Perhaps your finance company is slightly tightening some underwriting strategy when a contract is first originated at the time of vehicle delivery.

But some shops evidently are loosening a bit when refinancing contracts, as RateGenius is seeing the highest approval level ever through its network of more than 150 finance company partners nationwide.

Read more

When StoneEagle F&I senior vice president of business development Joe St. John worked as a dealership manager, he taped a dime to the phones of store employees in the finance department to remind them of the revenue goal for every delivered vehicle.

“Now, if you’re running less than $1,000 a car, you probably need to find another job,” St. John said during this episode of the Auto Remarketing Podcast when he highlighted the newest data gathered via StoneEagleMETRICS.

The specific data is included in the current edition of SubPrime Auto Finance News and a further discussion about it is available through the conversation with senior editor Nick Zulovich.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Finance companies appear to be mitigating some risk amid soaring vehicle prices, asking dealerships to collect more in down payments from consumers before the contract enters a portfolio.

The second-quarter data compiled by Edmunds seems to reinforce that potential scenario, especially within the used market that established a new record in the firm’s database.

Read more

Rising home values often prompt families to refinance their mortgages.

Soaring used-vehicle prices evidently have done the same thing within the auto-finance space, according to a report from RateGenius, which works with more than 150 partners nationwide to help consumers refinance their installment contracts.

RateGenius’ report indicated that approval odds for contract holders across the U.S. are more favorable today than they’ve ever been — a 66% increase in approvals since May of last year — making a strong case for consumers to refinance while circumstances are in their favor.

Other key findings from the report include:

• Among popular vehicle make and models refinanced in the RateGenius network, the 2017 Ford F-150 pickup increased in value by $10,475 (up 40%) from May of last year to May of this year.

• The next greatest percentage increase was the 2017 Nissan Rogue, which increased by $3,775 (up 30%).

• The 2017 Honda Civic sedan value increased by $3,800 (up 28%), followed by the 2017 Jeep Wrangler which had the second-highest average gain in value, $6,325, but the smallest overall increase (up 25%).

• The average retail loan-to-value ratio across all auto refinance applications in May 2021 was 102%, the lowest on record.

• Last month, the average retail LTV was 26% lower than January of last year, 18% lower than January of this year and 27% lower than last May.

“Consumers should take advantage of this market sooner rather than later and refinance their auto loan while conditions are still so favorable,” RateGenius chief executive officer Christopher Speltz said in a news release.

“It’s difficult to predict how long the current semiconductor chip shortage and low new vehicle supply will last, so we encourage consumers to maximize this opportunity to refinance and optimize savings on their auto loan,” Speltz continued.

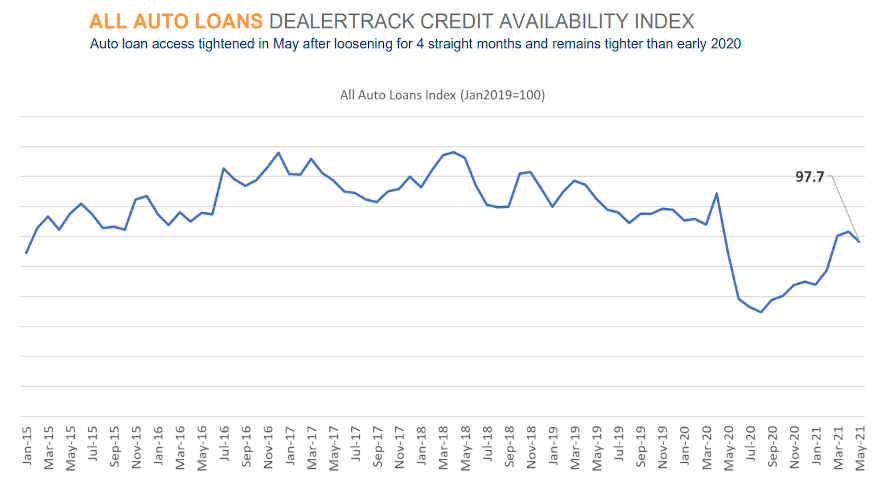

You might have noticed it’s been a little more difficult to get your potential buyer’s deal bought by your network of finance companies.

The newest Dealertrack Auto Credit Availability Index showed just how much of a pinch in paper funding is happening.

Read more

Experts from Cox Automotive and the National Association of Federally-Insured Credit Unions (NAFCU) each digested actions and comments by the Federal Reserve on Wednesday after the Federal Open Market Committee (FOMC) voted unanimously to keep interest rates unchanged.

Both experts honed in on how policymakers offered a glimpse about when their strategy could change to modify the target range for the federal funds rate that currently sits at 0 to 0.25%.

“Today, the Federal Open Market Committee kept interest rates near zero and maintained our asset purchases. These measures, along with our strong guidance on interest rates and on our balance sheet, will ensure that monetary policy will continue to deliver powerful support to the economy until the recovery is complete,” chair Jerome Powell said during his opening comments of a press conference on Wednesday following the Fed’s latest action.

“Widespread vaccinations, along with unprecedented fiscal policy actions, are also providing strong support to the recovery,” Powell continued. “Indicators of economic activity and employment have continued to strengthen, and real GDP this year appears to be on track to post its fastest rate of increase in decades. Much of this rapid growth reflects the continued bounce back in activity from depressed levels. The sectors most adversely affected by the pandemic remain weak, but have shown improvement.”

After Powell offered his initial assessments, NAFCU chief economist and vice president of research Curt Long issued this statement that focused on the forward-looking parts of the chair’s remarks.

“As expected, the Fed moved forward its expected date for liftoff to 2023, and more than one-third of the committee believes it will occur in 2022,” Long said. “The inflation forecast increased for the current year, but not beyond. It appears that the change in the outlook for rate increases was motivated by dissipating downside risks resulting from progress in vaccine distribution, rather than the recent rise in price growth.”

In anticipation of being asked about how the FOMC is approaching its decision-making process, Powell offered these thoughts.

“Of course, these projections do not represent a committee decision or plan, and no one knows with any certainty where the economy will be a couple of years from now. More important than any forecast is the fact that, whenever liftoff comes, policy will remain highly accommodative,” Powell said.

“Reaching the conditions for liftoff will mainly signal that the recovery is strong and no longer requires holding rates near zero,” he added.

Of course, dealerships need to retail vehicles and finance companies need to fill their portfolios with quality paper now, as well as in 2022 and 2023. Cox Automotive chief economist Jonathan Smoke offered his observations about not only the current state of auto financing, but also how it is connected back to the Fed’s actions.

“Consumer loans like auto loans and mortgages are more directly related to these longer-term yields rather than the Fed’s short-term rate policy,” Smoke wrote in a company blog post. “The 10-year yield was up about 66 basis points during chairman Powell’s press conference compared to the end of last year.

“However, consumer rates on auto loans have not moved up so far this year as yield spreads on auto loans have narrowed,” Smoke continued. “In other words, consumers have seen less movement in rates and, in some cases, improvement in rates that contrasts with the upward movement of the 10-year. This is a result of lenders being willing to accept lower yield spreads with strong loan performance and record vehicle values.

“In fact, subprime borrowers have seen much lower rates this spring than at any point in 2020,” he added.

Smoke then explained movement in spreads is one ingredient Cox Automotive uses in gauging credit availability. Smoke noted that it appears financing is now more readily available now than a year ago.

“Average auto loan rates have moved in different directions by credit tier so far in June, but average rates for most credit tiers continue to be lower than a year ago. The Fed is not changing monetary policy in the near term, so trends in the economy and in the auto market will have more of an impact on the rates consumers see on auto loans this summer,” Smoke said.

“Even with bond yield and mortgage rates higher than the absolute lows last year, auto loan rates are not moving higher for every consumer. Some rates, especially for subprime, have been much lower this spring, and that has contributed to the very strong retail market,” he went on to say.

No matter how much — or perhaps how little — Fed moves impact the day-to-day operations at your dealership or finance company, Powell reiterated the institution’s pledge to all.

“We understand that our actions affect communities, families, and businesses across the country. Everything we do is in service to our public mission. We at the Fed will do everything we can to support the economy for as long as it takes to complete the recovery,” he said.

Protective Asset Protection’s latest industry survey focused on how the pandemic impacted the sales of F&I products both online and at the dealership.

Protective Asset Protection commissioned the online survey during March and took the pulse of nearly 500 F&I and dealership executives across the U.S.

According to the feedback, approximately a quarter of respondents said the sale of F&I products to customers has increased between 5% and 10% so far in 2021 compared with 2020.

The survey also addresses the increased role of digital retailing along with an increased shift in consumer demand for used vehicles.

The company highlighted that the pandemic created an opportunity for dealers and their F&I departments to offer more digital tools when customers are researching and selecting F&I product options for the vehicles they are shopping for.

The survey showed 45% of dealers now make F&I product information available online, followed by financing options/loan application online (35%), and F&I product selection and pricing online (33%).

Other key highlights of the F&I product survey included:

• 44% said the ability to adjust products offered based on a customer’s needs are most needed to sell F&I products online; followed by the ability for customers to select product and coverage options (41%), and online tools like videos to explain product benefits (38%).

• 42% said that increased coverage for existing protection products such as VSCs would be the most impactful to improving F&I product sales; followed by a more diverse set of F&I product options (41%), and more F&I products designed specifically for used vehicles (37%).

• 38% said that selling F&I along with increased transaction prices represent the biggest opportunities in selling F&I products today versus pre-pandemic; followed by longer loan terms (37%), and more EV/plugin sales (36%).

“With a greater emphasis on digital retailing, online shopping, used vehicle and EV/hybrid product sales, a larger number of dealers are looking for ways to maximize their opportunities in offering F&I products that cater to these shopper needs,” Protective Asset Protection senior vice president of distribution Rick Kurtz said in a news release.

“Expanded F&I product lineups, customized product offerings and additional F&I product education for both the dealer and their customers are all growing in importance for today’s transaction environment,” Kurtz said.

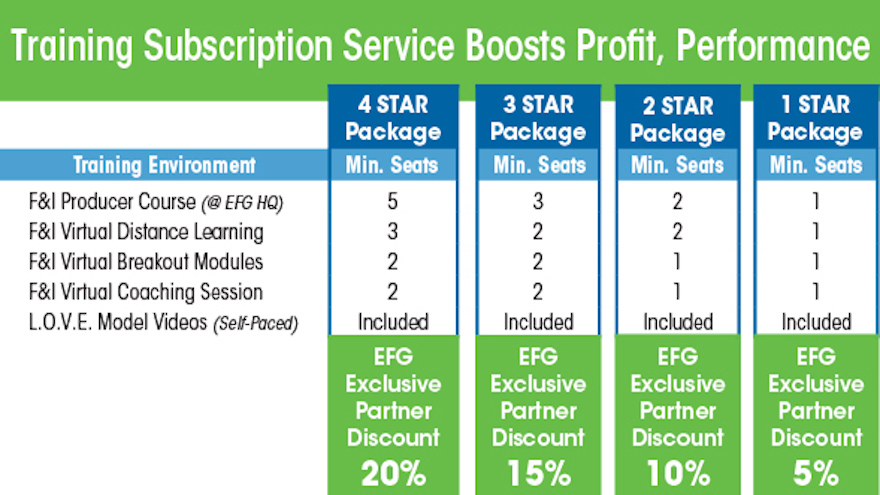

EFG Companies is looking to leverage lessons learned through the pandemic to help dealerships get the most out of their F&I activities.

This week, EFG announced the debut of its modular training subscription service that when piloted during the pandemic, resulted in an 18% lift in profit per unit sold (PRU) for clients.

EFG highlighted that its subscription-based training model includes both digital and in-person options, delivering timely tools in a learning environment that works best for each employee.

According to a news release, the service also supports the new digital retailing model many automotive and powersports retail dealers are launching.

That news release also included experiences from George Vasquez, the general sales manager with Moritz Kia Fort Worth in Texas.

“We have used EFG’s in-classroom training for decades, and over the last few years began taking advantage of the company’s digital platform,” Vasquez said.

“Now, with a subscription service bringing both together from a formal training strategy and pricing standpoint, we see yet another opportunity to accelerate our success and increase our performance standards due to EFG’s partnership,” he said.

When the pandemic forced dealers to pivot their sales model for both in-person and online sales, EFG insisted it was ready.

Aside from the company’s in-person classroom training, EFG recapped that it had invested heavily in building its media-rich digital training platform. This foresight allowed EFG’s trainers to continue driving dealer success through live, on-demand training.

Additionally, students were provided with an in-depth library of training articles, videos, and podcasts on topics ranging from compliance and overcoming objections, to adjusting to the “new norm.”

EFG chief revenue officer Eric Fifield elaborated about what dealers can accomplish in this “new norm” when coupled with the company’s latest training offerings.

“Our one-year training subscription model is designed to provide dealers with a defined cadence, resulting in significant performance improvements,” Fifield said.

“In March 2021 alone, the automotive industry saw a significant rebound in sales. However, our partners who are taking advantage of EFG’s Training Services saw 30% higher performance increases over clients not utilizing our training.”

EFG’s Training Subscription Service is available through a combination of in-person classes, virtual distance learning, virtual breakout sessions, virtual coaching, as well as 24/7 access to EFG’s online L.O.V.E. training portal.

Dealer management can select their preferred subscription package across a wide variety of curriculum, benefiting from up to a 20% discount from standard training rates.

Learn more about EFG services by going to www.efgcompanies.com.

Experian’s Q1 2021 State of the Automotive Finance Market report illuminated many attributes about the contracts originated during the opening quarter of the year, including how outstanding balances now are approaching $1.3 trillion as well as metrics based on geography.

This week, S&P Global Ratings shared insights about more seasoned paper, discussing how payments tracked in March as well as the depth deferrals and other accommodations still are being used.

Read more

Getting auto financing over the finish line to vehicle delivery already can be complex.

When the potential buyer falls within the confines of the Military Lending Act (MLA), it can become even more complicated.

Marci Kawski, a partner in the Madison Wisc., office of Husch Blackwell, joined the Auto Remarketing Podcast to explain the possible ramifications of a court decision recently surfacing in Virginia, involving a finance company, GAP coverage and the MLA.

To hear the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.