Veros Credit said it still is enjoying exponential growth while navigating through today’s challenging macroeconomic landscape.

To enrich its footprint in Texas, Veros Credit announced last week that it is slated to open a dealer and customer service center in Irving.

With the addition of this new Texas office in its second largest volume state, Veros Credit said the move will augment its ability to serve current and future dealership partners and customers.

“Texas is a tremendous market for Veros Credit. The addition of this new location will provide opportunities to further support employees currently located in the region, while creating openings for new talent,” Veros Credit chief operating officer Harvey Singh said in a news release.

“Despite the challenges of the past few years, Veros Credit continues to deliver strong results with a keen focus on positive growth.,” Singh added. “With the recent implementation of several key corporate initiatives, including Omni Channel, Customer and Dealer Portal, Veros Credit remains on track to deliver on our mission to be the preferred provider of auto financing solutions,” Singh continued.

“The groundwork we are laying shows our ability to scale and absorb increased levels of growth without compromising the service to our customers and dealerships,” Singh went on to say.

Experienced auto finance professionals interested in joining the Veros Credit team are encouraged to apply online through the company website at http://www.veroscredit.com/careers.

There might not be a robust amount of used and new vehicles available to retail, but access to credit to fuel originations and deliveries appears to be quite plentiful.

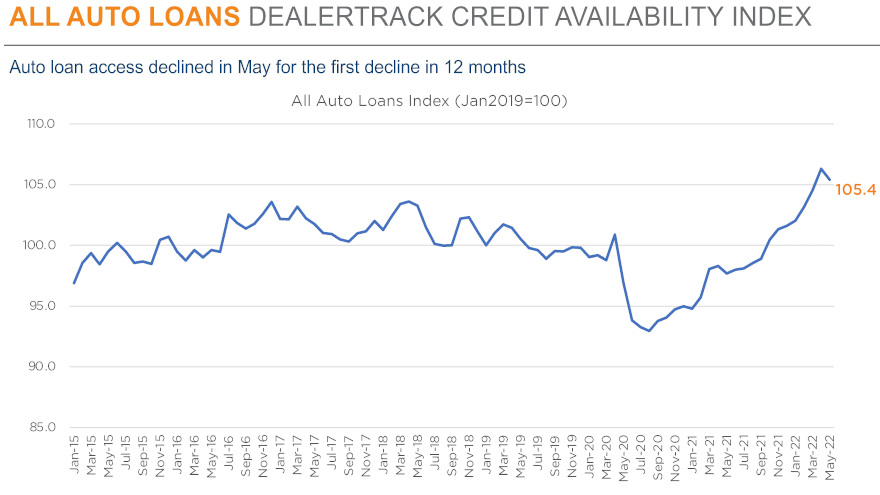

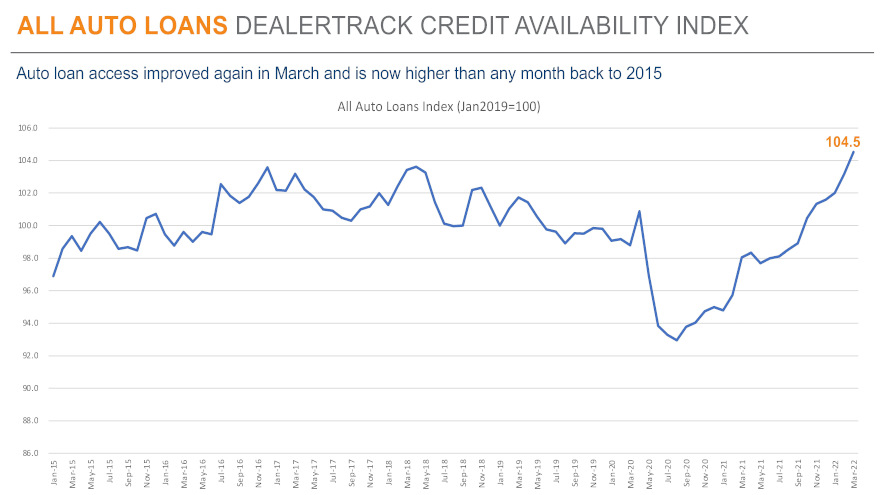

For the second month in a row, the Dealertrack Credit Availability Index rose to a reading that was the highest recorded in the data series going back to January 2015.

Cox Automotive indicated in a Data Point that the access to auto credit expanded again in March for many types of financing, as the index increased 1.3% to 104.5 in March, reflecting that auto credit was easier to get compared to February.

Analysts said access was looser by 6.6% year-over-year, and compared to February 2020, access was looser by 5.4%.

While the average yield spread on auto financing widened in March, Cox Automotive pointed out that other factors improved to more than compensate.

Analysts computed that the average installment contract increased by 53 basis points in March compared to February, while the five-year U.S. Treasury increased by 28 basis points, resulting in wider observed yield spreads.

“Credit access also improved across most lender types in March with credit unions having loosened the most. On a year-over-year basis, all lenders had looser standards with auto-focused financed companies having loosened the most,” Cox Automotive said in the Data Point.

Analysts recapped that each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Across all auto lending in March, the approval rate increased, the subprime share grew and negative equity grew, and the moves in those factors made credit more accessible,” Cox Automotive said. “However, yield spreads widened, terms shortened and down payments grew, so those factors moved against accessibility.”

More consumer trends

Cox Automotive mentioned in the Data Point that multiple measures of consumer sentiment ended up mixed in March.

Analysts said consumer confidence increased 1.4% in March, according to the Conference Board, when experts expected a decline.

“But the February index was revised down, so the March index came in very close to expectations,” Cox Automotive said. “The underlying measures of present situation and future expectations moved in opposite directions as present situation improved, but future expectations declined.”

“Plans to purchase a vehicle in the next six months declined and remained down year-over-year,” Cox added.

Analysts also mentioned the sentiment index from the University of Michigan declined 5.4% in March as both current conditions and expectations declined, with inflation accelerating.

Cox Automotive went on to note that the Morning Consult daily index declined 1.4% in March, but it was down 6% at mid-month at the peak of gas prices and recovered much of the early March decline as gas prices stopped increasing and moderated slightly.

Meanwhile, through its news release, Numerator, a data and tech company serving the market research space, released its monthly inflation insights update to provide a view of rising prices through March, with added context by consumer demographic segments.

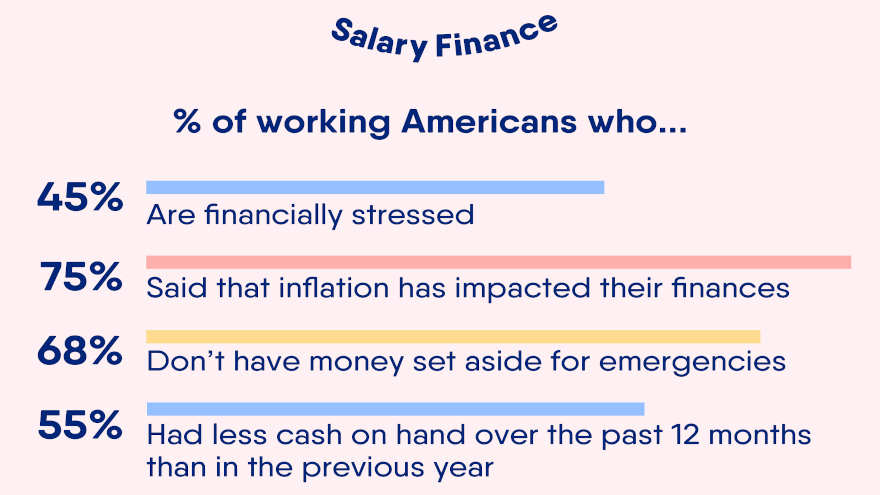

Numerator shared three findings that might be relevant to potential vehicle buyers based on its ongoing survey of more than 10,000 consumers that is designed to provide additional detail around financial health, outlook and spending. Those findings included:

• Hispanic / Latino consumers reported an improvement in their financial situations over the past month, with 49.5% of consumers reporting a “good” or “very good” outlook in March versus 47.7% of consumers in February.

• Gen Z was the only group to show a decline in financial security, as more of these consumers reported a “poor” or “very poor” financial outlook in March than in February (17% versus 14.4%).

• Fewer consumers say they have spare cash, most notably Asian consumers. More than one in five consumers (22.8%) say they do not have extra funds available, a trend even more pronounced among Asian consumers (28.6%).

New-vehicle affordability discussion

Another Data Point highlighted the newest Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

Analysts shared that the new-vehicle affordability remained stable in March but remains near the low in affordability set in December as rate increases in 2022 offset income gains and modest price declines.

“The inputs to the index again moved in differing directions in the month,” analysts said while noting that the number of median weeks of income needed to purchase the average new vehicle in March remained 42.9 weeks, as was the case in February.

Supporting affordability, Cox Automotive and Moody’s Analytics said the price paid moved 0.3% lower following a larger decline in February. The peak in pricing arrived in December at $47,064.

While median income also grew, analysts acknowledged the rest of the factors worked against affordability.

“Incentives declined slightly. The average interest rate increased another 32 basis points,” Cox Automotive and Moody’s Analytics said. “As a result of these moves, the estimated typical monthly payment increased 0.3% to $691, which was a new record high.

“New-vehicle affordability in March was much worse than a year ago when prices were lower and incentives were higher. The estimated number of weeks of median income needed to purchase the average new vehicle in March was up 18% from last year,” Cox Automotive and Moody’s Analytics went on to say in the report.

This week, Zurich North America said it is expanding its F&I sales distribution strategy by adding select F&I agencies to complement its national direct sales approach.

The company explained through a news release that the move lays a foundation for reaching a wider market of dealers across the United States. Zurich is one of the nation’s leading providers of property and casualty (P&C) insurance and F&I solutions for dealers offering a full suite of vehicle protection products for gas-combustion, hybrid and electric vehicles.

“Expansion into the F&I agency space is a game changer for us and a big win for auto dealers,” said Vince Santivasi, head of direct markets for Zurich North America. “Making our products, services and training available through select agencies means more auto dealers can access Zurich’s F&I expertise and expanded capabilities to benefit the bottom line for their businesses.”

Zurich’s F&I agency operations is being led by Todd Kaminski, who is the company’s head of business development. Zurich launched these operations in January and is developing a network of select F&I agents to represent Zurich to dealers across the U.S.

The company highlighted these agents have access to Zurich’s F&I products, programs and solutions designed to meet the unique needs of dealerships and their customers.

In addition to vehicle protection products, Zurich mentioned offerings available through select agents include income development and profit participation programs, as well as compliance resources to help dealers maximize profits and address a growing and changing environment.

Zurich pointed out that has utilized a direct market distribution model to sell F&I products and services to dealers for more than 50 years. Zurich can trace its roots in the automotive industry to 1922.

“We remain steadfastly committed to our robust national sales force,” Santivasi said. “Combining the stellar reputation and proven success of our direct markets sales team with the expanded reach and expertise of select F&I agencies only strengthens our opportunities and broadens our horizons.

“As we celebrate 100 years of service to auto dealers, we also are focused on the next 100 years of customer service, innovation and sustainability,” Santivasi went on to say. “Adding select agents to our distribution model to help reach more auto dealers is one way we are looking to the future.”

Agents interested in learning more can visit the Zurich’s F&I agencies website.