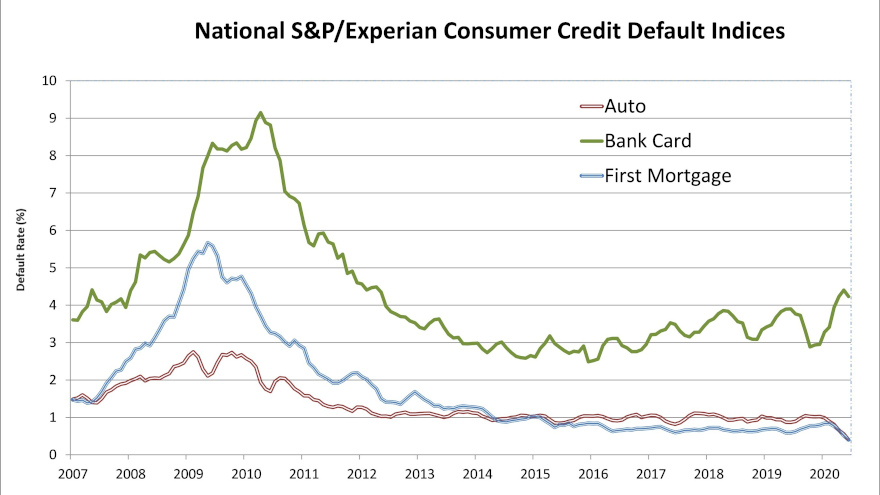

Auto defaults are moving counter to other credit segments.

Auto defaults rose for the fifth consecutive month in November, according to the S&P/Experian Consumer Credit Default Indices, but they are still below the reading that analysts pinpointed before the pandemic started.

On Tuesday, S&P Dow Jones Indices and Experian released data through November, showing that the auto-default rate rose 5 basis points to come in at 0.64%. The rate bottomed out at 0.40% in June, while in February, it stood at 0.89%.

For comparison, last November’s rate was 1.02%.

Meanwhile, S&P and Experian reported that their November composite rate — representing a comprehensive measure of changes in consumer credit defaults — actually dropped 7 basis points to 0.46%.

Analysts added that the bank card default rate fell 24 basis points to land at 2.56%, and the first mortgage rate dipped 7 basis points lower to 0.28%.

Looking at the top five metropolitan areas, S&P and Experian discovered each one registered a decline in November compared to the previous month.

Miami produced the largest decrease, dropping 27 basis points to 0.86%. New York came in 17 basis points lower at 0.41%, while Los Angeles’ rate fell 16 basis points to 0.37%.

While not as much, analysts added that the rate for Dallas dropped 5 basis points to 0.56%, while Chicago dipped 4 basis points lower to settle at 0.54%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

As contract extensions and other accommodations by finance companies continue to expire, auto defaults continue to rise.

According to data through October released by S&P Dow Jones Indices and Experian, auto defaults now have climbed for four consecutive months after bottoming out a record low in June at 0.40%.

Analysts pegged the October reading at 0.59%. Back in January before the pandemic arrived, they said auto defaults stood at 0.99%.

And looking back 10 years ago as auto financing still was rebounding from the Great Recession, S&P Dow Jones Indices and Experian had auto defaults at 2.04%.

Meanwhile, the other parts of the newest S&P/Experian Consumer Credit Default Indices continue to decline.

The composite rate, which represents a comprehensive measure of changes in consumer credit defaults dropped 10 basis points to 0.53%.

Analysts said the bank card default rate fell 20 basis points to 2.80%, and the first mortgage default rate decreased 11 basis points to 0.35%.

Looking at the default data with the five largest metropolitan areas, S&P and Experian discovered they all dropped in October compared to the previous month.

Analysts found that Miami posted the largest decrease, sinking 67 basis points to 1.13%.

New York dropped 30 basis points lower to 0.58%, while Los Angeles declined 18 basis points to 0.53%.

Analysts added the rate for Chicago dipped 7 basis points to 0.58% as Dallas edged 1 basis point lower to 0.61%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

While Kroll Bond Rating Agency (KBRA) described credit performance during the July collection period as “solid,” the data through August released by S&P Dow Jones Indices and Experian earlier this week showed that auto defaults remain on the rise.

The auto portion of the S&P/Experian Consumer Credit Default Indices climbed for the second month in a row, ticking up by 6 basis points on a sequential basis to land at 0.53%. The latest reading is 13 basis points higher than the June figure that set an all-time low at 0.40%.

A year ago, auto defaults sat at 0.98% and have been below 1% each month so far in 2020, according to data compiled by S&P Dow Jones Indices and Experian.

Meanwhile, the newest composite rate, which represents a comprehensive measure of changes in consumer credit defaults, edged up 1 basis point in August to come in at 0.67%.

As the bank card default rate fell 41 basis points to 3.45%, analysts noted that the first mortgage default rate ticked 4 basis points higher to 0.48%.

As they do on a monthly basis, S&P Dow Jones Indices and Experian also examined data from the five largest metropolitan areas, finding that four of them posted higher default rates in August compared to the previous month.

Miami recorded the largest increase, rising 16 basis points to 1.99%. New York moved 10 basis points higher to 0.96%, while Dallas increased 4 basis points to 0.65%.

The rate for Los Angeles inched up 1 basis point to 0.76%.

Chicago was the only one of these large metro areas to record a decrease in August, dipping 1 basis point to 0.65%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

Just like when weather forecasters watch for hurricanes to make a turn toward land this time of year, finance company leaders likely have been eyeing for when defaults would make an industry-wide move higher because of the coronavirus pandemic.

According to data through July released on Tuesday by S&P Dow Jones Indices and Experian, that turn has arrived.

The auto portion of the S&P/Experian Consumer Credit Default Indices showed the metric rose 7 basis points in July on a sequential basis to land at 0.47%, representing the reading’s first uptick in nearly a year.

The reading edged up 2 basis points from August to September to land at 1.05% and has drifted lower since that point, dropping to a 10-year low in June at 0.40% as finance companies aided struggling contract holders with an array of modifications since COVID-19 arrived back in March.

Meanwhile, S&P and Experian reported that their composite rate — which represents a comprehensive measure of changes in consumer credit defaults — remained unchanged in July at 0.66%, a record low according to the firms’ data going back 10 years.

For comparison, the composite rate in July 2010 stood at 3.42%.

Also of note among the newest readings, analysts said the bank card default rate fell 37 basis points in July to 3.86%, while the first mortgage default rate ticked up 3 basis points higher to come in at 0.44%.

Turning to a review of the July data from the five largest metropolitan areas, S&P and Experian found three readings moved higher when compared to the previous month.

Miami posted the largest increase, jumping 43 basis points to 1.83%. New York rose 12 basis points higher to come in at 0.86%, while Los Angeles edged 3 basis points to land at 0.75%.

Analysts pointed out Dallas declined 5 basis points to settle at 0.61%, and Chicago dipped 2 basis points lower to close at 0.67%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

For what it’s worth amid so much uncertainty nowadays triggered by the coronavirus pandemic, auto-finance defaults are at the lowest point recorded by S&P Dow Jones Indices and Experian going back 10 years.

According the data through June released on Tuesday morning, the auto portion of the S&P/Experian Consumer Credit Default Indices dropped 16 basis points to come in at 0.40%; a reading less than half of what it was back in January.

For context, here is where the auto-default reading has stood at the year’s midpoint since 2010:

2019: 0.87%

2018: 0.93%

2017: 0.82%

2016: 0.91%

2015: 0.85%

2014: 0.96%

2013: 1.00%

2012: 1.04%

2011: 1.29%

2010: 1.70%

It’s highly likely the newest default reading is so low because of how many contracts have been modified by finance companies for consumers who have been impacted financially by the pandemic. Both Kroll Bond Rating Agency (KBRA) and S&P Global Ratings discussed their finding on that topic that SubPrime Auto Finance News recapped in this report.

Turning back to defaults, analysts found the composite rate of the S&P/Experian Consumer Credit Default Indices that represent a comprehensive measure of changes in consumer credit defaults declined 12 basis points in June to settle at 0.66%.

Analysts went on to mention the bank-card default rate fell 17 basis points to 4.23%, and the first mortgage default rate decreased 11 basis points to 0.41%.

Looking at the June data within the five largest metropolitan areas, the S&P/Experian Consumer Credit Default Indices indicated four of the cities posted sequential declines in June.

Chicago generated the largest decrease, dropping 14 basis points to 0.69%. Dallas was right behind, falling 13 basis points to land at 0.66%, while New York dropped 9 basis points to settle at 0.74%.

Analysts said Miami came in 3 basis points lower to register at 1.40% in June. However, they pointed out that Los Angeles went in reverse as its rate edged 2 basis points higher to 0.72%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

Perhaps again reflecting how COVID-19 is turning data topsy-turvy, S&P Dow Jones Indices and Experian reported the auto-finance default rate in May came in at the lowest rate in 10 years.

According to the latest update of the S&P/Experian Consumer Credit Default Indices, the auto default rate dropped 10 basis points in May to land at 0.56%. The rate now has declined each month so far this year and now stands roughly half of what it was back in November and December when it was 1.02%.

The default reading coincides with TransUnion also reporting that more than 100 million consumer-credit accounts currently are in some kind of modification program because of the coronavirus pandemic. Those accounts include not only auto financing, but mortgages and credit cards, too.

Meanwhile, the composite rate, which represents a comprehensive measure of changes in consumer credit defaults also came in lower in May, dropping 12 basis points to settle at 0.78%.

Also dropping significantly, analysts noted the first mortgage default rate fell 14 basis points in May to 0.52%.

However, moving in the opposite direction, S&P and Experian pointed out the bank card default rate rose 17 basis points to 4.40%.

Looking at the data from the five largest U.S. metropolitan areas, analysts found that May default rates dipped month-over-month.

S&P and Experian discovered Chicago posted the largest decrease, down 13 basis points to 0.93%. New York was just off that pace, dropping 12 basis points to 0.83%, while Miami was right behind with an 11 basis-point decline to settle at 1.43%.

Dallas’ reading moved 9 basis points lower to 0.79%, while Los Angeles fell four basis points to 0.70%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

Perhaps still reflecting seasonality, S&P Dow Jones Indices and Experian noticed the auto-finance default rate improved in March.

In fact, the rate not only improved, but it also dropped to the lowest reading going back 10 years.

With other data sets are showing soaring unemployment and plunging used-vehicle values, the auto component of the March S&P/Experian Consumer Credit Default Indices came in at 0.81%, dropping 8 basis points compared to the previous month.

And according to analyst data available going back to February 2010, the latest auto default reading edged out the previous low, which was set in June 2017 at 0.82%

Meanwhile, the March composite rate — a comprehensive measure of changes in consumer credit defaults declined 3 basis points on a sequential basis to land at 0.99%.

Analysts found the bank card default rate rose 53 basis points to 3.94%, while the first mortgage default rate fell 7 basis points to 0.77%.

Looking at the latest data by location, S&P and Experian determined four of the five largest U.S. metropolitan areas posted lower default rates in March compared to the previous month.

Miami enjoyed the largest decrease, dropping 23 basis points to 1.43%. Los Angeles decline 9 basis points to land at 0.71%.

Analysts noticed New York and Dallas each ticked 1 basis point lower to settle at 0.99% and 1.01% respectively.

Chicago was the only city of the five that did not decrease as its March default rate of 1.21% remained unchanged from the previous month.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

Here’s some encouraging news amid all of the economic turmoil caused by COVID-19. The auto segment of the S&P/Experian Consumer Credit Default Indices showed a significant decline in February.

On Tuesday, Dow Jones Indices and Experian released their data through February and reported that auto defaults dropped 10 basis points on a sequential basis to land at 0.89%. That’s the lowest reading since last July when it also stood at 0.89% after two straight months when analysts pegged the metric at 0.87%.

And for some perspective in light of the coronavirus impact, data from Dow Jones Indices and Experian indicated the reading in January 2010 was 2.57% as the industry still was recovering from the Great Recession.

Turning back to the February data, Dow Jones Indices and Experian indicate the composite rate — a comprehensive measure of changes in consumer credit defaults — remained unchanged at 1.02%.

Analysts also found the first mortgage default rate stayed unchanged in February, too, holding at 0.84%. Going counter to the auto sector, Dow Jones Indices and Experian noticed the bank card default rate increased 13 basis points to 3.41%.

Among the five major metropolitan areas analysts track for the monthly update, analysts pointed out four cities posted lower default rates in February compared to the previous month.

Miami generated the largest decrease, dropping 11 basis points to 1.66%. New York fell 7 basis points to 1.00%, while Los Angeles dropped 6 basis points to 0.80%. Dallas dipped 5 basis points to settle at 1.02%.

Chicago was the only major metropolitan area that increased in February, rising 4 basis points to 1.21%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

While the composite reading might be in the midst of rising for three consecutive months, the auto portion of the S&P/Experian Consumer Credit Default Indices posted a decrease to begin 2020.

On Tuesday, S&P Dow Jones Indices and Experian released data through January, and analysts found the auto-finance default rate dropped 3 basis points on a sequential comparison to settle at 0.99%. The decline left the auto default rate below 1% for the first time since August when it was 0.98%

And how did 2019 start for the auto space? The auto-default rate last January was exactly the same at 0.99%. The readings to begin 2018, 2017 and 2016 all came in above 1% as analysts pegged them at 1.07%, 1.06% and 1.04%, respectively.

As for that previously mentioned composite rate — a comprehensive measure of changes in consumer credit defaults — S&P Dow Jones Indices and Experian watched it rise 6 basis points to 1.02%. Analysts acknowledge the composite rate now stands at its highest level since March 2015.

S&P Dow Jones Indices and Experian went on to mention the bank card default rate jumped 33 basis points to 3.28%, while the first mortgage default rate moved 4 basis points higher to 0.84%.

Next, analysts turned to the five largest major metropolitan areas they track for their monthly updates. S&P Dow Jones Indices and Experian noticed four of those five cities posted default rises in January on a sequential basis.

Dallas posted the largest increase, climbing 9 basis points to 1.07%. Chicago came in right behind with an increase of 8 basis points to 1.17%. Miami wasn’t far off the pace, either, with an uptick of seven basis points higher at 1.77%, as Los Angeles rose 6 basis points to 0.86%.

Analysts pointed out New York was the only cities of these five that saw defaults decrease as the Big Apple’s rate dipped 2 basis points to 1.07%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

The auto default rate in December came in at the same pace analysts spotted during the previous month and at nearly the same level or even much lower than what they noticed to close the calendar going back 10 years.

According to data through December released by S&P Dow Jones Indices and Experian on Tuesday, the auto loan default rate remained unchanged at 1.02%. That’s also the same rate analysts noticed when 2014 finished.

At the end of 2018 as well as 2016, the rate stood at 1.03%. You have to go back to data S&P and Experian compiled a decade ago to spot default rates significantly higher at the end of a year. Analysts reported that 2010 finished with the rate at 1.69% while 2009 wrapped up with the rate 2.67%, the high point of their available data set.

Turning back to the most recent recap of the S&P/Experian Consumer Credit Default Indices, analysts found that the composite rate — which represents a comprehensive measure of changes in consumer credit defaults — rose two basis points to 0.96%.

The bank card default rate edged 1 basis point higher to 2.95%. and the first mortgage default rate ticked up 3 basis points to 0.80%.

Looking next at the five major metropolitan statistical areas S&P and Experian track each month, the firms noticed two cities posted higher default rates in December compared to the previous month.

Miami generated the largest increase, rising 17 basis points to 1.70%, while Los Angeles rose 3 basis points to 0.80%.

New York and Chicago both decreased 5 basis points to settle at 1.09%.

Dallas also had a decline to finish 2019, dipping 3 basis points to come in at 0.98%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.