Ever since some consumer-advocate commentators latched onto one piece of recent auto-finance data, experts from the automotive world replied with context to counter thoughts that thousands soon would be walking because they no longer had a vehicle.

While vehicle affordability and delinquent volume continue to make headlines, new findings from Experian’s Q4 2018 State of the Automotive Finance Market report released on Thursday show these trends may not be as dire as they seem.

In fact, Experian found the percentage of 30-day delinquent contracts improved year-over-year, while the percentage of 60-day delinquencies saw only a minimal uptick over the same time period.

The report shows 30-day delinquencies dropped to 2.32 percent from 2.36 percent a year ago, while 60-day delinquencies increased to 0.78 percent from 0.76 percent the previous year. The percentage of delinquent loans continues to remain stable even as more and more consumers rely on automotive financing.

In Q4 2018, the report indicated 85.1 percent of all new-vehicle purchases were financed compared to 81.4 percent in Q4 2010.

“While delinquencies can be an indicator of automotive finance market health, it’s important to examine these trends within the larger industry context,” said Melinda Zabritski, Experian’s senior director of automotive financial solutions. “With more car shoppers using automotive financing options, it’s natural to see an uptick in the volume of delinquent loans.

“Lenders need to factor in additional historical trends, such as the percentage of subprime loan originations and shifting payment options, to gain a more complete picture and make the right lending decisions,” Zabritski continued.

Experian acknowledged that much of the conversation surrounding delinquency rates is driven by questions of vehicle affordability, specifically the average financed amounts and monthly payments.

Experian reported the average amount financed for a new vehicle was $31,722 (up $623 from the previous year), while the average amount financed for a used vehicle surpassed $20,000 (up $488 from the previous year).

The report also mentioned the average monthly payment for a new vehicle was $545 (up $30 from the previous year) and the average for a used vehicle was $387 (up $16 from the previous year).

Another component of the conversation around vehicle affordability is interest rates — which for new-vehicle financing was 6.13 percent, up from 5.11 percent a year ago. For used-vehicle financing, the average interest rate was 9.59 percent, according to Experian’s information.

“As loan amounts, monthly payments and interest rates continue to rise, there are a number of factors for consumers to consider as they research their car-buying options,” Zabritski said.

“While consumers appear to be doing their due diligence when making borrowing choices that fit their budget, lenders also play a large role,” she continued. “Every consumer deserves access to quality credit, and lenders should leverage all available data to offer the most comprehensive financing options to car shoppers.”

Additional findings for Q4 2018 from Experian included:

• Total outstanding automotive balances in Q4 2018 was $1.178 billion.

• The percentage of outstanding balances held by subprime and deep subprime consumers remained below 20 percent (19.69 percent).

• Loan originations to super prime consumers grew 3.3 percent to 20.54 percent of total originations.

• Leasing grew year-over-year. The percentage of new vehicles that were leased reach 28.76 percent compared to 28.28 percent a year ago.

• Eight of the top 10 new leased models in Q4 2018 were crossover utility vehicles and trucks.

• The gap between the average new and used monthly payments continued to widen, reaching $158.

Experian is hosting a webinar to discuss the entire State of the Automotive Finance Market report. Registration for the event can be completed here.

And ahead of Thursday’s report release, Zabritiski shared her thoughts on the finance space for an episode of the Auto Remarketing Podcast recorded during the Vehicle Finance Conference hosted by the American Financial Services Association in San Francisco this past January.

The episode is available below.

An executive with nearly 20 years of experience with Consolidated Asset Recovery Systems and Dealertrack now is part of the leadership team at Servicing Solutions.

The loan servicing organization specializing in primary and back up servicing announced on Wednesday that its new vice president of sales is Garrett Cline.

“I’ve known Garrett for years, and I can think of no one better suited to carry the Servicing Solutions message forward to companies looking to significantly improve their loan servicing function,” Servicing Solutions executive vice president of sales and marketing Jeff Swisher said.

“He is an accomplished sales and training leader with the ability to consult with companies to solve their most pressing business challenges. I’m excited to have him on board,” Swisher continued.

Prior to joining Servicing Solutions, Cline spent six years with Consolidated Asset Recovery Systems (CARS), a technology and services company focused on the repossession and remarketing of assets. He was responsible for new business development in the eastern United States within the automotive finance space.

Earlier in his career, Cline spent 12 years with Dealertrack Registration and Titling Services in various sales and training roles.

And in other company news, Servicing Solutions also is preparing to host a free educational webinar to help finance companies.

Servicing Solutions pointed out that a continued explosion in disruptive technologies has led to Internet and mobile-technology being used more than ever with financial transactions. However, along with this explosion comes an increased level of compliance and operational risk, corporate responsibility, as well as government regulation and oversight for companies attempting to keep up with the times and their customers’ ever-increasing set of demands.

This webinar will address the need to have a compliance readiness program in place within your business. Furthermore, it will cover best practices communications should an organization run afoul of a regulatory authority.

The training event set to include Robert Caracciola of Servicing Solutions along with Michael Thurman of Thurman Legal is scheduled for 2 p.m. ET on Tuesday. Attendees can register for this free webinar by going to this website.

With Cox Automotive experts suspecting that “credit will likely tighten as the appetite for subprime declines,” the company also shared the makes that have the largest penetration of subprime retail installment contracts and vehicle leases so far this year.

Cox Automotive chief economist Jonathan Smoke reviewed the much-publicized data recently released from the Federal Reserve Bank of New York that generated so much attention because it showed more than 7 million contract holders were in delinquency. Smoke shared his assessment first in this Weekly Summary and then expanded in exclusive analysis shared with SubPrime Auto Finance News beneath a title line that read, “Credit will likely tighten as the appetite for subprime declines.”

Smoke continued, “Year-over-year, the number of severe delinquent accounts is up 4.4 percent. Subprime auto loan delinquencies increased much more, as the number of subprime severe delinquent accounts is up 5.9 percent.

“The subprime severe delinquency rate on auto loan accounts was 5.14 percent, which was the highest rate for any December since the Great Recession,” he noted.

“The auto delinquency problem is mainly in subprime as subprime severe delinquencies represent 69 percent of severe delinquencies, yet subprime accounts only represent 20 percent of active auto loan accounts,” Smoke went on to say.

So which brands might be most connected to those subprime contracts that could be in peril? According to data fueled by Dealertrack, here are the badges with the leading amounts of subprime market penetration:

1. Mitsubishi

2. Dodge

3. Fiat

4. Chevrolet

5. Buick

6. Toyota

7. Chrysler

8. Honda

9. RAM

10. BMW

To mimic the famous Mark Twain quip, perhaps reports about the drastic demise of the auto finance industry are greatly exaggerated.

As some commentators latched onto delinquency metrics shared recently by the Federal Reserve Bank of the New York, auto default data contained in the latest the S&P/Experian Consumer Credit Default Indices showed improvements in January both on a sequential and year-over-year basis.

S&P Dow Jones Indices and Experian reported this week that the auto loan default rate in January fell 4 basis points from the previous month to 0.99 percent. The latest reading is also 8 basis points lower than the opening month of 2017.

As previously reported in SubPrime Auto Finance News, the New York Fed data attracted plenty of attention since it revealed more than 7 million contract holders were in delinquency. However, Fed analysts offered some perspective by drilling deeper into that information.

Default data compiled by S&P Dow Jones Indices and Experian showed that the auto metric has been below 1 percent for 8 of the past 12 months and currently sits 12 basis points below the high point analysts have seen during the past five years. That high-water mark for auto defaults was 1.11 percent recorded in January 2014 and again in October and November of 2017.

Meanwhile turning back to the January information, S&P Dow Jones Indices and Experian determined the composite rate — which represents a comprehensive measure of changes in consumer credit defaults ticked up 1 basis point from previous month to land at 0.90 percent.

Analysts noticed the bank card default rate rose 8 basis points to 3.42 percent, while the first mortgage default rate came in 2 basis points higher at 0.69 percent.

Looking at the five largest U.S. markets that S&P Dow Jones Indices and Experian watch for each monthly default update, three cities posted higher default rates in January compared to previous month.

The rate for Miami increased 26 basis points to 2.19 percent, while the rate for Dallas climbed 4 basis points to 0.89 percent.

New York’s default rate ticked up 3 basis points to 0.99 percent as the rate for Chicago remained unchanged in January at 0.88 percent

Finally, the rate for Los Angeles decreased 3 basis points to enjoy the lowest reading of these five cities at 0.49 percent.

Following a month where default rates for all loan types increased, David Blitzer pointed out January data showed default rates changed little from the prior month. The managing director and chairman of the Index Committee at S&P Dow Jones Indices explained the longer-term trend shows that default rates have mostly stabilized.

Blitzer added the composite rate has fluctuated within a narrow band as the last time this rate was more than 10 basis points off of the current level was nearly four years ago in March 2015.

“The uptick in the bank card default rate combined with a decline in the auto default rate reflects volatility in the consumer economy,” Blitzer said. “Coming off some swings in market sentiment and recovering from the government shut down, there was a sharp drop in December retail sales and a pullback in January automobiles sales.

“Consumer sentiment has also bounced around, but has recovered in the latest reports. Consumers and investors are both trying to discern which trends will shape the 2019 economy,” he continued.

Blitzer closed by making one more forward-looking point.

“Despite continuing uncertainty about economic policy, two factors favorable to the economy persist: low inflation and a strong labor market. These trends should support the economy and limit any increase in consumer credit default rates,” he said.

“The risks facing the economy in the first half of 2019 are in trade where tariffs or Brexit could upset things, and in the financial sector where worries about corporate earnings and anxiety of possible Fed rate hikes could spook the markets,” Blitzer went on to say.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

A quartet of analysts took a deep look at the auto finance data after the Federal Reserve Bank of New York’s Center for Microeconomic Data released its Quarterly Report on household debt and credit on Tuesday.

At first blush, it might look inflammatory that the New York Fed data fueled by Equifax showed that more than 7 million people had an auto finance contract at least 90 days delinquent by the time 2018 finished. However, the data set also pointed out that more than 89 million people have some form of auto financing — a lease or retail installment contract. That’s the highest figure ever recorded, according to the Fed data from Equifax that goes back to 1999.

All told, auto financing surged by $53 billion year-over-year to close 2018 at $1.27 trillion; again the highest figure ever recorded.

While perhaps collection departments, forwarding companies and repossession agents will see a surge of activity this year, New York Fed experts offered some clarity. Andrew Haughwout, Donghoon Lee, Joelle Scally and Wilbert van der Klaauw collaborated on the Federal Reserve Bank of New York Liberty Street Economics blog for a post titled, “Just Released: Auto Loans in High Gear.”

They wrote, “After years of growth among borrowers across the credit score spectrum, 2018’s strength in auto loans was primarily driven by those originated by the most creditworthy individuals, while originations to those with scores below 720 have leveled off, albeit at high volumes. The high volume of prime originations has caused a quality-shift in the outstanding pool of auto loans and, as of the fourth quarter of 2018, 30 percent of the $1.27 trillion in outstanding debt was originated to borrowers with credit scores over 760.

“Meanwhile, the share of total auto loans outstanding that was originated to subprime borrowers fell to 22 percent. In fact, these percentages would suggest that the overall auto loan stock is the highest quality that we have observed since our data began in 2000,” they continued.

“However, with growth in auto loan participation, there are now more subprime auto loan borrowers than ever, and thus a larger group of borrowers at high risk of delinquency,” the experts went on to say.

The report went on to mention that auto financing is just part of what’s pushing overall debt to new highs.

The report showed that total household debt increased by $32 billion (0.2 percent) to $13.54 trillion in the fourth quarter of 2018. It was the 18th consecutive quarter with an increase, and the total is now $869 billion higher than the previous peak of $12.68 trillion in the third quarter of 2008.

Furthermore, analysts found overall household debt is now 21.4 percent above the post-financial-crisis trough reached during the second quarter of 2013.

The report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

Haughwout, Lee, Scally and van der Klaauw acknowledged that auto finance delinquency rate of 2.36 percent as of the end of 2018 is much higher than the reading of 1.5 percent seen in 2012. But they also viewed it in the context of how many vehicles have rolled over the curb, filling finance company portfolios during that span.

“The surging auto loan industry has been on our radar for more than five years now. But, the level of loan originations has been commensurate with auto sales, with a steady 50 to 60 percent financing share of combined new and used vehicle purchases — a percentage surprisingly stable in our sample period, which suggests that car loans have been tracking the growth seen in motor vehicle sales,” they wrote in the blog.

“Although rising overall delinquency rates remain below 2010 peak levels, there were over 7 million Americans with auto loans that were 90 or more days delinquent at the end of 2018. That is more than a million more troubled borrowers than there had been at the end of 2010 when the overall delinquency rates were at their worst since auto loans are now more prevalent,” they continued.

“The substantial and growing number of distressed borrowers suggests that not all Americans have benefitted from the strong labor market and warrants continued monitoring and analysis of this sector,” they concluded.

All of the metrics Westlake Technology Holdings shared about its 2018 performance headed in directions that would please just about any executive team or board of directors.

And the company already is aiming for double-digit improvement this year.

The company recently announced its portfolio grew 35 percent in 2018, finishing at an all-time high of $8.33 billion in assets under management. Executives highlighted that core automotive indirect financing originations and a reduction in net loss percentage contributed to this growth.

Westlake said its core indirect financing operations delivered 40.5 percent growth over 2017, while 31-plus-day delinquency dropped by 9.0 percent. The company calculated these reduced delinquencies led in part to a 5.6-percent decline in net losses as a percent of total assets.

Westlake mentioned its 2018 mix of originations continued to move toward a more full-spectrum portfolio, as near-prime and prime credit tiers (defined as contracts with FICO scores of 600 and higher) represented 40.5 percent of 2018 deals.

Westlake Technology Holdings group president Ian Anderson said, “2018’s success was made possible by our outstanding employees, implementation of the latest technology and the commitment to achieving our goals.

“For 2019 we project another strong year with increased growth and market share across all our companies,” Anderson added.

Besides indirect financing, Westlake Financial’s other companies saw tremendous growth as well, including:

— Western Funding ended 2018 with 76.6 percent year-over-year growth, a 12.5-percent reduction in 31-plus-day delinquencies and a 18.4-percent drop in net loss percentage.

— Wilshire Consumer Credit decreased its 31-plus-day delinquency by 17.8 percent with a 13.2-percent drop in net loss percentage.

— Credit Union Leasing of America (CULA) grew 29.5 percent this past year.

— Westlake Flooring Services grew 33.0 percent year-over-year with a 69.5-percent reduction in 1-plus-day delinquency and 79.1-percent drop in net loss percentage.

Furthermore, Westlake’s newest company, Westlake Portfolio Management (WPM), enjoyed strong first-year success with $350 million in portfolio servicing of active and inactive accounts.

Westlake chief financial officer Paul Kerwin said, “2018 was a great year for us, because we increased market share while maintaining profitability.

“We set aggressive goals, and our employees did an amazing job executing the plan,” Kerwin went on to say.

For 2019, Westlake Technology Holdings said it is targeting 20-percent growth over 2018 and expansion of its direct lending platform on LoanCenter.com.

Dealerships interested in learning more about Westlake Financial Services are invited to contact Westlake directly at (888) 893-7937 or online at www.westlakefinancial.com.

Dumb question: Who wants to make more money? We all do, of course. But is opening your business to more credit-challenged consumers worth chasing more delinquencies and repos? Good question; and one that becomes problematic if you don’t take the right steps to minimize your risk. But, can I reduce risk and make more money without spending more? Great question.

Traditionally, the industry’s approach to managing risk involves manual processes that are tedious and time-consuming. Maintaining and following up on exhaustive consumer records of everything — phone numbers, addresses, employment — requires time and manpower you simply don’t have. As a result, taking on the operational cost of expanding your subprime business could be a nonstarter. One look at the consumer contact and employment statistics for this market segment underscores the burden.

The information chase

According to the FactorTrust Underbanked Index: Consumer Stability report, a borrower who has changed his or her mobile phone number four or more times over a 90-day period has a 77 percent higher default risk than a borrower who has done so only twice. Additionally, a borrower who has had three or more ZIP codes over a 90-day period has a 63 percent higher default risk than a borrower with one ZIP code. Further, among the underbanked, 16 percent applied with a different employer within 30 days, 20 percent within 60 days, 23 percent within 120 days and 34 percent within one year.

Remember the Wayne Gretzky quote, “I skate to where the puck is going to be, not where it has been?” Keeping up with subprime consumers is like trying to predict where that puck will be, which is nearly impossible without the tools to help.

If cars could talk

There is an option for managing risk in the subprime market that supplements a dealer’s ability to vet these consumers: gathering vehicle intelligence. With advances in aftermarket telematics and driver analytics, the latest technology can provide customer insights far beyond the standard vehicle location data associated with early GPS systems.

When it launched onto the buy-here, pay-here scene more than 15 years ago, GPS made it much easier to find a vehicle for repo. Over the years, the technology has evolved to look at location data over time, with the ability to predict where a vehicle will likely be at any time of the day or night with incredible accuracy. For example, the technology can now identify a change of job or home address through deviations in driving patterns. Let’s face it, unless they’re the James Bond type, most people have a set daily routine bouncing back and forth between home and work. Modern GPS solutions can detect major life changes by analyzing location data in relation to time of day, day of week, and pattern frequency.

Similarly, these same algorithms can automate and expedite loan stipulations that typically require hours of calling to verify addresses and workplace information. It’s also useful in preparing agents for repossession, when needed, to better target the right place and time for recovery. Accurately predicting vehicle location under specific circumstances (such as during Monday night football) leads to easier, less costly and less risky recoveries.

Smart solutions combine vehicle intelligence with proactive alerts to further reduce operational costs. Cars that aren’t driving, aren’t paying, so automated alerts for “non-driving” scenarios, such as vehicles impounded to tow lots, abandoned vehicles, and battery disconnects save dealers thousands of dollars each year. The ability to set geo-fences — virtual boundaries around key locations like tow lots, state borders and ports of entry — can help you keep your finger on the pulse of your assets without any effort on your part.

As with any technology purchase, reliability should be one of the main evaluation criteria. Leading GPS providers have always-on platforms (ask about uptime and availability rates) and wide-reaching network support that keeps vehicles connected no matter where they roam. You should ask any provider you’re vetting about the quality and quantity of the data its devices track. It’s no longer enough to monitor vehicle location every 24 hours, as was the industry standard. You need near real-time visibility that can only come from telematics devices that report data at 5-minute intervals or less, giving you the confidence to act when action is warranted.

Finally, the unique value of modern telematics is its ability to drive increased payments. Gone are the days when “starter interrupt” was the only way to get the attention of a delinquent customer. With 85 percent of the U.S. population carrying smartphones, the key to customer engagement is mobile. If the GPS technology you’re considering (or currently using) doesn’t offer a mobile component that opens up a soft-touch but high visibility communication channel between you and your customer, keep shopping.

Ask and ye shall receive

To thrive and survive in this hyper-competitive business, dealers must look beyond their current constraints in servicing this segment. Advanced vehicle intelligence offers not only a safer path to do business with the subprime consumer, but also the operational efficiency necessary to improve the bottom line. If you’re thinking about GPS as a recovery tool, think again, and remember what your teacher said back in grade school: “there are no dumb questions” — except the ones you don’t ask your suppliers.

Brian Deeley is a director of product management at Spireon. He can be reached at [email protected].

Anyone who has been involved with the repossession industry over the past several years knows that the world looks very different today than before the Consumer Financial Protection Bureau arrived. Most of the focus during this period has been on third- and fourth-party oversight. Given the CFPB’s official position on vendor management, it is no longer acceptable to rely solely on the agent or repossession management company to keep their shops in order.

Today, extensive vetting, on-site visits to every storage lot, proper contracting, performance/compliance score cards and broader insurance coverage are the norm. As a result, lenders and regulators can be comfortable that the agents recovering cars on their behalf have been well vetted and are closely monitored. Indeed, the CFPB has expressed general satisfaction on this aspect of vendor management

At this point, there are two primary areas the CFPB is focused on when it comes to repossession:

1. Fees that consumers are charged for retrieving personal property, and to a lesser extent redeeming their vehicle

2. Repossessions made in error

Adequately addressing these issues will pretty much squeeze out the remaining regulatory concern and legal exposure.

The “fees” issue has largely been addressed, especially by major lenders. Most have either mandated that any consumer charges be billed back to the lender (and posted to the customer’s account) or the allowable charges have been capped at defined and reasonable levels. There is still the issue of ensuring that agents follow the requirements, but we will save that for another post.

This leaves the issue of repossessions in error as the final major area to be addressed. Indeed, the CFPB has referenced the matter in its last two bulletins.

The vast majority of repossession in errors occur due to communication breakdowns. We see two types:

1. Internal communication breakdown within the lender’s operation where the auto repossession management company or agent was not notified when a repossession order was put on hold or closed. As a repossession management vendor for lenders, there is not much we can do to impact their internal processes/operations.

2. Vendor(s) communication breakdowns when a hold/close has been issued properly by the lender but the proper communication and systems updating by all involved parties did not take place.

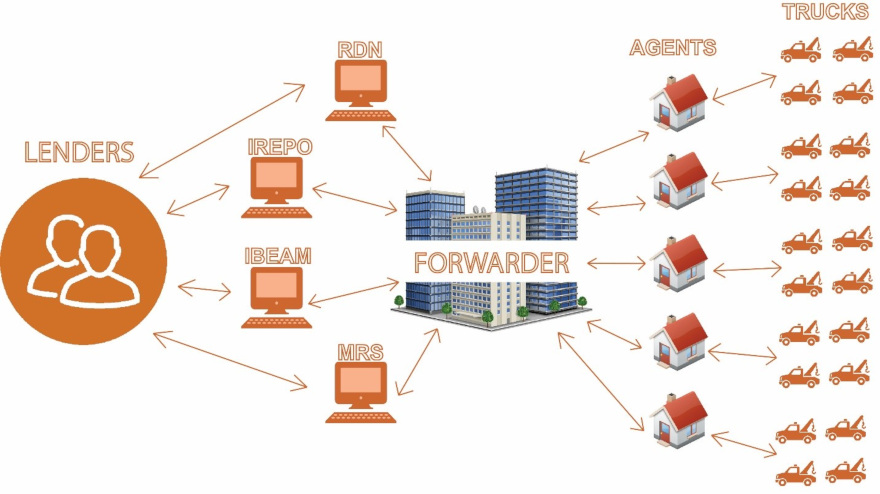

The latter is largely a technology issue. The lenders, management companies (forwarders) and agents generally operate on different platforms and degrees of sophistication. And for each of these players, there are multiple platform options. Breakdowns can occur at each point along the way and these breakdowns account for a large percentage of repossession in errors. The diagram at the top of this page illustrates the challenge and the components/integrations that must be in place to solve the problem.

To address the challenge, there must be close to real time communication from lender to forwarder to agency system of record to repo truck driver. Fortunately, recent improvements in systems integrations and the emergence of mobile platforms supporting repossession agency operations, provide solutions to the challenge, for the first time.

Today, there are two primary mobile platforms that, if integrated properly, can support the data exchange requirements. These are RDN/Clearplan and the Recovery Compliance Mobile (RCM) platform provided by MBSi. While each takes a somewhat different approach, both are solid systems that are designed to provide compliance functionality at the truck level. The recent acquisition of Clearplan by RDN and KAR Auction Services does offer some additional functionality and efficiencies made possible by the fact that the vast majority of repossession agencies use these two platforms as their systems of record.

If your institution relies on repossession management companies (forwarders) to coordinate the repossession activity, deep integrations with these platforms must be in place. Due to internal constraints, very few have the capability to facilitate the data between the various parties regardless of the source. At ALS Resolvion, we have invested heavily in these integrations and by mid-February, we will be only utilizing repossession agencies that deploy this type of mobile technology in the field.

Our expectation is that more and more lenders will be mandating real time “two-way” communication all the way down to the truck level. Doing so will bring us all very close to meeting both regulator and lender senior management expectations for squeezing out repossession made in error.

Mike Levison is the chief executive officer of ALS Resolvion. More details about the company can be found at www.alsresolvion.com.

Just ahead of the American Financial Services Association’s Vehicle Finance Conference, Allied Solutions announced the restructuring of its claims and recovery product, REPOPlus & Track.

The provider of insurance, lending and marketing products to financial institutions in the U.S. for more than 35 years, explained what’s new with REPOPlus & Track on Monday. In addition to claims and recovery services provided with REPOPlus, four distinct insurance monitoring options are available in an effort to offer flexibility to lenders seeking a cost-effective, efficient insurance tracking solution. They include:

— Auto Match

— Basic Track

— Active Track

— Advanced Track

After years of offering REPOPlus as a recovery service to finance companies, Allied Solutions indicated that it utilized this experience to develop value-added tracking options to maximize cost benefit.

The company highlighted each track offers a variety of support for electronic insurance notifications, loan files, paper insurance documents and borrower communications. These options can provide insurance monitoring and tracking support for a myriad of finance companies, including small to large volume and prime to subprime markets.

Allied Solutions insisted the combination of REPOPlus & Track with insurance monitoring options can provide finance companies a comprehensive loss and recovery and optimization program. Track solution options range from basic to full coverage of service monitoring.

“Allied Solutions recognizes that our clients have a diverse set of needs when it comes to their monitoring and optimization programs,”, CEO, Allied Solutions chief executive officer Pete Hilger said.

“We have created a comprehensive solution that ensures lenders receive the information they need to best measure and assess risk, protect their collateral and ensure optimization of insurance recovery claims,” Hilger went on to say.

Allied Solutions will share additional information about REPOPlus & Track during AFSA’s conference, which begins on Tuesday in San Francisco.

If contract holders already were 30 days behind on their installment payment when Halloween arrived, they now might be up for repossession, especially in the 20 states that Experian identified as having a 30-day delinquency rate above 2 percent at the end of the third quarter.

According to Experian’s State of the Automotive Finance Market report, the overall 30-day delinquency rate improved year-over-year in Q3, ticking 16 basis points lower to 2.23 percent.

What Experian classifies as finance companies — institutions that typically do not hold consumer deposits and oftentimes cater to subprime customers — finished Q3 with a much higher 30-day delinquency rate than the average. For finance companies, the rate stood at 3.95 percent.

Among those 20 states with 30-day delinquency rates above 2 percent, Experian showed how the swath stretched from New York (2.34 percent) down the Eastern Seaboard to Florida (2.61 percent) and westward to Nevada (2.31 percent).

The latest data indicated state with the highest rates included Mississippi (4.11 percent), Maryland (4.03 percent) and Louisiana (3.5 percent).

On the opposite end of the spectrum, Experian reported that Washington and Oregon tied for the lowest Q3 30-day delinquency rate at 1.20 percent.