Credit Product

| Timeframe |

Auto |

Credit Card |

Mortgage |

Personal Loans |

| June 2020 |

1.50% |

1.48%* |

1.07% |

3.11% |

| May 2020 |

1.55% |

1.76%* |

1.14% |

3.14% |

| April 2020 |

1.33% |

1.87%* |

1.27% |

3.27% |

| March 2020 |

1.37% |

1.96%* |

1.40% |

3.40% |

| June 2019 |

1.23% |

1.71%* |

1.36% |

3.10% |

*Credit card delinquency rate reported as 90+ DPD per industry standard; all other products reported as 60+ DPD. Source: TransUnion

Over the course of the pandemic, TransUnion said a substantial segment of consumers have continued to make payments but are also proactively engaging with their credit providers to discuss payment options.

TransUnion’s ongoing Financial Hardship Survey indicated that of consumers with a current financial accommodation on a loan, 32% are in favor of repayment plans that will allow for paying down debt gradually while continuing regular payments. A smaller percentage (18%) preferred paying off all postponed payments with a lump sum and 21% indicated they would like financial accommodations to be extended further.

“By many accounts, we are still in the early phase of the pandemic, and there is some uncertainty still around the nature of the economic recovery we may experience. It will likely be months before the financial impacts of COVID-19 begin to materialize from a credit performance standpoint, and some of this will be dependent on any additional government actions,” Komos said.

During this period of time, lenders will need deeper consumer insights to better calibrate risk across their portfolios and make more informed decisions,” he went on to say.

TransUnion’s June Monthly Industry Snapshot Report features insights on consumer credit trends around personal loans, auto financing, credit cards and mortgage loans.

Additional resources for consumers looking to protect their credit during the COVID-19 pandemic can be found at transunion.com/covid-19.

It is an interesting time for both lenders and borrowers. The impacts from COVID-19 have been unexpected and far reaching, raising questions for many lenders as their customers seek convenient and applicable repayment alternatives. As delinquencies rise or threaten to rise — creating concern and potential portfolio volatility — many lending businesses are searching for alternative ways to navigate this new normal. Moving toward a borrower-focused digital collections strategy is a safe route being traveled by many.

As a lender, what does it mean to have a digital collections strategy? While the term “digital-collections strategy” may seem vague at first pass, the key is to focus on the importance of meeting your borrowers wherever, whenever, and however they want to be met. This must be the backbone of any digital approach and is a foundation many lenders have not yet constructed or even considered.

When businesses evolved to adopt an online presence in the early 2000s, consumer communication and payment collection was barely an afterthought if given any thought at all. Companies by and large applied traditional “print” strategies and methodologies to the new online medium essentially focusing on brand and product advertising. As technology advanced and consumer trust grew, more businesses began harnessing the true power of the internet and started meeting, conversing, and ultimately transacting with their customers online. Apple released the first “smartphone” to the masses in 2007, and consumer engagement changed again — now people could conduct personal business from the palm of their hand from almost any place in the world. By 2015 smartphones had made it into the pockets and on the nightstands of most Americans, and the opportunity to redefine the collections experience for lenders and their customers became abundantly clear.

Giving borrowers the ability to engage lenders on their smartphones – away from home or work – was a positive dynamic shift, but we know that it is only one of many potential conduits for communication and repayment. Consumers expect more choices, and while lending institutions that employ just one or two digital lines of interaction will indeed see benefits, only companies with a comprehensive and cohesive digital strategy — one that transcends the traditional collector and borrower communication and repayment relationship by investing in an omnichannel borrower experience — will benefit the most.

At Payix, we’ve seen a clear trend with lenders utilizing our platform as part of their digital collections strategy to combat the impacts of COVID-19. Although anecdotal evidence points to industry-wide decreases in payment collections beginning in March and continuing through May, we saw a week-over-week drop through March — coinciding with the conclusion of tax season and start of the pandemic, a recovery in April (most likely due to government stimulus checks), and a return to baseline in May and into June.

In a pandemic state, when many people are hesitant to resume normal activities, a lender who invests in borrower-facing tools, designed to aid in communication and repayment, highlights a willingness to not only accommodate the needs of their customers, but also increases the probability of returning to pre-pandemic collection rates.

Relying solely on in-person payments to drive revenue, collecting a mailed check sent to an office address, or hitching a horse to a wagon as a means to get where you’re going — these are all things of the past. Companies with a digital platform that includes communication and collections solutions aimed at customers wrestling with the ever-changing complexities of this new world — these businesses are breathing easier today as the future continues to unfold.

Preston Cecil is the chief operating officer and co-founder of Payix. Offering white-label products and real-time loan management system integration, Payix helps lenders and loan servicers improve their ability to engage with borrowers and collect payments. More details are available at payix.net.

The ongoing COVID-19 pandemic is keeping the Federal Trade Commission busy.

Andrew Smith, who is the bureau of consumer protection director at the FTC, testified at a U.S. Senate hearing on Tuesday. Smith said that to date, the FTC has received more than 131,419 consumer complaints related to COVID-19, including complaints about the government’s economic impact payments.

According to the testimony Smith offered to the Senate Commerce Committee’s Subcommittee on Manufacturing, Trade, and Consumer Protection, the FTC has been monitoring consumer complaints and the marketplace for a variety of scams related to the COVID-19 pandemic.

He explained how scammers are seeking to take advantage of the pandemic in a variety of ways, including unsubstantiated health claims, robocalls, privacy and data security concerns, sham charities, online shopping fraud, phishing scams, work-at-home scams, credit scams and fake mortgage and student loan relief schemes.

“Alongside the health concerns presented by COVID-19, many consumers are facing substantial economic and financial hardships because of the pandemic,” Smith told the federal lawmakers. “These are also dire times for small businesses. The FTC has been on the lookout for frauds targeting financially vulnerable consumers and small businesses and is pursuing warning letters and law enforcement to protect them from further financial harm.

“Millions of American consumers lost their jobs because of the pandemic,” he continued. “With families to support, many consumers are seeking alternative ways to make money. We have redoubled our efforts to identify scam business opportunities that look better than they are.

“The FTC also recognizes that the financial hardships caused by the pandemic are not just limited to consumers,” Smith went on to say. “Small businesses have sought out relief and loans through the Paycheck Protection Program (PPP) or other programs authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act."

As of this week, Smith indicated the FTC and the Small Business Administration have issued eight warning letters to companies making claims that could lead consumers and small businesses to believe these companies are somehow affiliated with the SBA, that consumers and small businesses could get Payroll Protection Program loans by applying on their website, or otherwise misleading small business about federal loans or other temporary small business relief.

“As with deceptive health claims, the FTC believes that the fastest way to take down these false claims is by issuing warning letters. However, as always, in some cases, the FTC will pursue law enforcement,” Smith said in reference to the FTC filing a complaint on April 17 against one such company posing as an approved PPP lender.

“The FTC will continue to monitor the marketplace and will take action where appropriate to combat such frauds,” he added.

Smith closed his prepared testimony by reiterating the FTC’s objectives.

“The commission appreciates Congress’s confidence in the FTC’s ability to protect consumers, especially with the unique challenges presented by the current COVID-19 pandemic. Through our enforcement, education, and policy efforts, we will continue to ensure that your confidence is well placed,” Smith said.

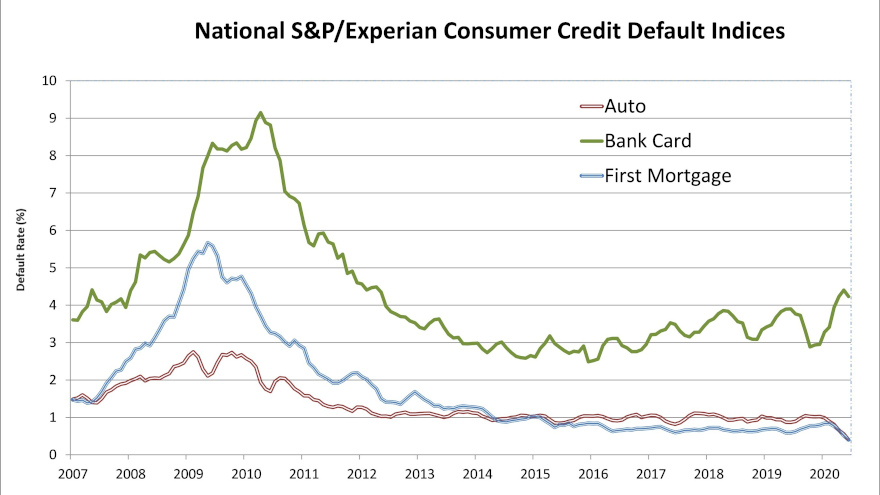

For what it’s worth amid so much uncertainty nowadays triggered by the coronavirus pandemic, auto-finance defaults are at the lowest point recorded by S&P Dow Jones Indices and Experian going back 10 years.

According the data through June released on Tuesday morning, the auto portion of the S&P/Experian Consumer Credit Default Indices dropped 16 basis points to come in at 0.40%; a reading less than half of what it was back in January.

For context, here is where the auto-default reading has stood at the year’s midpoint since 2010:

2019: 0.87%

2018: 0.93%

2017: 0.82%

2016: 0.91%

2015: 0.85%

2014: 0.96%

2013: 1.00%

2012: 1.04%

2011: 1.29%

2010: 1.70%

It’s highly likely the newest default reading is so low because of how many contracts have been modified by finance companies for consumers who have been impacted financially by the pandemic. Both Kroll Bond Rating Agency (KBRA) and S&P Global Ratings discussed their finding on that topic that SubPrime Auto Finance News recapped in this report.

Turning back to defaults, analysts found the composite rate of the S&P/Experian Consumer Credit Default Indices that represent a comprehensive measure of changes in consumer credit defaults declined 12 basis points in June to settle at 0.66%.

Analysts went on to mention the bank-card default rate fell 17 basis points to 4.23%, and the first mortgage default rate decreased 11 basis points to 0.41%.

Looking at the June data within the five largest metropolitan areas, the S&P/Experian Consumer Credit Default Indices indicated four of the cities posted sequential declines in June.

Chicago generated the largest decrease, dropping 14 basis points to 0.69%. Dallas was right behind, falling 13 basis points to land at 0.66%, while New York dropped 9 basis points to settle at 0.74%.

Analysts said Miami came in 3 basis points lower to register at 1.40% in June. However, they pointed out that Los Angeles went in reverse as its rate edged 2 basis points higher to 0.72%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

Kroll Bond Rating Agency (KBRA) and S&P Global Ratings continued to use their examinations of the U.S. auto loan asset-backed securities (ABS) market to offer a look not only at that particular segment but also views on what the overall health of auto financing might be.

Beginning with S&P Global Ratings, analysts there said May brought what they called “a glimmer of hope” for the auto ABS market with a substantial reduction in extension rates, which appear to have peaked in April, according to their latest report.

For prime paper, S&P Global Ratings indicated the extension rate dropped 62.5% to 2.16% in May from 5.76% in April.

For the four subprime auto ABS shelves the firm watches — AmeriCredit, Santander's DRIVE and SDART and World Omni's Select — S&P Global Ratings said extensions dropped 43.5% to 8.9% from 15.7%.

S&P Global Ratings attributed the tremendous decline in new extensions in May to a number of factors, including:

• The lifting of stay-at-home orders brought some furloughed employees back to work.

• The government's enhanced unemployment benefits of $600 per week gained momentum after initial delays at the state level.

• Stimulus/relief checks of up to $1,200 were received by many consumers.

• Some of those who needed hardship relief in March or April received multi-month-long extensions, thereby obviating the need for another extension in May.

“However, even with May's drop in deferments, the percentage of loans receiving extensions remained higher than February's pre-COVID-19 levels. Further, for some issuers, the percentage of their pools in extension status remains high at 10% or more,” S&P Global Ratings said.

“The big question at this point is whether loans, when they come out of extension status, will be able to resume normal payments,” S&P Global Ratings continued. “This will depend upon how quickly the COVID-19 spread can be contained and business activity can more fully resume, unemployment levels and whether enhanced unemployment benefits, namely the extra $600 per week, remain intact or are replaced with some other form of additional income to compensate those who remain out of work due to the pandemic.”

Meanwhile, KBRA determined June remittance reports showed improving securitized auto finance delinquencies during the May collection period.

Analysts indicated early-stage delinquencies (30 to 59 days past due) fell 10 basis points month-over-month and 44 basis points year-over-year to 0.70% in the KBRA Prime Auto Loan Index, while the percentage of non-prime borrowers in the early stages of delinquency fell to 5.87%. That’s down 105 basis points month-over-month and 260 basis points year-over-year.

KBRA discovered later-stage delinquencies (60 days or past due) also dipped month-over-month in both indices, but the decreased were more modest.

Furthermore, as fewer contract holder have become delinquent over the past few months (resulting in fewer defaults), KBRA went on to note that both indices posted a month-over-month and year-over-year decline in annualized net loss rates.

“As discussed last month, we believe enhanced unemployment benefits and federal stimulus checks likely helped some borrowers catch up or stay current on their auto loan payments,” KBRA analysts said in their latest report.

“The large percentage of borrowers receiving payment relief during the month (in the form of loan extensions) was also likely an important driver in keeping delinquency rates subdued,” analysts continued.

While S&P Global Ratings indicated they might have peaked in May, KBRA asserted that the percent of non-prime borrowers enrolled in a hardship assistance program continued to climb in June, reaching 23.09% or up 451 basis points month-over-month and 1,952 basis points year-over-year, while the percent of prime borrowers enrolled in an assistance program remained relatively flat, at 8% in June, up 15 basis points month-over-month and 748 basis points year-over-year.

KBRA wrapped its analysis by reviewing June’s asset-level disclosures that showed mixed credit metrics during the May collection period.

Analysts found that the percentage of prime and non-prime contract holders who went from 30+ days delinquent to current dropped 649 basis points to 40.9% and 101 basis points to 39.8%, respectively, versus the previous month, but are still well above pre-pandemic levels.

Finally, the percentage of prime contract holders who rolled from 60 days or more past due to charge-off rose 377 basis points to 17.4%, while the percentage of non-prime contract holders moving from 60-day delinquency to charge-off increased 9 basis points to 20.1%.

Confession time. While taking some graduate degree courses, I struggled mightily with the statistics class.

The thought of standard deviations and Z tables still makes me twitch a little.

Nonetheless, I took a few moments on Thursday morning to examine the latest update on unemployment insurance weekly claims compiled by the U.S. Department of Labor. As finance companies certainly know, without gainful steady employment, their contract holders are going to struggle to maintain payment frequency.

The Labor Department said that for the week ending July 11, the advance figure for seasonally adjusted initial claims came in at 1,300,000, a decrease of 10,000 from the previous week’s revised level. The reading marked the seventh week in a row that weekly claims landed below 2 million. But it’s still been 18 consecutive weeks of claims above 1 million, including the spikes of 6.9 million on March 28 and 6.6 million on April 4.

I’m literally shaking my head after typing those statistics trigged by the coronavirus pandemic.

Some experts and politicians are saying the economy is improving and individuals are going back to work. Again, the Labor Department data shows some wobbly trends.

Federal officials also compile how many persons are claiming unemployment insurance. Here is a rundown of the last five readings, deriving from the week that ended the measurement timeframe along with the week-over-week change.

— June 27: 32,003,330, down 433,005

— June 20: 32,922,335, up 1,410,788

— June 13: 31,491,627, up 916,722

— June 6: 30,553,817, up 1,294,309

— May 30: 29,165,753, down 350,326

Again, acknowledging that statistics are not my strong suit, perhaps my assertion here is a bit skewed. But if weekly unemployment claims are growing faster than individuals coming off of programs and going back to work, this pandemic is still wrecking the economy beyond any previous measurement ever recorded.

What’s even more concerning, in my opinion, is unemployment insurance enhanced by the federal government through the CARES Act is set to expire this month.

There’s little doubt that the extra $600 per week individuals are collecting via unemployment insurance might have kept some retail installment contracts current.

While not as firm as the Labor Department data, ParentsTogether, a national parent-led organization with more than 2 million members, released the results of a survey of more than 1,500 parents from around the country, highlighting the impact the coronavirus crisis is having on families and children. The survey found that, as CARES Act funding ends this month, more families say they are struggling now than in March and April.

According to the survey results distributed this week, 70% say their “family is struggling,” up from 58% in March and 61% in April. Of those who believe they should be eligible for unemployment, 60% have not received any payments.

Some of the comments ParentsTogether shared from survey participants paints an even bleaker scene.

“I am alternating paying all my bills. It just depends on what I have in the bank for that month. A few bills I have had to skip longer than a month or two, such as water and garbage bills and I have been able to get some more time, but it only puts me further behind. I need to be able to go back to work full time and get some overtime to catch up completely,” a woman from Oregon said.

Another woman from Texas added, “I stopped paying all credit cards, had to choose between credit card payments or food/electricity. I have vulnerable family members and cannot return to work until COVID-19 cases drop, our local hospital is currently at 100% capacity. I have no health insurance and am scared to death of catching this virus, with underlying health conditions it could be lethal.”

A sincere round of appreciation to all of the finance companies who are working with customers who are in situations like described in the ParentsTogether survey. Customer-service representatives are likely to be offering assistance for some time.

“Last month’s optimism as businesses were reopening has since given way to concerns over reinforced shutdowns, announced delays in school openings and growing consumer fears. A smooth path back to normal was never likely, but it will still leave consumers and businesses more cautious until a vaccine is ready and widely available,” said Curt Long, chief economist and vice president of research for the National Association of Federally-Insured Credit Unions (NAFCU).

Nick Zulovich is senior editor of SubPrime Auto Finance News and can be reached at [email protected].