With the third quarter having closed on Thursday, Edmunds noticed four intriguing auto-finance trends, as each metric established new records in its database.

Analysts explained that these trends surfaced because consumers are paying more than ever to finance used vehicle purchases as tighter inventory and fewer discounts in the new-vehicle market push shoppers to seek alternatives in the used market.

Read more

Plenty of exciting football action is on the docket this weekend with multiple Top 25 matchups in the college realm and Tom Brady playing his first NFL game against the New England Patriots.

Flagship Credit Acceptance is leveraging the enthusiasm for football with its newest promotion to help dealers celebrate this year’s college and NFL football season with a little friendly competition that is all about getting back outdoors, enjoying the fall weather and creating the ultimate tailgating experience.

Through a campaign called Any Given Saturday, Flagship Credit Acceptance will award one dealer in each of the finance company’s nine regions across the country with premium tailgating prizes every week. All dealers that are eligible for promotions can compete against other dealers in their area.

According to a news release, weekly winners will be selected based on the largest week-over-week increase in applications, enabling any store to win. The winning dealership will be awarded premium tailgating prizes that include Yeti coolers, Apple AirPods, portable smart speakers and other tailgating essentials.

Each week, a new prize will be awarded to one dealership in each region. The competition begins every Sunday and runs through the following Saturday. The winners will also be highlighted across Flagship’s social media channels the following week.

“We are excited to see the auto industry strengthening, and while dealers still face several lingering challenges from the pandemic, we felt it was important to reinforce that we are here to help them be successful,” Flagship Credit Acceptance president and chief operating officer Jeff Haymore said in the news release.

“Any Given Saturday is a great way to show our support through a fun and rewarding competition.”

To learn more about Flagship Credit Acceptance, visit www.flagshipcredit.com.

One of the most enthusiastic and knowledgeable regular guests on the Auto Remarketing Podcast recently returned, as StoneEagle F&I senior vice president of business development Joe St. John came back to discuss what’s happening in dealership finance offices nowadays.

We also delved into another topic that’s one of St. John’s passions; mergers and acquisitions that are happening not only in the franchised dealership sector but also in the F&I space, too.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Cox Automotive’s newest updates of indexes that track auto financing showed mixed developments with regard to dealerships being able to get their potential buyers financed and providers’ appetite to build portfolios.

Read more

In this episode of the Auto Remarketing Podcast, Lena Bourgeois discussed auto-finance metrics that are not getting as much attention nowadays but perhaps should.

The senior vice president and general manager of automotive services at Equifax also shared anecdotes from recent client meetings about what’s top of mind at dealerships and finance companies.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

According to a nationally representative survey conducted by personal finance website WalletHub, 87 million Americans will look at vehicles to buy this Labor Day weekend.

And WalletHub’s 2021 Labor Day Weekend Survey showed that the top two considerations potential buyers will evaluate are ones that probably shouldn’t surprise dealerships or finance companies.

WalletHub said 25% of participants picked vehicle price as the most important factor, followed by monthly payment at 21%.

“Americans are very interested in buying cars this Labor Day weekend, as 23% more people will look at cars this year compared to 2019,” WalletHub Jill Gonzalez analyst said. “This is great news for car manufacturers and sellers, because car prices are currently at an all-time high and these companies stand to make large profits. Interest in buying cars is also a good indicator of consumer confidence because it shows that a growing number of people feel financially stable enough to make big purchases.”

Two other notable tidbits from WallHub’s survey included:

— 91% of consumers are still more likely to buy a vehicle in-person rather than online

— 62% of consumers worry more about affording their monthly payment for their vehicle financing rather than the premium for car insurance

The significant rise in wholesale prices experts have been discussing for much of the year spilled into auto financing.

According to Experian’s latest State of the Automotive Finance Market report released on Thursday, analysts spotted notable increases in several categories with used-vehicle financing.

Read more

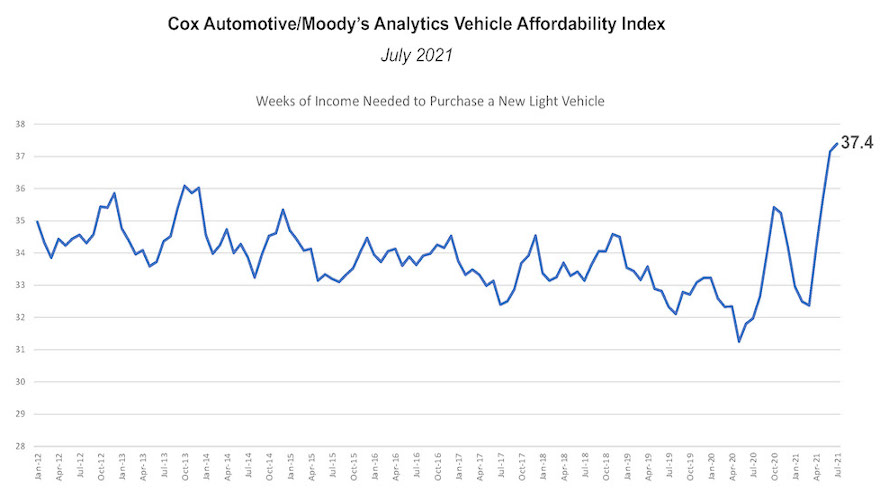

No matter where the individual might land on the credit spectrum, the financial capability needed to acquire a new vehicle is now at the most difficult point ever seen by experts from Cox Automotive and Moody’s Analytics.

According to the newest Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) released on Monday, the number of median weeks of income needed to purchase the average new vehicle in July increased to 37.4 weeks, establishing a new record. That reading is up from the revised June mark, which analysts recalibrated upwardly to 37.2 weeks.

“With market dynamics leading to record prices and a nine-year low in incentives, new-vehicle affordability declined this spring and has hit record lows in each of the last two months,” analysts said in a new Data Point posted on Monday. “Without improving incomes and favorable interest rates, the decline in affordability would have been even worse July.

Cox Automotive and Moody’s Analytics explained that the factors that drive affordability moved in different directions in July.

“The price paid moved higher and incentives declined, but estimated median incomes increased and the average financing rate declined slightly,” analysts said. “Even with rates slightly lower, the estimated typical monthly payment increased to a record high.

“With the decline in July, new-vehicle affordability was much worse than a year ago when prices were lower and incentives were much higher,” they continued. “Affordability in July was worse than at any month covered by the index data, which dates to January 2012.”

Analysts recapped that the VAI is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book. They noted this industry measure is released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.

Southern Auto Finance Co. (SAFCO) now has more financial resources to operate in the subprime auto finance space.

The company announced this week that it finalized new partnerships with Capital One and One William Street that are providing a new credit facility totaling $204.5 million.

According to a news release, these four-year agreements with Capital One and One William Street replace an existing asset-backed lending facility with a warehouse type of facility.

SAFCO indicated that these facilities will set up the company for future funding, which could include entering the securitization market.

“This investment by market leaders Capital One and One William Street clearly demonstrates the value of the technology we have acquired, as well as our sound business model, to ensure that we can continue to thrive during challenging conditions,” SAFCO chief executive officer George Fussell Sr. said in the news release.

“The subprime auto finance sector as a whole is experiencing rapid growth, and with this new facility we are poised to take full advantage of it,” Fussell continued.

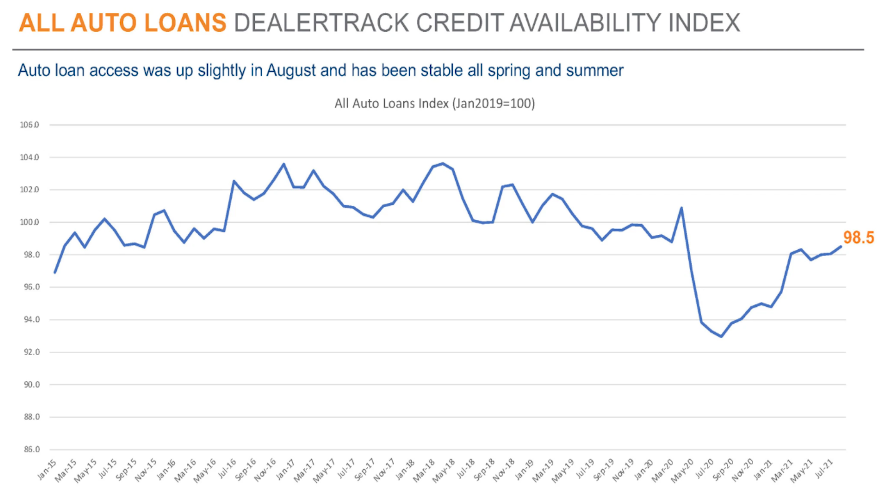

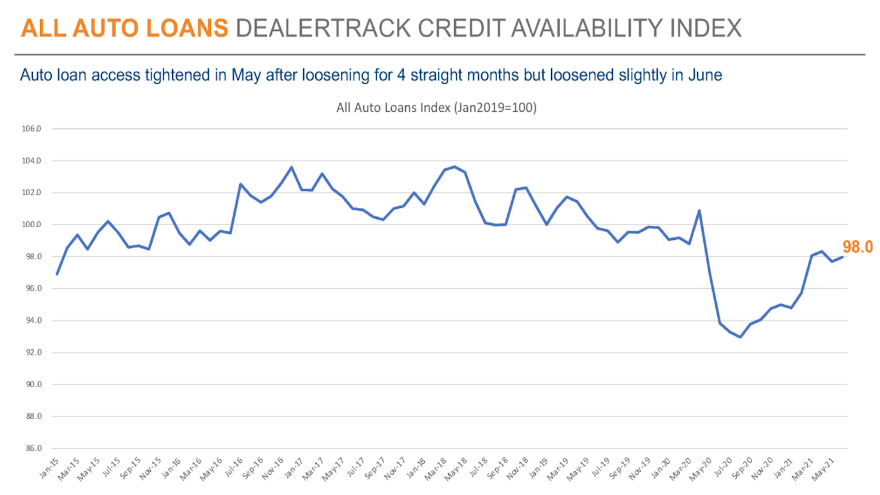

While consumer confidence might be mixed, Cox Automotive discovered more access to credit last month for potential vehicle buyers who needed it — especially if they had stronger credit backgrounds.

According to the newest Dealertrack Auto Credit Availability Index released this week, credit for auto financing improved modestly in June after tightening in May.

Read more