You likely weren’t overreacting if it seemed like it was more difficult to get your dealership’s contracts bought last month.

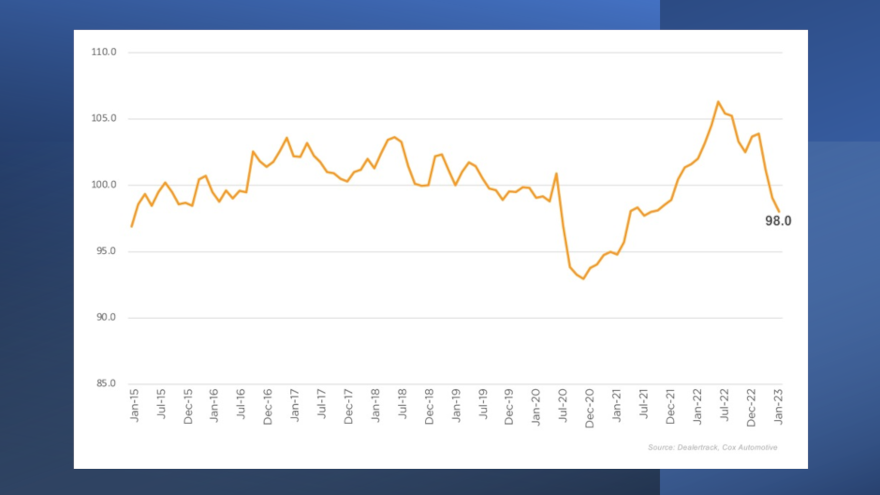

Cox Automotive reported access to auto credit tightened again in January, according to the Dealertrack Credit Availability Index for all types of auto financing.

The index declined 1% to 98.0 in January, reflecting that auto credit was harder to get in the month compared to December.

Analysts said the decline in access reflected conditions that were tightest since …

Read more

Last week, Informativ announced a new, complete, and proactive credit and compliance offering.

The service provider that includes Credit Bureau Connection (CBC), Dealer Safeguard Solutions and CreditDriver said this revamped solution brings together innovative, mobile-first consumer credit prequalification and lead generation,

This proactive vehicle sales compliance solution that protects dealerships from costly violations of the FTC’s expanded Safeguards rule, as well as reliable and comprehensive credit reporting and compliance support.

“A great deal is at stake for dealerships as they navigate new and expanded FTC guidelines,” said Informativ CEO David Carner, whose company provides more than 7,000 automobile dealers and other businesses with credit-focused lead generation, credit reporting and compliance solutions.

“Our technology works together from the moment a lead is captured using QR code technology and the consumer’s mobile device identification, to deliver enriched data to dealerships, protect against fraud and enforce a complete and proactive compliance process, both in-store and online, from the sales floor to F&I, and beyond, so dealers can stop hoping they’re compliant, and instead, start knowing they’re compliant,” Carner continued in a news release.

Informativ’s credit and compliance technology, Credit Bureau Connection and Dealer Safeguard Solutions, are geared to enable a proactive, consistent and enforceable process on in-store and remote deals that protects consumer data, follows federal guidelines, prevents dealerships from violations that can result in devastating fines, and supports a seamless, faster sales process as there is less paperwork to handle.

Andy Graff is chief technology officer and vice president of innovation at Galpin Motors.

“My team says, ‘Please, whatever you do, don’t take it (Dealer Safeguard Solutions) away because it’s helping us sell cars faster, more compliant’,” Graff said in the news release. “It’s also creating a great experience for our customers.”

Informativ added that its lead generation and prequalification technology focuses on a mobile-first experience, which can lead to 30% higher conversion rates compared to website prequalification.

By leveraging a buyer’s mobile phone carrier data once a dealership’s unique QR code is scanned, information can be quickly and easily collected and provided to the dealership, including the lead source.

“Attaching Informativ’s QR code technology to our existing advertising has been a gamechanger,” said Mike Lopretta, general manager of Razzari Ford. “We picked up 58 additional leads on our first campaign alone.”

Visit www.informativ.com for additional information.

While Cox Automotive mentioned that overall consumer sentiment has been steadily improving, TransUnion discovered the youngest generations continue to be more optimistic about their financial future in the next 12 months than their older counterparts.

The latest TransUnion Consumer Pulse study indicated that two in three Gen Z and millennials remain optimistic compared to …

Read more

Shopping for a vehicle comes with all kinds of stressors for a consumer — some of which can affect their relationship with the dealer and lender. The decision to require a shopper to undergo a credit verification can be stressful for many consumers — for different reasons

Some consumers are worried about the score that will come back on the other end. Some are worried if the score will be high enough to qualify them for the car or truck they’re really hoping to get. Others aren’t so much worried about the score that will come back, but they are worried that the act of running their credit specifically will “ding” their credit a little.

Why are soft pulls so effective today?

These reasons are why soft-pull credit checks are so effective today. A soft pull credit check is similar to a simple background check. It allows the dealer and lender to review a shopper’s credit score and financial standing but it does not impact their credit score.

Soft pulls are important to dealers and lenders for multiple reasons. Perhaps a shopper is unsure if they can afford a specific car or truck because of reduced cash flow during the pandemic. A soft pull can alert them to their status if they’re pre-approved before moving forward with financing options.

Soft pulls can strengthen consumer confidence and trust in making the right decision, and since they aren’t locked into anything they can resume shopping and even assess varying price ranges. They can also be beneficial to those who may be a little less confident about their credit standing. Perhaps they acknowledge their credit is poor but their vehicle has broken down and don’t have to worry about having their credit “dinged” while reviewing exactly what they can afford next.

Soft pulls are a necessity with digital retailing

Sure, for all of these reasons dealers and lenders should be offering soft pulls. However, when you consider the era of Digital Retailing we’re now in, soft pulls are no longer a preference – they’re a must.

Research from SalesForce says that in a survey of 7,000 consumers, 53% would share personal data in exchange for a personalized shopping experiences1. Why is this important? Because today’s digitized car shopping process is all about personalization.

This means soft pulls combined with a “credit-first strategy” are imperative to the success of every dealer and transaction today. A fully personalized digital retailing system requires accurate monthly payment quoting — early on in the shopping process. Everything from vehicle selection, financing, credit eligibility, and trade-in valuations can affect a person’s payment composition. Obtaining credit at the beginning of the digital retailing process ensures a true personalized shopping experience that will help close more deals.

Credit-first and soft pulls work together

The right credit-first strategy, combined with a soft-pull approach is now enabling more seamless transactions in today’s digitized world of sales. Soft-pulls work in concert with the credit-first approach and do not require a customer’s date-of-birth nor social security number. With just the customers’ name and address, soft-pulls allow an early-stage snapshot of the customers’ credit profile, and insights into their buying power before you start building any deal.

With interest rates changing more frequently right now, establishing the right credit tier and payment options early on in the shopping process will benefit everyone involved and build more trust into the process. There is nothing worse than a customer assuming or estimating the payment in his or her mind throughout the transaction process, only to learn just how much changed interest rates may affect the final deal inside the F&I manager’s office at the end.

Where soft pulls benefit other areas of a dealership

Aside from today’s digital shopping process, soft pulls can also benefit dealers in the service lane. Combined with solutions that include equity calculators, smart dealers are now easily integrating these features into their daily workflows as a way to build additional conquest opportunities.

These additional tools built with soft-pull technology are helping dealers and service managers offer quick valuation calculations to show customers how and where it might make sense to consider a new vehicle on the lot compared to the repair bill. This certainly benefits the customer make a wise decision, but it also helps dealers conquest a customer that may not originally be theirs, along with additional used and pre-owned inventory.

Trying to build a digital retailing system for your dealership without soft pull technology is like building a car without tires. It might look nice, but you won’t get anywhere anytime soon.

Ken Hill is managing director for 700Credit, a leading provider of credit reports, compliance, identity verification and soft pull products. For more information, visit www.700credit.com.

We wrap up our series of podcasts recorded during this year’s Non-Prime Auto Financing Conference, hosted by the National Automotive Finance Association, with a visit with Davis + Gilbert partner Joseph Cioffi.

Cioffi, who also runs the Credit Chronometer, discussed where risk is now percolating and how finance companies are handling it.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Cox Automotive and Comerica Bank each shared upbeat economic and financing trends that should be welcomed by dealerships and finance companies.

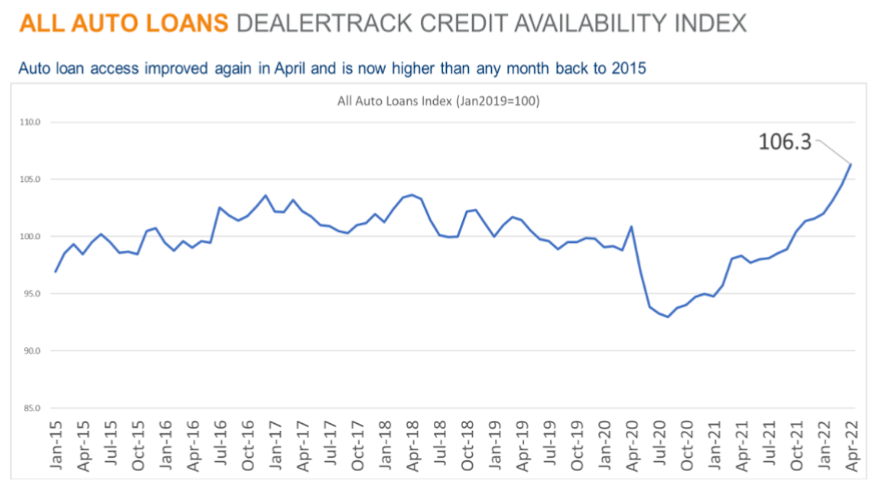

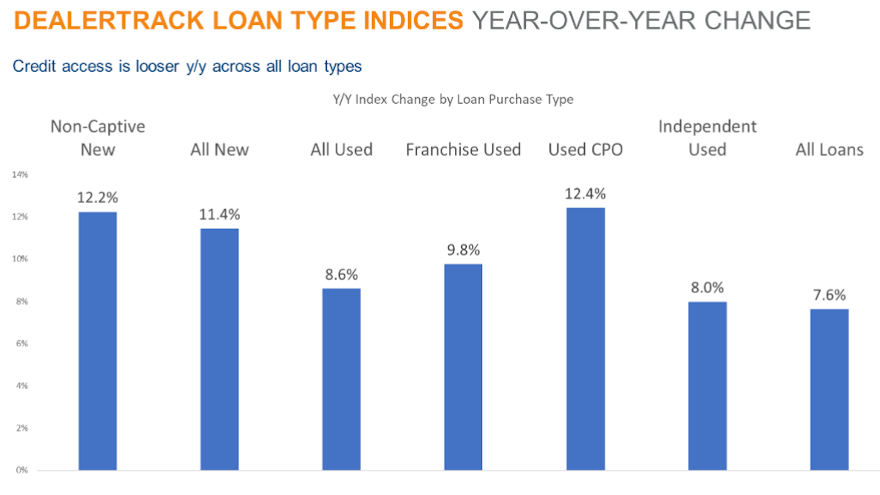

First on Tuesday, Cox Automotive said access to auto credit expanded again in April, according to the Dealertrack Credit Availability Index for all types of auto financing.

Read more

The ninth edition of the Reality Check: Paycheck-To-Paycheck research series, conducted by LendingClub Corp., in partnership with PYMNTS.com, showed that close to two-thirds of the U.S. population — 64% or about 166 million adults — were doing so in March. That’s similar to the reading reported from the January survey.

But the newest research installment was the credit edition, which examined the growing shares of U.S. consumers in

Read more

The newest global study by TransUnion showed how much credit is being utilized, especially by individuals classified as either credit unserved or underserved.

TransUnion reported on Thursday that more than 45 million consumers are considered to be either credit unserved or underserved in the United States.

However, TransUnion’s study determined that about one in four consumers — 24% to be exact — who started as credit underserved were found to have migrated to becoming credit active in a two-year window prior to the pandemic.

During the height of the pandemic, TransUnion also noticed that the percentage of consumers becoming more credit active decreased slightly to 22%, with the profile of those consumers skewing younger than the pre-pandemic sample.

In addition to the United States, the TransUnion global study titled, “Empowering Credit Inclusion: A Deeper Perspective on Credit Underserved and Unserved Consumers,” observed consumer credit behavior in Canada, Colombia, Hong Kong, India and South Africa. TransUnion said in a news release that the company compiled the study to get a better sense of the market size of these unserved and underserved consumer segments.

“Our study clearly points to hundreds of millions of consumers around the globe being credit unserved or underserved,” said Charlie Wise, senior vice president and global head of research and consulting at TransUnion. “These credit disadvantaged consumers are often unable to access financial products and services because they have no, or little, credit history.

“This study served to better understand how many people are truly under- or unserved from a credit perspective, while also determining paths for them to gain more credit opportunities,” Wise continued in the news release.

TransUnion explained the study explored the characteristics and behaviors of credit unserved and underserved consumers and their overall sentiments toward credit, while offering key insights into the credit journeys of these consumers.

Analysts pointed out that unserved consumers are defined as any person who has never had an open traditional credit product (such as a credit card, personal loan, or auto financing, to name a few) as reported on the TransUnion consumer credit database.

TransUnion also noted the underserved population has minimal credit participation, limited to a single type of credit product and no more than two open accounts of that type, and have been active in the credit market for at least two years.

This study specifically excluded new-to-credit consumers — those who have opened their first product within the past two years — from the underserved population, as many of those new-to-credit consumers become more fully credit active soon after opening their first product.

According to TransUnion, the study sought to understand those consumers who remain unserved or underserved over a longer time period.

Analysts said two cohorts of consumers were studied, each over a two-year time period. The first was during the pre-pandemic period beginning March 2018 through March 2020, and the second beginning in June 2019 and studied through the pandemic time period of June 2021.

TransUnion wanted to determine if there were any pandemic-related shifts with consumer credit migration trends.

While some unserved consumers (also called credit inactive consumers) may have traditional credit scores when they open their first credit product, analysts noted that many consumers do not.

Wise explained this lack of a credit score and any history of credit activity is an impediment for these unserved consumers to get their first credit product, as many finance companies are hesitant to extend credit to consumers without any credit history or score.

For these traditionally unscorable consumers, Wise said they face a “chicken or egg” conundrum of how to get that first credit product when they lack a credit history.

“This reality underscores the importance of incorporating alternative data into the financial ecosystem so that fewer consumers find themselves as credit invisible. Once these consumers can be evaluated by financial institutions, lenders can better determine where there might be new opportunities for growth and how they can expand credit inclusion,” Wise said.

The study also found that consumers who migrated from underserved to served (opened at least one new product type) over the two-year period had more inquiries — applications for new credit — than consumers who remained underserved.

While some of that higher inquiry activity was attributable to the fact that they opened new accounts, TransUnion indicated the overall higher level of inquiry activity by those consumers who migrated to the served segment implies that these consumers have a significantly higher demand for new credit, and that this demand is not necessarily being met by lenders and finance companies.

“The number of new credit inquiries were materially higher for consumers that migrated to served compared to consumers who remained underserved,” Wise said. “These consumers appear to want more credit, but they are not necessarily able to access the credit they want, potentially due to their limited credit history. This highlights a missed opportunity for lenders who are seeking to grow and add new customers.

“Many of these underserved consumers would likely be well-performing and profitable borrowers, but because of their limited credit history, lenders are reluctant to extend them credit,” Wise added. “Incorporating alternative data on consumers into lending decisions could enable lenders to get a fuller picture of the financial capacity of underserved consumers and make credit available to more of them.”

To learn more, TransUnion is offering a webinar titled, “Addressing Credit Needs of Underserved Consumers.”

For more information and insights from the global TransUnion study, “Empowering Credit Inclusion: A Deeper Perspective on Credit Underserved and Unserved Consumers,” you can download the report via this website.

Access for all types of auto financing expanded in January, according to the newest Dealertrack Credit Availability Index.

But change might be coming with the likelihood of interest rates rising, with one economist calling it a “coin toss” as to how much the increase will be when the Federal Reserve announces its decision next month.

Cox Automotive reported that the Dealertrack Credit Availability Index increased 0.4% to 102.0 in January, reflecting that auto credit was easier to get in the month compared to December.

Analysts said access was looser by 7.6% year-over-year. And compared to February 2020, Cox said availability was looser by 2.9%.

Furthermore, analysts said the last time the time Dealertrack Credit Availability Index was this high was November 2018.

“A key reason for the improvement in credit availability in January was that the average yield spread on auto loans narrowed to the lowest level since January 2018,” Cox Automotive said in its index report.

“Even though the average auto loan saw a higher rate in January compared to December, bond yields increased by a larger amount, resulting in the lower observed yield spreads,” analysts continued.

“Credit access also improved across lender type in January with auto-focused finance companies having loosened the most,” Cox added. “On a year-over-year basis, all lenders had looser standards with auto-focused finance companies having loosened the most.”

Each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and loan details including term length, negative equity and down payments.

The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Across all auto lending in January, yield spreads narrowed, and terms lengthened, and the moves in those factors made credit more accessible,” Cox Automotive said. “However, down payments increased, the approval rate declined, and the negative equity share declined, and the moves in those factors made credit less accessible.

“The subprime share was unchanged in January from December,” analysts added.

Cox Automotive mentioned some other trends that can play a factor in auto financing, noting first that consumer sentiment fell in January.

Analysts recapped that consumer confidence declined 1.2% in January, according to the Conference Board, erasing some of December’s 2.9% gain. The movement left confidence down 14.2% compared to February 2020.

“The underlying measures of present situation and future expectations moved in opposite directions as present situation declined but future expectations improved,” Cox Automotive said. “Plans to purchase a vehicle in the next six months increased to the highest level in six months and was higher than a year ago. Plans to purchase a home also improved to a record level.”

Analysts also pointed out that the sentiment index from the University of Michigan declined 4.8% in January as both current conditions and expectations declined.

The Michigan reading was the lowest since November 2011, according to Cox.

Analysts went on to mention that the Morning Consult daily index of consumer sentiment declined 2.1% in January, leaving it down 3.3% year-over-year and down 24.1% from the end of February 2020.

Meanwhile, Comerica bank chief economist Bill Adams also chimed in with a discussion about interest rates and what the Federal Reserve might do.

“With economic activity looking resilient to Omicron in early 2022, inflation gaining momentum, and energy prices rising, the Fed is pivoting rapidly to withdraw stimulus from the U.S. economy,” Adams said in an analysis released on Thursday.

Adams recounted that the minutes of the Federal Open Market Committee’s meeting on Jan. 25-26 lay out a potential FOMC course for the Fed to start shrinking their balance sheet later this year.

Adams also explained that the meeting minutes reaffirm that asset purchases (known as quantitative easing or QE) will end in March. He recapped that the FOMC said, “participants generally noted that current economic and financial conditions would likely warrant a faster pace of balance sheet runoff than during the period of balance sheet reduction from 2017 to 2019 and a number of participants commented that conditions would likely warrant beginning to reduce the size of the balance sheet sometime later this year.”

The Comerica Bank expert closed by stating the FOMC minutes confirm that a federal funds rate hike is very likely at the FOMC’s next meeting on March 15 and 16, but “shed no light on whether members are considering a 0.50% hike (as opposed to a ‘normal’ 0.25% hike).

“By extension, FOMC members’ recent discussion of a 0.50% hike in public statements could be part of a deliberate strategy to guide the public’s expectations toward a half percentage point hike. Comerica Economics sees the March rate decision as a coin toss between a 0.25% hike and a 0.50% hike,” Adams went on to say.

It’s a challenge non-prime and subprime auto finance companies face regularly inside their underwriting departments. An application lands from a consumer with a thin credit file or one who isn’t scored at all.

Experian and Oliver Wyman recently found expanded data and advanced analytics can improve access to credit for nearly 50 million credit invisible and unscoreable Americans

The companies said their new research outlined the challenges consumers face when trying to access credit, how the financial services industry can increase financial inclusion and score 96% of applicants

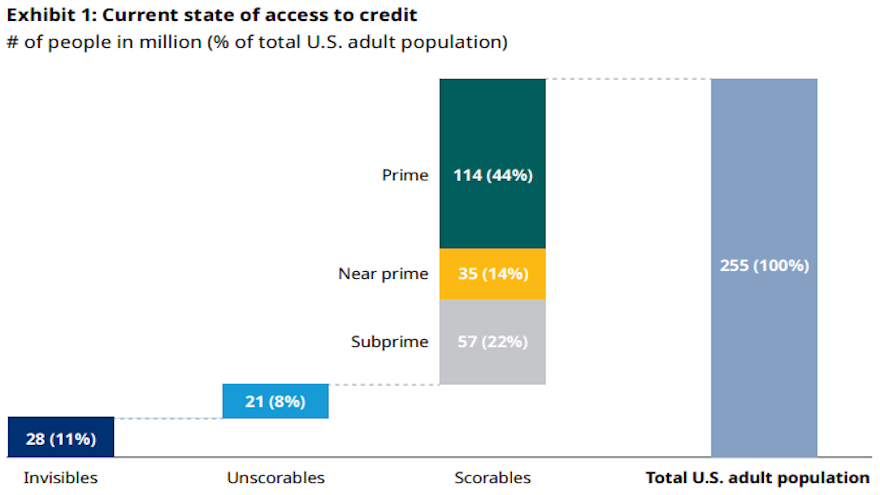

Nearly 106 million U.S. consumers are unable to secure credit at mainstream rates either because they are credit invisible, unscoreable by conventional credit scores, or have a subprime or below credit score, according to new research recently released by Experian and Oliver Wyman.

The research showed that by using expanded data sets such as rental payments, trended data, utility information and more and advanced analytics in their decisioning, finance companies can improve access to credit for nearly 50 million credit invisible and unscoreable consumers, as well as millions of consumers currently considered subprime.

“We are committed to providing lenders with the right tools and insights to drive financial inclusion and have seen significant progress in recent years with many leading lenders leveraging expanded Fair Credit Reporting Act regulated data and advanced analytics,” said Greg Wright, chief product officer and executive vice president at Experian Consumer Information Services. “Yet, as an industry, we can and must do better to ensure more consumers can access financial services at affordable rates.

“While the findings show we are moving in the right direction, financial access depends on complete industry adoption of new data and insights as well as business practices that proactively address the historical gap that’s existed in serving more consumers,” Wright continued in a news release.

Experts acknowledged that access to fair and affordable credit can help consumers get a college degree, buy a vehicle or home, start or expand a business and ultimately help establish careers, build wealth and achieve greater financial success. Yet, in financial inclusion and access to credit, Experian and Oliver Wyman found just 42% of the adult population lacks a conventional credit score in the range that would typically enable access to credit at mainstream rates.

Additional key findings Experian and Oliver Wyman research include:

— 19% of American adults do not have a conventional credit score. This figure includes 28 million adult Americans who are credit invisible and 21 million who are unscoreable. An additional 57 million have subprime or below credit scores

— Credit invisibility more frequently impacts underserved communities with 26% of Hispanic consumers and 28% of Black consumers unscoreable or invisible compared to 16% of White and Asian consumers

— Credit invisibility often impacts younger consumers, with 40% of credit invisibles in the United States being below the age of 25

— Immigrants and consumers from low-income neighborhoods are more likely to face barriers in accessing mainstream financial services

The report explained that finance companies can expand access to credit for currently underserved consumers by increasing the number of consumers they can assess and by improving their ability to identify the true credit quality of borrowers. Leveraging expanded data, or nontraditional credit data, and advanced analytics can help lenders achieve both.

According to Experian’s research, when advanced analytics and machine learning are combined with expanded data sets as they are with Experian’s Lift Premium score, 96% of applicants can be scored, including an estimated 65% of the credit invisible population and the entire conventionally unscoreable population.

Wright added this level is significantly greater than the 81% of consumers that can be scored by conventional scores.

In addition, 6 million consumers whose conventional scores are subprime could be upgraded to near-prime or above based on the expanded data used in the score, according to Experian.

“Now is the time to begin leveraging sophisticated tools like Experian Lift Premium to ensure all consumers can get the credit they deserve,” Wright said.

The report also pointed out increased opportunities to further drive financial inclusion with expanded data sets, including utility payments, rental payments, consumer permissioned data and bank account data. One example noted is Experian Boost.

Since launching in 2019, nearly 9 million consumers have enrolled in Experian Boost to improve their credit scores by adding their on-time cell phone, utility and video streaming service payments directly to their Experian credit file.

Experian and Oliver Wyman noted that finance companies increasingly can utilize not only their own relationship banking data, but consumer-permissioned data from other financial accounts to improve their credit decisions.

They said the use of consumer-permissioned data in underwriting — once the exclusive province of fintech disruptors — is expanding among mainstream finance companies.

“Responsibly expanding access to credit is both an untapped business opportunity, and a chance to have positive social impact in our communities and with historically disadvantaged groups,” Oliver Wyman partner Mike Hepinstall said in the news release.

“Better identifying and serving creditworthy customers is an opportunity to grow while doing good.”

To download the complete report, go to this website.